TigerSoft News Service 4/4/2010

www.tigersoft.com

TigerSoft News Service 4/4/2010

www.tigersoft.com

Why The Market Keeps Going Up.

What Wall Street Is not Telling You.

By William Schmidt, Ph.D. (Columbia Univeristy) and Author of TigerSoft and Peerless

Wall Street's Control over Obama,

How Wall Street Is A Clear and Present Danger.

Insider Trading Is Rampant.

It is said everytime the young Bill Clinton would start to veer to the left as President,

Alan Greenspan and Robert Rubin would come into the oval office and tell him, "We need to

talk. This is the way things work around here". Similarly, when Obama first came to office

in January 2009, he made several speeches attacking Wall Street's excesses as primary

cause for the World's financial crisis of 2008. The market promptly responded and fell

from 9700 to 6500, a decline of 33%, between the time he was elected to early March

the next year.

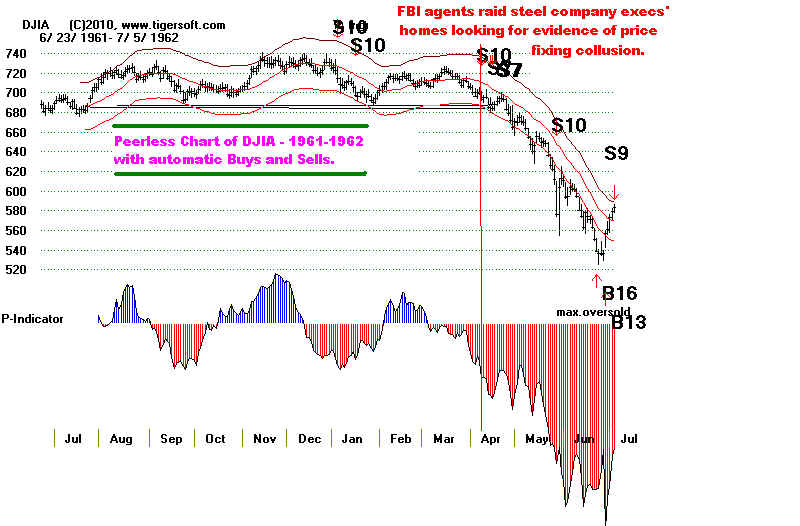

Obama got the message. He was only the President. Wall Street controls the corporate

economy and the account balances in millions of IRAs. In effect, Wall Street holds America

hostage. If Obama tried to bring Wall Street to account for causing the Crash of 2008,

there could easily be another, even bigger Crash. Wall Street had more than enough power

to do this. JFK learned this in the first half of 1962 when his challenge to US Steel caused

Wall Street to drop prices faster and farther than the Cuban Missle Crisis did in the Fall of 1962.

See - http://www.tigersoft.com/Tiger-Blogs/7-22-2007/index.htm

What is worse, Wall Street could make money, too, dropping the stock market. There

is no legal deterrent to a massive manipulated bear raid. Wall Street only has to quickly buy

leveraged short ETFs and use its program trading tools to sell short thousands of stocks in a

nanosecond, all on downticks, even stocks that it did not have to borrow first). They could crash

the financial system and bring all lending to a complete stop.

This is what made Obama quickly switch gears. It was as though, the CEO of Goldman Sachs

called the President and said. "Mr. Obama, we were your largest camapign contributor. We run

things around here. You work for us. Did you forget? You're only President. Now, if you don't

want a total collapse, reverse your course, now. I've talked to Bernanke. We and the FED are

fully prepared to work with you, but you must not challenge us and rock the boat. In return, we

will stop all short selling and push the market up and up. That will make your big campaign

contributors happy. Keep the populist rhetoric to a minimum. It just makes problems for all of us."

Obama got the message. He told them he would change his tone. The market

turned up. In mid-March 2009, he went on Jay Leno's show. Leno asked him: "Shouldn't

somebody go to jail?" Obama flat-out declared, without even a minimal, preliminary investigation

of the Crash, that "most of the stuff that got us in trouble was perfectly legal." Obama made it

seem all just so unfortunate. No crimes had been committed. No investigation was even needed.

http://www.tigersoft.com/Tiger-Blogs/3-19-2009/index.htm

It was at that moment that Obama showed that he would protect Wall Street at the expense of

Main Street and taxpayers. This was exactly what Wall Street wanted to hear. Without demanding

any investigation of the Crash first, Obama was telling Americans that there was:

1) no fraud (as when Goldman sold bundled mortgages but then for its own account sold

short housing and other bank stocks to the tune of many billions),

2) no false accounting (as when the failing big banks manipulated their books to

cover-up their losses),

3) no illegal short sales (a widespread illegal practice that the SEC has ignored),

4) no manipulating the market downwards in the Fall of 2008 (as when short selling hedge

funds aggressively sold short and made billions and billions),

5) no misuse of credit default swaps which let the big Wall Street banks bet on the

bankruptcy of AIG and others,

6) no disclosure of conflicts of interest between New York Fed and Goldman Sachs

in giving it special treatment (example - the FEd's declaring Goldman a commercial bank.)".

7) no timely full disclosure of secret Fed deals. (As when many tens of billions in the AIG

bailout secretly went to the biggest banks.)

It was at that moment that a powerful consortium, a new triumvirate was formed. Wall Street,

Obama and the Federal Reserve, each for defferent reasons, would cooperate to push stock prices

much higher.

Clearly, the Fed's multi-trillion dollar subsidies of Wall Street since the Crash are part

of a secret agreement wherein the biggest banks buy stocks, do not sell stocks short and are

not required or even encouraged to make small business and consumer loans with the trillions

the Feds has given them as loans for their toxic debt collateral. Meanwhile, the Obama Administration

tosses out populist rhetoric to fool people, but maintains the status quo for the biggest Wall Street

banks and corporations. He allows them to continue the same obscene pay and dangerous

business and investment practices that caused the financial collapse of 2008. So, sad to report,

the same people who caused the 2007-2009 World Financial Collapse and permitted it to occur

by their lack of regulation of Wall Street are still very much running the show and making the

same mistakes but on a much bigger scale, since s the banks have now gotten much bigger and

the Fed has made four trillion in very risky loans to these culprit banks, in the name of all Americans.

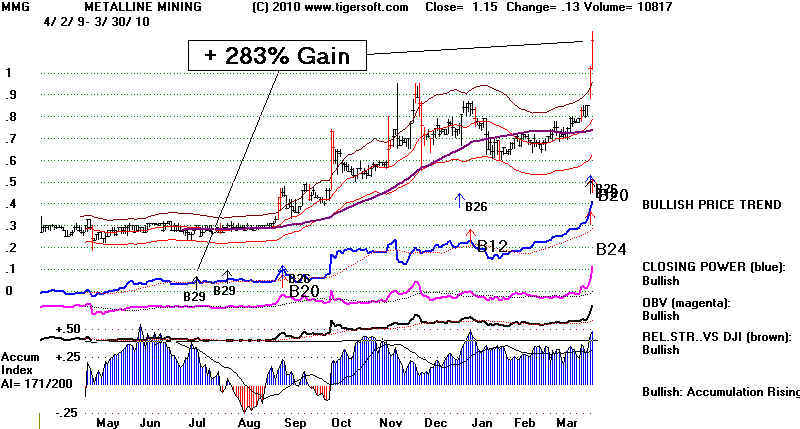

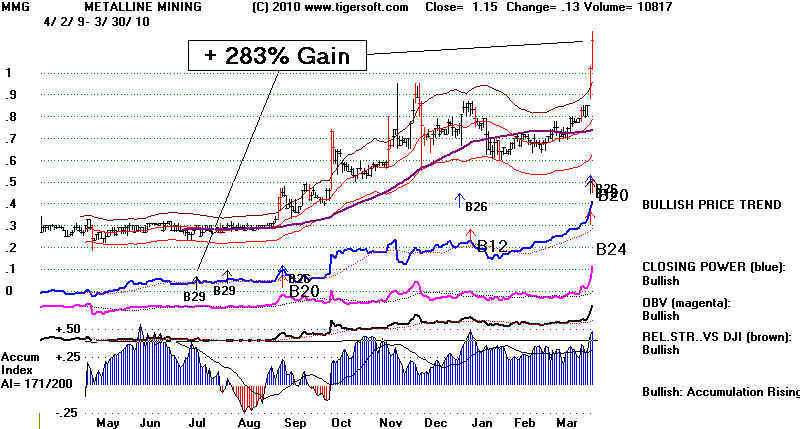

Right away, TigerSoft saw through Obama's empty rhetoric and recommended buying the new

era's "bubble" stocks starting on March 9th, 2009, a day off the bear marhet bottom. We certainly

believe that Obama, the FEDand Wall Street have now completely forsaken Main Street America.

Running up stocks is great for us. Our TigerSoft people have made a lot of money in the bull

market that we called by buying the same stocks insiders and Wall Street professionals were buying..

But there are millions and millions who are probably now permanently unemployed because of

greed connection between Wall Street and Washington. The stock market is up much more than 50%

in the last year. But the average consumer is just as strapped for cash and for many, their savings

have been exhausted. Manufacturing jobs are still disappearing from America. Unoffical

under-employment remains close to 20%. The slef-employed whose business is down sharply are

not counted in the official numbers. Nor are those who are too discouraged to look. Instead,

the government counts as employed part-time workers who cannot find full time jobs. The pay

for too many of these is not a living wage.

We are citizens, too. We see our job here at TigerSoft, not just to make money for our

sunscribers, but to debunk Obama's very conservative, anti-democratic myth of "trickle-down"

from Wall Street to Main Street and to penetrate the sinister veil of secrecy that conceals

Wall Street's control over the President, the Treasury Secretary, most of Congress, especially

Senators and the Federal Reserve. In fact, knowing the truth has very much helped our customers

take back in trading profits some of the money Wall Street would have otherwise reaped just for itself.

In the same way, seeing all the insider selling in 2008, allowed Tiger users to criticize banksters

like Washington Mutual, Bank of America and CitiGroup while selling these bank stocks short

and profit from their plunges. Why should only insiders sell out at the top? Why shouldn't we too?

Continmued below Wall Street's Buying Spree in Low Priced Stocks.

|

Tiger Software

Research on Individual Stocks upon Request: Composite Seasonality Graph

|

Wall Street's

Buying Spree in Low Priced Stocks.

December 17, 1997 - Wall

Street's Best Kept Secret - Low Priced Stocks

June 6, 2009 The Great 2009 Bull

Market. Why Is Wall Street

Concealing The Huge Surges in Low Priced Stocks?

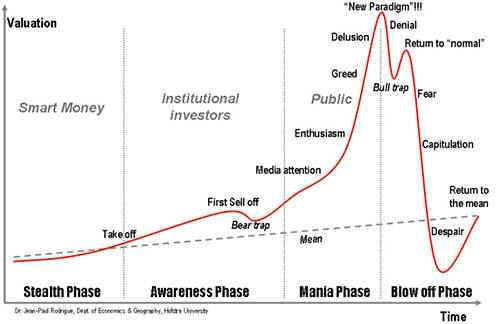

We warned of a rip-roaring new bull market, especially in low-priced stocks 9

months ago.

What

are the historical precedents for the size market advance we saw in 2009-2010?

Still

no Peerless Sell?...When do we take profits? Find out what we think now, by

subscribing

to

our Nightly Hotline, $298/year.

What Wall Street Is Not Telling You.

Wall Street's "Dirtiest Little Secrets" are NOT the obscenely high executive pay there,

the billion dollar bailouts or even the hyping and fraudulent misrepresentation of bubble-stocks or illegal

front-running. It is not even Wall Street's abetting of the tax-evasion and trading done by tens of thousands

of rich Americans and corporations with Swiss bank accounts. Sadly, it is not even Wall Street's destruction

of American Democracy by the wholesale buying of Congress and Presidents through bribes, i.e. million

dollar campaign contrition.

Well then, what are Wall Street's two "Dirtiest Little Secrets" that are hardly ever

mentioned and never discussed by public officials or TV broadcasters?

They are:

(1) the rampant, universal, deeply-rooted and mostly unregulated

UNREPORTED, UNOFFICIAL INSIDER TRADING in Stocks &

Commodities done by the Associates of the very corporate insiders

who must and usually do report their insider stock transactions.

(2) the frequent, also unregulated but now Federal Reserve Encouraged

PROFESSIONAL MARKET MANIPULATION.

Fortunately for Tiger users, we can now spot most of the

significant insider trading and professional stock manipulation.

We do this using the TigerSoft tools, concepts and automatic

Buy and Sell signals that TigerSoft has invented and spent nearly

30 years testing, refining and fine-tuning. Please read more...

Here is what we have learned:

Please read: TigerSoft's Explosive

Super Stocks - "Follow The Insiders' Money"

2009's Biggest Gainers

Example:

DDRX (Diedrich Coffee) was the best performing stock

for the last 12 months. +3400%

See how TIgerSoft spotted it early-on.

The SEC is meant to give investors the sense that the investment playing field is level

and fair. It is not. Insider trading is rampant and very largely unregulated. Fortunately

TigerSoft has devised unique ways to let you watch what Wall Street insiders and professionals

are buying or selling. Buying what they are buying and selling what they are selling is a

"game changer" for all investors and traders. Profits become much easier and safer.

As an insider, you will also start to see much more clearly just how closely Washngton

depends on Wall Street and vice verse. If anything, Obama's Administration has tightened

this relationship.

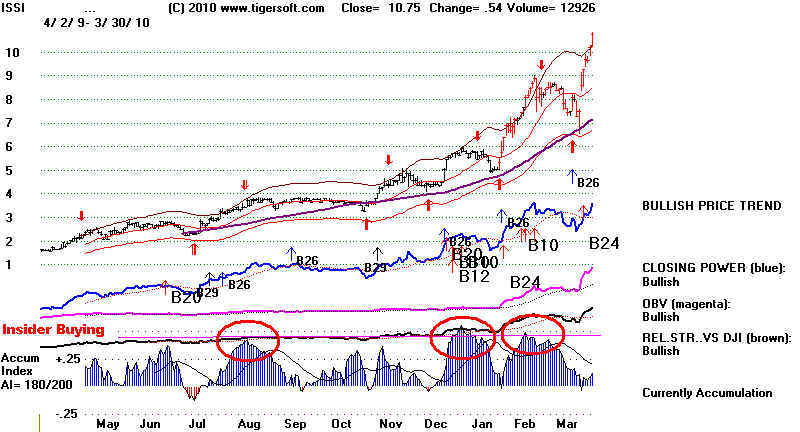

Insiders' and Professionals' Bubble Stocks

Accelerating Uptrends: VRX RDWR ISSI

Intense Accumulation

Take-Offs - AEHR

EMIS HUSA MMG