Tiger Software - Helping Investors since 1981

Make Your Retirement Grow

Suggestions:

Peerless Stock

Market Timing: 1928-1966

Track

Record of Major Peerless Signals

Earlier

Peerless-DJIA charts 7 Paths To Making 25+%/Yr. Using

TigerSoft

Index Options

FOREX trading

Investing

Longer-Term Mutual Funds

Speculative

Stocks Swing

Trading Day Trading

Stock Options

Commodity Trading

Research on Individual Stocks upon Request:

Composite Seasonality Graph of Any Stock for $125.

Example of

historical research NEM - Newmont Mining. Order Here.

Previous

TigerSoft Blogs on Silver:

This is not the first recommendation made here of Silver and

SSRI. Here are the earlier mentions of SSRI.

February 10,

2007 As

Silver Moves Past $17, Is This The Start of An Exciting Third Wave Up

November

2, 2007 Silver

Stocks: A New Run Is Starting

October 28, 2007 Evaluating Breakouts:

Case Study: The Silver Stock SSRI

September 19, 2007 Gold Breaks out with

Power as Fed Cuts Interest Rates by 1/2%

June 26, 2007 Silver Is Starting To

Tarnish.

May 18, 2006 Calling A Bottom Using The

Diagonal Lines Command with SSRI.

February 2, 2006 "Hi-Ho,

Silver"...>$10/ounce SIL

November 29, 2005 Silver Stocks Are Shining

|

Silver Is Now Roaring Up. How Much Higher?

How Will We Recognize A Top?

-------------------

Silver ETF - SLV Now -------------

Silver is up about 50% since the breakout in October 2007..

Recent Volume is high

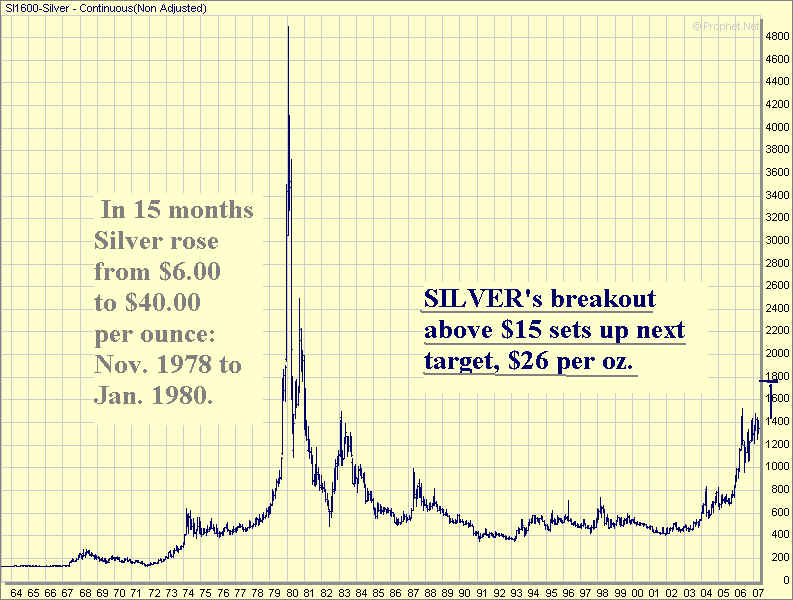

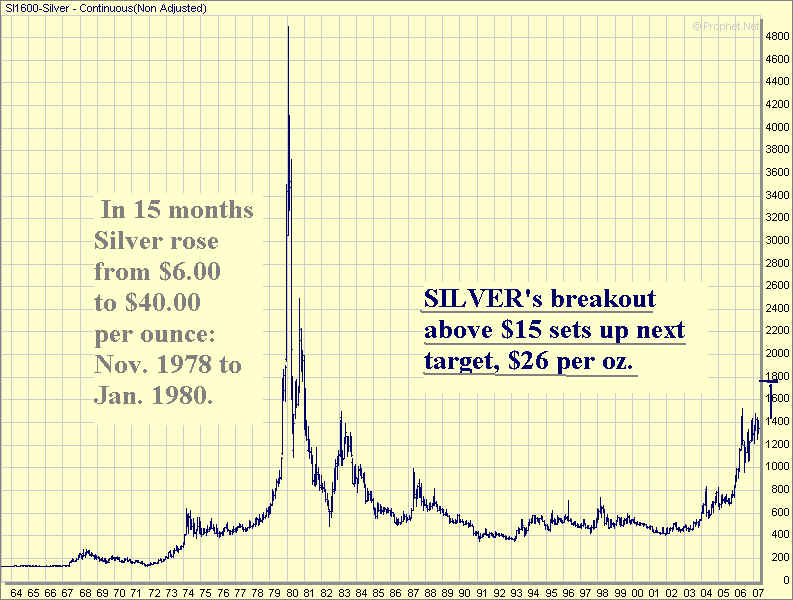

Historically silver has sold between

1/12th and 1/16th

the price of Gold. Silver is now at about 1/46th the price

of Gold. If Gold surpasses $1,000, Silver will go along for the

rise very nicely.

Silver is used more for industrial purposes than

Gold, so it might have been expected that Silver would

now be under-performing Gold, because of fears of a world-

wide economic slowdown. But that is not true. Americans

see Silver as a way to protect themselves against the decline

in the dollar, which is now falling at an annualized rate of 11.1%/year.

By contrast, Silver is rising at an annualized rate of 32%/year.

The Silver ETF (SLV) is making it very easy to buy some

protection against the Dollar's declining further. So Silver

may go much higher. But that will depend, in part, on the Federal

Reserve. Lowering interest rates weakens the Dollar and boost

speculation in precious metals. In addiiton, low interest rates

reduce the comparative cost for someone buying Silver, which

pays no interest. In 1980, the Fed had to raise interest rates to

20% to stop the rise in precious metals and commodities. Current

rates are very much below that.

TigerSoft Tools in Action.... When

Should We Sell.

A blow-off top is very likely. That's what happened in

January 1980

after

Silver had risen from $9.00 to $48 in 4 months. In the chart below

you

can see how the TigerSoft program would have spotted the insider

buying

in August and September as the Hunt brothers bought up all the

silver

contracts as they could. The breakout in November over 17 is

interesting

because that compares with Silver's breakout this past year

above

15. Once Silver cleared 20 a second time, on 12/12/79, it rose

spectacularly.

It peaked on 1/17/80 at 48.50. Some may compare this with

what

Silver does this time around.

What

can we learn from how the 1979-1980 blast-off in Silver about how

to know when Silver has peaked?

1, The TigerSoft chart lets you put in

different length moving averages and bands above them The peaks

at 39 and 48 hit a band 100% above

the rising 50-day ma. This is a possibility, of course. I think

we should watch for that again.

2, We also use hyperbolic uptrend lines.

On the chart below is the hyperbolic function y=mx^2. Placing

a sell stop beneath the uptrendline

seems a good approach. Commodities are famous for rising

hyperbolicaly and then collapsing.

(Editor's note - This was used on our Hotline)

3. Another is to sell when silver hesitates

after a double from the breakout above a 3-month

consolidation such as we see

in the surrent silver chart at 14 last October and in the 1979-1980

chart above 17 in November.

4. And yet another, is to sell if it doubles in a

month, such as it did from 12/19/79 (23.63) to

1/17/80 (48.50)

--------------------------------------------- Silver's 1979-1980 advance.

----------------------------------------------------------------- -

More Comments

Silver had been dormant for many years since 1980. To a chartist, $48.5 is a

reasonable goal on the

current advance. The current amount of

Accumulation is much lower than it was in 1979 when the Hunt Brothers

were trying to corner the market in Silver.

But volume today is relatively higher on the current rally and the

Silver ETF make sit much easier for the public to Buy

Silver. That could produce a very dramatic rise.

The mid-1980 peak at 25 will prpably act as some

resistance to the immediate rally. At this point, $24-$26

looks like a good initial goal, but we'll have

to wait and see.

Subscribe to our Hotline and

stay informed about our views on Silver and much more.

Long-Term Chart of Silver

========================================================

Previous

TigerSoft Blogs on Silver:

This is not the first recommendation made here of Silver and SSRI.

Here are the earlier mentions of SSRI.

February 10,

2007 As

Silver Moves Past $17, Is This The Start of An Exciting Third Wave Up

November

2, 2007 Silver

Stocks: A New Run Is Starting

October 28, 2007 Evaluating Breakouts:

Case Study: The Silver Stock SSRI

September 19, 2007 Gold Breaks out with

Power as Fed Cuts Interest Rates by 1/2%

June 26, 2007 Silver Is Starting To

Tarnish.

May 18, 2006 Calling A Bottom Using The

Diagonal Lines Command with SSRI.

February 2, 2006 "Hi-Ho,

Silver"...>$10/ounce SIL

November 29, 2005 Silver Stocks Are Shining

=======================================================

|