| Daily Blog - Tiger Software |

Tuesday - June 26, 2007

Silver Is

Starting To Tarnish.

On

11/29.2005, I wrote for subscribers that "Gold has just broken $500 an ounce....

Silver had just

surpassed $8.00 for the first time in 20 years". I noted the bullish

breakouts

of NEM, PAAS and SSRI. But nearly all good

things and certainly all bull markets come to

an end eventually. NEM showed heavy insider trading when it was above 50 and we

recommended it as a short sale. We now know that insiders were dumping the stock

because they knew that their Central Asian properties were being nationalized and

their

earnings outlook was poor. They waited until the stock was down 10 points to tell

their

shareholders. It is now 38 and threatening to make new lows for the last

year.

Newmont - 2005-2006

Newmont 2006-2007

SSRI has risen 150%

since TigerSoft recommended it here in November 2005. It

keeps

finding more silver in South America. But even it, the strongest of the gold and

silver stocks, has turned bearish, having shown heavy distribution from the Tiger Accumulation

Index and completed a bearish price-pattern.

As traders, we should also recognize the possibility

that SSRI will hold above 32

and then come charging back above 36. (False moves to the down-side are part of this

stock's 'MO'.) A move quickly back above 36 would be

bullish and get us to buy it again. The

current decline owes, I think, to the Fed not wishing to let the

dollar weaken any further. As the

British Pound reached $2 and the EURO made 5 year highs a month

ago, they have tried to drive

up the dollar by threatening to raise interest rates. In

the long run, the dollar looks very weak

and silver and gold are natural hedges. But for now, SSRI has broken key support and I would

advise staying clear of it.

Silver Standards - 2006-2007

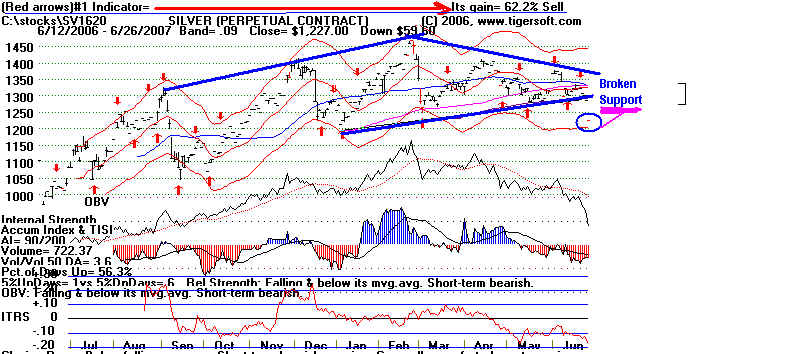

Silver 2006-2007

Silver (SL1620 Perpetual Commodities' Contract using Dial

Data)

shows distribution from our Accumulation Index and very aggressive

selling from

the downtrending OBV

Line. The price pattern is a bearish head and shoulders

pattern, whose neckline

has already been violated..

![]() So, what's going on here with Gold and Silver? The Federal Deficits

So, what's going on here with Gold and Silver? The Federal Deficits

are as massive

and scary as ever. I think it's that interest rates are going to be

raised by the Fed

in the next few months or even much sooner, as they try to defend

the dollar.

More about this linkage in coming reports here.

Tiger's Automatic Buy and Sell Signals have gained 60.6% on XAU (Gold Index) chart

for the past year, The XAU (Gold Stocks' Index) has gained nearly 100%. Investors in

gold and silver stocks would have done much better for the past few years using our

automatic signals than just buying and holding.

An XAU move above 150 would be a meaningful breakout. More about this linkage in coming

reports here, especially if the XAU makes its move. The chart below lends itself to the belief

that there will be an upside breakout, unless the Fed raises rates to protect the dollar.