About Tiger Software

About Tiger Software

Creator of TIGER SOFTWARE since 1981 william_schmidt@hotmail.com 858-273-5900

www.tigersoft.com www.tigersoftware.com

--------------------------------------------------------------------------------------------------------------------------------------------

William Schmidt, Ph.D. (Columbia University), B.A. (Yale University)

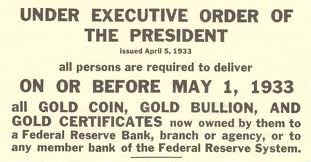

My dissertation awakened me to the pernicious power of financial elites.

The Crash of 2008-2009 confirmed that and the FED's transfer of Trillions

more to Wall Street in 2020-2021 was just more proof. For us on the outside,

this shows that we must study market history if we hope to succeed in our own

investments and, just as important, we must study the market behavior of

the Professionals who dominate the trading of the biggest bank stocks. They

have the inside track when it comes to knowing what the Federal Reserve is

going to do next and they are the ones who rig the ups and downs of the market

using the unlimited funds the FED provides them under the slogan that the

"Big Banks are too larger to be allowed to fail."

See my http://www.tigersoft.com/dissertation/index.htm

-------------------------------------------------------------------------------------------------------------------------------------------

Stock Market Historical Studies - Peerless Stock Market Timing: 1915-2013 - On Line Nightly Hotline

Insider Trading Charts - Automatic Buys and Sells - Explosive Super Stocks - Killer Short Sales

Tiger Power Stock Ranker - Nightly Stock Data - Customized Research

Public Letter to Traders and Investors Concerned about Their Retirement

Subscribe to Our Nightly HOTLINE How To Get Started for yourself with our software. Full Tiger Package

-------------------------------------------------------------------------------------------------------------------------------------------

The present "Tiger" is the result of 40+ years of original, full-time research into the stock market.

I have learned a great deal from many wonderful customers, users and friends. I have also found that there

is no better way to develop and refine one's thinking about a subject than to have to try to predict its behavior each day.

Get our software and subscribe to our hotline. I think you will learn a lot. I know I have.

One major advantage we have is our independence. Our own fiercely independent views

on political economy and Wall Street insider trading have given us a big advantage compared

to most market commentators who too often flatter the rich and adhere to such silly orthodoxies as:

> Government is a "barren whore",

> Wall Street knows best how to run Corporate America and Finance Gov't.

> The rich are smarter than everyone else.

> 47% of the US population are free-loaders.

> The government should balance its budget every year,

> Military spending is the only legitimate Federal spending program,

> the SEC is there to protect small investors,

> Precious metals should be in everyone's portfolio,

> "Free trade" is best,

> Unions are evil and American labor costs are way too high,

> America has the best "and fairest Democracy" in the World,

> Global warming is a myth.

> Freedom must be defended with Guns and De-Regulation.

> We have a "free market" and its makes for democratic government.

My studies of Political Economy show otherwise. See www.tigersoftware.com

Not being tied to orthodox financial analysis, lets my studies see the connections

between Wall Street and Washington DC. It allows my studies to see that the

interests of Main Street, Wages, American Jobs, the US Economy and Wall Street are

seldom in synch, but it is usually Wall Street's priorities that win out. When you

understand these things, there is no mystery why Wall Street often rises when

there is bad news for Main Street.

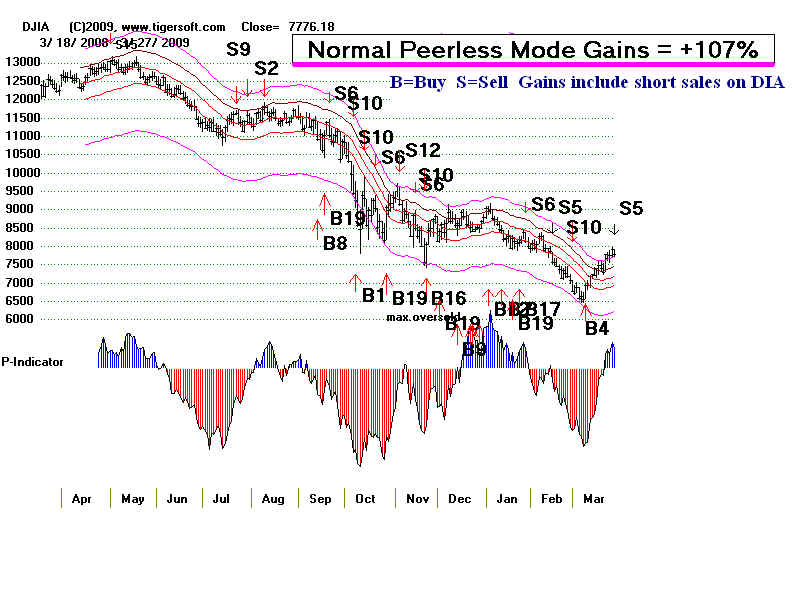

My job for 43 years has been to predict the Stock Market. My market timing system,

Peerless, has helped a lot. But, only by giving up all the silly fairy tales above

allows one to trust the many otherwise unexpected Peerless Buy and Sell signals.

Discoveries

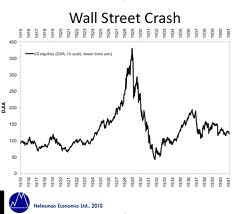

Back-tested to 1915, the automatic Peerless Buys and Sells time the stock market 's

intermediate-term tops and bottoms far better than anyone, including me when I

started, could ever imagine. Each new year demonstrates this..

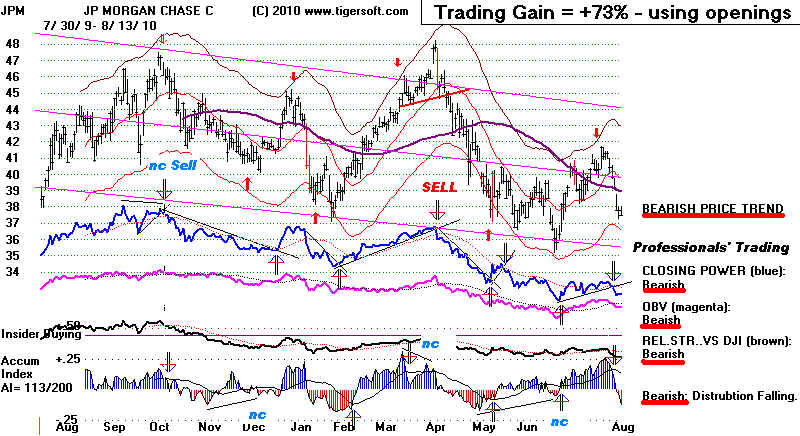

When Peerless says we are in a bull market, buy confidently and aggressively

with TigerSoft. When Peerless gives a Sell, sell short the stocks that both

Professionals and Insiders are selling, as readily identified by TigerSoft's

Accumulation Index and Closing Power.

But you can hedge, too. And there are many short-term swings up and down,

In most markets, you also can do very well hedging, by being long our

"Bulllish MAXCP" stocks and short our "BEARISH MINCP" stocks at the

same time. And if you are a short-term traders, our QuickSilver trading

tools are exactly what you want to use with ETFs, especially leveraged one.

3/25/2011

31 Years of Automatic Peerless General Market Buys and Sells applied to SP-500 Stocks

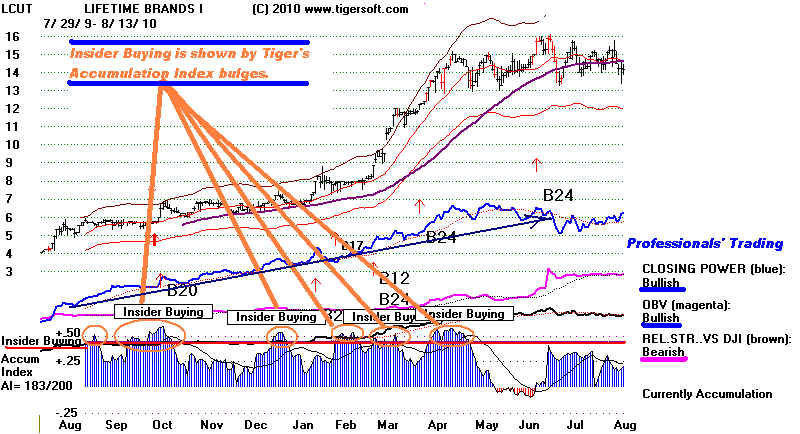

SAMPLE TIGERSOFT INSIDER TRADING CHART

Tiger Users know to watch for:

1) the bulges of intense insider buying from our Accumulation Index,

2) the trend changes of Tiger's Closing Power, which usually leads prices and

3) whether our Peerless Stock Market Timing is on a Buy or Sell.

In the chart below, the up-arrows show the Peerless Buys in this period.

Note the very highs levels of bullish Accumulation by institutions and

insiders.

WE CLOSELY STUDY MARKET HISTORY

"History is the witness of time, the lamp of truth,

the embodied soul of memory, the instructress of life, and

the messenger of antiquity." (Cicero)

It is not most certainly not "bunk" as Henry Ford said.

"For historians ought to be precise, truthful, and quite unprejudiced,

and neither interest nor fear, hatred nor affection, should cause them

to swerve from the path of truth, whose mother is history, the rival of time,

the depository of great actions, the witness of what is past, the example

and instruction of the present, the monitor of the future. " (Cervantes)

A Personal Note

I have found that markets' cycles of greed and fear, complacency and high anxiety,

hope and despair alternate over and over again. This is the mass psychology

we must master in the stock market. It is these highly predictable emotions which

we measure and which professionals "feast" upon.

I believe others than just those who are Wall Street insiders will want to understand

and gain from these lessons of history.

If the average investor knew just how much the market repeats and repeats certain

key patterns, initially he or she would be amazed. That amazement would next turn

to anger, when that novice realizes just how much they have been taken advantage of

by Wall Street, Insiders and Professionals.

In 2009, Wall Street's gloves came off. Nearly bankrupt, they had to openly grab

whatever they could from the government and the taxpayer. And they got away with it.

The big banks are bigger than ever, as are their profits and their executive bonuses.

This came as no surprise to us. Bernanke gave them trillions and Obama pardoned

them without any investigation. Will history repeat? Wall Street has gotten even

richer, more bloated and unaccountable. The bull market is dependent upon the FED's

free money. How much longer can the Wall Street bubble grow?

On Wall Street:

Insider Trading is Rampant

Professionals Now Rig Stock Prices with Extra FED Help and Approval.

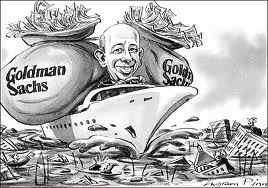

Goldman Sachs Is "The GREED CONNECTION" between Wall Street and Washington