TigerSoft News Service 10/6/2009

www.tigersoft.com

TigerSoft News Service 10/6/2009

www.tigersoft.com Other Free Tiger Blogs - http://www.tigersoft.com/Tiger-Blogs/index.htm

GOLD's HISTORIC BREAKOUT

MAKES US REMEMBER THE 1970's

by William Schmidt, Ph.D.

1976-1980: 550% Rise in 4 Years with Democrats in Power.

Buy and Holding Is Dangerous See All The Peerless Real-Time Signals: 1981-2009

Tiger Software - Helping Investors since 1981 Make Your Retirement Grow

Suggestions:

Peerless Stock Market Timing: 1928-1966

Track Record of Major Peerless Signals

Earlier Peerless-DJIA charts

7 Paths To Making 25+%/Yr. Using TigerSoft

Index Options

FOREX trading

Investing Longer-Term

Mutual Funds

Speculative Stocks

Swing Trading

Day Trading

Stock Options

Commodity Trading

Research on

Individual Stocks upon Request: Composite Seasonality Graph

of Any Stock for $125. Example of

historical research NEM - Newmont Mining. Order Here.

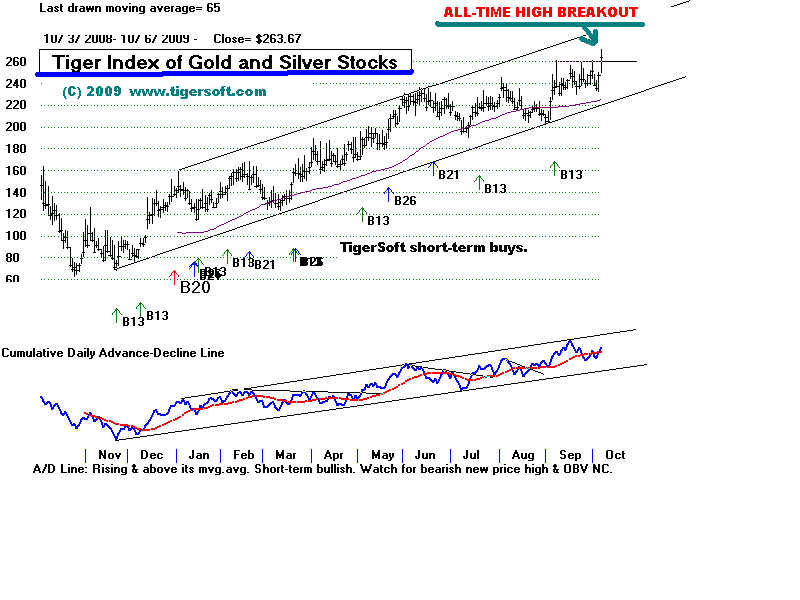

GOLD MADE AN ALL-TIME NEW HIGH TODAY.

It has taken years to develop this pattern.

It is very unlikely that this is a minor false breakout.

A sharp rise in gold usually leads to a steep stock market decline in a matter of weeks or a few months.

Gold traders can make some money now buying gold stocks. But, it is likely, that the US stock markets

are coming much closer to the start of a serious downturn. So far, the decline has been avoided. And so

far, our Peerless system has not given a Sell signal. But a sharp rise in Gold usually ends badly for the general

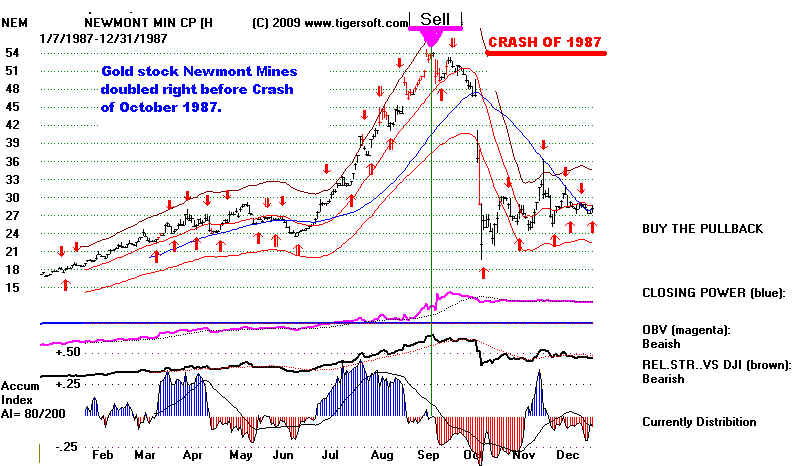

stock market. Consider the case of how well gold producer Newmont's rise in 1987 predicted

the Crash. The stock took off in July 1987. At the end of September, the stock showed serious

big money distribution. The rally to 54 was accompanied by negative readings from the TigerSoft

Accumulation Index. At the beginning of October 1987, Peerless gave a major Sell on the DJI. And

just three weeks later, the DJI was 35% lower and NEM had given back all its gain.

Between 1977 and 1980, when then Democrats were in power, gold rose more than 550%. It was

a rough period of time for investors. Each and every produced either a bear market or a mini-crash.

That was a time when Carter's appointment as Chairman of the Federal Reserve, Pail Volcker, raised

interest rates to 20% to combat commodity speculation and prevent a downward spiral of the Dollar.

Our current Fed Chairman, Ben Bernanke, has studied the 1930s closely and concluded that the

Federal Reserve then could have headed off the Depression by dramatically lowering interest rates.

"Easy money" is Bernanke's appraoch now. Under this policy, US Banks can borrow money from

the Fed at rates close to 0%. They can then buy US Treasuries and pocket the difference. Yesterday,

he reaffirmed this policy and said that interest rates will not go up any time soon. He undoubtedly realizes

that if he raised rates, the interest on the 2 trillion Dollars of US indebtedness would quickly bury

the US Treasury under even more massive debt.

Bernanke's announcement that low interest rates will continue for some time coupled with the

huge prospective budgets is very bullish for Gold. It vitrtually guarantees Gold speculators that

they need not fear a sudden rise by the FED of iinterest rates to defend the weakening Dollar. Raising

interest rates makes US Treasury securities more attractive to foreigners and is one of the major ways

a country can make its currency more attractive internationally as it finances its debt.

The period of time, the 1930s, that Bernanke studied did not have the Dollar playing the major role it does

now as an international currency. It is not clear that Bernanke sufficently realizes that his "cheap money"

approach, as appropriate as it might be if high unemployment and a slack economy were the only

considerations and US banks actually lent the money they borrow out to small businesses.

But the banks are mostly sitting on T-Bills or playing the stock market with the cheap money the

Fed is giving them. They are actually cutting back on loans, by all reports. Clearly banks are not helping

finance a recovery, unless it is assumed that rising stock prces will encourage stock traders to spend

more money. This is "trickle down" economics. It does not address the severe inequalities of wealth

and income in the US. It makes them worse. Most people have very little money, when 5% own

95% of all wealth. An economic recovery in this environment is very difficult or impossible. More and

more economists realize that such maldistrubtion of wealth lay at the heart of the Depression

(buying power was exhausted). It helps explain why FDR's New Deal ultimately failed to produce

an economic recovery. It took the economic collapse of Europe and Japan in World War II to

bring an American industrial recovery to millions and millions in the 1950s.

In Russia in 1906, Tsar Nicholas tried a variation on this "trickle down" approach with his "wager

on the strong" peasants. It failed and revolution followed.

"in 1906, a new Tsarist minister, Stolypin, launched an all-out attack on the peasant commune,

as the basis for the new policy known as the ‘wager on the strong'. Stolypin aimed to resolve both Russia's

economic problems and her social problems by fostering peasant differentiation and the destruction of

the ‘village community' ...(by encouraging) richer peasants to consolidate their landholdings and produce

bigger commercial surpluses, fostering agricultural growth, whilst poorer peasants would be driven off

the land and into the cities where they could be kept in check by repression more easily...Stolypin was

assassinated by an anarchist (middle class) peasant organiser (Narodnik) in 1911, and there is no doubt

that Stolypin's ‘reform' of traditional agrarian structure ...made an important contribution to fueling the

social revolutionary process which erupted five years later...(and led to the Soviet revolution.) "

( http://era.anthropology.ac.uk/Era_Resources/Era/Peasants/russia.html )

And, potentially making matters

much worse, foreigners are now vocally losing confidence in the US Dollar and

are starting to favor other

currencies, like the Euro or Yen. If foreigners, particularly the Chinese, decide

suddenly and en masse to dump their

Dollars and sell their US Treasury Securities, because the decline in the Dollar

is reducing these investments

intolerably, the Dollar may crash down sharply in value vis-a-vis other

currencies. In that event,

Americans will find that much of what they buy in stores suddenly will be much

higher priced, exactly at a time

when many are jobless and have so little money, as it is already. The

government printing presses at the

Treasury will be turned loose, as lenders disappear, and the Dollar

will go into a terrible spiral

down. Gold will be one of the few safe places for Americans to to keep their

savings safe.

US DOLLAR'S DOWNTREND

CLASSIC TECHNICAL ANALYSIS NOW

SETS UP

A MINIMUM TARGET OF 130 FOR GLD

AND A

MINIMUM TARGET OF 1300 FOR GOLD

(1) GOLD IS THE BIGGEST

GAINER FOR THE LAST YEAR AMONG ALL INDUSTRY GROUPS,.

(2) GOLD AND STOCKS ARE

PARTICIPATING VERY WELL.

(3) MANY STOCK MARKET

AVERAGES DENOMINATED BY GOLD

ARE DECLINING