|

OIL's ROLLER-COASTER RIDE:

2006-2008

All you needed to know

to master the ride were:

Price Patterns and TIgerSoft's measures of Insider Buying and Selling.

Watch the trends of TIger's Closing PowerTrend and

TigerSoft's Accumulation.

Only TigerSoft offers these tools.

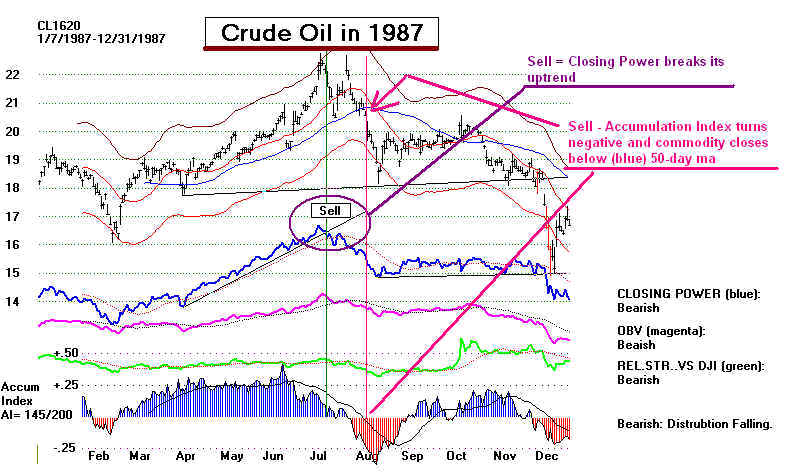

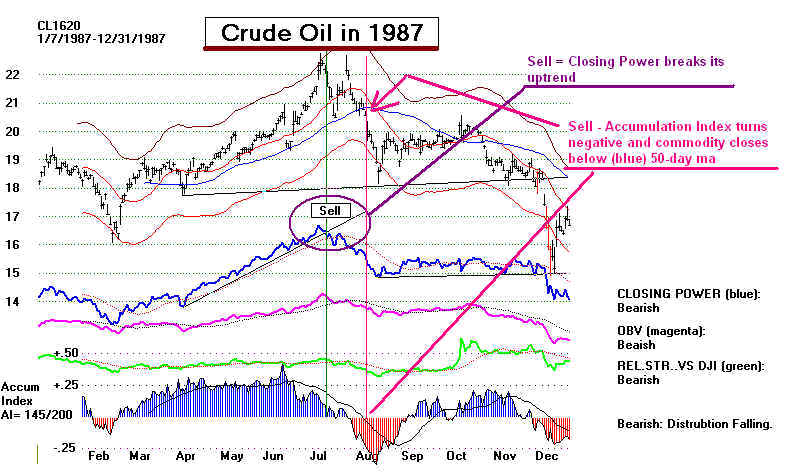

First, look back at 1987. The

same rules applied then.

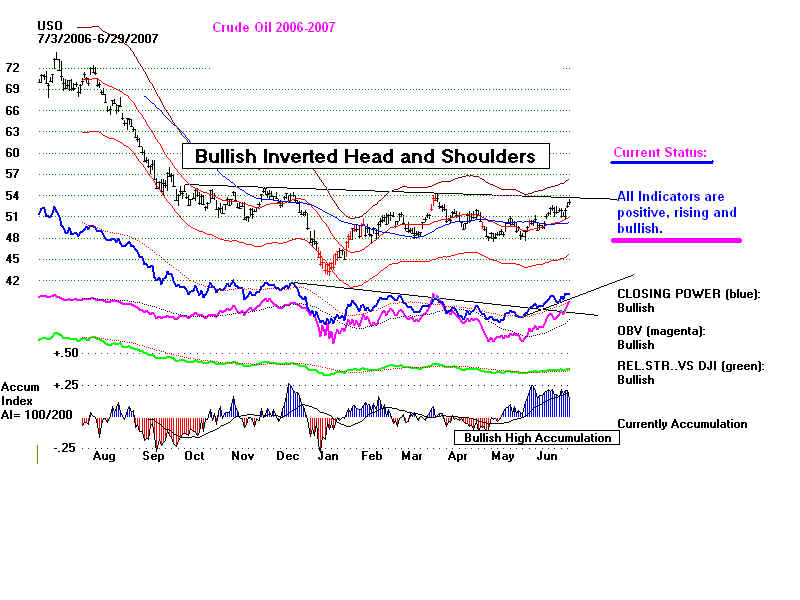

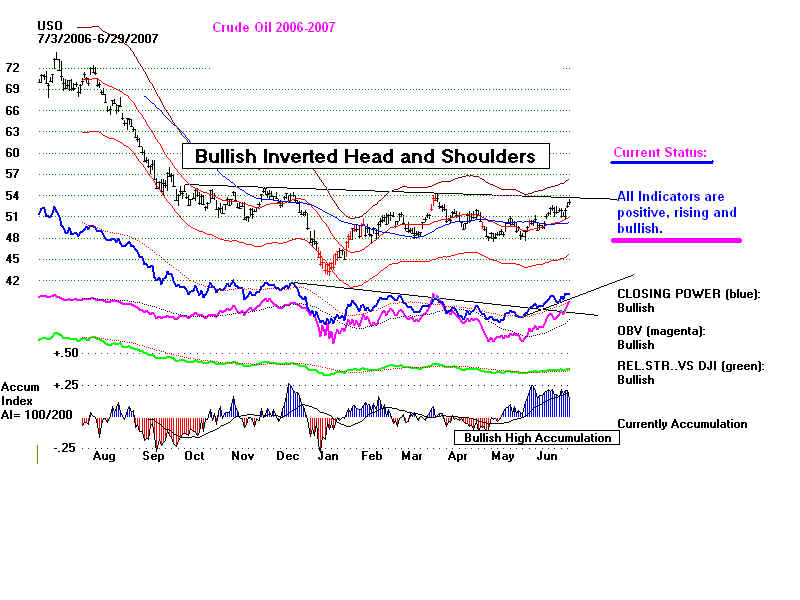

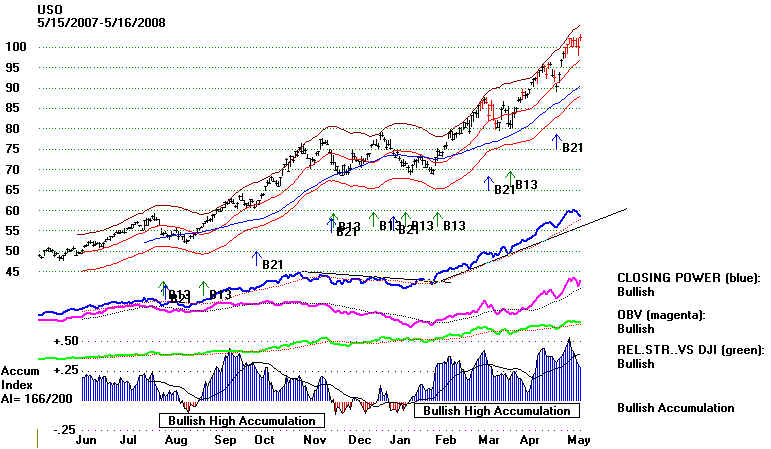

=============================== 2006-2007

==================================

Note bottom formation - and positive and

rising internal strength indicators

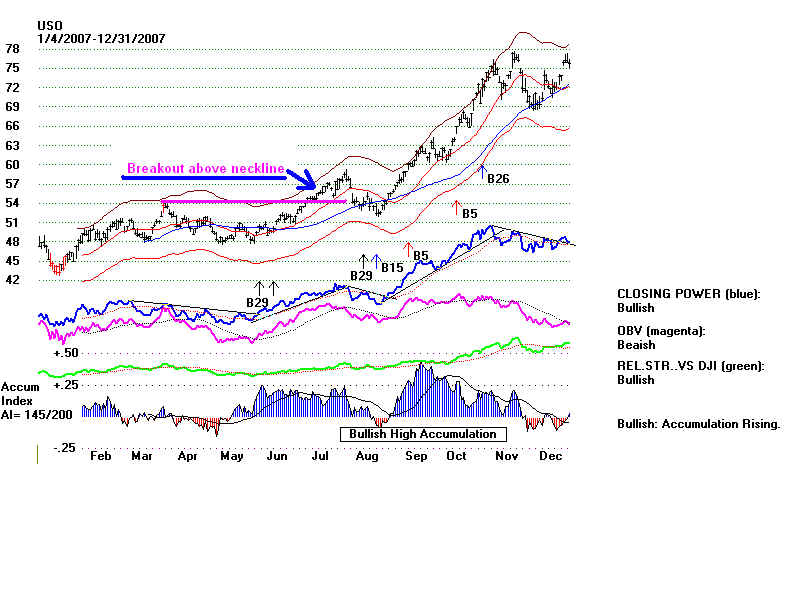

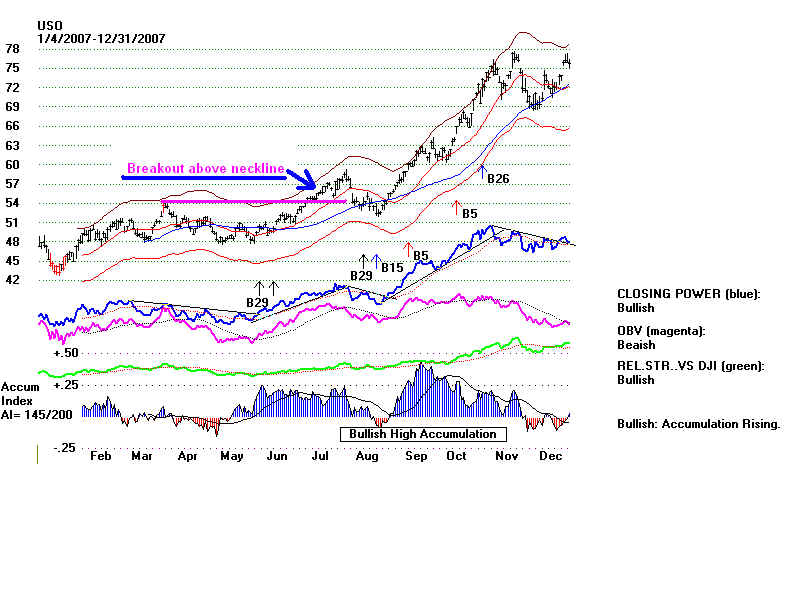

=============================== 2007

==================================

Breakout is richly confirmed by positive

internals and rising prices.

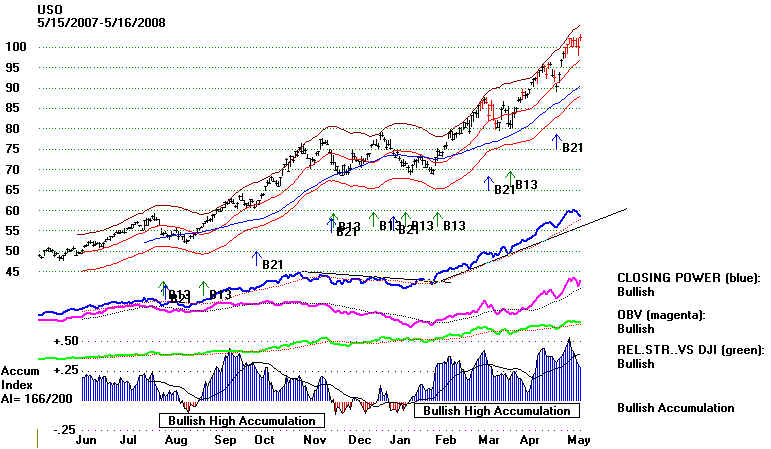

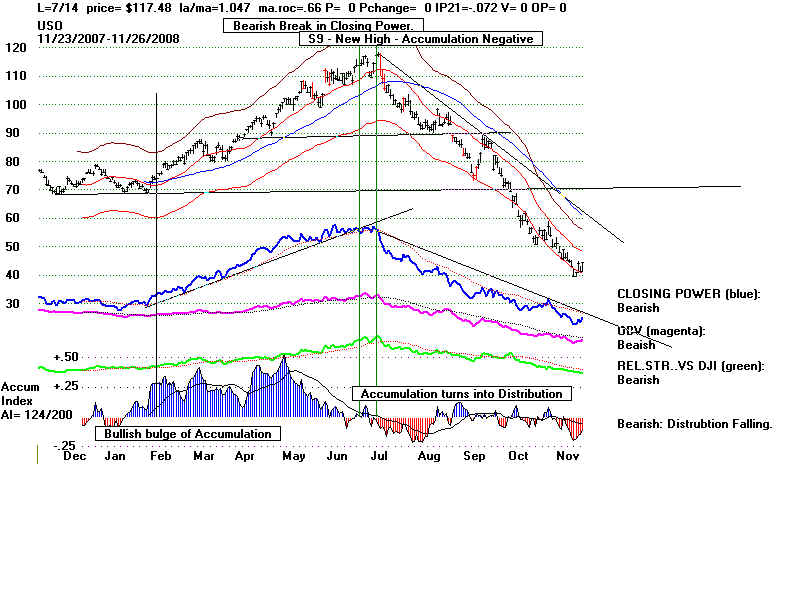

=============================== 2007

-2008 ==================================

Rising prices are richly confirmed by positive internals

and rising prices.

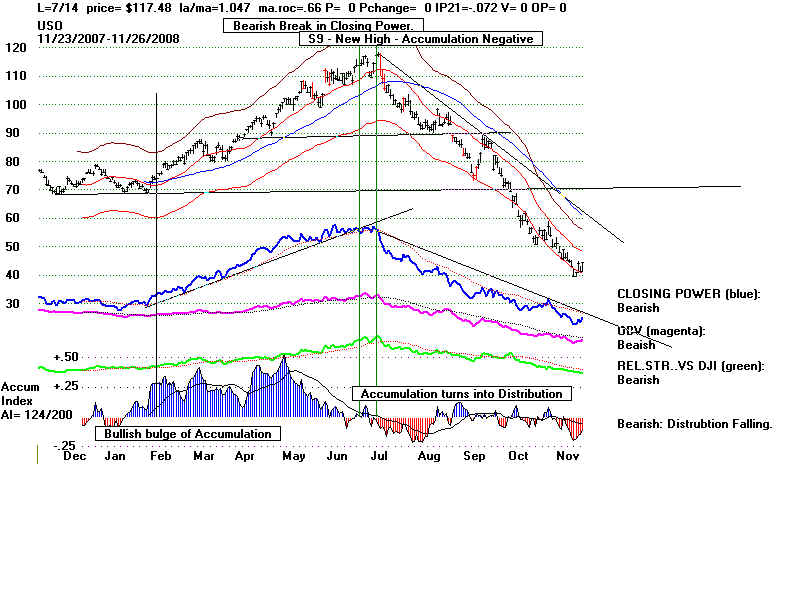

======================== 2008 ==============================

The Top was marked by a trend-change,

from rising to falling

and from positive to negative. But before that, notice how Accumulation

turned to Distribution. The last high showed negative readings. This

neabs that Insiders had switched from Buy to Selling. After this big an

advance, selling was advised. The downward pressures of Hedge fund

selling was very clear as the decline unfolded. Breaking below support

levels should have invited you to sell short. When you have tools as

good as ours, you can become very aggressive.

=======================================================

|