|

TigerSoft

Indexes of Selected Stocks:

(1)

Trade Their Trends and Buys and Sells.

(2)

Use sector A/D Lines to confirm price new highs and lows and see trend-changes..

(3)

Note Support and Resistance.

(4)

Is there aggressive Buying or Selling?

(5)

Is there big money accumulation or distribution?

(6)

Is this a good group to be in based on relative strength?

The first chart below is the TigerSoft Index of 18 Stock Brokerages.

Use

the red arrows to take positions at the next day's opening.

TigerSoft's

Big Trading Profits

Longs

Only Profit = +43.5%

Shorts

Only Profit = +296.6%

Charts

shown below:

Stock Brokerages

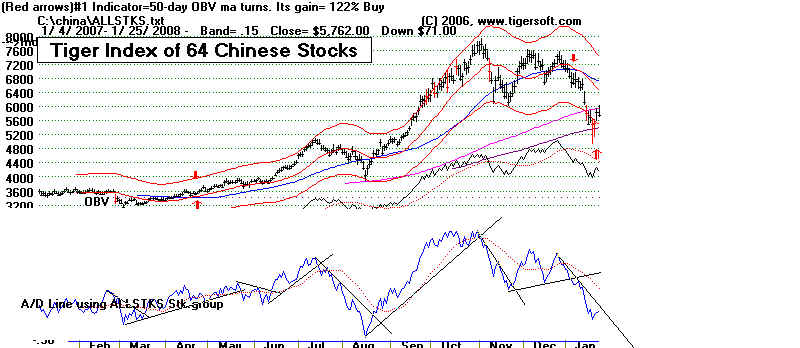

Chinese Stocks

Home-Building Stocks

Gold/Silver Stocks

Oil Stocks

FTSE (UK) Stocks

(1) Trade Their Buys and Sells.

(2) Use sector A/D Lines to confirm price new highs and lows and see trend-changes..

(3) Spot Support and Resistance.

(4) Is there aggressive Buying or Selling?

(5) Is there big money accumulation or distribution?

(6) Is this a good group to be in based on relative strength?

TigerSoft gives you

many trading advantages. The one I want to emphasize today is the ability

to build indexes of your choice of stocks. This lets you

see all the key indicators, as well as

automatic TigerSoft Buy and Sell signals and an Advance-Decline

for your group of stocks.

Our Tiger Data base is organized to make this easy. And you

can designate the stocks you wish

to use in an index.

Below is

the current TigerSoft Index Chart for 18 Stock Brokerages. Trading

the short side

when a red down-arrow appears has been very profitable.

Using the red arrows with the top

trading system would have gained a trader 296% using just the

short side. This assumed $10,000

was started with and each trade conservatively costs $40 in

commissions and slippage. The software

lets you see that there were 19 trades, including the last one

which is still open. The average gain

was 4.9% for the 16 winning trades. Only 2 were

unprofitable.

------------------------------------

Tiger Index of Stock Brokerages -----------------------------------

The top

row of a TigerSoft chart shows the basis for the Red Up (Buy) and Down (Sell)

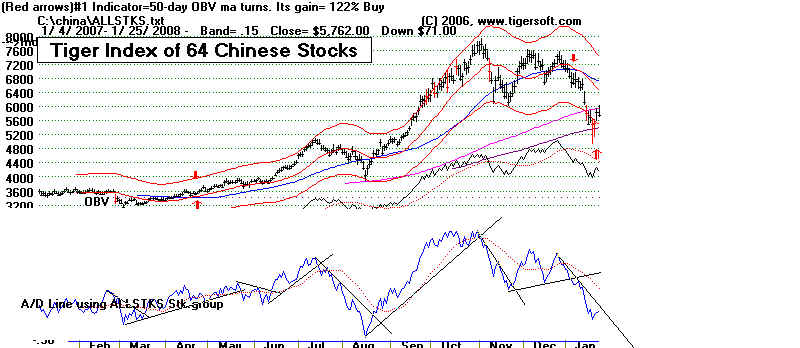

When this system does not give enough

buys and sells, use the Advance-Decline

feature and

draw trendlines. This makes trading

the wild Chinese market a lot safer.

-------------------------------- Tiger Index of Chinese

Stocks --------------------------------------------------------

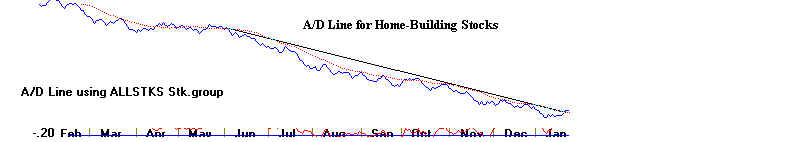

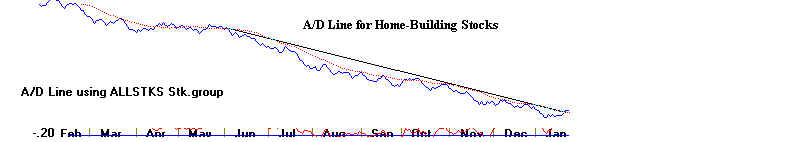

Home Building stocks have been in a long

decline. But that may be changing. The Tiger

ITRS

(relative strength) indicator has finally turned positive and the Advance-Decline Line for

the group is about to

break its long down-trendline. The group is on a Red Buy.

--------------------------------- Tiger Index of Home-Building Stocks

---------------------------------------------------

-------------------------- Tiger

Index of Gold/Silver Stocks --------------------------------------------- -------------------------- Tiger

Index of Gold/Silver Stocks ---------------------------------------------

The chart of the Tiger Index of

Gold and Silver stocks gives very good Buys and Sells. Trading

these signals would have gained 67% for the period

shown. In addition, we can clearly see that

these stocks are locked in a trading range. e

can see the levels to Buy and Sell. We see that there

is aggressive Buying from the fact that the OBV Line

is making new highs ahead of price. We also

must note that significant selling on strength is

taking place. This a bullish sector. It has outperformed the

DJI since July. Finally, we are told, in

general, to avoid buying these stocks at the opening, as there

usually are better prices later in the day.

-------------------------- Tiger Index of Oil Stocks

---------------------------------------------------

Oil stocks should rally.

Prices have retreated back to their March lows and there is a new

red Buy on the screen.

------------------------------ Tiger Index of FTSE (UK)

Stocks -----------------------------------------------------

See how the May peak, and the

high for 2007, was not confirmed by the FTSE A/D Line.

|

-------------------------- Tiger

Index of Gold/Silver Stocks ---------------------------------------------

-------------------------- Tiger

Index of Gold/Silver Stocks ---------------------------------------------