|

What Friday's Biggest Gainers and Losers Can Teach

Us?

-

Use TigerSoft Automatic Buys and Sells.

-

Trading at the Next Day's Opening Works Fine.

-

Sell Stocks that break below key moving averages (like 50- and 65-) when Tiger Accum.

Index is negative.

-

Sell Short on key TigerSoft Short Sale Signals.

-

Bulges (above .50) of high accumulation (TigerSoft indicator) signal buying opportunities.

-

Dips (below -.25) of TigerSoft Accumulation Index signals it's time to sell.

-

Watch for divergences between price and the TigerSoft Accumulation Index.

Everything you need for very profitable trading.

TigerSoft Introductory

Software... Only $99.

TigerSoft

Automatic Red Buys and Sells do superbly with most mature tech stocks. San Diego's

Qualcomm trades nicely with TigerSoft Red Buys and Sells. Buying at the

opening after a red Up Arrow

and selling on the next red Down-Arrow would have gained 38.5% this last

year. Adding the short sales,

the gains would have been 77.2%. This is typical of many mature tech

stocks. See our introduction to

TigerSoft for many more examples: http://tigersoft.com/--3--/Explanation/index.html

================================= QUALCOMM

=========================================

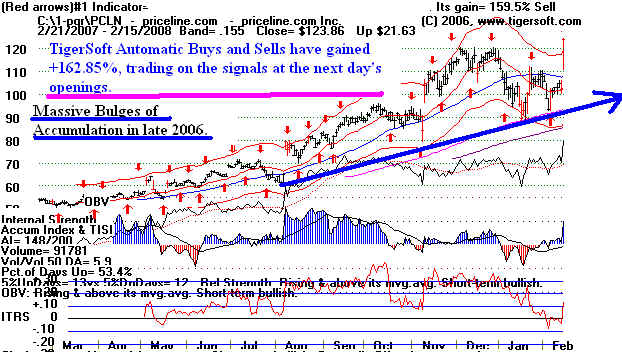

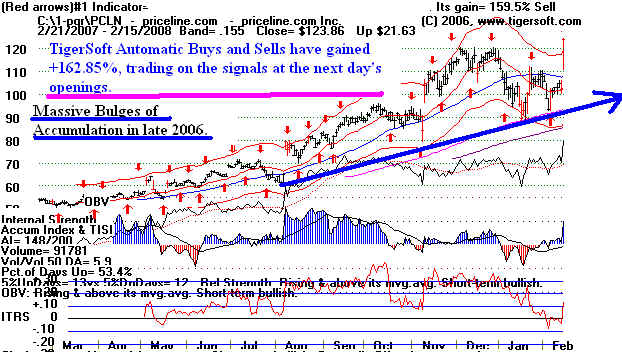

======================== PRICELINE.COM

==========================================

|

Watch

TigerSoft Accumulation Index and automatic signals to see when to Sell and when to Sell

Short.

|

Very Significant

Insider Selling comes before stock's decline. Then bulge from TigerSoft's

Accumulation

Index brings a good Buy.

|

Bearish

divergences between price and TigerSoft's Accumulation Index produce reliable Sell S9

Signals.

|

This chart shows how an intense of bulge of Accumulation sets off

a very nice rally until

the stock has a false

breakout. See other examples of a

false breakout.

|

==================================================================================

|