|

Watch The Professionals

To Catch

The Tops

in "Bubble -Trouble"

Stocks

Stocks that have made big runs upward

have to be sold sometimes.

Holding

them too tightly could let one lose all his or her big profits. That will

cause a

terrible case of regrets and self-recriminations. Fortunately, TigerSoft

can show

you how to sell very close the top. What we show here, over again,

is how the

stock tops out only when the Tiger Professional Power and/or Closing

Power

reverses and breaks its steep uptrend. Knowing this should give is

more

confidence to play "bubble" stocks, since we can now see when to sell.

And this

knowledge will also help us identify market tops, since so many of

these

explosive super stochs top out only when their sponsors see a top in the

general

market. That was true in early 2001 with QCOM, HGSI and IMCL. It was

true in

2006 and 2007 with any nymber of housing and bank stocks. And it was

true in

2008 with Crude Oil and silver stocks, to mention a few.

---------------------------------- QCOM 2000

-----------------------------------------------

TigerSoft losing Power Pct

---------------------------------- HGSI 2000

-----------------------------------------------

TigerSoft Pro-Power Indicator

----------------------------------

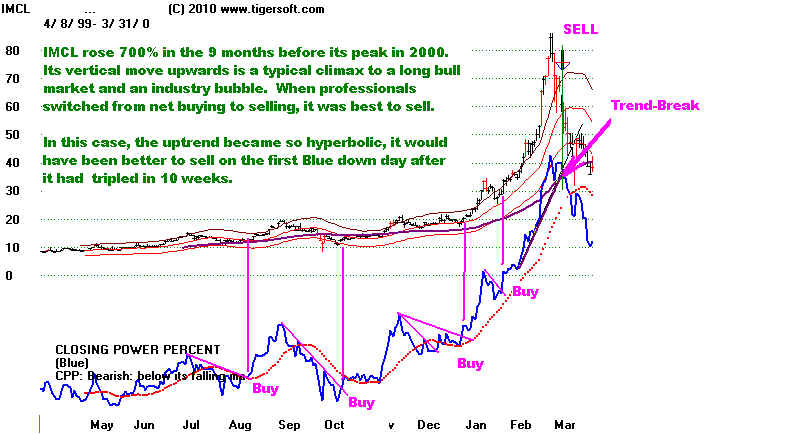

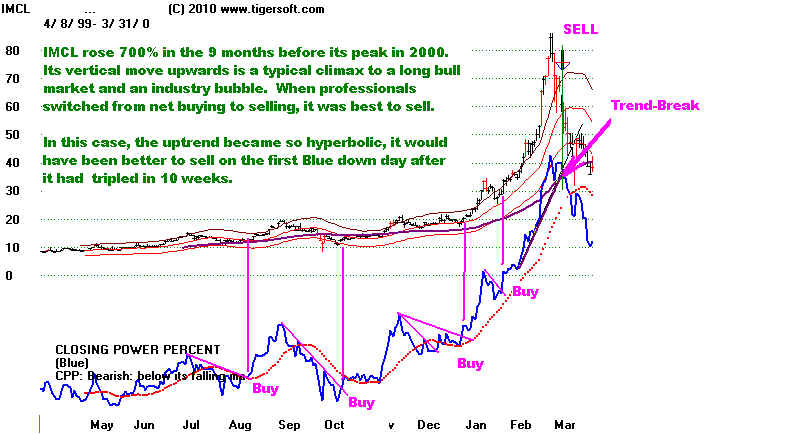

IMCL 2000 -----------------------------------------------

Closing Power Pct

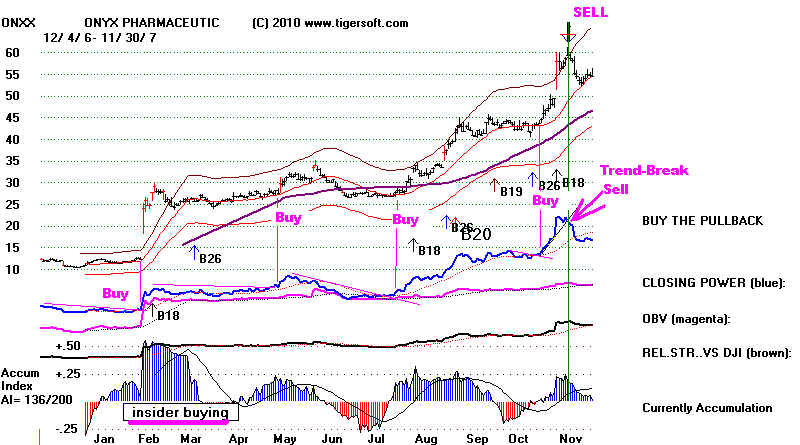

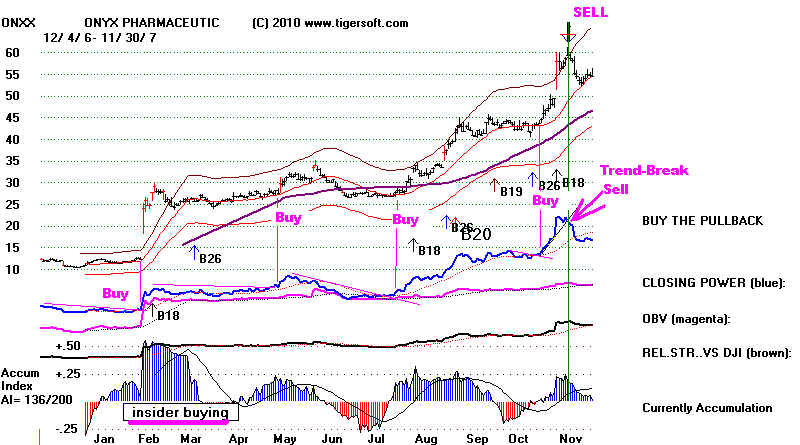

-------------------------------- ONYX

2006-2007 -----------------------------------------------

Closing Power Trend-Reversal at top.

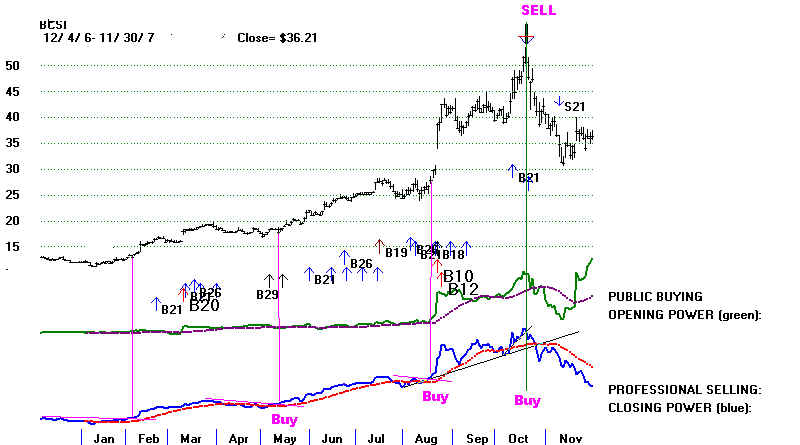

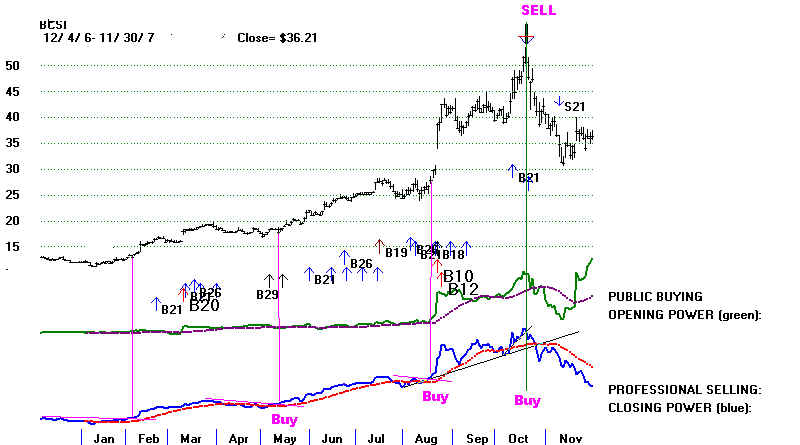

-------------------------------- TBSI

2006-2007 -----------------------------------------------

Closing Power Trend-Reversal at top.

---------------------------------

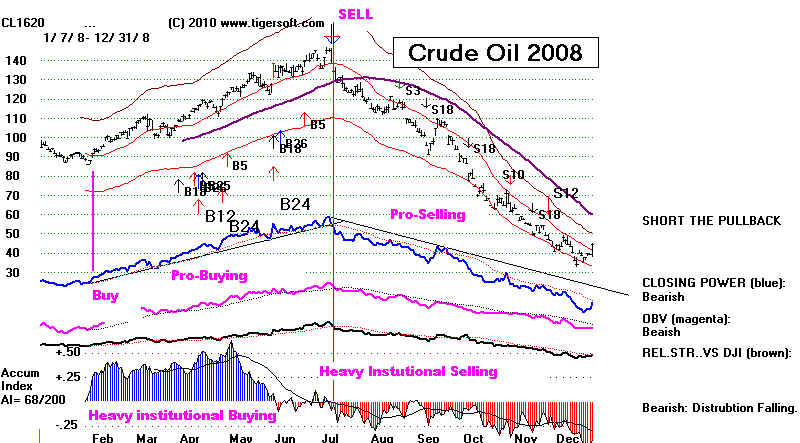

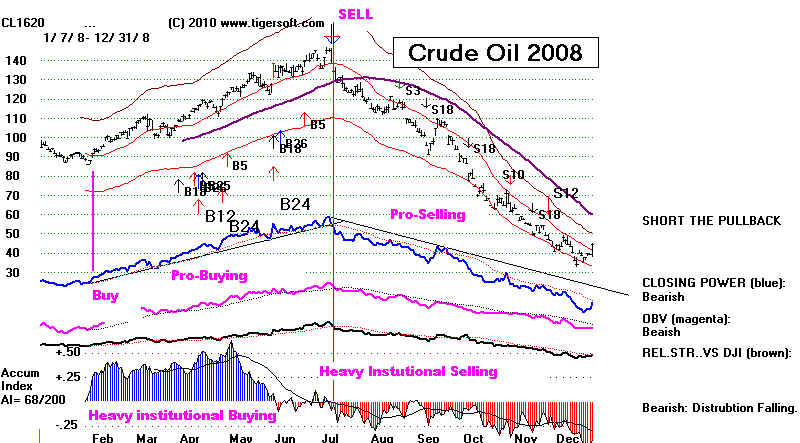

Crude Oil 2007-2008 -----------------------------------------------

Closing Power Trend-Reversal at top.

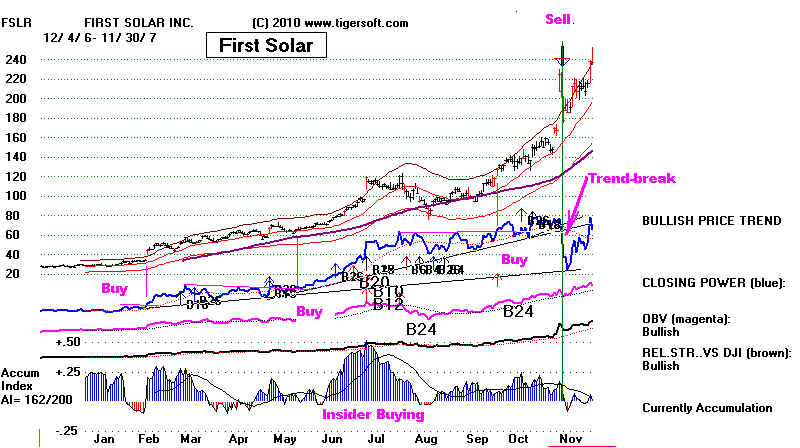

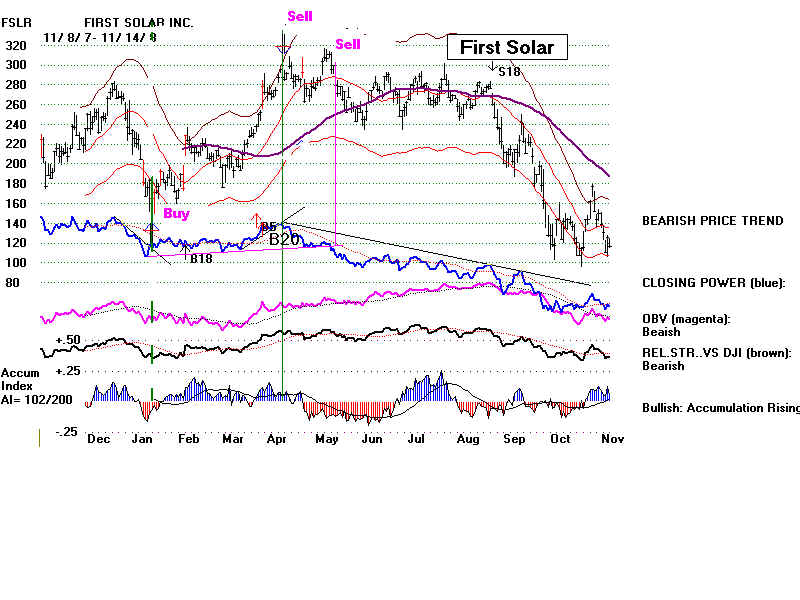

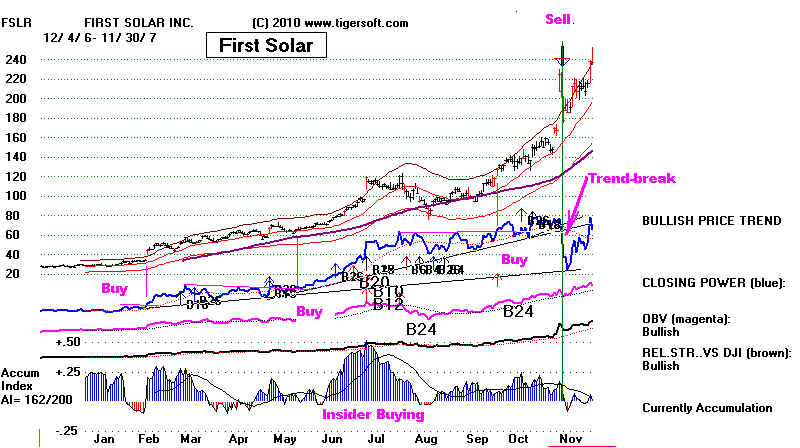

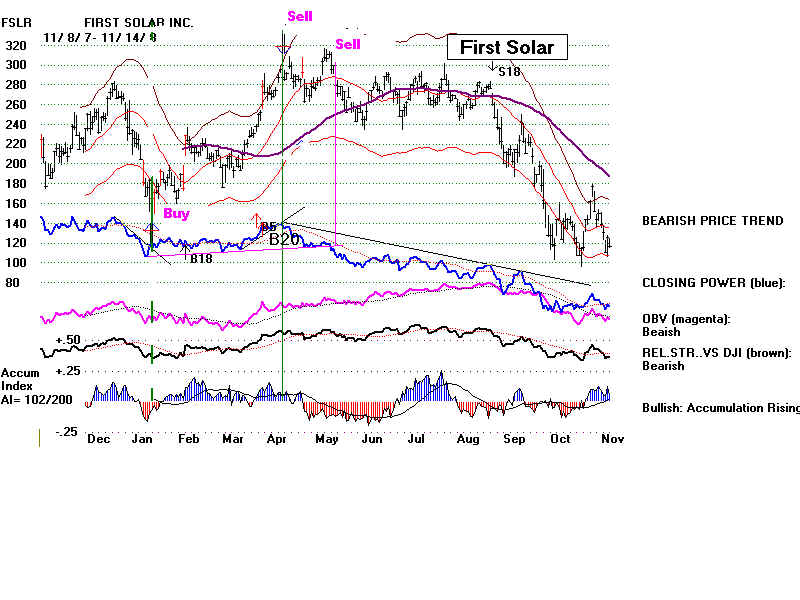

--------------------------------- FSLR

2007-2008 -----------------------------------------------

Closing Power - Here the first Closing Power trend-break

was premature.

If this happens, Buy it on the next CP

downtrend-break and Sell on the

next CP-uptrend break.

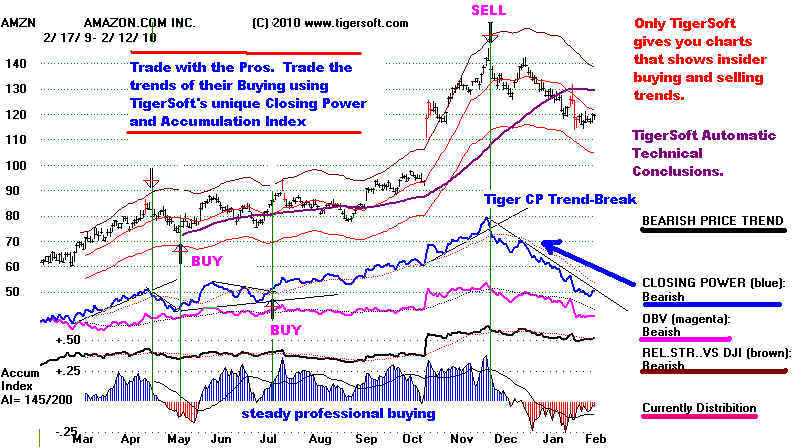

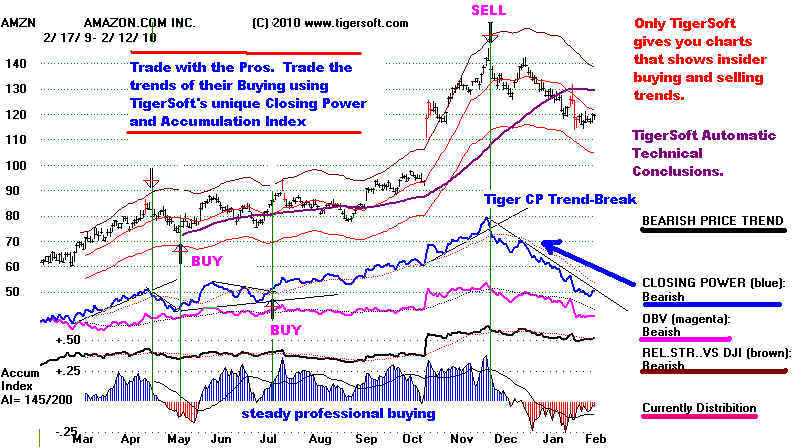

-------------------------------- AMZN

2009-2010 -----------------------------------------------

Closing Power Trend-Break

-

AMZN cannot

be said to have had a bubble-type advance.

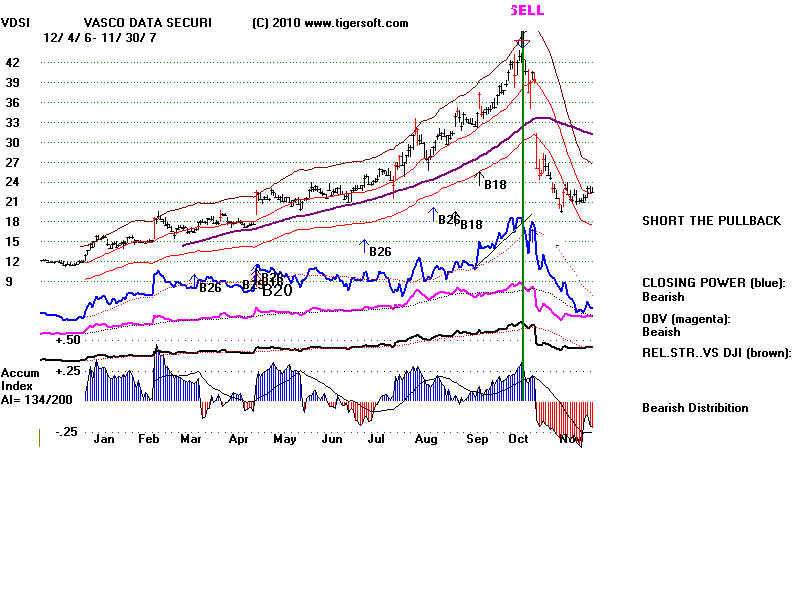

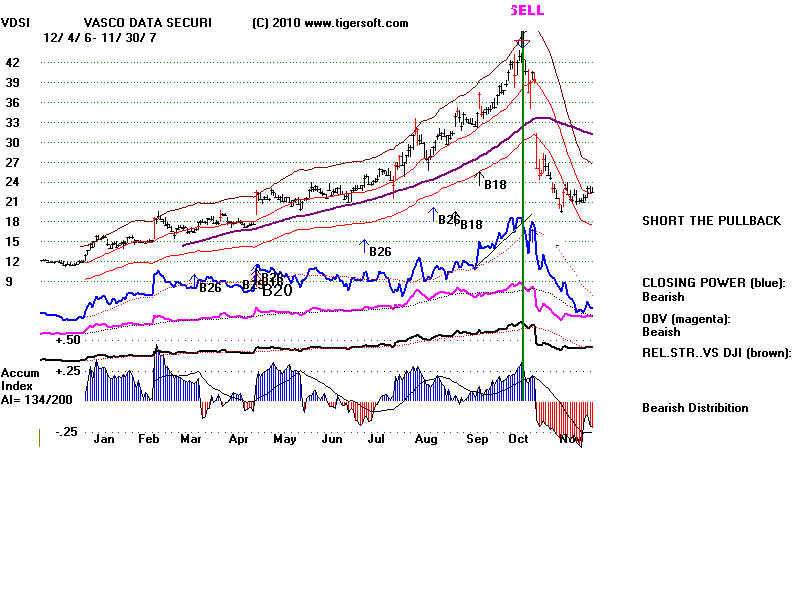

Other Charts showing

big advances and CLosing Power Uptrend-Breaks

|