|

Daily Blog - Tiger Software Back

to Home Page - www.tigersoft.com |

KTEC Key Technologies

shows very steady intense and extensive

Big Money" accumulation, as of 12/22/2007.

Look at the charts

below for the charts of 2006 and 2007. This usually

means

mutual funds are taking positions or the news is getting

out that the

company is doing very well.

KTEC now shows more 'Big Money Accumulation' than all but five

or six stocks in the 6500 TigerSoft monitors. It suggests big

investors

see a rosy future for their stock, barring a bear market for

stocks

as a whole.

Big Money buying is very evident. This is the best

predictor of significant

price gains. TigerSoft has studied what best predicts the

best gainers

extensively for many years.

See http://www.tigersoft.com/Tiger-Blogs/8-30-2007/index.htm

Insiders are selling to

institutional buyers. The stock is way below the

radar of most small investors. It should go

significantly higher, as investors try

to avoid risk by buying more defensive stocks, including

those in food related businesses.

It has already achieved the 58% yearly gain we expect from

typical stocks that look

it did in the Fall of 2006, in terns of intense Accumulation and

a price breakout.

Earnings Are Good.

November 15, 2007 - Nov 15, 2007 -- Key Technology, Inc. (NasdaqGM:KTEC - News)

announced sales and operating results for the year ended September 30,

2007. Net sales for fiscal 2007

were $107.5 million, a 26.8% increase over the $84.8 million reported

for fiscal 2006. The Company

reported record net earnings for the year of $7.4 million, or $1.37 per

diluted share, compared with a

net loss of $793,000, or $0.15 per diluted share, for fiscal 2006...At

the close of the September 2007

quarter, the Company's backlog was a fourth-quarter record of $30.9

million compared to $22.8 million

at the close of the corresponding period one year ago, an increase of

35.9 %... We are pleased that our

operating expenses to sales ratio for fiscal 2007 dropped 6.9% from

fiscal 2006. This decrease contributed

significantly to our 8% operating earnings to sales performance for

fiscal 2007. Our analysis convinces us

that we can make further improvements to operating earnings percentage

in 2008 with programs that we are

already pursuing."

Food Industry Is Strong

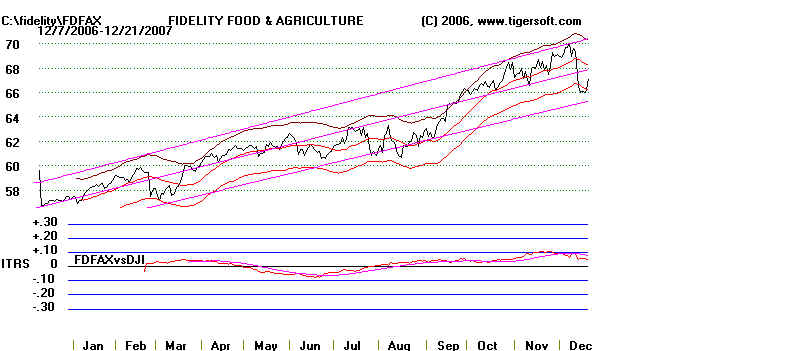

The Fidelity Food Sector fund has been rising since mid 2007, despite a weak market for

many groups..

What KTEC Does

http://finance.yahoo.com/q/pr?s=KTEC

Key Technology, Inc., together with its subsidiaries, engages in the design, manufacture,

sale, and service of process

automation systems, integrating electro-optical inspection and sorting, specialized

conveying, and product preparation

equipment. The company's automated inspection systems are used in various applications to

detect and eliminate defects

and foreign materials during the processing of raw and semi-finished products. It offers

ADR Systems, which are used

to transport, inspect, and remove defects from French fries; Tobacco Sorter 3, tobacco

sorting systems used in tobacco

threshing and primary processing; Tegra System, an optical sorter that provides in-air

defect removal; the Optyx family

|of sorters, which offers a combination of on-belt and in-air sorting; and pharmaceutical

and nutraceutical inspection

systems. The company also provides conveying and process systems, including the

SmartShaker vibratory solutions of

Iso-Flo and Impulse branded conveyor systems; Farmco rotary grading systems; Turbo- Flo

steam blanchers; Fort?

process control systems; Freshline product family for fresh-cut; and additional conveying

and processing equipment.

These conveying and process systems are used in conveying, transferring, distributing,

aligning, feeding, metering,

separating, and grading, as well as blanching, cooking, pasteurizing, cooling, cleaning,

washing, and drying. In addition,

Key Technology provides spare parts, and post-sale field and telephone-based repair

services. The company offers its

products to the food processing industry, as well as tobacco and pharmaceuticals

industries. It markets its products

directly and through independent sales representatives in the United States and

internationally. Key Technology was

founded in 1948 and is headquartered in Walla Walla, Washington.

Key Technology Inc.

150 Avery Street

Walla Walla, WA 99362

United States - Map

Phone: 509-529-2161

Fax: 509-522-3378

Web Site: http://www.keyww.com

Who's Buying and Selling in 2007?

Corporate insiders are exercising options to buy the stock and selling.

Gordon Wicher - Officer

SOLD 5,000 1,875 5000 9000 12,000 20,400

8,600 14,000 36,000

5,000 7,000 20,361 15,000 or more than

150,000 shares

( http://biz.yahoo.com/t/54/366.html )

Donald Washburn

- Officer 15,000

Michael Shannon -

Officer 125,581 1,300 7,100 15,000 16,500

10,000 2,456

( http://biz.yahoo.com/t/53/366.html

)

and others.

Yahoo reports: ( http://finance.yahoo.com/q/it?s=KTEC

)

Insider Selling To Mutual Fund Buyers

It

is common for corporate insiders to sell shares to institutions. They do this

because they

realize the best way to get outsiders to see what

they have created is to offer them a part of the

package. Then they will have a vested interest

in spreading the word. Walla Walla is long way

from Wall Street. This seems a plausible

explanation for the option exercising and selling

seen. Fidelity, for example, does not seem to

have a position in this company. To me that

suggests potential ahead.

INSTTUTIONAL HOLDERS

| ROYCE & ASSOCIATES, INC. | 378,343 | 6.81 | $11,388,124 | 30-Sep-07 |

| ALYDAR PARTNERS, LLC | 350,000 | 6.30 | $10,535,000 | 30-Sep-07 |

| BANK OF AMERICA CORPORATION | 347,322 | 6.26 | $10,454,392 | 30-Sep-07 |

| DIMENSIONAL FUND ADVISORS INC | 265,980 | 4.79 | $8,005,998 | 30-Sep-07 |

| WACHOVIA CORP NEW | 242,145 | 4.36 | $7,288,564 | 30-Sep-07 |

| BJURMAN, BARRY & ASSOCIATES | 177,500 | 3.20 | $5,342,750 | 30-Sep-07 |

| KENNEDY CAPITAL MANAGEMENT, INC. | 173,385 | 3.12 | $5,218,888 | 30-Sep-07 |

| NUMERIC INVESTORS, LIMITED PARTNERSHIP | 144,735 | 2.61 | $4,356,523 | 30-Sep-07 |

| Clarus Capital Group Management LP | 83,951 | 1.51 | $2,526,925 | 30-Sep-07 |

| AXA | 61,034 | 1.10 | $1,837,123 | 30-Sep-0 |

---------------------------------- KTEC 2006 -------------------------------------------------------------------------