2008's Biggest Losers: Days back= 8

12 / 31 / 2007 - 1 / 11 / 2008

Rank Symbol Name Price Pct.Gain AI(0-200) Closing Power

--------- ----------------------------------- ---------- ------------ ----------- --------------

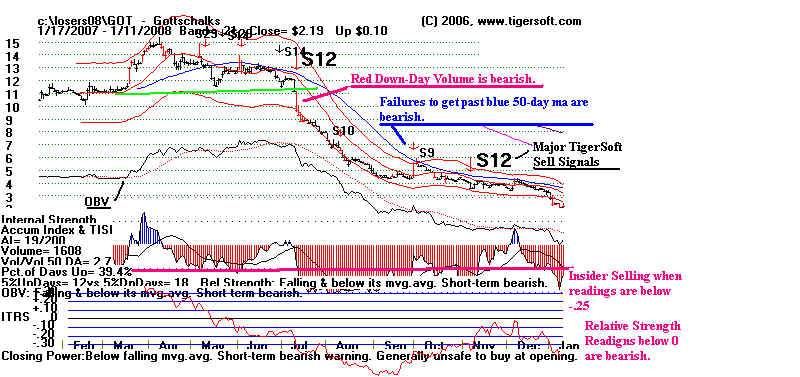

1 GOT Gottschalks 2.19 -35% 19 39%

Thursday January 10, 8:29 am ET Gottschalks Says December Same-Store

Sales Tumble 13.8 Pct, Sees 4th-Qtr Profit Below Forecast

Insider Transactions of 10,000 or more as reported by Yahoo.

| 15-Mar-07 |

FAMALETTE JIM

Officer |

20,000 |

Direct |

Disposition (Non Open Market) |

| 15-Mar-07 |

LEVY JOSEPH

Officer |

10,000 |

Direct |

Disposition (Non Open Market) |

| 21-Mar-07 |

SCHMIDT MIKE

Officer |

14,000 |

Direct |

Disposition (Non Open Market) |

| 4-Sep-07 |

LEVY JOSEPH

Director |

40,500 |

Direct |

Disposition (Non Open Market) |

2 NANO Nanometrics Incorporated 6.42 -35% 117 44%

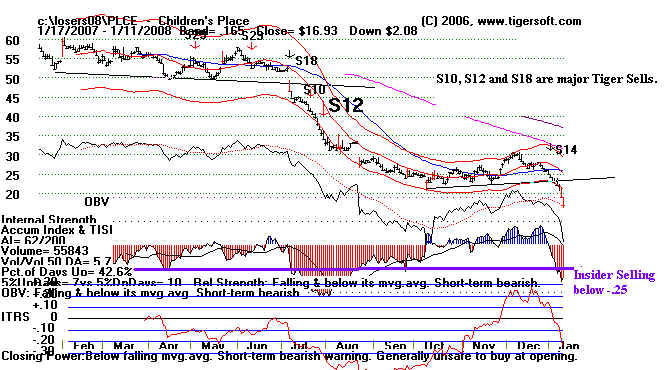

3 PLCE Children's Place 16.93 -35% 62 42%

2007 Sales results. 1/10/2008

2 NANO Nanometrics Incorporated 6.42 -35% 117 44%

3 PLCE Children's Place 16.93 -35% 62 42%

2007 Sales results. 1/10/2008

| 19-Mar-07 |

SILVERSTEIN RAINE

Beneficial Owner (10% or more) |

100,000 |

Indirect |

Disposition (Non Open Market) at $0 per share. |

| 19-Mar-07 |

DABAH RENEE

Beneficial Owner (10% or more) |

100,000 |

Indirect |

Disposition (Non Open Market) at $0 per share.

|

| 21-Dec-07 |

DABAH EZRA

Director |

22,000 |

Indirect |

Sale at $27.16 per share

|

7 directors granted 190,000 shares on December 7th at NO COST.

4 RFMD RF Micro Devices 3.73 -35% 46 43%

Insider Sales for last six months: 377,500 shares

4 RFMD RF Micro Devices 3.73 -35% 46 43%

Insider Sales for last six months: 377,500 shares

5 SPEC Spectrum Control 10.03 -35% 111 46%

6 SPF Standard Pacific Corp. 2.2 -35% 42 39%

7 VSAT ViaSat 22.72 -35% 139 50%

8 BKUNA Bankunited Financial Corp 4.48 -36% 39 42%

Insider Transactions - http://finance.yahoo.com/q/it?s=BKUNA

5 SPEC Spectrum Control 10.03 -35% 111 46%

6 SPF Standard Pacific Corp. 2.2 -35% 42 39%

7 VSAT ViaSat 22.72 -35% 139 50%

8 BKUNA Bankunited Financial Corp 4.48 -36% 39 42%

Insider Transactions - http://finance.yahoo.com/q/it?s=BKUNA

9 MW Men's Wearhouse 17.52 -36% 120 44%

Yahoo reports insiders sold a net of 115,500 shares in last 6 months.

George Zimmer sold 4 lots of 37,500 shares apiece since last June,

at between 51.23 and 39.34.

9 MW Men's Wearhouse 17.52 -36% 120 44%

Yahoo reports insiders sold a net of 115,500 shares in last 6 months.

George Zimmer sold 4 lots of 37,500 shares apiece since last June,

at between 51.23 and 39.34.

10 WRLS Telular Corporation 4.4 -36% 157 51%

Yahoo reports insiders sold a net of 180,414 shares in last 6 months.

10 WRLS Telular Corporation 4.4 -36% 157 51%

Yahoo reports insiders sold a net of 180,414 shares in last 6 months.

11 ACAT Arctic Cat 7.58 -37% 37 47%

| 23-May-07 |

DELMORE TIMOTHY C

Officer |

44,999 |

Direct |

Sale at $19.38 - $19.38 per share. |

$872,0002 |

| 8-Jun-07 |

SKIME ROGER H

Officer |

28,600 |

Direct |

Sale at $19.40 - $19.42 per share. |

$555,000 |

| 9-Aug-07 |

NESS WILLIAM G

Director |

2,000 |

Direct |

Sale at $17.51 - $17.51 per share. |

$35,000 |

| 13-Aug-07 |

NESS WILLIAM G

Director |

4,000 |

Direct |

Sale at $17.56 - $17.56 per share. |

12 LYTS LSI Industries 11.62 -37% 82 48%

13 MDTL Medis Techn. 9.73 -37% 104 44%

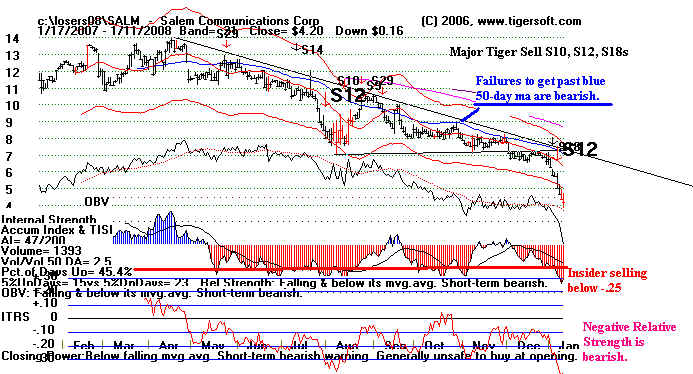

14 RSTO Restoration Hardware 4.2 -37% 77 38%

15 SALM Salem Communications Corp 4.2 -37% 47 45%

12 LYTS LSI Industries 11.62 -37% 82 48%

13 MDTL Medis Techn. 9.73 -37% 104 44%

14 RSTO Restoration Hardware 4.2 -37% 77 38%

15 SALM Salem Communications Corp 4.2 -37% 47 45%

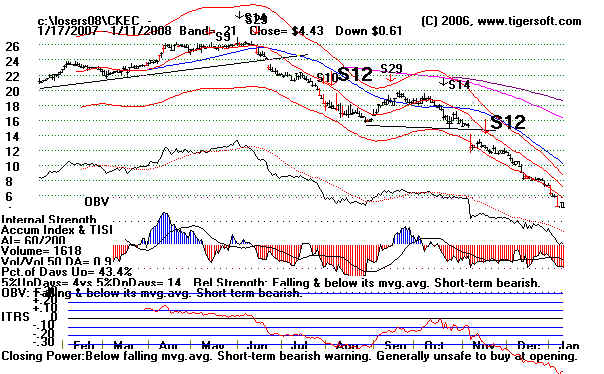

16 CKEC Carmike Cinemas 4.43 -39% 60 40%

| 29-May-07 |

RHEAD ANTHONY J

Officer |

54,963 |

Direct |

Sale at $26 - $26 per share. |

$1,429,000 |

17 GBE Grubb & Ellis Co. 3.95 -39% 103 44%

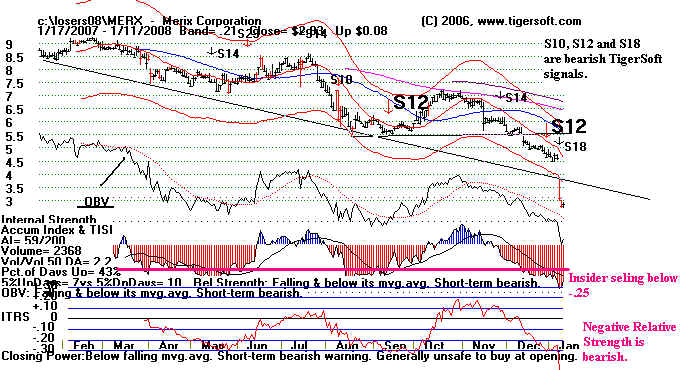

18 MERX Merix Corporation 2.83 -40% 59 41%

17 GBE Grubb & Ellis Co. 3.95 -39% 103 44%

18 MERX Merix Corporation 2.83 -40% 59 41%

19 MTH Meritage Corporation 8.78 -40% 38 36%

20 TLB Talbots 6.96 -42% 91 44%

19 MTH Meritage Corporation 8.78 -40% 38 36%

20 TLB Talbots 6.96 -42% 91 44%

21 EFII Electronics For Imaging 12.88 -43% 128 50%

22 ININ Interactive Intelligence 13.96 -48% 100 48%

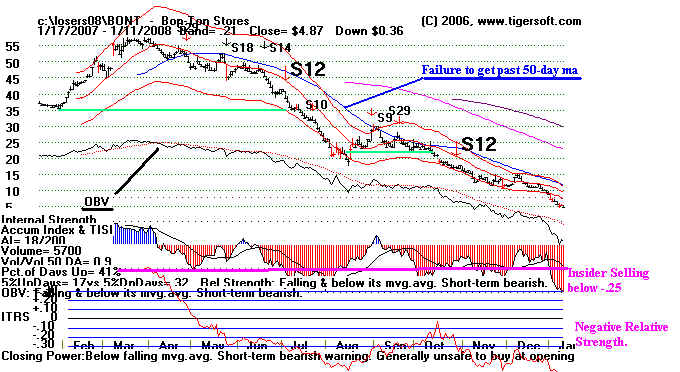

23 BONT Bon-Ton Stores 4.87 -49% 18 41%

24 IQW Quebecor World .9 -50% 20 42%

See comments - Hall of Shame

24 IQW Quebecor World .9 -50% 20 42%

See comments - Hall of Shame

25 WCI WCI Communities 1.9 -50% 36 39%

25 WCI WCI Communities 1.9 -50% 36 39%

|