TigerSoft New Service 7/15/2010

TigerSoft New Service 7/15/2010 What's New from TigerSoft in 2009-2010?

1) Peerless Automatic Buys and Sells are now back-tested to 1928.

There's a lot to learn from the 1930s.

2) TigerSoft Builds Indexes of Any Group of Stocks with Buy/Sell

Signals, A/D Line, Charts of Pct of Stocks above 65-dma, and much more..

3) TigerSoft Builds a Table showing the statuses of all stocks'

Opening and CLosing Powers.

4) TigerSoft's Data Page now gives you downloadable data on

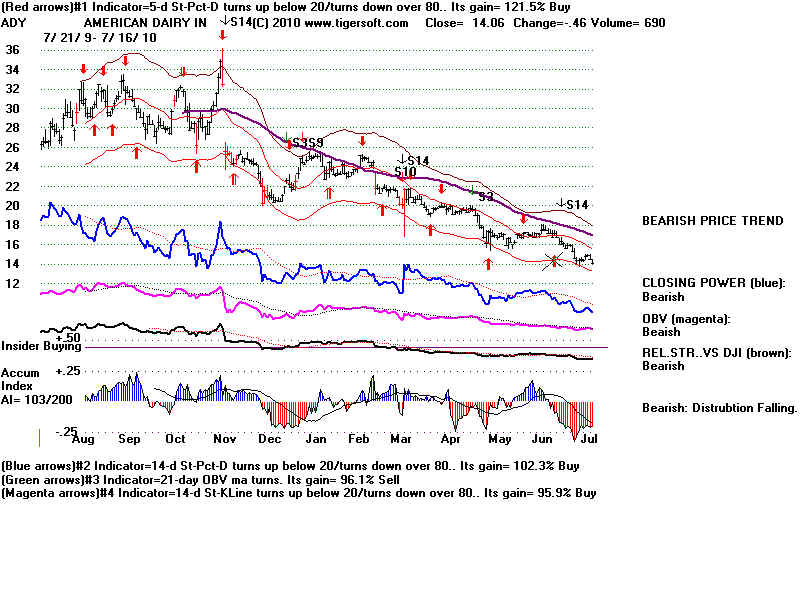

A) All the Stocks whose Closing Power is making new highs and

B) All the Stocks whose Closing Power is making new lows.

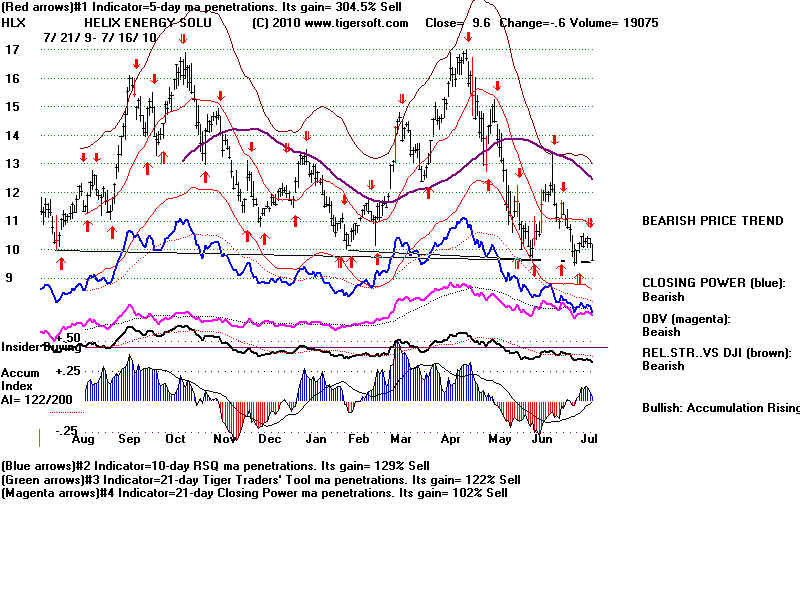

5) TigerSoft's Data Page now gives you downloadable data on

All the Stocks best traded with Short-Term Indicators. Most made

more than 100% in the last year.

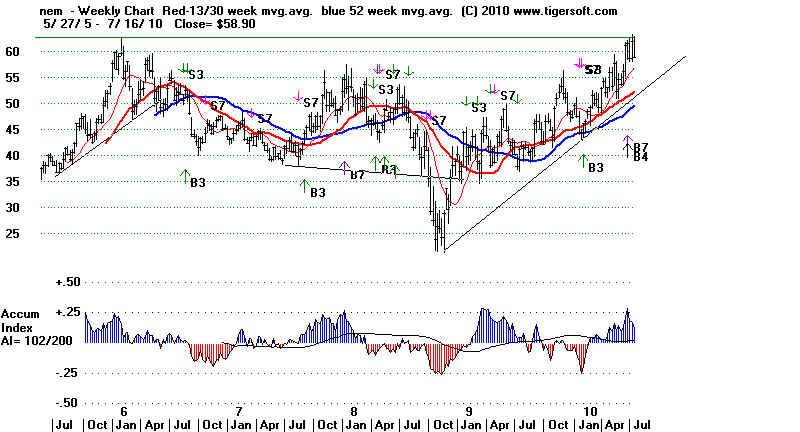

6) TigerSoft flags new 5-year weekly highs and lows for 600+

stocks, mostly in the SP-500 and NASDAQ-100 and shows new

weekly Buys and Sells on 5-Year Charts.

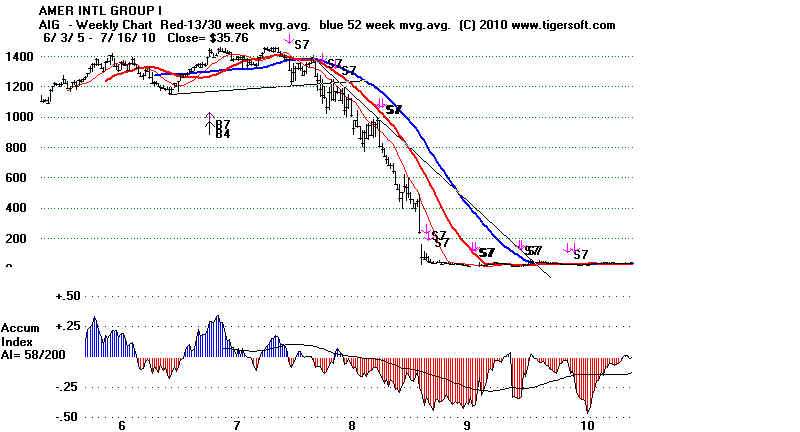

Make Money. Use TigerSoft To Track Key Insider Buying and Selling in All Your Stocks

www.tigersoft.com PO Box 9491 - San Diego, CA 92169 - 858-273-5900 - william_schmidt @hotmail.com

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

|

Tiger Software

|

Existing owners of TigerSoft want to stay current. There

are two ways of doing this.

A.) For $295, we provide all the updates to the Peerless

and TigerSoft plus 3 months of the Nightly Hotline and

Nightly Data on 6000 stocks.

B.) For $595, we provide all the updates to the Peerless

and TigerSoft for a year, full documentation and 12 months

of the Nightly Hotline, Nightly Data on 6000 stocks and

Tiger's Bullish and Bearish Special Situations and Weekly

Elite Stock Professional Report.

Call us 858-273-5900

or email us william_schmidt@hotmail.com

or Fill Out this Order Form

Elite Stock Professional Service ("ESP") for one year.

New Research

All New Software Updates

Data for 6000 Stocks...

Nightly Hotline

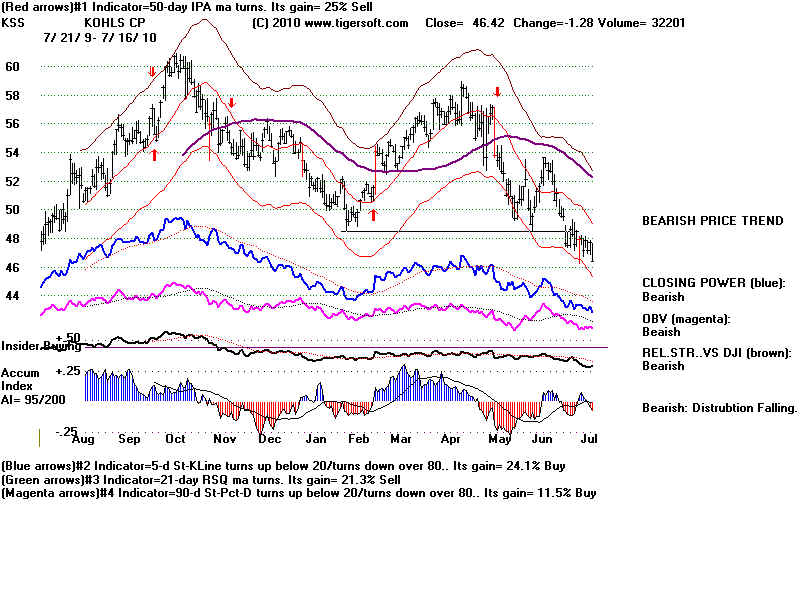

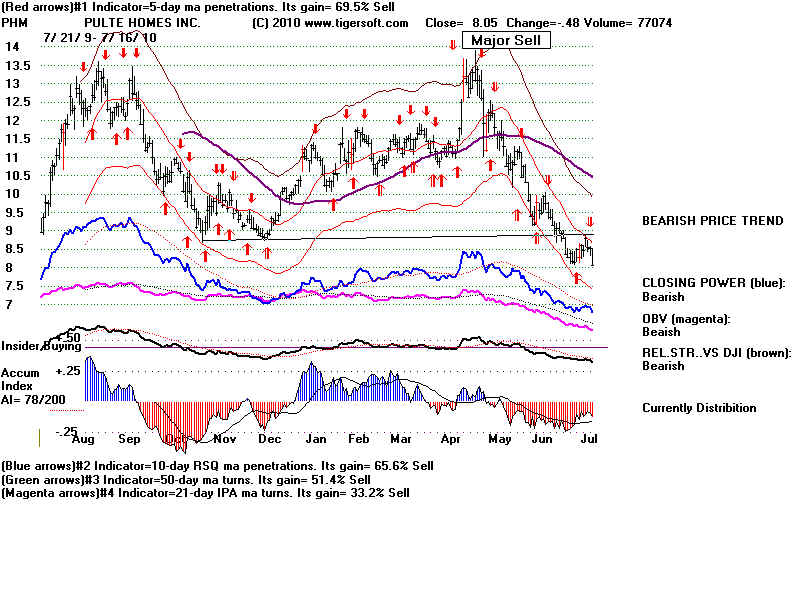

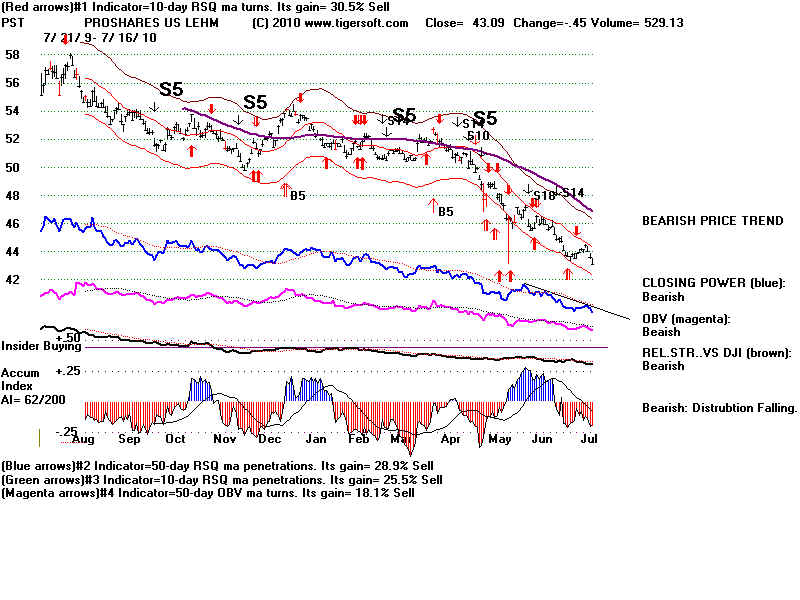

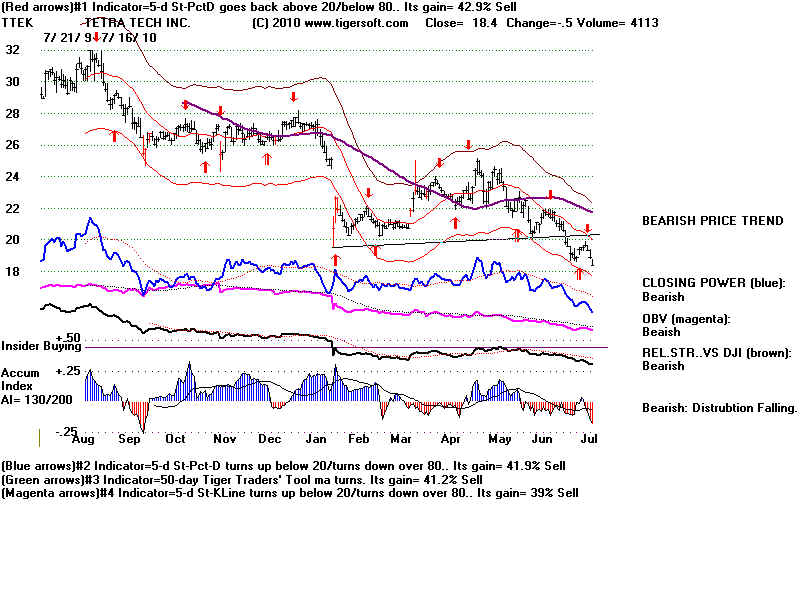

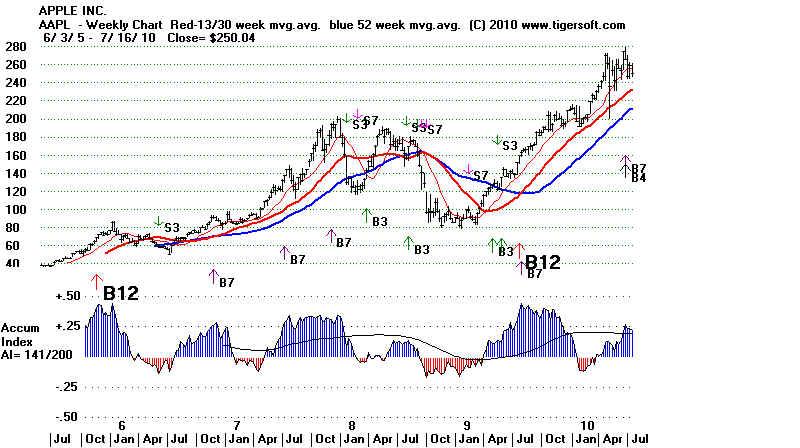

Bullish Special Situations

Bearish Special Situations

Weekly On-Line Posting of Most Highly Accumulated Stocks

.... $595. ===> Order Here

What's New from TigerSoft?

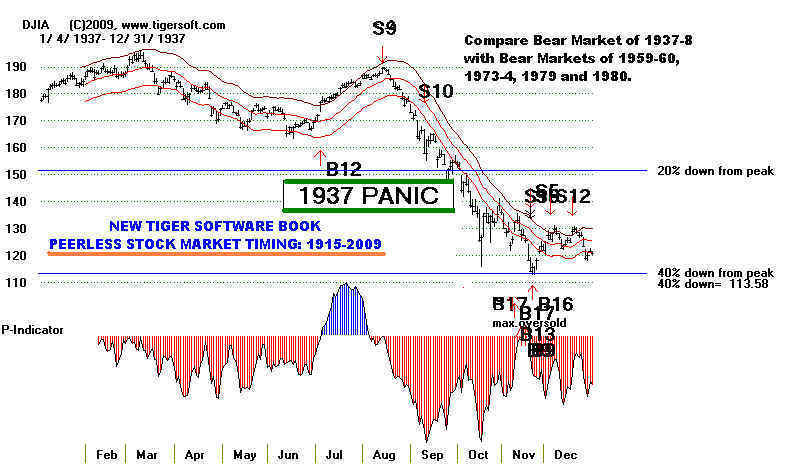

1) Peerless Automatic Buys and

Sells are now back-tested to

1928. Here is a sample from

1937. This shows the DJIA at the

time FDR was backing away from New Deal Public Works programs

in favor of traditional deflationary budget balancing. The DJI

fell nearly 50% in 6 months! Is the market now at such a dangerous

point. Subscribe to our Hotline and find out what we think.

"SELL

S9"

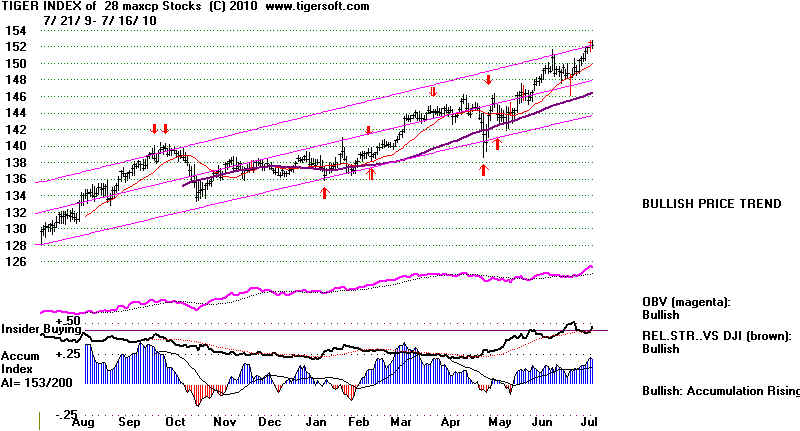

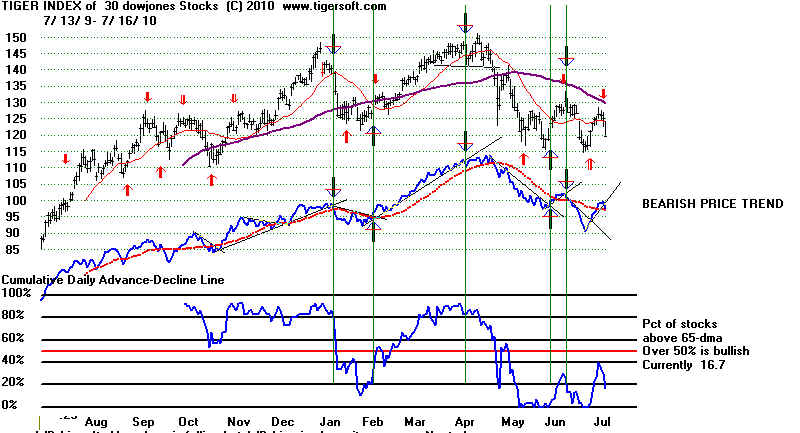

These Tiger-Index charts weight the stocks by volume x price,

instead of by price alone, as the DJIA does.

You also get automatic Buys and Sells with key TigerSoft indicators.

Sample - DJIA - 7/17/2010

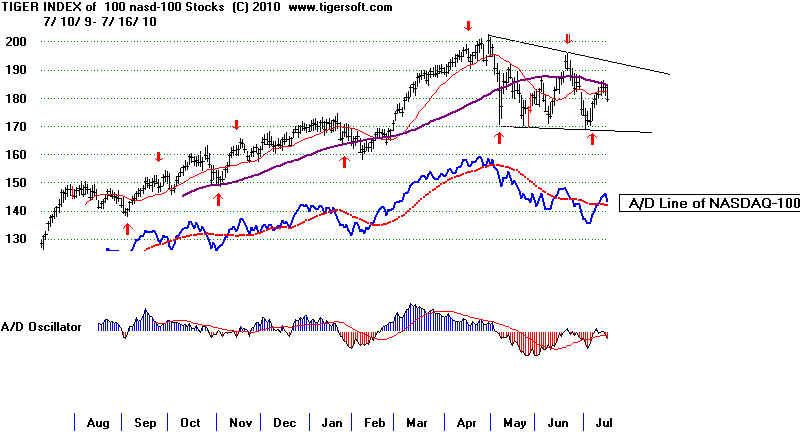

Charts also show the groups' A/D Line, A/D Oscillator and the P-Indicator.

as well as the percentage of stocks over 65-dma.

Vertical lines show where A/D Line trend-breaks occur on DJIA-30.

A/D Line and A/D Line Oscillator for NASDAQ-100 Stocks

Power status.

Both UP is the most bullish trading condition, until CLosing

Power breaks its uptrend.

Both DOWN is the most bearish trading condition, until CLosing

Power breaks its downtrend.

Get the sense of the current market from this:

Presently, none of the DJIA-30 are either BOTHUP (bullish) or

BOTHDOWN (bearish. Table does show that each day the BOTHUP

condition is true for AA (Alcoa), the stock rises 1.3%. HPQ's average

daily gain is 1.2% in this condition. BAC's stock is the most vulnerable

when the BOTHDOWN condition is obtained.

Just click on any row and "Graph" to get the Tiger graph.

No stocks are bullish rated UU, BOTH UP

Exclamations show a change.

Opening/Closing Power Status, DAILY AVG GAINS for BOTH UP and BOTH DOWN 7/ 13/ 9- 7/ 16/ 10 C:\dowjones ------------------------------------------------------------------------------ Symbol Status Both Up Both Down ------ ------ Daily Avg. Count Daily Avg. Count ------------------------------------------------------------------------------ AA UD .013 42 -.013 37 AXP UD! .009 72 -.013 23 BA UD .008 71 -.005 26 BAC ?D .007 38 -.016 4 CAT UD! .006 86 -.007 23 CSCO UD! .007 23 -.01 21 CVX UD .005 63 -.005 36 DD UD! .006 41 -.008 18 DIS UD! .011 26 -.01 19 GE UD .005 64 -.01 22 HD UD .005 48 -.007 27 HPQ U? .012 9 -.007 26 IBM D? .003 9 -.007 14 INTC UD .007 48 -.009 17 JNJ UD! .002 24 -.002 22 JPM UD! .004 53 -.009 24 KFT UD .005 30 -.005 21 KO U? .002 10 -.006 23 MCD U? .004 88 -.005 17 MMM UD! .004 65 -.004 15 MRK U? .004 56 -.005 6 MSFT UD .004 25 -.005 29 PFE UD .009 27 -.005 34 PG ?U .006 38 -.002 21 T ?D! .004 32 -.005 10 TRV UD .007 40 -.008 26 UTX UD! .004 62 -.004 32 VZ UD .005 37 -.005 19 WMT UD .003 49 -.004 28 XOM UD .007 17 -.008 26 ------------------------------------------------------------------------------------------------------ 30 Stocks in this directory 26 Stocks with Rising Openings 1 Stocks with Falling Openings 1 Stocks with Rising Closings 24 Stocks with Falling Closings 0 BOTH UP Stocks 0 BOTH DOWN Stocks