Home

Page: www.tigersoft.com (C) 2013 www.tigersoft.com

858-273-5900. william_schmidt@hotmail.com

PEERLESS STOCK MARKET TIMING: 1915-2013

Peerless

- "Market history repeats and repeats. Insiders know these lessons.

Do

you? Peerless studies these patterns that repeat and repeat. It has turned

this

history into an intermediate term trading system of automatic Buys and Sells.

Learn

its rules and make much more money trading..

30% Annualized Rate

of Return since 1993 Trading SPY

Each of the Peerless Buy and Sell rules have worked for over 70 years!

On-Line

Book Order Here: $95

One Year of Peerless/Tiger

HOTLINE $298

Peerless Stock

Market Timing: 1929-2010 $395.

TigerSoft &

Peerless Stock Market Timing: 1929-2010 $495.

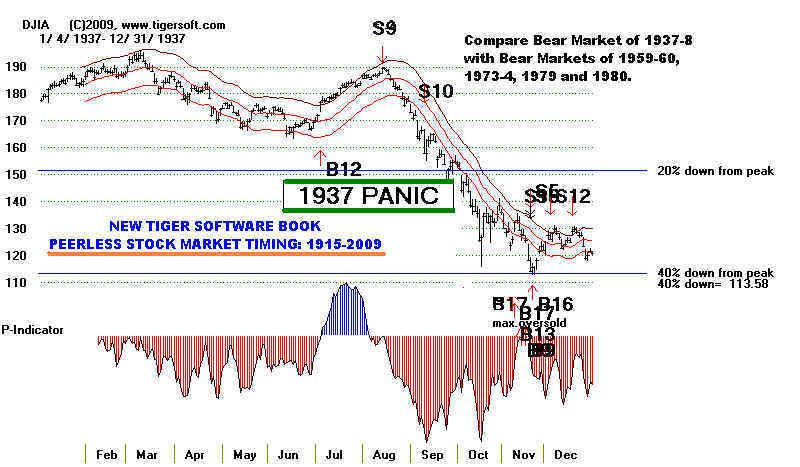

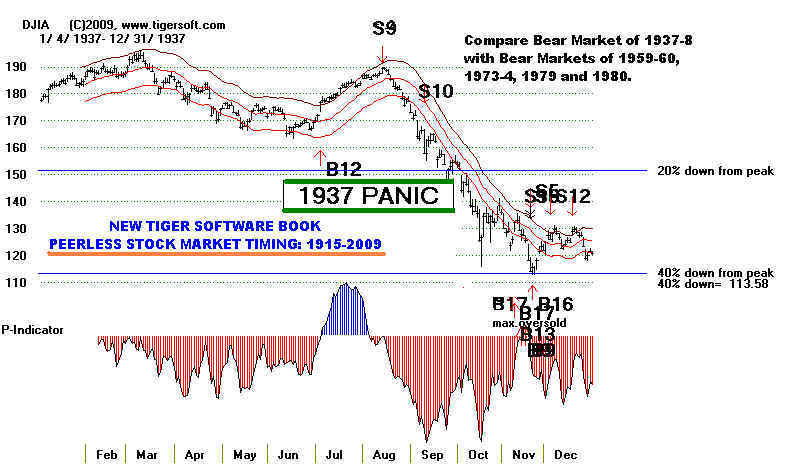

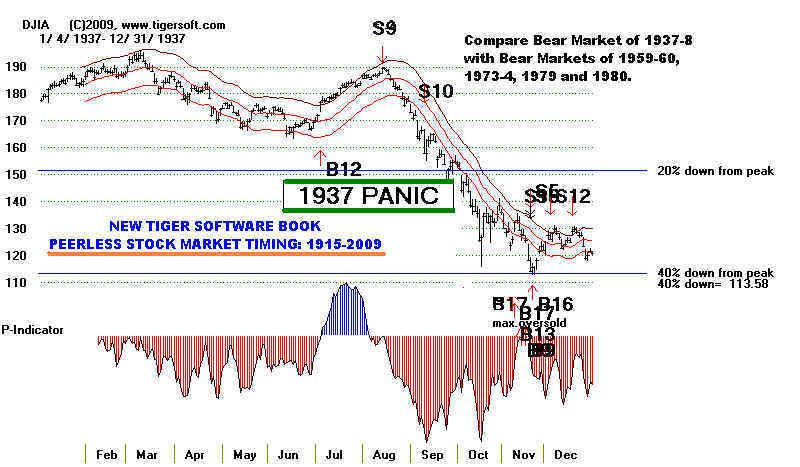

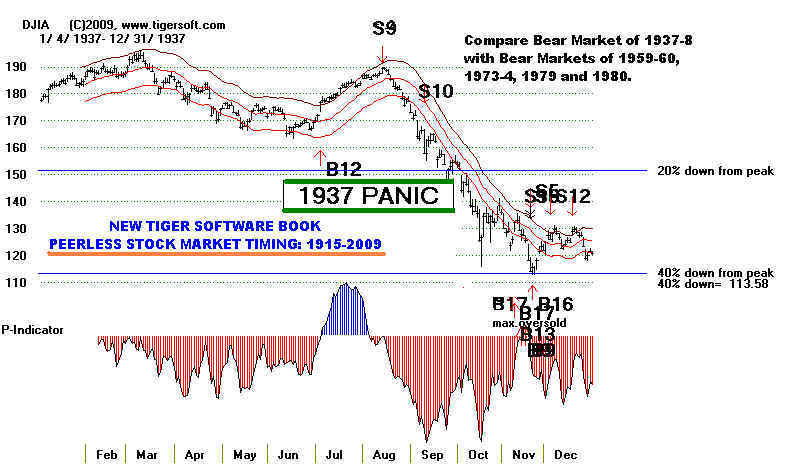

1937 Top and 47% Crash in

7 Months

Peerless Sell S9s and Sell S12s Call

Nearly All Market Tops!

Links to Peerless Studies at tis

site:

Peerless has called every significant top

and bottom since 1981

Peerless Software

Peerless

and Successful Retirement Peerless and Mutual Funds

Peerless and

ETFs DIA, QQQQ, SPY

Peerless

and Foreign ETFs UK Australia India

China France

2006 - Real-Time Peerless Signals

2007 - Real-Time Peerless Signals

2008 - Real-Time Peerless Signals

New Peerless Stock Market Timing: 1915-2009

On-Line Book

Order Here: $95

The Peerless Buys and Sells are automatic.

In our book, they are explained and their track record

is presented in depth. We see how reliable and

strong each is. We see what conditions weaken and

strnegthen them, especially seasonality.

The astute trader

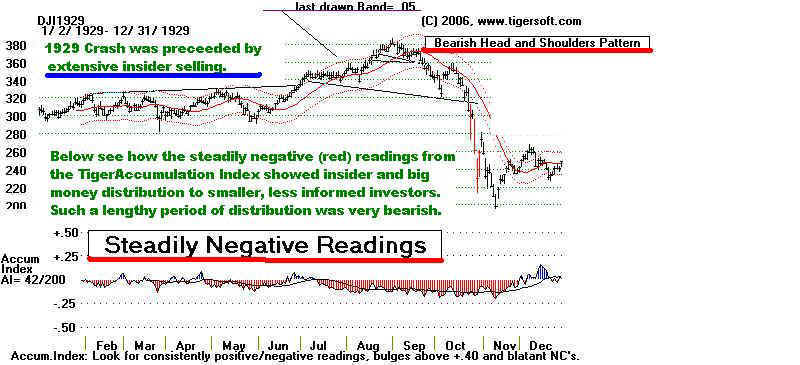

will want more. Accordingly, he/she will also see how Peerless uses the A/D Line and New

Highs and Lows. It is vital to learn

the strengths and also the weaknesses breadth indicators show historically.

Price patterns are also important. But

sometimes they are a trap. Peerless shows when that it most likely

and how to detect their falseness as they are being

made. Read Peerless and learn how to use chart patterns

like Inverted

Head and Shoulders and Wedge

Patterns, by seeing them repeat and repeat over a period of

85 years. See how profitable it is to use Divergence Analysis.

This is where we looking to see if the DJI-30's

new highs and lows are confirmed by an assortment of

key indicators we have created for this purpose

- P-Indicator.

V-Indicator, Accumulation, Closing Power, Synchrocity, IPA and OBVPct. Compare

our

tools wuth those in the public domain: Volume, OBV, Stochastics, Commodity Channel

Index.

We think you will like

our tools even more. Dr. Schmist pioneered Price Bands, Seasonality and Regression

Channels back in the early 1980s.

See how important they are over and over as we spot each year's market tops

and bottoms. We also offer what we

think are the best ways to use Key

Moving Averages to watch the market's

own Momentum.

Uptrends are self-perpetuating past a certain point. So are declines. Get our

book and see

how we identify

the high inflection points.

We think you will be

fascinated by the interplay of sych factors as:

Government Leaks to Wall Street,

Insider Buying, Insider Selling,

Seasonality, the Presidential 4 Year Cycle,

Fed Monetary policies and Fed Chairmen's words,

Unemployment and CPI Data,

Gold and Oil Prices,

Wall Steet Program Computerized Trading,

Sinister Wall Street Bear Raids and Bucket Shops, which are still allowed by the SEC,

Predictible Cycles of Mass Hysteria, Fear and Greed,

Public versus Professional Buying and Selling

War, War, Invasions

Assassinations and Heart Attacks....

These forces are constantly interacting.

Amazingly, throughout the years, the Peerless Buys and Sells seem

almost always to know what's most important, where

stock prices are headed. Thus, you will discover

just what Technical

DATA is most essential. It's so easy to get overwhelmed. Let us show

you what

data you absolutely must have to do a good job of

market timing. .

.

There's a lot to keep in mind. So, we show you

how to employ these factors systematically. And,

most importantly, we show you how to simplify

everything by using the Peerless

Automatic Buy and

Sell Signals. Each major Buy

and Sell signal is discussed in detail. Each signal's Track Record back

to 1928 is given. You will see what

key Technical Variables

produced the signal and which ones to look

at most closely to judge its likely success and

power.

The book will be uniquely helpful. It will show

all the DJIA charts since 1915, the full year and

the two-half year charts. You will learn how to

spot important tops and bottoms using our P-Indicator,

the NYSE A/ D Line, the TigerSoft Accumulation Index,

OBV-PCT and Daily Volume.

It will be an inavaluable reference book. The track

record of each Peerless signal will be given

along with an emphasis on the importance of the

4-year Presidential cycle, the role of politics and

the FED. This will give many more details about

the exact basis of each signal. You will also get

all the unmarked charts since 1915 with the key

indicators. This you will want to print out and

mark up and write your own notes on. Elsewhere,

I have placed key notations on each chart.

Buying and Blindly Holding Is Dangerous.

So is, trusting Wall Street, CEOs of Fed Chairman's To

Warn You in Time or even Tell You The Truth.

Peerless Stock Market Timing:

1915-2009

The First Task for A

Successful Trader:

Determine How Safe The Market Is.

Our Peerless Stock Market

Timing: 1915-2009 Will Tell You When The Market Is Safe

and When It Is Dangerous. Look at Its real-time

track record. As the world markets

become more and more integrated, the Peerless

automatic Buys and Sells have proven

themselves universally. Peerless averages 3

reversals per year. The average gain on

the DJI from Buy to Sell produces an average gain of

17%/year. 91% of Peerless signals

have been profitable. We provide all the data

needed. And if you prefer to simply get the

Buys and Sells with explanations and historical

justification, subscribe to our popular

on-Line Nightly Hotline.

Buys and Sells You Can Count On and Understand.

- Our Famous Warning of June 24, 2007 -

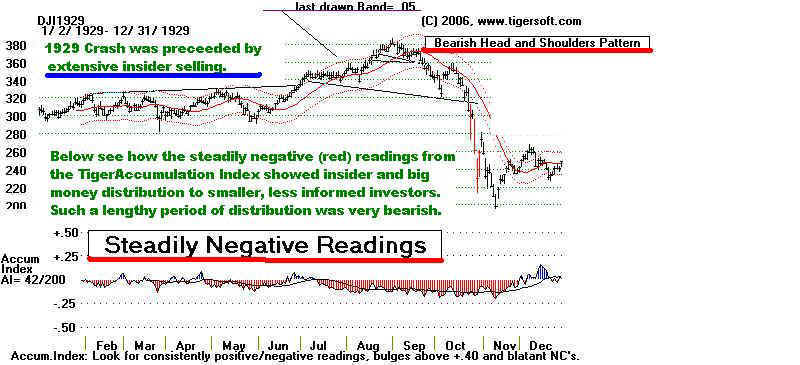

The 1929 Crash: Could It Happen Again? Yes - Absolutely.

The 1937 47% Crash:

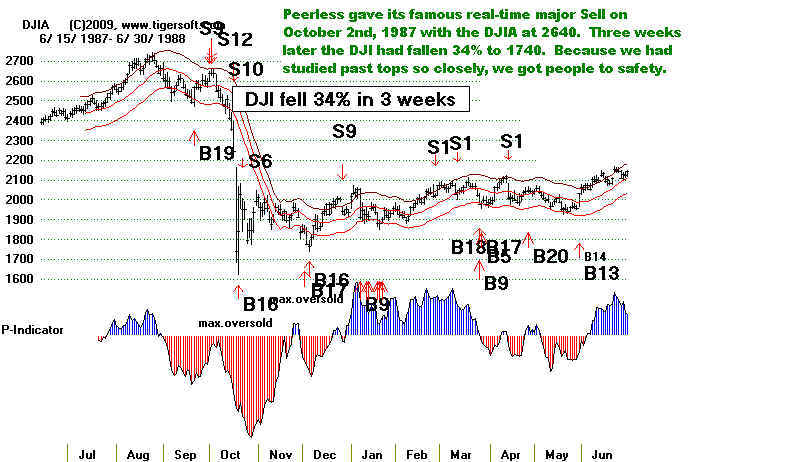

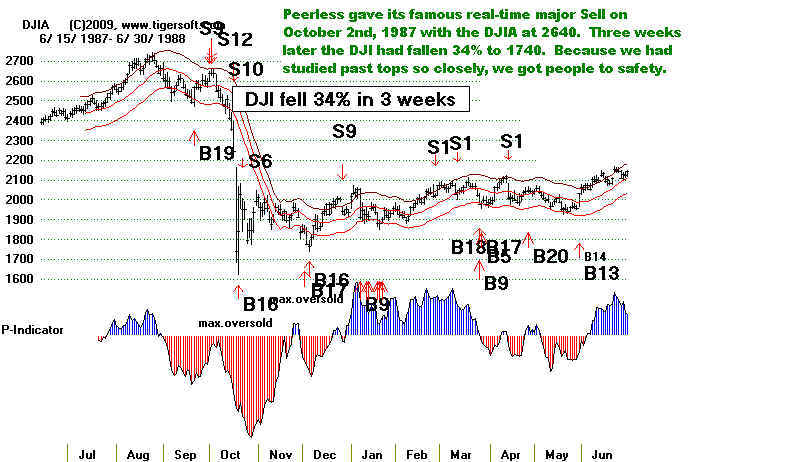

The 1987 Crash:

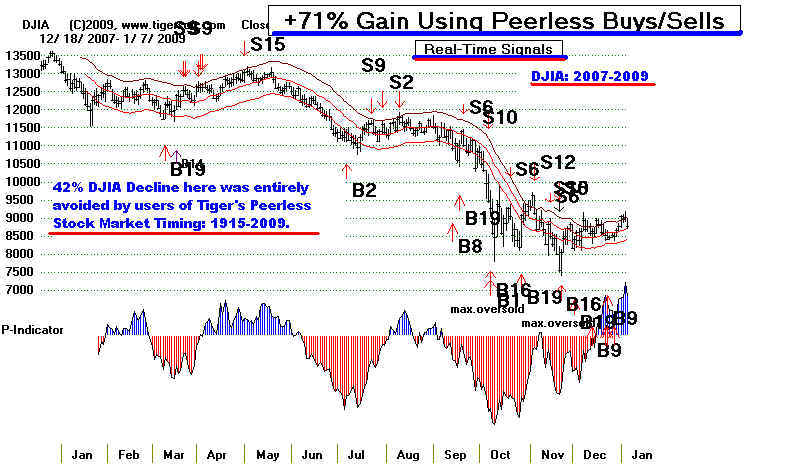

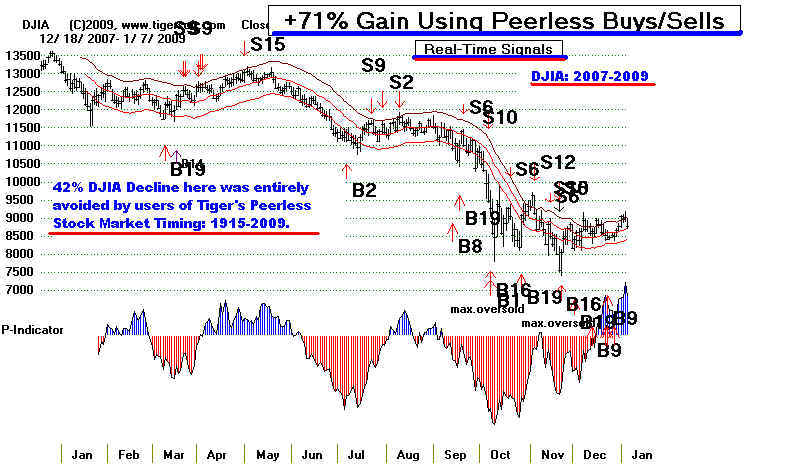

The 2007-2009 Crash:

6/18/2009

Bigger Profits and More Safety

Peerless Gain = +96% April

2008-March 2009

Calling All Tops: 1929, 1937, 1957 1959, 1962, 1966,

1973, 1978, 1979, 1980, 1987, 1990, 1998, 2000 and 2007

Calling All Bottoms: 1933, 1938, 1942, 1949, 1953, 1958, 1961, 1962, 1967, 1970, 1975,

1978,

1980, 1982, 1984, 1988, 1991, 1995, 1998, 2003... (See these in Peerless book....)

LOOK AT THE SUPERB PEERLESS TRADING GAINS from 7/30/2008 to 6/25/2009:

SPY

+132% QQQQ +129% IWM +230.8%

EWU (UK) +158% EWW (Mexico) +288% FXI (China) +221%

EWZ (Brazil) +452% EWO (Emerging Markets) +277%

IBM +114% AAPL +206% NEM +296%

SSRI +5005%!!! (Longs and Shorts)

Example: IWM

(Russell-2000) Buying and Selling Gain is shown first, +61.3%

Buying, Selling and Selling Short Gain

is shown second, +198.8%

Buying and Holding Loss from 7/30/2008 to 6/5/2009 = -24.9%