| Daily Blog - Tiger Software Back to Home Page - www.tigersoft.com TigerSoft Blog Peerless Stock Market Timing: 1915-2008 |

Sunday - June 24, 2007

The 1929 Crash: Could It Happen Again?

Yes- Absolutely.

By William Schmidt, Ph.D.

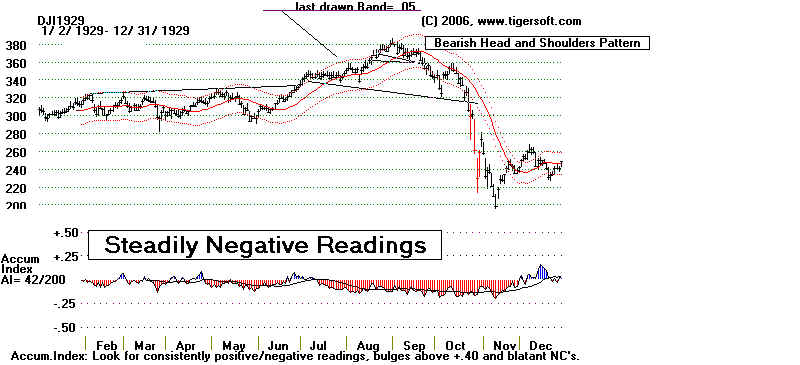

Looking back, we can see that the Tiger programs would have easily

spotted the top as it was being made in the Summer of 1929. The Tiger

"Accumulation Index" had been mostly very negative for months. Big Money

was getting out of the market. They were "distributing" their shares to

the naive and uninitiated. The amount of distribution is often a very good sign

of how deep the resulting decline will be. In 1929 it was massive. "Big Money"

did not have to start dumping their shares until the neckline of the classically bearish

head and shoulders pattern was violated early in the October 1929 Crash.

If you are lucky, you will never see a chart of a major index showing such heavy

and steady "distribution" as in 1928-1929, over such a long a period. But the charts

of 1969, 1972-1974, 1987 and 1999-2000 do show that when tops take a long time to

take shape, the resulting declines are deeper and last longer, too. All the red

distribution in the Tiger chart proved quite prescient, as the DJI declined until 1933

and lost 85% of its value.

Origins of TigerSoft's Accumulation Index

The Tiger Accumulation Index was invented by me (William Schmidt, Ph.D.)

in 1972. Until 2007, I had not looked at the 1929 data. So, this chart is one

more important validation of the importance of the Tiger "Accumulation Index".

While in graduate school at Columbia University, I had worked for Smith Barney (then

Harris, Upham) in their headquarters in NYC and had seen the way institutions

"distribute" big blocks of shares during the day and at the close. I did the first calculations

with this tool on a Bowmar calculator late in 1972. At first, I thought I had made an

error in the formula, because all the charts showed very heavy distribution (negative

Accumulation readings). But I had not. The 1973-1974 bear market was about to

unfold.

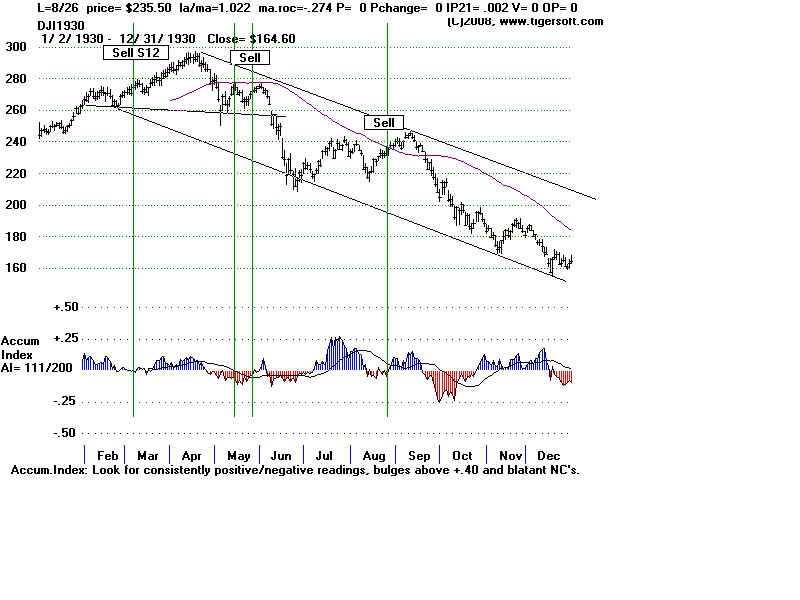

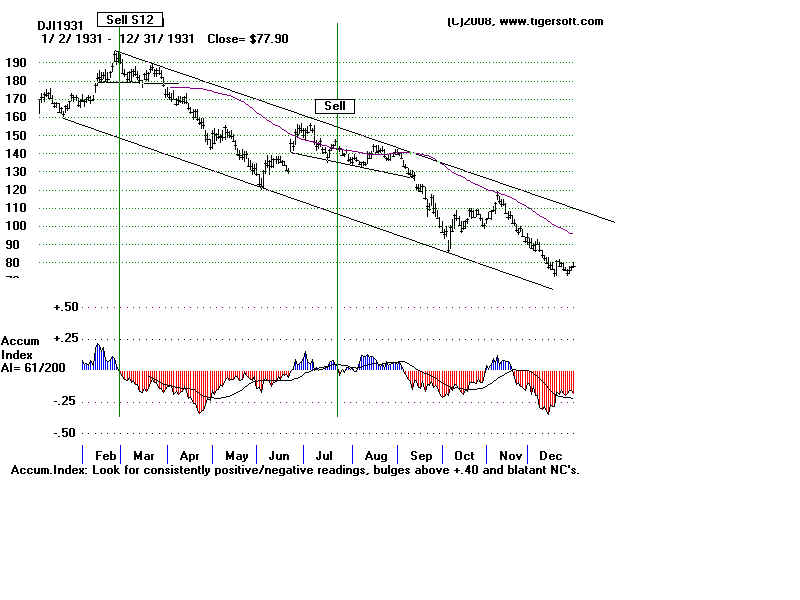

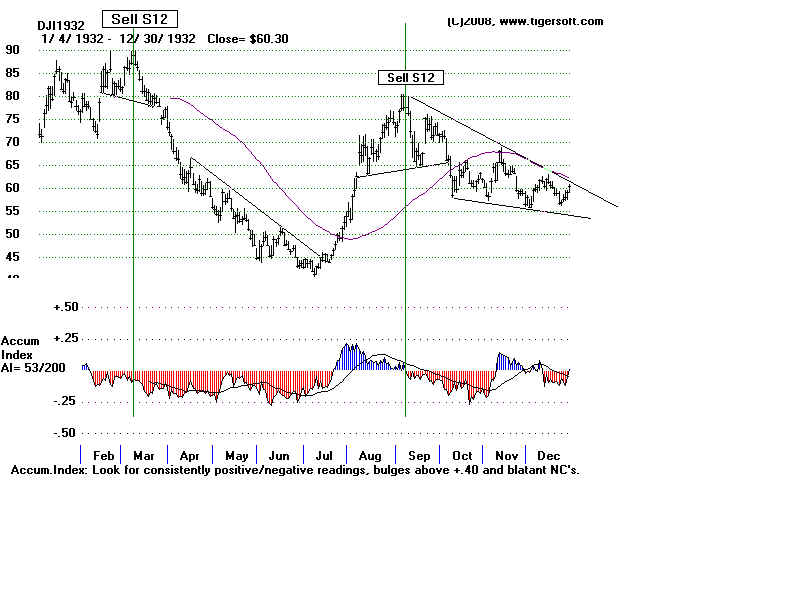

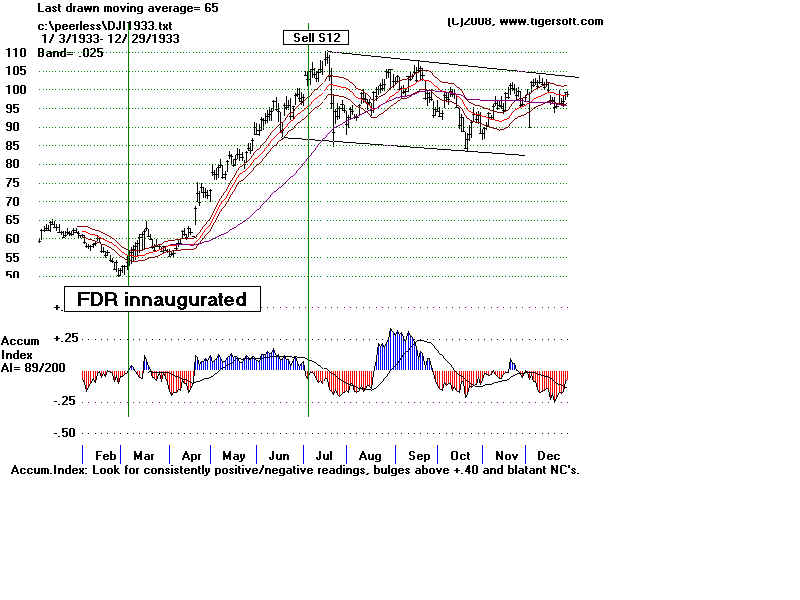

At the bottom of this page, see the Peerless charts of 1930-1933.

Note how the bearish readings from the TigerSoft Accumulation Index

when new highs were made and serving as Sell S12s, would have kept

someone trading back then out of trouble and warned them of a new

decline about to occur.

Here is a song from February 9, 1930 by George Olsen,

Here is a song from February 9, 1930 by George Olsen,

called "I'm In The Market For You"

Play It.

(Source: http://www.btinternet.com/~dreklind/thecrash.htm)

I'll have to see my broker

Find out what he can do.

'Cause I'm in the market for you.

There won't be any joker,

With margin I'm all through.

'Cause I want you outright it's true.

You're going up, up ,up in my estimation.

I want a thousand shares of your caresses too.

We'll count the hugs and kisses,

When dividends are due,

'Cause I'm in the market for you.

Could A Crash and A Depression like 1929-1933

Happen Again in the US? Yes!

Absolutely. Though you won't

see this said very often by orthodox economists or

politicians. Keep in mind that the US Government is now much deeper in

debt and the US

has a far worse balance of payments problem than it did in 1929. True, margin requirements

for stocks are 50%, not 10%. But the volume in index related

derivatives is enormous and they are

now factored to double the underlying index's volatility.

The bursting of the vastly

over-extended housing bubble certainly could be the trigger now.

Under-consumption and serious maldistribution of wealth were causes for the 1929

Crash and Depression.

Thus, we have to be concerned about the extent to which middle-class Americans have

exhausted their credit

now. And we must also note the bearishness inherent in the severe

maldistribution of wealth in

America now, where the top one percent own more than the bottom 95%. This

rivals 1928.

The world bull market has gone

largely up, uncorrected since 2003. A severe world-wide

equities' decline from a lofty, wildly over-bought condition would savage the

buying power

of many, many businesses and consumers around the globe. Illegal

insider selling has been

very pronounced. There will be another round of class-action lawsuits

against CEOs

for dumping their shares on the basis of inside information not yet released

to the general public.

This will hurt investor confidence significantly, just as it did in

2001-2002.

The US Federal Reserve Board has,

except for brief periods, always been much more

interested in finding ways to finance the US federal deficit than guarantee

reasonable

levels of employment. So, I would expect them to be very slow to

lower interest rates.

A "run" on the dollar or a severe oil shortage will make their job

much harder. Too many

mainstream economists are of the Chicago monetarist school. As a

result, they will

keep pushing monetary solutions when more basic problems, like the

3 billion dollar

Iraq blunder. The exporting of jobs and maldistribution of wealth

will go unaddressed

by the Republican Bush Administration. Trickle down monetary

solutions will

not replenish the much diminished purchasing power of middle class and

working

cloass Americans. The quick fixes Bush and

Congress develop will not rescue the

sinking economy. They will deny the severity of the coming crisis

until it is too late.

They will be too little and too late. Their failure will underline

the crisis of confidnce,

but not solve it. Factory orders will be delayed and unemployment

will rise sharply,

thus making matters worse.

When Congress tries

finally to protect American jobs with tariffs, we will be going back to

the economic nationalism of the Smoot-Hawley Tariff of 1930. Moreover,

note how the

Democrats have now abandoned Keynesian fiscal policies as they promise

to balance the

federal budget in order to besmirch Republicans for the massive budget

deficits of the Bush

years. And if the Democrats cut military spending and troops in Iraq,

the multiplier effect will

be working in reverse, as thousands of soldiers become civilians again.

Many

unorthodox economists correctly have pointed out that each US recession

since 1948 has been deeper and required larger and larger deficit

governmental

spending to end the recession. The US deficits are

now so large, it is not clear how,

other than printing billions and billions more paper money, any

Keynesian public

work program could be funded.

Moreover, I doubt if

there is another deep turn-downwards in the US economy,

that we can we really expect the Japanese and Chinese, who have already

financed

so much of the US debt, to allow the US to deliberately further

unbalance the budget

to the extent necessary to jump-start a US economic recovery?

Lastly, civil unrest

would be highly likely, as the difference between the haves and the have

nots in the

US is now back to levels not seen since the 1920s. That

would send even more

US capital overseas.

George

Bush let 9/11 happen, he let New Orleans be destroyed, he has

destroyed Iraq for millions and millions who have no electricity,

no clean water,

no jobs and no schools. In his war on Iraq, Bush has wasted

three trillion dollars

(when all the bills come in). Think how much good that would have

done spent

on American infrastructire and education. Bush is hopelessly

stubborn and even

more arrogant. (I have met him. I know whereof I

speak!) His buddies are

looters. He is just the man to make a bad situation even

worse! Where will

Americans go? Four million Iraqui have left Iraq.

Sources: See http://www.commondreams.org/archive/2007/07/30/2860/

The Depression Years, The DJI

and TigerSoft's Accumulation Index

The

famous Peerless Sell S12 would have kept

allowed someone back in these years to sell short

most of the major tops. This is the same signal

that we use now. It called the top in

October 1987, for example.

1930 |

1931 |

1932 |

1933 |