|

Tiger Software 's Peerless Stock Market Timing: 1915-2009 Visa/MC $395 Includes software. Data and Hotline for 3 months.

(C) 2009 |

Special $395

Peerless Stock Market Timing

ORDER PEERLESS

STOCK MARKET TIMING HERE.

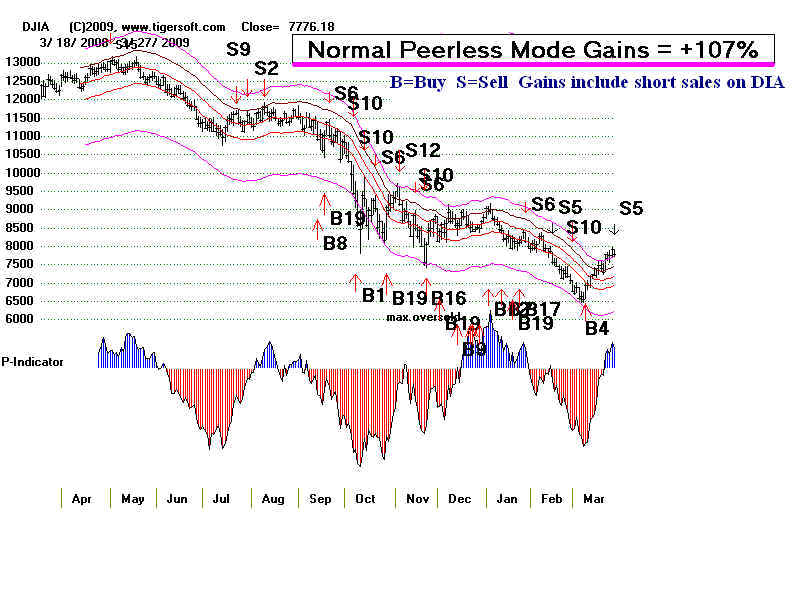

April 2008 - March 2009 Trading Gain on DIA

+96%

Using

Peerless'es Buys and Sells on the would have gained a trader 113% on the DIA in the

DIA from

April 2008 to March 2009. Here are the trades. Our software shows what would

have

happened starting with $10,000 and taking each trade. Here we assume that each trade

has a

slippage (commissions and differences between bid and ask) of $40 with each trade)

and that

the trades are taken at the close the day of the signal. Had the trades been taken

at the next

day's opening, the gains would have been +96%. It should be noted that our Hotline

actually

improved on some of these trades, such as covering the short sale on DIA on 3/9/2009

at 6547.06,

well below the next day's Buy signal at 6926.49.

5/1/2008 Sell Short DIA @ 129.96 using

$10,000

9/15/2008 Cover Short DIA and buy DIA @109.8 using

account's new value of $11,551.25

9/22/2008 Sell DIA and Sell Short DIA @ 110.5 using

account's new value of $11624.89

10/8/2008 Cover Short DIA and buy DIA @91.4 using account's

new value of $13634.26

10/14/2008 Sell DIA and Sell Short DIA @ 93.67 using account's new

value of $13972.89

10/28/2008 Cover Short DIA and buy DIA @91.14 using account's new value

of $14350.28

11/5/2008 Sell DIA and Sell Short DIA @ 91.85 using

account's new value of $14462.07

11/21/2008 Cover Short DIA and buy DIA @80.54 using account's new value

of $16242.87

1/29/2009 Sell DIA and Sell Short DIA @ 81.53 using

account's new value of $16442.52

3/10/2009 Cover Short DIA and buy DIA @69.14 using

account's new value of $18941.27

3/27/2009 Sell DIA and Sell Short DIA @ 77.81 using

account's new value of $21316.46

open.....

Had these signals been used to trade the SPY for this period at the openings the next day,

the gain would

have been 118.52%. For the QQQQ, the gain would have been 110.45%.

The software

allows one to superimpose the Peerless signals on any other chart. When you

do this, you will

quickly see the enormous value of Peerless.

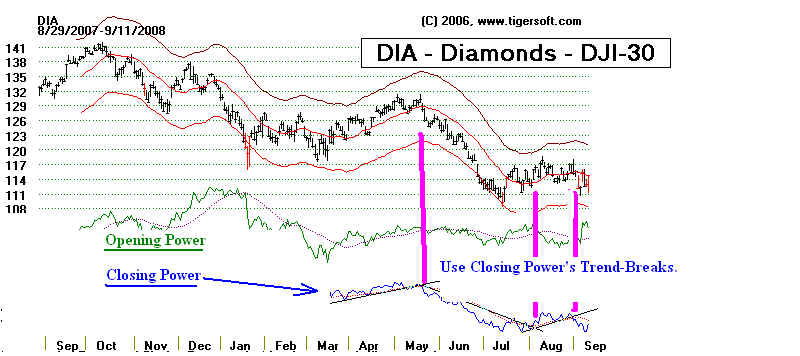

Below is the DJI chart on which the signals were based.

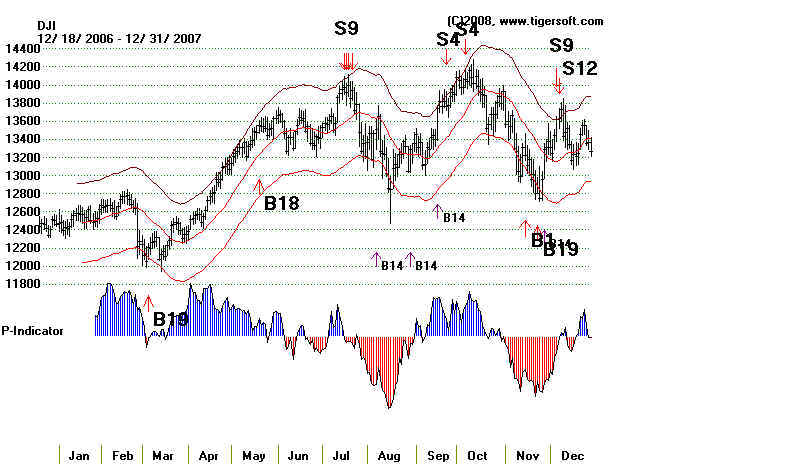

Peerless 2007 DJI Chart

Buys and Sells Gain =

37.9%

You do not have to suffer through declines in the stock market. And you do not

need to wonder if it's safe buy. Peerless can show you exactly when to get

out of the market.

It has done that, REAL-TIME, in early 1981, January

1984, October 1987,

July 1990 and at the tops in 1997, 1998, 2000, 2001, 2007, 2008 and 2009.

Peerless can show you

when it's safe to buy, just as it did real-time August 1982,

July 1984, December 1987, October 1990, January 1995, October 1997, October 1998

and March 2003 when major Buys occur.

Peerless can be

used by traders of general market ETFs, S&P Futures and most stocks, too.

Here are the reversing Buys and Sells since 2005. Investors will need to undertand

how we

use the past track record of each signal and particular signals in combination to get a

sense

of when the moves will be very big. See more below.

Recent Buys and Sells of Peerless

Signal Date

DJI

Gain

------ ----- ---

----

BUY 4/21/2005 10219

13.2%

SELL 5/5/2006 11578

4.9%

BUY 6/15/2006 11015

1.2%

SELL 6/30/2006 11150

3.1%

BUY 7/18/2006 10799

14.8%

SELL 1/5/2007 12398

2.3%

BUY 3/2/2007

12007 14.4%

SELL 7/17/2007 13971

3.3%

BUY 8/7/2007

13504 1.9%

SELL 9/24/2007 13759

3.9%

BUY 11/14/2007 13223

3.0%

SELL 12/6/2007 13619

12.6%

(Note: this was third set of major sells in 6 months.

Very bearish. See below.)

BUY

3/7/2008 11900

5.5%

SELL 3/24/2007 12549

13.0%

BUY 9/15/2008 10918

0.9%

SELL 9/22/2008 11016

16.0%

BUY

10/8/2008 9258

0.1%

SELL

10/14/2008 9311

2.6%

BUY 10/28/2008

9065

0.8%

SELL 11/5/2008 9139

12.0%

BUY 11/21/2008 8046

1.3%

SELL 1/29/2009 8149

Cover 3/9/2009

6547 19.7%

BUY 3/10/2009 6926

12.3%

SELL 3/27/2009

7776

-3.1%

BUY 4/3/2009

8018

9.3%

SELL

6/9/2009 8763

as of 6/15/2009

When Do Biggest Moves

Occur?

Here's The Key Pattern We Look for

The biggest sell-offs and bear markets come after there has been three or

more series of

major Sell signals over eight, or so months. You can see by October 1987, there had

been

three separate Sell S9 and S12 sets. Look at the chart below. Then

compare it with the

recent 2007-2008 case.

=========== 1987 Crash Was Preceded by Three Sets of Sell S9

and Sell S12s ================

The breakdown below 2500 (important support from previous lows) in October meant that

a severe decline

was coming soon. From July 2007 to March 2008, there had been

four sets of

major sells. All the worst declines in the stock market since 1942, which is far

back

as we can get

some of the key data to produce Buys and Sells, showed this pattern: 1959-1960,

1960, 1969-1970, 1973-1974,

1981-1982, 1987, 1990-1991, 2000-2003. There's

more we can

say. But that

should be enough to get some of you to start using Peerless.

=========== 2008 Crash Was Preceded by Four Sets of Major

Peerless Sells ================

Peerless Major Buys and Sells Will Help You Trade Nearly Everything.

Nearly all markets move up and down with the major Peerless

signals. You certainly can

this principle was true this year, 2008. Nothing has escaped the bear.

Our research in this

area is substantial. See the work we did on this regarding how well Peerless Buys and Sells traded the

Fidelity Sector funds, back in 2004. No matter what you trade,

Peerless will help you time

the many intermeditate-term moves. The only occasional exceptions are

oil and gas, gold

and Japan.

Peerless Is Simple and Automatic

Peerless is simple and automatic. No interpretation is required of its

signals. Buy on a red Up-Arrow

"B" Signal, like a "B9". Later sell on a red Down-Arrow

"S" Signal, like an "S9". The signals would

normally be taken on the next day, at the opening. We have done many studies showing

the value of

using these signals over time. The signals beat buy and hold handily. Always,

one would have used

them to get before a bear market would have dropped your holdings dramatically.

Always, we were

able to take advantages of bull markets. See the difference, the older Peerless

would have meant to

a typcial retirement account. The newer (just released) Peerless is more effective

and back-tested

25 additional years. The older rules were validated and some new Buys and Sells have

been added

that take into account seasonality.

.. Plan for your Returement

.. Plan for your Returement

Important

Retirement Planning

Originally written in 1981,

there were then 10 Buy signals and 10 Sell signals. Some of these

had to be interreted. That is not true now. Since 1981, we have also added a

few new signals.

But all the basic rules have worked superbly at the criticial tops and bottoms.

The October 1987 top was called perfectly with the original

system. So would

this year's top. In the 1990s, we came to appreciate the importance of Tiger's

Accumulation Index for calling major tops. Its negative and positive divergences

have

produced excellent signals.

In 2005, preparatory to a new book on Peerless, I started

to back test the programs further

back than 1966. Using NYSE Advance amd Decline data back to 1942, I refined

Peerless even

more by introducing market seasonality. It should be noted that the

Accumulation Index has

been tested back to 1928, the earlier point for which we can get data. Its bearish

divergences

would easily have let someone back then see that 1929 was a major top with severely

bearish

divergences.

------------------------- Heavy Red Distribution

before 1929 Crash -------------------------

More links on

Peerless:

Peerless Real-Time Signals: 1981-2008

Stock Market

Bear Markets and Their Bottoms' Charts: 1915-2008

Buying and Selling, the DJI-30 or an equivalent investment:

Using Peerless would have turned $100 in 1965 into $89,600 in 2007.

This is the equivalent of +17.5 %/year. Making this much a year

does wonderful things to a retirement account!

By comparison, buying and holding the DJI-30 from 1965 to 2007

would have only increased the value of the original $100 investment to

only $1437 in 2007.

Using Peerless and only buying and then selling (no short sales)

1965-2007

61 of the 67 trades (91.0%) would have been profitable.

On average 1.6 trades per year. Avg. Trade's Gain = +11.2%

Peerless Averaged +17.5%/year compared with Buy and Hold of 7%.

The Peerless gains of simply buying and selling on the reversing major Peerless signals

are understated, in that no consideration is given the interest received while in cash.

This would probably have increased the average annual return by more than 2.5%,

making the average annual return 20%.

See

also:

http://www.tigersoft.com/--1--/index.html

http://www.tigersoft.com/majorpeerless.htm

http://www.tigersoft.com/products/peerless.htm

Many internal strength indicators are included to help you fine-tune the intermediate-term

Peerless signals and give you a way also to trade tactically the market's shorter-term moves.

Lines may be drawn. Percentage retracements or moves up from a low are shown. Automatic trendlines

and regression channels are included. Likely percentage retracements are helpful, too.

Buy The Original

We brought price bands to charting software before anyone else. True! Back in 1981.

We also invented the Tiger's Accumulation Index, Opening and Closing Power, among

other superb market timing and stock trading tools. You will need TigerSoft,

as well as Peerless, to take advantage of these powerful discoveries.