Since 1981, we have been helping Professionals and the Public

around the World to Maximize Stock Profits and Avoid Devastating Declines.

Tiger Software Charts Make Analysis of Stocks Simple, Easy and Profitable!

6/25/2009

Learn How You Can Beat The Pros.

(1) Peerless Stock Market Timing and (2) TIGERSOFT

Two Premier and Independent Trading Systems.

--- LEARN FROM HISTORY & INSIDER TRADING! ---

"Those who don't know history

are destined to repeat it." Edmund Burke

(1) PEERLESS STOCK MARKET TIMING's

SIMPLE & AUTOMATIC BUYS & SELLS

Superbly profitable STOCK TRADING GAINs since September 2008

of over 200% were quite common in more speculative stocks. 50% Gains

in "safer: blue chip stocks were the norm. 46% of the stocks

randomly sampled gained more than 100% in the last 9 months.

The way to get gains like this is to use our Peerless Stock Market Timing.

Appreciate that using Peerless to Buy and Sell beat Buying and Holding in all

the 50 cases we randomly sampled for this page. Gains of more than

24% were obtained lin the last 12 months with the major market ETFs like

DIA, SPY and QQQQ to hedge a portfolio. Click on their charts with the Peerless

Buys and Sells superimposed on their TigerSoft charts. These results

assume purchases and sales are made at the opening on the day after the

Peerless Buy or Sell. $10,000 is started with. All proceeds are kept fully invested.

Each trade is assumed to cost $40 in commissions.

PEERLESS TRADING RESULTS: 9/15/2008 to 6/25/2009

Buying/Selling Buying/Selling/Selling Short

DJIA ETF DIA + 24.1% +95.6%

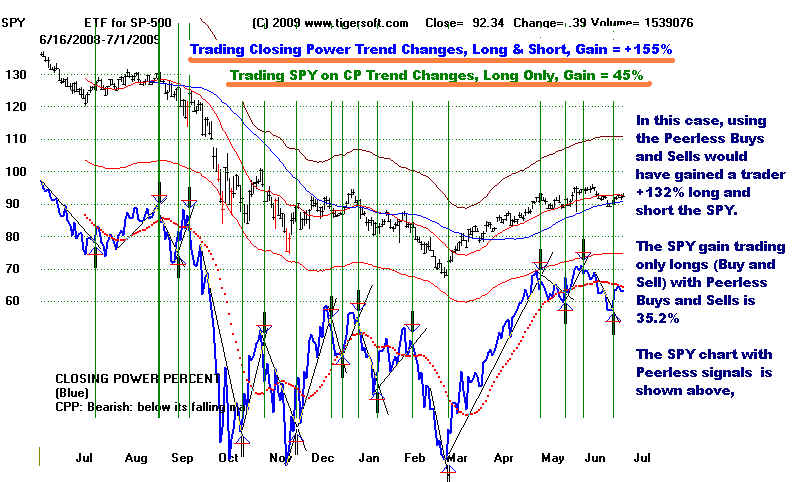

SP-500 ETF SPY + 34.8% +131.5%

NASDAQ-100 ETF QQQQ +41.1% +129.1%

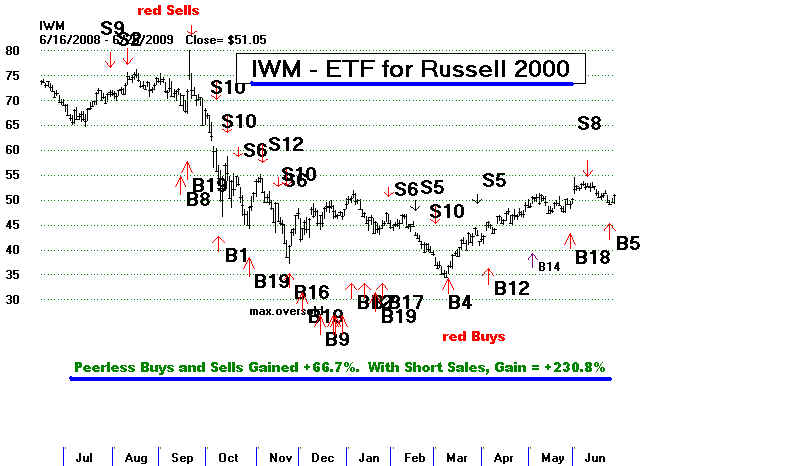

RUSSELL 2000 ETF IWM +66.7% +230.8%

Chinese ETF CHN +32.6% +122,3%

Australia ETF EWA +40.8% +155.4%

UK ETF EWU +38.6% +157.6%

Brazil ETF EWZ +125.0% +451.5%

India Fund IFN +100.9% +323.6%

Indonesia Fund IF +254.7% +958.5%

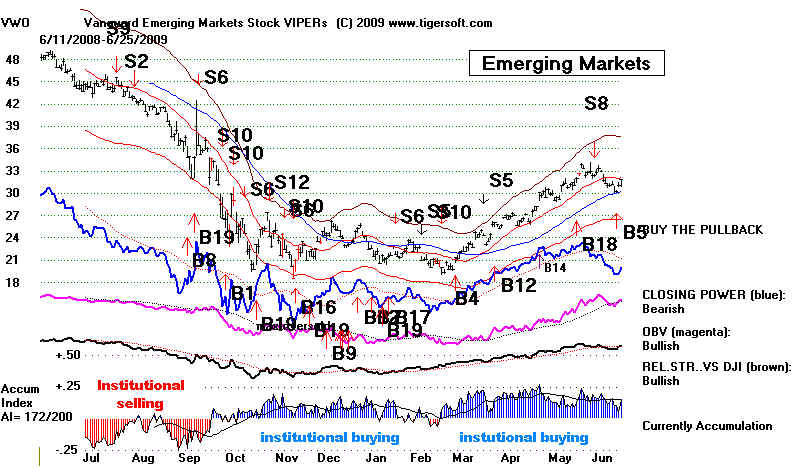

Emerging Mkts VWO +81.4% +277.0%

Peerless Buys and Sells Super-Imposed on TigerSoft CHart of IWM

Peerless Buys and Sells Super-Imposed on TigerSoft Chart of VWO

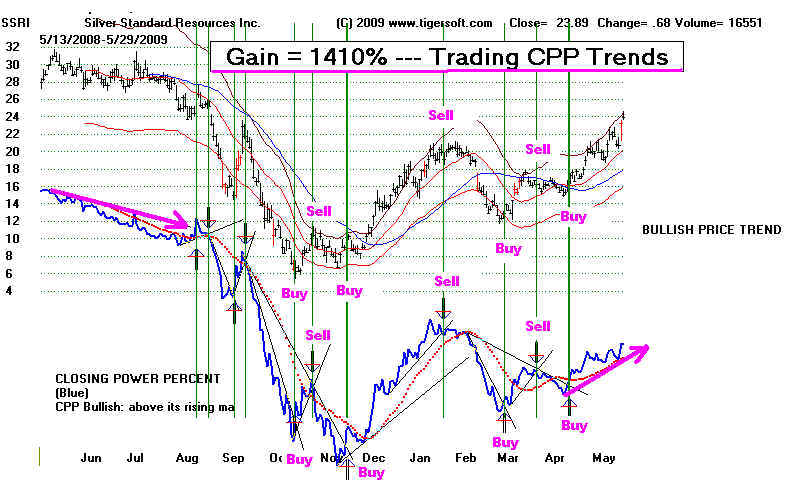

(2) TIGERSOFT CLOSING POWER TREND-BREAKS

The returns do vary, of course, from stock to stock. Fortunately,

TIGERSOFT shows you how to pick stocks that than insiders are

buying and tend to tend to rise more than most when there is a new

reversing Peerless Buy signal. And using TigerSoft's tools, you can

confirm the automatic Peerless Buys and Sells with a completely

different trading system based on our TigerSoft Closing Power.

Call or write us today.

(C) 2009 www.tigersoft.com 858-273-5900 william,_schmidt@hotmail.com PO Box 9491, San Diego, CA 92169

Welcome to www.tigersoft.com

This site is for people with an open mind about the

stock market.

If you are bound to simply "BUY and HOLD", we can help, but that is not

what we focus on here. Trading, not "buying and holding", with

Peerless

and TigerSoft is much safer and more profitable, as you will see.

If

you wish to discover what stock market professionals DO NOT want

you to know about how they rig the stock market's up and downs, please continue.

Specifically, to see how Goldman Sachs has rigged the booms and busts in stocks and

commodities since the 1920s, see the current issue of Rolling Stone. We will

produce a summary in a few days.

We have been professionally studying rigged markets and insider buying

and selling for more than 28 years. We can help you a lot. Please read a

little

of what we have to say about INSIDER TRADING and then give us a call.

In a trading great system, people want

simplicity, unambiguous and non-emotional

Buys and Sells, reasonably open and rational rules, lengthy back-testeding and

easy replication of results. Our Peerless Stock Market Timing satisfied all these

needs.

Peerless automatic Buys and Sells are straightforward and simple to apply.

Buy the next day after a reversing Peerless up arrow Buy and Sell when there is

a reversing down arrow Sell. The signals you get have been back-tested to

1915.

The documentation explains each signal. And the signals are consistently profitable,

especially for the last year, as the market has become wilder and wilder.

Superb Gains Using

Peerless Stock

Market Timing's Buys and Sells

Super-Imposed on 50 Randomly

Chosen Stocks:

9/15/2008- 6/25/2009

Our Peerless Stock Market Timing: 1915-2009

produces Buys and Sells

on

the general market that can be profitably applied to nearly every investment

vehicle. This is because of how intetegrated all financial markets now are

everywhere, Simply superimpose the Peerless Signals on your stock, if you

have

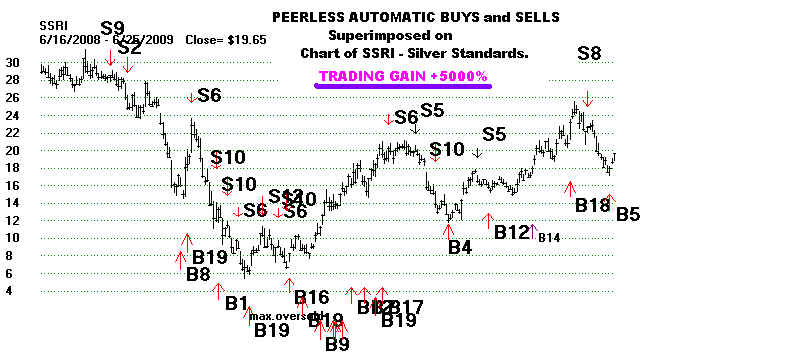

Peerless and TigerSoft. As an extreme example, we first show SSRI,

a

volatile silver mining stock. The gains here were phenomenal.

Hard to Believe, But True.

Buying, Selling and Selling short SSRI on the reversing Buys and Sells

would

have gained a trader more than 5004% profits

in the last year. Only Buying

and

Selling SSRI on the opening the day after the Peerless Buy and Sell, respectively,

would

have gained a trader 795% since September 15th. The gains here are

exceptional. They are presented to show the possibilities of really good market

timing.

The

future for this stock, or any individual stock, is necessarily uncertain.

But

buying a few different stocks with each Buy should work very well.

Volatile SSRI's (Silver Standards) Stock and Peerless Buys and Sells

![]()

What happens to

$10,000 using Peerless and re-investing profits?

Trades

Price Investment's Value Gain

(1) Buy 9/15/2008 15.25

$10000

Sell 9/22/2008 23

$15082

+ 50.8%

(2) Buy 10/8/2008 13.39

Sell 10/14/2008 11.38

$12818

-15%

(3) Buy 10/28/2008 7.07

Sell 11/5/2008 10.64

$19289

+50.5%

(4) Buy 11/21/2008 9.11

Sell 1/29/2009 20.78 $44002

+128.1$

(5) Buy 3/10/2009 12.13

Sell 3/27/2009 16.04

$58185

+32.2%

(6) Buy 4/3/2009 15.39

Sell 6/9/2009 23.01

$85389

+49.5%

(7) Buy 6/23/2009 18.74

$89535

19.65 on 6/25/2009

Amazing Peerless trading gains are not unusual for volatile stocks.

Returns using Peerless on other key stocks for the last 9 months

were

very good. Note we count only the Buys and Sells. No short sales were

made.

The

software Lets you readily compare gains here with what would have happened

simply buying and holding. Below is a large random sample of stocks beginning

the

letter "A". There were

losses. These had to be taken quickly and considered

a

necessary expense. If taking a small loss is impossible psychologically, even

after

studying the overall returns, TigerSoft and Peerless are not for you.

,

Stock

Peerless Gain

Buy & Hold Gain

Winning Trades Losing Trades

(9/15-2008-6/16/2009) (9/15-2008-6/16/2009)

-------- -------------------------------

------------------------------- -------------------------

-----------------------

AA

+42.6%

-58.6%

4

2

AAI

+261.2% +88.0%

5

1

AAPL

+72.0% +1.9%

5

1

AAN

+24.5% +7.0%

4

2

ABIO

+8.2% -55.1%

3

3

ABT

+8.0% -22.2%

4

2

ACAD

+366.1% -14.1%

5

0

ACCL

+74.1% +17.9%

5

1

ACTG

+327.8% +75.7%

5

1

ACTU

+159.0% +37.3%

5

1

ADAT

+215.1% +110.0%

3

3

ADP

-4.5%

-17.4%

3

3

ADY

+593,4% +461.3%

5

1

AET

+83.3% -44.4%

4

2

AEZS

+245.7% +197.5%

4

2

ALC

+66.3% -33.4%

5

1

ADBE

+31.0% =26.9%

3

3

ADM

+28.6% +21.0%

5

1

ADSK

+61.1% -36.6%

4

2

AEM

+220.1% +7.2%

5

1

AGEN

+678.0% +22.0%

4

2

AHS

-3.7% -63.3%

3

3

AIZ

+23.9% -55.9%

3

3

AKAM

+88.7% +28.2%

6

0

ALKS

+119.4% -22.8%

3

3

ALTR

+16.5% -18.4%

4

2

AMAT

+20.6% -32.9%

2

4

AMD

+178,7% -16.7%

6

0

AMG

+248.7% -29.8%

5

1

AMGN

+4.0% -17.1%

2

4

AMLN

+156.4% -44.6%

4

2

AMR

+75.2% -62.1%

3

3

AMTD

+80.8% -6.2%

6

0

AMZN

+38.3% +7.0%

3

3

ANDS

+10.7% -14.9%

5

1

ANSW

+147.8% -52.9%

6

0

ANW

+166.3% -34.5%

5

1

APA

+100.4% -20.0%

5

1

APOG

+194.0% -26.7%

5

1

APOL

+17.2% -4.4%

4

2

APD

+62.7% -23.0%

5

1

ARNA

+64.8% -3.6%

4

2

ASCA

+275.9% +11.7%

4

2

ASI

+148.6% -4.1%

4

2

ATCO

+412.6% +172.9%

3

3

ATVI

+9.9% -23.1%

4

2

AUY

+259.1% 16.9%

5

1

AVNR

+688.7% +88.3%

5

1

AVP

+44.0% -38.9%

3

3

AXP

+118.2% -27.8%

4

2

=========================================================================================

TIgerSoft's Trading System Is Different Than

Peerless

Closing

Power Trend-Breaks Offer

A

Powerful but Independent Trading System

Below

is the chart of SPY - an Exchange Traded Fund representing the SP-500.

We offer Peerless

Stock Market Timing and TigerSoft

for $495.

You can get Peerless by itself and you could

also

separately get the Tiger/Peerless Daily Hotline

which shows

the signals and discusses them for $298

for a year.

TigerSoft's Closing Power Trend-Trend Breaks

Also Give Great Buys and Sells.

We use TigerSoft's Closing Power Trends to confirm and mentally reinforce the

signals from Peerless. These signals are completely independent of Peerless.

So,

they act as a great confirming system. You may purchase only TigerSoft and

produce

the buys and sells on the stocks you're interested in just as shown below, using

TigerSoft's

Closing Power. To do this you will need TigerSoft and Data. The software is

$295 plus tax.

After 3 months, you will need to get nightly stock data. Our charge for data

is $150/year,

the lowest price anywhere. You may also purchase Peerless and TigerSoft for $495 and

get the data for 7 months, plus our nightly Hotline which discusses the general market,

key stocks and shows and explains each of the new Peerless Buys and Sells.

Are We Near A Top? Peerless Stock Market Timing:

1915-2009

Visitors here, go to this link after

viewing what we show below.

Insider Trading: The Mother's Milk

of Wall Street.

Now TigerSoft Let You Legally Trade

As Though You Were An Insider.

Insider Selling in 1929 versus Bunker Hunt's Buying Silver in 1979.

Watch The Insiders and The Rest

Is Easy. TigerSoft's

Explosive Super Stocks

TigerSoft Special

includes Data for 3 months. Order here $298. Next San Diego TigerSoft User Group Meeting

Next San Diego TigerSoft User Group Meeting What Could Be Simpler than TIGERSOFT?

AN EXAMPLE OF TIGERSOFT's BUYS & SELLS.

HOW TIGERSOFT CAN SAVE YOU

OR MAKE YOU

HUNDREDS OF THOUSAND DOLLARS.

Here's an example of how TigerSoft's 28 years of back-testing of original indicators

can help you in the stock market . Let's say, someone gave you a tip to buy SSRI, a silver stock,

because you tell them you're afraid that US budget deficits will inevitably cause inflation. You

look ahead and you see inflation because Trillions of Dollars will have to printed since foreigners

will at some point stop buying Treasury instruments, as the Dollar starts to decline very seriously

again.

You could have bought it last year at 30. You would now have a 20% loss. Worse,

you would have seen this stock drop to a low of 6. Much better would have been to use TigerSoft

and the trend-changes of one of our best indicators. Trend-changes can be spotted with a ruler.

This is not rocket science. The best indicator for this purpose is our CPP - Closing Power Percent.

CPP measures institutional and insider buying and selling trends. Its trend is your firiend. The last

Buy on the stock SSRI has brought a 33% gain, as the stock has risen from 18 to 24 in about

five weeks. Think what you could do with our solftware over a much longer time period. This

type of trading gain is not unusual with TigerSoft.

The rules are simple for trading with TigerSoft's Closing Power Percent Indicator..

Buy at the next days opening.when the Closing Power's downtrend line is

exceeded. .

Sell at the next days opening when the Closing Power's uptrend line is

exceeded. .

Using these rules would have gained a trader 1410% after commissions, buying and

also selling short. Please click on the links above to see how you can take advantage of TigerSoft's

techniques for spotting and utilizing insider buying and selling in the stock market. What we

show below applies to all stocks, commodities, currencies, metals and not just in the US, but

anywhere in the world. Always trade with the TigerSoft's Advantage to watch insider buying

and selling.

1410% GAIN USING TIGERSOFT WITH

A SILVER STOCK - SSRI - Silver Standards

(C) 2009 www.tigersoft.com

Our software lets you see how effective various trading strategies are. Here we assume

$10,000 is started with. The commissions and slippage for each trade are assumed to be $40.

All proceeds are re-invested. One can specify Buys only. And here the trades are taken

at the next day's opening.