|

12/2/2007 Summary; Peerless Buy B19. Trading Range Dynamics Dominate. Rallies Show Trading Range Dynamics, And Is Similar to 1956 and 1986. SAMPLE TIGERSOFT HOTLINE - TO SUBSCRIBE TO THIS HOTLINE FOR A YEAR, Click HERE. |

|

TigerSoft & Peerless Nightly Hotline ===== SAMPLE ===== (C) 2007 William Schmidt, Ph.D Book-Mark This Address 12/2/2007 Trading Guidance: Peerless Stock Market Timing: 1928-1966 Track Record of Major Peerless Signals Earlier Peerless-DJIA charts 7 Paths To Making 25+%/Yr. Using TigerSoft Index Options FOREX trading Investing Longer-Term Mutual Funds Speculative Stocks Swing Trading Day Trading. Stock Options Commodity Trading Daily Tiger-Blog: Stocks, Humor and Political Economy Insights that you will not get from the mainstream Media / These are designed to let you see the "Larger Picture." |

This shows the approach our Hotline takes and we suggest for traders and investors

First, we look at the Peerless DJI chart with signals and key indicators. We take into account the

price patterns and try to anticipate future support and resistannce. Historic parallels are considered.

We always watch key commodities and leading indicators for the technology sector. Lastly,

my background is in political ecoomy, so I try to incorporate macro-economic trends that also

appear in the Tiger Blog.

The last Peerless signals are buys preparatory to the usually bullish December seasonality.

However, the DJI's price pattern suggests lots of selling awaits any move to 13800-14000, because

of the potential head and shoulders pattern a top there would mean if we take 12700 as the

neckline-support in such a pattern. The Peerless Indicator is still quite negative. A rally to the

upper band with it negative will likely bring a major Sell, even though December is normally bearish.

The first 3-6 months of a Presidential Election year (2008) often bring substantial declines

(1916, 1920, 1924, 1932, 1940, 1948, 1952, 1960, 1968, 1980, 1984, 2000 and 2004). There were

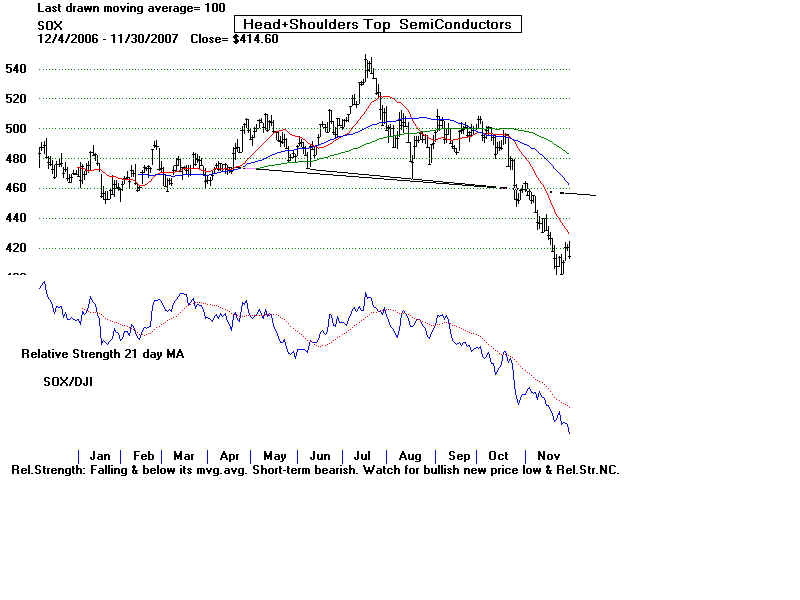

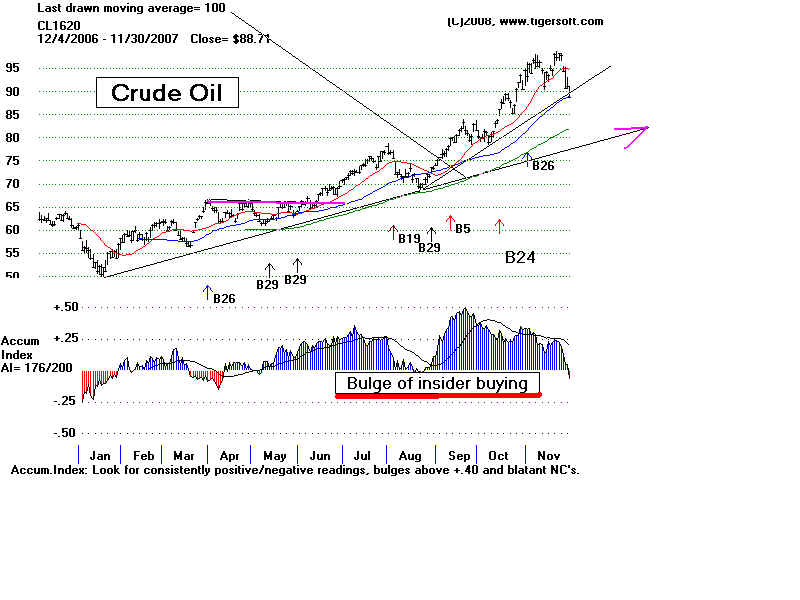

13 such cases and 11 exceptions.since 1916. Financial stocks and semi-conductor stocks have turned

very weak. Oil stocks and Gold are strong. The consumer is will be pressed hard if oil prices keep rising.

And the Semi-Conductor Index's weakness is telegraphing a warning for the NASDAQ and QQQQ.

The maldistribution of wealth in the US now resembles 1928. The first few months of next year

are apt to be difficult because of the bearish seasonality for the first 3-6 months of a Presidential

Election year...

------------------------------------- DJI-30 ------------------------------------------------------------

12/1/07 - The DJI appears to have tested the 12700-12800 level successfully.

The A/D Line did confirm the new low of 11/15 but (red) NYSE Down Volume did not by

a wide margin. Now breadth is improving. The NYSE A/D Line downtrend has been broken.

So the Buy B19 looks good and Buy B19s have a great track record. They work 95%

of the time. For these signals, the average gain is 9.4% on the DJI at the time of the next

major Peerless Sell Signal from 1965 and 2005. There have been two additional B19s since.

They were both profitable. The reversing Buy B19 on 3/6/2007 gained 14.4%.

I have emphasized the importance of seeing the market now as being

dominated by (1) trading range dynamics, (2) the Fed's desire to prop up the market

until after the next election with interest rate cuts, (3) the foreign markets' strength

as being the locomotives for this very long bull market. The longer term problem and

and counter force posed by the Dollar's weakness, (4) Decembers are usually

bullish, especially after the middle of the month.

1) Trading Range Dynamics

Having successfully tested the lows of a wide trading range, prices usually move back

up very easily to the top of the trading range. In our case, that means a move back up to

13,900-14,000, perhaps after some chewing up of the resistance at 13600. The DJI is now just

below 13,400. I suggest looking at the charts for 1956 and 1986 to see fine examples of trading ranges

that the DJI has entered every 30 years since 1956. See website's blog for 10/21/07.

http://www.tigersoft.com/Tiger-Blogs/10-20-2007/index.htm

2) The Fed's Propping Up the Market until after the next Presidential Election.

It is extremely difficult to be too cynical regarding the Fed when you see how much

pressure is put on them by politicians and how their actions tend to favor the

political party that appointed the Fed Chairman. My website's blog for 8/19/2007

http://www.tigersoft.com/Tiger-Blogs/8-18-2003/index.htm

shows these. If I am right, the Fed will lower rates until perhaps the middle of next year.

In this way they can show homeowners and the housing industry they care. And they

will avoid being controversial. In doing this, they risk weakening the dollar much more.

Hot international money goes where the interest rates are highest. So we have to watch

the US Dollar closely. The US Government routinely understates the level of inflation.

See http://www.tigersoft.com/Tiger-Blogs/11-19--2007/index.html

So, they must believe that whatever are the inflationary consequences of a lower dollar,

these can be hidden. That remains to be seen, because OPEC has its own point of view and

has tended to raise Oil Prices as the Dollar goes down. These pressures have become a vicious

circle. So we will watch the Dollar and Oil prices. Presently, there is the beginnings of a rally in the

Dollar because Crude Oil is falling back from the $100 bar. resistance. That is favorable for

a continuation of the present genral market rally for now. See the charts of the US Dollar,

Oil and Gold below.

3) We must recognize that the US stock market is now dependent upon the world

bull market, because overseas' sources supply the profits of the many US multinationals

that populate the indexes we watch, the the DJI-30 or the SP-500. We must watch the overseas

market because if these bull market end, the Chinese and others will be much less able to

keep buying US treasury bills. That would probably put much more pressure on the US Treasury

to raise interest rates exactly at a time the US economy is turning down sharply. The last few days

have seen strong recoveries in most overseas ETFs. The biggest gains were in China (PGJ),

Chile (CH), IFN (India). These are each up more than 10% since our Buy signal a week ago.

The gains in Brazil and Mexico were a more modest 4%. The UK, France, Spain and Europe, in general

were the weakest.

What the US will have to do to keep propping up the US markets and the dollar,

in the absence of any radical change in the lopsided ratio of the imports to exports, is to borrow

more money and sell off its assets. This will end badly when the US has no more valuable

assets to sell off or when foreigners stop making loans to the US. In Argentina, this condition

lasted for mosth of the 1990s before its economy turned down and went into a four year

recession before its Peso had to be dramatically revalued, causing 40% unemployment and

a fire-sale in its very depressed equities' market. The Chinese are learning to playing the role that

the IMF has been playing with countries like Argentina for years. This is the role of the casino

that keeps providing chips to a losing player until finally they get all his money. See my blog about

the Argentine financial collapse of 2002 and what we in the US can learn from it:

http://www.tigersoft.com/Tiger-Blogs/11-29-2007/index.html

Though the Chinese market is over-extended by most reckoning and shows dangerously

heavy red distribution for most of the last year's trading, it is destroying the recent bearish-looking

head and shoulders pattern. And that buys time. As long as the pattern's neckline (shown below)

is not violated, all is probably well, at least until the Chinese summer olympics are over and the Chinese

government may no longer trying to be putting up such a good face. See my blog about China

on November 27. http://www.tigersoft.com/Tiger-Blogs/11-27-2007/index.html

Watch for the Tiger Index of Chinese stocks to make another new high. I would then expect

resistance and the selling there to overcome the rally. That is usually what happens after a rally

takes place above the apex in a head and shoulders pattern, Note that at the last top in the Chinese

market, the Cumulative Advance-Decline Line for these 63 Chinese stocks failed to confirm a new

price high by the index. Such A.D Line non-confirmations are valuable market timing tools. You

can see this in the DJI-30 in July and the London FTSE recently.

The All-Foreign ETFs chart, as produced by TigerSift, shows an excellent advance since the

Peerless DJI major Buy B19, but it is not yet above the apex of its right shoulder. It still cannot

be classified as a bullish looking chart pattern. Weakness in European stocks seems to be the

problem. And that is directly related to a widespread lack of confidence in bank and home loans.

=============================== DOLLAR =====================================

After falling 19% for the past year, the Dollar has moved above its 21 day mvg,

avg. Looking back this past year, we see that these rallies have tended to be brief. In fact.

selling the dollar short each time it goes back below the black 21-day ma by, say .5%,

would have been an excellent way to make FOREX trades or just Buy Gold or Gold Stocks.

See the blog I have written about this: http://www.tigersoft.com/Tiger-Blogs/11-28-2007/index.htm =

.

========================== SILVER ===============================

Silver failed to make a breakout run upon moving over 147 a month ago. That

was a surprise. But realities are what we must face. It had made nice runs in the past, as you

can see in the Blog for 11/2, soon after earlier breakouts.

http://www.tigersoft.com/Tiger-Blogs/11-2-2007/index.html

But not all breakouts work and we have to decide if we want to stay in a stock, commodity

or currency that makes a "fakse breakout." False breakouts are often dangerous.

http://www.tigersoft.com/Tiger-Blogs/11-15-2007/index.html

Traders are well advised to respect them, even when it produces a small loss, and get out

of whatever it is that fails the breakout. Failed breakouts too often bring beg drops.

In this case, the dollar's long-term trend still looks very bearish. And I keep remembering

how silver rose from $15/ounce to $40/ounce in weeks. So, I am inclined to hold all the

precious metals' positions we have.

There is another force operating many of the Peruvian and Bolivian silver miners

are demanding much better pay and work conditions. The re-election for life of Chavez

is going to create more labor pressures on mining companies, even those that are Canadian

and not US owned. Silver production may be restricted in the future. That would be bullish

for the metals.

--------------------------------------------- NASDAQ -----------------------------------------------------------------------

The NASDAQ has almost reached the resistance of its 50-day ma. It is on its own

Buy B8. The NASDJI (relative strength) Indicator is weakening. The Accumulation Index

is negative still. Tech stocks usually do well from Novermber to April. So, perhaps, any

retreat may be simply a staging for an advance later. I find the weakness after the opening

in the chart of the QQQQ (Nasdaq-100) to be a warning, at least, for the present. Many

of the hottest NASDAQ-100 stocks like AAPL, GOOG and RIMM, have run up too fast

and may retreat next week.. See how the QQQQ's Closing Power is bearishly lagging

price. And below that, note the profound weakness of the SOX - Semi-Conductor Index.

----------------------------------- Semi-Conductor Index (SOX) -------------------------------------

======================= CONCLUSIONS ================================

There were 1350 more up than down on the NYSE. In fact, for 4 of the last

six days there have been more than 2200 daily NYSE advancers. While this seems impressive.

for the first time since 10/31/07, the number of NYSE new yearly highs exceeded new

yearly lows. For now , we will consider this a reflection of the pressures of tax selling,

but it bears watching. New lows should not exceed new highs so soon after the the DJI has made

a new high, as happened this July. That was definitely a warning.

The market's rally will probably continue. But I suspect it will be narrow. Defensive

and Biotech stocks will be favored. Tax loss selling will depress the weak stocks. I doubt if

the malaise in housing and home finance stocks will soon end. Look at the steadily negative

RED distribution in the Housing stocks. The strongest stocks will probably stall out at their

old highs. That may change. But that is the sense I get now.

------------- Oil and Commodities are showing unusual Accumulation and Strength ----------------------

Biotechs are stronger than the general market now. That is partly a defensive play.

But is also may mean that they are coming out of the locust like 7 year phase

of quiescence and could start to become much stronger. Our Stocks' Hotline

will look at these stocks closely this coming week.

XBI below is making its own all-time (albeit only two year) new high.

| TOP 10 HOLDINGS ( 33.77% OF TOTAL ASSETS) |

|

--------------------------

TigerSoft Oil/Gas Stocks ---------------------------------------------------

-----------------------------------------FIDELITY SECTOR FUNDS

--------------------------------------

Use this study to monitor ever-changing sector strength.

21-Day

GAIN - 12/3/07

Strongest

Pct Change

FDFAX Food

+1%

FSHCX Medical

+1%

FPHAX Pharmaceuticals

0%

FSMEX Medical Equipment

-1%

FSPHX Health Care

-2%

Weakest

Pct Change

FSVLX Home Finance

-15%

FNINX Networking/Infrastructure

-14%

FSAVX Automotive

-13%

FSPTX Technology

-11%

FWRLX Wireless

-9%

FSHOX Housing

-9%

FSLEX Electronics

-9%

FSAGX Gold

-9%

FDCPX Computer

-9%

-----------------------------------------------------------------------------------------------------------------------------------

FALLS IN YEARS ENDING IN "7"

1837 Panic

......

1887 September 19

(-2.24%) & October 12 (-2.29%)

1897 September 21

(-3.95%) & October 12 (-3.90%)

1907 Declined whole year from 90 to 55 in

November

37% decline.

Major banking panic October 22.

---------------------- My own study starts in 1915

-----------------------------------

1917 Early June peak at 99.... Bottom in December at 66 ... 33% decline.

Tip-off was well-tested support failure at 88 in August

...........................................................................................................................................

1927 Peak on 10/4 at 200... Fell to 181 on 10/24... 9.5%

decline

Tip-off was OBV NC at upper band.

Tip off was Accum.Index was negative at upper band

.....................................................................................................................................................

1937 Peak was at 190 on

8/16 ... Fell to 113.6 on 11/24 October

18 ...40% decline

Tip-off was OBV NC at upper 3% band..

Tip off was Accum.Index was <+.05 at upper 3% band.

.....................................................................................................................................................

1947 Peak was at 184 on

2/11... Fell to 163.60 on May 20.

...10.9% decline

Tip-off was small head and shoulders top with neckline break at 181 on 2/20

DJI made a 3-month high which was not confirmed by A/D Line

......................................................................................................................................................

1957 Peak was at 521 on

7/12... Fell to 419.80 on October

22. ...19.4% decline

Classic "Sell S9" at upper 3.0% band.

"Sell 12": Tip off was Accum.Index was <+.05 at upper 3% band.

Credit crunch. Sputnik

.....................................................................................................................................................

1967 Peak

was at 943 on 9/25... Fell to 826 on March 22. ...12.4% decline

"Sell 12": Tip off was Accum.Index was <+.03 at upper 2.8% band.

Tip-off was head and shoulders top with neckline break at 918 on 10/13

.....................................................................................................................................................

1977 On-going

bear market which did not bottom until March 1978...

In 6/22 DJI reached 2.5% upper band at 926. ...19.0% decline

......................................................................................................................................................

1987 Peak was at

2702 on 8/26... Fell to 1739 on October 19. ...35.6% decline

10/1 at 2639 "Sell 12": Tip off was Accum.Index was <0 at upper 2.8% band.

10/2 at 2640 Classic "Sell S9" at upper 2.6% band. Hit 1739 on 10.19 34.1% decline

......................................................................................................................................................

1997 Peak was at

8015.5 on 10/1... Fell to7498 on 10/28 6.5% decline

"Sell 12": Tip off was Accum.Index was <0 at upper 2.5% band.

......................................................................................................................................................

2007 10% So far,

the DJI has fallen to a low 10% below its year's high.

=============================================================================

NYSE New

Highs (note link)

NYSE NHs New Lows

-------------- -------------

11/30

36 35

11/29

36 60

11/28

34 73

11/27

19 176

11/26

18

230

11/23

12 99

11/21

14 444

11/20

22 499

11/19

20 415

11/16-

20

234

11/15

8 189

11/14

9 121

11/13

15 126

11/12

11 287

11/9

18 360

11/8

41 388

11/7

60 364

11/6

129 146

11/5

51 230

11/2

62 186

11/1

46 130

10/31

196 40

10/30

112 47

10/29

237 37

10/26

184 43

10/25

103 82

10/24

56 60

10/23

52 50

10/22

22 92

10/19

15 187

10/18

108 83

10/17

73 72

10/16

44 100

10/15

54 78

10/12

161 21

10/11

98 20

10/9

173 14

10/8

57 14

10/5

131 6

10/4

51 11

10/3

21

9

10/2

82 16

10/1

146 5

9/28

43 18

9/27

97 18

9/26

81 27

9/25

39

27

9/24

49 20

9/21

71 70

9/20

40 13

9/19

89

5

9/18

89 11

9/17

22 31

9/14

26 27

9/13

31 32

9/12

30 49

9/11

23 18

9/10

15 47

9/7

6 30

9/6

24 15

9/5

14

18

9/4

37 12

8/31

26

9

8/30

16 22

8/29

21 19

8/28

3 27

8/27

13 15

8/24

19

7

8/23

11 10

8/22

9

10

8/21

7

21

8/20

8 24

8/17

10 34 Quite a recovery

8/16

4 634 Extreme!

8/15

1

549

8/14

2 332

8/13

8

125

8/10

3 174

8/9

22 146

8/8

70

63

8/7

28 141

8/6

21 261

8/3

13 279

8/2

29 66

7/31

11 160

7/30

14 176

7/27

8

221

7/26

11 503 (correct?)

7/25

18

215

7/24

12

232

7/23

81

78

7/20

34

74

7/19

112

65

7/18

45 NC! 80

------------------------------S9/S12----------------------------------------------------

(Source:http://dynamic.nasdaq.com/asp/52weekshilow.asp?exchange=NYSE&status=HI)

============= After 12/2 seasonally ==================

Since 1965, the

DJI has risen

67% after the next 3 trading days.

56% after

the next 5 trading days.

46% after the next 10 trading

days. Avg. decline =

+0.0%

80% after the next

21-trading.

Avg. decline = +2.1%

69% after

the next two months.

Avg. decline = +3.1%

69% after the next three months Avg., gain =

+4.3%

===============================================================

STOCKS

Please consider

getting Tiger Soft and Power-Ranker to Find these stocks

each night or subscribe to the Full Hotline including Stock

Recommendations

for Tiger Software. Subscribe to the Tiger ESP Stocks' Hotline service to get current stock

picks

and follow-ups 3 times a week. Order for $595/year.--