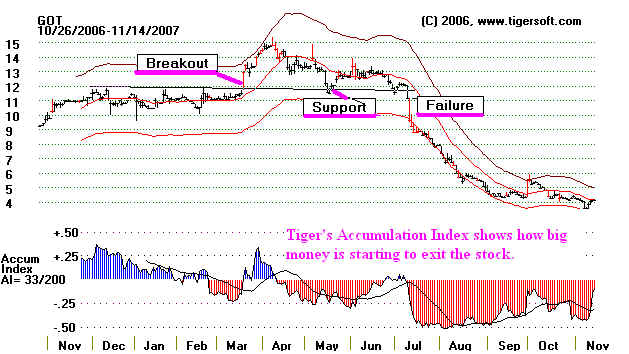

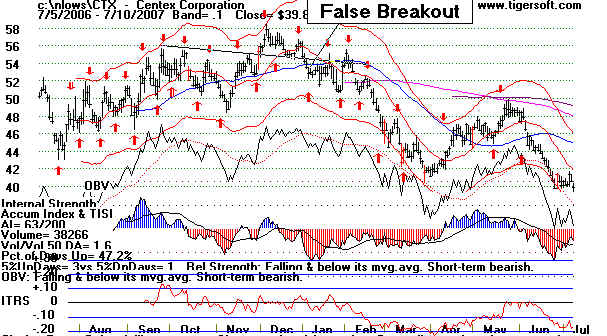

FALSE BREAKOUTS:

How To Predict and Spot Them.

How To Profit from Them.

Traders will inevitably find themselves

owning a stock that

makes a false breakout like the ones show below. The hardest part

will not be in spotting the falseness of the breakout, but in getting

yourself to take a small loss. This is essential money management.

Take the loss. You can always buy the stock back if it makes

a subsequent high. The danger of a 33% loss or more is quite high.

Savvy traders look for these patterns to short. They know the

breakout has already forced the more nervous short sellers to

cover. Without short sellers to cushion the decline, prices

can fall a long way.

False Breakouts above Flat Tops Are Obvious and Often Very

Bearish.

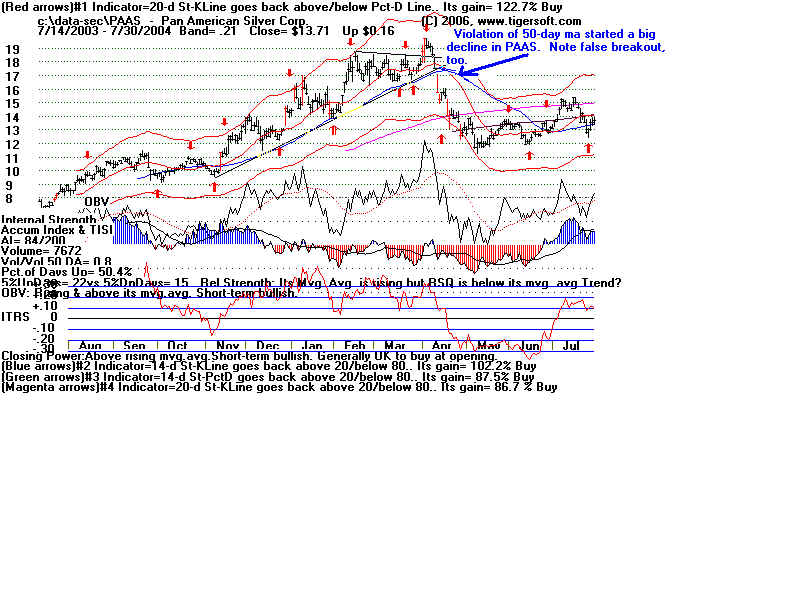

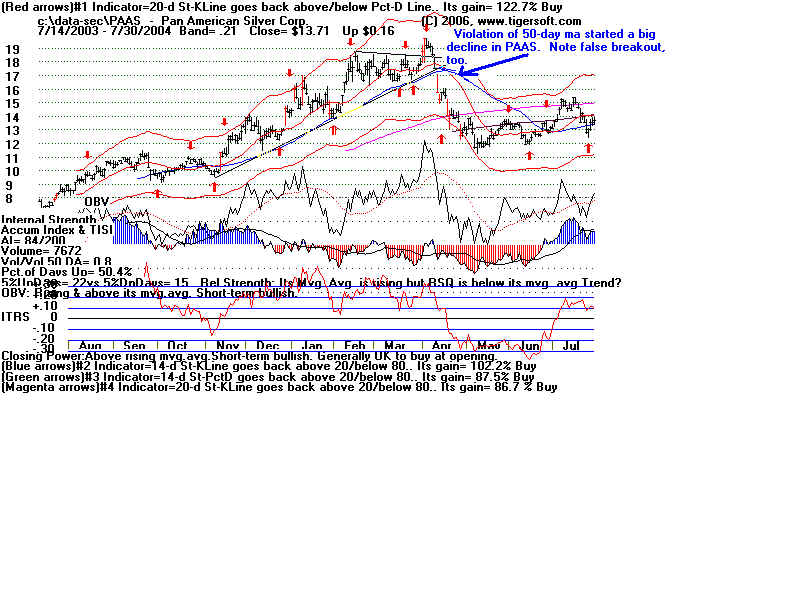

PAAS had already doubled in 7

months. That made the March breakout late. 20 is often

a significant psychological

price barrier. The negative (red) Tiger Accumulation Index showed that

insiders were heavy sellers

before, during and after the brief breakout in March. The plunge

on heavy volume below the

50-day ma proved the stock was in trouble. It subsequently lost

50% of its entire advance

from 8 in July. This chart shows that OBV did confirm the breakout.

It was the Tiger Accumulation

Index which gave you the best clue that the breakout was false.

BASIC TECHNICAL ANALYSIS

Good technical analysis requires a mastery of the concepts of support and resistance.

Inspecting charts, you will often see very traceable

lines of support that go through a

series of lows made by the stock, index or commodity.

Oppositely, a resistance line goes

through a series of highs. Some people use closing

highs and lows to develop these

important lines. I have found intra-day highs and

lows often make better lines, but it's the

closings that must move past the line for a breakout or

breakdown. The support level may

have to be tested many times before a rally ensues. But

once the support is seen as reliable,

prices typically get bid up to the overhead resistance line, if

present. Similarly we see prices

sag once it becomes clear that a stock, index or commodity cannot

get past a resistance

point. In this case, prices usually fall back to the most

reliable line, or, sometimes, zone of

support. The DJI chart of 1986 shows the importance of

recognizing support and resistance.

BREAKOUTS

At some point the support or resistance level is overcome. The

company's earnings picture

changes, new players come onto the scene, the Fed

takes a different tact: all these and many

other pieces of news or developing stories can cause

price breakouts or breakdowns. Prices

breakouts or price breakdowns usually bring a speedy

move away from the previous trading

range or price hesitation pattern. After the

breakout, prices are expected to move up or down,

at a minimum, the height of the previous trading

range. Many times they move up much

further. And the breakout run are often very

fast. This is why breakout playing is so popular.

Investors Daily has devoted whole segments of its

newspaper to this concept. Breakout buying

has a long history of successes, but no where more so

than in long bull markets. Read what

Jesse Livermore and Nicholas

Darvas wrote about this exciting way of trading.

"Jesse Livermore noticed several

things about stock market leaders in an up trending market. Their price

kept going up. That’s how you make money. He would look for industry groups that were

leading the market

and trade only the leaders of that group. This made perfect sense. A leading industry

group means only one

thing: there are more stocks going up than other groups. Not rocket science, but when

you're risking your

own money, you don't want it to be. By trading only stocks in a leading industry group you

can focus on that

small subset of stocks actually rising. He avoided weak stocks and their industry groups.

The probabilities

were too great of losing money...

"If Jesse found a stock he liked, he would decide in advance how many shares

he’d buy. If he decided

to

buy 400 shares of AAPL, he’d first purchase 100. If the price increased, he’d

buy another 100; then finish with

a

purchase of 200 shares if it kept rising. He needed confirmation that a stock would make

him money. What

better way to confirm a stock price is going up…than if it’s going up."

(Source: http://www.learnstockmarketlegends.com/jesse-livermore.html

)

Read

the reviews of the books by Darvas on Amazon.

http://www.amazon.com/o/ASIN/0818403969/105-0932341-4166013?SubscriptionId=19BAZMZQFZJ6G2QYGCG2

All New Highs Are Not Breakouts

New highs do not

necessarily entail a Breakout past well-tested resistance. There are

many more new highs that there are breakouts

past a horizontal line drawn through at least

3 previous highs. It is breakouts that we

are most interested in. But Tiger's internal strength

indicators validate new highs generally.

MTH below made a new high, but had no flat well-

tested resistance that it moved above.

So, it was not a "breakout" on 12/6 as we use that term.

Nevertheless, the falseness of its rally can be

seen in:

1) OBV did not make a corresponding new high.

2) The Tiger Accumulation Index was less than half of what it was 2 months' earlier.

3). The ITRS (Relative Strength) did not confirm the new high and was an insipid

.-3

Authenticating

Breakouts

Please see the discussion of this topic I began here on October

28, 2007.

TigerSoft and Peerless make much of breakouts and how to authenticate them, so that

we can buy the strongest of them and avoid the ones

that fail. Breakouts and breakdowns

are most reliable when the stock moves in the

direction of the overall market. Thus, a young

bull market with growing numbers of daily New Highs

is very beneficial to the breakout Buyer.

An aging bull market, or one that is ending, shows

many more false breakouts. In fact,

when you spot a number of false breakouts, you should

immediately consider the likelihood

that a severe correction or a bear market may be

beginning.

The best

price breakouts are also usually confirmed by a surge of volume. Our Tiger

Charts show increases of volume by making the price

bar red for that trading day. Price gaps

also make a breakout or breakdown more reliable.

The Tiger Charts let you authenticate breakouts by

showing a variety of internal strength

indicators, the majority of which should be making a

new high when prices breakout to new

highs. The same thing is true in reverse.

On Balance Volume should confirm a new high. This

measures aggressive buying. When it does not, a

pullback is often seen. See

the chart of SSRI

below. The Black OBV Line failed to confirm the

stock's recent price breakout over 40. The

Accumulation Index was positive and did reach the

levels of the old highs. The ITRS (Relative

Strength) definitely confirmed the breakout.

----------------------- SSRI: Example of Breakout and Pullback

------------------------------------------------------------

A true price breakout may still retreat without

achieving its price objective. But the

best breakouts advance 10% to 30% very quickly and

fulfill their minimum price objective,

sometimes in only a few days. In the chart

above, I would take the previous trading range

to be 14 point high, 40-26. If we consider the

price breakout to be 39, then the height

of the earlier pattern sets up a price objective of

39 + 14, or 53. SSRI still has more upside price

action ahead.

Broken

Resistance Becomes Support. Note the breakout at 31 in July was confirmed by

all our key indicators. In August prices did

pullback to the point of breakout. The retreat

quickly found support. The ITRS stayed very

positive. The Accum. Index turned only

slightly negative. Soon prices burst upwards to

a new high on (red) high) volume and moved

much higher. Any inspection of charts in a

rising general market environment will produce

hundreds of examples of pullbacks to the support of

earlier breakouts, just like this.

========= ABX Breaks our, Tests Point of Breakout and Rises

Sharply. ===============

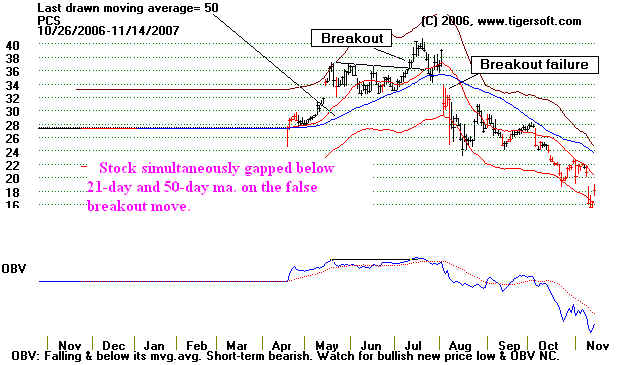

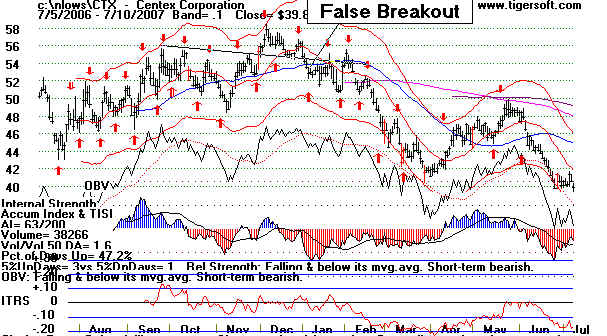

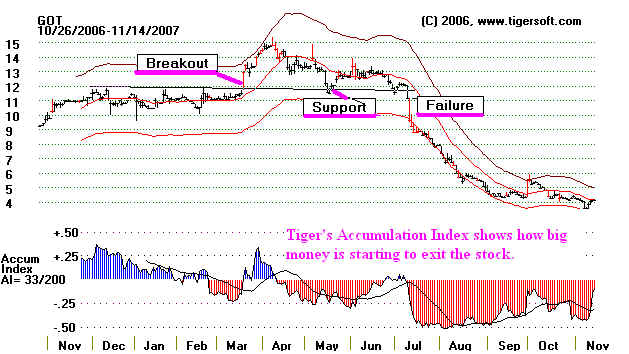

BREAKOUT FAILURES

Breakouts do sometimes fail. In these cases. prices move up a little and then

within a month or

two, fall back below the point of breakout. This usually occurs

because the general

market has faltered, because bad news has broadsided this

particular stock market or the

stock has been manipulated to force a short covering rally.

In all three cases, the

stock's initial move up has caught unsuspecting bulls. And

as the stock declines, they

will dump the stock if they are traders, rather than let losses

run or they will wait and wait

to get out even, thereby constituting resistance for

next rally up to the point of

breakout. When we look through old charts, we see

very few cases like the ones

below, where there is a truly false breakout above a

well-defined, well-tested

horizontal resistance. They are rare. But here some

cases to study.

Traders Must Sell on A Clear Breakout Failure.

Very Aggressive Traders Should Even Sell Short.

The

examples above show holding a stock that breaks out and then

quickly retreats back below the

point of breakout on a closing basis by

a few percent is a lot better

tactic than hoping somehow the breakout

failure is an illusion. It

will help you to see that most false breakouts

have internal strength indicators

which did not confirm the breakout.

Consider the possibility that the

stock broke out on a day when

the biggest players were absent,

that the breakout was artificial in the sense

that it was chiefly the result of

buying from people reading charts (!?)

and that it may signify an

important turn downwards by the market,

or, at least, the industry that the

stock was in.

|