|

Lessons from Argentina

Currency Collapse of 2002

You

know a country has problems when its main publicly

traded phone

company drops from 50 to 2 in two and a half

years. That was the case in Argentine. That stock's direction

matched

the US markets. But the size of the decline was

an Argentine

nightmare. Its nearly total collapse occurred

because of the

2002 collapse of the Argentine Peso.

Argentine Telephone Stock in ADRs

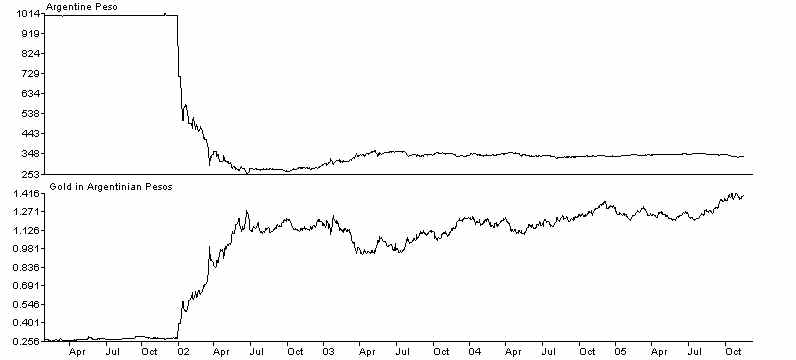

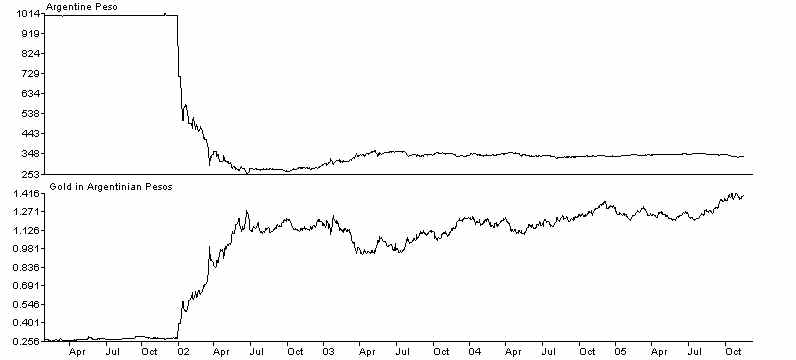

2002 Collapse of Argentine Peso.

The chart below shows how fast the Peso lost its value.

When it was suddenly de-coupled

from the Dollar, it fell 75% in 6 months. The decline was rapid, but not immediate.

What

Caused The Peso's Collapse in the First Half of 2002?

A brutal military dictatorship ruled Argenina from1976 to 1983. Thirty

thousand simply

disappeared.

Many were tortured and pushed out of air planes. There were no trials.

The dictatorship

ran up huge debts in failed projects and the Falkland/Malvinas

Islands War. (Compare this with George

Bush's absurdly arrogant war on Iraq, which

economists say will cost the US $3 trillion.)

Unemployment and international isolation ended the distatorship and there was an election

in 1983.

The new government tried to restore the

Argentine economy by creating a new currency. New state loans

were required on which in six years the government

defaulted. In 1989, Argentina's inflation reached 200%

per month, topping 3,000% annually. A

new government came in, campaigning on a populist platform,

then privatized the telephone, energy and water

services. With the new proceeds, the government started to

restore confidence in Argentina's currency and

economy. IMF loans were procured. The new Peso had a

monetary value fixed by the value of the US Dollar.

Life got immediately better for those with property and

good jobs. They could travel abroad, import

household appliances and computers. But Argentina's own exports

suffered and recession became endemic. To pay

its quickly rising debts, Argentina had to keep borrowing

more money from the IMF, it had nothing more to sell

off, so it delayed its repayments. In 1999, Argentina's

GDP dropped 4%. Exporters wanted a devaluation.

But Argentine banking experts argued against a controlled

devaluation, in which the Peso would be de-linked

from the Dollar. Devaluation was painted as unpatriotic.

So, the government did nothing while the recession

turned into a depression as the 2001 world-wide recession hit.

With government funds being exhausted and the

countries balance of trade worsening, wealthy Argentines converted

their money to Dollars and took it out of the country

for safety, This encouraged a "run on the Banks".

"The

official unemployment rate approached 20 percent and more than 40 percent

of the population lived under the poverty line. This

evolving economic apocalypse frightened

the wealthy elite who began to send their

peso/dollars abroad for safekeeping. This emptied

the Argentine Central Bank coffers of foreign

reserves which were heretofore used to amortize

the nation's humongous foreign debt of US$141 billion

(the greatest per capita foreign debt in

the world with the exception of the US.)" ( http://www.gold-eagle.com/gold_digest_03/vronsky062303.html

)

In 2001, people fearing the worst began withdrawing large sums of money from their bank

accounts, turning pesos into dollars and sending them

abroad, causing a run on the banks. The government then

enacted a set of measures that froze all bank

accounts for twelve months, allowing for only minor sums of cash

to be withdrawn. Many Argentines became enraged and

took to the streets of important cities, especially Buenos

Aires in 2001 to 2002. At first. there were simply noisy

demonstrations, but soon they included property destruction,

often directed at banks, foreign privatized companies, and

especially big American companies. Foreign capital

stayed away and .matters worsened.

Confrontations between the police and citizens became a common sight,

and fires were also set on Buenos Aires avenues. A State of

Emergency was declared, but this produced violent

protests in December 2001 in which several died.

The President fled in a hellicopter and residned, creating a

a political vacuum. An interim goverment emerged from

the Legislative Assembly. It defaulted on the larger

part of the public debt, $93 BILLION at the end of 2001

A new President, Eduardo Duhalde, was appointed

by the Legislative Assembly. Announcing "we are

in collapse" and "Argentina is bankrupt", he abandoned the

1-1 peso dollar parity in favor of a provisional 1:4 pesos

per dollar. All Dollar accounts were converted by law

to Pesos at this rate! It defaulted on $143 billion

in debt.

"After a few months, the exchange rate was left to float more or less freely. The

peso suffered a huge

depreciation, which in turn prompted inflation (since

Argentina depended heavily on imports, and had no means

to replace them locally at the time). The economic

situation became steadily worse with regards to inflation and

unemployment during 2002. By that time the original 1-to-1

rate had skyrocketed to nearly 4 pesos per dollar,

while the accumulated inflation since the devaluation was

about 80%. (It should be noted that these figures were

considerably lower than those foretold by most orthodox

economists at the time.) The quality of life of the average

Argentinian was lowered proportionally; many businesses

closed or went bankrupt, many imported products became

virtually inaccessible, and salaries were left as they were

before the crisis."

ARGENTINE RECOVERY SHOCKS THOSE WHO SAID

A COUNTRY

CAN NOT SIMPLY WALK AWAY FROM ITS INTERNATIONAL DEBTS

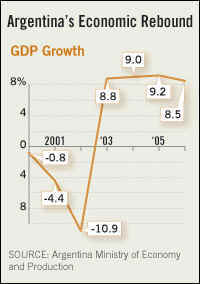

A year later, the economic outlook began to improve dramatically. Unlike in the

1990's, the cheaper price

for the Peso encouraged exports and tourism. The Peso

slowly revalued on its own. The trade surplus became

very large. While imports started to rise as citizens

began to prosper, foreign capital came into Argentina

worked to counter that force and strengthen the Peso.

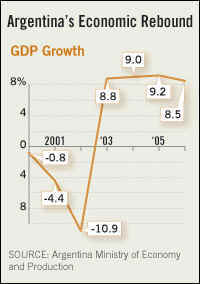

GNP surged 8.8% in 2004, 9.0% in 2005, 9.1%

in 2005 and 8.5% in 2006. Nine million people in

Argentina still live below the poverty line, but that's half

the number who suffered so five years ago.

Trendy Argetine restaurants...Elegant hotels... Smartly dressed guests....Harp concertos.

Busy outdoor markets on a sun-drenched. Flourishing tourism...

.

Argentina's Lessons for the US.

(1) A war is a great drain on

national resources. The occupation of Iraq puts the US at grave financial risk.

Three trillions dollars will have been wasted by Bush and

Cheney's blunder. We may never recover.

TigerSoft Bog -

3/7/2008 -The Real Cost of Bush and Cheney's Iraq ...

(2) Until the US can start to export much more, its

currency will be under steady pressure. Since this

article was written, a world-wide financial panic has hit.

This has made the Dollar and US Treasury

instruments seem to be havens for investors who have nowhere else

to turn. When, however, the

world-wide recession ends or China chooses to no longer provide

the US any more loans, the Dollar

will likely come down very hard, putting the US at risk of

discovering first-hand what Argentina has learned.

(3) The stronger Dollar since the fall of Crude oil in the Summer

of 2008, has made it even harder

to export American manufactured goods and allowed foreign

products to continue to dominatethe

shelves of American stores. This only makes the Dollar more

vulnerable longer term and brings

the US closer to the Argentine case.

(3) The world wide recession may very well dry up foreign

loans that keep an insolvent government afloat.

That is what happened to Argentina in 2001 and triggered

the collapse of its currency. Watch for signs

that China changes its policy of buying US Treasuries or an

OPEC decision to use currencies other

than the Dollar as the primary medium of international

exchange for buying its oil.

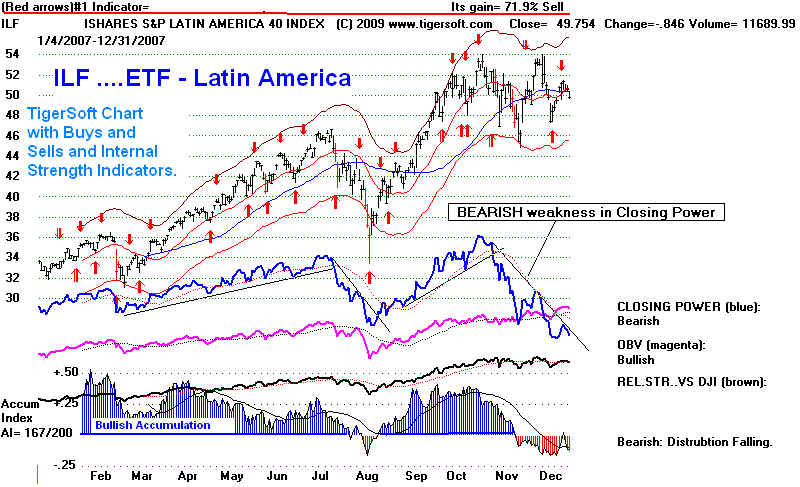

(4)The world wide bull market from 2003-2007 had been

leaving most of the US behind. The rising

foreign markets had the effect of creating a flight

from the dollar among American investors. Now,

the break in the bubble is making investors consider the

Dollar a safe place to put their money.

5) But US financial institutions, because of their reckless

use of leverage, are now in 2009, essentially

insolvent. So, they are no longer in a posiiton to

benefit from a strong Dollar. This will dramatically

hurt the long term trade imbalance of the US.

American banks are widely distrusted and despised, by

Americans and foreigners alike, as trillions of Dollars

must be raised by the Treasury and the Federal

Reserve to keep these Zombie Banks alive. This short-term

borrowing makes the US Goverment that

much more debt-ridden and financially vulnerable. The

grotesqueness of the bailouts for banks reveals

as never before how beholden both major political parties in the

US are to Wall Street.

(5) If the US follows the

Argentine model, its government will be tempted to sell off its finest assets in

sweetheart deals which they will term

"privatization". This has not happened yet, But as Obama

moves towards puting the US Government into a

position of owing $2 trillion, we may even see the

National Parks be privatized. Selling rights to

pollute to coal-burning US utilities is a sign of the times.

(6) More important, is what is happening to corporate

America. The 2008-2009 market massacre

is allowing China, and any foreign investor that wishes, to

buy corporate America for pennies on the

Dollar. When there is a recovery, profits will not

stay in this country. They will go overseas, if

the Argentine model plays out.

(7) The IMF bailed Argentina out, again

and again. "Like a gambling house that keeps handing out

chips to a losing player to keep him in the game, to clean

him out, the IMF kept shoveling dollars

into Argentina, until she had lost everything she

had." When their stock market was down to "give away"

levels, the banks and brokerages that control the IMF

bought Argentine stocks. In that way, the

backers of the IMF can lose billions in loans and still

make money.

http://64.233.167.104/search?q=cache:Q-i2wWDU_BQJ:www.worldnetdaily.com/news/article.asp%3FARTICLE_ID%3D25862+Argenitna+IMF+debacle%22&hl=en&ct=clnk&cd=1&gl=us&client=firefox-a

China and the

"friendly" OPEC countries are now doing this to the United States. But we

are not

being warned by our government, whose short term interests

are served by more borrowing.

(7) Government efforts to forbid the drain of currency can

create violent protests. If Obama raises

taxes too swiftly on the richest Americans, we can expect their

capital to go to overseas tax havens.

Already, the rich are wailing that Obama is a secret Marxist and

has started a "class war" against

the rich.

(8) At some point, when Americans wake up and find that

they are owned by foreigners, they will

turn nativist and kick and scream. But it will be too

late and poverty will become very widespread

because the collapse of a currency creates its own dynamics

and the decline starts to feed on itself:

At this point, nothing can stop its collapse.

Example: Fear of a currency collapse ---> flight of capital ---> unemployment

---->riots

-----> more fear and more flight of capital. The cycle only ends with a financial

panic and devaluation.

(9) A sudden and severe drop in a currency dishes up stark

changes in business and personal

consumption, as vital imports cannot be afforded and

businesses needing them fail. This sends

poverty and unrest to very dangerous levels. Such is

the experience of Argentina in 2002-2003.

10) At the same time, a very

over-priced currency soon generates recession and rapid increase

in impoverishment, too. Review Argenitina between

1997 and 2001. This is because the IMF will only

grant its loans (bailouts) on conditions that the

Government lay off many of its own workers and make

deep across-the-board cuts in its spending and and social

safety-net programs.

----- See World Bank's detailed study of this:

http://www-wds.worldbank.org/external/default/WDSContentServer/IW3P/IB/2003/07/22/000094946_03070904012091/Rendered/INDEX/multi0page.txt

The International Monetary Fund:

A Critical View by Pat Buchanan

: December 29, 2001

"The beneficiaries of IMF bailouts are the First World

speculators and plungers who find their emerging market

paper going rotten, but can access the Treasury and

Fed to get the IMF to bail out their clients, so they can get

their money out, while ours pours in. A second

beneficiary is the overpaid IMF employees with tax-free

salaries, who travel the world first-class as they

play savior of troubled nations. With the hook of our dollars,

they acquire real power by making the recipient

nations debtors, clients and captives of that rising New World

Order in which the IMF is to play a commanding role.

Bottom line: The IMF is the social safety net of

Goldman

Sachs. It exists to spare the Money Power the

free-market consequences of its idiot investments. Argentina's

is the greatest default in history – not the

last. More are coming. For all that keeps this game going is a U.S. trade

deficit of $450 billion and IMF and World Bank loans

that shovel tens of billions of dollars abroad annually to

stave off defaults. ( http://www.worldnetdaily.com/news/article.asp?ARTICLE_ID=25862

)

Economic Debacle in Argentina

|

The IMF Strikes Again

by Arthur Macewan

Dollars and Sense magazine, March / April 2002

As Argentina entered into the lasting downturn of the period since 1998, the IMF

continued, unwavering,

in its financial support. The IMF provided "small" loans, such as $3 billion in

early 1998 when the country's

economic difficulties began to appear. As the crisis deepened, the IMF increased its

support, supplying a

loan of $13.7 billion and arranging $26 billion more from other sources at the I end of

2000. As conditions

worsened further in 2001, the IMF pledged another $8 billion.

However, the IMF coupled its largesse with the condition that the Argentine government

maintain its

severe monetary policy and continue to tighten its fiscal policy by eliminating its budget

deficit.

(The IMF considers deficit reduction to be the key to macroeconomic stability and, in

turn, the key to

economic growth.)

The Argentine government undertook deficit reduction with a vengeance. With the

economy in a

nosedive and tax revenues plummeting, the only way to balance the budget was to

drastically cut

government spending. In early July 2001, just before making a major government bond

offering,

Argentine officials announced budget cuts totaling $1.6 billion (about 3% of the federal

budget),

which they hoped would reassure investors and allow interest rates to fall. Apparently,

however,

investors saw the cuts as another sign of worsening crisis, and the bonds could only be

sold at high

interest rates (14%, as compared to 9% on similar bonds sold just a few weeks before the

announcement

of budget cuts). By December, the effort to balance the budget required cuts that were far

more severe;

the government announced a drastic reduction of $9.2 billion in spending, or about 18% of

its entire budget.

http://www.itulip.com/forums/showthread.php?t=507

http://64.233.167.104/search?q=cache:qWYUHAQlwzsJ:www.zonalatina.com/Zldata208.htm+argentina+2001+currency+chart&hl=en&ct=clnk&cd=30&gl=us&client=firefox-a

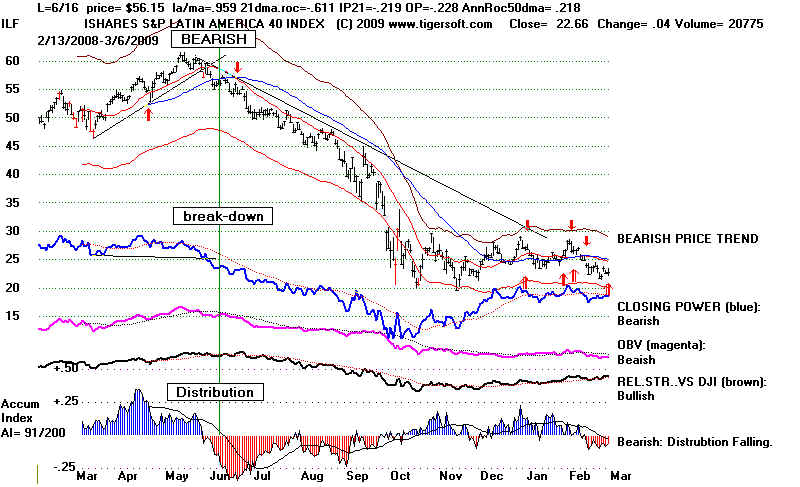

===================================================================================

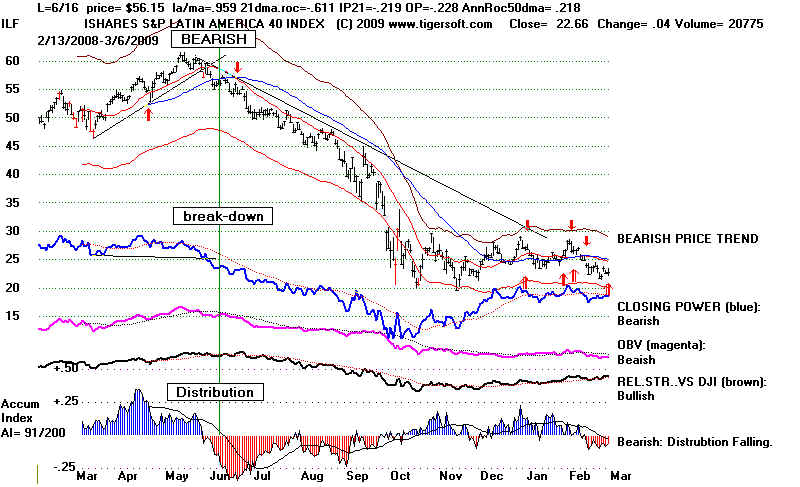

2008-2009 ILF - ETF

for Latin America

|