|

Stocks in Tiger's CHINA Group.

Actions Semiconductor Co., Ltd. (ACTS) - Actions Semiconductor Co.,

Ltd., through its subsidiaries, operates as a fabless semiconductor company in the

People's Republic of China. The company designs, develops, and markets integrated platform

solutions, including system-on-a-chips (SoCs), firmware, software development tools, and

reference designs for manufacturers of portable media players.

AIRYY - Air China (pink sheets)

ANGGY - ANGANG STL SPADR (pink sheets)

Aluminum Corp. of China Ltd. (ACH) - Aluminum Corporation of China Limited,

together with its subsidiaries, engages in the production, sale, and research of alumina

and primary aluminum in the People's Republic of China.

Acorn International, Inc. (ATV) - Acorn International, Inc., through its

subsidiaries, operates as an integrated multi-platform marketing company

in the People's Republic of China. It operates two primary sales platforms, TV direct

sales platform and nationwide distribution network. The company, through its TV direct

sales platform, markets its own proprietary products and services, as well as third-party

products and services.

Baidu.com, Inc. (BIDU) - Baidu.com, Inc. provides Chinese language

Internet search services. Its services enable users to find relevant information

online, including Web pages, news, images, and multimedia files through its Web site links

MORGAN STANLEY CHINA (CAF)

If you want to bet on a bubble collapse, consider shorting a China-focused ETF. "The

$1.1 billion Morgan Stanley China ETF (NYSE:CAF

- News) is the only U.S. ETF that invests

primarily directly in China companies," Oberweis said. "Other ETFs invest mainly

in Hong Kong.

CNOOC Ltd. (CEO) - CNOOC Limited, together with its subsidiaries, engages in the

exploration, development, production, and sale crude oil, natural gas, and

petroleum products in China.

China Fire & Security Group, Inc. (CFSG) - China Fire & Security Group,

Inc., through its subsidiaries, engages in the design, development, manufacture, and sale

of various fire safety products for the industrial fire safety market in

the People's Republic of China. It also engages in the design and installation of

industrial fire safety systems.

China Telecom Corp. Ltd. (CHA) - China Telecom Corporation Limited and its

subsidiaries provide wireline telecommunications and broadband services

in China. The company provides telecommunications and information services covering voice,

data, image, and multimedia in 20 provinces, municipalities, and autonomous regions in

China.

Chindex International Inc. (CHDX) - Chindex International, Inc. engages in

the provision of healthcare services, as well as in the sale of medical

equipment, instrumentation and products. It operates in two divisions, Healthcare Services

and Medical Products. Chindex International has operations primarily in the People's

Republic of China and Hong Kong. The company was founded in 1981 and is headquartered in Washington, District of Columbia.

CDC Corp. (CHINA) - CDC Corporation provides enterprise software,

online games, mobile services and applications, and Internet and media services.

The company's Software segment offers enterprise resource planning, customer relationship

management, supply chain management, order management systems, human resources and payroll

management, and business intelligence products. CDC Corporation is headquartered in

Causeway Bay, Hong Kong.

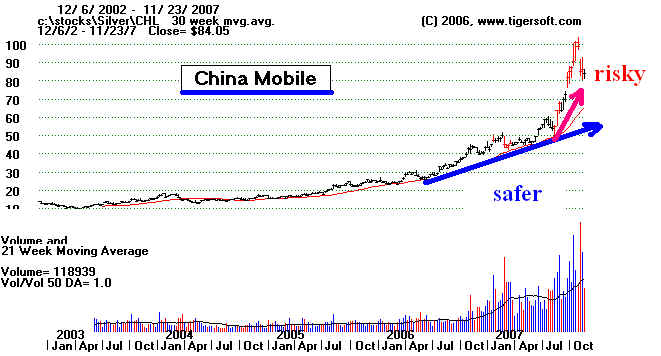

China Mobile Limited (CHL) - China Mobile Limited, through its subsidiaries,

provides mobile telecommunication and related services in Mainland China and Hong Kong.

Its services include local calls, domestic long distance calls, international long

distance calls, intra-provincial roaming, inter-provincial roaming, and international

roaming. The company is based in Central, Hong Kong.

China Mobile Limited is a subsidiary of China Mobile Hong Kong (BVI) Limited.

China Fund Inc. (CHN) -The China Fund, Inc. operates as a

nondiversified, closed-ended management investment company. The fund

primarily invests in the equity securities of companies and other entities with

significant assets, investments, production activities, trading, or other business

interests is China, or which derive a significant part of their revenue from China. Closed-end funds, on the other hand, often trade at a significant discount

or premium to the value of their assets. One reason for the disparity is related to

investor interest; funds in popular sectors tend to have smaller discounts or higher

premiums than funds in out-of-favor areas of the market.

Chunghwa Telecom Co. Ltd. (CHT) - Chunghwa Telecom Co., Ltd. provides integrated

telecommunications services in Taiwan. Its

principal services include fixed line services, including local, domestic long distance,

and international long distance telephone services; cellular services; and Internet and

data services comprising HiNet, its Internet service provider, fiber to the building

services, asymmetrical digital subscriber line services, and leased line services.

China Unicom Ltd. (CHU) - China Unicom Limited, an integrated

telecommunications operator, offers a range of telecommunications services in

China. Its services include GSM and CDMA cellular, international and domestic long

distance, and data and Internet services. The company was founded in 2000 and is

headquartered in Central, Hong Kong.

China Medical Technologies Inc. (CMED) - China Medical Technologies, Inc.

develops, manufactures, and markets medical devices for the treatment of

solid cancers and benign tumors in the People's Republic of China.

China Netcom Group Corp. (Hong Kong) Ltd. (CN) - China Netcom Group Corporation

(Hong Kong) Limited, together with its

subsidiaries, provides broadband communications and fixed-line telecommunications services

in China.

China Techfaith Wireless Communication Technology Ltd. (CNTF) - China Techfaith

Wireless Communication Technology Limited operates as a handset design and software

solutions provider in the People's Republic of China.

CHWTY - CHINA WIRELESS TECHN (pink sheets)

China Sunergy Co. Ltd. (CSUN) - China Sunergy Co., Ltd. and its subsidiaries

engage in the design, development, manufacture, and marketing of solar cells in China. The

company manufactures solar cells from silicon wafers utilizing crystalline silicon solar

cell technology to convert sunlight directly into electricity through a process, known as

the photovoltaic effect.

Ctrip.com International Ltd. (CTRP) - Ctrip.com International, Ltd. and its

subsidiaries provide travel related services including hotel reservation, air-ticketing,

packaged-tour services, as well as Internet advertising and other related services. It

sells air tickets for Chinese airlines, including Air China, China Eastern Airlines, China

Southern Airlines, and Shanghai Airlines, as well as international airlines operating

flights originating from cities in China, such as United Airlines, Northwest Airlines, Air

Canada, DragonAir, and Lufthansa.

DIPGY - DATANG INTL PWR ADR (pink sheets)

New Oriental Education & Technology Group (EDU) - New Oriental Education

& Technology Group, Inc. provides private educational services based

on the number of program offerings, total student enrollments, and geographic presence in

the People's Republic of China. It offers its program, service, and products in six areas:

language training; test preparation; primary and secondary school; educational content,

software, and other technology development and distribution; online education; and other

services and products.

iShares MSCI Hong Kong Index (EWH)

Focus Media Holding Ltd. (FMCN) - Focus Media Holding Limited operates

out-of-home advertising network using audiovisual television displays in the People's

Republic of China. Its out-of-home advertising network consists of commercial location

network, in-store network, poster frame network, mobile handset advertising network,

outdoor LED network, and movie theater network.

Greater China Fund Inc. (GCH) - The Greater China Fund, Inc. operates as a

nondiversified, closed-end management investment company. The fund primarily invests in

the equity securities of companies in the People's Republic of China.

China GrenTech Corp. Ltd. (GRRF) - China GrenTech Corporation Limited and its

subsidiaries engage in the manufacture and sale of wireless coverage

products and services to telecommunication operators in the People's Republic of China.

Its wireless coverage products include indoor coverage products and outdoor coverage

products, as well as base station coverage extension products.

Guangshen Railway Co. Ltd. (GSH) - Guangshen Railway Company Limited, together

with its subsidiaries, primarily provides railway passenger and freight transportation

services between Guangzhou and Shenzhen, as well as certain long-distance passenger

transportation services.

SPDR S&P China (GXC) - The investment seeks to replicate as closely as

possible, before fees and expenses, the total return performance of an equity index based

upon the Chinese equity market. The fund invests at least 90% of assets in the securities

that comprise the index. Top 10 Holdings: Bank of China 3988.HK, China Comstruction Bank,

China Life 2628.HK - 6.79%, China

Mobile 0941.HK - 12.91% of

assets, China Shenua - 1088.HK, CNOOC -

0883.HK, Indi & Commrcl Bnak of

CHina, PETROCHINA - 0857.HK -

6.42% of assets, PINH AN - 2318.HK,

Sinopec.

Home Inns & Hotels Management Inc. (HMIN) - Home Inns & Hotels Management,

Inc. engages in the development, lease, operation, franchise, and management of economy

hotel chains in China.

Huaneng Power International Inc. (HNP) - Huaneng Power International, Inc. and

its subsidiaries develop, construct, operate, and manage thermal power plants in China. It

engages in the development, construction, operation, and management of power plants in

Liaoning, Hebei, Shanxi, Shandong, Henan, Fujian, Jiangsu, Zhejiang, Guangdong, Jiangxi,

Gansu, and Hunan provinces, as well as in Shanghai and Chongqing municipalities.

Hurray! Holding Co. Ltd. (HRAY) - Hurray! Holding Co., Ltd. engages in the artist

development, music production, and offline distribution in China. It acts as online

distributor of music and music-related products, such as ring tones, ringbacktones, and

true tones to mobile users through various wireless value-added services platforms over

mobile networks and through the Internet.

JA Solar Holdings Co., Ltd. (JASO) - A Solar Holdings Co., Ltd., through its

subsidiaries, designs, manufactures, and sells solar cells primarily in the People's

Republic of China. The company offers monocrystalline solar cells. It sells its products

primarily through a team of sales and marketing personnel to solar module manufacturers,

who assemble and integrate its solar cells into modules and systems that convert sunlight

into electricity.

51job Inc. (JOBS) - 51job, Inc. provides integrated human resource

services to employers and job seekers in China. It offers recruitment related

advertising services, including print advertising, online recruitment, and executive

search services; and other human resource related services, such as training and business

process outsourcing.

China Finance Online Co. Ltd. (JRJC) - China Finance Online Co. Limited, through

its subsidiaries, engages in selling online financial services analyzing financial

and listed company information in the People's Republic of China.

Jinpan International Ltd. (JST) - Jinpan International Limited, an investment

holding company, engages in the design, manufacture, and sale of cast resin transformers

for voltage distribution equipments in the People's Republic of China.

Linktone Ltd. (LTON) - Linktone, Ltd. provides telecom media, entertainment, and

communication services to mobile and fixed phone users in the People's

Republic of China. It engages in the development, aggregation, marketing, and distribution

of consumer telecom applications for access by users.

Kongzhong Corp. (KONG) - KongZhong Corporation, through its subsidiaries,

provides wireless interactive entertainment, media and community services to mobile phone

users in the People's Republic of China. It also specializes in the development,

marketing, and distribution of consumer wireless value-added services.

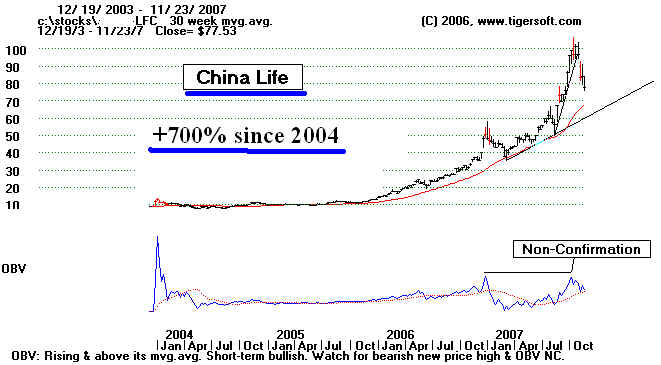

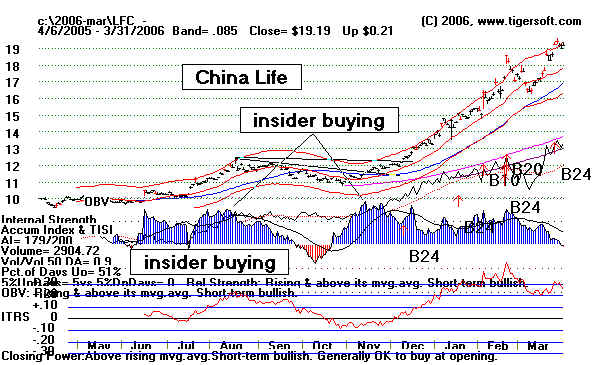

China Life Insurance Co. Ltd. (LFC) - China Life Insurance Company Limited

provides annuity products and life insurance to individuals and groups in China. The

company offers products and services, such as individual and group life insurance,

accident, and health insurance. It distributes its products through its direct sales

representatives; agents; intermediaries; and commercial banks, postal savings, and

cooperative saving institutions. The company was founded in 1949 and is headquartered in

Beijing, China. China Life Insurance Company Limited is a subsidiary of China Life

Insurance (Group) Company.

eLong Inc. (LONG) - eLong, Inc., through its subsidiaries, provides online travel

services in the People's Republic of China. It offers travel information and

hotel reservations at approximately 3,500 hotels in 294 cities, as well as air tickets in

approximately 50 cities through its toll-free call center, reseller network, and Web

sites.

Mindray Medical International Ltd. (MR) - Mindray Medical International Limited,

through its subsidiary, Shenzhen Mindray Bio-Medical Electronics Co., Ltd., engages in the

development, manufacture, and marketing of medical devices. It operates through three

segments: Patient Monitoring Devices, Diagnostic Laboratory Instruments, and Ultrasound

Imaging Systems.

The9 Limited (NCTY) - he9 Limited, through its subsidiaries, engages in the

development and operation of online games, and Internet and Web site related businesses in

the People's Republic of China. It has licenses to operate various massively multiplayer

online role playing games.

Ninetowns Internet Technology Group Company Limited (NINE) - Ninetowns Internet

Technology Group Company Limited, through its subsidiaries, provides enterprise

solutions to streamline the import/export process in the People's Republic of

China (PRC).

Netease.com Inc. (NTES) - NetEase.com, Inc., through its subsidiaries, operates

an interactive online and wireless community in China. It provides

Chinese language content and services through its online games, wireless value-added

services, and Internet portals.

PacificNet, Inc. (PACT) - PacificNet, Inc. provides gaming and mobile

game technology, e-commerce, and customer relationship management (CRM) in China.

Its gaming products are designed for Chinese and Asian gamers with focus on integrating

localized Chinese and Asian themes and content, advanced graphics, digital sound effects,

and popular domestic music, with secondary bonus games and jackpots. The company's gaming

products include: multi-player electronic table games, such as Baccarat, Sicbo,

Fish-Prawn-Crab, and Roulette machines, as well as server-based games with multiple client

betting stations; slot machines; bingo and keno machines; video lottery terminals;

amusement with prizes machines; gaming cabinet and client/server system designs; online

i-gaming software design; and multimedia entertainment kiosks. PacificNet's gaming clients

include hotels, casinos, and gaming operators in Macau, Asia, and Europe, while its

e-commerce and CRM clients include various telecom companies, banks, insurance, travel,

marketing and business services companies, and telecom consumers in Greater China. The

company was founded in 1987 and is headquartered in Beijing, the People's Republic of

China.

PowerShares Gldn Dragon Halter USX China (PGJ) - The investment seeks results

that correspond generally to the price and yield (before the Fund's fees and expenses) of

an equity index called the Halter USX China index(SM). The fund normally invests at least

80% of total assets in equity securities of companies deriving a majority of their

revenues from the People's Republic of China. It may invest at least 90% of total assets

in equity securities that comprise the China Index. The fund seeks to match the

performance of the China Index. Top holdings are: ACH, LFC, CHL, CN, CHA, CHU. CEO, HNP,

PTR and Sinopec. (4.5% to 5.99% of assets each).

PetroChina Co. Ltd. (PTR) - PetroChina Company Limited, together with its

subsidiaries, engages in petroleum and natural gas related activities in

the People's Republic of China. It operates in four segments: Exploration and Production,

Refining and Marketing, Chemicals and Marketing, and Natural Gas and Pipeline.

Sinopec Shanghai Petrochemical Co. Ltd. (SHI) - Sinopec Shanghai Petrochemical

Company Limited engages in processing crude oil into synthetic fibers, resins and

plastics, intermediate petrochemical products, and petroleum products primarily

in the People's Republic of China.

Sina Corp. (SINA) - SINA Corporation operates as an online media company

and information services provider in the People's Republic of China. It provides

region-focused online portals, MVAS, search and directory, interest-based and

community-building channels, free and premium email, blog services, audio and video

streaming, online games, classified listings, fee-based services, e-commerce, and

enterprise e-solutions. "In most cases, investors would expect the mixture of

three tantalizing ingredients -- wireless, China, and advertising -- to result in hockey

stick stock charts. But in the case of several companies providing wireless

value-added services (WVAS) in China, the recipe is causing more cases of indigestion,

with many stocks down 50% or more so far this year. China's WVAS market is made up of

companies such as KongZhong (Nasdaq: KONG), Linktone,

and Hurray! Holdings (Nasdaq: HRAY), which

offer wireless access to content such as games, music, and messaging applications.

But these players are increasingly moving to diversify away from purely wireless offerings

in light of a rapidly changing marketplace. "While many competitors have already

turned in retreat, KongZhong believes that the wireless Internet holds great potential and

is still in its early stages in China. The company recently reported earnings that were

largely in line with expectations, commenting that WVAS revenues were flat on a sequential

basis. With leading wireless operator China Mobile (NYSE:

CHL) making up 75% of these

revenues, the company was feeling the negative impact of new

policies China Mobile put in place that favor its own embedded offerings.

KongZhong is working to develop a wireless advertising business line to make up for an

uncertain future in the wireless services segments. The company has so far had

success courting customers such as Nike (NYSE: NKE), BMW, and

Blackberry maker Research In Motion (Nasdaq: RIMM). Competitor Hurray! has

taken a different tack in light of dismal performance, however, choosing to merge with

private Chinese media content and production company Enlight Media. This move will broaden

the combined company away from its wireless focus and make it a cross-platform media

provider" .

( http://www.fool.com/investing/general/2007/11/26/not-everything-is-flying-high-in-china.aspx

)

Shanda Interactive Entertainment Ltd. (SNDA) - Shanda Interactive Entertainment

Limited, through its subsidiaries, engages in the development and operation of online

games in China.

China Petroleum & Chemical Corp. (SNP) - China Petroleum & Chemical

Corporation, through its subsidiaries, operates as an integrated oil and gas, and

chemical company in the People's Republic of China and Hong Kong. Its oil and gas

operations include exploring for, developing, and producing crude oil and natural gas;

transporting crude oil, natural gas, and products by pipelines; refining crude oil into

finished petroleum products; and marketing crude oil, natural gas, and refined petroleum

products.

Sohu.com Inc. (SOHU) Sohu.com, Inc. provides a range of online

products and services to consumers and businesses in the People's Republic of

China. Its products and services to businesses include brand advertising and sponsored

search.

Solarfun Power Holdings Co. Ltd. (SOLF) - Solarfun Power Holdings Co., Ltd., through

its subsidiary, Jiangsu Linyang Solarfun Co., Ltd., engages in the development,

manufacture, and sale of photovoltaic (PV) cells and PV modules primarily

in the People's Republic of China.

Suntech Power Holdings Co. Ltd. (STP) - Suntech Power Holdings Co., Ltd.,

through its subsidiaries, engages in the design, development, manufacture, and marketing

of photovoltaic (PV) cells and modules. It also provides PV system

integration services in China.

Telestone Technologies Corp. (TSTC) - Telestone Technologies Corporation

provides wireless communications coverage solutions in Vietnam,

Indonesia, Malaysia, Thailand, and India. Its wireless coverage solutions include research

and development, and application of wireless communications technology.

TSGTY - TSINGTAO BREWERY LTD - pink sheets

TSL - Trina Solar Ltd.- Trina Solar Limited, through its subsidiary,

Changzhou Trina Solar Energy Co., Ltd., engages in the manufacture and sale of solar-power

products primarily in China.

Vimicro International Corp. (VIMC) - Vimicro International Corporation, through

its subsidiaries, engages in the design, development, and marketing of mixed-signal

semiconductor products and solutions for the consumer electronics and communications

markets in the People's Republic of China.

Qiao Xing Universal Telephone Inc. (XING) - Qiao Xing Universal Telephone, Inc.,

together with its subsidiaries, engages in the manufacture and distribution of

telecommunications products primarily in the People's Republic China. It

primarily manufactures mobile phone handsets under CECT and COSUN brands.

Yanzhou Coal Mining Co. Ltd. (YZC) - Yanzhou Coal Mining Company Limited engages

in underground coal mining, preparation and processing, sales, and

railway transportation of coal. It has interests in Xinglongzhuang, Baodian, Nantun,

Dongtan, Jining II, and Jining III coal mines.

China Southern Airlines Co. Ltd. (ZNH) - China Southern Airlines Company

Limited, together with its subsidiaries, engages in the airline operations in

the People's Republic of China, Hong Kong and Macau regions, and internationally. It

provides domestic and international passenger, cargo, and mail airline services.

also

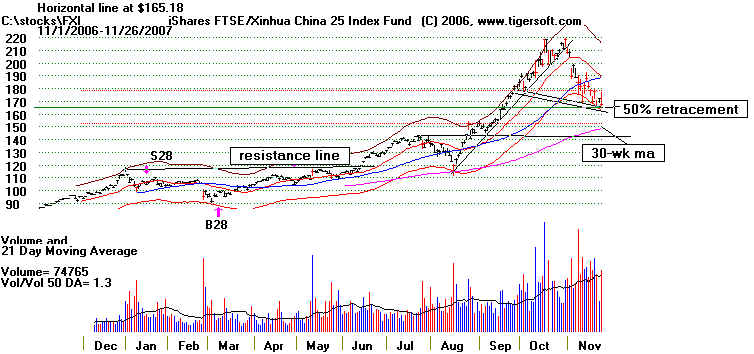

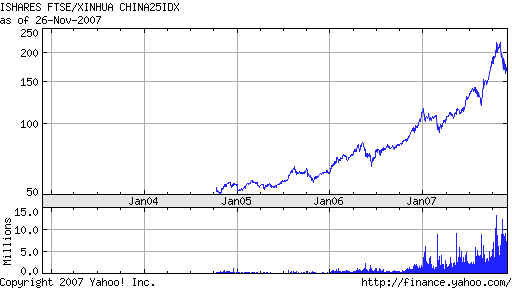

iShares FTSE/Xinhua China 25 Index (FXI) - The investment seeks investment

results that correspond generally to the price and yield performance, before fees and

expenses, of the FTSE/Xinhua China 25 index. The fund generally invests at least 90% of

assets in the securities of the index or in ADRs, GDRs or EDRs representing securities in

the index.

TOP 10 HOLDINGS ( 62.57% OF TOTAL ASSETS)

| Company |

Symbol |

% Assets |

| CHINA COMM CONS |

1800.HK |

3.92 |

| China Construction Bank |

N/A |

5.76 |

| CHINA LIFE |

2628.HK |

8.6 |

| China Merchants Bank |

N/A |

3.87 |

| CHINA MOBILE |

0941.HK |

10.93 |

| CHINA SHENHUA |

1088.HK |

4.55 |

| CNOOC |

0883.HK |

4.56 |

| Industrial & Commercial Bank of China |

N/A |

6.09 |

| PETROCHINA |

0857.HK |

9.42 |

| PING AN |

2318.HK |

4.87 |

|

|

|

|

|

Since writing this, I received

a note from Marc LeClerc in Canada. He says we

Since writing this, I received

a note from Marc LeClerc in Canada. He says we

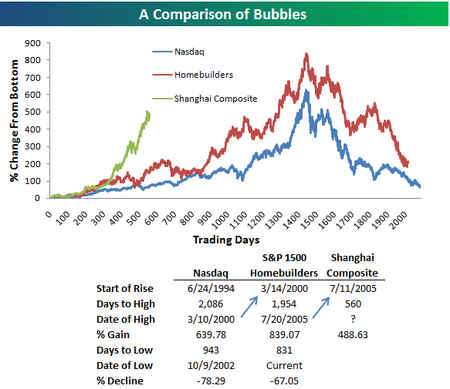

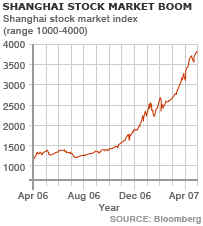

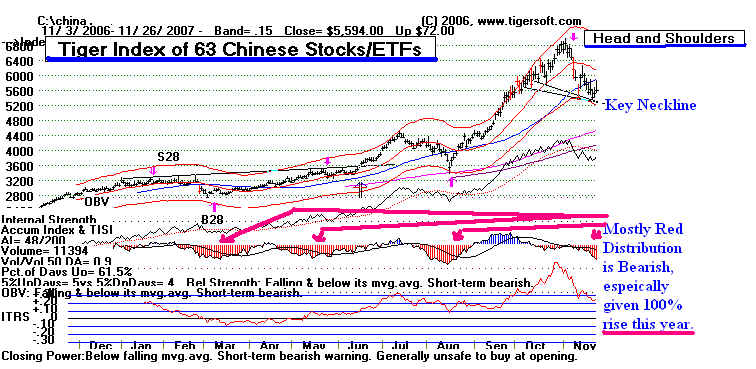

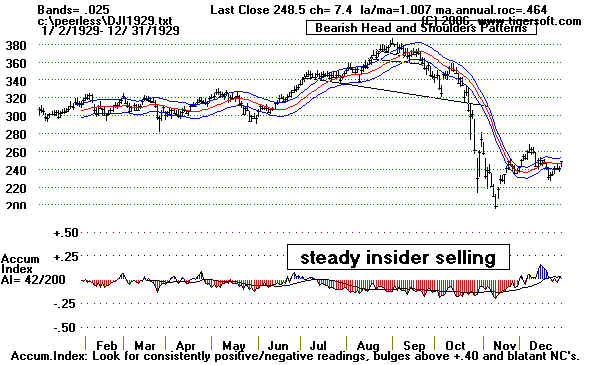

China Looks Like The DJI in 1929

China Looks Like The DJI in 1929

For those that want to short Chinese stocks, consider EXP. ProShares

launched an exchange

For those that want to short Chinese stocks, consider EXP. ProShares

launched an exchange