TigerSoft and Peerless Daily

Hotline

www.tigersoft.com/-2GBL13HL/index.htm

The

location of this Hotline will change tomorrow (Wednesday)

night.

The

location of this Hotline will change tomorrow (Wednesday)

night.

If you did not get the new email address, please email me.

william_schmidt@hotmail.com

(C) 1985-2013 William Schmidt, Ph.D. www.tigersoft.com All rights strictly reserved.

---> To renew this Hotline, order here $350 (check) - $360(Visa/MC)

=====================================================================================

A Guide To Profitably Using The

Tiger Nightly HOTLINE

A Guide To Profitably Using The

Tiger Nightly HOTLINE

TigerSoft and Peerless Links, Older

Hotlines...

Most recently: http://tigersoft.com/-SBL13HL/index.htm

Please report broken links to william_schmidt@hotmail.com

=====================================================================================

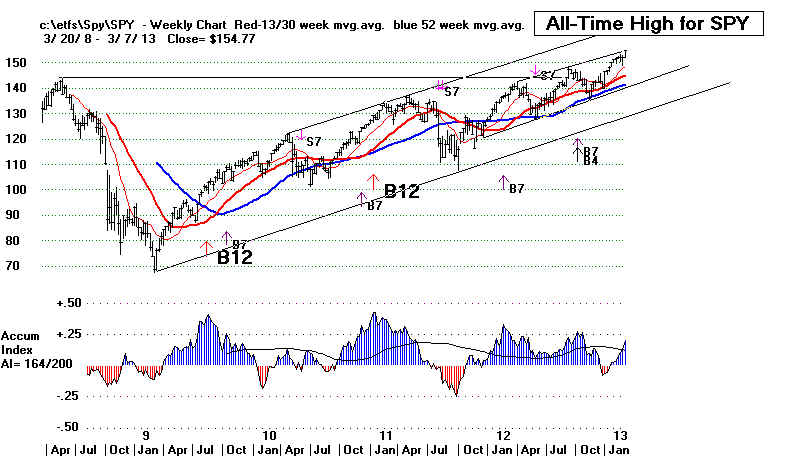

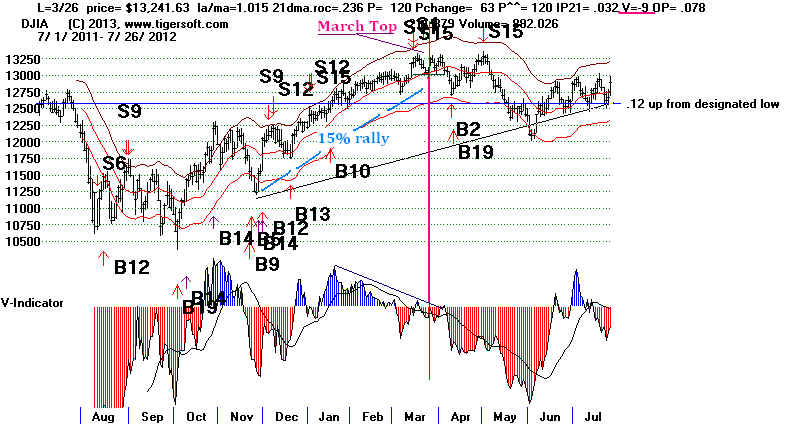

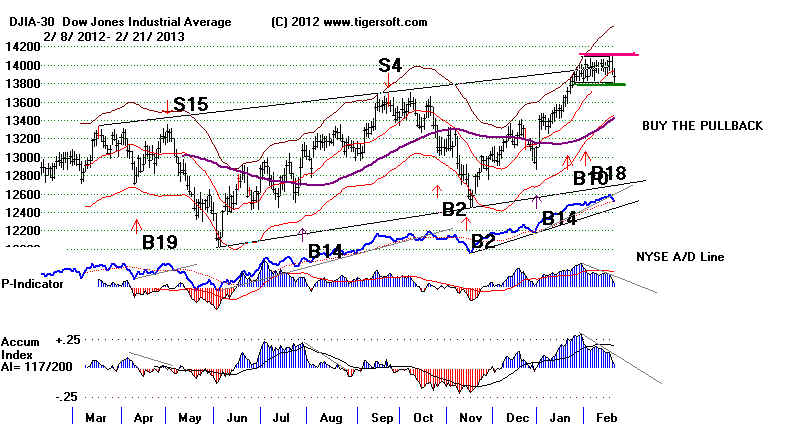

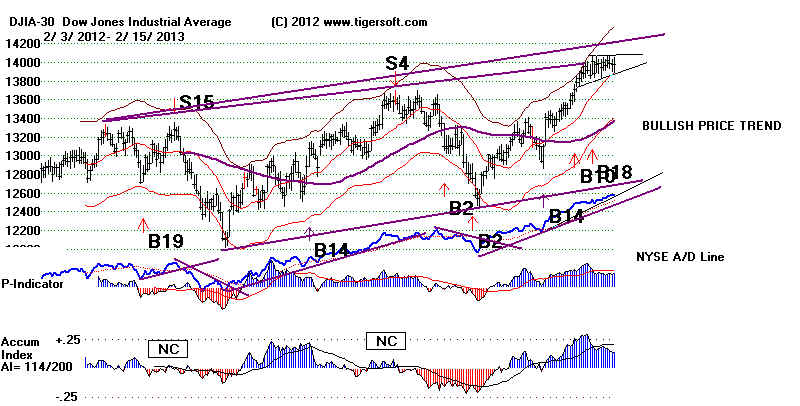

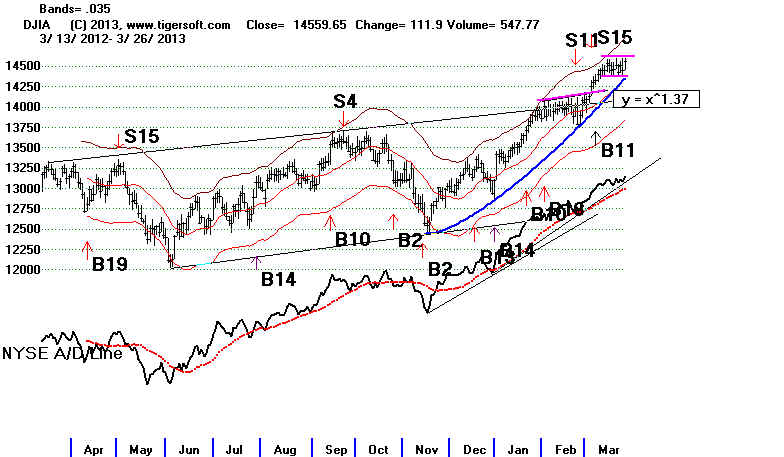

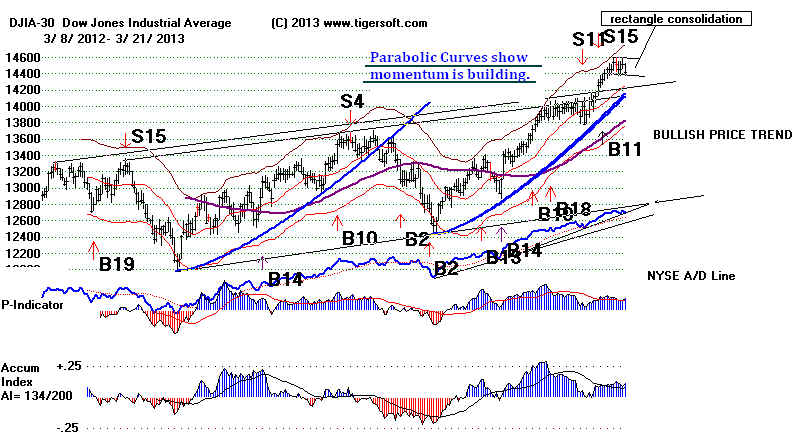

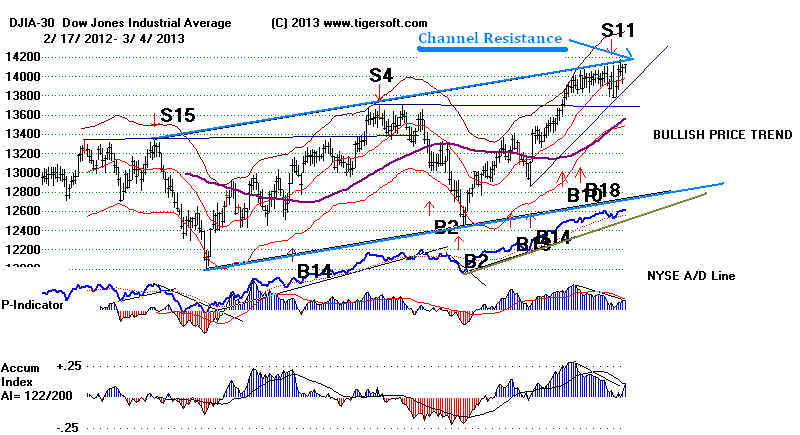

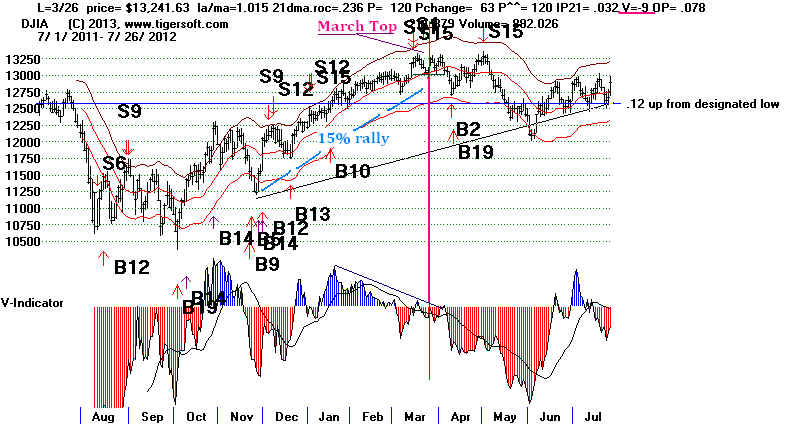

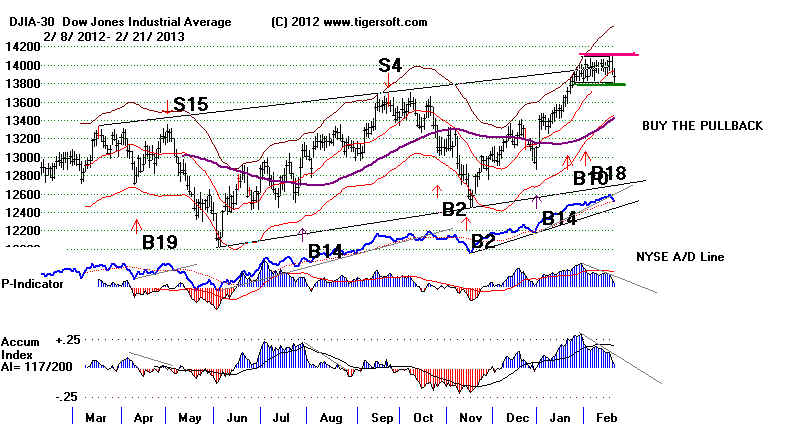

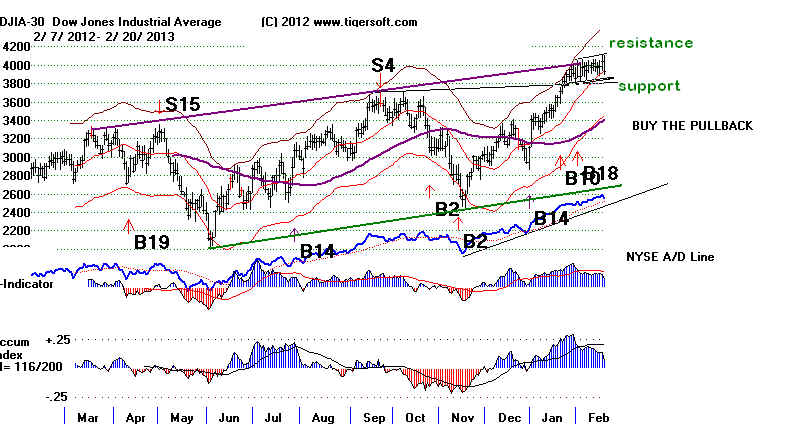

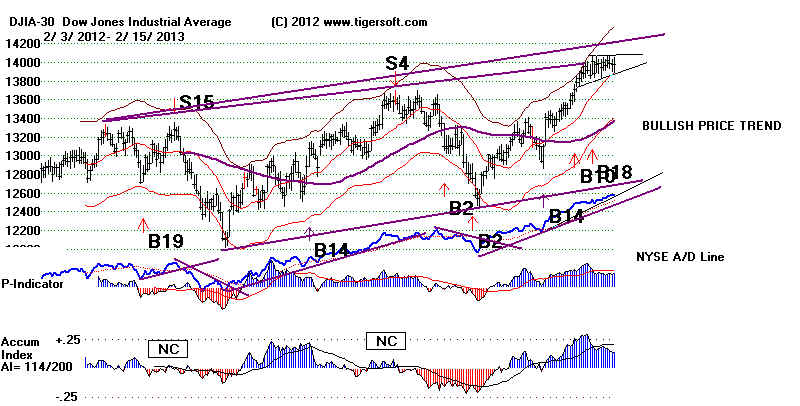

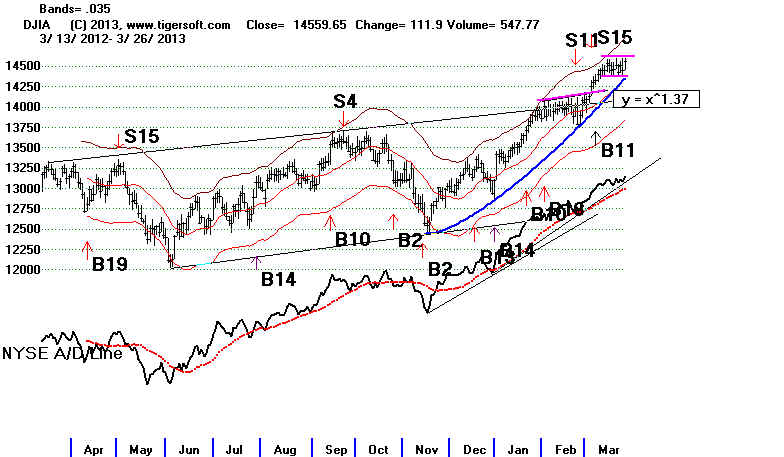

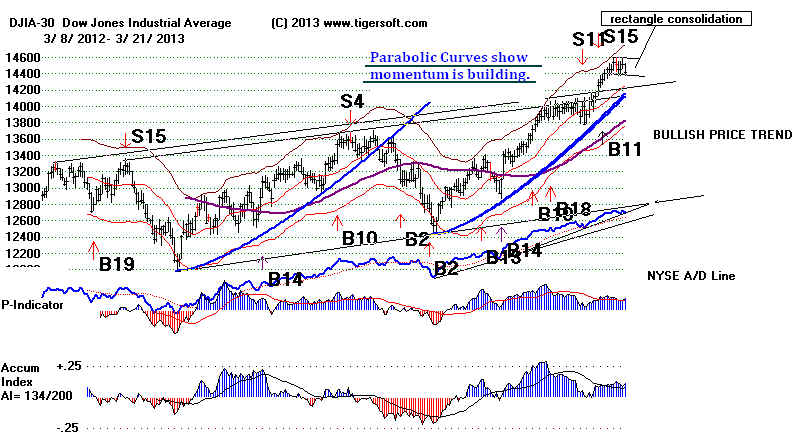

3/26/2013 The DJI's New High Closing did not get past 14600. We

still want a breakout which closes above the highest levels of the recent

trading range, a bullish flag pattern. The battle

between the profit-takers

and more aggressive public buyers is still in full swing.

Orthodox Peerless

followers of the Sell S9 should not give up hope. But they should keep

in mind that longer-term very low-cost Big Bank borrowing like Bernanke has

introduced is unprecedented. I would prefer not to sell

short DIA or

SPY until there is a Sell S9, a Sell S12, an A/D line trend-break or

the key Closing Powers for SPY and DIA drop below their 21-day ma.

3/26/2013 ---> To All Key Index

and Leading Stock Charts

---> 222 MAXCP stocks Bullish MAXCP

Stocks (3/26/2013) BULLish plurality

---> 65

MINCP stocks Bearish

MINCP Stocks (3/26/2013)

--->86 New Highs on NASDAQ 15 new lows. BULLish

plurality

--->174 New Highs on NYSE 5

new lows. BULLish

plurality

3/26/2013 Key Values: DJI 14560 +112 la/ma= 1.015 21dma-roc = 0.645 P= 405 Pch= +135

IP21 = +.156 (on 1/30/2013 IP21 was .293) V =

+37 Opct =

.379 65 day-pct-up = .09

(Note the big improvement in 21-day ma ROC and IP21 today from yesterday.)

It's important to note, too, that the DJI's new high today was not confirmed by other

indexes (SP-500, NASDAQ, Value Line, OEX, NYSE) or the Closing Power

and DailyVolume remained low. This is not immediately bearish. But it is

a warning for bulls not to celebrate yet.

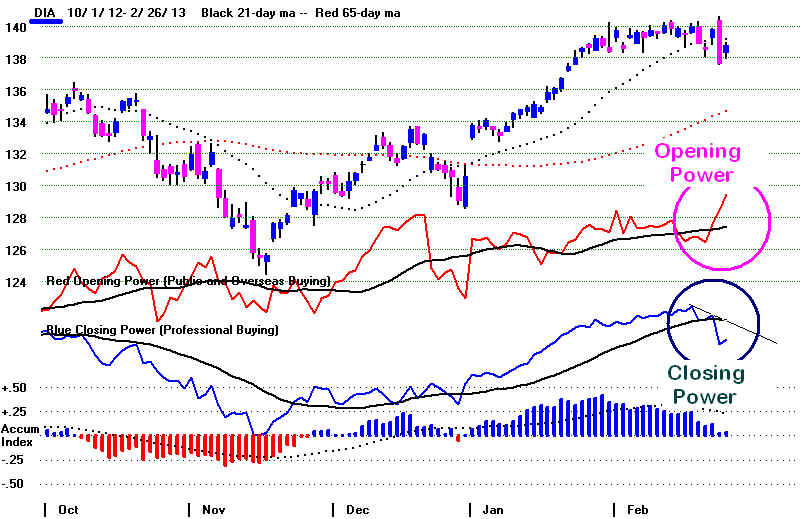

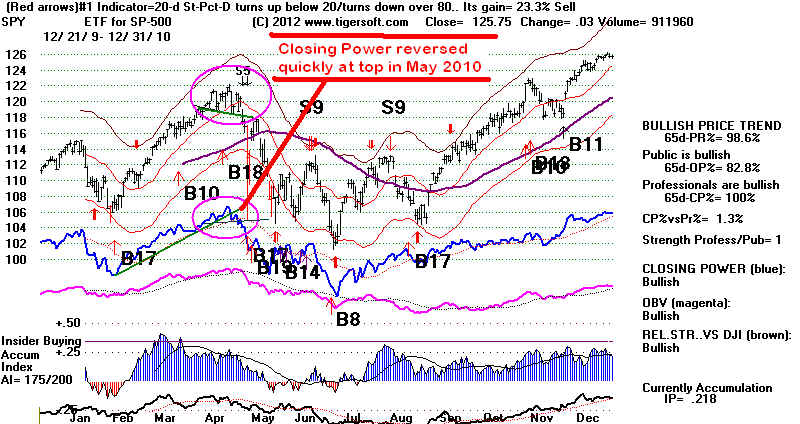

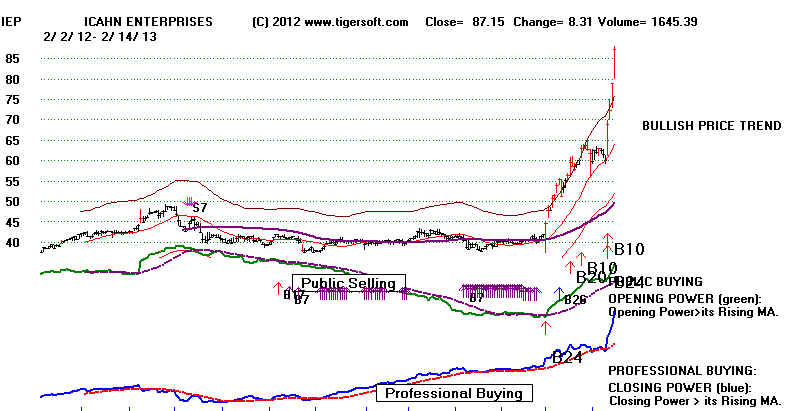

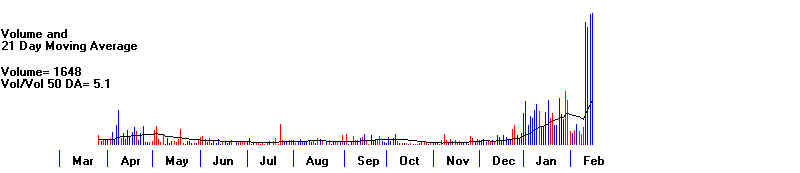

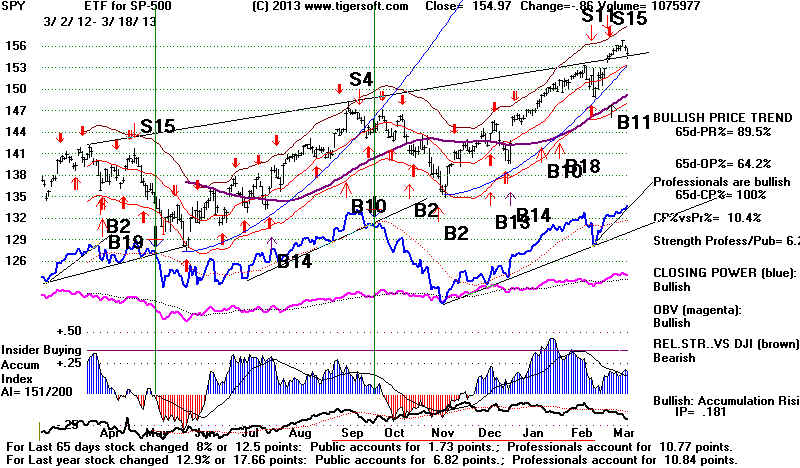

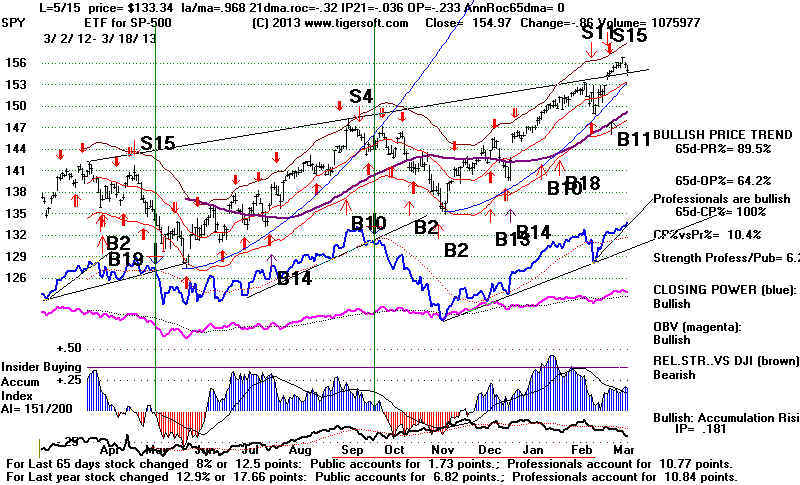

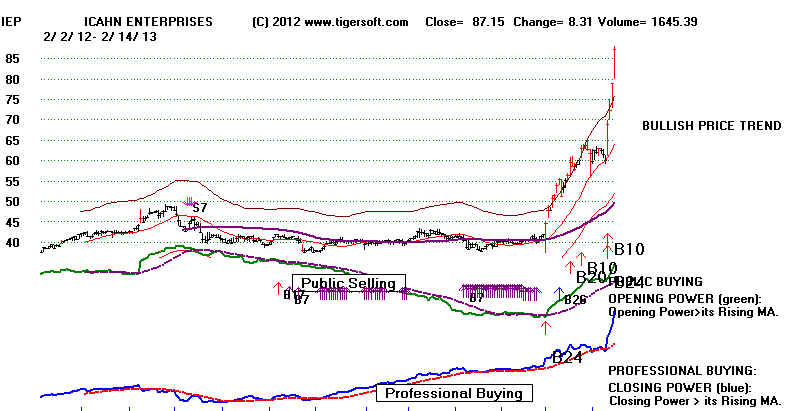

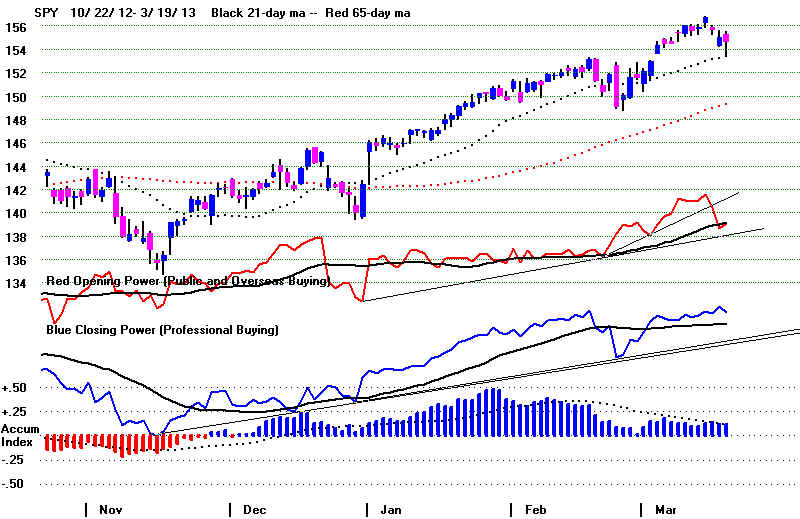

Bullish are the DJI's parabolic uptrend, the all-time high and

relatively high level of Accumulation . They show that most big institutional

investors are holding their positions tightly after heavily buying in January. They

do not want to sell yet, for fear of missing higher prices. The many bulges of

very high Accumulation in January in many, many stocks was one of the

bullish factors we spotted back then to make us bullish.

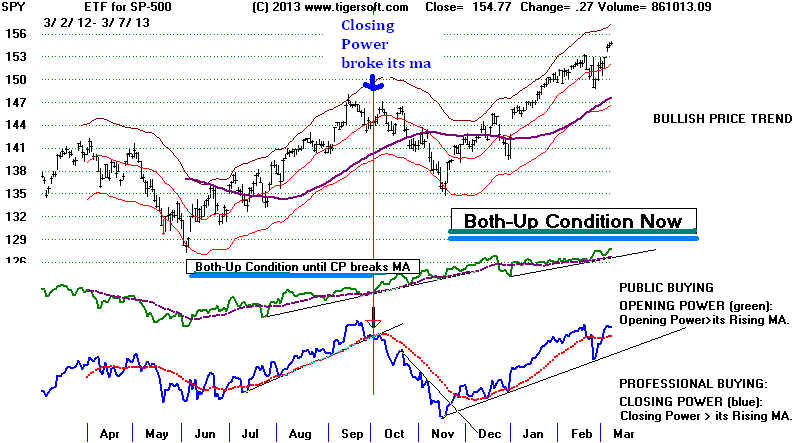

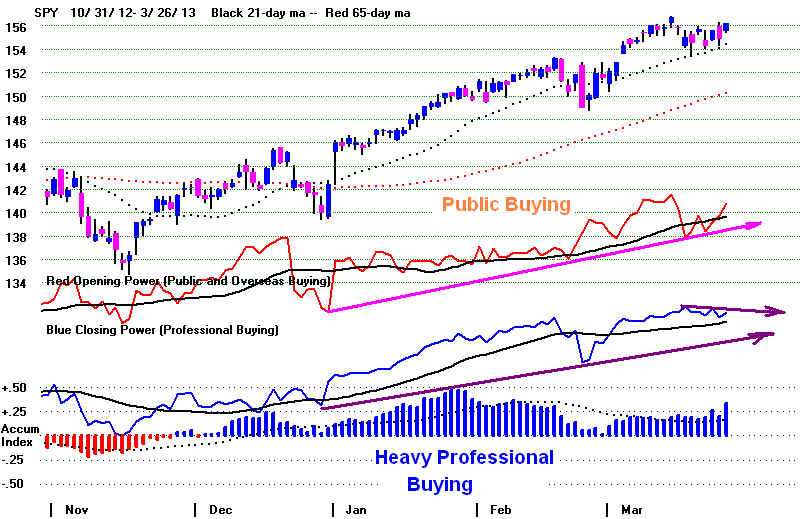

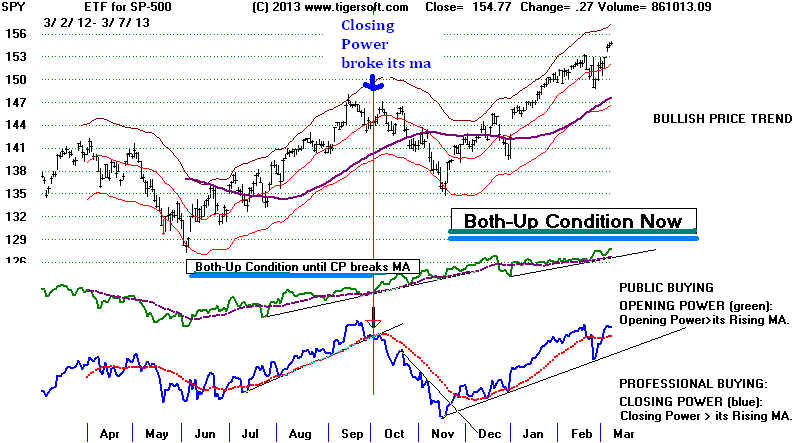

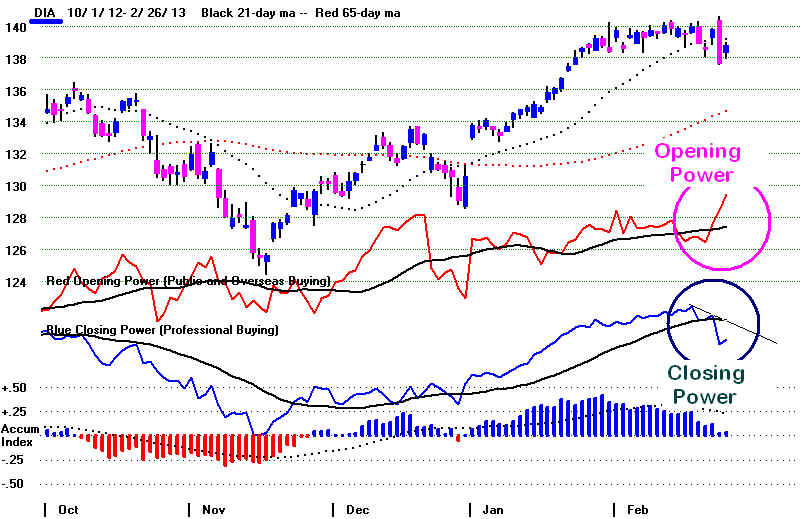

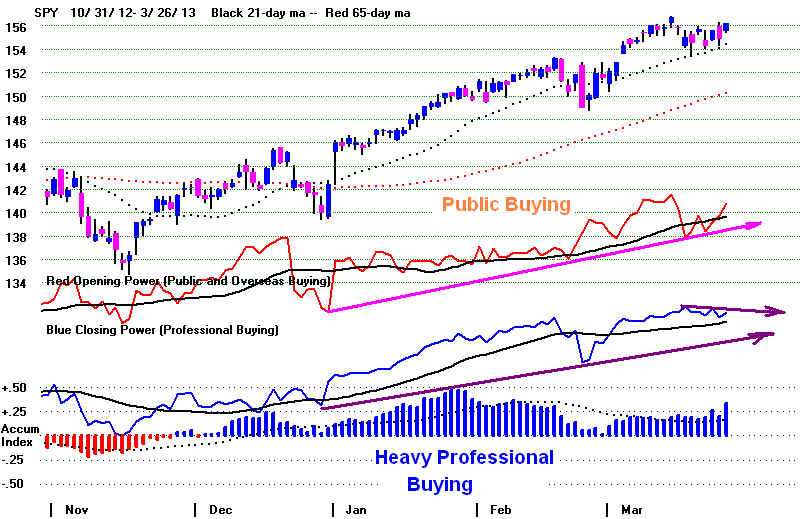

Now with the Opening Power rising, we can see that the broad Public is buying

more and more aggressively. This is what we would expect in a more and

more specualtive market, driven by the Fed's repeated promises not to

raise interest rates until at least 2014.

Seasonally, as I showed last night, this would be a typical time for a

clearer and more powerful breakout. Perhaps, 15000 will be seen very

soon. A clear breakout above flat resistance, especially when the underlying

trend is rising faster and faster, can be very exciting. What headlines the

DJI at 15000 would make, especially if accompanied by on Employment data!

Gold stocks are still in the doldrums. This is usually bullish for the

stock market. Crude oil has turned up. This will help XOM and CVX,

two high priced DJI stocks.

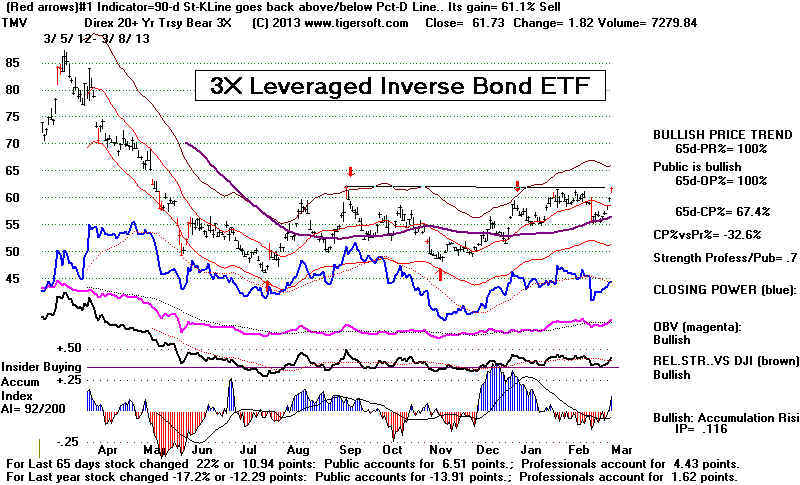

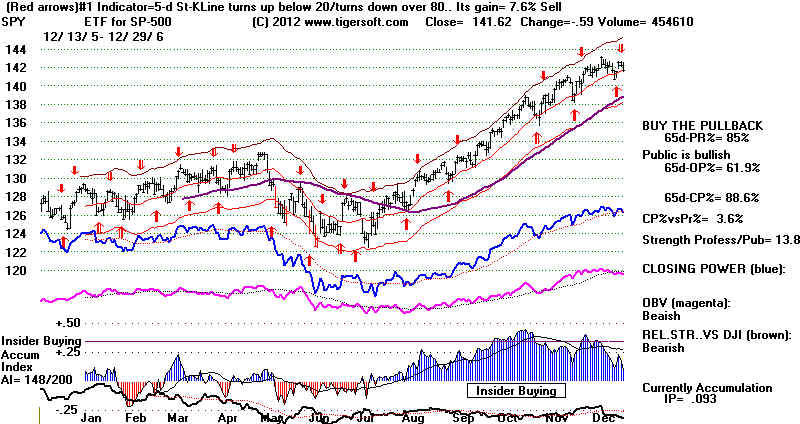

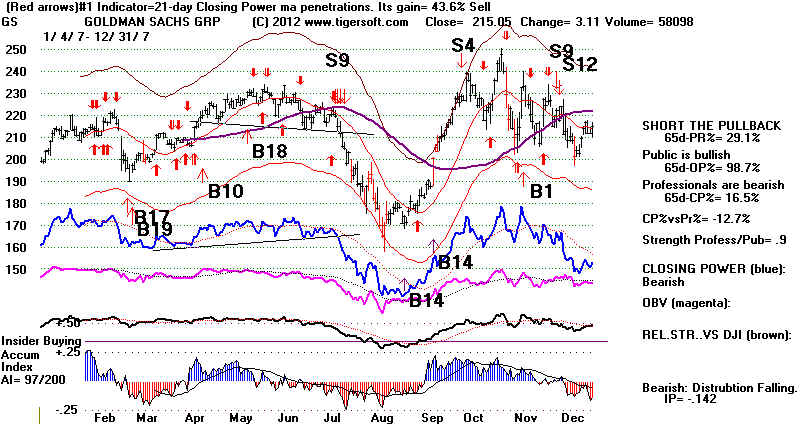

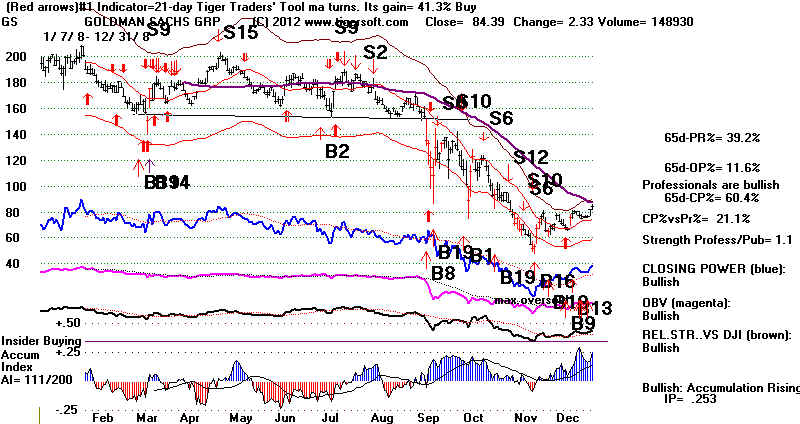

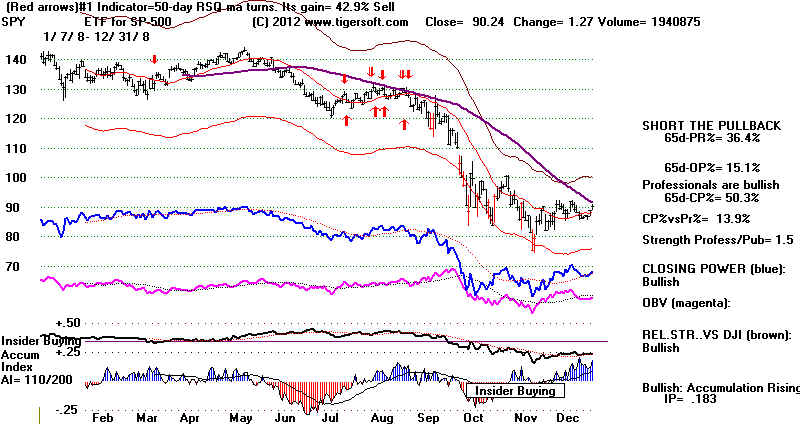

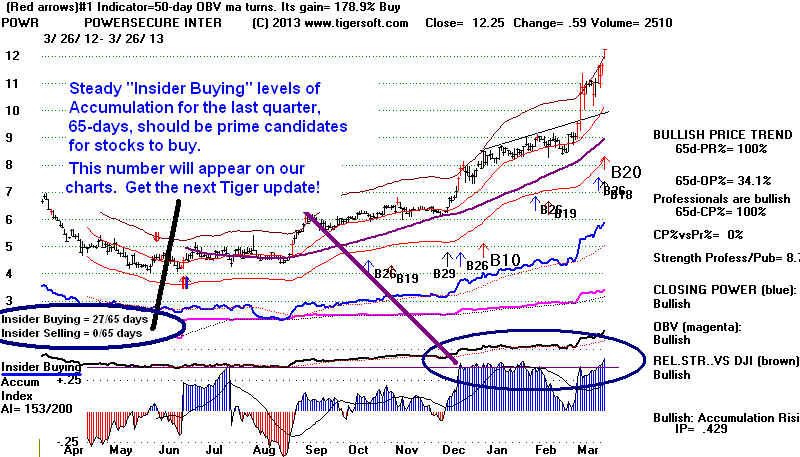

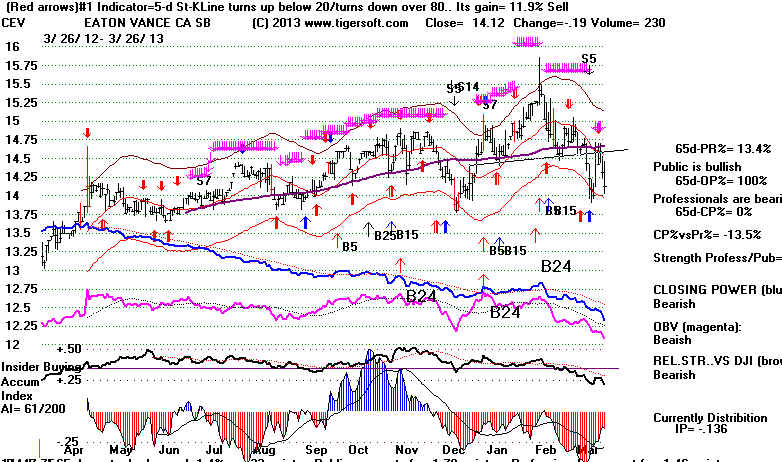

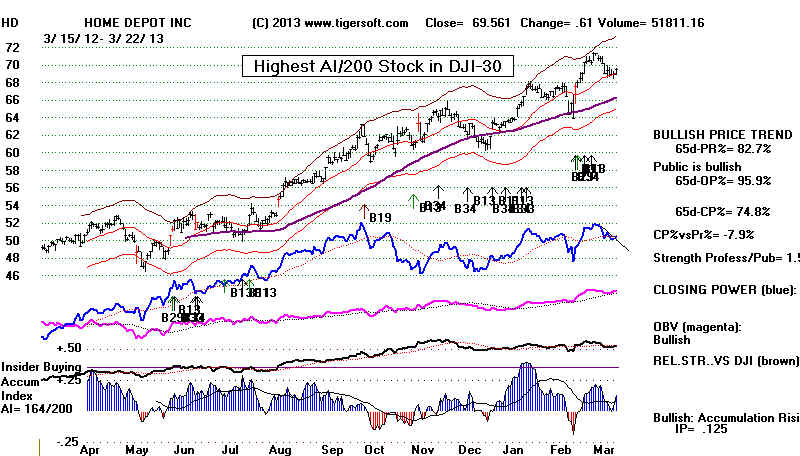

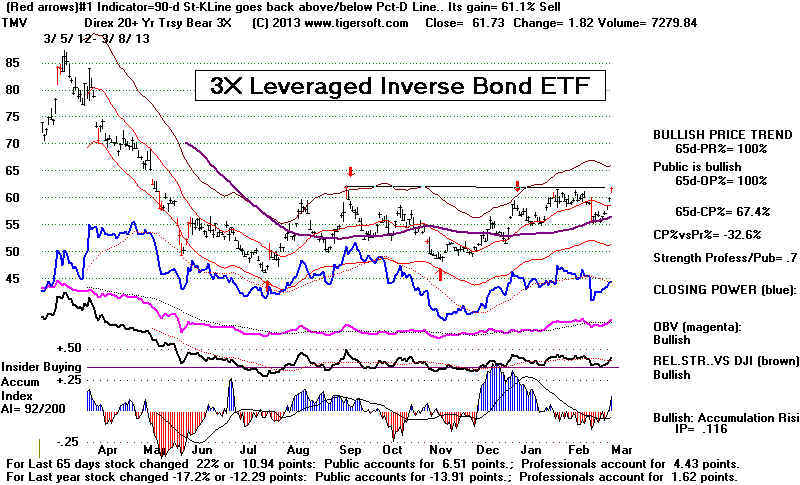

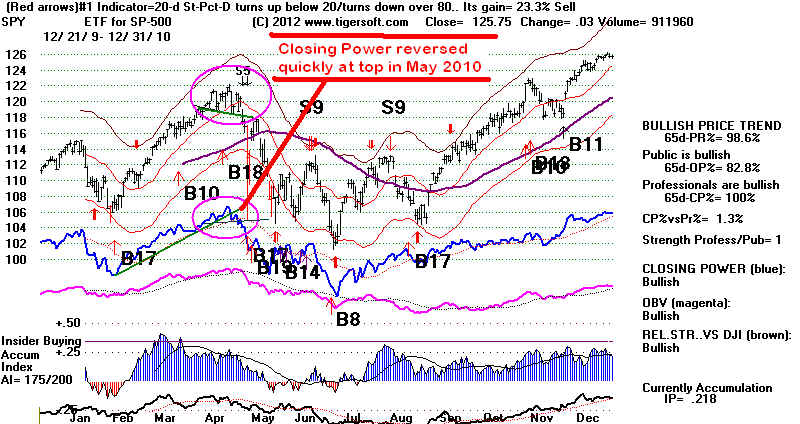

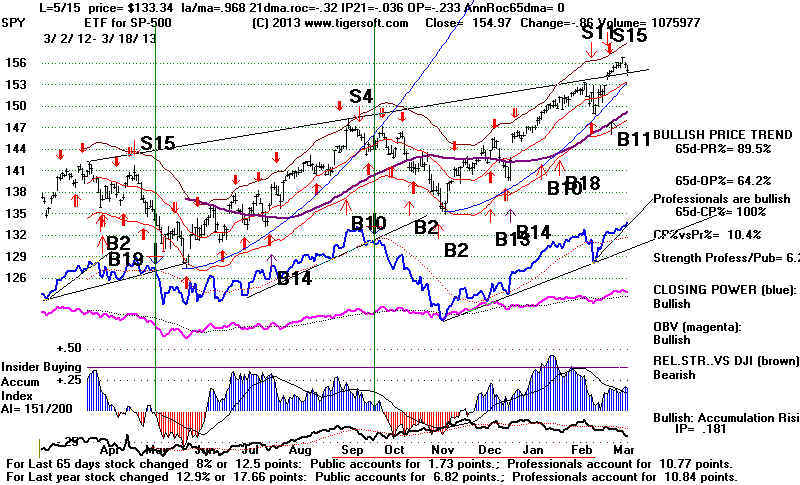

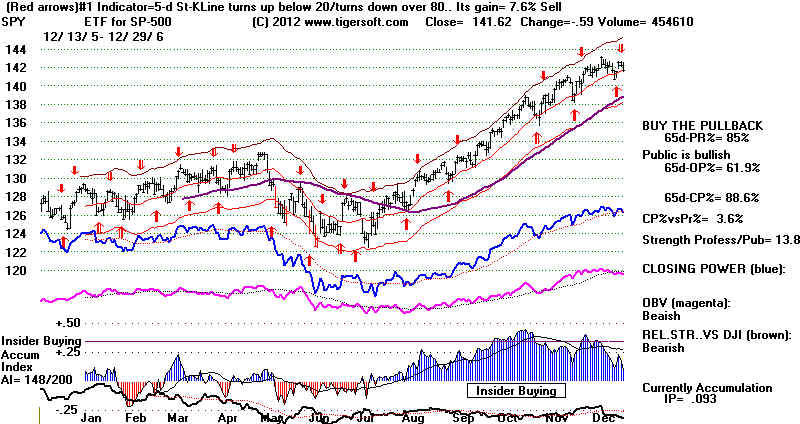

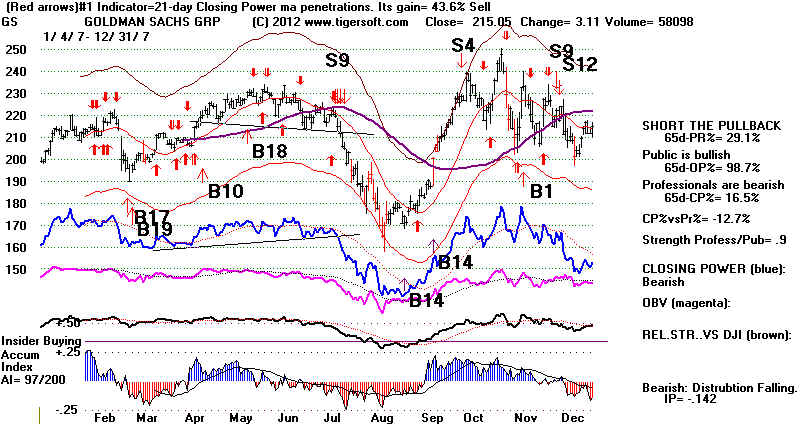

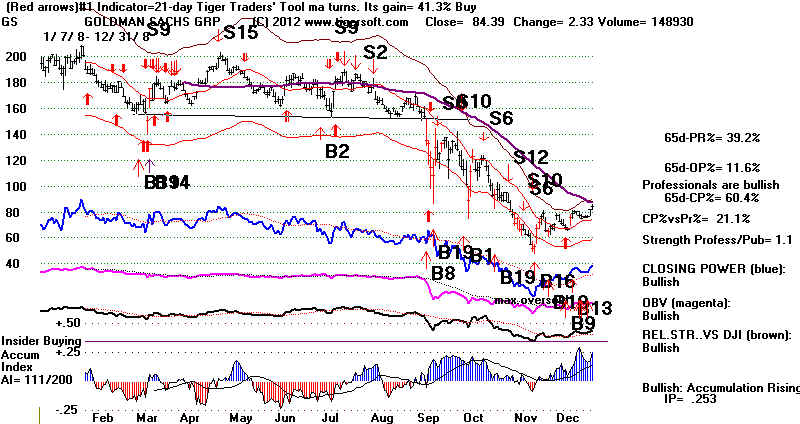

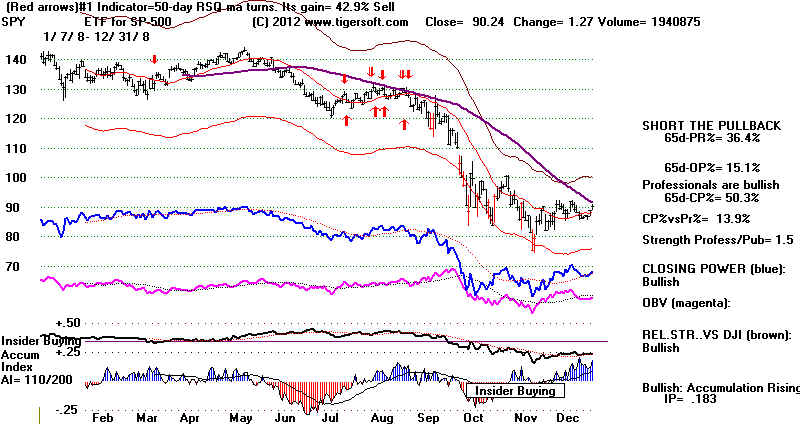

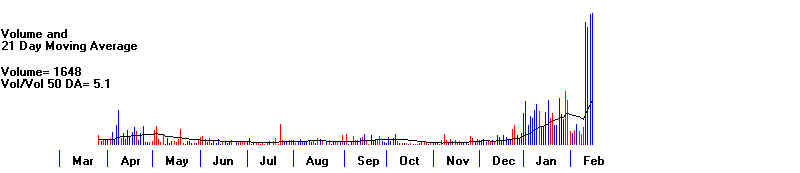

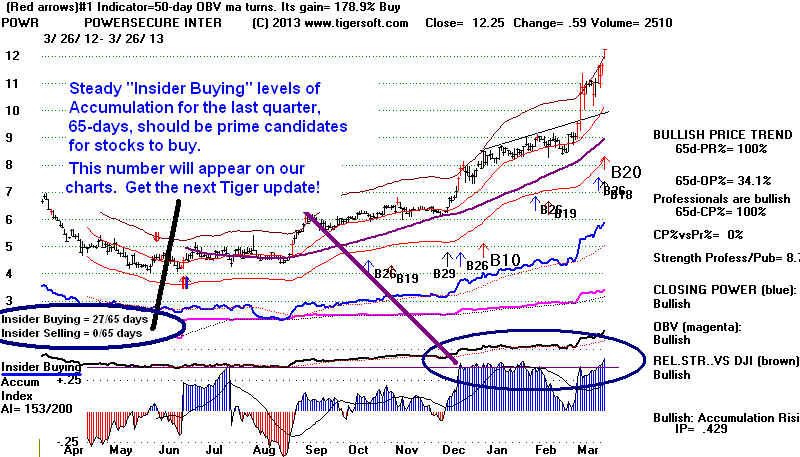

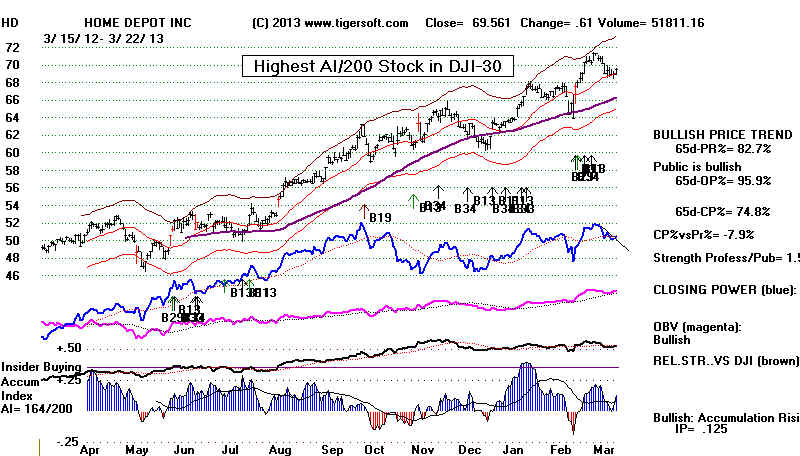

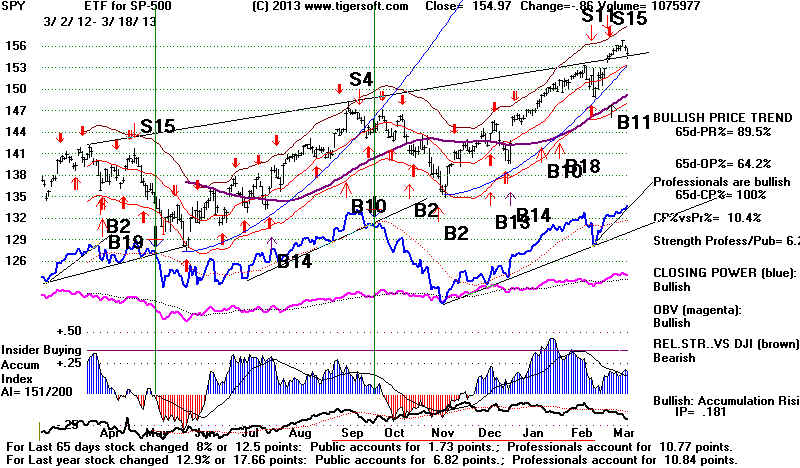

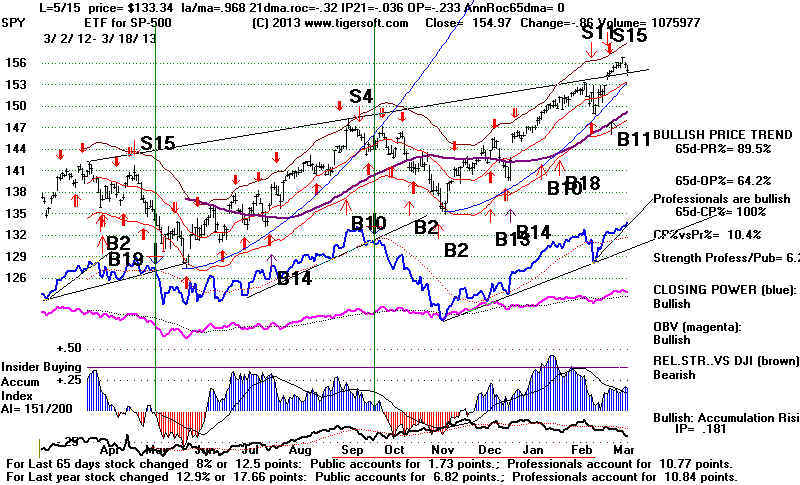

New Research and New Tiger Charting

I want to place more emphasis on steadily high

readings from the Accumulation

Index for the last 65 trading days and start counting the number of the

days when IP21 is above +.375 in this period and post that number on the

chart. Oppositely, I want to count the number of days here that show

an IP21 below -.25. Stocks with 65-day-IP21-counts above a certain

level will be flagged. Timing their purchases with Closing Power trend-breaks

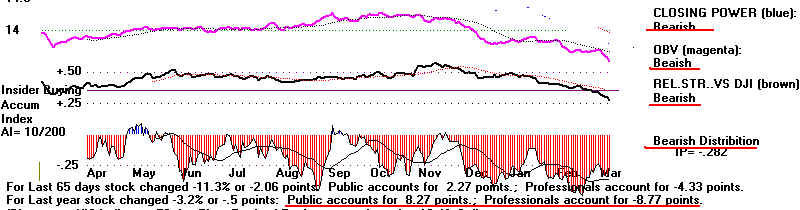

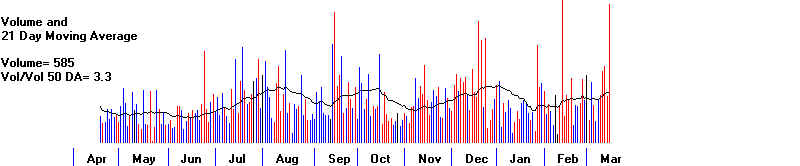

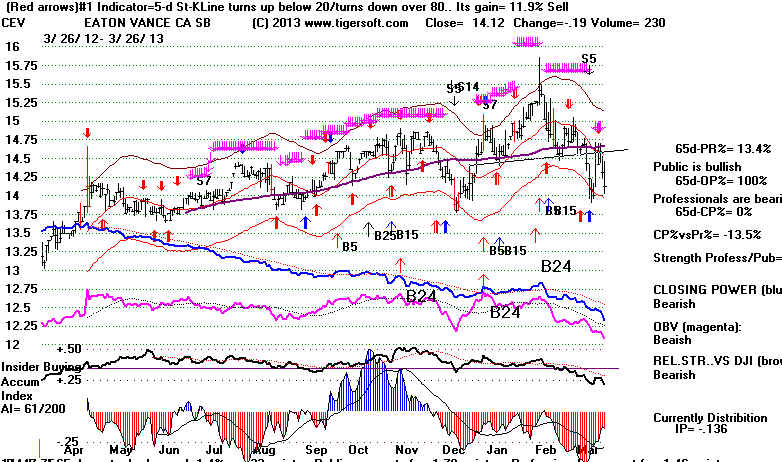

should work out well. Contrast the extreme differences in levels of Accumulation

for the last 65 trading days in the charts below. The results here are typical.

====================================================================================

OLDER HOTLINES

====================================================================================

3/25/2013 Bullish and Bearish Forces Fight

For Control Now.

"Sorry, Bulls", and "Sorry, Bears", Hedging Still Seems

Advisable.

The DJI reversed downward today from the top of its minor

trading range. That lends hope to orthodox users of Peerless who

took the Peerless Sell as an automatic sign to sell short DIA or SPY.

But I have to say, all in all, there are more bullish forces at work

now

than bearish factors.

3/25/2013 ---> To All Key Index

and Lesding Stock Charts

---> 205

MAXCP stocks

Bullish

MAXCP Stocks (3/25/2013) BULLish plurality

---> 70

MINCP stocks Bearish

MINCP Stocks (3/25/2013)

--->89 New Highs on NASDAQ 10 new lows. BULLish

plurality

--->104 New Highs on NYSE

12 new lows. BULLish plurality

3/25/2013 Key Values: DJI 14448 -64

la/ma= 1.01 21dma-roc = 0.373 P= +269 Pch= -99

IP21 = +.088

(on 1/30/2013 IP21 was .293) V = -4 Opct = .269 65

day-pct-up = .075

Movements like this in such a trading range ARE important, but mostly

in that they confirm the exact bounderies of support (14380) and resistance (14600).

The more well-tested such resistance and support is, the more reliable

the eventual breakout. Movements up and down in such a trading range,

are not really reliable clues which way the market will ultimately break.

If there had not been a Sell S15, I would say that the odds were 2:1 or even 3:1

in favor of an upside breakout. This is because flag or rectangle price

patterns

are much more likely to be continuation patterns than reversal patterns. So

until we have a price breakout or breakdown above or below the trading range,

I think we just have to wait to be bullish or bearish enough to buy or sell short

SPY or DJI. I have said waiting for the A/D Line to break its uptrend

would probably be safest, too.

On the positive side, I mentioned the DJI's unusual upward parabolic

momentum, that it is up more than 7.5% above its level of 3 months ago,

that the P-Indicator is above +180, the IP21 is above +.10 ans the DJI

is at an-time high. None of the earlier Sell S15s had all these bullish

factors all at once. Since there are still many more MAXCP stocks

than MINCP stocks, too, we can easily find stocks to be long and

still hedge by shorting some of the bearish MINCP stocks. This has been

a profitable strategy and seems reasonable while we wait to see which way the

market breaks.

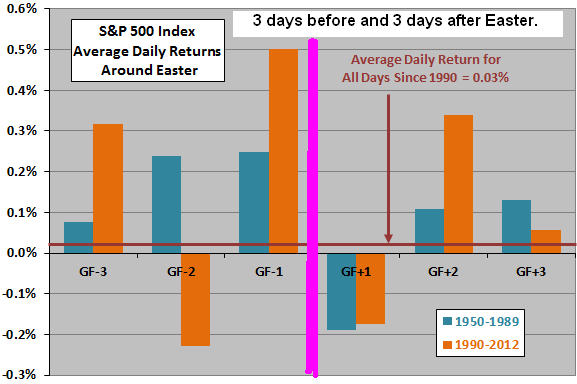

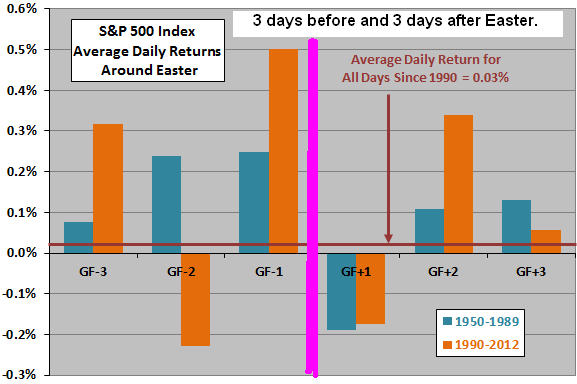

Seasonality is a bullish factor at work now, too: first because the 3 trading

days before and after Easter are generally up more than are typical days;

http://www.cxoadvisory.com/4525/calendar-effects/stock-returns-around-easter/

and second, because there are very few market tops since 1965 that

peak

in the last week of March. Peaks in the period March 21st-April 7th

are 50% less likely to occur than than those ealier in March and or later

in April. Only two such declines, 1949 and 1981, occurred in the year

after a Presidential Election between March 21st and April 31st.

March and April DJI Peaks

before Declines of More than 5%

March 1-21st

March 21st-April 7 April 8 -

April 31

--------------------

-------------------------

---------------------------

3/7/1945 6%

3/25/1949 9%

4/18/1960

5%

3/17/1953 12%

3/31/1952 5%

4/28/1971

12%

3/4/1955

6%

4/6/1956 10%

4/18/1972

5%

3/14/1962

26%

3/25/1970 20%

4/10/1979 6.5%

3/14/1974 35%

3/24/1976 4%

4/27/1981 20%

3/17/1975 5.5%

3/27/1986 5%

4/21/1986 5%

3/16/1977 17%

4/7/1987 8%

4/12/1988 8%

3/16/1984 5%

4/6/2004 6%

4/17/1991 5%

3/18/1988 5%

4/11/2000 9.5%

3/18/1996 5%

4/26/2010 13.5%

3/11/1997 10%

3/12/2002 31%

3/7/2005 8%

3/15/2012

9%

|

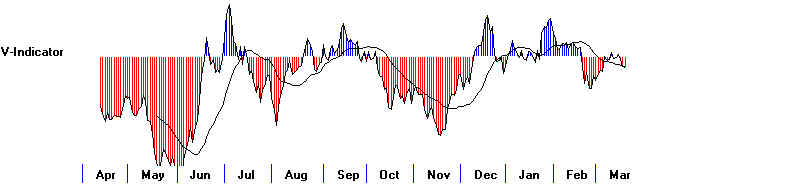

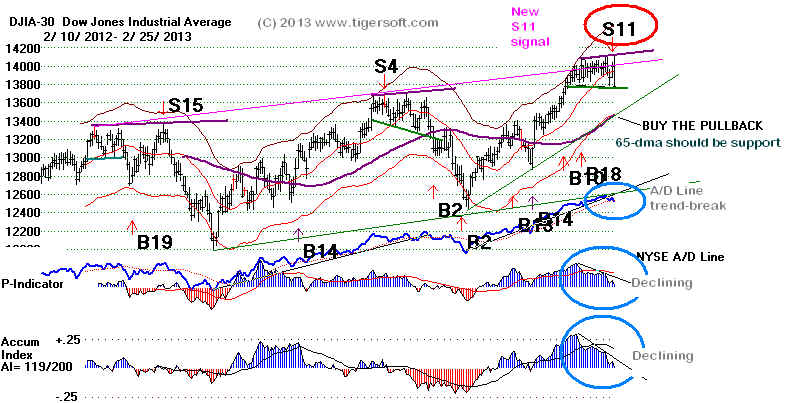

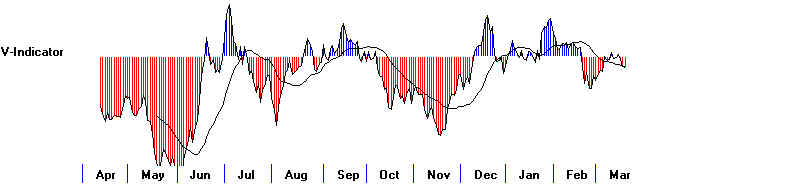

Bearish Aspects To The Market Now

apart from the Sell S15 and V-I Negative Non-Confirmations.

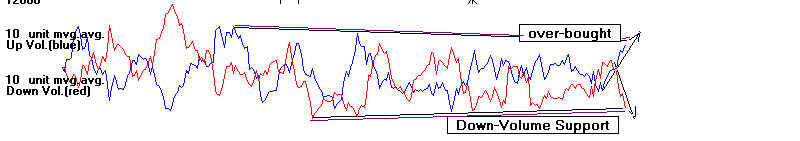

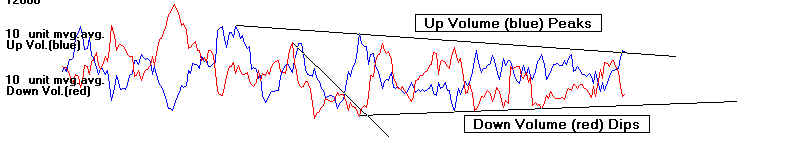

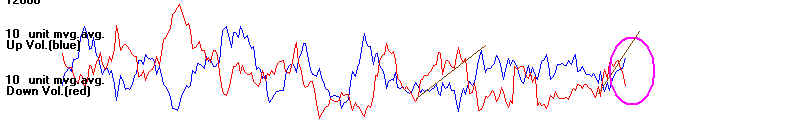

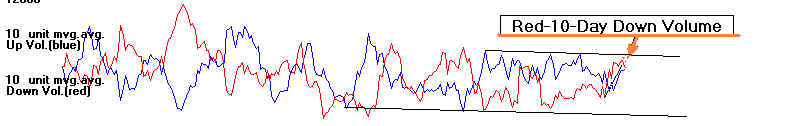

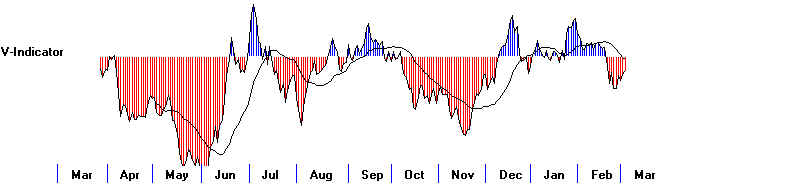

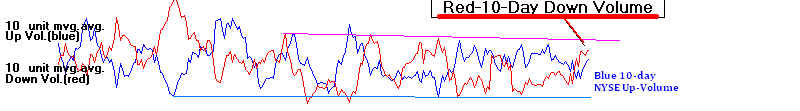

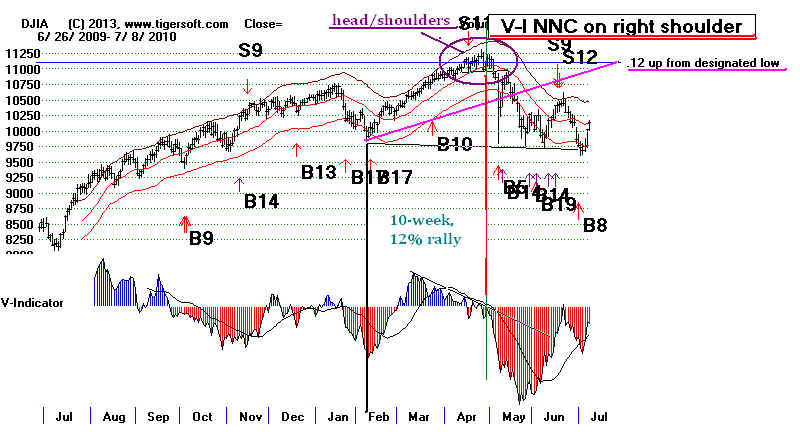

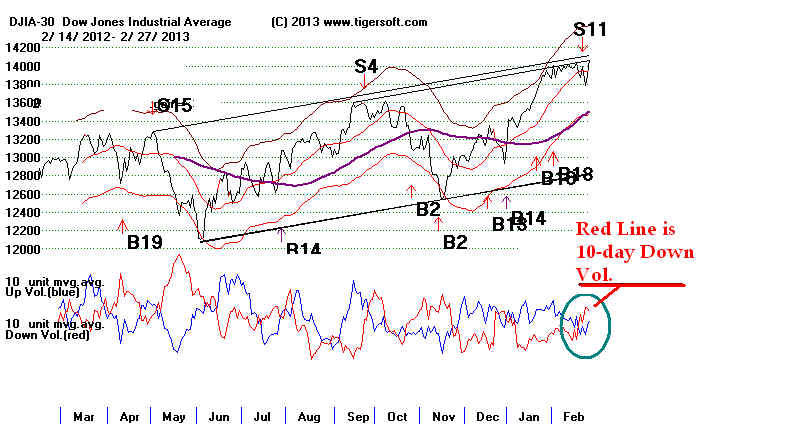

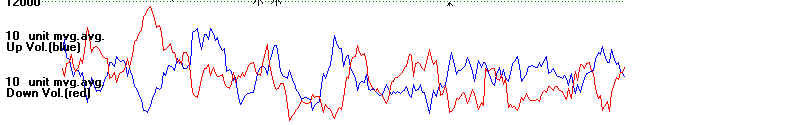

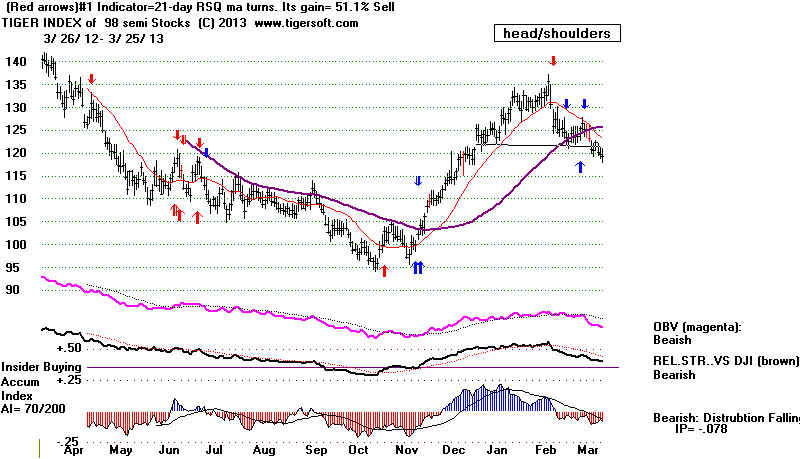

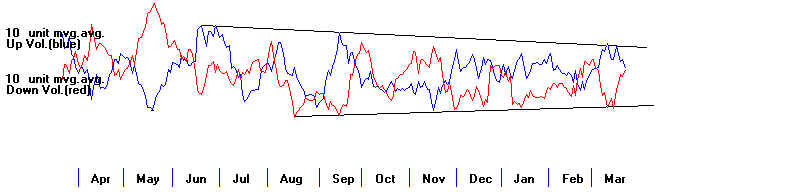

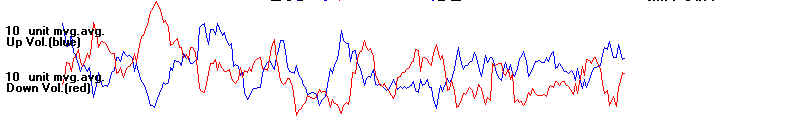

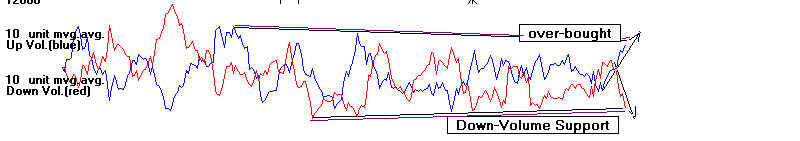

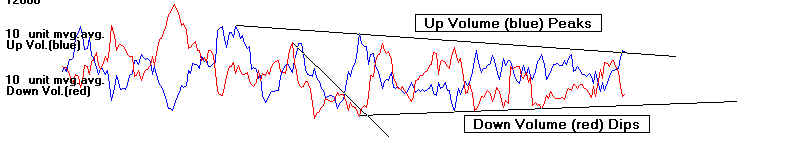

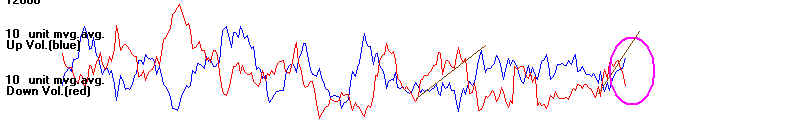

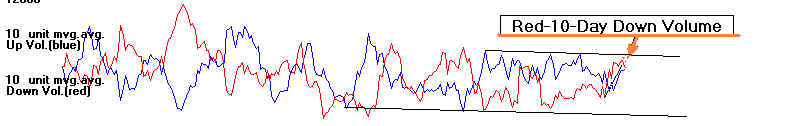

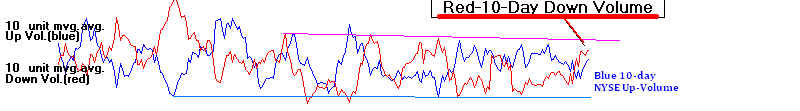

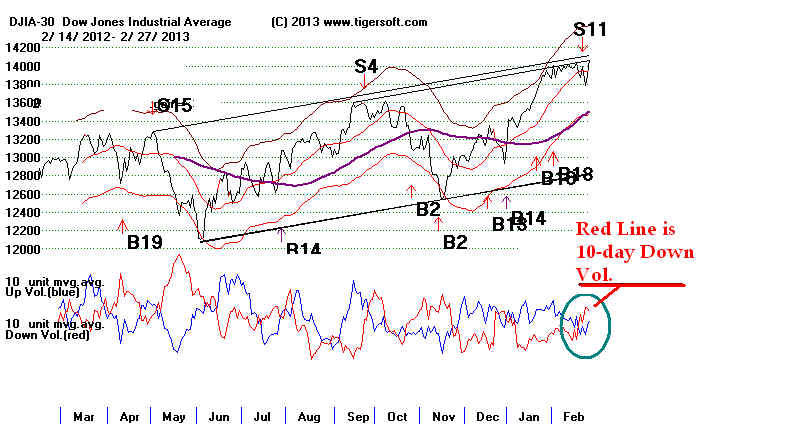

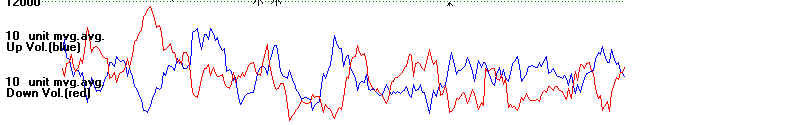

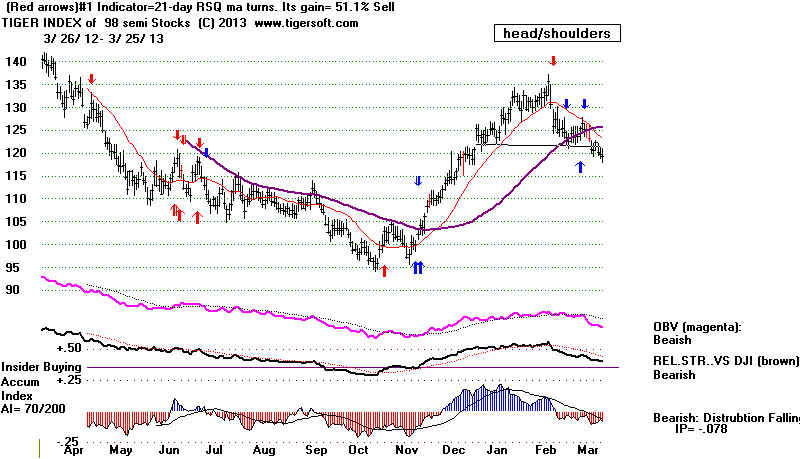

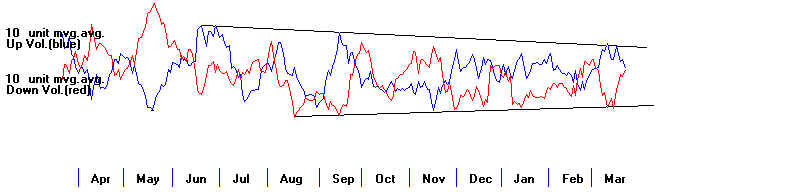

On the negative side, see below how the 10-day NYSE Down Volume has now

risen above the 10-day Up Volume. See also how the volatile Tiger Semi-Conductor

Stocks have a completed head/shoulders pattern. Being capital intensive,

semi-conductors often lead a valid recovery, but top out before the general

market does. And one more chart should caution us. Professional shorts

are not yet spooked by the market's apparent strength. I say this based on

the Tiger Index of the Most Heavily Shorted Stocks as of mid-February. That

index is at its support line and could easily breakdown.

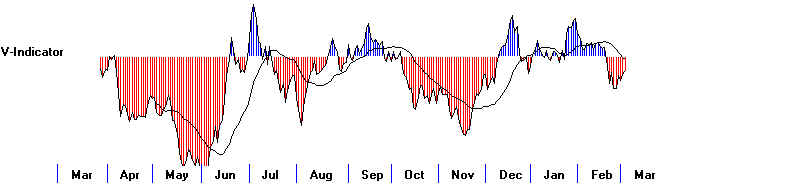

10-day NYSE Down Volume is now above the 10-day NYSE Up Volume.

|

Tiger Semi-Conductor Stocks have a completed head/shoulders pattern

|

Most Heavily Shorted Stocks

|

j

===================================================================================

OLDER HOTLINES

===================================================================================

3/22/2013

Let's Not Fight The Fed here

until

the NYSE A/D Line Uptrend Is Broken?

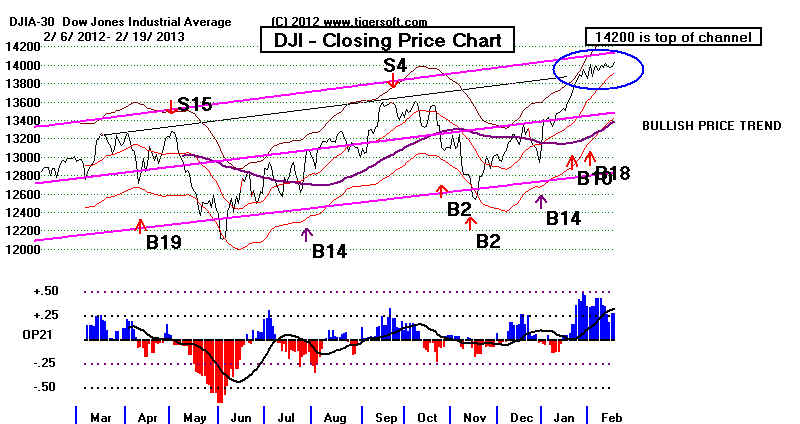

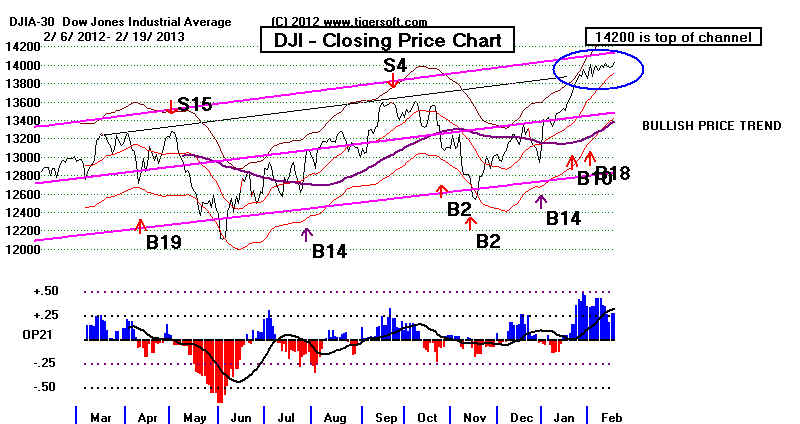

The DJI has not yet

broken out past 14600 to new highs. But it is important to

know that Breakouts in Accelerating Uptrends often bring exciting upswings.

I call these parabolic breakouts. See some examples.

http://www.tigersoft.com/-2GBL13HL/ParabolicAscents/index.html

They are rare with individual stocks and even rarer with the

DJI-30. They usually

show a speculative bubble is developing. Once started, the mass emotions

underlying the quickening trend, must play out, it seems, like an iron law..

But before the buying climax, which is often a vertical takeoff, very

profitable trading opportunities are presented if you buy the breakouts

and sell when the accelerating uptrend is finally broken. The DJI's price

upswing

is becoming parabolic. Accordingly, breakouts here have good trading potential

provided

one places stops beneath the uptrend.

A DJI close over 14600 into all-time high territory has that potential.

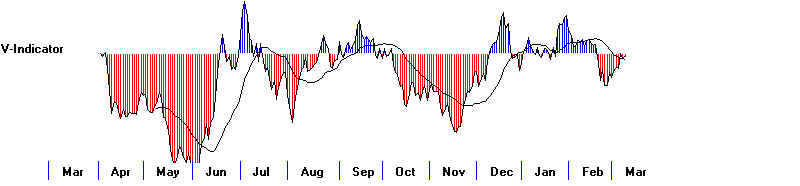

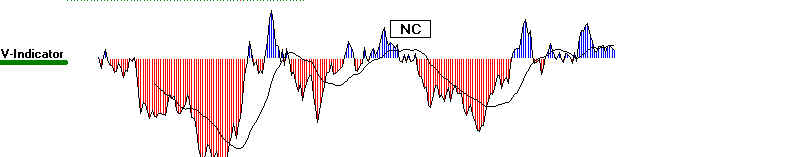

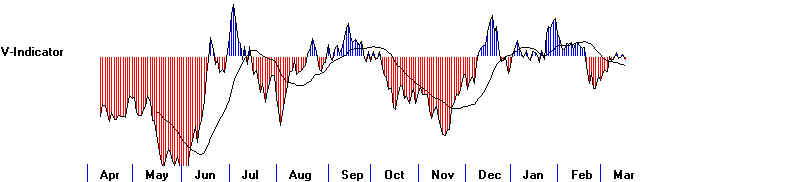

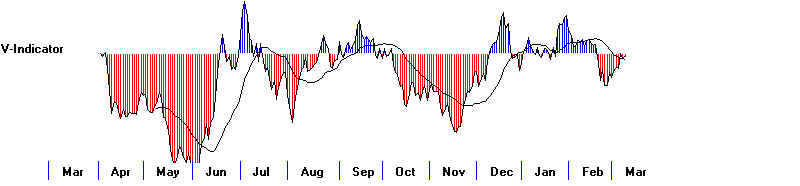

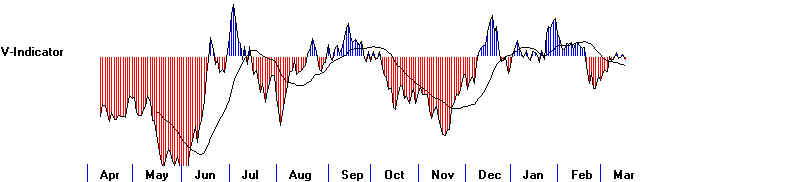

Friday we saw big jumps upward int he P-Indicator, Accumulation Index

and the V-Indicator turned positive by a wide margin. A big jump

upwards should be expected this coming week if there is a breakout.

It is also possible that 14580 will stop the rally again. As long as

the accelerating uptrend-line is not violated, the upside potential

of a parabolic breakout will still be present..

3/22/2013

---> To All Key Index and Lesding Stock

Charts

---> 281

MAXCP stocks

Bullish

MAXCP Stocks (3/22/2013) BULLish plurality

---> 42

MINCP stocks Bearish

MINCP Stocks (3/22/2013)

--->65 New Highs on NASDAQ 10 new lows. BULLish

plurality

--->101 New Highs on NYSE

9 new lows. BULLish

plurality

3/22/2013 Key Values: DJI 14512 +90 la/ma= 1.016 21dma-roc = 0.527

P= +367 Pch= +94

IP21 = +.126

(on 1/30/2013 IP21 was .293) V = +25 Opct = .369 65 day-pct-up = .088

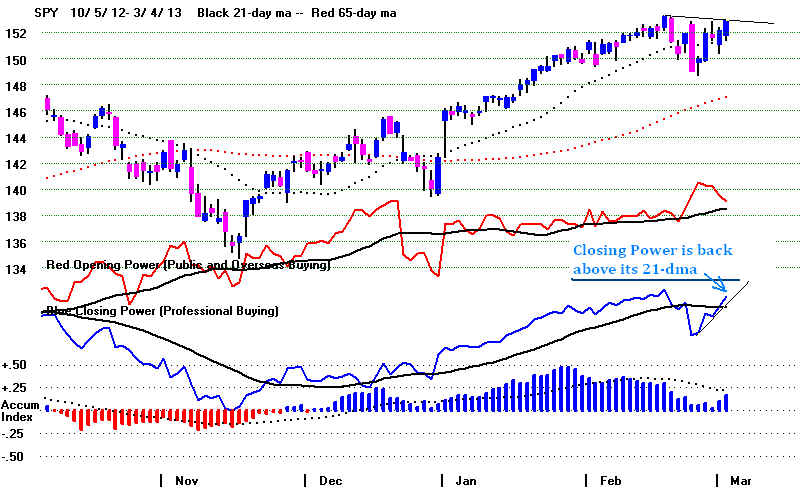

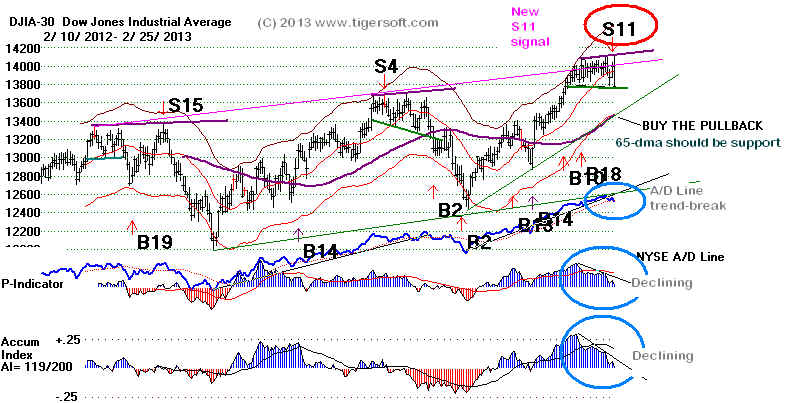

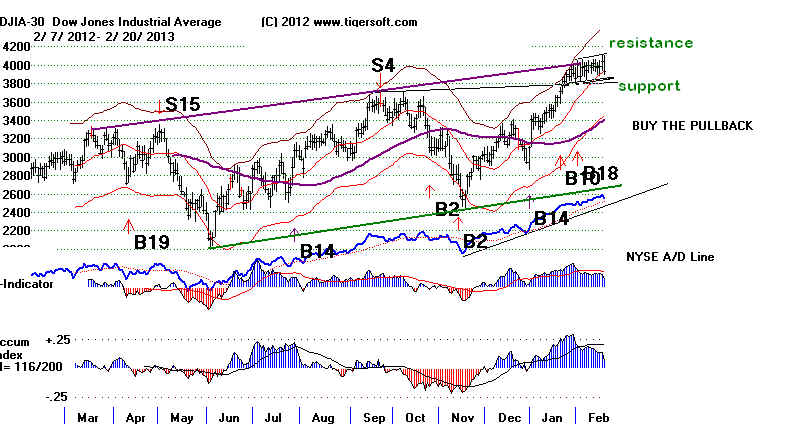

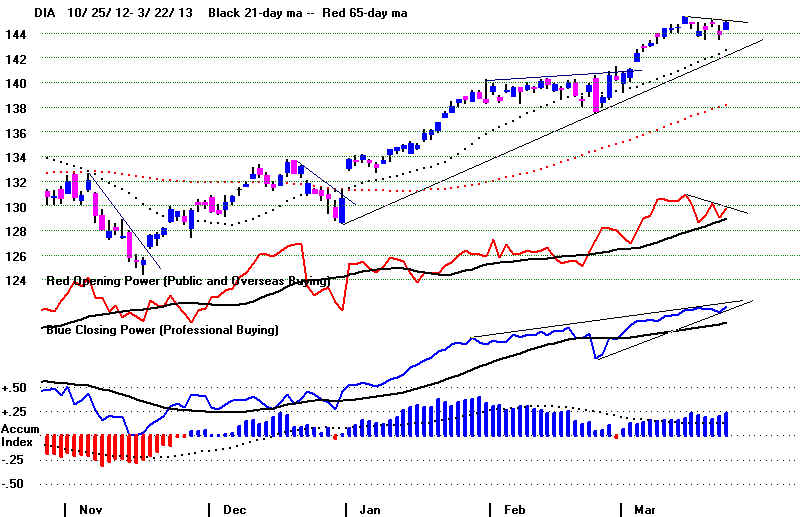

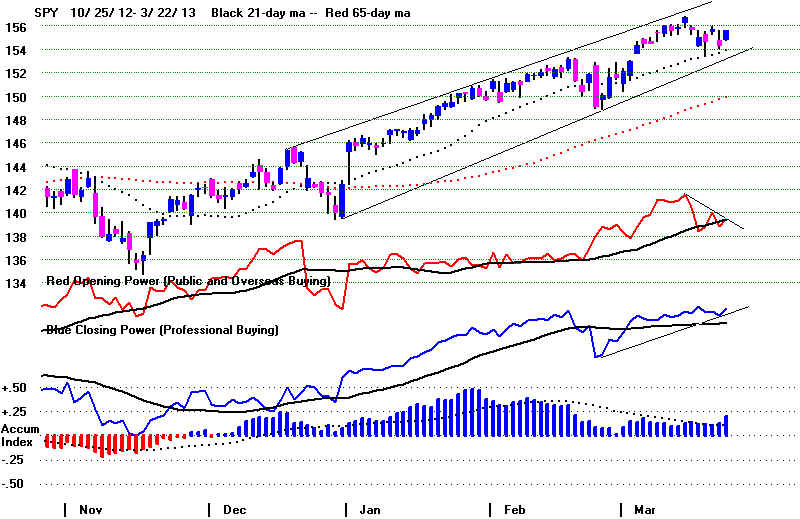

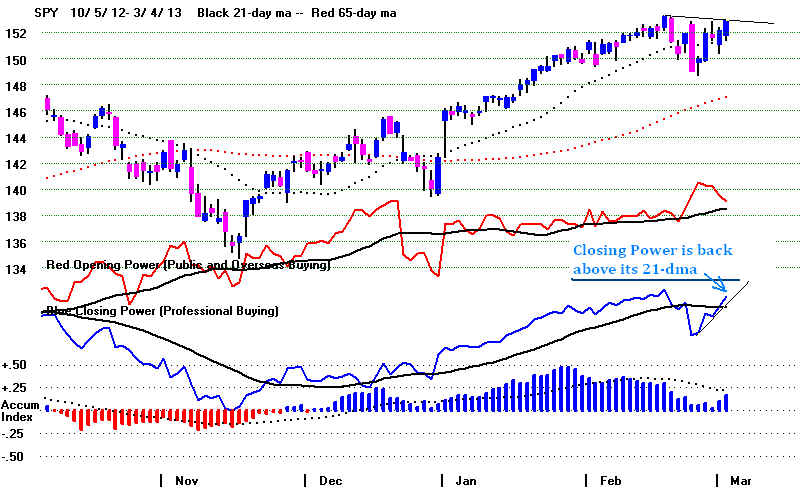

The A/D Lines, Closing Power and Accumulation Indexes

still look too good to

short DIA or SPY. It would be a good idea to buy back some of the stocks

we sold higher on their pull-backs to near-term support now as their Closing Powers

hook back upwards. Our

Stocks' Hotline will buy back some of the high Accumulation stocks

we sold. Look at HD (below), SPNC, TRIB and SGMO.

Until the Closing Powers weaken much more, I would not sell short DIA or SPY,

despite the Sell S15.

Buy DIA or IWM on closing breakouts above 146 and 95. The Sell S15

signal

will be revised if it produces a paper loss of more than 3.% and the DJI closes

above 14800.

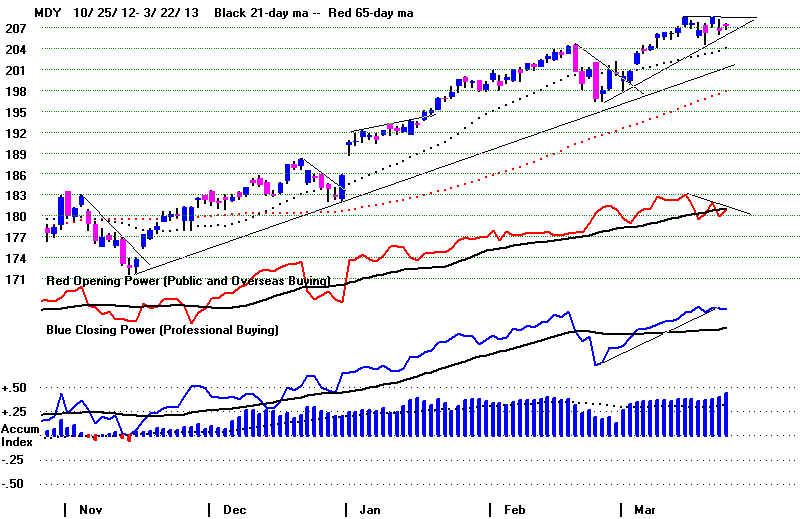

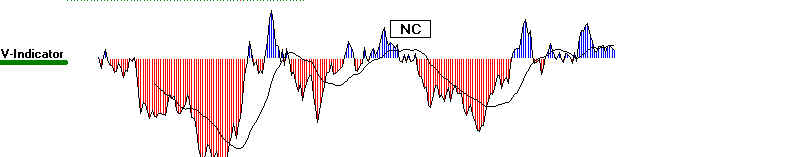

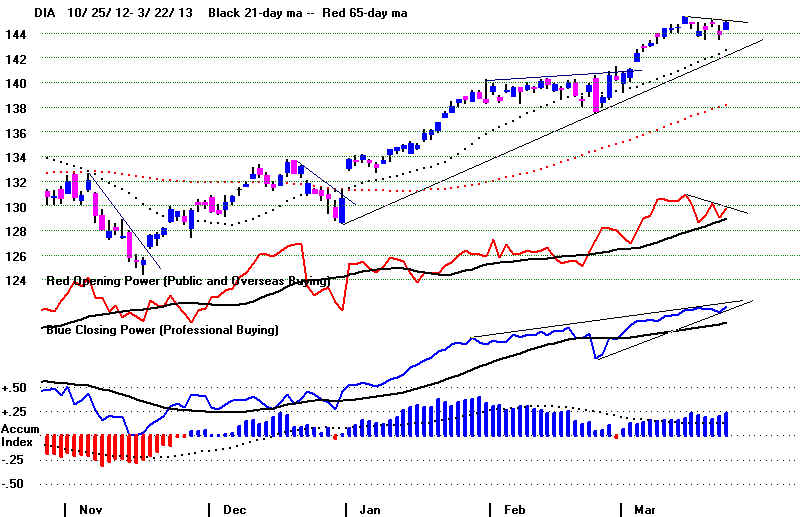

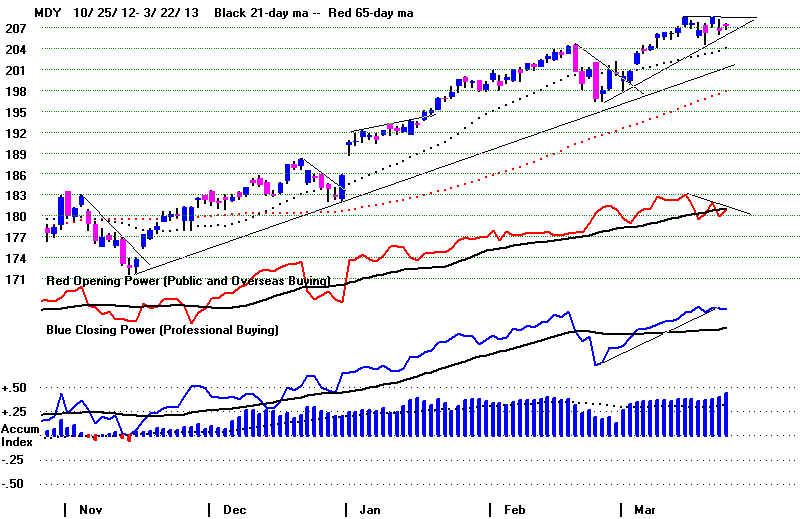

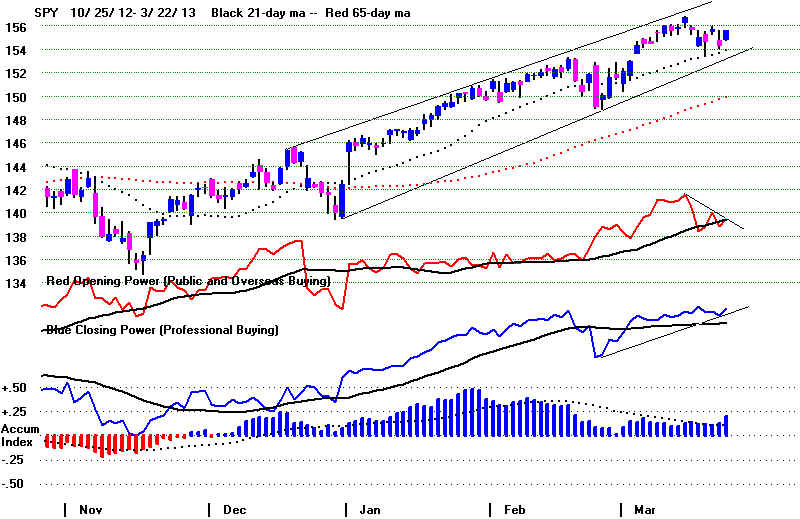

The Tiger CandleStick charts for DIA, SPY, IWM and

MDY show rising Accumulation

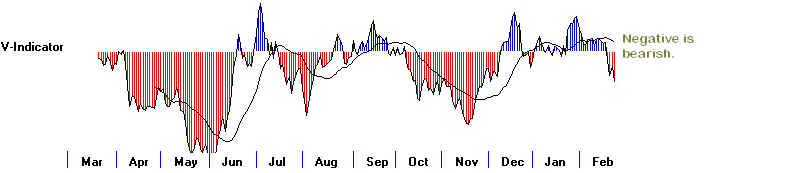

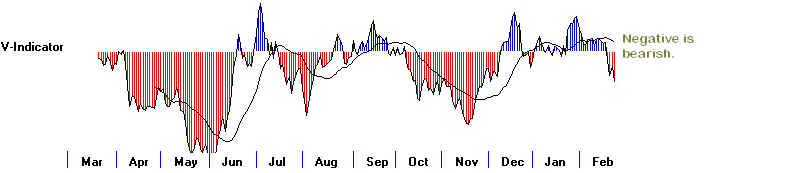

and rising Closing Powers. The volume weakness that the negative V-I Indicator picks

up on is not evident in these charts. There is ample precedent for the DJI and DIA

leadign prices higher.

A DIA close above 145.6 would be a bullish breakout into all-time

high terroritory. Short-term traders should play that. MDY, which represents

mid-caps,

would probably breakout, too. That makes it a buy candidate on a breakout. SPY and

IWM are lagging, probably because of big AAPL's weakness. SPY would need to surpass

158 to make an all-time high.

A DJI Move above 14800 Would Cancel The Sell S15

The existing Peerless Sell S15

(which is based mostly on negative V-I readings)

appears to be losing its battle with the Fed's very low interest rates, the confirming

A/D Line, the accelerating DJI price trend, the bullishness of the DJI's all-time high

and steadily positive IP21 readings above +.08. I mentioned that the Peerless

track record would have been improved before the current Sell S15 by disallowing

these signals when the IP21 is above +.08, the adjusted P-I is above +175 and the

65-day pct change is above 7.75%. See Sell S15.

But orthodox Peerless users

will not want to make this change too quickly. If this Sell S15 fails, and produces

a paper loss of more than 3.5%, the Sell S15 will have to be revised.

.

Certainly if the DJI were to close above 14800, being short the market based

on the Sell S15 would be ill-advised. But should we wait that long?

14800 on the DJI would mean a bullish breakout above the upper boundaries of

its rectangle price pattern. It would also mean a paper loss on the Sell S15

above 3.5%. Such a paper loss would not be consistent with previous Sell S15s

going back to 1965. So on a close by the DJI above 14800, I would cancel the

Sell

S15 and issue a "B15" like the "B11", which reversed the S11.

But should we wait so long? Consider the 2 biggest earler S15 paper losses,

These

were back in in February and March of 1936. This was when the V-Indicator could only

be

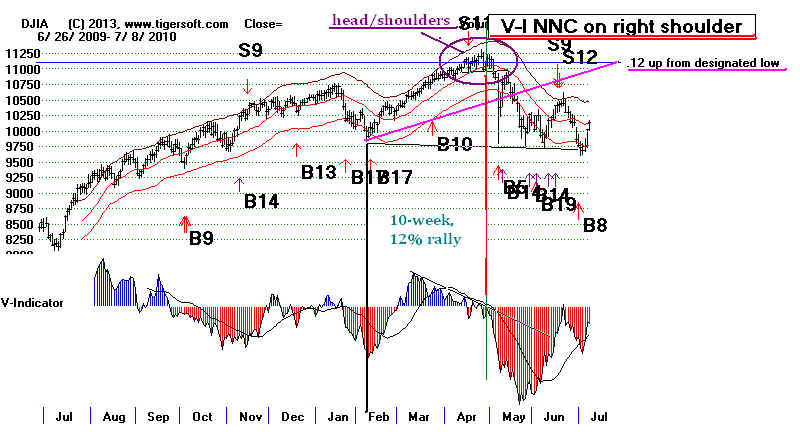

estimated using trading volume and the ratio of NYSE advances to declines. Look

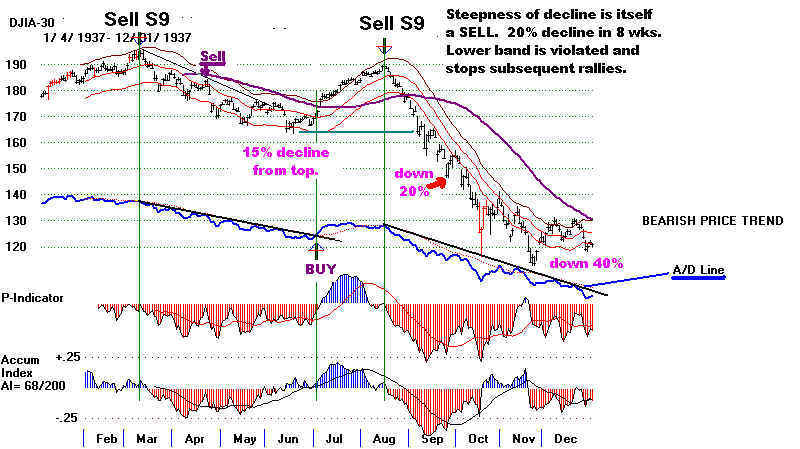

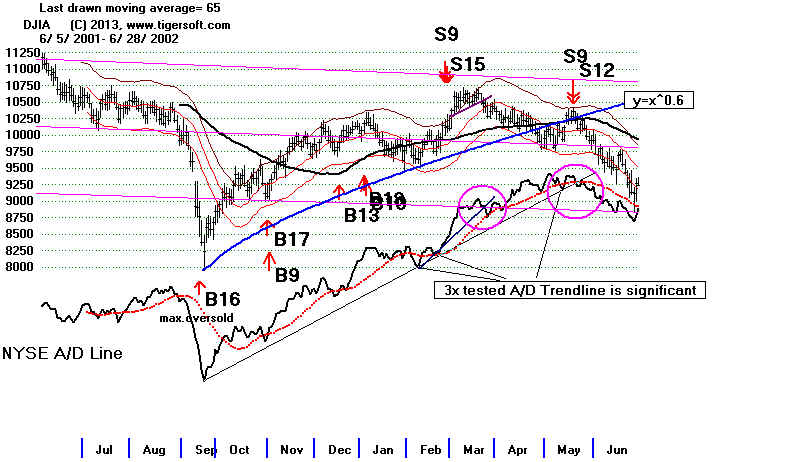

at the 1935-1936 Peerless chart below. Its momentum in March was too strong

to be stopped by an S15. Only after the A/D Line started to fail to confirm new

highs did a top develop. And that final top had to bring both an S9 and an S12.

The DJI closed 2.6% over the 21-day ma and showed negative non-confirmations

by the P-Indicator, IP21 as well as V-Indicator.

Study Paper Losses of Sell

S15 in 1935

This may be what is in store for us now.

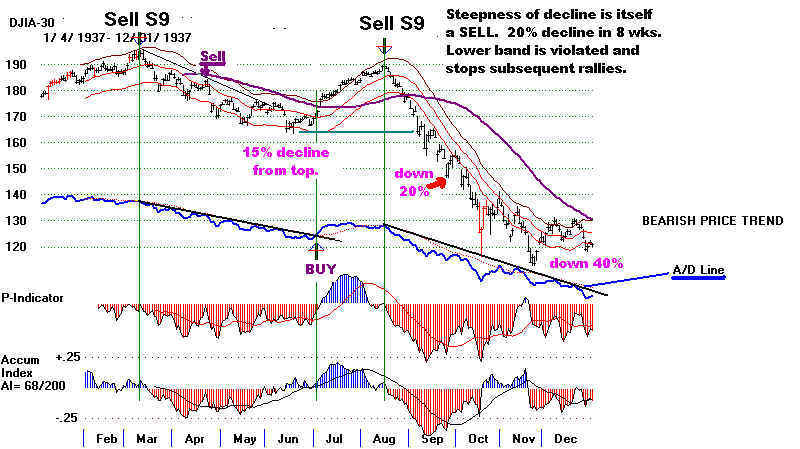

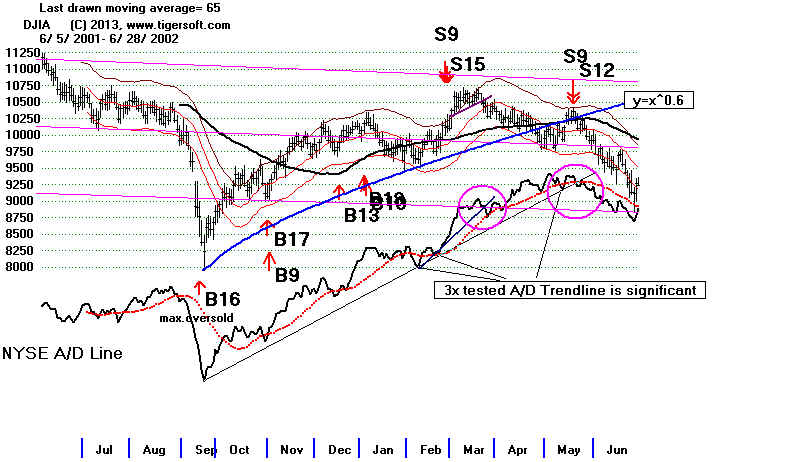

the DJI may keep rising until one of 3 things happen:

1) the A/D Line fails to confirm a new DJI closing high,

as in April 1935 (and before many other big DJI declines),

2) we see a Peerless Sell S9/S12, which we also see at the final

top in April 1935,

3) or the A/D Line breaks its uptrend. When interest rates

were very low in 2001 and 2002, Peerless Seels were followed and

confirmed by A/D Line trendbreaks.

|

|

=====================================================================================

OLDER HOTLINES

======================================================================================

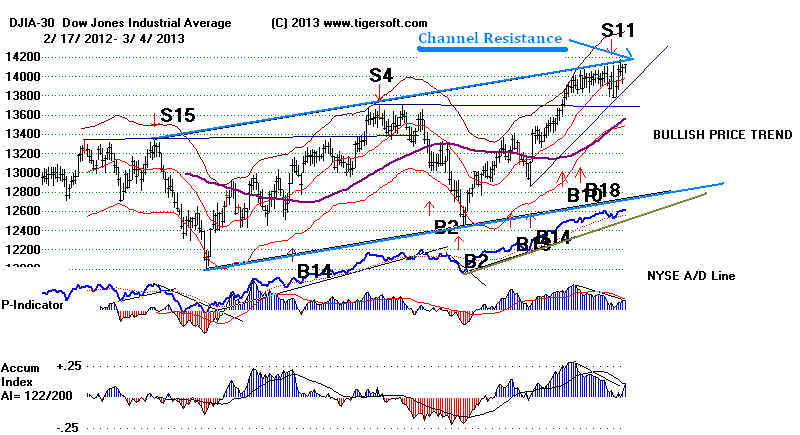

3/21/2013

Sell

S15

versus Momentum, NY Professionals and The Fed

More hesitation is very probable for 2-3 weeks, based on the earlier Sell

S15s

taking

place with a confirming A/D Line and strong upward momentum. But see the

accelerating uptrend again that I have drawn on the DJI chart. If that uptrend-line

holds on

its next test, it is quite possible the DJI will advance very powerfully.

This is

what can happen when a accelerating parabolic curve takes control

and there

is a new breakout above resistance. More on this, if this scenario

develops.

I take the operative Peerless signal to be the Sell S15. The

B11 simply tells

us that the

S11's suggested stop loss point was reached. So, that cannot

over-rule

the Sell S15. And the Sell S15 did occur. We can't use incorrect

data

because we don't like the result. As for Sell S15s, I have suggested a

stop loss

of more than 3.3%. With the Sell S15 at 14253.77, a suggested stop

loss here

would occur on a DJI close above 14752. We will revisit this before we

actually employ

it.

Cyprus

Next week, we see

how bad the bank situation in Cyprus is and whether they

are driven out of

the Euro nations. The Europeon bankers' and finance ministers'

demands seem to

be impossibly high. But who knows if they are bluffing? Will depositors

in Greece, Spain,

Portugal and Italy take their money out of theiir banks for

for fear of EEC

bankers doing the same thing in their countries when their country

again needs more

money to keep using the Euro? Will Cypruss start

printing its old

Pound notes again? With what outcome? Having its own currency

would help

promote tourism and exports. But the government there seems to be

much more

concerned about protecting the many off-shore depositors who hold 37% of

all bank deposits

there. Will Russia insert itself as the white knight for orthodox

Cyprus and to

protect its own big depositors in Cyprus? Don't count on

the world's big

bankers wanting to raise the issue of money laudering, tax havens

and banking

secrecy any time soon. And therein lies a big part of why Cyprus is just

a tip of the

financial iceberg.

All these things

do matter here in the US because our big banks have lots of

Europeon

bonds. Given all these unknowns, taking some profits has been

recommended. Professionals got a little more nervous today, but not by much.

Long experience

tells them not to fight the Fed, especially when they often have

inside access to

any big changes.

3/21/2013 ---> To

All Key Index and Lesding Stock Charts

3/21/2013 ---> Tiger

Industry Index Charts

---> 296 -49 MAXCP stocks Bullish MAXCP Stocks (3/21/2013) BULLish plurality

---> 31 -6 MINCP stocks Bearish MINCP Stocks (3/21/2013)

--->35 -74 New Highs on NASDAQ 5 new lows.

BULLish plurality

--->71 New Highs on NYSE

7 new lows. BULLish

plurality

3/21/2013 Key Values: DJI 14421 -90 la/ma= 1.011 21dmaroc = +.413

P= +272 Pch= -4

IP21 = +.115 (on 1/30/2013 IP21 was .293)

V = -4 Opct = .088 65 day-pct-up = .088

Today we

saw more profit-taking in the leading stocks. The DJI is still 1.1% above

the support

of its 21-day ma. So far, the retreat looks minor but the number of advancing

stocks was

the lowest it's been since February 25th. The monthly cycle mwould seem to

explain

this. The 21 trading day monthly cycle puts downward pressure on the market until

a few

trading days before the new month. This down-ward pressure will come to an end

tomorrow or

next week. See the

work of Arthur Merrill. Our own statistics show that after

March 21st,

the DJI falls 60% of the time the next trading day, goes flat for a few days

and then

turns up, so that though the next two weeks are up slightly. April is usally a good

month.

Since 1965, the DJI is up 66% of the time over the next full month.

But 2:1

odds are not conclusive. A lop-sided, biased roulette wheel can still occasionally

hit numbers

it mostly misses. Our signals all have a historical probability of more

than 75%.

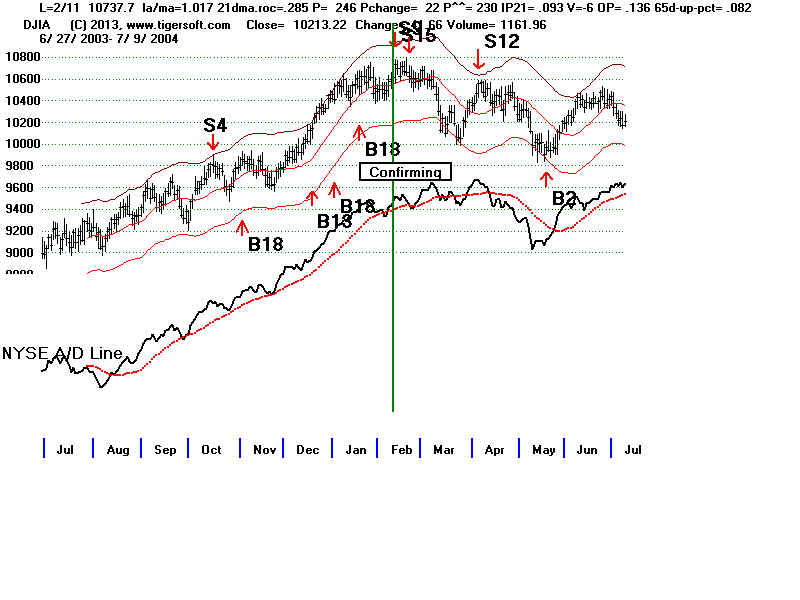

Let's study more closely the 3 cases of earlier Sell S15s when the A/D Line

was strong

and confirmed the last new high of the Sell S15.

It

took 3 weeks in the first case (2004) before the DJI broke decisively below the 21-day

ma.

This was after a yea rof rising DJI prices. Only when the P-Indicator turned

down,

did the DJI finally begin to fall. By then the IP21 had turned negative and the

momentum of the 21-day turned down. The DJI was still up 8.4% from 21- days

ago.

The

second case (2005) took place on a false breakout above a 3x test flat DJI top.

The

65-day momentum was much weaker than now. The DJI was up only 4.7% over

its

level 3 months earlier. The DJI now is still up more than 8.5% above what it

was

3

months ago. So this case, is probably not as close a parallel to the present.

The third case (2012) also fought the Fed's Quantitative Easing. And here, too

the DJI was up more than 8.5% above its level of 65 days before. As in the first

case, the DJI wemt sidewise more than 2 weeks before falling to the lower band

and a new Buy signal. Only when the P-Indicator turned negative did the DJI then

fall.

These cases suggest that the DJI will hesitate more than fall over the next 2-3 weeks.

A decline by the P-Indicator or the IP21 (Accum. Index) below 0 would tell us the

support of the 21-day ma is used up. This is interesting because I havce a"

rule of .07"

The odds of the rising 21- day ma being decisively penetrated are less than 50% as long

as the 21-day ma-roc is above +.07 and the IP21 is above +.07. Right now the rising

21-day

ma looks pretty strong. The current 21-day ma roc is +.413 and the IP21 is +.115.

Date DJI

%Gain %-Paper LA/MA A-ROC P-I

IP21

V-I Opct

65-day Pct Change

Loss

PI^^ (Adjusted P-I)

Pct Change

-----------------------------------------------------------------------------------------------------------------------------------------------------

2/11/2004 10737.70 +7.2

0 1.017

.285 +246

.093

-6 .136

.082

3/4/2005 10940.85 +6.6

0 1.017

.381

+251

.093

-15 .14

.047

highest P-I

3/14/2012 13194.10 +3.6 0.5

1.019 .295

+129 .069

-24

.231 .09

3/5/2013 14254.77

1.019 .208

+229

.083 -32

.116 .089

high

high

=====================================================================================

OLDER HOTLINES

=====================================================================================

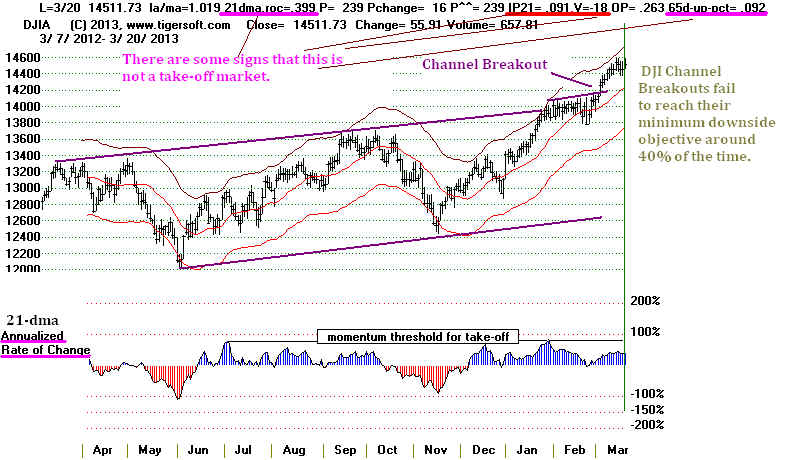

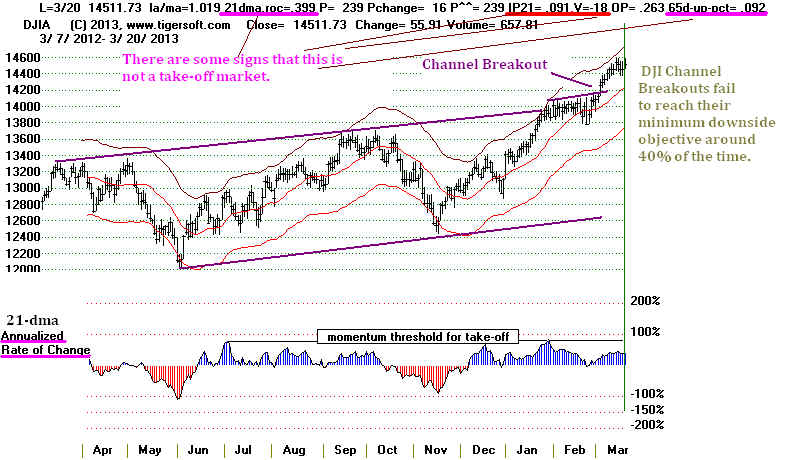

3/20/2013

Sell

S15

versus Momentum, NY Professionals and The Fed

Tonight I want to note the signs that we have not achieved a market

take-off,

despite the low interest rates. In some respects, this is constructive, as it shows

that

an "asset bubble" is not a certainty. But it does show the market may have

a month or more of consolidation before it can go much higher. Sell S15s

can work out even when the A/D Line was confirming the last new closing DJI high.

3/20/2013 ---> To

All Key Index and Lesding Stock Charts

---> 347 +15 MAXCP stocks Bullish MAXCP Stocks (3/20/2013)

BULLish plurality

---> 37 -3 MINCP stocks Bearish MINCP Stocks (3/20/2013)

--->109 + 62 New Highs on NASDAQ 12 new lows. BULLish

plurality

--->213 +133 New Highs on NYSE

12 new lows. BULLish plurality

3/20/2013 Key Values: DJI 14512 +56 la/ma= 1.019 21dmaroc = +.3399

P= +229 Pch= +7

IP21 = +.091

(on 1/30/2013 IP21 was .293) V = -18 Opct = .263 65

day-pct-up = .092

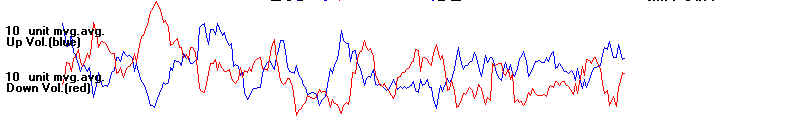

Most Professionals are still playing the market on the upside. Many more

stocks still show high Accumulation and Closing Power strength than vice verse.

Though the red (see below) 10-day NYSE Down Volume is rising again, most Pros

are not yet selling. And sure enough, the market could only manage 3 down days,

before the FED stepped in and assured us that they would continue to keep rates low

for a long while.

Catching a falling knife upside is a good metaphor to describe the risks of

buying stocks when they are in a free fall. What's a good metaphor for

selling short a market whose momentum is getting stronger and stronger?

Actually, the momentum now is steadily up but not getting stronger and stronger.

Not, at least, if we measure it by the annualized rate of the DJI's 21-day ma, which

is under +.40. The .70 level that marked takeoffs in many, but not all, early DJI

take-offs.

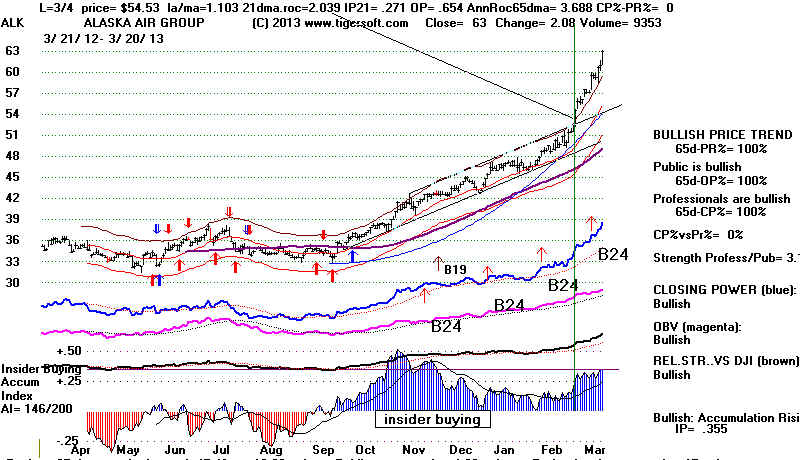

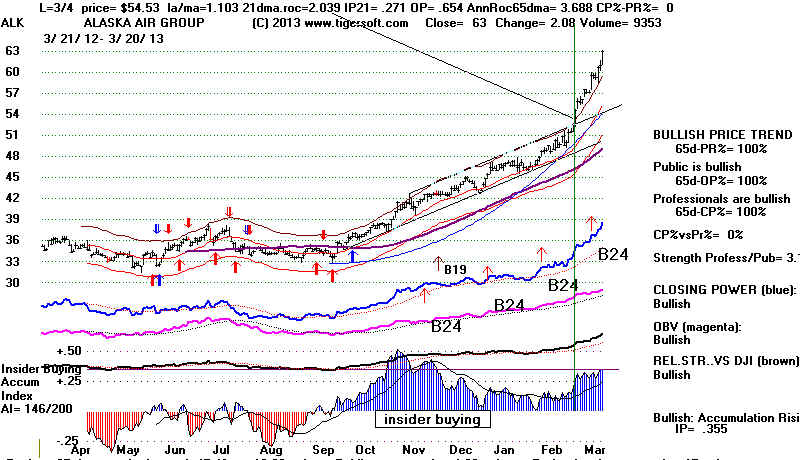

Look at Alaska Air to see how momentum combined with high Accumulation

has leads to much higher share prices. Its 21-day ma at the point of its price

channel breakout was rising at an annualied rate of 203.9%. Its 65-day ma annualized

rate

of change was 368.8%. This is momentum!. Also in contrast, the DJI's

Accumulation now has fallen way off and is now below +.10

Another way, we can spot take-off momentum is with flat topped breakouts into

all-time high. Two weeks ago we had a channel breakout but not a flat-topped

breakout.

The difference is important. The study I did a month ago here showed that the

failure rate

for DJI price channel breakouts was much higher than flat topped (judged B10) breakouts.

And another sign of great market strength is how much the DJI is up over the last

65 trading days. A week or more with the DJI up more than 10% over its level

3 months before would be a sign of great strength. We saw this, for example, in the

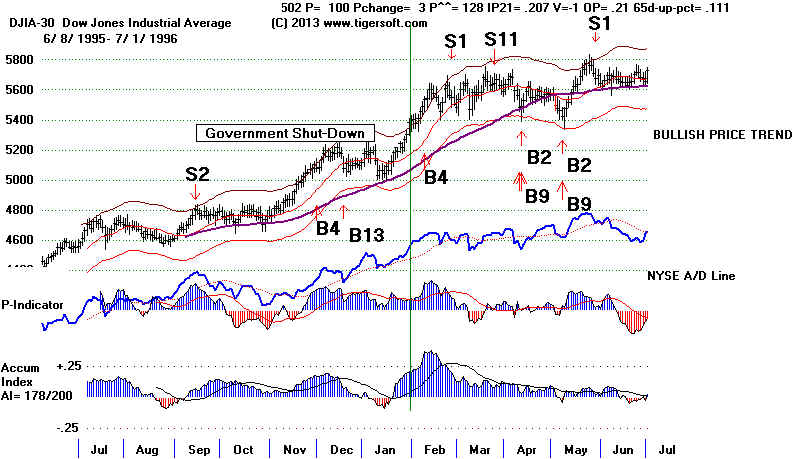

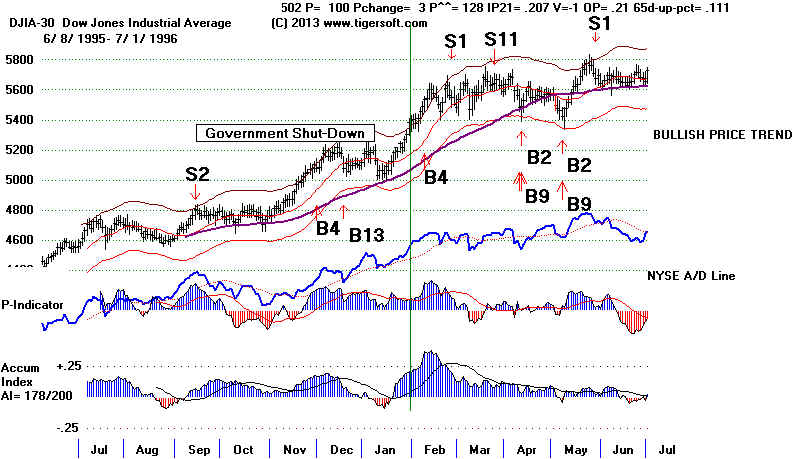

January 1987 take-off, in April 1995 and in January 1996, all very good times to

chase stocks. That we have not this year seen a week's

readings on this indicator

above +.10 suggests the DJI may not be able to escape the gravitational pull of

normal over-bought and over-sold status.

But the accelerating uptrendlines are in place and the A/D Line has so far confirmed

the DJI's advance this year. This is a broad market advance.

How important is good breadth? It is very important. But by itself, it

does not

guarantee the DJI will push higher. That, at least was the experience in early

1977 and in 2001 and 2002 when the NYSE A/D Linewas finally broken.

I went back over all the past S15s (There were more than 20.) to see if there were

many cases where the DJI did reverse downward from a new closing high even though

the A/D Line was confirming the advance up to that point. That is the case

now.

The A/D Line is very strong. That is a reflection of low interest rates and, more

and

more, an improving US economy. Actually, there were 3 Sell S15s when the

DJI reversed even though the A/D Line was confirm the DJI strength at the time

of the Sell S15s. See all the Sell S15s and the A/D Lines

here. Below are the

3 cases where the A/D Line did confirm the DJI high on earlier Sell S15s.

Interestingly,

two were in March: 2/11/2004, 3/3/2005 and

3/14/2012.

===================================================================================

OLDER HOTLINES

===================================================================================

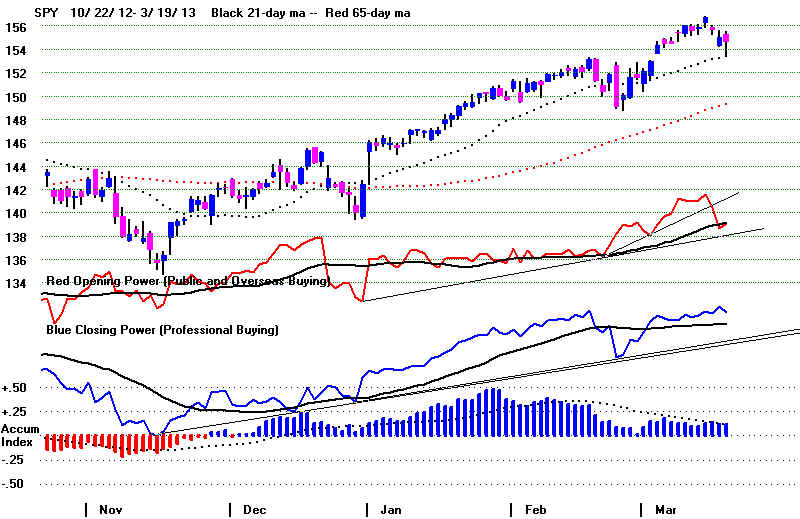

3/19/2013

Sell

S15

versus Momentum, NY Professionals and The Fed

Foreign Markets Have Turned Down Much More Than The US Stock Market.

Using the corrected data for 3/4/2013, Peerless now has a Sell S15 signal

to caution us to do some profit-taking and hedging. I have not suggested

shorting SPY because the momentum is strong, the A/D Line is still

rising and the Closing Powers are still in uptrends. In the comments

here and at Sell S15, you can see that I have questioned this Sell

S15

because the P-Indicator is above +200 and the 65 day pct. change is above

7.75%. Usually, the A/D Line was lagging at the time of earler Sell S15s

Here it is not. That is the reason I suggested that some of you may want

to wait to sell and use an A/D Line trend-break for deciding when. to sell.

I have tried to avoid making more work for myself. So since paper losses

of 2% to 3% were not uncommon with Sell S15s, I have decided to stand by it.

See below that I like using accelerating price uptrendlines when there has

been a breakout, such as we saw at 14200, above the channel resistance.

(Tomorrow I will show more examples of this curved uptrendline. The programs

should also a slope where the curve decelerates. They do not now.)

NY Professionals remain quite bullish. The Closing Powers for the key ETFs

have hardly dropped in this 3-day decline. Each early sell-off is followed

by a good recovery. This is usually a reliable sign of strength. For SPY,

higher openings have accounted for only 1.98 of the 11.23 points SPY has gained,

while closes above the opening have caused 9.25 points' rise.

Now the green Opening Power for SPY is back to its rising 21-day ma. Watch to see

if the Opening Power turns up. This represents overseas net buying as much as it

represent Public buying. We have to wait another day or two to see what happens

in Cyprus when the banks re-open after depositors were suddenly told that the

north Europeon big banks would be taking a hefty percentage of depositors'

money for debts undertaken by their country.

Another few trading days down is what the DJI typically shows after March 19th.

However, over the next month is up 70.2% of the time. The average DJI gain is 1.5%

in this period. The most typical mmediate

aftermath of triple-witching Friday, March 15th

is a decline to the lower band.

Sell

S15s often come early. This could well be one of those cases. If the

DJI

does rally, we will need to see how broad the rally is. See below the biggest

paper

losses for Sell S15s after 1965 in the 2nd quarter. Right now the A/D Line

is

stronger than the DJI. That was not true in these two cases. This suggests

a

stronger market now than in either of these two cases.

4/6/72 1.0% maximum paper loss on Sell S15

|

4/14/92 3.2% maximum paper loss on Sell S15  |

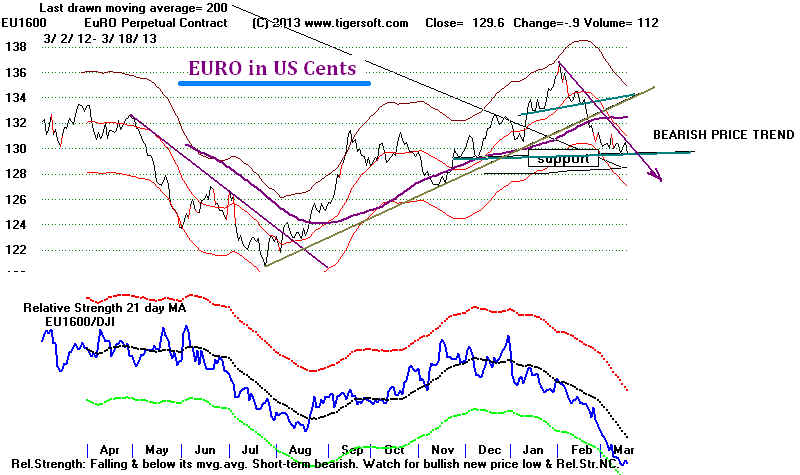

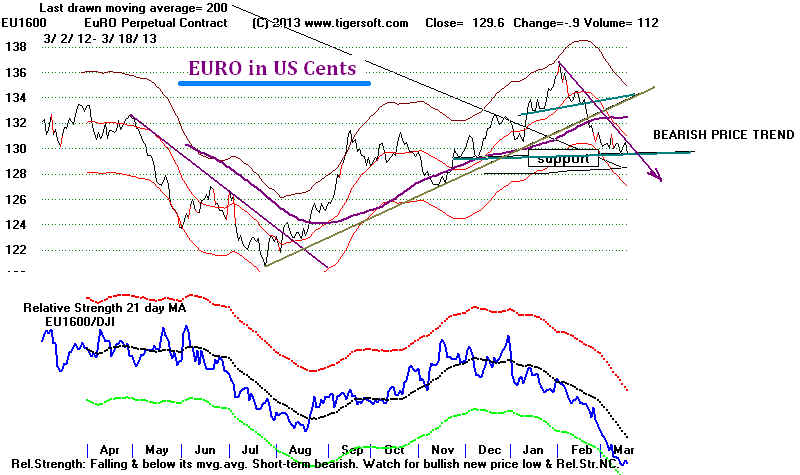

Europe's Crises Help The Dollar and That Helps The Fed Boost US

Stocks

So

far, each crisis of the EURO has given the US Dollar a boost. A lot of nervous hot

money

has

come here. The Feds have taken advantage of the Dollar's strength to continue

very

low interest rate policies. So, for now, the blunders of the Europeon bankers

have

served to boost the Dollar, US bonds and US stocks. But if the Depression in

parts

of Europe continues, the whole EEC experiment could come undone. Bond holders

in

these countries will get more than a hair-cut. The Tiger Index of Non-US ETFs

now

shows a serious breakdown below support. Serious economic turmoil in Europe will

hurt

US stocks. But the waves take time to cross the Atlantic.

Non-US Stock Markets Have Been Hit Hard.

The

EURO and the EEC Central Bankers keep muddling through from one crisis to

another. The core problem of high regional unemployment is beyond them. Local

currencies are the only way out. But this is, of course, not acceptable to the

central

bank elites. It's very clear that these bankers are getting very nervous. They

have

their stock markets going up with talk of easing austerity and protecting big lenders

but the economic projections remain gloomy for Italy, Spain, Portugal and

Greece.

Actually "dismal" is probably more accurate. So how much longer will the

people in these

pooerer counies put up with their own governments failed efforts to protect the average

people from the demands of the central bankers as transmitted through their local

political minions? Sooner or later, one or more these countries will decide to break

free

and control their own monetary and fiscal policies.

3/19/2013 ---> To

All Key Index and Lesding Stock Charts

---> 332 -126 MAXCP stocks Bullish

MAXCP Stocks (3/19/2013) BULLish plurality

--->40 -9 MINCP stocks Bearish MINCP Stocks (3/19/2013)

--->47 New Highs on NASDAQ 10 new lows. BULLish

plurality

--->80 New Highs on NYSE 14

new lows. BULLish

plurality

3/19/2013 Key Values: DJI 14456 +4

la/ma= 1.017 21dmaroc = +.398 P= +222 Pch= -18

IP21 = +.108

(on 1/30/2013 IP21 was .293) V = -21 Opct = .266 65

day-pct-up = .083

=====================================================================================

OLDER HOTLINES

=====================================================================================

3/18/2013

Our Sell S15 Cannot Be Dismissed. A

Profit-Taking Retreat

to 14000 Is Probably Unavoidable while Europeon Central Bankers

and Finance Ministers Scramble To Undo The Damage

To Confidence They Themselves Have Caused.

NYSE Professionals Keep Buying. They expect the Fed

to offer assurances tomorrow that they stand ready to

bolster US banks and bonds. But the Cypress Crisis shows

just how bad the judgement of Euro Bankers is. Insead of

shoring up the the Cypriot Banks, their proposed confiscation

will surely cause a widespread "bank run" there.. And that

that could spread to Spain, Greece and Italy. Such a widening

contagion would surely negatively impact US banks, too.

On our Stocks' Hotline, I have decided to take some more profits and

sell

short more stocks, so that we are now weighted fairly heavily short.

The

rally that we have recently seen since the DJI got past 14200 would not be out of

the

ordinary for a Sell S15, as 20% of them initially produce paper losses of more

than

2.5%. The Sell S15 also gives us a way to lock in some nice profits.

So, I

have not rescinded the Sell S15. More selling and hedging seem reasonable.

While I would like to discount or

even dismiss the Peerless Sell S15 because

the P-Indictor remains very

positive and the DJI is up more than 7.8% in the last

65 days, the situation here

could get much worse very quickly if Cypriot banks

fail

and the country is forced to leave the Euro and print its own currency.

Because Cypress

is so

small and the stakes are so large, I would think the Europeon Central Bank

is

now rethinking its refusal to extend more credit to Cypress and its banks.

But

who knows? Professionals in the US think this will quickly all pass like a tropical

thunder squall. What I do know is that if the US Professionals do change their

minds and

begin

to sell in earnest, we better, too! So, watch the DJI 14200 support. It should

not

be

broken. Watch the NYSE A/D Line uptrend. A break in it would be bearish.

And

of course, watch the Closing Power for SPY. If it breaks its uptrend, the

rising 21-day ma will be tested and if that is broken, 14000 on the DJI and 148

on

SPY will come next.

3/18/2013 ---> To

All Key Index and Lesding Stock Charts

---> 458 MAXCP stocks Bullish

MAXCP Stocks (3/18/2013) BULLish plurality

--->49 -78 MINCP stocks Bearish MINCP Stocks (3/18/2013)

--->58 New Highs on NASDAQ 6 new lows. BULLish

plurality

--->68 New Highs on NYSE 9

new lows. BULLish

plurality

3/18/2013 Key Values: DJI 14452

-62 la/ma= 1.018 21dmaroc

= +.402 P= +240 Pch= -31

IP21 = +.119

(on 1/30/2013 IP21 was .293) V = -21 Opct = .275 65

day-pct-up = .082

The Fed To The Rescue Again

I expect that the FED will say tomorrow that it will always be ready to

ensure the safety of US banks and rescue of bond holders, if needed.

For a while, it will succeed. Bonds may go up a few days more,

as foreign hot money moves into US Dollars with the EURO's fate

in doubt because of threat of widespread bank runs later this week

that will probably push Cypress Banks into bankruptcy. My sense is

that the only way out if this happens will be for Cypress to print its

own currency. But this is heresy to the central bankers. It could set

the pattern for Greece, Portugal and Spain and end the EURO's

dominion in these countries.

All this was brought on because the bankers'

government in Cypress

and

the usual north Europeon Finance Ministers thought that Cypriots would just

stand

by while their money was stolen by bankers to pay for the

banks'

own missteps. Big surprise. They will not!

The dangers for the EURO have suddenly got worse. What if

people

in other countries start pulling their money out of banks because

they fear similar confiscations? The bungling finance minsiters have

made things much worse. Interest rates are so low, hiding the money

under a matress makes sense. How then banking system continue

when there are no deposits? These strains, stresses and contradictions

will get worse until full employment is restored. But short-sighted

orthodoxies and fears that governments might do a good job as the

employer of last resort prevent the ruling elites from seeing their

own long-term interests. Instead, in desperation, they clumsily try to

confiscate depositors' funds. The perception that central bankers are well-

dressed thieves will be a hard one to shake.

=====================================================================================

OLDER HOTLINES

=====================================================================================

3/15/2013 1/6

Chance for A Decline to The Lower Band. There

Was A Sell S15 on

March 5th with Corrected Data. We Have To Be

More Hedged and

Take Some Profits.

Usually good bread

and momentum win out over weak Volume.

But not always.

Will the very weak Bond Market spill over to the

stock market.

The steeper the

decline in Bonds, the more the risk to stocks because

of Margin Calls

and the higher risk of a jump in Interest Rates.

If we take the Sell S15 now as the active signal (and for reasons explained below, this

should be questioned, I think.) we see that paper losses of 2.0% or more occurred in

about

20% of the Sell S15s. This would be another case. The Sell S15 occurred

on

3/5/2013 with the DJI at 14253.77. It has since risen to a high closing

of 14539.14.

Had

we taken this signal at the time, it would have produced a 2.0% paper loss.

The

10-day winning streak of the DJI was broken Friday on unusually high volume.

After

a rally, this is bearish. See the red circles where volume was high.

The

DJI did reach a point 2.8% over the 21-day ma. the day before. The DJI has not

closed more than 3.5% over the 21-day ma since October 2011. So the upside would

seem

to be limited unless the high priced DJI stocks like IBM, MMM and CVX

attract very aggressive new buying. Watch them this coming week. They were

the

leaders.

A

decline back to the rising 21-day ma now at 14167 (and rising 25 points a day) would

seem

likely and might actually be healtier than a run straight up to 15000. I doubt if

such

a

decline would take the DJI below the point of breakout at 14200. Breadth and

the

A/D

Line have been too strong and, as we've seen time and again, Professionals keep

resuming their buy programs after mid-day.

If we look

at the market's key values for Thursday in the past, namely

V-I < 5

LA/MA >1.0285

IP21 > .10

P-I >100

65-day Pct Change > .09

we see a

serious decline is relatively unlikely in the next 6 weeks. There was one such

decline in

the 6 past parallels found. See below. An additional 4% to 9% DJI rally

occurred in

3 of the 6 cases. In 2 cases, the DJI went slighlty higher and then pulled

back

to just

below the 21-day ma. So, without a Sell S9, Sell S12 or a head/shoulders pattern

as in May

2010, it usually takes a while to reverse the momentum inherent in a market

that is up

more than 9% in 3 months. Here are the cases since 1980:

Past Cases with Key Values Similar to 3/14/2013 Date DJI LA/MA P-I IP21 65-ch Short-Term Result

--------------------------------------------------------------------------

8/7/1980 950.94 1.031 131.6 .154 .140 2% further rise

and then 4% fall.

10/7/1982 965.97 1.049 118.14 .104 .181 9% further rise

DJI was up 6% in two days after B9

1/31/1996 5395.3 1.042 100.19 .207 .116 4% rise in a week.

11/12/1996 6266.04 1.031 104.00 .128 .096 5% rise in 2 weeks

2/13/1997 7022.44 1.031 101.67 .125 .116 1% further rise

This was also a Sell S9 Then 10% decline. then 10% decline.

11/25/2009 10464.4 1.030 175.43 .168 .095 DJI went narrowly

sidewise for a month.

3/14/2013 14539.14 1.028 306.90 .110 .105 ???

|

I Would Discount The "New"Sell S15 of 3/5/2013

You will

note a new signal has appeared when the Peerless signals are super-imposed on

the DJI

chart. This is the S15

on 3/5/2013. It occurs if the data for 3/4/2013 is corrected.

Several

readers had called my attention to what they they thought was an error in the

data as I

got it from Dial Data and Yahoo. They were right. I had taken the

theortetical

high to be

14130 instead of 14160.19. Yahoo was wrong. I took the highs of the 30 DJI

stocks

and using

the divisor recalculated the theoretetical high. I did not trust Barrons. They have

made some

mistakes recently, switching the theoretical with the actual trading high.

But their

14160.19 number checks out. My thanks to those who noticed this.

I do think

that the "new" Sell S15 produced by the new data is questionable.

It is based

on the V-Indicator being negative. But here it occurs with the P-Indicator

above +175

when the DJI is up more than 7.5%. If you look at the history

of Sell S15s, you will see this

set of conditions has failed before.

Sell S15s, Gains, Paper Losses and Key Values

Date

DJI %Gain

%-Paper LA/MA A-ROC P-I

IP21 V-I

Opct 65-day Pct

Change

Loss

PI^^ (Adjusted P-I)

Pct Change

2/18/36 153.4 + 3.1 6.8 1.029

. 608 57

.016 -28 .18

.064

PI^^ = 255

--------------------------------------------------------------------------------------------------------------------------------------------

3/4/36 156.7 +5.2 4.6

1.028 .477

28 -.016 -139

.033 .092

---------------------------------------------------------------------------------------------------------------------------------------------

4/1/36 158.9 +6.5

1.4 1.018 .206

-40

-.097

-265 .207 .101

---------------------------------------------------------------------------------------------------------------------------------------------

2/10/37 189.4 +12.6

2.6

1.019 .391 -10

.034 -202

.055 .037

----------------------------------------------------------------------------------------------------------------------------------------------

3/5/37 194.1 +14.7 0.1

1.028 .373

-15

.037 -231

.092 .056

-------------------------------------------------------------------------------------------------------------------------------------------------

1/5/60 685.5 +9.8

0 1.018

.40

4

-.038

-170

.095 .079

-----------------------------------------------------------------------------------------------------------------------------------------------

3/26/70 791.05 +18.9

0

1.019

.35 -24 -.017

-1

.055 .006

--------------------------------------------------------------------------------------------------------------------------------------------------

4/6/72 959.44 +5.0

1

1.020

.159 -70 .036

-1

.086

.045

--------------------------------------------------------------------------------------------------------------------------

5/25/72 969.07 +5.9

2.2 1.025

.279

-10 .004 -1

.225 .059

--------------------------------------------------------------------------------------------------------------------------------------------------

1/5/1973 1047.49 +8.9

0.4 1.023

.238 -77

.039 -2 .053

.09

---------------------------------------------------------------------------------------------------------------------------------------------------

3/24/76 1009.21 +4.2

0

1.024 .192

-64

-.033 -1 .293

.165

----------------------------------------------------------------------------------------------------------------------------------------------------

4/21/76 1011.02 + 4.4

0

1.019 .345

-1

.038 -1

.07 .067

-----------------------------------------------------------------------------------------------------------------------------------------------------

2/13/80 903.84 +14.0 0

1.028 .478

-26

-.01

-1 .206 .108

-----------------------------------------------------------------------------------------------------------------------------------------------------

4/24/81 1020.35 +17.4 0

1.018 .061

1

-.012

-1

.11 .073

biggest

------------------------------------------------------------------------------------------------------------------------------------------------------

1/2/90

2810.15 +7.5

0 1.028 .453

36

.08 -4

.093 .04

-----------------------------------------------------------------------------------------------------------------------------------------------------

4/14/92 3306.13 +1.6

3.2 1.017

.256

-59 .033 -10 .231

.036

biggest

-------------------------------------------------------------------------------------------------------------------------------------------------------

4/21/98 9184.94 +16.9 1.7 1.024

.37

13

.045

-7 .056

.056

--------------------------------------------------------------------------------------------------------------------------------------------------------

1/7/2000 11522.56 +4.8 1.7

1.021 .48

-23

-.028 -59

.341

.083

highest AROC

highest OPct

--------------------------------------------------------------------------------------------------------------------------------------------------------

2/11/2004 10737.70 +7.2 0

1.017 .285

+246

.093

-6 .136

.082

---------------------------------------------------------------------------------------------------------------------------------------------------------

3/4/2005 10940.85 +6.6 0

1.017 .381

+251

.093

-15 .14

.047

highest P-I

-------------------------------------------------------------------------------------------------------------------------------------------------------

5/1/2008 13040

+12.7

0 1.029

.405 +178

.047 -28

.076 .043

--------------------------------------------------------------------------------------------------------------------------------------------------------

X Dubious because P-I

>+200 and 65 Pct change is over .085 (8.5%)

1/4/2012 12418.42 -1.3 1.3 1.025

.393

+211 -.045 -4

.10 .121

high

highest

----------------------------------------------------------------------------------------------------------------------------------------------------------

3/14/2012 13194.10 +3.6

0.5 1.019

.295

+129 .069

-24

.231 .09

---------------------------------------------------------------------------------------------------------------------------------------------------------

5/1/2012 13279.32

+2.9 0

1.018 .061

+78

-.003 -87

.036 .046

--------------------------------------------------------------------------------------------------------------------------------------------------------

X Dubious because

P-I > +200 and 65 Pct change is over .085 (8.5%)

3/5/2013 14254.77

1.019 .208

+229

.083 -32

.116 .089

high

high

=======================================================================================

N= 23 or 25 Avg Gain =

8.35%

Avg Paper Loss = 0.88% |

3/15/2013 ---> To

All Key Index and Lesding Stock Charts

---> 413 -1 MAXCP stocks Bullish

MAXCP Stocks (3/15/2013) BULLish

plurality

---> 122 +15

MINCP stocks Bearish MINCP Stocks (3/15/2013)

--->109 New Highs on NASDAQ 9 new lows. BULLish

plurality

--->184 New Highs on NYSE 15

new lows. BULLish

plurality

3/15/2013 Key Values: DJI 14514

=25 la/ma= 1.024 21dmaroc = +.447 P= +271 Pch= -35

IP21 = +.128

(on 1/30/2013 IP21 was .293) V = -6 Opct = .276 65 day-pct-up = .092

====================================================================================

OLDER HOTLINES

====================================================================================

3/14/2013 No Peerless

Sell.

DJI Is Now Running Easily in All-Time High Territory.

It is 2.8%

over its 21-day ma. Expect the upper 3.5% to act as resistance.

But with

the DJI up 9.5% over its level 65 trading days ago, there is probably

too much

momentum The upper 3% band is now at 14537 and rising 10 points

a day.

Led by IBM

(+3.74 ) and CVX (1.64) the DJI moved higher and higher all day,

NYSE

Breadth was a healthy 2:1 on the upside with NYSE Up Volume almost 3 times

its Down

Volume. We have no Peerless sell signal since the reversed Sell S11.

Professionals are much more heavily buying than selling short, except for

Bond Funds

and Gold Stocks, both of which often move down when the stock

market is

very strong. Note that both the Public and Professionals are net buyers.

The DJI is

now opening higher and going still higher at the close most days. We

see this in

the fact that both Opening and Closing Power are in uptrends. This is

very

bullish, at least until Closing Power finally breaks it uptrend.

Bond Bubble

There is

still no media discussion now that I can find of a bond bubble. That was

also true

of the housing bubble in 2005 and the Chinese stock bubble of 2007.

Some bond

fund investment advisors are dismiss the idea of a bubble, by maintaining

that the

steep decline in bonds now is mostly in Municipal Bonds, It is occurring, they say,

because the

tax exempt status of "MUNIS" may be changed in the budget negotiations

now said to

be going on. Maybe. But all the Bond Funds look terribly weak.

If I were

to design a perfect bearish chart, an ideal one, that all others might strive

to avoid,

I could not make an uglier chart now than those shown among the most

"bearish" Bond Funds in our MINCP charts. They have it all:

head/shoulders patterns,

increasing volume on the neckline breaks,

Closing Power falling at a 30-degree angle on a yearly chart,

many, many red Sell S7s,

Public Buying despite the decline and

massive amounts of Red Distribution signiying insider selling.

The Essence of Bearishness

The Fed May Lose Control of Interest Rates

I have to

stick with my view that the stock market's rally is showing us

that the

economic recovery is slowly accelerating. If so, stocks will draw more

and more

money out of bonds. Demand for loans will push up rates inevitably.

And the

up-trends could accelerate. Inflation is not a factor now. The Dollar

is strong.

But at some point, if inflation does return or the Dollar does turns

down that

will put added pressure on the Fed to protect the Dollar and raise rates.

In essence,

it seems unlikely that the Fed can keep 10-year rates at the levels they

were in the

1940s.

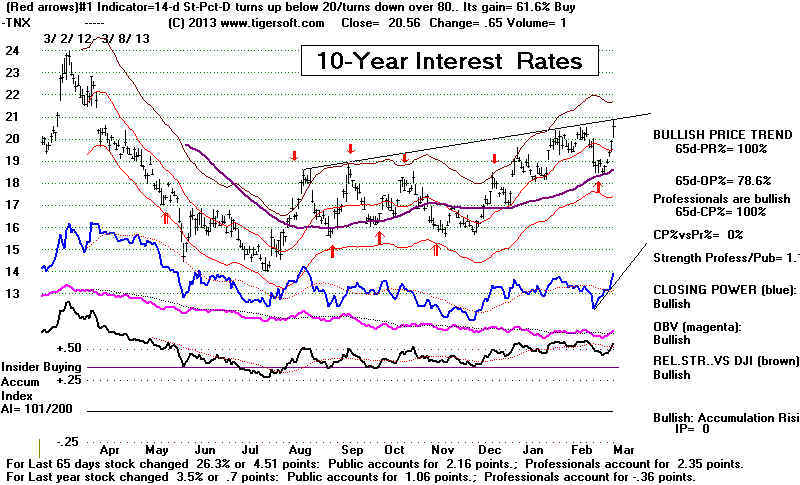

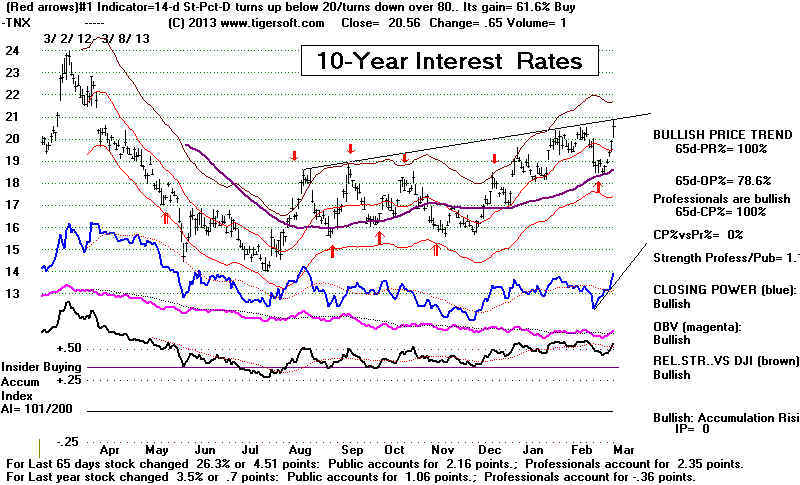

10-year Treasury Yields

-

3/14/2013

---> To All Key Index and Lesding Stock

Charts

---> 414 +98 MAXCP stocks Bullish MAXCP

Stocks (3/14/2013) BULLish

plurality

---> 107 +44

MINCP stocks Bearish MINCP Stocks (3/14/2013)

--->176 New Highs on NASDAQ 9 new lows. BULLish

plurality

--->293 New Highs on NYSE 17

new lows. BULLish

plurality

3/14/2013 Key Values: DJI 14539

+84 la/ma= 1.028 21dmaroc = +.439 P= +307 Pch=+7

IP21 = +.132

(on 1/30/2013 IP21 was .293) V = +4

Opct = .373

=================================================================================

OLDER HOTLINES

=================================================================================

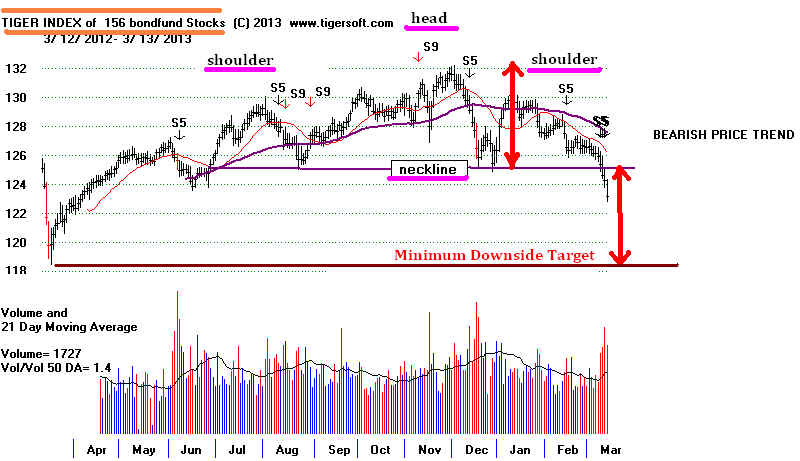

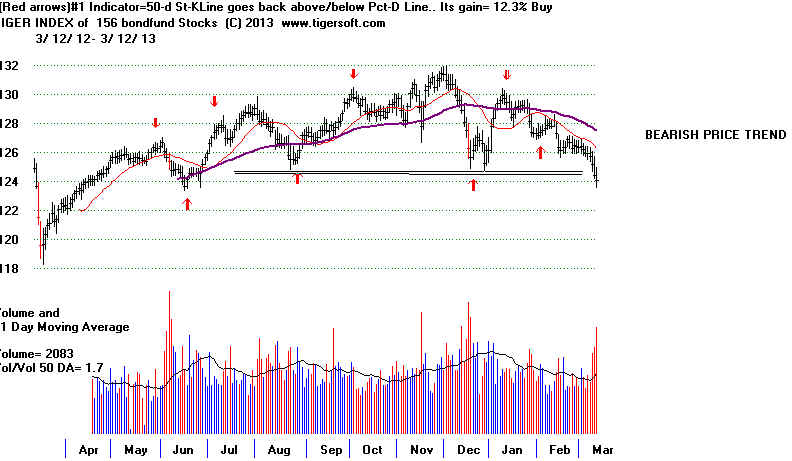

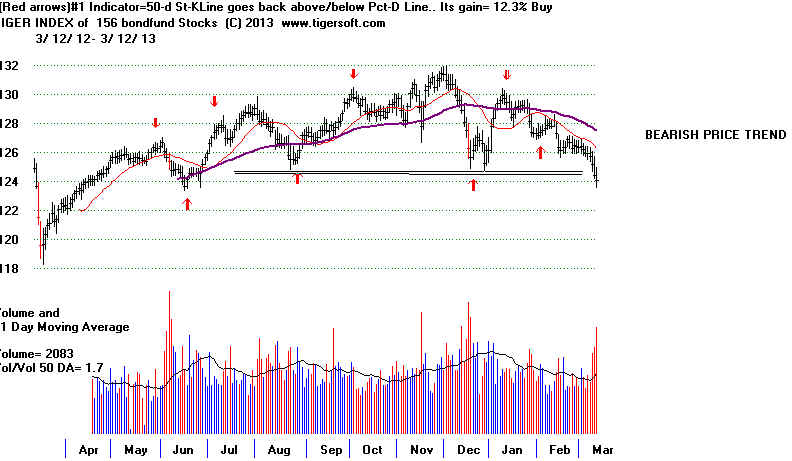

3/12/2013 Money Keeps Coming Out of Bond Funds and Is Moving into

The DJI.

There is a risk

that their cave-in could get much worse and that would bearishly

affect stocks.

But mostly, when bonds go down, confidence in stocks is swelling

and they rise.

I consider

Peerless to still be on a Buy because of breakout past 14200 into

all-time high

territory. If the breakout fails, and the DJI falls back below the

expected 14200

support, then we may have to reconsider things, but for now I

consider Peerless

to still be on a Buy.

-------------------------------------------------------------------------------------------------------------------------------------------------------

3/13/2013

---> To All Key Index and Lesding Stock

Charts

---> 316 +17 MAXCP stocks Bullish MAXCP

Stocks (3/13/2013) BULLish

plurality

---> 74 +2

MINCP stocks Bearish MINCP Stocks (3/13/2013)

---> 81 New Highs on NASDAQ 11 new lows. BULLish

plurality

--->155 New Highs on NYSE 8 new lows.

BULLish plurality

3/13/2013 Key Values: DJI 14455

+5 la/ma= 1.024 21dmaroc = +.409 P= +300 Pch=+33

IP21 = +.125

(on 1/30/2013 IP21 was .293) V = -1 Opct = .352

-------------------------------------------------------------------------------------------------------------------------------------------------------------------

Professionals Remain Bullish

Professionals are still aggressively buying many more stocks than they are

shorting.

The number of MAXCP stocks tonight is 316 while the number

MINCP

stocks is 74. Of the MINCP stocks, 47 are Bond Fund ETFs.

This should

alarm bond holders. Volume is rising, but it is not yet at the levels

seen at the

June and December lows. Prices have broken these lows' support.

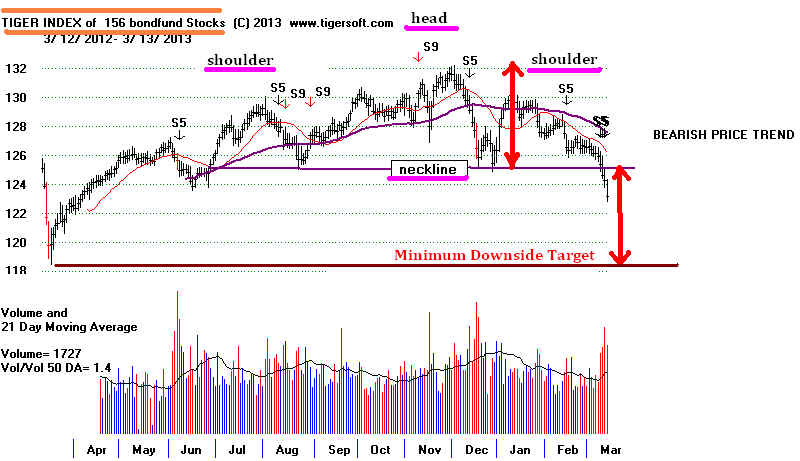

Even a

short-term selling climax has not been reached. The Head/Shoulders

pattern in

our TigerSoft Bond Fund Index is still more than 5% lower.

Bond Funds Continue To Fall

without Any Headlines or Public Fanfare.

What Groups Are Represented in

the MINCP Stocks Tonight

Gold Mining Stocks: ABX, ASA, EGO, GG, SID,

Bond ETFs: AFB,

BFK, BFZ, BKCC, BKK, BNA, BTA, CAF, CXE, DSM, FAX,

GGN, ITM, LEO, MCA, MIY, MNP, MQT, MSD, MT, MVF, MYD, MYJ, MYM,

MYN, NAC, NAD, NCP, NIF, NIO, NMA, NMD, NMO, NMZ, NNC, NPT, NRK,

NUC, NHO, NVC, NEV, OZM, PML, PMM, VKI, VMO, VR,

Biotechs: ARNA, EBS, VPHM

Short ETFs: DOG, DXD, SHM,

Others: CLF, COH, EPU, EXAS, FNSR, IMO, LF, NOV, ROST, TAC, TAN, TCK,

TDS, VICR, VOCS, WTR,

Remeber

that the DJI is at an all-time high and broke above well-tested rising

resistance

at 14200. I would judge there is 250 points downside potential

and nearly 500

points upside potential in the DJI. Until we get a new Peerless

Sell Signal, a

head/shoulders top or the Closing Powers break below their

21-day ma, I

would play the long side and give the market more chance to advance,

with a few

exceptions, the most notable being taking short positions in bond funds

and a few of the

other Bearish MINCP stocks.

As I've shown,

significant tops do sometimes occur in March, but usually later

than that.

The DJI's Day Up-Streak Is Proably Bullish

The DJI has now

risen 9 days in a row. The longest streak, 13 days in a row, since 1945

was in early 1987

right beforea 20% advance in 4 months.

See Table 2

below. In 6 cases the DJI rose 1% to 3% more before a top. In 9

cases

it rose 5% or,

at least, a month more. In 7 cases it was

at or within a week of a

sell-off. This roughly gives us a 2:1 probability of a move still

higher.

Where the DJI was

up 9% to 11% from 65-day ago, as now, we see the 5 cases

shown in

tonight's Table-1. In 4 of them the DJI moved significantly higher.

In one case, the

P-Indicator finally turned negative and an obvious head and

shoulders top

appeared.

Streak Up Pct

Result

ended 65-days

at X

days up:

-----------------------------------------------------------------------------------------------------------------------------

TABLE 1 What Happens When DJI Is Up 9

Straight Days and Up 9%-11% over

the last 65 trading days?

1) 9/2/55 10

9.9%

2.9%

Peerless gain follows. Top is a week

later.

-------------------------------------------------------------------------------------------------

2) 1/13/67 9

9.7%

6.3%

Peerless gain and 14 week advance.

--------------------------------------------------------------------------------------------------

3) 4/16/71 10

10.5%

one week away from important

top.

--------------------------------------------------------------------------------------------------

4) 7/14/89 9

+9.2%

8.5% Peerless gain and Sell 10 weeks later.

---------------------------------------------------------------------------------------------------

5) 11/14/96 10

+10.2%

10.3% Peerless gain over next 3 momths

----------------------------------------------------------------------------------------------------

TABLE2

What Happens When DJI Is Up 9 Straight

Days?

Streak Up Pct

Result

ended 65-days

--------------------------------------------------------------------------------------------------------------------------5/17/48 10 13.0% +1.5% gain 3 weeks later.

---------------------------------------------------------------------

10/20/48 9 2.8% +1.8% Peerless gain at

top only a week away from a significant top.

----------------------------------------------------------------------

2/6/50 9 7.3% Big Peerless gain follows

Advanced for 4 more months

----------------------------------------------------------------------

9/14/54 9 8.4% Much higher prices follow.

-----------------------------------------------------------------------

1/28/55 11 12.0% up another month before quick decline to LB

-------------------------------------------------------------------------

4/18/55 9 7.0% Decline to rising 65-dma followed.

-----------------------------------------------------------------------

6/27/55 9 7.8% 2.3% Peerless gain follows. Top is a week later.

-----------------------------------------------------------------------

9/2/55 10 9.9% 2.9% Peerless gain follows. Top is a week later.

-----------------------------------------------------------------------

7/7/59 10 7.8% 2.9% Peerless gain follows. Top a month later.

-----------------------------------------------------------------------

11/30/59 10 7.4% 1.8% Peerless gain follows. Top is a week later.

-----------------------------------------------------------------------

3/18/64 9 7.2% DJI went sidewise.

-----------------------------------------------------------------------

2/3/65 9 3.6% DJI pulled back to 65-dma immediately.

----------------------------------------------------------------------

1/13/67 9 9.7% 6.3% Peerless gain and 14 week advance.

-----------------------------------------------------------------------

4/25/67 9 4.9% One week before decline to LB.

-----------------------------------------------------------------------

5/3/68 9 6.0% DJI turned down and fell to LB.

------------------------------------------------------------------------

12/2/70 12 4.7% 16.8% Peerless gain and 6 month rally.

------------------------------------------------------------------------

1/26/71 9 10.1% 8.1% Peerless gain and 4 month rally.

---------------------------------------------------------------------------

4/16/71 10 10.5% one week away from important top.

---------------------------------------------------------------------------

7/26/73 10 -0.7% Major TOP

---------------------------------------------------------------------------

1/14/87 13 +12.0% 18.2% Peerless gain and Sell 4 months later.

---------------------------------------------------------------------------

7/14/89 9 +9.2% 8.5% Peerless gain and Sell 10 weeks later.

----------------------------------------------------------------------------

12/31/91 11 +5.1% 3.6% Peerless gain and sell 2 months later.

----------------------------------------------------------------------------

5/20/96 9 +3.4% Top occurs one week later.

---------------------------------------------------------------------------

11/14/96 10 +10.2% 10.3% Peerless gain over next 3 momths

----------------------------------------------------------------------------

3/13/13 9 +9.5% ????

|

DJI HIGH FOR 3/4/2013 - DATA ERROR?

The DJI's high Data that we have used for 3/4/2013 should, perhaps,

be changed to

14160.19. The data we used was what was provided us from

Dial Data and was

the same that appeared in Yahoo that night. But Barrons'

and the Wall

Street Journal data is what we have tried to use everywhere.

However, if I put

the 14160.19 number in place of our number (14128.21) it would

have given us a

Sell S15 a week ago. Making a change now makes too much

work at this

stage. More important, it is not clear that March S15s are reliable.

And most

important, I have spotted recent errors in Barron's theoretical

and trading

highs, where they have reversed the numbers. So, for all these reasons,

I'm going to keep

on using the 14128.21 number.

===================================================================================

OLDER HOTLINE

===================================================================================

3/12/2013

Hedge by Shorting The Lowest Power Ranked

Bond Funds.

Only A Shallow Retreat Seems Likely,

I Consider The Peerless Sell Signal Cancelled.

Today's DJI marginal new high was accomplished mainly because of unusual strength

in MRK and in two of the highest priced DJI stocks, BA (+1.22), IBM (+.47).

The DJI advanced alone. The Blue Chips are haven for those selling bonds, just

as biotechs are often bought by speculators when other tech stocks appear

over-bought.

The NYSE A/D Line failed to confirm today's rally. The NASDAQ losr 10.55,

the NYSE fell 22, the SP-500 dropped back 3.72, the OEX dipped 2.44 and

the Value Line shed 5.73. This is a divergence, but I doubt if it is bearish

enough to bring much of a decline. For that we will need to see a new Peerless

Sell Signal and/or a head/shoulders top.

The only scenario I can see which would bring about a serious DJI decline now

would be if bonds fall apart and investors and big banks rush to sell them

to them in a panic and margin calls ensue. That is a possibility. See the

now completed Head/Shoulders in the Tiger Index of Bond Funds and rise

of red high volume.

Expect the Fed to try to prevent this. Expect to see one of Bernanke's

cohorts on the FED say that that they will keep rates very low in order

to prevent undue strains on the market (and big banks). But that could

be a losing battle if unemployment falls to 6.5% later this year or

early next year.

The DJI Momentum Is Very Bullish

The DJI is now 2.5% over its 21-day ma. It has been 18 months since

the DJI was able to rise past the resistance of the 3.5% upper band, now

at 14600. So, its immediate upside appears limited, barring unexpectedly

bullish news. That does not mean there will be much of a decline in the

next month. 14100-14200 was the point of recent breakout. It will

likely act as support if there is a decline.

History suggests that the DJI is likely not to decline by much. When we look

back at the past since 1965, we see the DJI continues to rally even though the

V-Indicator is negative at the 2.5% upper band when:

1) the DJI is more than 10% above its level 3 months ago,

2) the P-Indicator is very positive and

3) the IP21 is above +.10.

The Sell S11 did not allow for this factor, the percentage up from 65-days

ago. The DJI was up 10 9%

from 65 days before on the day of the Sell S11

on 2/22/2013. That seems to be an important consideration. I want to

add a new band line that lets users display this 10% up line for all charts.

I want to see if this should be considered in other Peerless signals.

Below is our current DJI chart and the only two other past cases when

conditions #1, #2 and #3, above, were present between 1965 and 2013.

la/ma

P-I IP21

V-I Pct up from 65 days ago.

Outcome

3/12/2013 14450.06

1.025 266 .124

-4

.109

?????

la/ma

P-I IP21

V-I Pct up from 65 days ago. Outcome

la/ma

P-I IP21

V-I Pct up from 65 days ago. Outcome

2/6/1986 1600.69

1.037 101 .139

-2

.107

Up for 3 more months

la/ma

P-I IP21

V-I Pct up from 65 days ago. Outcome

1/31/1996 5395.3

1.042 100 .207

-1 .111

Up for 5 more weeks.

3/12/2013 ---> To All Key Index

and Lesding Stock Charts

---> 299 -58 MAXCP stocks Bullish MAXCP

Stocks (3/12/2013) BULLish

plurality

---> 72 +2

MINCP stocks Bearish MINCP Stocks (3/12/2013)

---> 124 New Highs on NASDAQ 6 new lows. BULLish

plurality

--->204 New Highs on NYSE 6 new lows.

BULLish plurality

3/12/2013 Key Values: DJI 14450 +3 la/ma= 1.025 21dmaroc = +.387 P=

+266 Pch= -76

IP21 = +.124

(on 1/30/2013 IP21 was .293) V = -4 Opct = .302

====================================================================================

OLDER HOTLINES

====================================================================================

3/11/2013

Sorry, But Bond Funds Do Look Dangerous.

Hedge by Shorting The Lowest Power Ranked Bond Funds.

I was warned that Unemployment will probably not fall to 6.5% this year and so

should not count on the FED's ending their promotion of very low interest rates.

Perhaps, but there's no denying that some big professionals are selling some

of their biggest municpal bond holdings. now. They do not want to get trapped in

them when everyone starts to sell them.. By our standards, their charts look

particularly vulnerable. They look even more vulberable

than housing stocks looked

at their tops in 2005 and 2007.

See also June 28, 2007

"Housing Shows No Bottom in Sight."

http://www.tigersoft.com/Tiger-Blogs/6-19-2007/index.htm

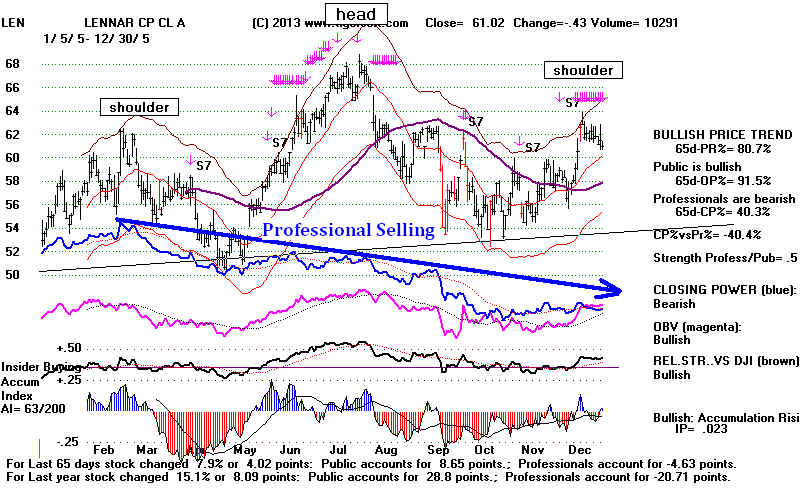

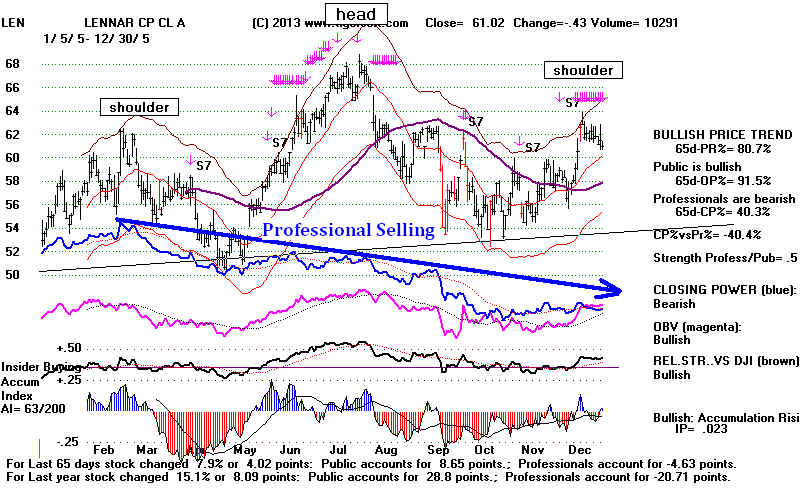

LEN's Top in 2005 looked less bearish than some big bond

funds Do NOW.

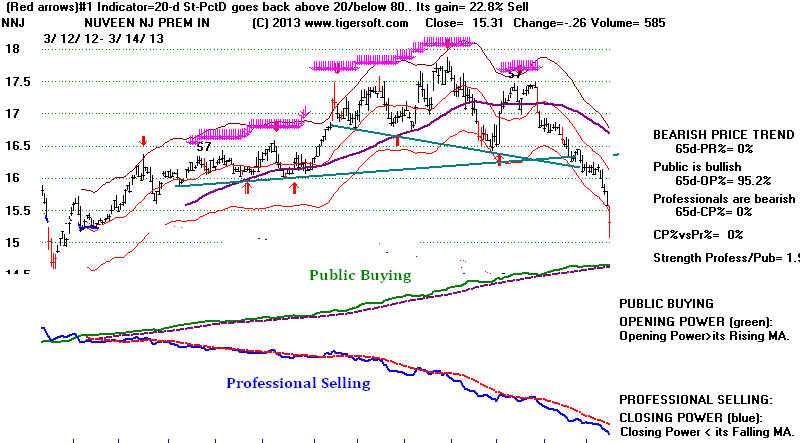

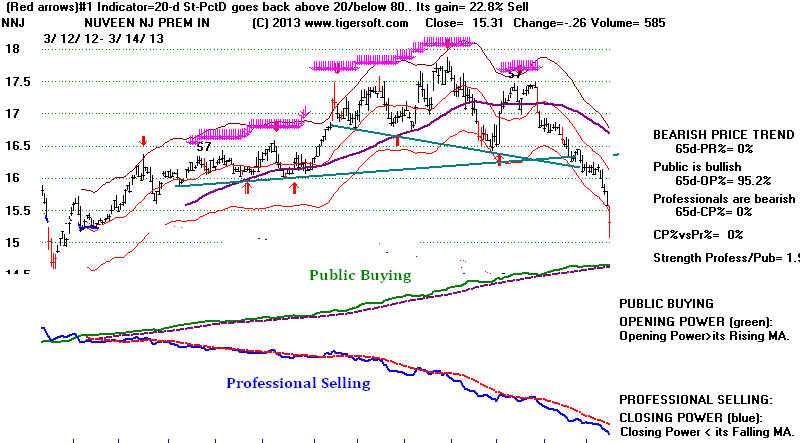

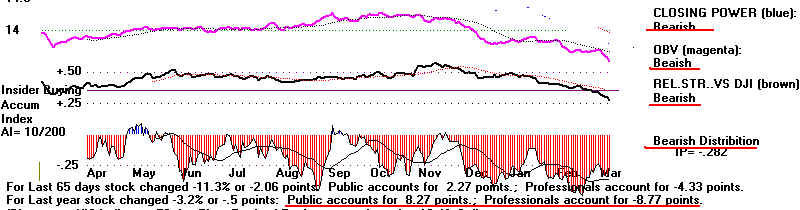

The Closing Powers of NNJ,

MYJ, NVN, BSE, AYN, BKK, PCW, NNP, BBF

and NNY are all making new lows ahead of prices, just

as the Accumulation shows

heavy red institutional selling and the 65-dma and

earlier lows are being broken.

DJI Retreat Seem Likely

Today, a weak openking could not prevent the DJI' from rallying again. But,

a breather and a little profit-taking seems likely. The DJI has reached an

over-bought position. It is 2.7% over the 21-day ma. It has not been able to

close above its 3.5% upper band since October 2011.

See below how the 10-Day NYSE Down Volume has fallen to its support line, just as

has the 10-day Up Volume risen to its resistance line. We'll see tomorrow if they

start converging bearishly.

Because the DJI is up more than 10% over the past 65 days and has a rising

A/D line and no sell signals other than the weak Sell S11 at this time of the

year, the odds are against much of a retreta.

Professional Shorts are still covering. We judge this from the our Tiger Index

of the 47 most heavily shorted stocks as of mid February. See how the Index

has risen today back above its 65-dma.

3/11/2013 ---> To All Key Index

and Lesding Stock Charts

---> 357 +76 MAXCP stocks Bullish MAXCP Stocks (3/11/2013) BULLish plurality

---> 70 +27

MINCP stocks Bearish MINCP Stocks (3/11/2013)

---> 124 New Highs on NASDAQ 6 new lows. BULLish

plurality

--->204 New Highs on NYSE 6 new lows.

BULLish plurality

3/6/2013 -> Special:

Very

High Power-Ranked Dividend Stocks

3/11/2013 Key Values: DJI 14447 +50 la/ma= 1.027 21dmaroc = +.467 P= +342 Pch= +32

IP21 = +.128

(on 1/30/2013 IP21 was .293) V = +8 Opct = .284

====================================================================================

OLDER HOTLINES

====================================================================================

3/8/2013

The Turn-Down in Bond Funds Is Bullish for The Stock Market.

However, Democrats in the White House in years after the Presidential Election

have brought more declines over the next 6 weeks than rallies, by 5 to 3 since 1945.

But longer term, the rally is likely to continue. If we look out 3 months, having

a Democrat in the White House the year after a Presidential Election has achieved

DJI gains in 9 of these 12 cases since 1917.

A re-test of 14200 is a possibility. But momentum like this usually brings still

higher prices. So, until we have a new Peerless Sell

Signal, a Head/Shoulders top

or the SPY CLosing Power goes below its 21-day ma, I would expect the DJI to

work

higher.

Since 2010, many have predicted the bond bubble will burst. That may be what

is now happening. If bonds do drop, some of that money will surely go into

Blue Chip Stocks.

Is the stock market rally telling us that official unemployment will drop to 6.5% in a few

months? Would that bring an end to low interest rates and cause a rush to selling

in low interest bonds. I think so. Bubbles are probably unavoidable.

Cancel the Sell S11

My judgement is that we have to cancel the Sell S11. The Paper Loss, now 2.8%,

is not in keeping with past Sell S11s since 1965. Bullishly the DJI has broken out

into all-time

high territory and above the top of its price channel. The A/D Line and CLosing

Powers

are rising. And seasonality is bullish. Since 1965 the DJI has risen 61.7% of the

time over the next week and 61.7% of the time over the next month.

A Democrat in the White House

When a Democat sits in the White House in

the year after the Election, the odds since

1917 have been 7:4 that the DJI would be lower on May 1st than it was on

March 10th of that year. But the losses are all small since 1945. And

bullishly,

over the next 3 months, the odds of a rally based on all the data below are 75%

and except for 1937, none brought declines of more than 5%.

March 10 May 1

July 10 Pct Change

March 10-July 10

---------------------------------------------------------------------------------------------------

Wilson 1917 91.10

93.40 93.10

+2.2%

FDR 1933 53.80

77.80

104.10

+95.4%

FDR 1937 194.40

174.30

177.40

-8.7%

FDR 1941 123.60

115.30 127.80

+3.4%

----------------------------------------------------------------------------------------

Truman 1945 175.60

173.90 167.10

-4.8%

Truman 1949 175.60

174.10 179.90

+2.4%

JFK 1961 663.60

677.10

693.10 +4.4%

LBJ 1965 892.39

922.31 879.49 -1.4%

Carter 1977 946.73

926.90 907.99

+6.5%

Clinton 1993 3478.34

3427.55 3521.06 +1.2%

Clinton 1997 7079.39 6976.48 7886.76 +11.4%

Obama 2009 6926.49 8212.41

8146.52 +17.6%

Can the DJI keep rising here? A lot delends on the action of its highest priced

components:

IBM 210.38 212 is needed for a new all-time

high and 12-mo high.

CVX 118.57 119 is needed for a new all-time

high and 12-mo high.

MMM 105.71 all-time high

MCD 98.71 101 would be a 12-month high.

UTX 92.07 12 month high.

CAT 90.51 below 65-dma

XOM 88.97 at

65-dma

TRV 81.65 12-month high

BA 81.23 12 month

high

JNJ 78.19 12 month high

The DJIA is weighted by price only. This means that the 10 highest price DJI stocks

cause nearly 60% of the DJI's movement and the top five account for 33,3% of

the DJI movement. As you can see above, five of the highest priced DJI stocks

are running in, i.e. they are at 12 mont highs, but 3 of the top 4 are at or just below

resistance, namely IBM, CVX and MCD. We must watch them closely now.

BONDS ARE ANTICIPATING 6.5% UNEMPLOYMENT

10-year interest rates are creeping up.

They now stand at 2.1%. Let's watch to

see if they breakout above this level.

Our Bearish MINCP Stocks includesome municipal

bond funds now.

If rates short-term rates rise even to 3%, there is apt to be considerable

"adjustment" (aka "drop") in bond prices.

The Fed has said they would keep rates "low" until Unemployment

officially

drops to 6.5%, another 0.6% below the levels now. But "low" compared to

what? Historically, 3% or 3.5% is low.

The economy is now improving steadily if not strongly. So, it's likely that 6.5%

will be reached later this year. I think that this makes many big bond holders

nervous,

because if rates go back up, bonds will surely go down. And they could lose

33%

of their value very quickly if 10-year rates were to go back up to 4%.

It fair to guess that these concerns also help account for why stocks are rising

while bonds are falling. Blue chips are being bought with some of the money coming

out of the bond market. The gains there are just too big to be happy getting only

2.3%. That's why Professionals are selling some of the biggest bond funds.

We actually should probably consider shorting some of them. Their chart patterns

look very bearish: key price support being ruptured, Closing Power making new

lows ahead of price and lots of heavy red Distribution recently.

3/8/2013 ---> To All Key Index

and Lesding Stock Charts

---> 281 +37 MAXCP stocks Bullish MAXCP Stocks (3/8/2013) BULLish plurality

---> 43 +7

MINCP stocks Bearish MINCP Stocks (3/8/2013)

---> 153 New Highs on NASDAQ 6 new lows. BULLish

plurality

--->229 New Highs on NYSE 7 new lows.

BULLish plurality

3/6/2013 -> Special:

Very

High Power-Ranked Dividend Stocks

3/8/2013 Key Values: DJI 14397 +68 la/ma= 1.025 21dmaroc = +.348 P= +2095 Pch= +24

IP21 = +.111

(on 1/30/2013 IP21 was .293) V = -6 Opct = .215