www.tigersoftware.com

Views the mainstream media eschew.

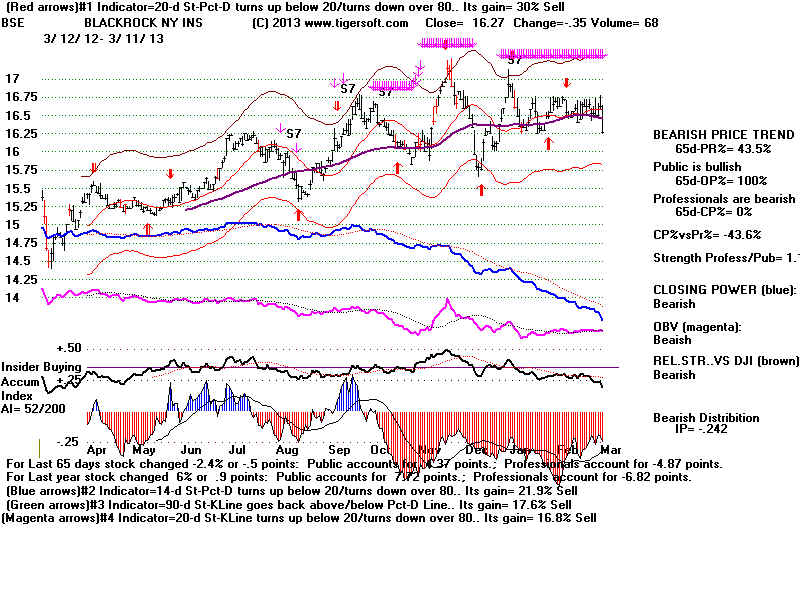

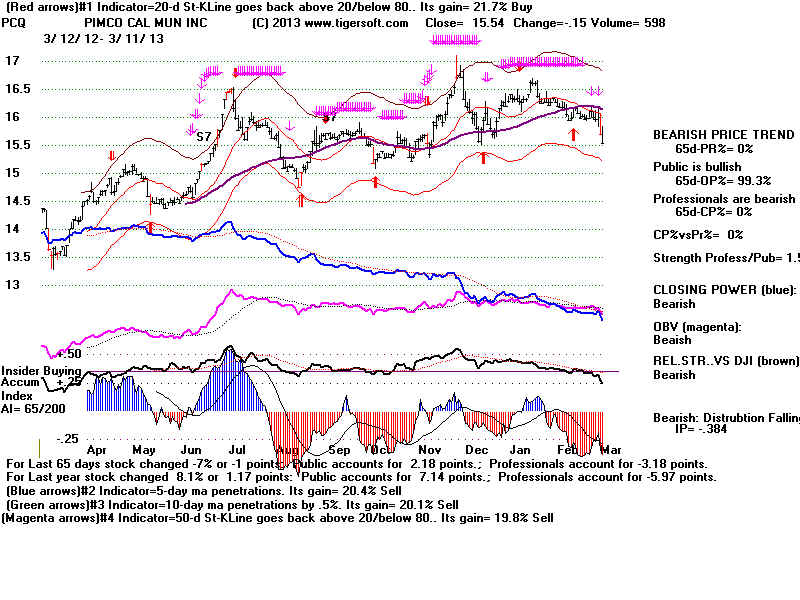

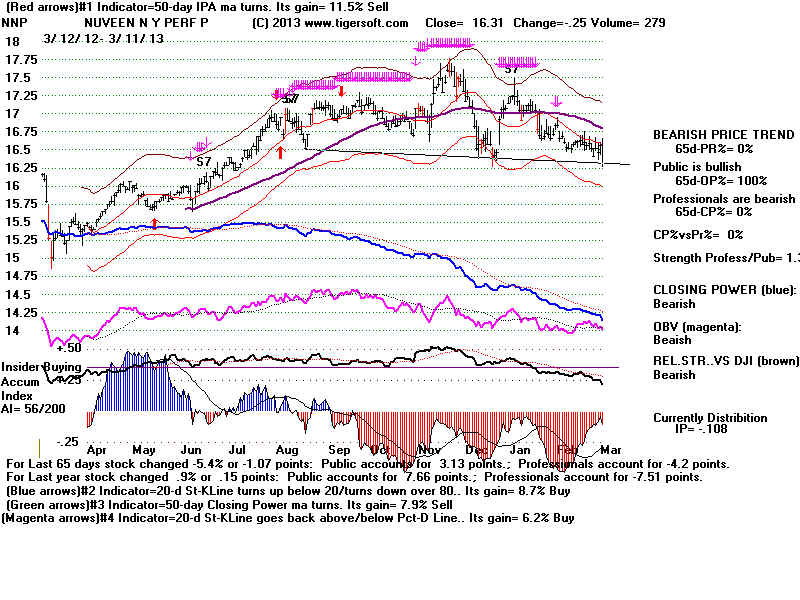

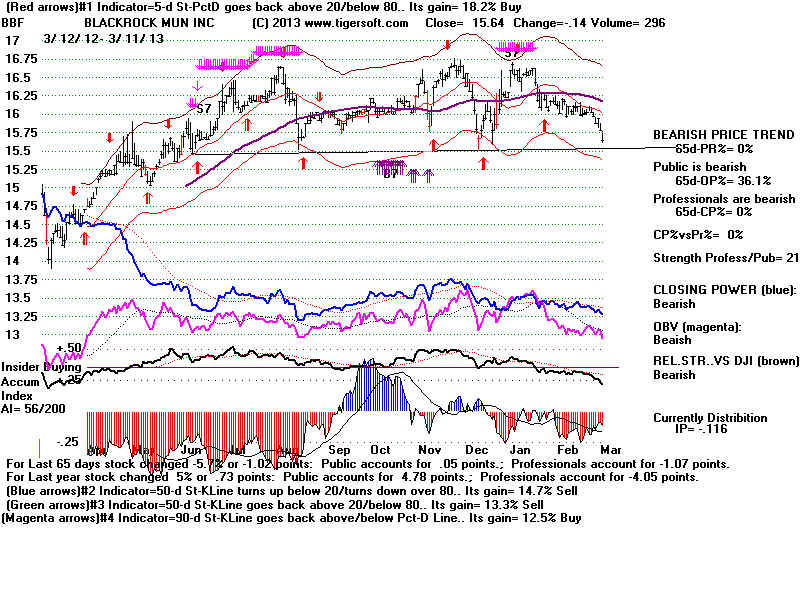

SELL SHORT BOND FUNDS

3-11-2013

www.tigersoft.com

(C) 2013 Wm. Schmidt, Ph.D.

The Stock Market's rally is telling us that the offical unemployment level is likely to drop

below 6.5% sooner than the Fed thinks. At least, that is my take on the DJI's spirited

rally. When that happens, demand for loans and mortgages will surely rise sharply. And

the Fed will no longer need to, or be able to, keep interest rates very low. Bonds

will surely fall as interest rates start rising back again. Keep in mind that long-term

interest rates sold with more than a 14% yield in 1980. When the world economic

slow-down ends, expect other currencies to strengthen. This will inevitably mean

the withdrawl of hot overseas money from US bonds as their haven.

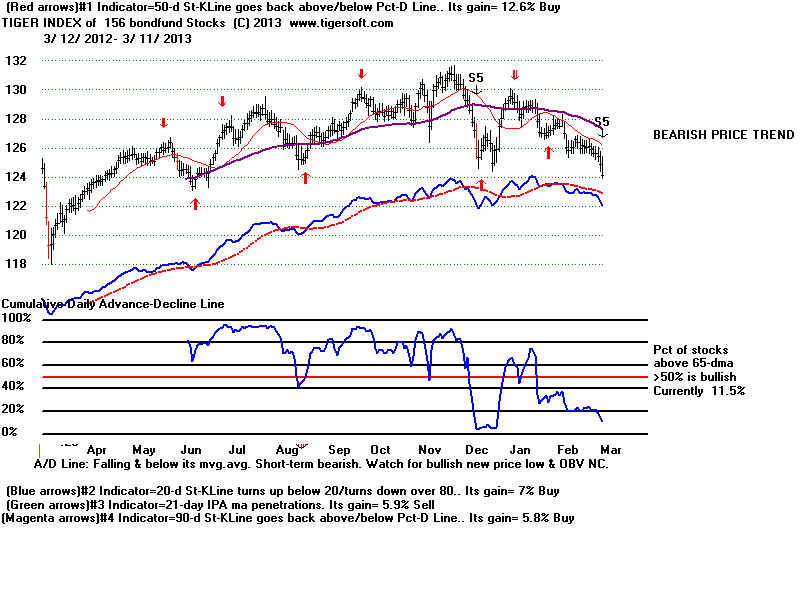

Tiger Index of 156 Bond Funds