www.tigersoft.com 858-273-5900 PO Box 9491, San Diego, CA 92160

ORDER Peerless and TigerSoft Special - $495 Nightly On-Line Hotline $350/yr Subscribe

Safe and Profitable Peerless Investing in Foreign ETFs since 1986:

France (en France) Germany (Auf Deutch) Italy (Parliamo l'italiano) Russia (po Russki)

Spain / Latin America/Mexico en Espanol) Brazil (em PortuguÍs) Singapore

TigerSoft's PEERLESS SIGNALS and

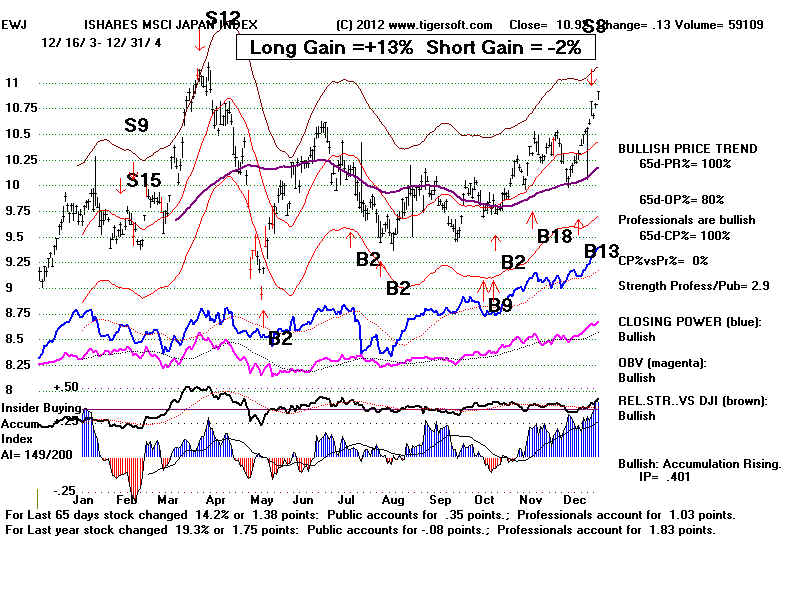

TigerSoft's PEERLESS SIGNALS andJAPANESE MARKETS as measured by EWJ - NYSE ETF for Japan

The World-Wide Markets are now closely linked. When a Peerless Buy

signal predicts a DJI rally, the Japanese markets also typically rise, though

often by a lesser amount than many of the other country funds.

Similarly, when Peerless gives a reversing Sell signal, the DJI and the rest of the

world markets are in for a decline, including the Japanese markets and EWJ.

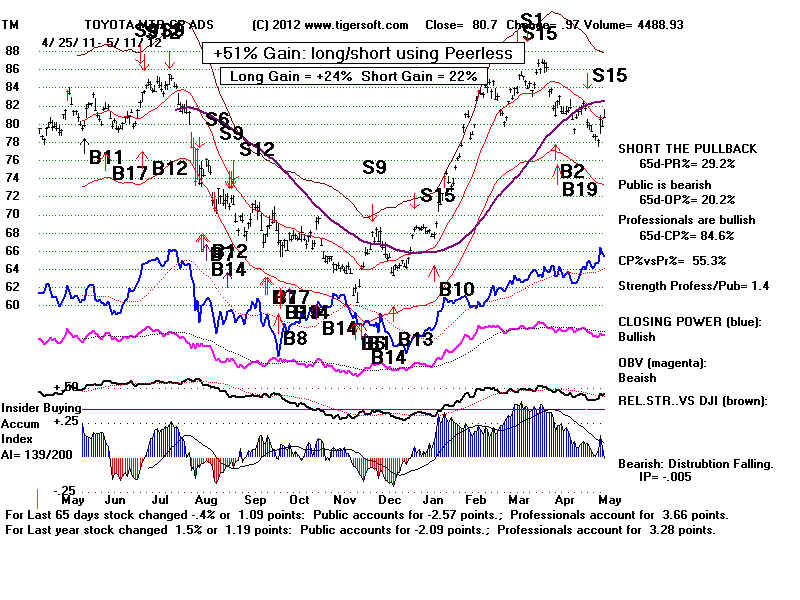

EWJ, we show here, is a better investment vehicle for our Peerless system than

most individual Japanese stocks, like Toyota.

Peerless Trading Results Using EWJ: 2003-2012

Peerless Trading Results Using EWJ: 2003-2012Since 2007, EWJ was more profitably traded long and short with the

Peerless reversing Buys and Sells than Toyota (TM), for example,

a single leading Japanese company.

Long and Short Long Short

TM EWJt EWJ EWJ

Toyota Japan Japan Japan

-----------------------------------------------------------------------------------------

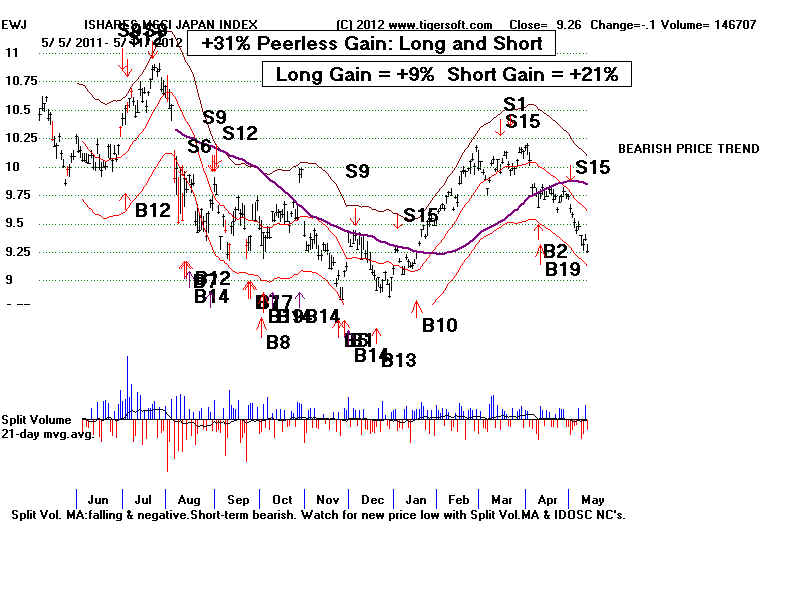

2011-2012 +52% +31% + 9% +21%

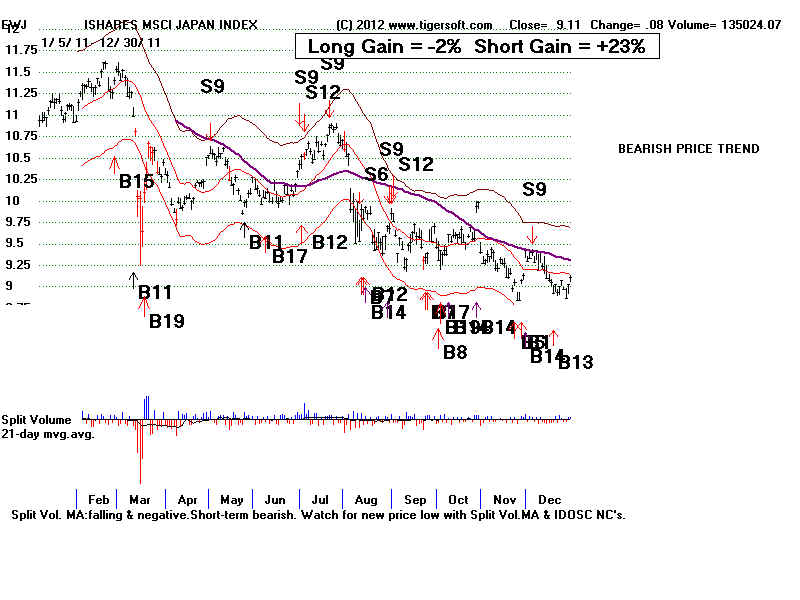

2011 +2% +21% -2% +23%

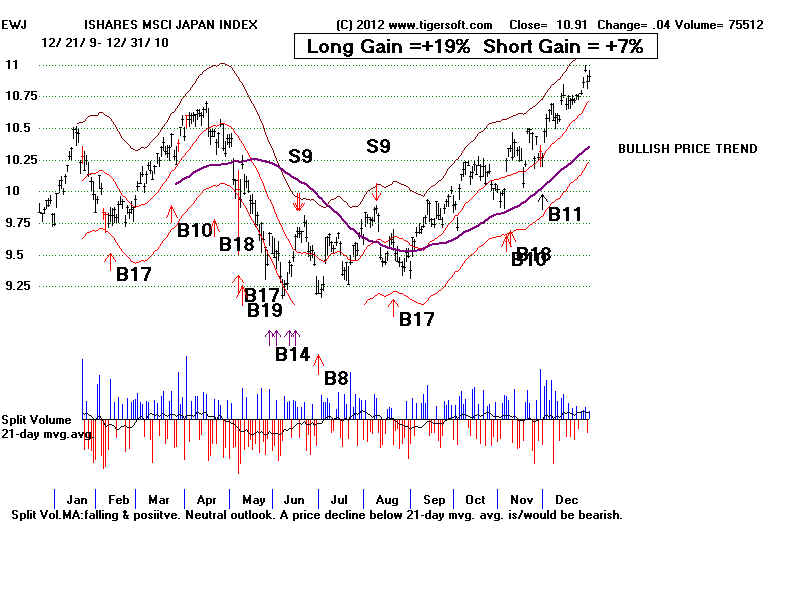

2010 +22% +28% +19% +7%

2009 +14% +41% +31% +15%

2008 +72% +78% +21% +47%

2007 +23% +38% +14% +21%

----------------------------------------------------------------------------------------

2006 +109% +73% +40% +27%

2005 +54% +42% +33% +7%

2004 +8% +11% +13% -2%

2003 NA +38% +36% +2%

For those not familiar with EWJ, please see Yahoo's description. Currently

the biggest 10 holdings of EWJ are:

| Top 10 Holdings of EWJ (22.4% of Total Assets) |

|---|

|

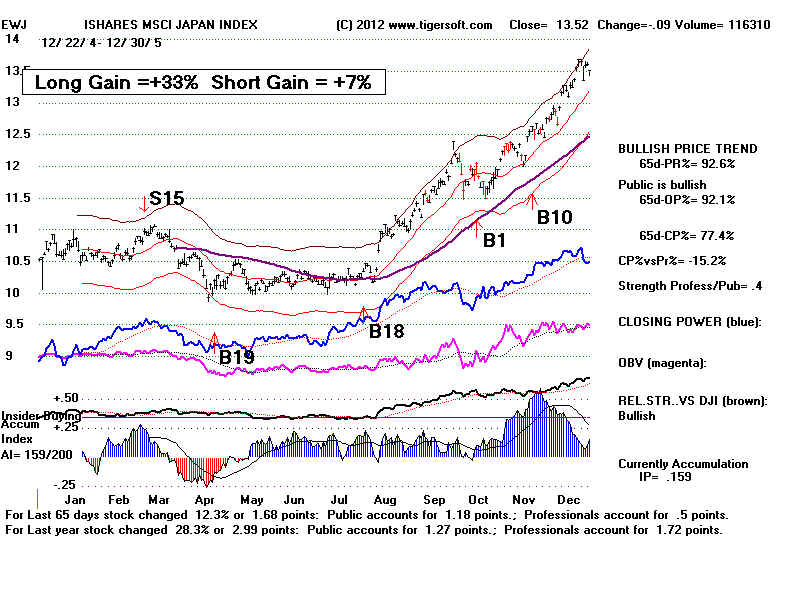

Toyota traded with Peerless Buys and Sells The charts below show Peerless

Buys and Sells from the DJI

The charts below show Peerless

Buys and Sells from the DJI

super-imposed on

the EWJ (Japan) since 2003.

We use EWJ out of conveniuence to represent the Japanese markets.