Welcome from Tiger Software

to

our Singapore visitors and friends.

Peerless Buy and Sells Make Trading Singapore

Stocks Very Profitable

Buy or Sell? Success or Failure? Peerless is

the Difference.

Apply our Peerless Buy and Sells to your Stocks to avoid

Crashes

and be fully invested for the bull markets. You will

be smiling!

See

how well our Peerless Stock Market Timing trades stocks in Singapore.

Record of Peerless Trading of EWS - NYSE ETF for

Singapord: 1998-2012

Total Long Short

Gain Gain Gain

======================================

1998 +108% +72% +21%

1999 +40% +34% +5%

2000 +17% -3% +21%

2001 +53% +24% +24%

2002 + 0% +11% +13%

2003 +30% +32% -1%

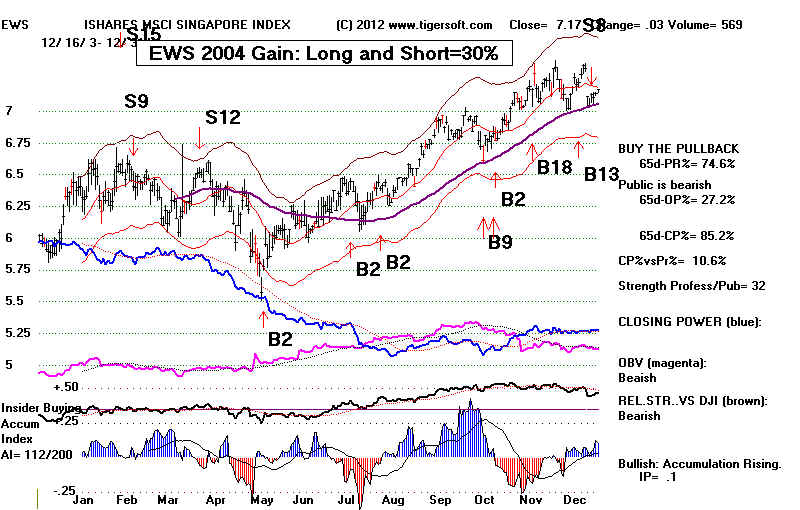

2004 +30% +20% +9%

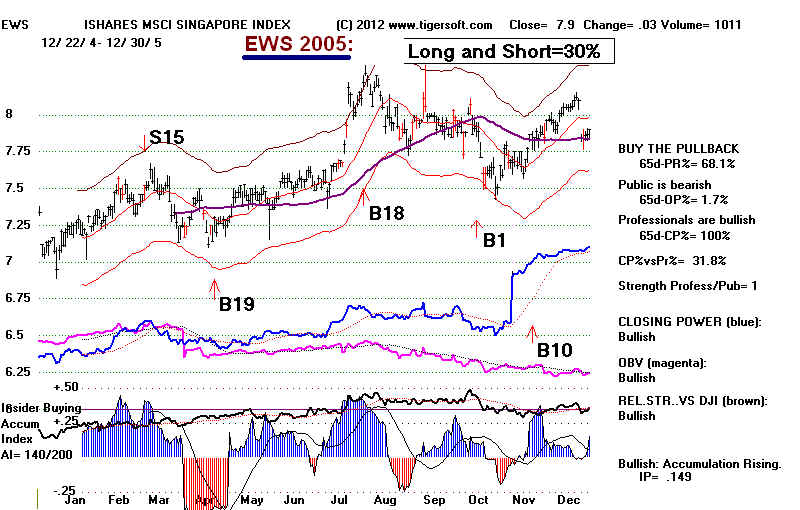

2005 +11% +8% +3%

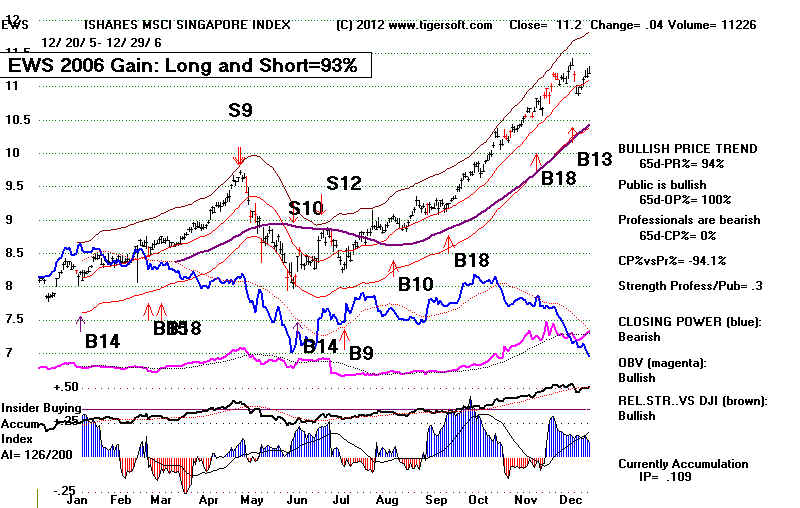

2006 +93% +58% +20%

2006 +147% +58% +20%

2007 +91% +54% +23%

2008 +85% +8% +71%

2009 +103% +93% +5%

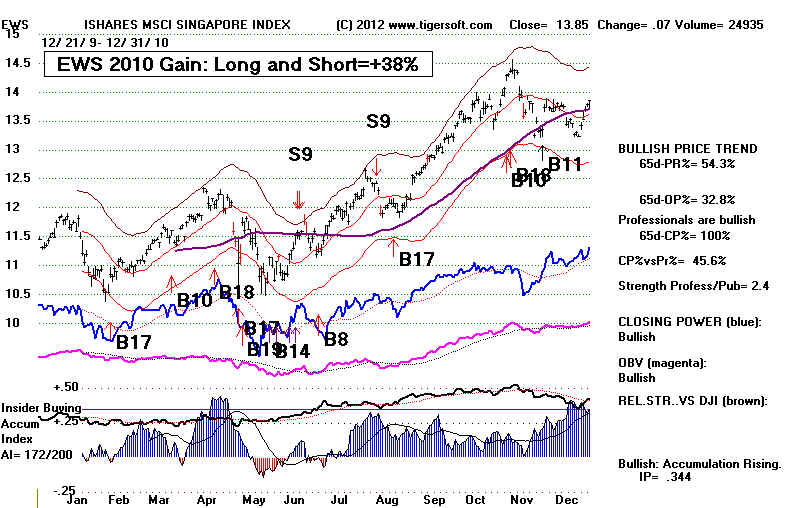

2010 +38% +33% +4%

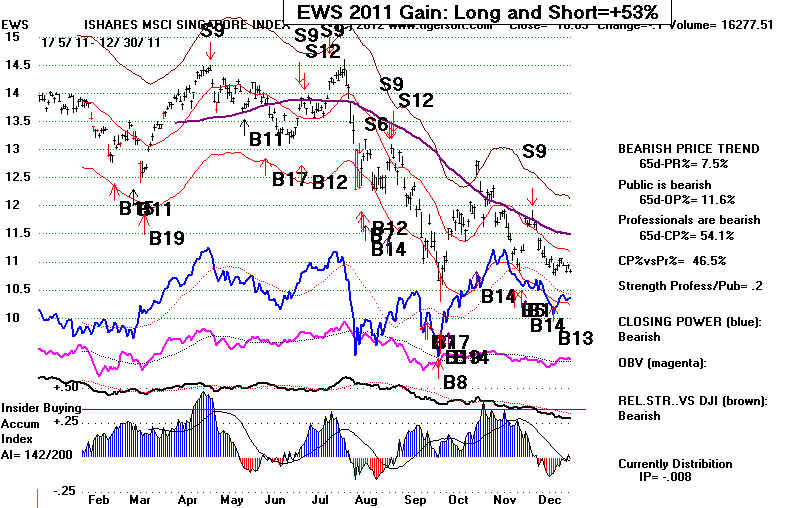

2011 +53% +14% +34%

2012 +55% +21% +28% ends 5/10/2012...

EWS is the NYSE ETF for Singapore. It only invests in

Singapore stocks. Below are its 10 biggest holdings now.

http://finance.yahoo.com/q?s=ews&ql=1

| Top 10 EWS Holdings (65.29% of Total Assets) |

|

| Company |

Symbol |

% Assets |

| SingTel |

Z74.SI |

10.74 |

| DBS |

D05.SI |

10.48 |

| UOB |

U11.SI |

10.30 |

| Oversea-Chinese Banking Corp Ltd |

OVCHF.SI |

9.53 |

| Keppel Corp Ltd |

KPELF.SI |

6.92 |

| Genting SP |

G13.SI |

4.55 |

| Wilmar |

F34.SI |

3.96 |

| Capitaland |

C31.SI |

3.13 |

| Jardine C&C |

C07.SI |

2.95 |

| SPH |

T39.SI |

|

|

EWS: 2011-2012

An

Introduction to Peerless Stock Market Timing

for Investors Who Want to Trade Stocks More Profitably.

www.tigersoft.com

Simply speaking, We can help you make more money.

In life, good timing is everything. It is the same in the stock market.

-------------------------------------------------------------------------------------------------------

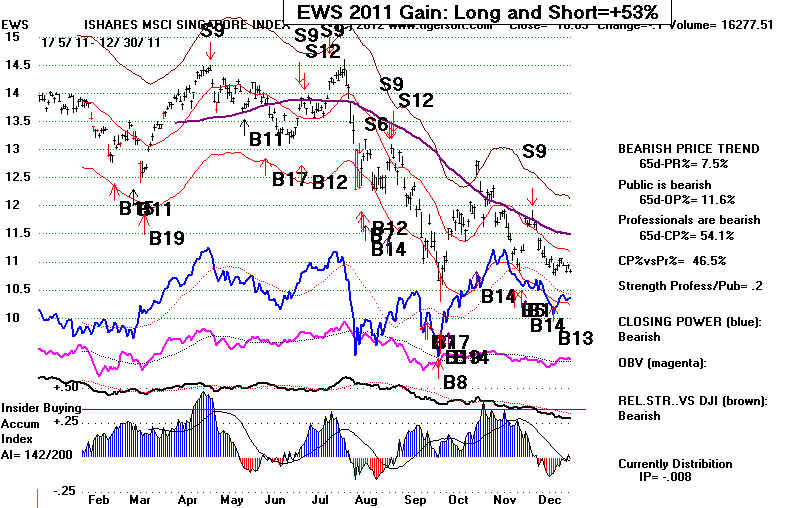

EWS: 2011

I invented our "Peerless Stock

Market Timing" in order to understand when

I invented our "Peerless Stock

Market Timing" in order to understand when

it is best to buy and sell stocks in the stock market in the US.

----------------------------------------------------------------------------------------------------------------------

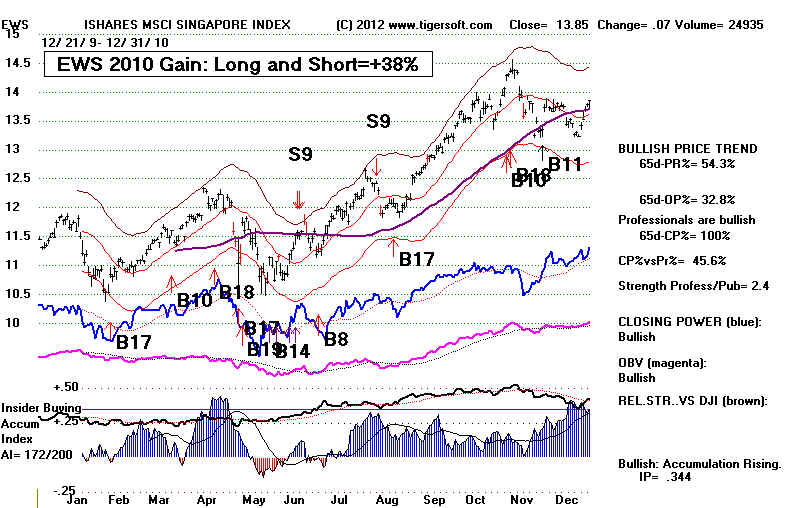

EWS: 2010

Accordingly, back in 1981, I wrote a

collection of rules about when best to buy and when best to sell.

Accordingly, back in 1981, I wrote a

collection of rules about when best to buy and when best to sell.

----------------------------------------------------------------------------------------------------------------------

EWS: 2009

All the rules worked successfully many times in the previous decade.

----------------------------------------------------------------------------------------------------------------------

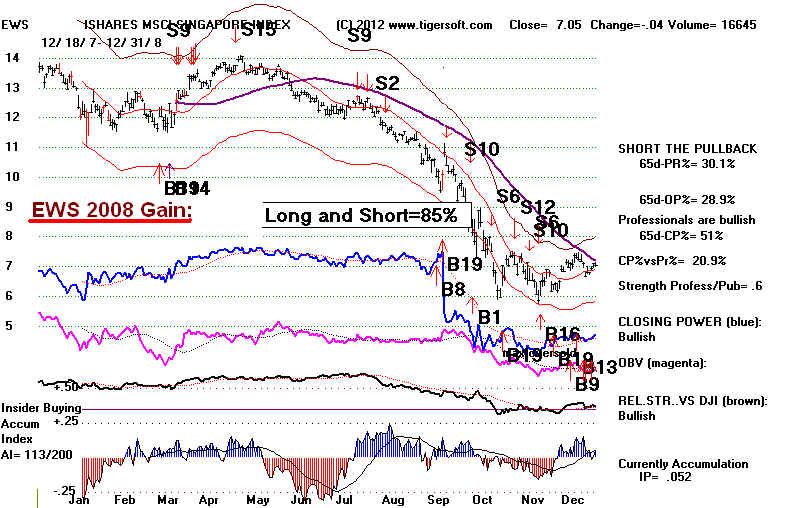

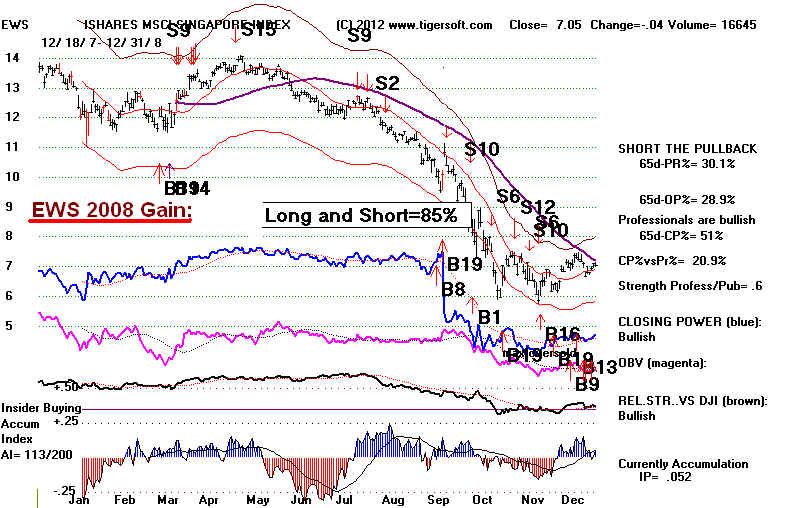

EWS: 2008

Frequent past success was a requirement for their inclusion as rules.

The vast majority of the rules were developed by me in 1981.

----------------------------------------------------------------------------------------------------------------------

EWS: 2007

Since then I have seen these rules bring very real trading profits to many clients.

They have each been successful at least 80% of the time.

----------------------------------------------------------------------------------------------------------------------

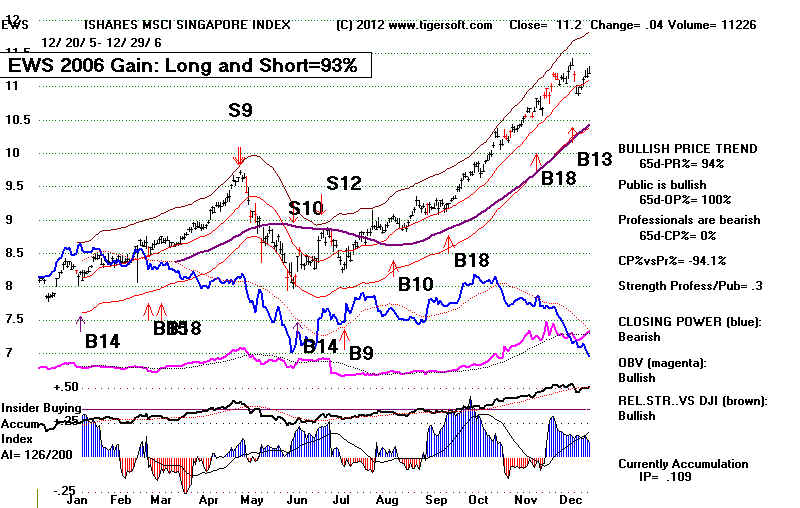

EWS: 2006

A few more rules were added in 1983 and

1993 to reflect sudden huge market advances and insider distribution of stocks just before a

big decline.

----------------------------------------------------------------------------------------------------------------------

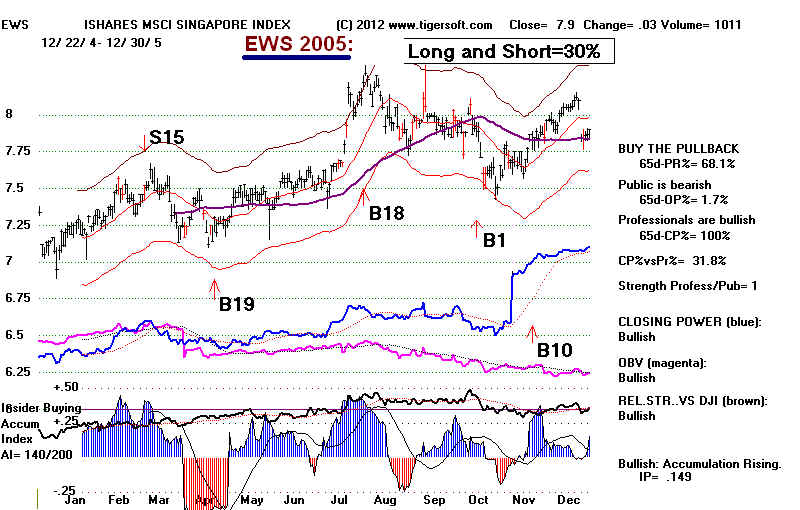

EWS: 2005

All these original Peerless rules were founded on American stock

market

history from 1965 to 1993.

----------------------------------------------------------------------------------------------------------------------

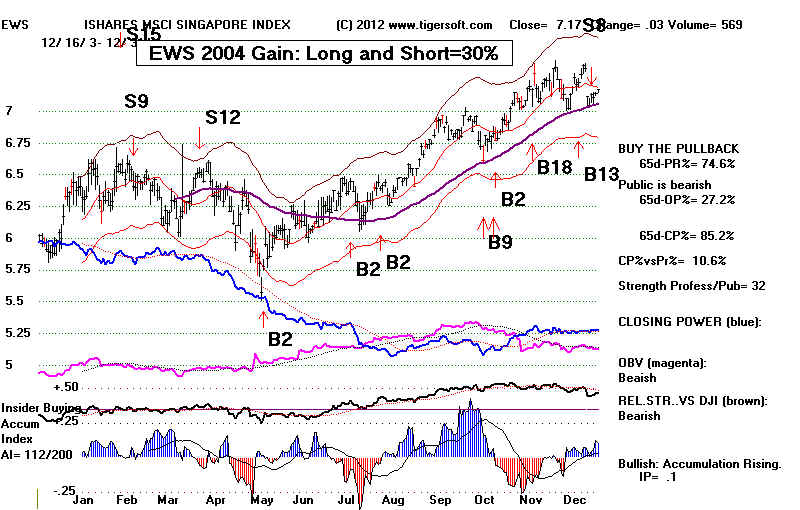

EWS: 2004

Then in 2007, I obtained the

historical data for stock market trading from 1915 to 1965. This

allowed me to see clearly for the first time the powerful role played

by the 4-year Presidential cycle in the stock market.

----------------------------------------------------------------------------------------------------------------------

EWS: 2003

As a result, I improved some of the rules about when to buy and sell stocks.

I took into account the 4-year Presidential cycle and the lessons of the earlier period

before 1966.

----------------------------------------------------------------------------------------------------------------------

EWS: 2002

For example, it turns out that a very good time to buy is in the beginning of the 3rd year

of the 4-year Presidential cycle.

----------------------------------------------------------------------------------------------------------------------

EWS: 2001

This was true in 1911, 1915, 1923, 1927, 1935, 1941, 1951, 1955, 1959, 1963, 1967,

1971, 1975, 1979, 1983, 1987, 1991, 1995, 1999, 2003, 2007 and 2011. That is 22 cases in

the last 100 years.

----------------------------------------------------------------------------------------------------------------------

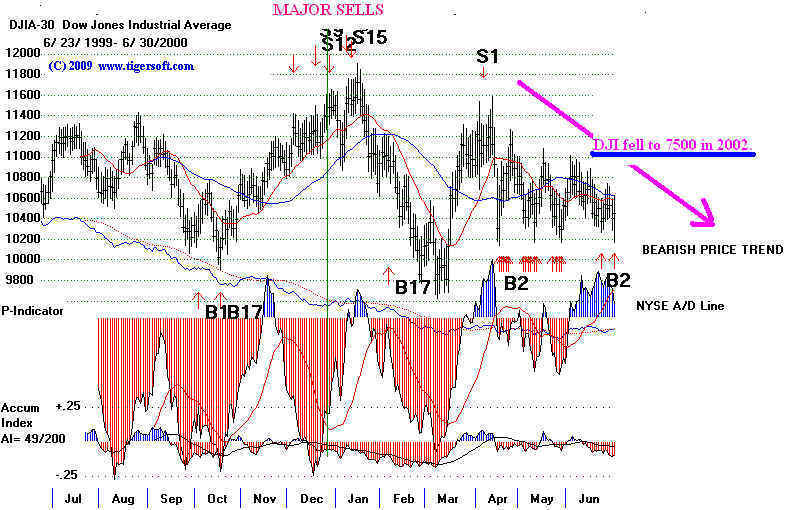

EWS: 2000

It was not true in 1919, 1931, 1939, 1947. 4 cases.

In other words, buying at the beginning of the 3rd year in the

4-year cycle

would have been profitable 84.6% of the time.

----------------------------------------------------------------------------------------------------------------------

EWS: 1999

Of course, conditions and circumstances may change in the

futures.

But you have to admit, this strong tendency has lasted 100 years.

----------------------------------------------------------------------------------------------------------------------

EWS: 1998

I have translated all these rules into a computer

program.

ou can buy this and use it for profitably buying stocks

in Singapore

and almost anywhere else in the entire world.

----------------------------------------------------------------------------------------------------------------------

A

crash like that of 1987 would be felt everywhere in the world.

These rules work not only

in the US, but also in France, China, Australia, Russia and Singapore, etc. because all

the stock markets in the world are closely connected and tightly linked.

----------------------------------------------------------------------------------------------------------------------

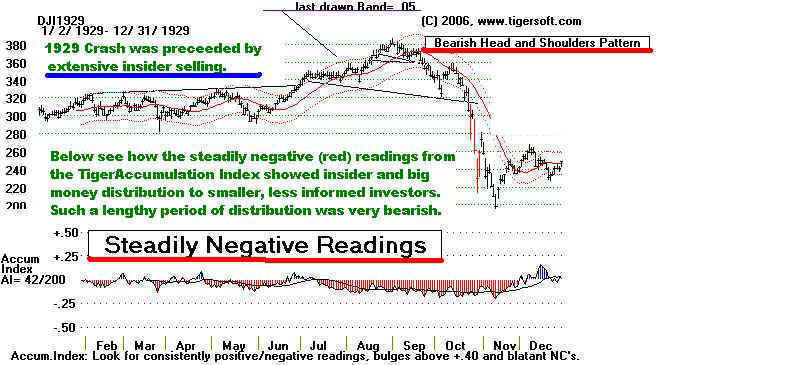

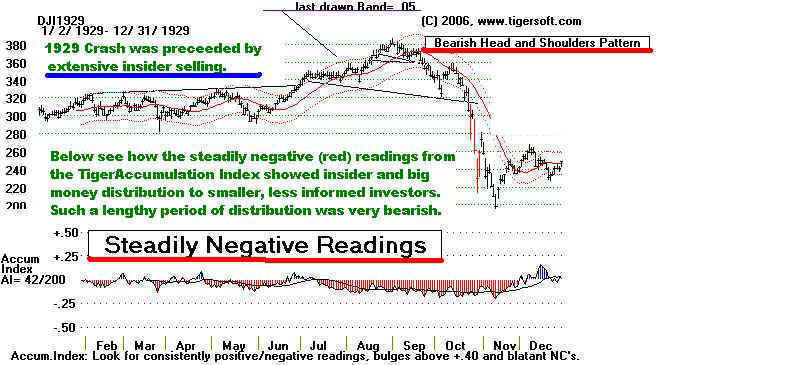

"SELL S9, SELL S12"

The 1929 Crash: Could It Happen Again? Yes - Absolutely.

This may be considered

evidence that all the world's stock markets are

largely controlled from within the biggest New York banks.

----------------------------------------------------------------------------------------------------------------------

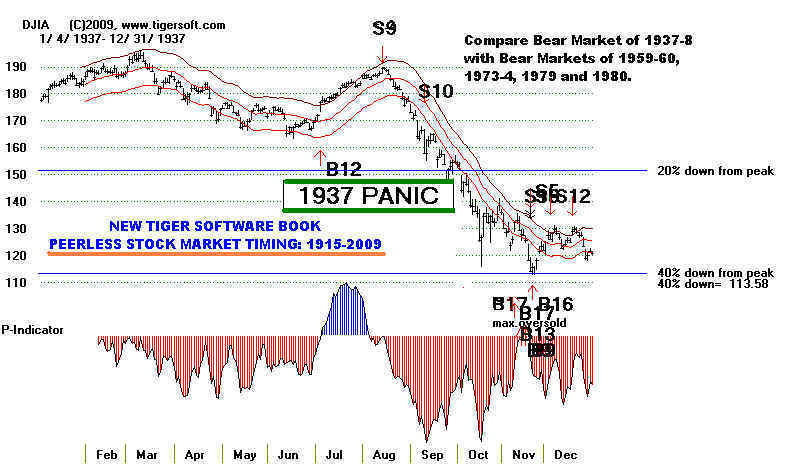

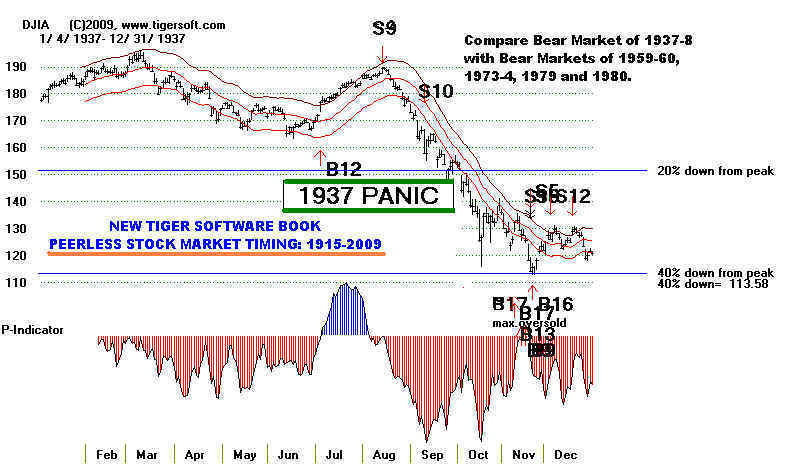

The 1937 Panic:

"SELL S9"

But I leave the question now to others of why there is this so much linkage between the

stock markets of the world.

----------------------------------------------------------------------------------------------------------------------

1957 Bear Market:

"SELL S9"

There is ample evidence that shows the close linkage of 40% of the

world's biggest companies to the biggest banks, Barclays, JP Morgan and Goldman Sachs,

etc.

----------------------------------------------------------------------------------------------------------------------

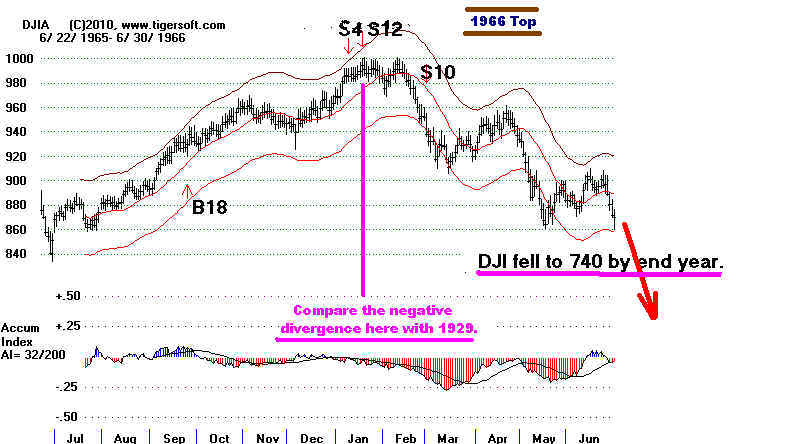

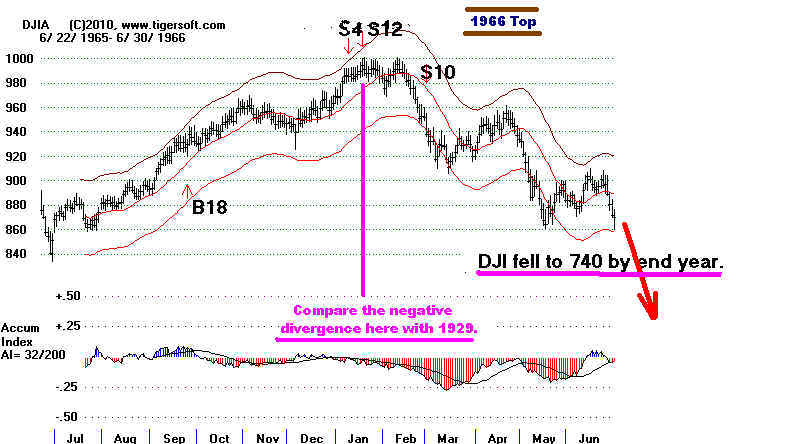

1966

Bear Market:

"

SELL S12"

Precisely because these banks are so powerful, Peerless will most probably continue to be

successful for a long time or until the people regain control

of their own economies.

http://www.newscientist.com/article/mg21228354.500-revealed--the-capitalist-network-that-runs-the-world.html

----------------------------------------------------------------------------------------------------------------------

Peerless has been designed to get you out of the market BEFORE

a Bear Market drops the values of your stocks. It has done called

all the major world wide stock market tops.

------------------------------------------------------------------------------------------------------

1973 Top to 1973-1974 Bear Market:

"SELL S9 SELL S12"

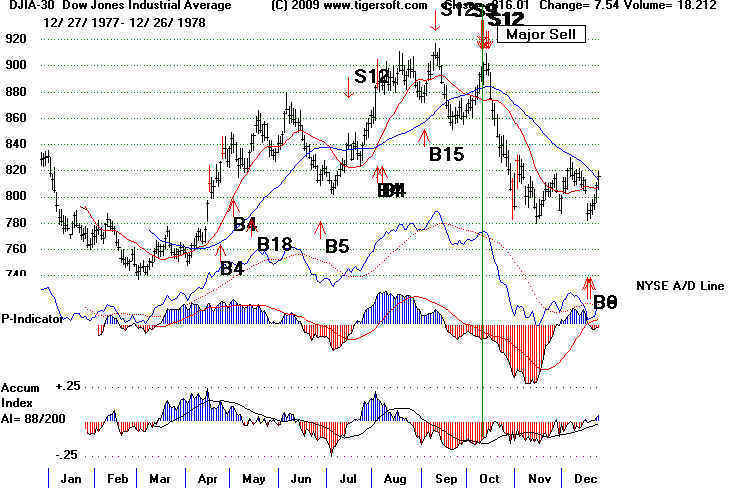

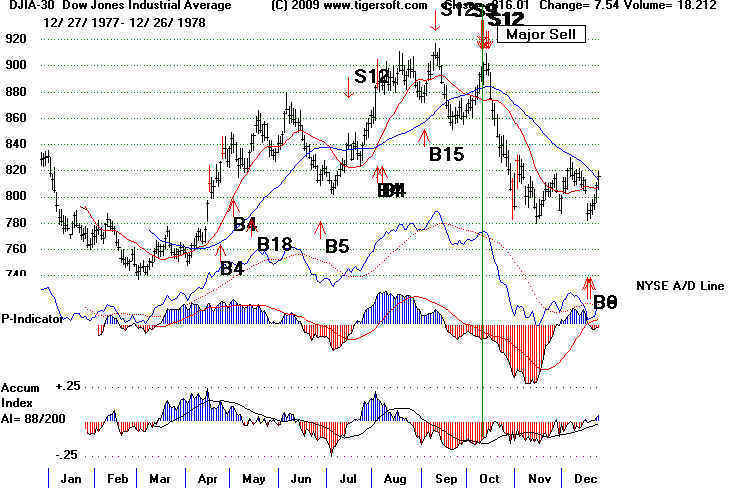

1978 Mini Crash:

"SELL S9 SELL S12"

1990 Bear Market

"SELL S9"

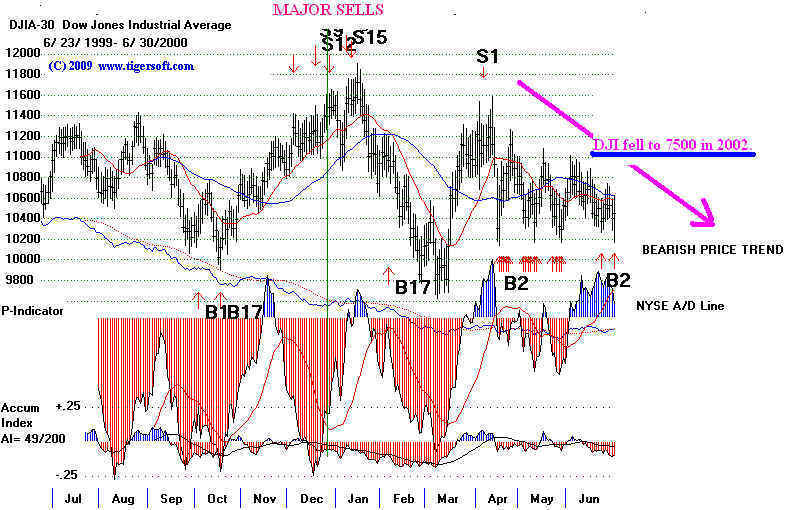

2000-2003 Bear Market

"SELL S9 SELL S12"

I invented our "Peerless Stock

Market Timing" in order to understand when

I invented our "Peerless Stock

Market Timing" in order to understand when  Accordingly, back in 1981, I wrote a

collection of rules about when best to buy and when best to sell.

Accordingly, back in 1981, I wrote a

collection of rules about when best to buy and when best to sell.