TigerSoft and Peerless Daily

Hotline

(C) 1985-2015 William Schmidt,

Ph.D. www.tigersoft.com

All rights

strictly reserved.

===>

New TigerSoft Weekly Charts are Coming on all stocks.

We want them to be viewable using the same categories we use with the Daily

data.

Tiger Software

858-273-5900 PO Box 22784 San Diego, CA 92192 Email

william_schmidt@hotmail.com

------------------------------------------------------------------------------------------------------------------

9/28/2015

125+ TigerSoft Charts -

Go to

www.tigersoftware.com/HH/index.html

9/28/2015

New Highs: NASD 8

NYSE 273

New Lows: NASD

0 NYSE 409

9/28/2015

Bullish MAXCP Stocks over

$5

27 -11 ---->

www.tigersoft.com/MAXMIN/9-28-2015/MAXCP.html

Bearish MINCP Stocks

over $5

627 +402 -->

http://www.tigersoft.com/MAXMIN/9-28-2015/Bearish.html

Professionals used today's rally to short more

stocks.

------------------------------------------------------------------------------------------------------------------

9/28/2015

The DJI declined 1.52% (313) today and has fallen back to the 16000

support shown on the Hourly chart. This also represents a test of the

lower

2.3% band below the 21-day ma. It is still 335 points above it lowest

closing level in the August sell-off. Many times the DJI must make a

nominal

closing low before reversing. The 2010 and 2011 corrections only

ended when the

DJI closed marginally below its previous lowest closing. The NASDAQ is

still

17.6 points above its lowest closing level in the current correction and the

SP-500

is 14 points above its low. Bullish divergences at this point usually produce a

successful reversing Peerless Buy signal. So, by this approach we still need more

weakness.

DJI Hourly Chart

DJI Daily Chart

We have no Buy signal yet from the current Peerless program. However,

the 2006-Peerless (which was not back-tested for the periods 1928-1965

or 2006-2015 did give a minor Buy B8 based on the improvement

of the P-Indicator. This Buy signal assumes that we judge the market now

to

still be in a trading range. The breakdown below 17000 negated that, I believe.

The DJI and the US markets need to prove themselves. We should not

assume that we have not started a bear market, considering that we are

at the end of Fed subsidies of big bank investments in the stock market,

that there are world-wide Deflations in stocks, commodities and consumer demand

and that the same leveraged vehicles that produced this artificial bull market

may soon be used in reverse if 15600 on the DJI does not hold.

Perhaps, this view will prove to be too bearish. One might consider

the current market a "correction" until the DJI drops and closes down more

than, say, 15% or 20% below its highest closing. For myself, I

would rather just wait to see a new Peerless Buy from the current Peerless.

It has been carefully back-tested over the whole period, 1928-2015.

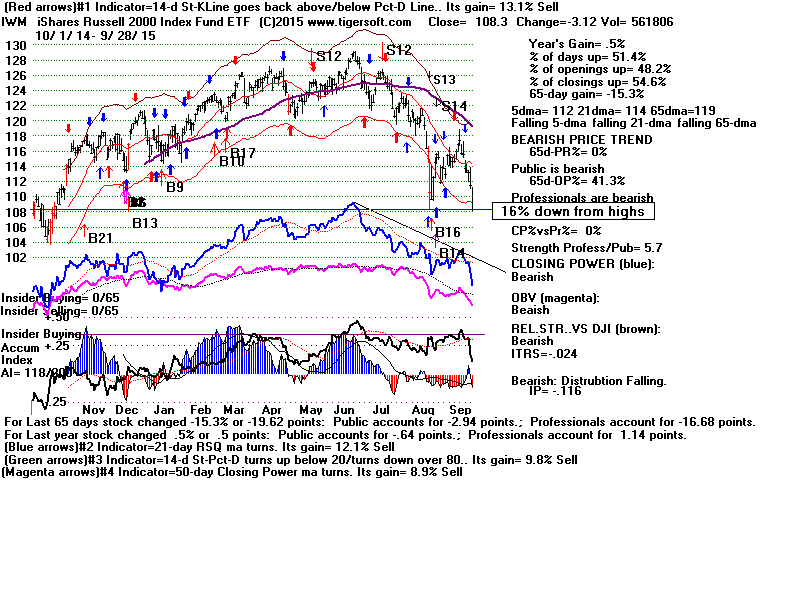

The Russell-2000 did make a new low today. Its ETF (IWM) was down

twice as much as the DJI. IWM fell for the 7th straight day. Volume

was

very high. It is now down 16% from its high. Both its Opening and

Closing Power are falling.

Should we cover our short sales in IWM and some of the numerous MINCP

stocks that have been hit hard? In 2008, I did a lengthy study of bear

market shorts. The conclusion I reached then was that we are best served

by using a break in the steep Closing Power downtrend to time the

covering of Bearish MINCP short sales. This argues against covering now.

There is another reason not to cover just yet. I noticed today that the

most

apparent reason for today's sell-off was that NY Fed Governor said rates

would almost certainly go up later this year.

See

http://www.msn.com/en-us/money/markets/the-fed-speaks-and-investors-scratch-their-heads/ar-AAeSD9M

But this is hardly news. This is what Chairwoman Yellen said on

Sept 18th

at the FOMC meeting. In fact, today, Chicago Fed Governor Evans said he

felt

the FED should wait until next year. So, there was no obvious reason for

all the selling. But, it was very widespread today. While we

could consider

covering some of our short-sales as a "public service". We we are usually

better off waiting for the bad news to come out to cover. If we cover now,

we may just be forced to go short at lower prices.

It's true that today's trading bore many of the outward characteristics of a

selling climax. It occurred on a Monday. There were 8x more stocks

down

than up on the NYSE. No stock on the NYSE made a new high.

But if we look back to 1929, we see there are many more cases when big market

declines began with such poor breadth numbers than they occurred at the

bottom or even before a big rally. Using a ratio of more than 7 decliners

to advancers would actually have brought good Sell signals in 63% of the

cases when they occurred when the DJI was down more than 11%

and the DJI was either in a correction or starting a bear markets.

How Well Did A

Daily Ratio of More than

7 NYSE Decliners to Advancers Work as

A Sell Signal When DJI Declined More Than 10% from Highs?

Good

Bad (It was at or near the bottom.)

Oct-Dec 1929 3

1

Aug-Dec 1937 8

1

May 1940

1

1

Aug-Dec 1941 7

1946

4

1

1948-1949 3

1

June 1950

2

1957

3

1

1962

5

2

1965

1

1966

1

1

1968

1

1969

1

1973

1

1978

3

1

1979

1

1

1980

3

1

1981

1

1

1987

1

1

1990

1

1997

1

2007-2008 1

1

2010

4

2011

2

2

2015

1

================================

49 successes (63.5%) 28 failures (36.5%)

Most Stocks Are probably Already in Bear Markets

Only 13% of the 6000 stocks we get data for each night are now above their 65-dma.

There is lots of resistance overhead and Down Volume remains much greater than

Up

Volume. In these circumstances, especially at this time of year, it's unlikely

that

|

the 65-dma will even be reached. The 21-day ma of unadjusted NYSE Up

Volume minus

Down Volume made another new low today.

As long as it is falling, we should not expect the DJI to escape the need

for a full re-testing of its recent lows. The falling A/D Line sends the same

message.

========================= Previously Here

==========================================

What would we buy? The number of new lows is too low to

encourage us to

expect anything more than modest moves by the Bullish MAXCs. True, we see

a handful of Finance stocks among the Bullish MAXCPs. This is not

much leadership.

It is defensive, based on dividends and selective rather than representative of

an

industry-wide move. .

If this correction was over, the "natural leaders" upwards would be biotechs,

semiconductors and big banks. But these groups are still falling.

Down volume

is still very heavy among them and their Closing Powers are falling.

Too many stocks are starting to look more and more like the weak oil/gas sector

and the very troubled foreign ETFs. We see this when we plot the Tiger

Index of

each of the Groups of stocks we track or simply watch the percentage of each

Group's stocks that are above their 65-dma. These numbers now show how few

Groups or sectors are holding up and how defensive the market has

become.

There is no hurry to buy something now. Bond Funds, Beverages and

Utilities offer only small gains. Perhaps, after a successful

mid-October

test of the lows, this picture will change.

There is something else to watch. Profound weakness in the Big Banks was

the primary

warning of trouble ahead in 2007. I think we should now be asking why are

big banks

acting much weaker than the general market now.

Pct of Stocks in a

Group above their 65-dma.

60%-70% Bond Funds

50%-60% Beverages

40%-50% Airlines, Utility.

30%-40% Education, Gold, Insurance, REITS, Retails

20%-30% Computers, Green. Hackers, Home Building,

Military, NASD-100, Russell-1000,

Semi-Conductors, Software, SP-500, Transportation.

.

10%-20% Autos, Biotechs, China, DJI-30, Electronics,

Finance, Ind. Materials, Regional Banks,

0%-10% Big Banks, Chemistry, Coal, Foreign ETFs,

Gaming, Oil Gas, Pipe Lines, Solar,

The DJI is doing its job well. This Blue Chip average very often at the

end of a bull market has the special duty of maintaining the appearance

that all is well with the US stock market and that all dips are therefore

buying opportunities. This is why the DJI often tops out after the

NYSE A/D Line does, why the number of new lows on the NYSE

and NASDAQ can be greater than the number of new highs even

as the DJI rises, and how institutions are able to get out of big positions

in stocks even as they top out. Thus Friday, though the DJI rose 113 for

the day, saw 129 more down than up on the NYSE,

Down Volume

was 53 million more than Up Volume and there

were 8 times more new lows

than new highs.

One of the most common ways the DJI strengthens the illusion that all

is well, is by having one of its higher priced components jump up

inordinately. That was true on Friday when NIKE rose +10.21. This

one

stock single-handedly lifted the DJIA by 68.2 points.

When Is The Correction Typically Over?

When we look back at the Peerless indicators in the past we can see

how to judge a correction is over. The best way is normally to simply wait

for a new Peerless Buy. No Peerless Buy signal seems likely now

until the DJI retests its lows near 15600-15700. In addition, we should

look

for reversal price patterns, such as a breakout above a precisely formed

flat top (example June 1940), a compact inverted head/shoulders (August 1950

and July 1965) or a falling wedge (Nov. 1971). The NYSE A/D Line will

often break a well-defined and well-tested downtrend-line.

But most commonly, and this was a surprise to me when I did the investigating

today,

we see the correction ending only when the 21-day ma of Unadjusted

Up Volume minus Down Volume turns up. If you are using Peerless, see some

examples of this: March 1968, October 1975, December 1978, November 1979,

October 1997, March 2000, April 2001, September 2007, July 2010 and October

2011.

Conclusion: since the the 21-day ma of Unadjusted Up

Volume minus Down Volume is making

new lows now, the correction is probably not over.

Troublesome Volume Signs in DJI Now.

Stay Short IWM

IWM would need to rise by 4.1 point tomorrow to turn up its

5-day ma. Its red down-day volume has dominated trading.

It needs to more closely test its lows.

======================================================================================

Earlier Studies:

======================================================================================

Bearish Seasonality Study from Tuesday Night....

It\s hard to be bullish now when we take into account Seasonality.

Since 1965, the DJI has fallen 55% of the time this week. And since 1999,

the bearishness usually lasts for the next three weeks. In this

period,

we see a regular pattern of DJI declines from Aug-Sept highs to a mid-October

low. We see this pattern below in 11 of the years 16 years since 1999,

where the DJI's bottom was not made until 10/10 and 11/26 (Thanksgiving.)

Year Low Closing

Peerless Signal

-------------------------------------------------------------------

1999 10/14 12% below

peak B1, B3 at bottom.

2000 10/18 12% below

peak B1, B2 at bottom.

2001 9/21 Bottom after 9/11

B16 at bottom

2002 10/19 19% below

Aug peak B1, B16 at bottom.

2003 9/30 4%

below Sept peak Already on a Buy. No new Buy signal.

2004 10/22 5.5% below Sept

peak. B1, B2 at bottom.

2005 10/22 4.5% below Aug

peak. Already on a Buy. No new Buy signal.

2006 DJI was advancing steadily in this

period.

2007 11/26 10% below Sept

peak. B3, B14, B18 at bottom.

2008 10/10 27% below August

peak. B16 at bottom.

2009 DJI was advancing steadily in this

period.

2010 10/10 27% below

August peak. B16 at bottom.

2011 DJI was advancing steadily

in this period.

2012 11/26 8% below

Sept peak. B2 at bottom.

2013 10/10 6% below August

peak. B16 at bottom.

2014 10/16 6.5%

below August peak. B1 at bottom.

TABLE A

When Does A Decline Become Really

Dangerous?

We have seen how the DJI recently did find support

at the lowest possible level consistent

with it making

only a corrective decline. There were 30 "corrections", each producing

a decline of less than 14%. This was more than two and a half times the

number of bear

markets that brought a decline of more than 20%.

But now look at what happens when there is a DJI decline more than 14.5%.

There

were 15 cases where the decline was at least 19%. These are highlighted

in red: 1929, 1937, 1940, 1946, 1957, 1962, 1966, 1973-4,

1977, 1981-2,

1987, 1990, 1998, 2000-3, 2007-9. There were only four declines of 15% and

18%.

(1948, 1971, 1980 and 2017) and there were three declines of 19% to 21%:

1957, 1980 and 1998. By contrast, there were 12 bear markets where DJI

fell

more than 21%. So, the odds are are almost 4:1 that any DJI decline of

more

than 14.5% will see the DJI fall more than 19% from its highs.

Declines in Bull Market That Were Corrections

or Became Bear Markets (Declines of more

than 19%)

From 1928 to 1966, there

were 9 9%-14% corrections

and 7 bear market

declines of more than 18%. One decline

fell 15% before

reversing, but 7 others fell at least as much as 18%.

1-3 > 1928-1929 before the September 1929 peak:

3 10% corrections.

4

1929 Bear Market started with 14.5%

decline from September peak and one-week rally, then collapse.

5 > April-May 1936 11% correction.

No bear market

6 > 1937 before the August 1939 peak

1 15% correction. DJI could not get back to

old high.

7

1937 Bear Market: DJI fell 33% before

there was even a brief rally back to falling 21-dma.

8 1940 Bear Market: DJI fell

24% before reversing.

9 > 1946 before July 1946 peak

1 10% correction

10

1946 Bear Market: DJI fell 26% before reversing.

11 > 1947-48: 11%

correction. No bear market

1 10% correction

12 > 1948-1949: 15%

decline and then recovery to new highs.

13 > June-July 1950 13.5% correction.

No bear market

14 > Sept-Oct 1955

10% correction. No

bear market 1 10%

correction

15-16 > 1956 before the July 1957

peak 2 10%

corrections.

17

1957 Bear Market: DJI fell 19.5% before reversing up past falling 21-day

ma.

18 >

1959 before the January

1960 peak 1 9.2%

correction.

19 18%

1960 Bear Market:

DJI fell 11% before reversing and rallying 10%..

20

1961-1962 Bear Market: DJI fell 27% before rallying. - there was a

massive head/shoulders

-----------------------------------------------------------------------------------------------------------------

21 > 1965 before January 1966

peak 1 10.5%

correction

22

1966 Bear Market: DJI fell 25% before rallying. - 5%

rebound when down 13.5%

23 > 1967-1968 before December 1968 peak 1

12% correction 5% rebound when down 10

24

10% corrections, 10%

recovery, then a fuller 16% decline from April 1971 top.

25 Deep 1973 Bear Market.

8% recovery after only a 10% decline.

26 > July-October 1975 10%

correction. No bear market.

27

1977-8 Bear Market.

28 > 1978

13.5%

correction in Sept-Oct 1978.

No deeper

bear market.

29 >

1979 11%

correction in Sept-Oct 1979.

No deeper

bear market.

30 >

1980 16%

correction in Feb-April 1980.

No deeper

bear market.

31 > 1980 before the April

1981 peak 1 10%

correction.

32

1981-1982 Bear Market. First temporary recovery to upper band after 19.5% decline.

33 1987

- 36%

Bear Market. No minor recoveries.

34 >

1989 1 10% correction. No deeper

bear market.

35 >

1990 1 10% correction. No deeper

bear market.

36 1990 - 21% Bear

Market.

37 > 1994

1 11% correction

No deeper

bear market.

38 > 1996

1 10% correction No deeper

bear market.

39 > 1997

1 13.5% correction in Aug-October 1997.

No deeper

bear market.

40 1998 -

19.5% Bear

Market.

41 > 1999

1 11%

correction.

42 2000-2003 Bear

Market. This began with DJI 16.5% decline.

Though there

were rallies in 2000 and 2001, most stocks fell and

were trapped in a long bear market.

43 >

2004 1

9%

correction.

No deeper

bear market.

44 >

2007 1

10%

correction. before the

October 2007 peak

45

2007-2009 Bear Market.

46 >

2010

1 13.5%

correction in April - July 2010.

No deeper

bear market.

47 2011 17%

Decline - May - October 2011

? No 10% corrections before

May - August 2015 top.

|

=============== Previous Comments Here ====================

Trouble

Lies Ahead

Somehow, it is the DJI and SP-500 which will have to lead ALL other

markets higher.

The broader US market remains quite weak. 90% of all stocks are below their

65-dma.

Somehow the US now must also lead the world markets out of their Deflationary

spiral.

This won't be easy. The de-Industrialization of America and the 35

year decline

in its middle class have gravely weakened Consumer Demand just when Foreign

demand is in the tank, too. This is why we watch the Four Horses of the

Deflation

Apocalypse. Many overseas markets are in a steep declines, as are

Commodities,

Oil/Gas and the Chinese market.

Friday watch the Jobs numbers closely. It's true that +200,00 new Jobs

have

been added in each of the last 3 months, but it is also true that the

recent June and July

numbers do show a deterioration both from a year ago and from the previous month.

I think we have to get past simply relying on the standard media's write-ups of

these numbers.

NEW NON-FARM EMPLOYEES IN US

8/8/2015 (in 1000s)

| Year |

Jan |

Feb |

Mar |

Apr |

May |

Jun |

Jul |

Aug |

Sep |

Oct |

Nov |

Dec |

Annual |

| 2004 |

161 |

44 |

332 |

249 |

307 |

74 |

32 |

132 |

162 |

346 |

65 |

129 |

|

| 2005 |

134 |

239 |

134 |

363 |

175 |

245 |

373 |

196 |

67 |

84 |

337 |

159 |

|

| 2006 |

277 |

315 |

280 |

182 |

23 |

77 |

207 |

184 |

157 |

2 |

210 |

171 |

|

| 2007 |

238 |

88 |

188 |

78 |

144 |

71 |

-33 |

-16 |

85 |

82 |

118 |

97 |

|

| 2008 |

15 |

-86 |

-80 |

-214 |

-182 |

-172 |

-210 |

-259 |

-452 |

-474 |

-765 |

-697 |

|

| 2009 |

-798 |

-701 |

-826 |

-684 |

-354 |

-467 |

-327 |

-216 |

-227 |

-198 |

-6 |

-283 |

|

| 2010 |

18 |

-50 |

156 |

251 |

516 |

-122 |

-61 |

-42 |

-57 |

241 |

137 |

71 |

|

| 2011 |

70 |

168 |

212 |

322 |

102 |

217 |

106 |

122 |

221 |

183 |

164 |

196 |

|

| 2012 |

360 |

226 |

243 |

96 |

110 |

88 |

160 |

150 |

161 |

225 |

203 |

214 |

|

| 2013 |

197 |

280 |

141 |

203 |

199 |

201 |

149 |

202 |

164 |

237 |

274 |

84 |

|

| 2014 |

144 |

222 |

203 |

304 |

229 |

267 |

243 |

203 |

271 |

243 |

353 |

249 |

|

| 2015 |

201 |

266 |

119 |

187 |

260

|

231

|

215 |

|

|

|

|

|

I consider Peerless not to be offering a current

reversing Buy or Sell now. This

is highly unusual, but so is the market. The nearly 1000 point advance

in only two days did not even take the DJI above its falling 65-day ma.

This gives the appearance of a DJI only making a bear market rally up to

resistance last week. In the next Peerless update (expected to be released

on Friday), the characteristics mentioned above will give an automatic Sell S14.

In an on-going bear market the S14 would call for selling and selling short.

But currently we are not officially in a bear market. A DJI decline of more

than 18% from its high is the standard used by Peerless). As such the Sell S14

is only a "take profits" signal;. In fact, the DJI has still not fallen

more than

14% from its highs so far. You will recall that I have shown here recently that

since 1928 77% of the numerous DJI declines of 10% to 13.5% were

"corrections" in an on-going bull market and soon brought recoveries back

to their old highs, at least. . So, the new Sell S14 in our market environment

only says what I have already said here, namely to mostly go to cash

unless you are a very short-trader and can watch the Hourly DJI during the

day and want to play the typical recovery that should develop between

15700-16000 and sell when the Hourly DJI's uptrend is violated or the

DJI again reaches 16700.

===============================================

Additional Notes

===============================================

Temporary Sharp Declines

and Extreme Artificial Sell-Offs.

Looking at the Peerless charts for 1987,

1997, 2011 and 2010

show us that the odds favor a retest of the 16000. Only the 1997

case would suggest that there will only be a shallow one- or two-day

retreat.

1987 Crash (Caused by

Reckless Computerized Trading in Index Options.)

1997 Parallel:

Only

two very shallow retreats here before old high was challenged,

2010

Flash Crash

2011 Republican Shut-Down of Federal Government

(Boehner says that this will not occur in 2015.)

From Wednesday night:

Other Sharp DJI Declines to The 13.5%-Down Level

When one studies other DJI recoveries in the past after sharp declines

to the 13.5%-14% support- level below the bull market peak, we see that

the falling 21-day ma does act as resistance for a week before prices

penetrate it and resume their rally. See the study here.

../../MAXMIN/8-28-2015/big_declines_and_the_importance.htm

Look especially at the charts of 1941 (months before Pearl Harbor),

1950 (a month after North Korea invaded South Korea) and

in 1997. Especially note the 1997 Panic. It occurred because of a

panic

in Asia with the DJI up very considerably over the prior 6 years.

Computerized trading then also drove the decline down excessively.

Wikopedia writes:

"The October 27, 1997, mini-crash is the name of a global

stock market crash

that was caused by an

economic crisis in Asia. The point loss that the

Dow Jones Industrial Average suffered on this day still ranks as the eighth

biggest

point loss and 15th biggest percentage loss since its creation in 1896. This

crash is

considered a "mini-crash" because the percentage loss was relatively small

compared

to some other notable crashes. But after the crash, the markets still remained

positive

for 1997. " (See

October 27, 1997, mini-crash - Wikipedia)

BUY B16s

B16

Trading Results by which Year in 4-Year Presidential Election Cycle

the Buy B16s occurred in.

Year

No. Avg.Gain

Presidential Election Year 5

.263

PE + 1

7 .281

PE + 2

8 .150

PE + 3

6 .115

B16 Trading Results by

which Month the Buy B16s occurred in.

Month

No. Avg.Gain

January

0 ---

February

1 .988

March

2 .220

April

2 .097

May

2 .135

June

2 .044

July

2 .047

August

2 .039 (lowest)

September

2 .153

October

3 .156

November

4 .172

December

4 .176

Previous August Buy

B16s

DJI

Gain

19660831 B16

788.51 .022 no paper

loss

la/ma AROC

PI PI-Ch IP21 V-I

OPct 65-dma Pct Change

.966 -.643

-257 41

-.189 -13 -.312

-.109

-------------------------------------------------------------------------------------------------------------

19710809 B16

842.65 .055

fell to 839.59 (0.4% paper loss)

la/ma AROC

PI PI-Ch IP21 V-I

OPct 65-dma Pct Change

.963 -.802

-277 -36 -.159 -4

-.404 -.102

-------------------------------------------------------------------------------------------------------------

20150825 B16 842.65

.055

la/ma AROC

PI PI-Ch IP21 V-I

OPct 65-dma Pct Change

.906 -1.216

-310 +50 -.084 -246

-.507 -.141 |

------------------------

Announcements

--------------------------------

E-Books

1

The On-Line Explosive Stocks

2

The On-Line Killer Short

Sales book

Purchase each all new book by CC for

$42.50 or send a check for $37.50 to me.

I call your

attention now to the many new concepts and

the considerable new research in them:

For example:

1) A very good New Tiger Buy B12 for Low

Priced Stocks

2) After Red high volume reversal days use CP

uptrend-breaks.

3) Buy the stocks the Federal Govt wants you

to buy.

4) 100-Day Power Rankings...

5) Using Closing Power Hooks after Buy B26s

and B20s.

6) How A Stock Reacts to Its Earnings Report

Is Very important.

7) TigerSoft Major Buy Signals' Combinations

Which are most Powerful? Reliable?

8) Augmented Buy B20s' Independent Success

Rate.

9) What factors warn a rising 65-dma will not

hold?

10) The classic cluster of technical

characteristics that commonly appear

in the 23 stocks falling 70% or more in

the deep pullback of 2011.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

PEERLESS STOCK MARKET TIMING:

A Guide To

Profitably Using The Tiger Nightly HOTLINE

New Peerless Signals and DJI Charts - version 7/4/2013

1965

1965-6 1966

1966-7 1967

1967-8 1968

1968-9 1969

1969-70

1970

1970-1

1971

1971-2 1972

1972-3

1973 1973-4

1974

1974-5 1975

1975-6

1976 1976-7

1977

1977-1978

1978

1978-79

1979 1979-80

1980 1980-1

1981 1981-2

1982 1982-1983

1983 1983-1984

1984

1984-1985

1985

1985-1986

1986 1986-1987

1987 1987-8

1988

1988-9 1989

1989-90

1990

1990-1 1991

1991-2 1992

1992-3 1993

1993-4 1994

1994-5 1995

1995-1996

1996

1996-7 1997

1997-8 1998

1998-1999 1999

1999-2000 2000

2000-1

2001 2001-2

2002

2002-3 2003

2003-4 2004

2004-5

2005 2005-6

2006 2006-7

2007 2007-8

2008 2008-9

2009

2009-10

2010 2010-11

2011 2011-12

2012

2012-2013

2013 2013-4 2014

Introduction to Tiger/Peerless Buys and Sells.

Different Types

of TigerSoft/Peerless CHARTS, Signals and Indicators

How reliable support is the DJI's rising 200-day ma?

-------------------------------------------------------------------------------------------------------------------

TIGERSOFT SIGNALS AND INDICATORS:

Documentation for TigerSoft

Automatic and Optimized Signals.

SPY Charts since 1994: Advisory Closing Power S7s, Accum. Index, 65-dma,

Optimized Signals.

"The

Jig Is Up": Calling September and October Tops.

A Keynesian's Warning Signs.

NUGT since 2012: A study of Tiger Technicals

Tiger Day

Traders Tool and most active Triple Leveraged ETFs

Advisory Pink Closing Power S7s at ETF at top since 1994

1994

1996

1997

1998

1999

2000 QQQ

SPY

DIA

2002

2007

2008

SPY 2011

2013-2014

Tiger Buy and Sell

Signals: New 2014 Research:

These are randomly chosen

groups.

but clearly we need to back-test them in more years.

You can replicate or do similar studies yourself

for other signals and/or other years.

9/1/2014 -

2014 Tiger

B19s - Steady rallying and no pullbacks below the 21-day ma.

9/2/2014 -

2014 Tiger

B17s on 14As taken alphabetically

9/3/2014 -

2014 Tiger B17s on 60

Biotechs taken alphabetically

9/4/2014 -

2014 Tiger

B18s on all "R" stocks taken alphabetically

* 9/8/2014 -

2014 Tiger

B20s - Conclusion: Use Closing Power trendbreaks in aftermath.

9/8/2014 -

2014 Tiger

B16s - Conclusion: Use mostly when

LA/MA under 1.05.

9/11/2014 -

2014 Tiger

B15s - Conclusion: Certain conditions

improved the results dramatically.

9/12/2014 -

2014 Tiger

B25s - Conclusion: 87.5% success rate

when other internals are positive.

9/15/2014 -

2014 Tiger B25s -

Best conditions for using B25s with somewhat

higher RSX capitalization stocks.

9/16/2014 -

New Tiger

Closing Power Take-Off Buy Signal in 2014: 14s, QQQ, DJI-30 and ETFs

9/17/2014 -

New Tiger

Closing Power Take-Off Buy Signal: 2009A-s

9/18/2014 -

New Tiger

Closing Power Take-Off Buy Signal: 2010A-s

9/21/2014 -

New Tiger

Augmented Sell S8s: DJI-30 - 2014

Requiring S8s to show

Negative CP%-Pr and IP21<+.15 produced a 70% success rate

in a rising market for

DJI-30 stocks and big ETFs.

9/24/2014 -

Tiger Sell

S14s: They make price breakdowns very bearish.

1/15/2015

-

Tiger Day

Traders' Tool Explained.

http://www.tigersoft.com/day-traders/index.html

http://www.tigersoft.com/Indicators/index.htm

http://www.tigersoftware.com/TigerBlogs/Aug-31-2009/index.html

NEW

2/16/2015

1) New -

Tiger Charts showing UP%, Opening-Up%, Closing-Up%

Note differences between bullish

and bearish stocks...

2) New -

UP%,

Opening-Up%, Closing-Up% Rankings of any directory.

3) New -

Display of what happens to a stock after various size openings up or down.

4) New -

6-month charts to better

show volume changes and 5-day ma with bands.

More profitable trading schemes coming...

Targeted Trading Opportunities:The Profits Quickly Add Up,

3/29/2015

Tiger CandleSticks:

IBB: 2001-2015

and

Recent Others.

====================================================================================

Earlier Hotlines

2-7-2014 to 3/19/2014

11-22-2014 to 2-6-2014

http://tigersoftware.com/555HL555/index.htm

10/9/2014 - 11/21/2014

http://tigersoftware.com/9933Hot/

9/2/2014 - 10/8/2014-

http://tigersoftware.com/2233HL/index.html

6/25/2013-9/1/2014

http://tigersoftware.com/112211-H/index.htm

11/22/2013-3/20/2014

http://tigersoft.com/1111-HL/index.html

10/22/2013-11/21/2013

Past

Hotline Predictions

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

==============================================================================================================================