TIGERSOFT will help you in many unique ways.

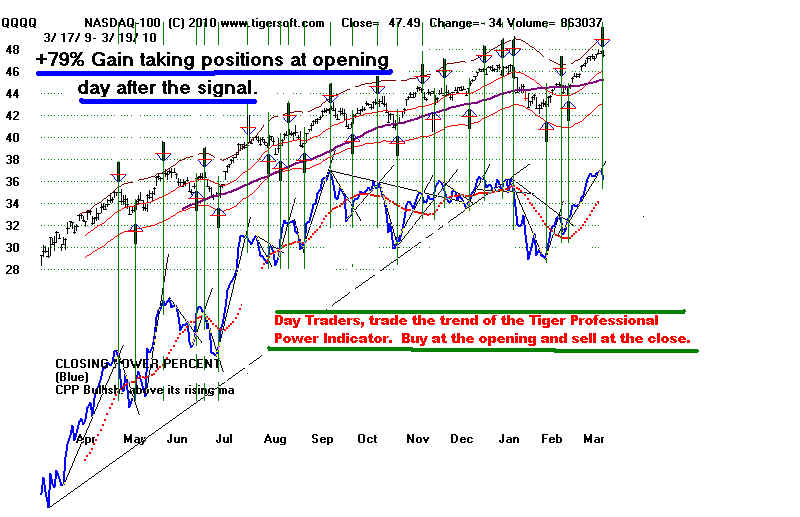

TigerSoft is an innovator. We teach 3-day classes

on this subject once a year.

Here are three immediate unique offerings TigerSoft gives a day trader.

1.) Trade the minor Professional Buying Power trend.

(2) Know if there Is there more risk or reward buying at opening?

When Tiger Day Traders' Tool is rising, day trade by buying at opening

and

sell at the close. The risk reward ratio is very favorable.

When Tiger Day Traders' Tool is falling, day trade

by selling short at opening

and

buy at the close. The risk reward ratio is very favorable.

(3) Scan all stocks for the best

candidates to buy/short at the opening.

TIGERSOFT offers much more than just Powerful

Automatic Buys and Sells or Superb

Internal Strength Indicators.

At the simplest level you can just subscribe to our HOTLINE

and

Special Situation Service

($535/year) and be informed when superb

trading situations arise. Below is JNPR's

chart.

Traders could have gathered as much as a 50% gain

in less than 3 weeks.

price data, there many ways a day trader will profit from TigerSoft.

First and foremost, being right about the general direction of the market

will make a big difference.

(1) Use TigerSoft's NASDAQ Buys and SELLs to spot meanigful

intermediate-term trend changes in technology and more speculative markets .

(2) Whatever you graph will show TigerSoft's Optimized BUY and SELL

signals. They appear automatically on each chart. Many stocks can be short-term

traded superbly with Tiger's Buys and Sells. This is apparent no matter volatile stock

you may choose to work with.

(3) NEW optimized BUYS are listed each night and ranked by performance,

so that you can pick the best new BUYS or SHORT SALES each night.

Below you can see that simple 10-day mvg. avg. penetrations (by a proprietary margin)

produced a trading gain of more than 544% in JNPR over the period, August 2001-

September 2002. This amount even allows a generous amount for commission and slippage.

This is another creation of TigerSoft that will make you a lot of money, we predict,

if used faithfully. No other software has it! This will give you a HUGE advantage

over other Day-Traders. It tells you whether you should be BUYING and when

you should be SELLING short at the opening. In JNPR's case above, knowing

which way to day trade it is very important. Assuming that the day trades are closed

at the close, the avg. gain on JNPR's Longs was 1.87% per day for on 105 days.

Short selling on the designated days produced an avg. gain of 1.62% per day on 128 days.

They also tell you when it is safe to hold a position overnight and when it isn't. In JNPR's case,

the overnight gain (close to next day's opening) was 1.0% per day when it was safe and

a -.9% per day when it was not. These gains annualize to more than 200%/year.

Interestingly, the best times to hold a stock long is when Tiger's Opening Power (TM) and

Closing Power are both rising. This is another condition that our programs flag each night

from any universe of up to 1,000 stocks.

..............

And there's more!

(5) Tiger Will Tell You What Day of The Week To Buy or Sell at the Opening and the Close.

(6) TigerSoft will tell you How The Stock tends To Behave after a Specified Number of

Consecutive Days Up or Down.

(7) TigerSoft will tell you which stocks lead your stock up or down by a day.

There's a lot more....

Consider another chart, shown below, HOM in 2005-2006.

Here are some of the ways TigerSoft can help a trader in this stock.

1) Note the optimized Red Buys and Sells. It is still on a buy from its top system for the

past year. So are the next tree best systems. The top system is simply using turns of the

21-day ma.

2) HOM has shown a powerful tendency to open high, but then close below the opening.

There is higher than normal risk for day traders with this stock if they buy at the opening.

There is less typical upside potential than downside risk by the close.

3) Weekly seasonality? TigerSoft shows that for the last year HOM was up

68.8% of the time on Mondays,

up 55.7% of the time on Tuesdays,

but only up 41.5% on Wednesdays,

up 48% on Thursdays

and 50% on Fridays.

On Wednesdays, the stock is particularly weak after the opening, rising only 37.7% of the time by the close.

4) TigerSoft also gives a Projected Low for the next trading day and a Projected Trading Day High.

5) Does the behavior of any stock today, predict HOM's price action tomorrow?

In HOM's case, the programs show that the DJI's rise today, by itself, gives only a 49.8%

likelihood of the stock rising the next day. Over the past year, HOM rises 53.4% of the time,

day-to-day.

6) Volatility? Is the stock's daily volatility favorable or unfavorable to a trader being long the stock?

There were 43 cases where the stock rose 5% and only 21 where it fell that much in a single day.

7) Is the the stock suitable for short-term trading? Or should it be held longer-term? Presently, the

best trading systems for HOM give Buys and Sells only less often than once a month. Other stocks may

be more suitable for short-term trader. If you are determined to trade it, what is the best short-term system.

TigerSoft will tell you. More than 60 systems are instantly tested with just one command.

8.) How much "slippage" is there if you take the signals at the close and act the next day's

opening? TigerSoft answers this. Instead of gaining 684%, one would have gained 504%.

9) What if you only traded it on the long side? Acting at the opening the next day, the

Red Buys and Sells would haved gained 606%. There were 4 winning trades and 2 losing trades.

The biggest intra-day loss was 20.2%.

10.) Projected Highs and Lows the next day. For day traders who want take profits not at the end of each day,

TigerSoft gives you an estimate of the next day's high or low based on the stock's volatility.

It, thus, tells you where to place a Sell Short Limit order for the next day if the Closing Power is Weak.

Ir it the Closing Power is strong an dthe Tiger Traders' Tool is rising, it will tell you where to place a Buy

order.

.....................................................................

Each of the above mentioned tools is only available with Tigersoft. There are many

other unique features. TIGERSOFT has long had a reputation of being an industry leader.

Use it and stay ahead of your competition. Call 858-273-5900 for more information.