TigerSoft and Peerless Daily

Hotline

www.tigersoft.com/HL888

(C) 1985-2015 William Schmidt,

Ph.D. www.tigersoft.com

All rights

strictly reserved.

Tiger Software

858-273-5900 PO Box 22784 San Diego, CA 92192 Email

william_schmidt@hotmail.com

------------------------------------------------------------------------------------------------------------------

Announcements

-

Tiger/Peerless UPDATE. A new TigerSoft/Peerless update

has been released today.

The new Tiger's update has the new Sell S12. It has the

new QuickSilver table which is produced for any directory's stocks.

It should work well with the stocks in FASTUP, FASTDOWN, LEVERAGE, HIGHIP21,

MAXCP, MINCP, REDSELL and NEAR65. With this QuickSilver

table displayed, you point the mouse at the symbol and click Graph.

The Peercomm will also allow you to get stock data again from Dial Data.

8/17/2015

200+ TigerSoft Charts -

Go to

www.tigersoftware.com/HH/index.html

8/17/2015

New Highs: NASD 56

NYSE 73

New Lows: NASD 43

NYSE 67

8/17/2015 Bullish MAXCP Stocks

133 ---->www.tigersoftware.com/MAXMIN/maxmin/8-17/Rbullish.htm

Bearish MINCP Stocks

60-->

http://www.tigersoftware.com/MAXMIN/maxmin/8-17/Rbearish.html

------------------------------------------------------------------------------------------------------------------

8/17/2015 Peerless

remains on Red Sell 12*s. The NYSE A/D Line

is still falling. The Hourly OBV-DISI Line is still in a short-term

uptrend. But watch for a break in the Hourly uptrends. I suspect the

upside now is quite limited. The DJI's hypothetical high hit the 17600

resistance.

This level is where it

suddenly reversed at the

beginning of last week. That will likely be too much resistance

for the DJI on this advance.

SPY is somewhat stronger. But its Daily OBV is lagging by a wide

margin. So, I doubt if it will be able to past its 65-day.

This is a market in which 75% of all stocks are below their 65-dma.

Twice as many groups have a majority of their stocks below their

65-day mvg.avgs, as have a majority above their 65-dma.

Overseas markets are getting weaker almost every day. This is a

prime reason for the continuing decline in oil prices. It has caused China

to devalue its currency. Their politicians are more concerned

about exporting industries' JOBS than keeping their currency strong.

The strong Dollar and weakening overseas economies do make

bankers and wealthy investors happy here. The leading US stocks

have become very appealing to Hot Money from overseas.

Their buying is mostly in stocks and bonds that benefit from the strong Dollar

|

and pay safe dividends. This helps explain the defensiveness of the market

now. The strongest groups now, REITs, Bonds and Utilities, of

course,

all pay dividends. Assured earnings rather than possible future

growth is favored. Thus, among the top performing groups now

are Beverage and Insurance companies.

So, this is a very selective and a defensive market. Risk-avoidance

is necessary. We can still buy stocks for short-term trades

using the Tiger Bullish MAXCPs, the highest ranked HIGH-UP%

and HIGH-IP21 Groups. Tonight, I also show how to use the

QuickSilver methodology against the FASTUP stocks. Meanwhile,

most of our shorts in bearish MINCP stocks keep declining, as do OIL,

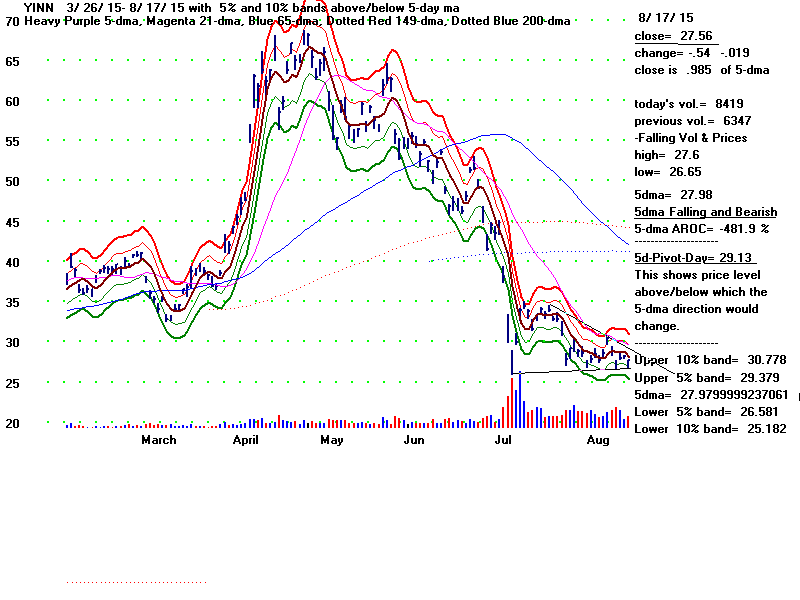

GAS, YINN, most Commodities and many Emerging Countries'

stocks. The US markets will be hard-pressed to keep rising with

so much weakness overseas especially if the Fed yields to the

pressure of those who would like a little Deflation here.

See below the ranking of the Industry Groups we follow

showing the percent of each group's stocks above their 65-dma.

Group

Percent of Stocks

above their 65-dma

-------------------------------------------------------------------

Insurance

75%

Home-Building 72.5%

REITs

67.5%

Beverage

64.7%

Gaming

62.5%

Bonds

62.2%

Big Banks

57.1%

Military

57.1%

Software

54.4%

SP-500

53.7%

Russell-1000 52.3%

Nasdaq-100

51.0%

Auto

49.2%

DJI-30

42.6%

Computer

42.4%

Anti-Hackers

40.7%

Retail

40.7%

Finance

40.0%

Biotechs

36.2%

Transportation 34.5%

Chemicals

32.1%

Green

26.3%

Education

22.2%

Industrial Mater. 21.2%

China

20.0%

Electronics

18.4%

Semi-Conductors 16.5%

Commodities

16.0%

Solar

15.0%

Gold/Silver

14.5%

Foreign ETFs 11.8%

Oil/Gas

9.7%

Food

6.7%

Coal

0.0%

Finding Short-Term Trades

among The Strongest Swingers

Using Tiger's "FASTUP" Group

and the new Tiger QuickSilver Program

QuickSilver lets you quickly find the stocks in fast-rising

5-day uptrends (or down-trends). When the 5-day ma is

rising at an annualized rate of more than 250%, the uptrend

is most likely to continue. The odds in favor of a rebound

up off the 5-day ma are greatest when Both the Opening

and Closing Power are rising and the current Accumulation

Index is over +.20 (or even higher). Look also at the charts

where these conditions are true to see how close the stock

is to price support, resistance, a breakout or a breakdown.

What's also nice about QuickSilver is that it also gives the

pivot-points below which a closing the next day will turn down

the 5-dma. Below are the top stocks examined this way.

Of course, the trick here is not to chase them too far above

their 5-day ma and to try to buy them on successful tests of the

5-day ma. To narrow the search down further, very high IP21s

and AI/200 scores should usually be favored. Also try to

pick stocks whose prices rise on rising, not falling, volume. And,

of course, look at their charts. These will also show you

the stocks' names. Some industry groups will be

over-represented here; these should be favored.

C:\FASTUP - 08/17/15

5-DMA ROC Symbol Last 5-dma Pivot Change

..............................................................................................

IP21 AI/200 OP-PWR CP-PWR PCT-Up Daily Vol. notes

==============================================================================================

1815.1 MRVC 17.07 14.83 12.75 .25

.26 111 Rising Rising .442 vol.fell on up-day

---------------------------------------------------------------------------------------------

1600.5 CLIR 5.38 4.99 4.12 .08

.26 121 Rising Rising .438 bullish

---------------------------------------------------------------------------------------------

1210.4 EZCH 21.71 19.66 16.87 1.05

.3 118 Rising Rising .494 bullish

---------------------------------------------------------------------------------------------

1055.2 NTLS 9.15 9.09 8.99 -.08

.24 91 Rising Rising .514 vol.fell on up-day

---------------------------------------------------------------------------------------------

960.5 DWTI 173.87 164.48 154.67 2.98

.32 105 Rising Rising .574 bullish

------------------------------------------------------------------------------------------------

945.7 ICUI 123.09 120.82 119.5 1.28

.28 110 Rising Rising .518 bullish

---------------------------------------------------------------------------------------------

807.1 PTNR 4.99 4.48 4.28 .53

.34 60 Rising Rising .418 bullish

---------------------------------------------------------------------------------------------

787.4 GSI .83 .79 .8 .08

.27 130 Rising Rising .386 bullish

---------------------------------------------------------------------------------------------

731 TREE 138.08 130.65 125.09 4.37

.28 179 Rising Rising .574 vol.fell on up-day

---------------------------------------------------------------------------------------------

707.9 RNF 15.3 14.89 14.27 .18

.47 114 Rising Rising .442 vol.fell on up-day

---------------------------------------------------------------------------------------------

547.3 DTO 113.89 110.44 106.74 1.24

.26 138 Rising Rising .578 bullish

---------------------------------------------------------------------------------------------

537.3 FLO 24.44 23.19 22.02 .42

.31 116 Rising Rising .53 vol.fell on up-day

---------------------------------------------------------------------------------------------

502.7 DEST 12.36 11.77 11.4 .46

.32 102 Rising Rising .466 bullish

|

Bearish Seasonality

Though the third year in the 4-year Presidential Cycle is normally quite

bullish, the median decline at some point from the DJI's peak to a

September or October bottom is 10% since 1945. So far,

the DJI has only fallen 4% from its July peak.

DJI's Declines in 3rd-4th Quarters of

Third Year of Pres. Election

1947 7/24//1947 6% decline to 7/1947

1951 9/13/1951 7% decline to 11/8/1951

1955 9/23/1955 10% decline to 10/10/1955

1959 8/3/1959 9% decline to 9/29/1959

1963 10/23/1963 10% decline to 11/22/1963

1967 9/25/1967 10% decline to 11/14/1967

1971 9/7/1971 13.5% decline to 11/23/1971

1975 9/8/1975 7% decline to 10/1/1975

1979 10/5/1979 11.5% decline to 11/7/1979

1983 7/26/1983 6% decline to 8/5/1983

1987 8/25/1987 36.5% decline to 10/19/1987

1991 8/7/1991 5% decline to 10/7/1991

1995 no declines

1999 8/25/1999 11% decline to 10/18/1999

2003 9/18/2003 4% decline to 9/28/2003

2007 7/19/2007 10% decline to 8/16/2007

10/19/2007 10% decline to 11/26/2007

2011 7/21/2011 16% decline to 10/3/2011

2015 7/16/2015 4% decline so far...

median decline = 10%

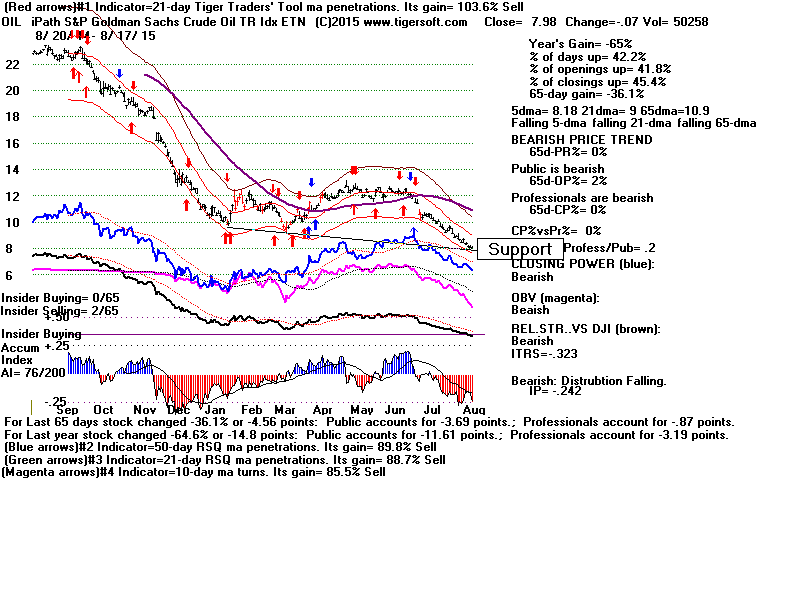

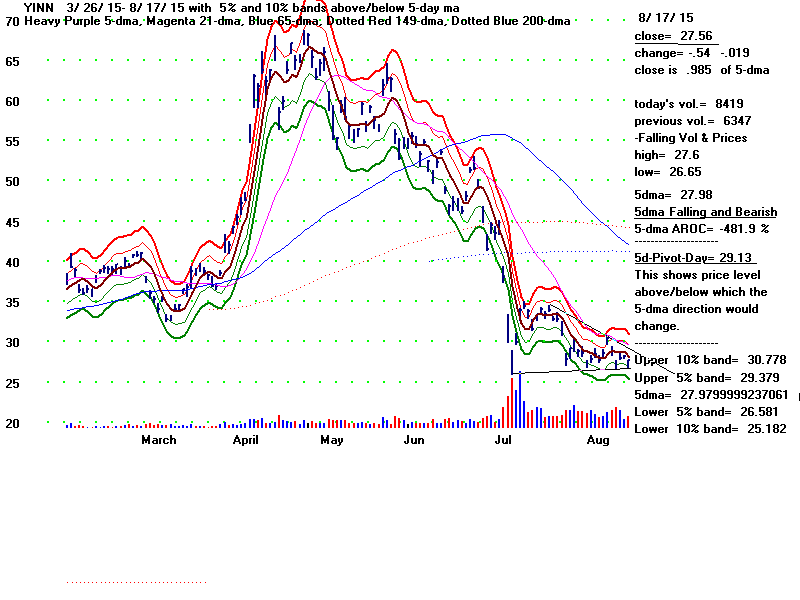

Watch to see if new lows are made by OIL, YINN and

the Tiger Index of Foreign ETFs. This will be quite bearish.

Crude Oil

|

YINN

|

Foreign (Non-US) ETFs

|

QUICKSILVER RANKING

OF MAJOR ETFS

BY 5-day MA AROC (at extremes) There are 8 DJI-30 Stocks with the bearish BOTH-DOWN condition.

Only 1 (HD) has the bullish BOTH-UP condition.

C:\dji-30 - 08/17/15

5DAROC Symbol Last 5-dma Pivot Change ..............................................................................................

IP21 AI/200 OP-PWR CP-PWR PCT-Up Daily Vol. notes

==============================================================================================

628.3 NUGT 4.26 4.16 3.96 .42

-.04 49 Rising ? .458 bullish

(Fast moving NUGT has turned back up at rising 5-day ma).

---------------------------------------------------------------------------------------------

88.7 HD 119.7 118.77 117.69 -.05

.18 97 Rising Rising .538 bearish

---------------------------------------------------------------------------------------------

35.4 TNA 82.81 80.42 80.15 2.39

.05 144 Falling ? .534 bullish

---------------------------------------------------------------------------------------------

16.4 MDY 275.89 272.91 272.26 2.6

.16 139 Falling Rising .51 bullish

---------------------------------------------------------------------------------------------

14.1 IWM 121.6 120.35 120.22 1.24

.03 143 Falling ? .534 bullish

---------------------------------------------------------------------------------------------

2.7 IBB 371.62 367.88 367.17 7.56

-.05 138 Falling Falling .554 vol.fell on up-day

(5 day ma has turned flats with BOTHDOWN Opening and Closing Power.)

---------------------------------------------------------------------------------------------

1.2 XOM 78.77 78.41 77.49 .41

-.1 75 Falling Falling .426 bullish

---------------------------------------------------------------------------------------------

-.3 SPY 210.56 209.25 208.67 1.14

.15 120 Falling Rising .506 bullish

---------------------------------------------------------------------------------------------

-6.4 QQQ 111.43 110.59 110.14 .92

.04 108 Falling ? .546 bullish

---------------------------------------------------------------------------------------------

-11.2 DD 54.27 53.57 53.39 .41

-.04 100 Falling Falling .478 vol.fell on up-day

---------------------------------------------------------------------------------------------

-13.6 OEX 924.98 919.94 917.65 4.23

0 115 Rising Falling .498 bullish

---------------------------------------------------------------------------------------------

-14.6 DIA 175.68 174.64 174.11 .78

.12 122 Falling ? .534 bullish

---------------------------------------------------------------------------------------------

-14.2 IBM 156.31 155.76 155.51 .56

-.08 88 Falling Falling .486 vol.fell on up-day

---------------------------------------------------------------------------------------------

-50.7 TECL 37.21 36.43 35.91 .64

.02 120 Falling Rising .55 bullish

---------------------------------------------------------------------------------------------

-55.9 PG 75.53 75.91 76.22 -.09

-.16 98 Falling Falling .47 bearish

---------------------------------------------------------------------------------------------

-84.1 GS 202.57 201.63 201.7 .55

0 129 Falling Falling .53 vol.fell on up-day

---------------------------------------------------------------------------------------------

-90.2 DIS 109.05 107.74 108 1.89

.11 114 Falling Falling .566 bullish

---------------------------------------------------------------------------------------------

-180.5 KOL 9.3 9.35 9.43 -.04

0 67 Falling Falling .402 vol.fell on down-day

---------------------------------------------------------------------------------------------

-196.4 OIH 30.95 31.58 31.93 -.17

.01 83 Falling Rising .422 bearish

---------------------------------------------------------------------------------------------

-373.2 SOXL 25.44 25.34 25.5 .75

.11 150 Falling ? .538 vol.fell on up-day

---------------------------------------------------------------------------------------------

-403 GASL 7.22 7.57 7.43 -.21

-.19 53 Falling Falling .402 vol.fell on down-day

---------------------------------------------------------------------------------------------

-414.6 OIL 7.98 8.18 8.4 -.07

-.24 76 Falling Falling .422 bearish

---------------------------------------------------------------------------------------------

-1118.8 DUST 23.72 25.27 27.83 -2.98

.13 147 Falling ? .522 vol.fell on down-day

--------------------------------------------------------------------------------------------- .55 vol.fell on up-day

|

------------------------

Announcements

--------------------------------

E-Books

1

The On-Line Explosive Stocks

2

The On-Line Killer Short

Sales book

Purchase each all new book by CC for

$42.50 or send a check for $37.50 to me.

I call your

attention now to the many new concepts and

the considerable new research in them:

For example:

1) A very good New Tiger Buy B12 for Low

Priced Stocks

2) After Red high volume reversal days use CP

uptrend-breaks.

3) Buy the stocks the Federal Govt wants you

to buy.

4) 100-Day Power Rankings...

5) Using Closing Power Hooks after Buy B26s

and B20s.

6) How A Stock Reacts to Its Earnings Report

Is Very important.

7) TigerSoft Major Buy Signals' Combinations

Which are most Powerful? Reliable?

8) Augmented Buy B20s' Independent Success

Rate.

9) What factors warn a rising 65-dma will not

hold?

10) The classic cluster of technical

characteristics that commonly appear

in the 23 stocks falling 70% or more in

the deep pullback of 2011.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

PEERLESS STOCK MARKET TIMING:

A Guide To

Profitably Using The Tiger Nightly HOTLINE

New Peerless Signals and DJI Charts - version 7/4/2013

1965

1965-6 1966

1966-7 1967

1967-8 1968

1968-9 1969

1969-70

1970

1970-1

1971

1971-2 1972

1972-3

1973 1973-4

1974

1974-5 1975

1975-6

1976 1976-7

1977

1977-1978

1978

1978-79

1979 1979-80

1980 1980-1

1981 1981-2

1982 1982-1983

1983 1983-1984

1984

1984-1985

1985

1985-1986

1986 1986-1987

1987 1987-8

1988

1988-9 1989

1989-90

1990

1990-1 1991

1991-2 1992

1992-3 1993

1993-4 1994

1994-5 1995

1995-1996

1996

1996-7 1997

1997-8 1998

1998-1999 1999

1999-2000 2000

2000-1

2001 2001-2

2002

2002-3 2003

2003-4 2004

2004-5

2005 2005-6

2006 2006-7

2007 2007-8

2008 2008-9

2009

2009-10

2010 2010-11

2011 2011-12

2012

2012-2013

2013 2013-4 2014

Introduction to Tiger/Peerless Buys and Sells.

Different Types

of TigerSoft/Peerless CHARTS, Signals and Indicators

How reliable support is the DJI's rising 200-day ma?

-------------------------------------------------------------------------------------------------------------------

TIGERSOFT SIGNALS AND INDICATORS:

Documentation for TigerSoft

Automatic and Optimized Signals.

SPY Charts since 1994: Advisory Closing Power S7s, Accum. Index, 65-dma,

Optimized Signals.

"The

Jig Is Up": Calling September and October Tops.

A Keynesian's Warning Signs.

NUGT since 2012: A study of Tiger Technicals

Tiger Day

Traders Tool and most active Triple Leveraged ETFs

Advisory Pink Closing Power S7s at ETF at top since 1994

1994

1996

1997

1998

1999

2000 QQQ

SPY

DIA

2002

2007

2008

SPY 2011

2013-2014

Tiger Buy and Sell

Signals: New 2014 Research:

These are randomly chosen

groups.

but clearly we need to back-test them in more years.

You can replicate or do similar studies yourself

for other signals and/or other years.

9/1/2014 -

2014 Tiger

B19s - Steady rallying and no pullbacks below the 21-day ma.

9/2/2014 -

2014 Tiger

B17s on 14As taken alphabetically

9/3/2014 -

2014 Tiger B17s on 60

Biotechs taken alphabetically

9/4/2014 -

2014 Tiger

B18s on all "R" stocks taken alphabetically

* 9/8/2014 -

2014 Tiger

B20s - Conclusion: Use Closing Power trendbreaks in aftermath.

9/8/2014 -

2014 Tiger

B16s - Conclusion: Use mostly when

LA/MA under 1.05.

9/11/2014 -

2014 Tiger

B15s - Conclusion: Certain conditions

improved the results dramatically.

9/12/2014 -

2014 Tiger

B25s - Conclusion: 87.5% success rate

when other internals are positive.

9/15/2014 -

2014 Tiger B25s -

Best conditions for using B25s with somewhat

higher RSX capitalization stocks.

9/16/2014 -

New Tiger

Closing Power Take-Off Buy Signal in 2014: 14s, QQQ, DJI-30 and ETFs

9/17/2014 -

New Tiger

Closing Power Take-Off Buy Signal: 2009A-s

9/18/2014 -

New Tiger

Closing Power Take-Off Buy Signal: 2010A-s

9/21/2014 -

New Tiger

Augmented Sell S8s: DJI-30 - 2014

Requiring S8s to show

Negative CP%-Pr and IP21<+.15 produced a 70% success rate

in a rising market for

DJI-30 stocks and big ETFs.

9/24/2014 -

Tiger Sell

S14s: They make price breakdowns very bearish.

1/15/2015

-

Tiger Day

Traders' Tool Explained.

http://www.tigersoft.com/day-traders/index.html

http://www.tigersoft.com/Indicators/index.htm

http://www.tigersoftware.com/TigerBlogs/Aug-31-2009/index.html

NEW

2/16/2015

1) New -

Tiger Charts showing UP%, Opening-Up%, Closing-Up%

Note differences between bullish

and bearish stocks...

2) New -

UP%,

Opening-Up%, Closing-Up% Rankings of any directory.

3) New -

Display of what happens to a stock after various size openings up or down.

4) New -

6-month charts to better

show volume changes and 5-day ma with bands.

More profitable trading schemes coming...

Targeted Trading Opportunities:The Profits Quickly Add Up,

3/29/2015

Tiger CandleSticks:

IBB: 2001-2015

and

Recent Others.

====================================================================================

Earlier Hotlines

2-7-2014 to 3/19/2014

11-22-2014 to 2-6-2014

http://tigersoftware.com/555HL555/index.htm

10/9/2014 - 11/21/2014

http://tigersoftware.com/9933Hot/

9/2/2014 - 10/8/2014-

http://tigersoftware.com/2233HL/index.html

6/25/2013-9/1/2014

http://tigersoftware.com/112211-H/index.htm

11/22/2013-3/20/2014

http://tigersoft.com/1111-HL/index.html

10/22/2013-11/21/2013

Past

Hotline Predictions

http://tigersoft.com/-HL42013/index.html

http://www.tigersoft.com/-2GBL13HL/index.htm

==============================================================================================================================