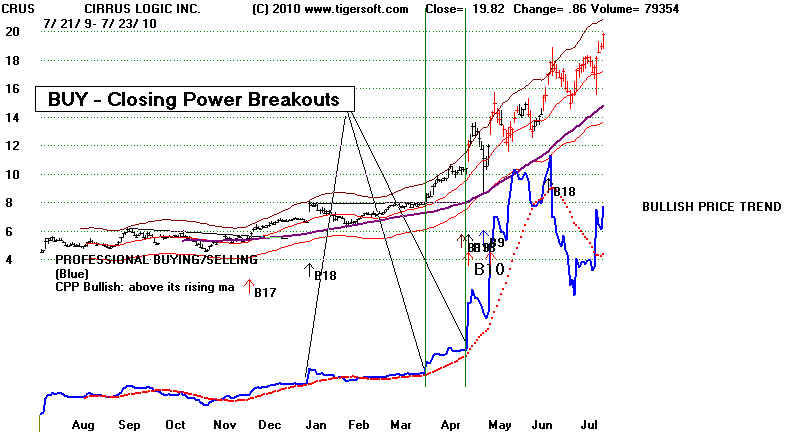

Dec 31, 2009 - July 23, 2010

140 Trading Days.

(C) 2010 William Schmidt, Ph.D. All rights reserved

858-273-5900 william_schmidt@hotmail.com www.tigersoft.com

Original and unique software and its documentation are offered here by its author.

TigerSoft has been serving investing professionals and members of the public since 1981.

(C) 2009 William Schmidt, Ph.D, (Columbia University) - All Rights Reserved.

TigerSoft Charts - Simple, Easy and Very Profitable!

-----------------------------------------------------------------------------------------------

The rules for finding stocks like these early on

using TigerSoft and the Tiger Power

Ranker appear in

Explosive Super Stocks

Tiger Users

see also Augmented B24 Study: Research: +36%/Year s 1990-2007

http://www.tigersoft.com/BiggestG/index.html

Research: Top

Performing Stocks of 2006-2007.

See

also http://www.tigersoftware.com/TigerBlogs/Oct29-2010/index.html

Insider Buying is

very apparent in most of the best performing stocks of any year...

Warning:

We watch Closing Power closely. When Professionals become net sellers of these

stocks,

it

isusually nest to lock in the nice profits.

See examples below:

Dec 31, 2009 - 7/23/2009

140 days

Over $10

Symboils Close Pct.Gain TigerSoft Automatic Signals

-------------------------------------------------------------------------------------

IDT 17.27 +256% B5 B12 B17 B18 B20 B24

GRNB 11.02 +210%

APKT 32.37 +194% B10 B20

CRUS 19.82 +190% B9 B10 B17 B18 B19

$5-10

WNC 8.11 329% B9 B10 B12 B18 B20 B24

CPE 5.79 285% B12 B17 B18 B20 B24

RDCM 5.61 231% B12 B17 B20 B24

IDIX 5.89 173% B9 B17 B20

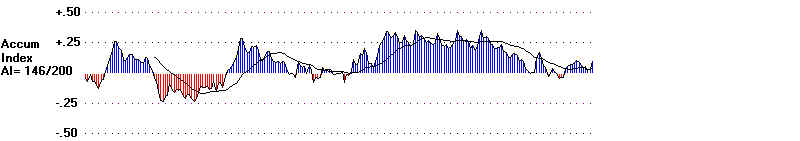

Big Capitalization stocks like CRUS also need Professional Buying to propel them up.

In this case, intense insider buying (shown from Accum. Index below) was not evident,

but note the dramatic increase in Professional Buying (above).

See the great surge of insder buying two months before the stock exploded upwards.