Track Insider Buying and Selling

Track Insider Buying and Selling

by Watching What The Pros Are Doing

Make TigerSoft's Closing Power Your Trading Friend.

Updated 6/30/2012 www.tigersoft.com TigerSoft Studies of Insider Trading

-----------------------------------------------------------------------------------------------------------------------------

Don't Be Fooled by Scheduled Insider Sales.

This is the SEC's "legal cover" that allows the insider trading.

Don't think that scheduled insider sales prove that insiders are not trading on non-public information.

Scheduling them in advance does not.mean they are not trading using non-public information. Advance

schedulied selling by insiders can still be rigged to preced the release of bad news. Here's how:

1. The SEC failed to require the scheduled selling to pre-establish the number of shares

that will be bpught or sold. The insider determines at his convenience the number of

shares without giving any prior notice.

2. The scheduled selling can be moved up in time. They can be stopped or started.

3 A plan can, it seems, be set up to be implemented only a few weeks later..

4. The release of the bad news can be delayed until the scheduled insider selling is completed.

5. The scheduling date is flexible and can be changed. The date can be changed, for example,

by factoring in price.

WikiLeaks

explains:

"Most of us think of

insider trading as illegal. It allows those with inside knowledge to tilt the playing

field,

with the small investors

invariably losing to the privileged few. Unfortunately for the small investor,

the big boys get to play by

different rules, and it has all been made legal, thanks to the SEC.

"In 2000 the SEC

promulgated Rule 10b5-1. The new Rule was designed to address the confusion

caused by a series of

court decisions that had left investors uncertain about what constitutes insider

trading. Rule 10b5-1

was designed to "clarify" what constitutes illegal insider trading.

"But top Wall

Street houses were not to be deterred from advantaging their big clients at the

expense of their small

ones. Wall Street firms like JP Morgan found loopholes in Rule 10b5-1

that allowed them to

continue trading on inside information "legally." Indeed, JP Morgan has gone

so far as to set up an

entire 'selling program' within its Securities division to help their clients

profit from the

loophole.

"Documents

obtained earlier this month by Wikileaks from JP Morgan Private Bank, which subtitles

itself as

"World class solutions for wealthy individuals and families", show the firm has

a dedicated '10b5-1

Selling program,'

along with a 'dedicated 10b5-1 team' to help its clients take advantage of the loophole.

"Here's

how it works:

"1. An

insider client transfers all or a portion of their company stock into a JP Morgan

Securities Inc. brokerage account.

"2. The insider then develops, in conjunction with the 10b5-1 team, a 'phased,

pre-planned

sales program to be executed at either market or specified prices'.

"3. Depending on the information available to the insider (but not the public), the

insider

can decide whether to execute the sale or not.

"By gaming the system this way, JP Morgan teaches insiders how to use their knowledge

to create a rigged market, one in which it is the "house" that always wins, and

the small

investor that always loses.

"Alan D. Jagolinzer, an assistant professor at Stanford University Graduate School of

Business,

completed a study of roughly 117,000 trades in 10b5-1 plans by 3,426 executives at 1,241

companies. He found that trades inside the plans beat the market by 6% over six months.

By contrast, executives at the same firms who traded without the benefit of plans beat the

market by only 1.9%.http://businessweek.com/magazine/content/06_51/b4014045.htm

(December 17, 2008)"

Jagolinzer explains:

"The words "prearranged trading plans" bring to mind a steady pattern of

trading over a

long period of time. When discussing their plans, companies tend to reinforce that

perception,

says LoPresti (who follows executive trades for Thomson Financial). But in

reality,

many executives sell huge numbers of shares in a very short time, and often right before a

tumble.

He then gives some glaring examples of insider trading which did

not disturb the SEC's rules

or rule-makers in any way.

"Consider

recent trades made by Paul J. Sarvadi, chairman and CEO of

"Consider

recent trades made by Paul J. Sarvadi, chairman and CEO of

Administaff Inc. " (AFF - Kingwood Tex.), a provider of personnel management

services.

The stock's price soared "from about 15 in May, 2005, to around 42 at the end

of October.

During that span, Sarvadi used a trading plan to sell shares worth an average of

around

$2.3 million a month. When the stock plateaued in November, his sales stopped.

By spring,

after the stock began another ascent, Sarvadi was ready to sell again. He instituted a new

trading plan on Mar. 9, and from Apr. 3 to May 1 sold shares for $19 million.

His timing

was impeccable. The last trade was at 59. On May 2, Administaff posted strong

first-quarter

earnings, but second-quarter forecasts disappointed investors. By May 3 the stock had

plunged 25%, to 44, then slid to around 31 by late July. Administaff declined to

comment."

(No stock chart is available. Sarvadi is now CEO of NSP

- Insperity. )

TigerSoft's Closing Power turned down a

a most timely point for traders in all the cases which

we

can chart in ur list here. Professionals, like market makers and hedge funds

operators

watch

for insider trading by compnay officials. They look for anything out of the

ordinary,

especially

for very large sell orders or sell orders coming from many different insiders

from

the same firm. Such insider selling is seen as a significant warning that

insiders know

that

there is bad financial news about to come out. In most cases, the Tiger Accumulation Index

also

weakened, but not as much as the Closing Power. Insititutions had not yet turned

bearish

in the rising general market of 2005 and 2006, from which these cases are taken.

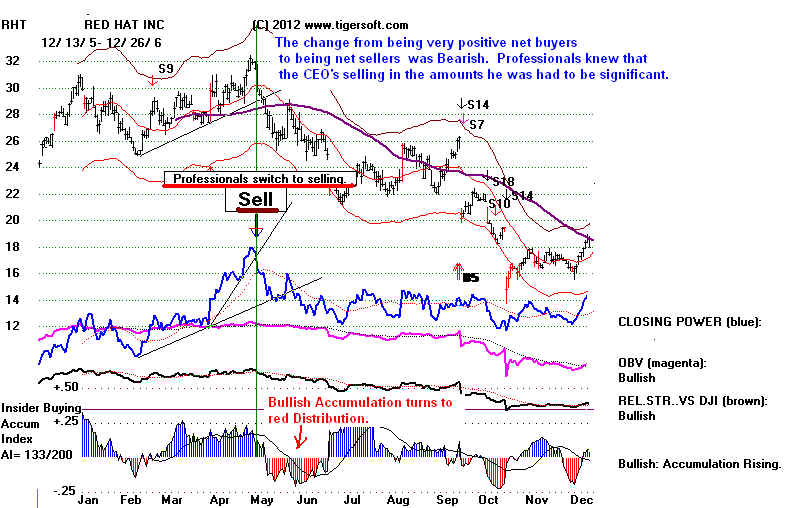

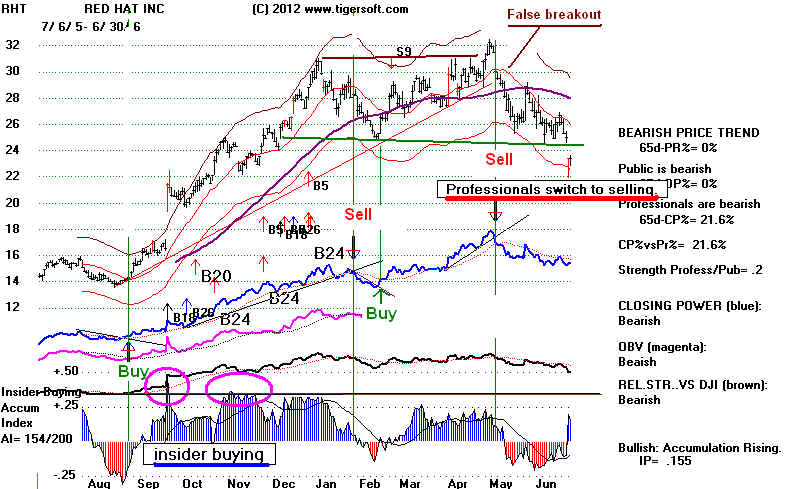

"Matthew J. Szulik, chairman and CEO of software co. Red Hat Inc.,

"Matthew J. Szulik, chairman and CEO of software co. Red Hat Inc.,

appears to have had similarly good timing. After the stock nearly tripled in 2005,

he began

selling shares through a plan on Jan. 5, 2006, with sales of 1 million shares for

$24 million.

From late January to June, he sold roughly 1 million more shares for $28 million. The

stock

hit 32 in May. But weaker-than-expected results in the June and September quarters

sent the

stock tumbling, to around 16. Red Hat declined to comment."

Watch if the Professionals change their stance on the stock.

TigerSoft's Closing Power

will tell you what the Pros are doing with their own money, rather than what they may

simply be saying for effect. Compare the chart below with the chart for RHT in the

year earlier, the second one. See the rising Closing Power and the very high blue

Accumulation on the rally from 14 to 30.

RHT - 6 months earler showed high accumulation.

Following the lead of the Professionals

with the TigerSoft Closing Power made trading here very safe. Usually, we see more

red

Distribution from our Accumulation Index at the top. Institutions, judging from the

mostly positive Accumulation Index, remained mostly holders here. The Professionals

were proven correct by the continuing weakness of the stock. . I

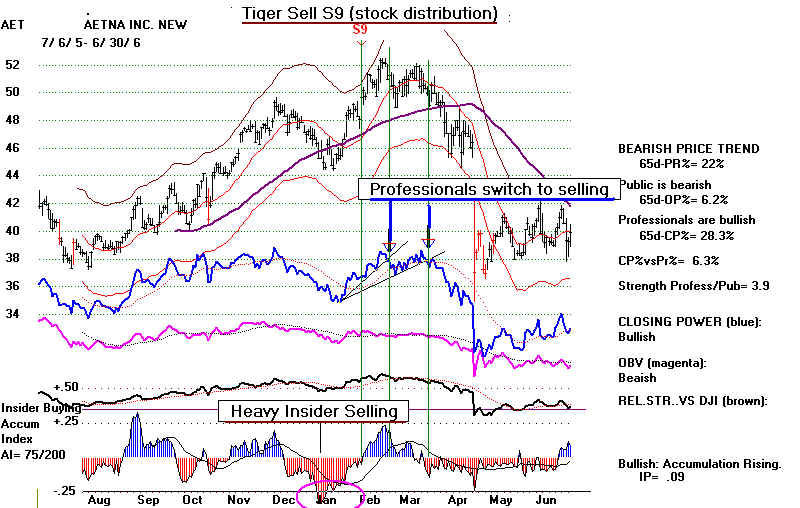

"Take the

slew of trades made by executives at health insurer Aetna Inc.

"Take the

slew of trades made by executives at health insurer Aetna Inc.

(AET) earlier this year. From early October to mid-November, 2005, three execs set up

plans through

which they sold shares during the month of February, 2006. As the stock peaked above

50--up

from 10 three years earlier--Chief Financial Officer Alan M. Bennett

sold 233,333 shares worth

$14.2 million, Senior Vice-President Craig R. Callen cashed out for $3 million, and

John W. Rowe, who retired as CEO that month but remained executive chairman through

September, sold shares for $44 million. The stock peaked on Feb. 23. Some

analysts began

raising questions about whether Aetna had priced its policies too aggressively the

previous fall.

Those fears appeared to be confirmed in April when results for the March quarter showed

that Aetna was spending a higher portion of its premiums providing care than it had a year

earlier.

The stock lost 20% in one trading day. In July, when second-quarter numbers showed things

getting worse, shares fell 17% in a day. An Aetna spokesman says selling was part of their

"systematic planning" for retirement and other things"

That several executives were selling is significant. It strongly suggests they were

selling

not for personal reasons, but because they knew the stock had beccame very

vulnerable.

Wall Street professionals saw this selling and became net sellers soon aftwards.

"In late April, for example, after a 10-month run in which shares of Memphis-based

"In late April, for example, after a 10-month run in which shares of Memphis-based

electrical manufacturer Thomas & Betts Corp. (TWB)) doubled, to

almost 60,

two top officials began selling shares. Over the next six weeks, CEO Dominic J. Pileggi

sold $7

million worth of stock, while CFO Kenneth W. Fluke sold $6 million worth over five weeks.

In June, as the company's growth slowed, the stock fell below 50; a month later it was

down to 45.

Thomas & Betts declined to comment other than to say the plans were set up in

mid-March.

"Broadcom Corp. (BRCM) CEO Scott A. McGregor sold shares

from May, 2005,

"Broadcom Corp. (BRCM) CEO Scott A. McGregor sold shares

from May, 2005,

through March of ...(2006). But while his automatic sales in 2005 averaged 2,750 shares a

month for

around $110,000, in January his trading went into overdrive. From Jan. 3 to Mar. 2 he sold

some

350,000 shares for almost $19 million. Many of those sales came as the stock surged toward

46

on Jan. 27 on better-than-expected performance. After analysts slashed their earnings

estimates in

April, the stock began a three-month slide, to around 22. While the stock was also hurt by

probes

into Broadcom's stock options practices, in July it also said third-quarter growth would

fall well below

forecasts. Broadcom did not respond to repeated requests for comment."

Professionals must have noticed CEO McGregor's big increase

in selling, because soon afterwards

they became net sellers.

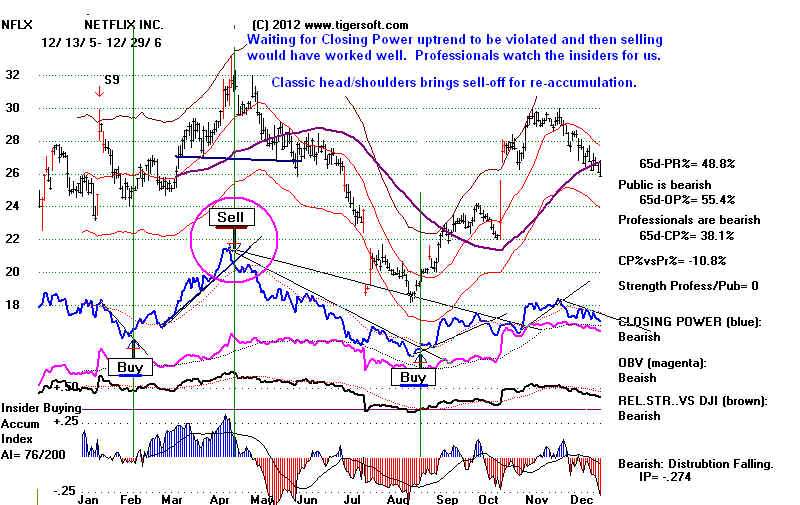

"Netflix

Inc. (NFLX)) CFO Barry W. McCarthy Jr. sold 4,000 shares a week

"Netflix

Inc. (NFLX)) CFO Barry W. McCarthy Jr. sold 4,000 shares a week

from November, 2005, to July, 2006. But on Apr. 19--less than a week before the stock

peaked

at 31--McCarthy sold an additional 40,000 shares for $1.2 million."

If

you study market history, as much we have since 1981, you will

see that our Tiger Accumulation Index measures of insider buying is

much more effective in predicting stock behavior than watching the

published reports of "insider" trading, as the US Securities and

Exchange Commission now defines it. And it works with overseas

stocks, too, for which there are no published reports of insider

buying and selling. It works so well because it measures all

"insider buying", not just that which is reported to the SEC.

In 1973, I produced the calculations for the Accumulation Index on a number

of stocks. They were all so bearish that I thought I had made a

mathematical mistake in the formula. I had not. It was the start of

the 1973-1974 bear market. True story.

The TIgerSoft Accumulation Index is one of several technical

tools for stock market analysis we have invented. Another is

our Professional versus Public Buying

and Selling concept.

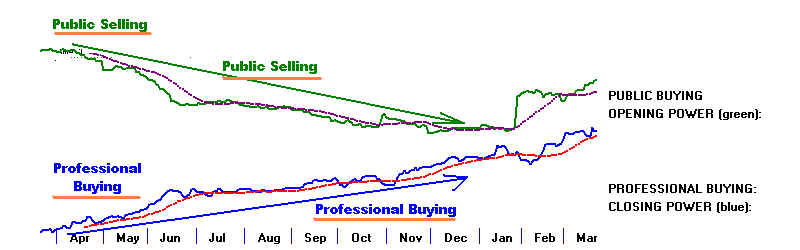

Most 2009 TigerSoft stock charts show the same bullish divergence

at the start of long advance: the Tiger Public Buying shows

heavy selling and skepticism while Professionals are very aggressively

Buying. See how the Public distrusted AAPL's early rise while

Professionals bought aggressively.

These indicators produce Tiger's automatic Buys and Sells.

They have been extensively back-tested back to 1979, even earlier.

With TigerSoft it is to easy to spot insider Stock Buying and

Insider Selling.

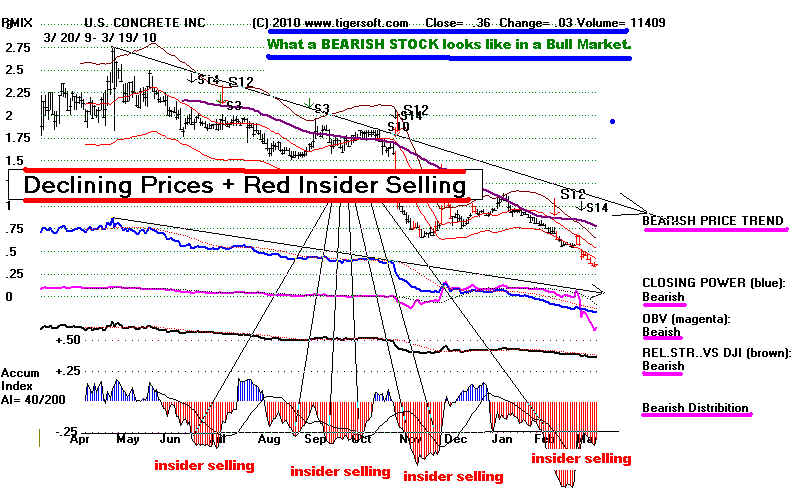

Imagine the

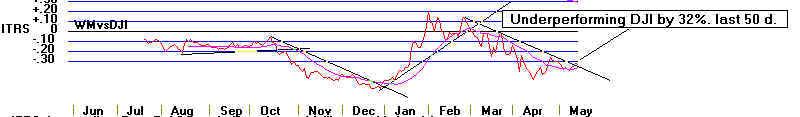

disappointment felt by those holding a declining

stock in the wonderful rally of 2009. Look at the chart below.

See how TigerSoft picks up on this stock's extreme bearishness

in

two important and unique ways, besides price trend.

1) The first is the way the Tiger Accumulation Index

frequently

dips below -.25 in red territory and thereby confirms the

falling price trend.

2) The second key warning for us is that Professionals were

selling

and it was the Public that was Buying. See at the

bottom of the chart how

the two lines representing these two perspectives diverge. Public buying

from Professionals is a loud siren.

A

daily TigerSoft chart below shows a year's price fluctuations

Most important is what the internal strength TigerSoft

indicators

at the chart's bottom shows. Most important are Extreme

Bulges

in the Tiger Accumulation Index. They show insider buying.

These bulges very often occur months before big price advances.

Insiders are buying because they are anticipating very good news in

the stock. It is that

good news which makes the stock rise. Very often

the Public does not believe

the early rally. But, typically, at some point, the

Public becomes a believer in the

stock. That is not immediately

bearish/ In fact, the

biggest gains take place in the later stages of

stock's long advance very often come when both the Public and the

Professionals buy the stock. This may create a buying climax, or

it may just bring the stock up to a much higher price plateau.

It is

worth noting that this "acceleration-up" bullish condition is one

our Tiger Ranker's best flags. It allows traders to make the big gains

in the shortest period of time.

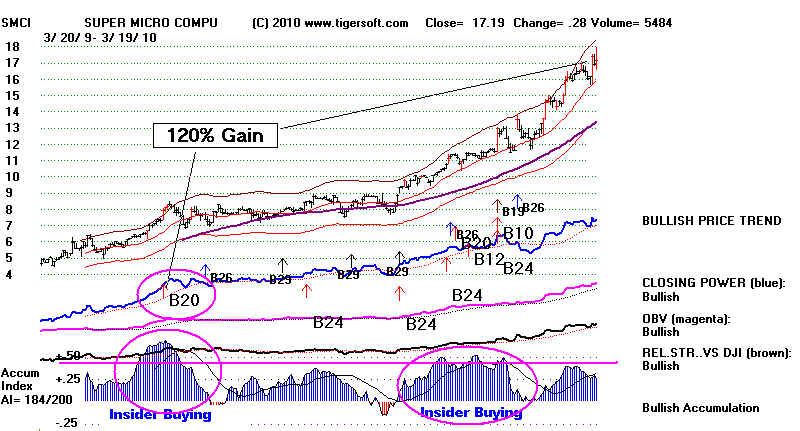

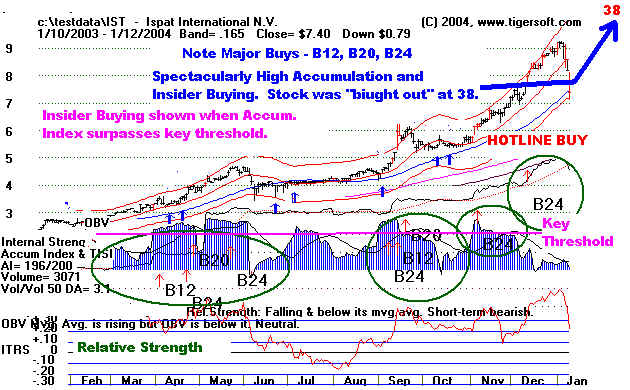

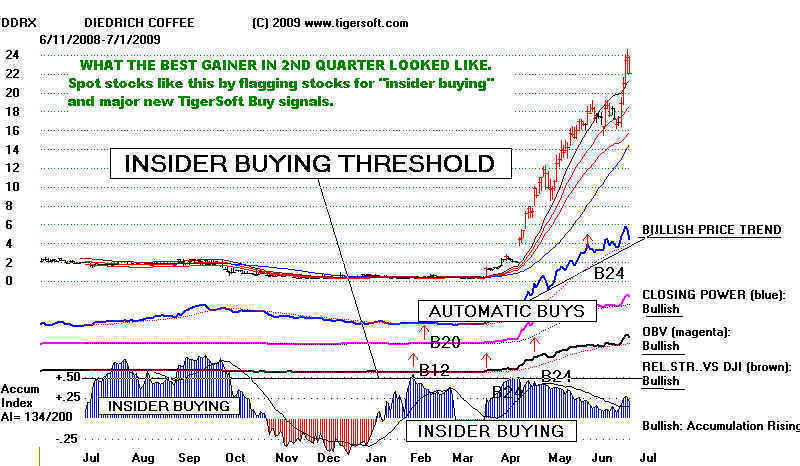

Below are some

Bullish examples of intense insider buying,

Public skepticism, Professional Buying and

late-stage Public

buying. The bulges of Blue Accumulation produce

red Buys.

Automatic Buy arrows

appear when the bulges and Professional

buying are considered very significant. The Buy B12, B20 and B24

signals show when TigerSoft users should buy the stock. Tiger

users may or may not know anything about the company. All they

need to know is that insiders and professionals are buying and that

TigerSoft has back-tested this method of

trading extensively,

as far back as 1928.

SCSS (below) is a another recent example. Click on CNAM, CYT, DTG,

EZPW, NENG, PCYC, SANM and WAVX to see some others. In

each case, notice

how the bulge of insider buying and TigerSoft automatic Buys soon afterwards

brought very profitable rallies.

It's true: these are smaller, less well know companies. That's where

the most opportunity has usually been. Bigger capitalization stocks

show the same characteristics. Mostly they don't move up as much.

Our website has hundreds of examples of the importance of looking for

these bulges of insider buying and watching what Professionals, not the

Public, is doing with its money, in all types of stocks, commodities and ETFs.

USE TIGERSOFT - TRADE LIKE AN INSIDER

So, now you see that you CAN Trade The Stock Market

like An Insider. The

major difference is that with TigerSoft

you can do it legally.

Insiders invariably trade at a huge advantage. Many know exactly

what the news will be for their company. Many trade illegally,

because the SEC is ineffective and serves mainly to make

individual stock investors think the playing field is level.

Below is a recent typical Tiger

pick. Study the TigerSoft chart.

See how it showed bulges of key insider buying and was a Buy

when the automatic Buy Signals appeared.

TURN INSIDER TRADING TO YOUR ADVANTAGE

BUY WHAT INSIDERS ARE BUYING

SELL WHEN INSIDERS ARE SELLING

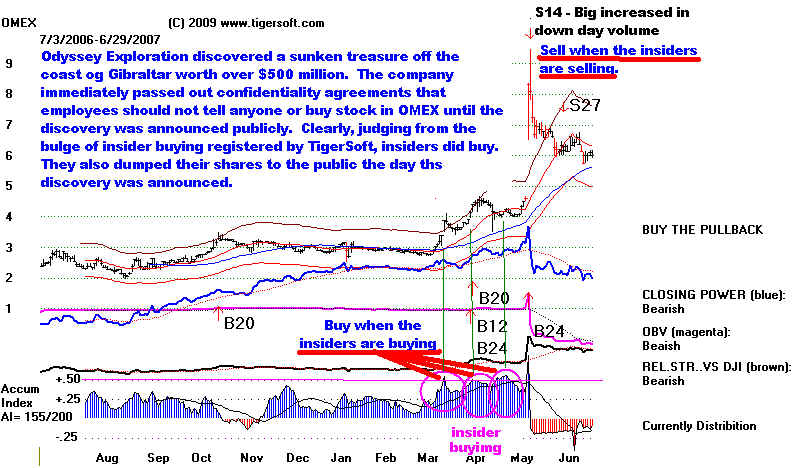

Odyssey Exploration - 2007 - is just one example

among thousands.

Someone always knows first. And,

most likely, he tells his wife or

someone else as part of a mutual

"back-scratching" business arrangement.

When an insider buys a lot of the stock in the

exploration company

he works for, his stock broker will usually

take notice and starts buying,

too. I would say such cases show

that it is nearly impossible to prevent

serious insider buying, even when the

company takes every step it can

to prevent it, as Odyssey in the example below

appears to have done.

Discovery

of The Black Swan - Discovery Channel

Odyssey Exploration, a publicly traded company in

Tampa,

discovered more than a half a billion dollars worth of Gold

and Silver in a 400-year old sunken treasure ship in the

Spring of 2007. The key oceanographer, Ernie Tapanes, who

made the actual discovery then bought more than 42,000 shares

of the company's stock before the company released the

information to the public.

I would say that judging from the jump in trading activity in the

stock at this time (See below), the oceanographer did not keep

the secret very well, even even though he and other Odyssey

employees had been advised by the company, that such

purchases would be illegal insider trading. Odyssey employees

were at the time required by the company to sign non-disclosure

pledges and a statement that they would not buy the stock until the

public announcement.

Tapanes was not the only eager new buyer in the last

two months of the chart below, when the stock rose 50% and

right before the public announcement of the discovery. Other insiders,

as TigerSoft defines them, who did not even work for the

company, were very likely pushing the stock up. The term "insiders"

refers to anyone privy to material non-public knowledge about the

company's prospects, not simply the CEO, officers of the company

or Board members who are legally required to report transactions in

the company's stock. The nested Tigersoft "B12", "B20" and

"B24"

signals register such trading and are our alerts. (For more

information about what is legally defined as "insider trading"

and TigerSoft's working definition of it for trading purposes, please

see - http://www.tigersoft.com/Insiders/index.html

)

Keeping A Secret like This Is Next To Impossible.

We will never know with any certainty who these other buyers were

and why they bought Odyssey at this time. Did Tapanes tell his wife

why he was buying 42,000 shares of stock? Did she tell others?

Did he or she call home to Canada or Cuba and tell anyone? I believe

it's more likely he told others. Who could keep a secret like this?

Tapanes, after all, was the one who found the treasure. Most people

in this situation would be bursting to tell of their life's dream come true.

Nevertheless, the law required him to tell no one. Once he started

working for a publicly traded company, he had fiduciary responsibilities

to the company's shareholders.

Did the brokers who took the unusual order to buy shares in the

exploration company by the lead explorer there, take note and buy

shares themselves? My experience with stock brokers suggests

they probably did. That's how they make a living! Did they tell

others? Again, that's how they make a living.

Motivations are always hard to disentangle. They are even harder

to prove. To further confuse the issue of why OMEX rose 50% in

the two months before the public announcement of the discovery,

we must mention that in March 2007, the Spanish government finally

consented to the company's excavation of the previously discovered

British ship, the Sussex. Spain had blocked this for 14 months.

(Source.)

What's more, the DJIA rose 10% from March to May 2007.

Our Recommendation To Buy

All we know for sure is that TigerSoft recommended buying

Odyssey at 4.24 on our Stocks' Hotline and Elite Stock Professional

(ESP) service two weeks before the company announced the

discovery of the "Black Swan". Here is an email I got at the

time:

May 18th, 2007

"Bill,

Just wanted you to know you made me a lot of money today...

OMR (now OMEX) entered my watch lists after showing up in the Elite report...

Not a bad day, up about $60,000 in a single stock. Without Tiger

I never would have found this...

Thanks, JS"

Odyssey Exploration's Stock

Prices

Just before The Accouncement

of The Discovery of The Black Swan

in May 2007

Announcement about The Treasure's Discovery

Not surprisingly, when the discovery was made public the stock

immediately doubled, at which point the the oceanographer

promptly sold his shares. The stock soon collapsed as Spain

challenged the company's right to "their" gold and short-sellers

ganged up on the stock, figuring that all the good news was

now out and most people who had been interested in buying the

stock aggressively would have already done so... Our Accumulation

Index quickly turned negative. This can occur when professional

short sellers take control of the stock. In other cases, it means

insiders are selling the

stock.

Below is the TigerSoft chart of Odyssey back then. Note that we

define bulges of our TigerSoft Accumulation Index above +.50 to be

"insider buying". The legal definition of "insider trading" is

not

practical for trading purposes. "Insider" trade reporting as required

by the SEC is quite limited in scope, applying mostly to the officers

of a company.

Odyssey Exploration - 2006-2007

The SEC's Reaction

Even the SEC admitted this was an egregious case of insider trading.

The toothless Bush SEC did not seek a criminal prosecution. It did not

require Tapanes to say under oath who else he had informed,

outside the company. Instead, Tapanes relinquished his profit

and paid an additional $107,000 fine. The SEC has said that no other

Odyssey employees were under suspicion of insider trading.

The St. Petersburg Times wrote: "Odyssey executives distanced

themselves from Tapanes on Thursday. In a written statement, the

treasure-hunting company identified him as "one of many independent

consultants" and "not a direct employee." But published accounts

show that the quiet, cigar-smoking Tapanes has been an integral part

of the company's success."

(Source: http://www.sptimes.com/2008/01/18/Business/Illegal_insider_tradi.shtml )

There are two morals here: (1) Heed the classic adage:

"Buy on the rumor and sell on the news." (2) Use TigerSoft.

The SEC is there to only give the appearance of a level playing field.

We at TigerSoft were not privy to the rumor; yet we recommended

buying Odyssey at 4.25 two weeks before it doubled, simply

because of the bulge of insider buying that the TigerSoft charts

showed. ( On July 15, 2009 the SEC charged six Odyssey

insiders with insider trading.)

If you study market history, as much we have since 1981, you will see

that our Accumulation Index measures of insider buying is much

more effective in predicting stock behavior than watching the

published reports of "insider" trading, as the US Securities and

Exchange Commission now defines it. And it works with overseas

stocks, too, for which there are no published reports of insider

buying and selling. The TIgerSoft Accumulation Index is one of

several technical tools for stock market analysis we have invented

and extensively back-tested that is truly indispensible to someone

seriously seeking consistent stock profits.

The battle for investment Survival Just Got

A Lot Easier with TigerSoft..

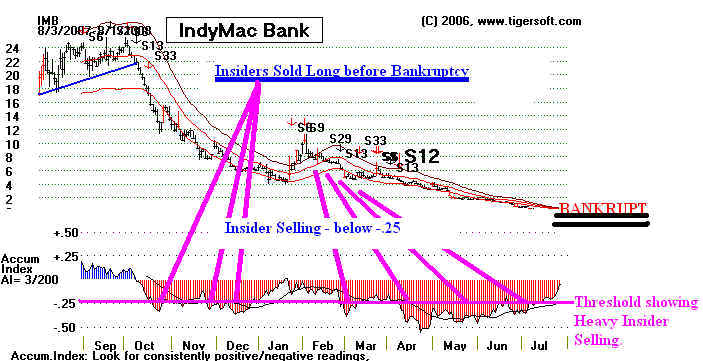

Insider Selling Is Rampant before A Bankruptcy or Steep Stock Decline.

Examples:

WAMU, CITIGROUP, BANK OF AMERICA, NORTHERN ROCK,

CHINESE STOCKS, INDY BANK, GENERAL MOTORS...

How Does TigerSoft Spot Insider Selling?

Deeply Negative (red) Accumulation and False Rallies.

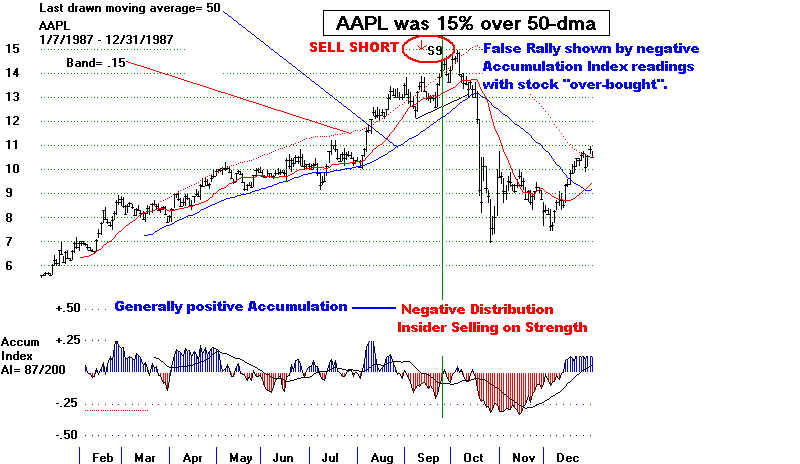

Example: Apple Computer's stock

dropped 50% in three weeks in 1987.

TigerSoft spotted it and warned customers of an impending

general market collapse. The method for spotting its top

has worked in calling general market and stoock tops

since 1929, as you will see below. The TigerSoft "S9"

on APPLE was very bearish, given how far up the stock was.

AAPLE - 1987 Top

What Identifies An Explosive Super Stock BEFORE It Doubles or Triples?

Lengthy periods of Positive (blue) Accumulation and

Intense Bulges of Accumulation and New Price Highs

Many examples - see AMGN, IST, KIRK, DDRX etc...below

Our trading strategy is simple.

First, know if the general

market is safe

or dangerous, by using Peerless Stock

Market Timing.

See Peerless Stock Market Timing:

1915-2009,

Secondly,

know whether Insiders and

Professionals Are Buying or Selling Your

Stocks.

Please read on for

more exmples.....

With TigerSoft it is to easy to spot early-on insider Buying and

Insider Buying

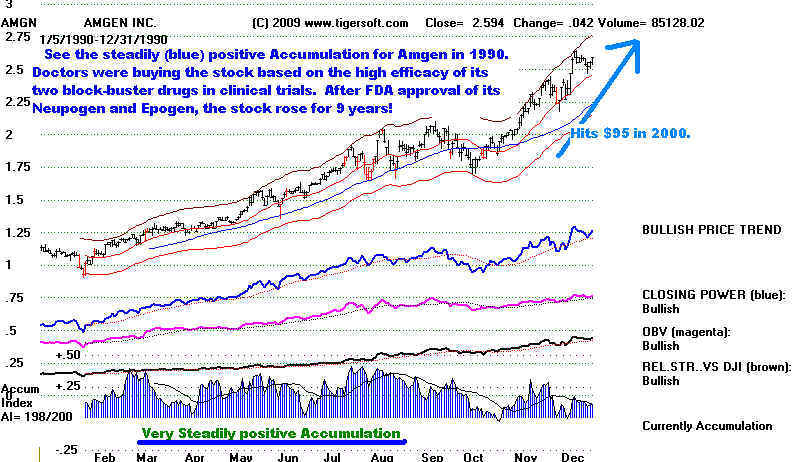

Steadily (blue) Accumulation means heavy institutional buying.

Example: AMGN 1990 -

hit $95 in 2000.

More information - Tiger's Power Ranker

If there are bulges of (blue) Accumulation above +.50 and prices

rise afterwards, consider savvy insiders themselves to be buying.

Use next automatic TigerSoft Buy then

and hold until (blue) 50-day

mvg.avg, is violated.

KIRK in 2009 is now 14.24, up 300% in 4 months!

There are many more like this in the stealthy 2009 Bull

Market.

Example: Take-Over target - IST rise from 9 to 38 in a year,

Insider Selling

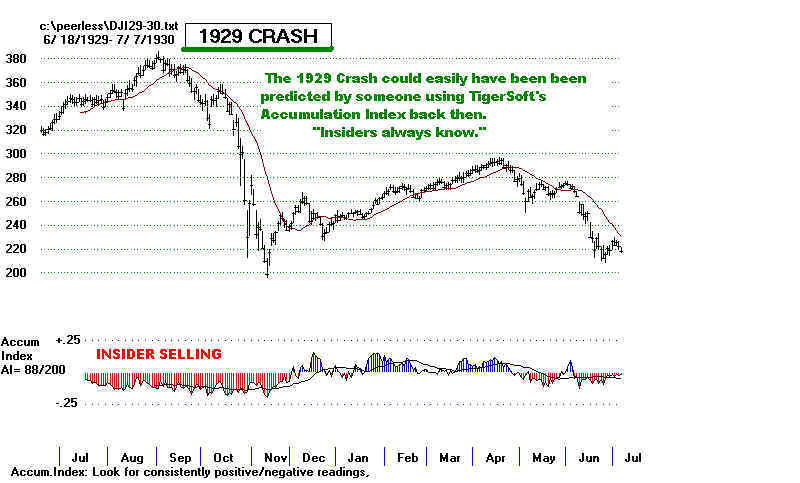

If the the Accumulation Index becomes steadily (red) negative

and drops below -.25, consider insider selling to be taking place.

Examples:

Dow Jones Industrial Avg, in 1929

False rallies showing (red) negative distribution

bring major severe market declines and bear markets.

See the false rally tops in the DJI

charts of 1966,1972, 1987,

2000 and 2007 at the bottom of this page.

Peerless Stock Market Timing:

1915-2009 shows them all.

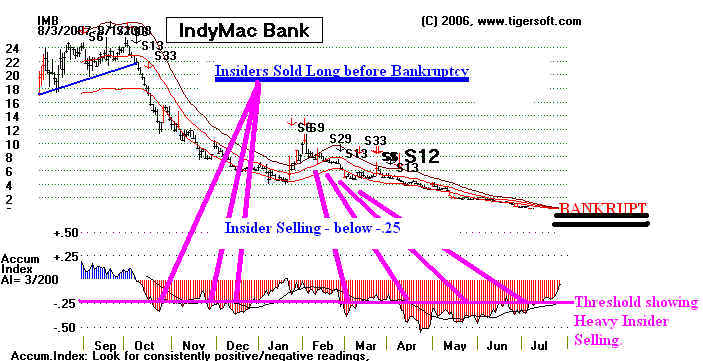

Insiders knew BANKRUPTCY was coming to INDY-MAC!

WASHINGTON MUTUAL: 2007-2008 Go To ZERO!

TigerSoft

warned it would go bankrupt in 2007 after seeing

how

extensive the insider selling was, specifically by its CEO.

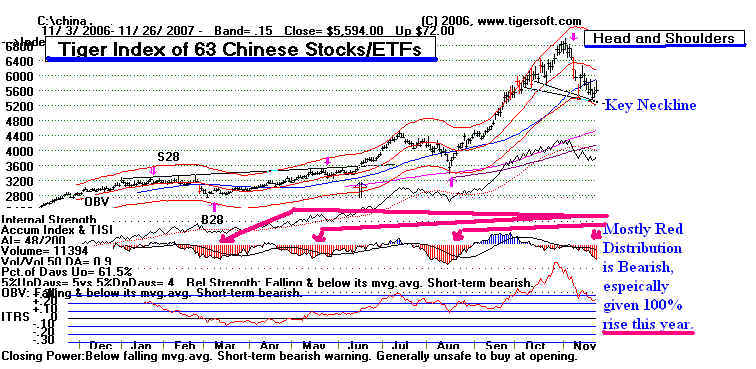

Chinese Stock Index in November 2007.

Our TigerSoft

predicted a Crash for Chinese stocks

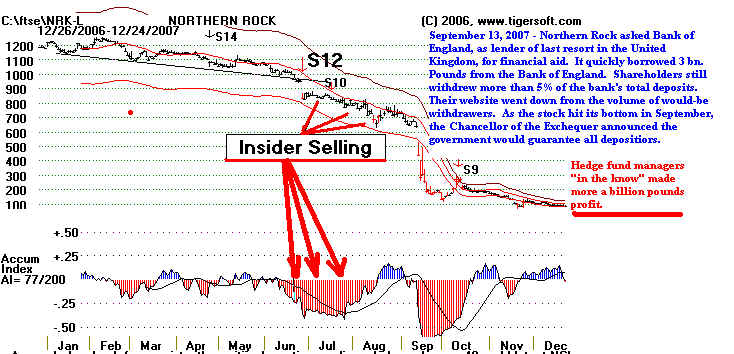

Insider Selling in England

British Northern Rock Debacle Made

Insiders A Billion Pounds

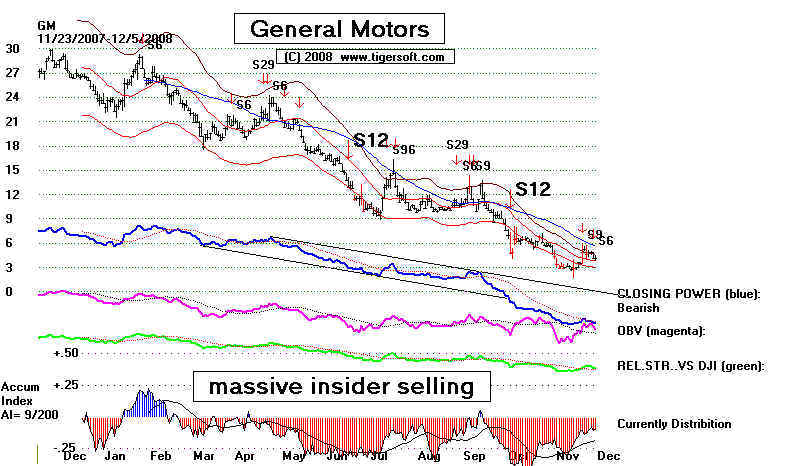

General Motors

So, trading and investing need not be difficult or dangerous.

TigerSoft, you will see, is Easy, Reliable, Fairly

Priced

And Is Backed up with Friendly Support and Rich

Historical Documentation from All Market Eras. We provide

data and a nightly hotline, so that you can "earn while

you learn" what we show you based on 28 years of

intensive studies of the financial markets.

(C) 2010 www.tigersoft.com

Since 1981, we have been helping investors and traders gain in

the stock market by showing them how to spot insider buying and

insider selling, using TigerSoft's Accumulation Index, Tiger's Closing Power

and Peerless Stock Market Timing: 1915-2010. Without such tools,

trading losses are a high risk in markets like we have just seen.

|

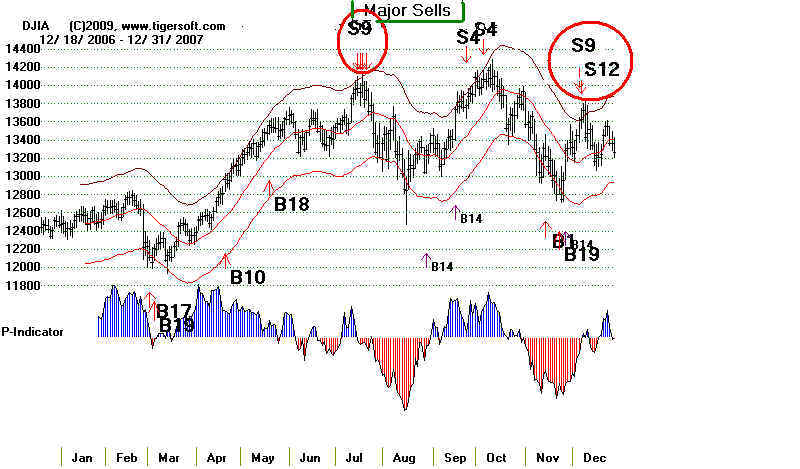

"CALLING ALL TOPS" - SAFETY IS THE FIRST PRIORITY The 2003-2007 bull market ended with multiple sets of major sells and a key support failure, This we show elsewhere is exactly how all other bull markets have ended since 1928. That year's data is the earliest there is for producing all the automatic Buys and Sells on our Peerless Stock Market Timing, 2007 - MARKET TOP  |

We offer:

Stock/Commodity Charting and Analytical Software.

Many Years of Back-Testing To Maximize Performance.

Unique Tiger's Trend and Insider Trading Analysis

A Nightly On-Line Hotline

Automatic Nightly Data Feed.

Our Software and Services Feature:

--- Unique Tools To Spot Key

Insider Buying and Selling.

--- Trading / Investing Software - Simple To

Use.

--- Make Your Retirement Account Safer

--- Buy The Best Stocks, When The Market Environment

Is Safe.

--- Time-Tested Automatic Buy and Sell Signals.

Plus

--- The World's Best Technical Support.

--- Monthly San Diego TigerSoft User

Meetings.

=====================================================================================

PROFITS ARE EASY - WHEN YOU'RE AN INSIDER

OR WHEN YOU USE TIGERSOFT!

TigerSoft will show you how to

make Goldman Sachs pay!

Goldman

Sachs Is "The GREED CONNECTION" between Wall Street and Washington

http://www.tigersoftware.com/TigerBlogs/April-7-2009/index.html

Paulson

Takes Corruption and Cronyism To Dizzying New Highs.

http://www.tigersoft.com/Tiger-Blogs/September19-2008/index.html

Goldman Sachs has its people everywhere in

government.

Small wonder it

is the most profitable, glorified Wall Street

hedge-fund,

masquerading as a commercial bank so that

it can get access

to cheap money at the Federal Reserve.

The CEOs at these companies have little shame.

So, don't

be surprised when

they try to steal your money, if you

don't have

TigerSoft to tell you the score and show you

how the game is

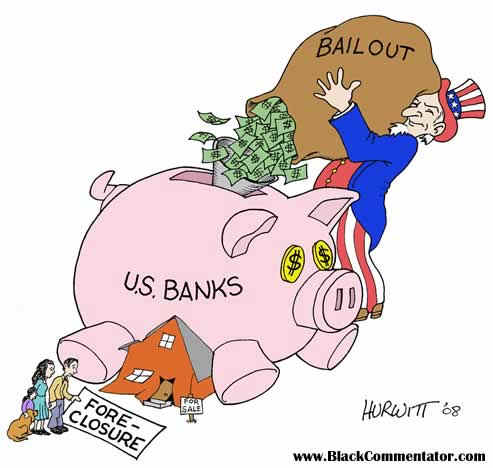

being played. Example: last September,

Henry Paulson,

Bush's Treasury Secretary - who had

previously been

Goldman's CEO, arranged a taxpayer gift

of $12.9 BILLION

for Goldman when he bailed out AIG.

If AIG - the big

insurance company - had been allowed to fail,

as Goldman's

rivals - Bear Stearns and Lehman Brothers -

did,

Goldman would be probably have gone broke or

have become just

another $10 has-been stock!

But Goldman had

been slipping protection money to Paulson,

now worth 1/2 Billion,

in the form of years of huge bonuses.

And now - what a

surprise! - we discover that Obama's

biggest campaign

contributor was none other than Goldman

Sachs. Not for

nothing as a result - but for a million dollars

up-front, Obama has

publicly declared that Wall Street had

done nothing criminally

wrong or fraudulent in bringing on

the 2007-2008 World

Financial Collapse. This Obama assures

us, while refusing to

order a full-blown investigation of

the facts behind the

Crash before prejudging Goldman's

innocence!

http://www.tigersoft.com/Tiger-Blogs/September19-2008/index.html

Goldman's TigerSoft Chart show how bullish a stock can

look

when the companies'

insiders know it is fully backed and

financed by the US

Government. The public thought Obama

would reform Wall

Street! Insiders at Goldman knew he

was their ally, protector

and benefactor!

TIGERSOFT CHART of GOLDMAN SACHS

In our opinion,

far too many CEOs are over-paid criminals.

They add insult to injury by then selling

millions of

dollars worth of their companies' shares at

the top

and buy them back at the bottom.

Too harsh? Who but a crook would take 1/2

Billion from

a company's shareholders and customers

and then sell out

his shares at the top, six months before the

company goes

bankrupt, for all practical

purposes?

With TigerSoft, we can see this insider

selling, as it is taking

place. We could even sell short

these shares and make

"killer short sale profits."

===============================================================

The soon-to-be criminal case of Anthony Mozilla,

ex-CEO of Countrywide Financial.

June 5, 2009 - Countrywide's Mozilo

charged with fraud, insider trading by SEC

Don't expect CNBC to tell you to sell.

CNBC's Jim Cramer urged his viewers in 2007 NOT to sell Countrywide.

February 7, 2007 - http://www.thestreet.com/story/10337828/jim-cramers-stop-trading-buy-countrywide.html

August 16, 2007 - http://www.thestreet.com/story/10374792/jim-cramers-stop-trading-dont-sell-countrywide.html

TigerSoft's Blog on August 2, 2007

showed folks how to find the best stocks like Countrywide to go short.

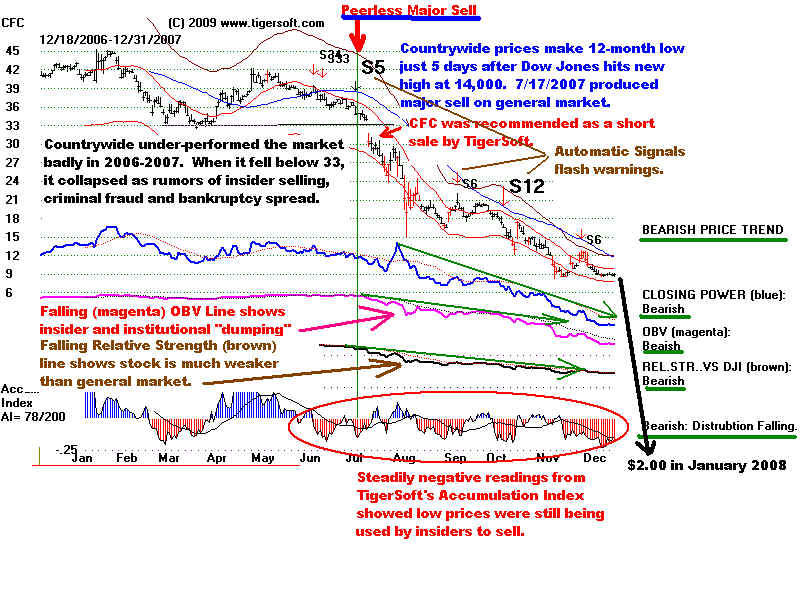

TIGERSOFT CHART of COUNTRYSIDE

FINANCIAL, 2007

SO MANY EXAMPLES OF INSIDER TRADING.

Insider selling before the collapse of a stock

is rampant.

Investors and traders need TigerSoft for their

own protection.

Here are some TigerSoft links showing insider

selling, heavy

(red) Distribution from TigerSoft and

subsequent price

collapses in shares:

Washington

Mutual - ex-CEO Killinger

CitiGroup - Board

member, ex-Goldman CEO,

US Treasury

Secretary under Clinton - Robert Rubin

Bank of America - Ken Lewis

Ryland Group - Dreier Chad

Donald Trump

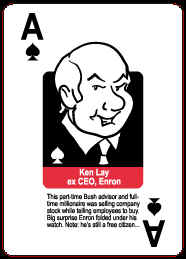

Here

are the three greediest of the greedy - CEOs who

defrauded shareholders and committed insider trading and

stock

manipulation. thestackeddeck.com's

This was

prepared before Goldman Sachs took the stage in 2007-2009,

Ken

Lay of Enron CEO

Card

Caption:

This part-time Bush advisor and full-time millionaire was

selling company stock while telling employees to buy. Big surprise Enron folded

under his watch. He happily drove up energy prices in 2001 by manipulating

the energy futures, causing deadly "brown-outs.".

Dennis

Kozlowski - Tyco CEO

Caption- "A true Tycoon of corporate

malfeasance: tax evasion, grand larceny,

enterprise corruption, falsifying business records, and securities fraud."

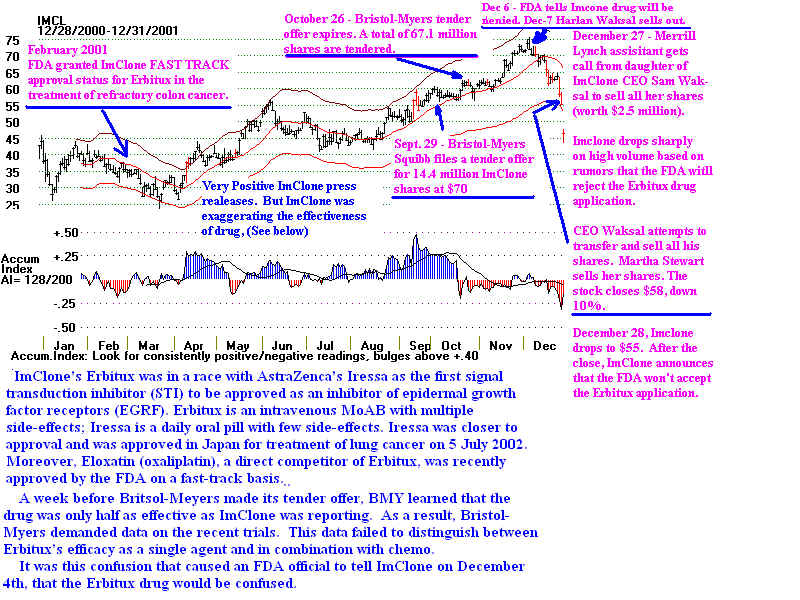

Martha Stewart and

Sam *the weasel)

Martha Stewart and

Sam *the weasel)

Waksaal of Imclone.

What A Stock Looks Like Headed To ZERO!

TIGERSOFT's ACCUMULATION INDEX

and CLOSING POWER ARE THE DIFFERENCE.

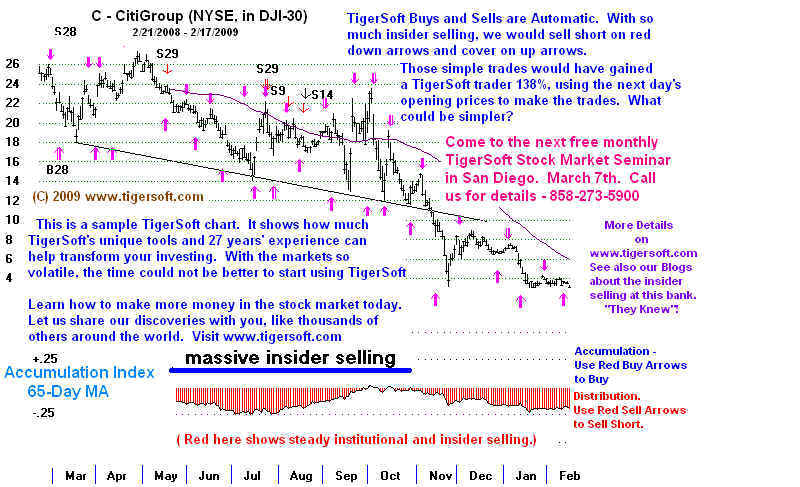

One

more example - CitiGroup. It hit $1.00 a share in March 2009.

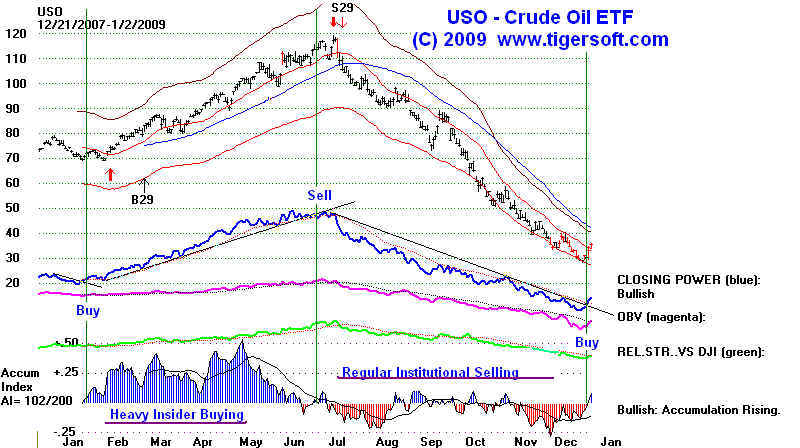

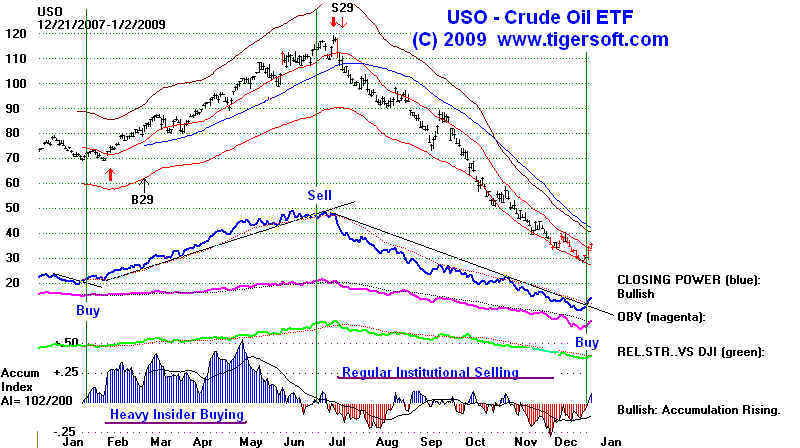

CRUDE

OIL: 2007-2008 Illustrates how quickly the Tiger Accumulation

Index can change from BULLISH ACCUMULATION to BEARISH DISTRIBUTION.

The trend-changes of Tiger'S Closing Power confirmed the trend-change.

Both tools were

invented by TigerSoft and have been back-tested as far

back as 1928.

====================================================================================

INSIDER BUYING IS THE SINGLE BEST

PREDICTOR

OF A FUTURE EXPLOSIVE SUPER STOCK

Bulges of intense

(Blue) Accumulation show insider buying. If the insiders are

savvy and the

general market holds up, prices will soon breakout to new highs

and advance

quickly. Only after prices have already risen a long way will the

good news that

propels them upwards come out. That is when the broad public

usually buys.

We want our people to get in at the beginning of the move. The

early major Buy

signals tell us when to buy. We hold as long as the trend is up,

using the blue

50-day moving average. TigerSoft makes finding such stocks

very easy.

Our Peerless Stock Market Timing tell you when the market is safe.

|

MORE EXAMPLES TO STUDY!