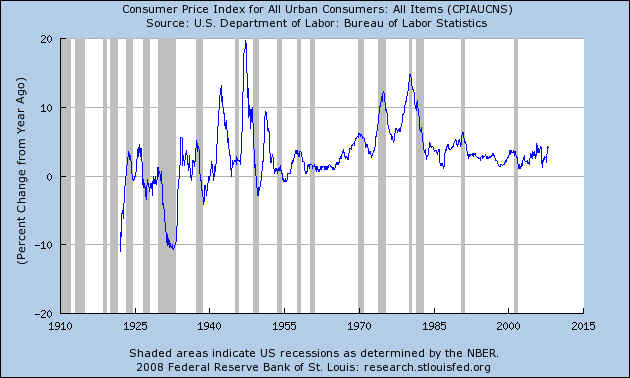

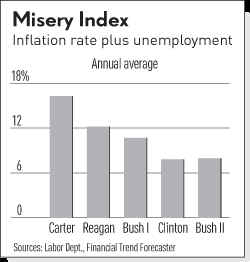

The Limits of Monetary Policy: Is Stagflation Coming?

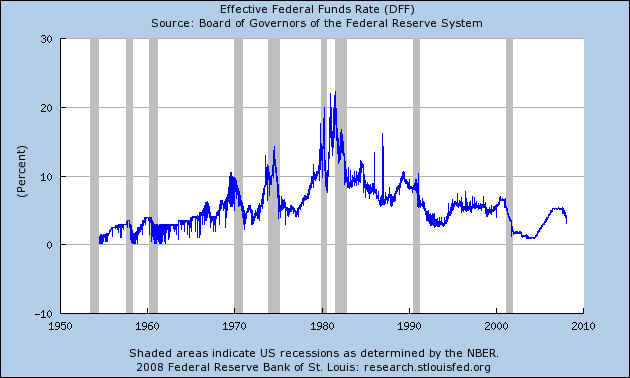

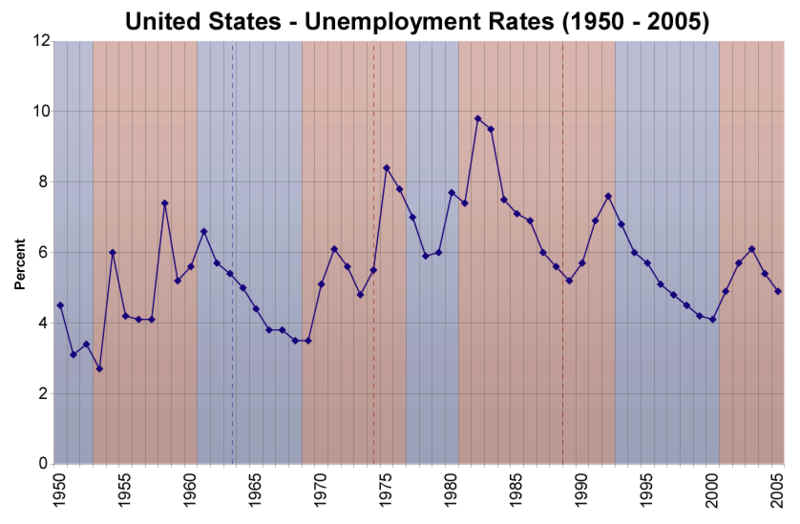

Monetarists like Bernacke are betting that lower interest rates can stimulate

business

and reduce unemployment. The trade-off is that inflation becomes a problem

theoretically if the economy becomes too over-stimulated. "Stagflation" is

a term

describing

the worst of all worlds: high unemployment and rising prices. The term,

is

attributed to Iain MacLeod, the British Chancellor of the Exchequer in 1965.

Stagflation

was a

significant problem in the US in the 1970s. Commodity and fuel prices rose

sharply but

so did unemployment. The cure that was engineered at the time was very

high

interest rates under Paul Volcker's stay as Federal reserve Chairman.

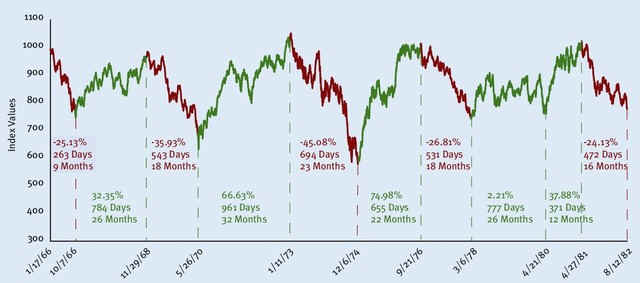

We need to watch carefully now to see if inflation heats up, as it seems to be,

and

unemployment rises, too. That would mean we have re-entered a period of

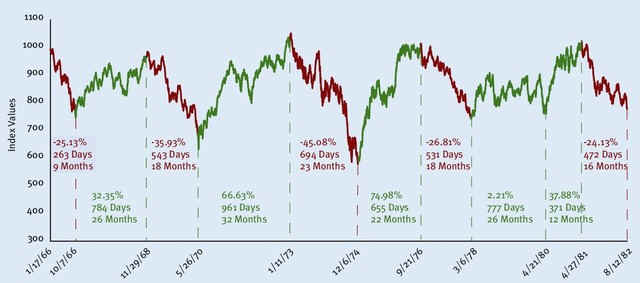

Stagflation. And if this happens, it will dramatically effect the stock

market. We will see

many more

violent swings ups and downs. The 1970s will be re-visited. And there

will be

increasing calls for much higher interest rates.

---------------------------------- DJI - 1966 to 1982

----------------------------------------------------------------

Greenspan, a Monetarist, had to lower rates 13 times and drop the Discount

Rate to

3/4% to get the stock market and the economy to recover. The Discount Rate

gives big

commercial banks money more cheaply, but there is no guarantee that

businesses

will borrow more just because money is cheaper. There is no guarantee

the those

same banks will pass along their lower rates. Presently, we see now that

banks have

seriously tightened their lending standards, not loosened them. And there

is no

guarantee that money won't be borrowed in the US to buy government bonds

elsewhere

where interest rates are higher.

To

have a positive impact on the US economy, Greenspan had to drop rates

to less

than 1%. But this much drop spawned a housing bubble and sent the US Dollar

spiraling

down. These have been costly problems. A Keynesian would argue that

public

spending on

American infrastructure should have been undertaken, rather than Iraq's.

This

immediately boosts employment, consumption and GNP. Keynesians would

point out

that Bush's tax cuts would have been more a stimulative if they had

gone to

working class people and not the wealthiest. Average income people spend

nearly 100%

of any tax cut they get while the wealthy save it.

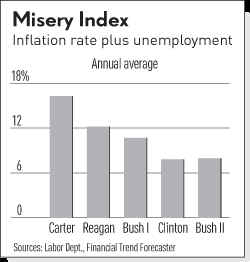

President Jimmy Carter's Biggest Regret

(Source: http://www.ibdeditorials.com/IBDArticles.aspx?id=264727202278115

)

Fed Chairman Paul "Volker dealt with stagflation by dramatically jacking up interest

rates, sending the economy into a tailspin. U.S. companies laid off thousands of workers,

and wages came under serious pressure (precisely the point of interest-rate hikes).Meanwhile,

U.S. policymakers began a campaign to open foreign labor markets to U.S. firms, using high

debt levels in "developing countries" as a lever.

As Southeast Asian and Latin American economies opened to U.S. capital, U.S. companies

began to shift operations overseas to take advantage of cheaper labor. That effect, too,

put serious pressure on U.S. wages.

As U.S. workers lost leverage, the labor movement -- so strong through most of the

post-war era -- went belly-up in the 1980s, and remains on the mat today.

Thus Volker fought inflation by directly attacking wages -- and won.

Meanwhile, oil prices declined steeply after their 1980 peak, also aiding Volker's war

on inflation. (They stayed generally low until the late 1990s, when a jump in demand from

China and India -- source of so many products enjoyed by U.S. consumers -- began to push

oil prices up.)

As wages stagnated and the economy shifted from manufacturing-based to services-based,

the U.S. began to grow briskly again. Stagflation had been

defeated.

Workers got the shaft, but they also won two bonuses: One was cheap oil. The other was

ever-cheaper stuff from Latin America, Southeast Asia, and eventually, China."

(Source: http://gristmill.grist.org/story/2007/9/13/164211/215

)

Volcker's Fed also elicited the strongest political attacks and most wide-spread protests

in the history of the Federal Reserve (unlike any protests experienced since 1922) due to

the effects of the high interest rates on the construction and farming sectors,

culminating in indebted farmers driving their tractors onto C Street and blockading the Eccles

Building.[3

(Source: http://en.wikipedia.org/wiki/Paul_Volcker

)

See - Shull, Bernard. 2005. The Fourth Branch: The Federal Reserve's

Unlikely Rise To Power And Influence. Praeger/Greenwood. |

Fed Chariman Paul Volker, August 1979-August 1987.982

Discount Rate:

Period in Effect

Percent

| 11/22/76 to 08/29/77 |

5.25 |

|

| 08/30/77 to 10/25/77 |

5.75 |

|

| 10/26/77 to 01/09/78 |

6.00 |

|

| 01/10/78 to 05/10/78 |

6.50 |

|

| 05/11/78 to 07/02/78 |

7.00 |

|

| 07/03/78 to 08/20/78 |

7.25 |

|

| 08/21/78 to 09/21/78 |

7.75 |

|

| 09/22/78 to 10/15/78 |

8.00 |

|

| 10/16/78 to 10/31/78 |

8.50 |

|

| 11/01/78 to 07/19/79 |

9.50 |

|

| 07/20/79 to 08/16/79 |

10.00 |

|

| 08/17/79 to 09/18/79 |

10.50 |

|

| 09/19/79 to 10/07/79 |

11.00 |

|

| 10/08/79 to 02/14/80 |

12.00 |

|

| 02/15/80 to 03/16/80 |

13.00 |

|

| 03/17/80 to 05/06/80 |

13.00 |

|

| 05/07/80 to 05/28/80 |

13.00 |

|

| 05/29/80 to 06/12/80 |

12.00 |

|

| 06/13/80 to 07/27/80 |

11.00 |

|

| 07/28/80 to 09/25/80 |

10.00 |

|

| 09/26/80 to 11/16/80 |

11.00 |

|

| 11/17/80 to 12/04/80 |

12.00 |

|

| 12/05/80 to 05/04/81 |

13.00 |

|

| 05/05/81 to 09/21/81 |

14.00 |

|

| 09/22/81 to 10/12/81 |

14.00 |

|

| 10/13/81 to 11/01/81 |

14.00 |

|

| 11/02/81 to 11/16/81 |

13.00 |

|

| 11/17/81 to 12/03/81 |

13.00 |

|

| 12/04/81 to 07/20/82 |

12.00 |

|

|

If Bernacke's super aggressive cutting of interest rates can turn the stock market

and the

economy back up, thereby avoiding a bear market and a recession, lots of Central

Bankers

around the world will follow the lessons he is offering. But if the US Dollar tanks

and

Commodity prices rise very rapidly, causing a sharp rise in inflation at a time of

high

unemployment, then his experiment - and that's what it is - will have failed.

The decline in the dollar has been hastened by the cut in interest rates. Hot

money moves

around the globe in search of the highest return, The Dollar has fallen

about 6%

since last August's rate cut. Imports cost that much more. The Dollar

remains

on a sell

from TigerSoft. But there may be hope. Crude oil prices have fallen since

reach

$100/bar.

As that is such a big part of consumer inflation in the US, it deserves to be

watched

closely.

------------------------------------- US Dollar Is Falling

at An Annualized 11.2% Rate ----------------------------------

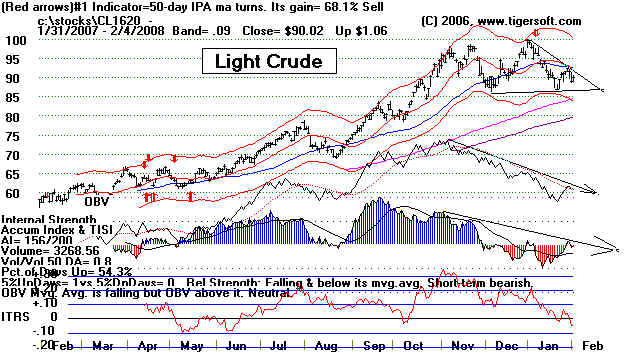

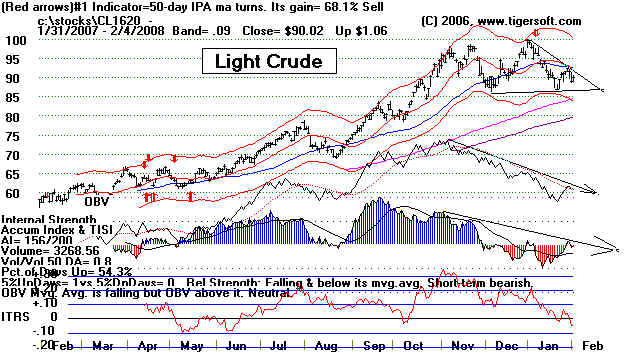

---------------------------------- Crude Oil Shows Weakening Internal Strength Indicators

----------------------

Crude Oil is on a TigerSoft well. Its recent highs were not confirmed by

new highs

also being made with OBV, On-Balance-Volume, a measure of aggressive

buying or

selling. In addition, the Tiger Accumulation Index remains in a downtrend.

So, at this

point, the Fed must be pleased that oil prices seem to have peaked and

OPEC is not

raising oil prices much. Normally, we would worry that a declining

Dollar

invited OPEC to cut production to raise oil prices to make up for the declining

Dollar.

----------------------------------------

Gold Keeps Making New Highs ------------------------------------------

Speculators bet against the US Dollar by buying Gold. In that, they show their

contempt

for "fiat-based currency". And for months, Gold and gold stocks have

have

been a

superb investment. Now there is some subsidence. But it may be just

temporary.

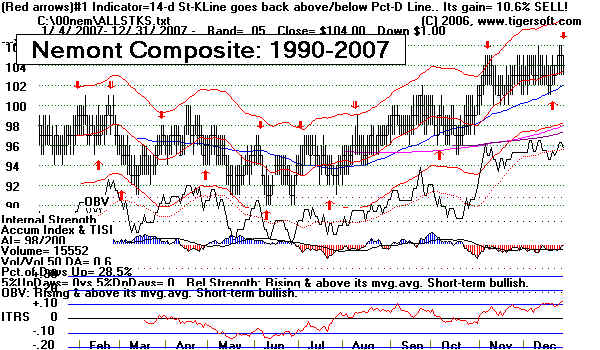

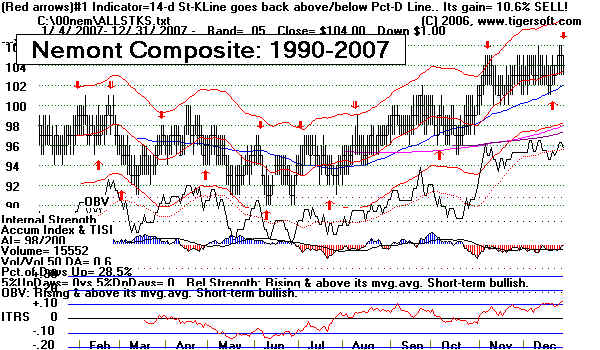

Mid Summer usually is the best time to buy a Gold Stock. Below is the

TigerSoft

composite Seasonality Chart of gold stock NEM from 1990 to 2007.

----------------------------------- GOLD STOCK SEASONALITY CHART

------------------------------------

(Charts like these are constructed for $150 at your request. Contact TigerSoft.)

Watch to see if Gold (below) holds above its black 21-day ma. Just as

$100 acted

as a magnet for

Crude Oil, $1000/ounce gold seems be a logical target.

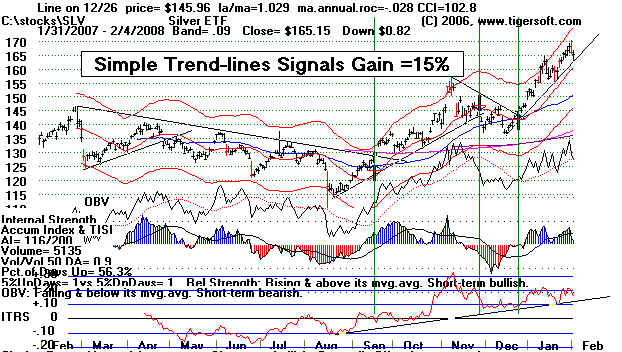

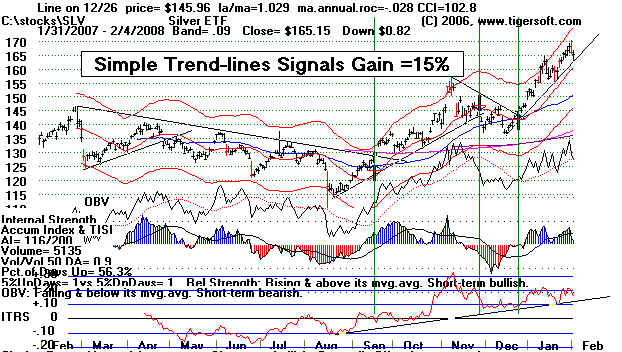

-------------------------------------------- Silver Is Strong, Too.

-------------------------------------------------------

------------------------ Copper - An Industrial Commodity

----------------------------------------------

Copper is used extensively in every major industry.

------------------------- DBB - ETF for Base Metals: Copper, Aluminum and Zinc

-----------------

An economic slow-down world wide should bring DBB down.

But the

long-term uptrend of copper look so strong and DBB shows so much

accumulation, it would be surprising to see it fall much below 21.

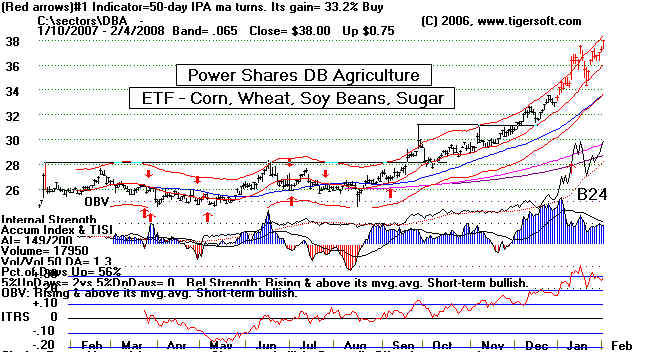

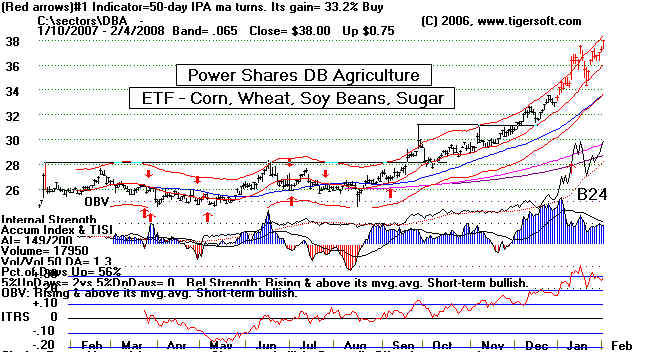

--------------------------------- Food Commodities Are Rising

Very Fast --------------------------

Food Commodities seem like a very good investment now. And if their

prices continue to rise, the drop in interest rates will be seen as causing a significant

boost to what consumers pay for basic foods. In that case, poorer fixed income

families will be carrying a heavy burden from the Fed's efforts to bail out banks and

brokerages for bad home loans by dropping the Discount Rate. Their strength

is

similar to what was seen in the 1970s.

------------------------------------------ CORN

--------------------------------------------------------

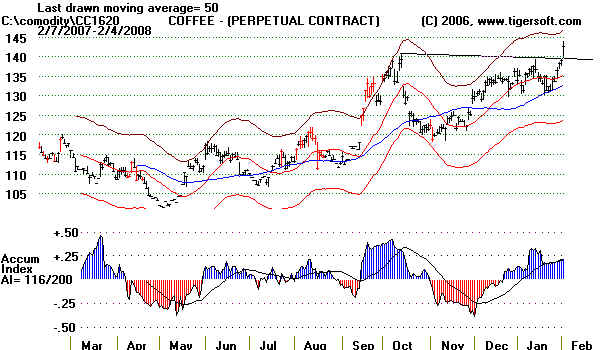

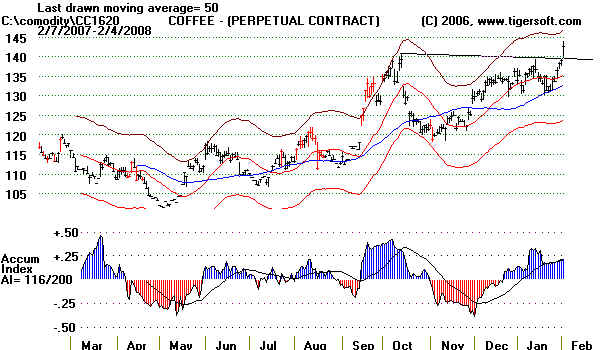

----------------------------------------- COFFEE

--------------------------------------------------------------------

--------------------------------------------- COCOA

-------------------------------------------------------------------

------------------------------------------- SOYBEANS

---------------------------------------------------------------

| PBS Interview with Paul

Volcker PAUL VOLCKER (Former Federal Reserve Chairman, 1979-1987): Inflation is

thought of as a cruel and maybe the cruelest tax, because it hits in an unexpected way, in

an unplanned way, and it hits the people on a fixed income hardest. And there's quite a

lot of evidence, contrary to some earlier thinking, that it hits poorer people more than

richer people.

BEN WATTENBERG:

Difficult times call for difficult actions. So as they say on Wall Street, Volcker slammed

on the brakes.

PAUL VOLCKER: We'll

take the emphasis off of interest rates and put the emphasis on the growth in the money

supply, which is at the root cause of inflation; too much money chasing too few goods in

the old proverbial way of putting the inflationary process. So we'll attack the

too-much-money part of the equation and we will stop permitting supply from increasing as

rapidly as it was.

BEN WATTENBERG: So

Volcker's Fed sold bonds. Less money in circulation pushed interest rates up to 19 percent

in 1981. That plunged America into its deepest economic downturn since the Great

Depression.

PAUL VOLCKER: I

would get asked the question a lot about "How can you conduct a policy that appears

to throw people out of work, anyway?" But I also felt that in the long run, there

wasn't any question that the economy was going to operate better in the context of price

stability.

BEN WATTENBERG: The

recession was painful, but inflation declined from its high of 13.5 percent in 1980 to 1.9

percent in 1986, and remained low and fairly level throughout the 1990s. Since 1983,

America has produced positive economic growth in 67 out of 71 quarters. This prosperous

economy helped set the stock market on a vigorous bull run.

Since 1981, the Dow Jones

Industrial Average has increased from 875 to more than 10,000. New investors poured into

the hot market, encouraged by the advent of IRAs, Keoughs and 401(k)s. By the end of the

century, America had become a nation of owners. A majority of Americans, 52 percent, owned

stocks.

(Source: http://www.pbs.org/fmc/segments/progseg14.htm

) |

THE CURRENT US DEFICIT IS:

U.S. NATIONAL DEBT CLOCK

The Outstanding Public Debt as of 20 Sep 2007 at 05:58:13 PM GMT is:

The estimated population of the United States is 303,037,971

so each citizen's share of this debt is $29,740.81.

The National Debt has continued to increase an average of

$1.42 billion per day since September 29, 2006!

Volker Endorses Obama!

"After 30 years in government, serving under five Presidents of both parties and

chairing two non-partisan commissions on the Public Service, I have been reluctant to

engage in political campaigns. The time has come to overcome that reluctance," Mr.

Volcker said in a statement today. "However, it is not the current turmoil in markets

or the economic uncertainties that have impelled my decision. Rather, it is the breadth

and depth of challenges that face our nation at home and abroad. Those challenges demand a

new leadership and a fresh approach."

He concluded: "It is only Barack Obama, in his person, in his ideas, in his

ability to understand and to articulate both our needs and our hopes that provide the

potential for strong and fresh leadership. That leadership must begin here in America but

it can also restore needed confidence in our vision, our strength, and our purposes right

around the world."

|

Next in the Series on Monetarists versus

Keynesians - This Coming Weekend.

What is the real level of employment?

|