Animals in a

laboratory sometimes curl up in a ball and may deny all stimuli

when

events take them by total surprise. Freud said, people sometimes are

in

a state where they know what to do but they cannot act. They are more

likely

to freeze when encountering an overwhelming threat. It's basic biology.

Immobility

slows their heart rate and lets them regain composure and start to

cope.

In some situations, this works well. In the wild, a lion, tiger or a bear

is

usually impelled to chase down and eat that which flees. But in the stock market,

doing

nothing can be be very costly if a bear market is starting.

In therapy, making such

people aware of the reality they face, the bases of their

irrational

beliefs and the consequences of acting or not acting in accordance

with

reality are essential first steps. Sadly for investors, a therapist has plenty

of

time, sometimes years, to:

(1)

probe the patient's psyche for the bases of their irrational belief structures;

(2)

repeat over and over what the pertinent reality is; and

(3)

show what the consequences will be of living in denial and not

changing

a self-destructive behavior.

The stock market is not so kind. It

will not wait for a therapeutic break through.

=========================================================

Light Bulb Humor

Q: How many Psychiatrists does it take to change a light bulb?

A: Only one, but the bulb has got to really WANT to change.

A': None; the bulb will change itself when it is ready.

=========================================================

Therapists

do make break-through with people who have stubbornly refused to

change

their behavior. They do this by clearly predicting what will happen

to

the patient if he or she does not change. When enough of the therapist's

warnings

(predictions) come true, the patient may finally accept reality |

and

make the necessary changes, provided they do not have too much emotional

stake

in their make-believe world.

We hope the way our predictions have a way of coming true, will help you.

Get Peerless. It is the cheapest

market insurance you'll ever buy.

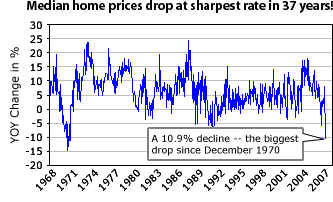

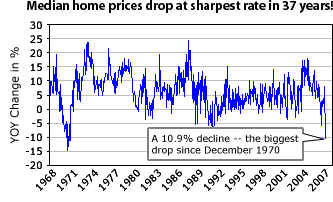

An Example of A Neurotic Denial: Homebuilders

For a long time, the home builders acted like deers in the headlights. They

saw

sales slow, but kept churning out homes. And even when they started

cutting

production, they kept staffing levels up under the assumption that any

dip

in home demand would be short-lived. Finally, some have cut staff,

production

and prices. The median price of a house fell by 10.9% last month

compared

to a year earlier. This was the biggest drop in the more than the

35

years that such data has been kept.

Financial Stocks - The Canary in The Mine

Will

the Fed bale out brokerage stocks as they did in 1987 and 1998?

Will

the Fed bale out brokerage stocks as they did in 1987 and 1998?

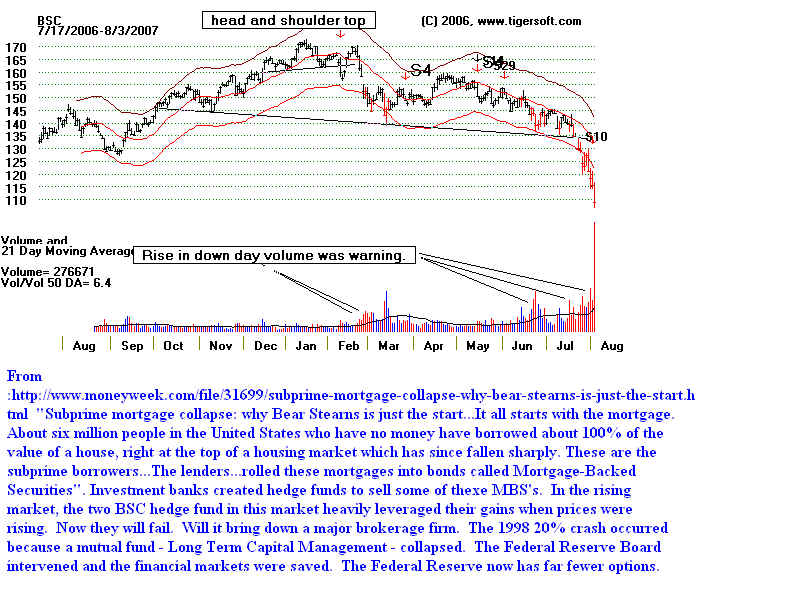

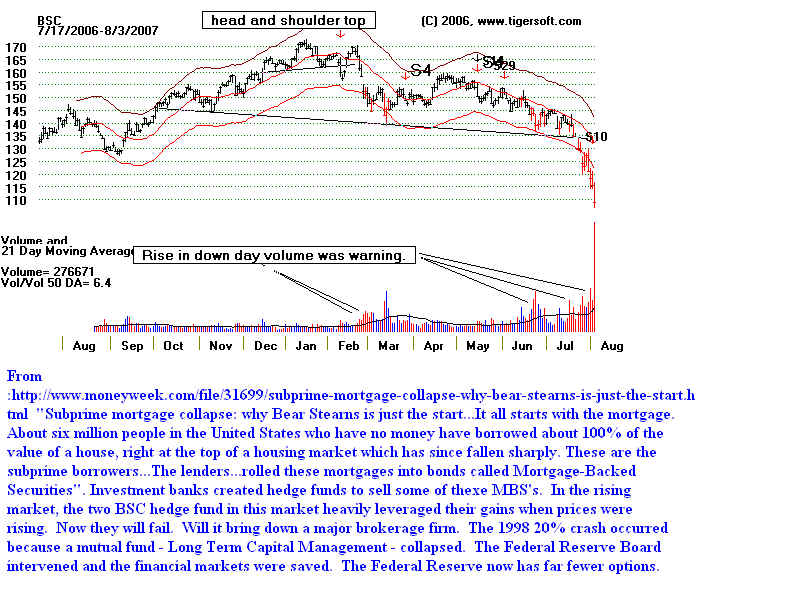

Housing and sub-prime defaults and bankruptcies may be just the beginning.

8/3/2007

Bear Stearns is in big trouble. http://online.wsj.com/article/SB118615761924887472.html

"When

have financial stocks ever been so over-leveraged?

(Jim

Rogers, CNBC 8/7/2007) Is a

crash a "done

deal?"

Bear Stears

- BSC is collapsing, way ahead of the rest of the market. Why?

How Many Predictions Must We Make That Come True,

before You Will Buy Our Peerless Stock Market

Timing?

When the stock market falls like it has since our July 17th major sell, most investors

covered their

eyes and refused to even listen for an

alarm, much less assist in the lowering of life boats. Our site has

posted numerous public warnings

since June. We are normally very bullish. But

the signs of big trouble

began to be too obvious to ignore and not

pass on.

June 18, 2007 - Global

Boom or Bubble?

June 19, 2007 - Big Declines in Years Ending in "7".

"Going back 120 years, the average DJI-30 decline

at some point in a year ending in '7' is 23%!"

June 22, 2007 - Summer Rally?

"There is a 68% probability of at least a

10% correction

by the end of October this year.. A top in July is the most

likely scenario."

June 28, 2007 - What Will Housing Stocks Do in A

Weak Market? They Are Collapsing in A Bull

Market.

July 2, 2007 - Where

Are The US High Tech Jobs Going?

July 12, 2007 - US

Dollar's Decline Is Getting Serious

July 17, 2007 - Peerless Major Sell

Warns of Impending Correction (if we are lucky)

or bear market.

|

Will

the Fed bale out brokerage stocks as they did in 1987 and 1998?

Will

the Fed bale out brokerage stocks as they did in 1987 and 1998?