Preface: April 27, 2010

by William Schmidt, Ph.D. (C) 2010 www.tigersoft.com

At its simplest, the Tahiti system buys at the end of every quarter the most

highly accumulated ("AI/200") stock in DJI-30. We use the rankings

produced by TIGER's Power-Stock-Ranker Software. We want usually

to avoid stocks whose AI/200 is less than 130, unless there has just been

an "extreme bear market". We also do not want to buy a stocks whose OBV

is lagging heavily. The "PricePct minus OBVPct" must not be below -30.

Most important, we need to use our Peerless system to avoid being caught in severe

bear markets. In addition, with TigerSoft we have the Tiger Closing Power.

If the Closing Power is in a downtrend, I would suggest waiting for the Closing

Power to break its downtrend. Doing that will give you more confidence.

You may even want to use margin in such cases, so good are the odds for a rally.

We want here to expand on our rules for our Tahiti system.

As suggested in the original 1994 Tiger "Tahiti System" book,

sheer prudence dictates we must taken into account when the general market

looks particularly dangerous using Peerless. Here we must consider the active

major BUY or SELL signals given by our Peerless general market timing system.

Four unreversed major Sell signals, especially SELL S9 and SELL S12 signals

in the space of 8 months establishes that the general market has become very bearish.

This is what occurred just before the start of the bear markets of 1969-1970, 1973-1974,

1981-1982, 1987, 1999-2001 and 2007-2009. In fact, the only bear market

without such signs of a market top occurred in 1977-1978 and that was a year

when many oil stocks did very well and, appropriately enough, oil stocks were

the Tahiti picks.

Our book shows the trades that might have been made if one were

NOT to have considered Peerless. In the tables below, we emphasize

investing only when Peerless shows that it is safe. Let me emphasize

that we strongly advise selling out all "Tahiti"-based purchases on the

fourth Peerless major Sell and waiting for the next major Buy to start Buying.

The bear markets of 2000-2003 and 2007-2009 showed the importance of this.

Much more money was made by simply selling out and waiting for the market

to be safe again. Using the first major Buy after a sell-off worked well enough

until the 2008-2009 period. This is our normal recommendation. After all,

you are deploying only 1/7 of your investment money in the first

purchase. So, buying a little early is not a problem.

Extreme Bear Markets

But the severity of the 2008-2009 decline warranted a different approach.

When the DJI is down more than 40% from its high of last 10 months

assume the stock market is in an "extreme bearish mode". This concept

is an important of Peerless. Separate Buy and Sell signals apply then.

This extreme bearish mode occurred only in 1930, 1931, 1932, 1933, 1937,

1938, 1987, 2008 and 2009. In these cases, wait for the DJIA's 65-day ma

to turn up, unless there is strong evidence that the decline has non-economic

causes, as in 1987 when unregulated, out-of-control computerized trading of

index options brought on a completely artificial decline.

Qualifying Stocks

In all cases, we want to screen the top AI/200 stocks. We use the

Tiger Power Ranker to do this in two ways. The first variable we

employ is "AI/200". This shows the amount of steady accumulation

for nearly a year in a stock. The highest AI/200 stock in the DJI-30

is the Tahiti choice at the end of each quarter. There are two exceptions.

If another Tiger variable, "OBV%-PR%" is less than -30 we would

not buy the stock. This shows too much aggressive selling. When the

most highly ranked Accumulation stock in the DJI-30 has an

OBV%-PR% less than -30, the next highest ranked (AI/200) stock in

the DJI-30 is used for purchase unless the next highest AI/200 stock

has an AI/200 score less than 130. In that case, no stock is bought for that

quarter.

Note this. After an extreme bear market, with the 65-day ma again

rising, we would be willing to buy the top AI/200 stock, even though its

AI/200 might be as low as 125. The reason for this is simply that

such very severe declines cause the levels of Accumulation to drop

dramatically.

Applying The Tahiti System To Other Groups of Stocks

The Tahiti system using the DJI works with only 30 blue chip stocks.

Thirty (n=30) is often considered by statisticians to be a minimum for a

acceptable sample. One would think that taking the highest AI/200 stock

from a larger universe, like the NASDAQ-100 or SP-500 stock should

work even better. Our testing, though limited shows this is true, but with

a caveat. See Seven Paths To 25/Year. The exception is that if a

smaller stock rises too much too quickly, say 200% or more, why

mechanically wait for 21 months to sell. Use the 65-day ma. Penetrations

of it with a negative Accumulation Index reading and weak Closing Power

usually are sufficient reasons to take profits. Similarly, if the 65-dma

turns down, selling is usually prudent even when the Accumulation Index

is positive. In these cases, we usually watch the Closing Power. When

its downtrend ends, there is usually another tradeable rally. A long-term

investor should just sell and find another stock at the end of the next quarter.

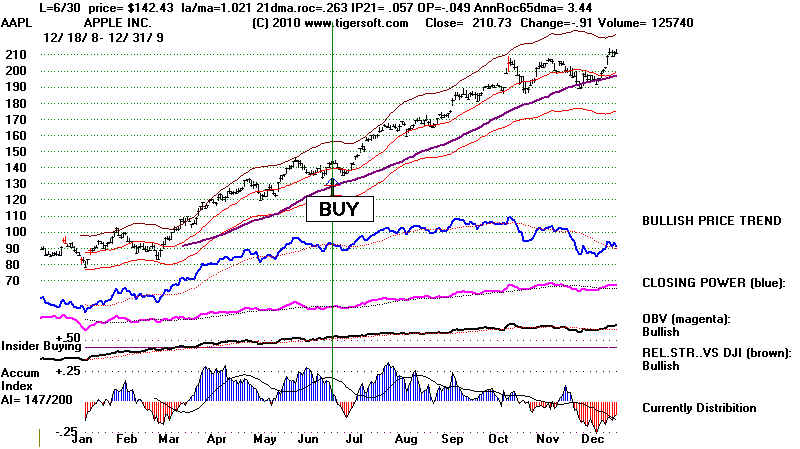

The 2009-2010 experience in taking the highest AI/200 stocks in other

groups confirms this. AAPL was the stock to buy in the NASDAQ-100

in mid 2009. When its Closing Power downtrend ended in early 2009,

it was a good trading Buy again.

Tahiti Approach Shows Best Industry To Invest in.

Beyond this, we suggest another valuable approach. Use the Tahiti system

to identify the best group of stocks to buy into. Thus, in the period 1976-1980,

oil stocks should have been bought, especially the highest Power-Ranked.

In 1990 and 1991, Merck was the highest ranked AI/200 DJIA stock. It did

well but much more money would have been made in buying Amgen, the highest

AI/200 stock among the larger biotechs. The best performing stock of 1991

was a biotech. In 2009, HPQ and IBM, two computer stocks, vied for honors

as the highest AI/200 stock. Instead of buying them. even better gains would

have been made buying the highest AI/200 computer stocks in the NASDAQ-100

and SP-500. These included Apple Computer, AAPL and DELL If you want to

trade, pick these high Accumulation stocks and play the Closing Power trends

on the long side.

TAHITI SELECTIONS SINCE 1970

USING PEERLESS TO REDUCE RISK

Below all the "Tahiti" picks, including the stocks that

met these conditions most recently. Below that, we want to mention some

other factors that should be used to make these selections as safe and profitable

as possible.

Stock Purchase Purchase Price 7 Percent

Date Price Quarters Gain if sold

Gain on 4th major Sell. including "S9"

-------------------------------------------------------------------------------------------------------------------------

1 Chevron 12/31/70 13.625 17.281 26.8%

2 Chevron 3/31/71 14.125 19.906 40.9%

3 PhlipMor 6/30/71 1.969 4.164 111.5% 95.6%

4 Merck 9/30/71 3.11 4.983 60.2% 63.9%

5 Merck 12/31/71 3.444 4.546 32.0% 48.0%

6 CocCola 3/30/72 5.101 5.124 0.5% 18.7%

7 PhlipMor 6/30/72 3.25 3.086 -5.1% 18.5%

8 PhlipMor 9/29/72 3.227 3.406 5.6% 19.4%

9 PhlipMor 12/29/72 3.695 2.25 -39.1% 4.3%

Note 4th S9 signal given in early January 1973. In addition. When NYSE breadth is this bad (A/D Line in steep downtrend, expect at best, trading range rallies. This is also a common pattern for the Presidential Election year. A false rally into January that lets the partisans of the winning party celebrate by buying stock at a high also is a common pattern. (See early 1969, early 1973 (below), end of 1976 false rally, early 1981, 2000 trading range and false peak early in 2001.

None of DJI stocks met minimum conditions for purchase on 3/30/73. 10 Boeing 6/29/73 1.123 1.358 20.9% 11 Woolwor 9/28/93 6.125 4.094 -33.2% 12 Boeing 12/31/73 .819 1.749 113.6% 13 Boeing 3/29/74 .93 1.596 71.6% 14 Boeing 6/28/74 1.152 1.749 51.8% 15 Boeing 9/30/74 1.07 2.695 151.9% 16 Boeing 12/31/74 1.041 3.028 190.9% 17 Un.Tech 3/31/75 10.25 19.438 89.6% 18 Chevron 3/31/75 12.125 20.5 69.1% (two stocks tied for first.)

19 Un.Tech. 6/30/75 14.5 17.375 19.8% 20 Texaco 9/30/75 23.5 29.125 23.9% 21 Texaco 12/31/75 23.375 28.125 20.3% 22 Texaco 6/30/76 28.125 26.0 -7.6% 23 Boeing 9/30/76 3.028 6.961 129.9% 24 Boeing 12/31/76 2.946 8.418 185.7% 25 Boeing 3/31/77 2.888 9.393 225.2% 26 Texaco 6/30/77 29.125 25.625 -12.0% 27 Texaco 9/30/77 28.125 27.625 -1.8% 28 PhlipMo 12/30/77 3.867 4.406 13.9% 29 UnionCa 3/31/78 2.614 2.807 7.4% 30 Un.Tech 6/30/78 21.188 20.625 -2.7% 31 Texaco 9/29/78 24.75 36.75 48.5%

No stocks met minimum qualifications on 12/31/78.

32 Merck 3/30/79 3.662 4.707 28.5% 33 Allied 9/28/79 12.84 16.324 27.1% +23.6%

No stocks met minimum requirements on 12/31/79 No stocks met minimum requirements on 3/31/80.

34 Disney 6/30/80 3.0 3.313 10.4% +27.0%

35 Goodyr 9/30/80 7.938 12.25 54.3% +25.2%

12/30/80 = no stocks qualify.

On 1/7/81, Peerless gave a fourth major Sell. Selling the positions then,

on 1/7/81 would have produced better results in two of three cases.

UnTech 3/31/81 28.125 28.313 0.7%

4/1/81, Peerless gave a fifth major Sell

The UTX trade, if made, should have been closed out.

CocaCo 6/31/81 2.896 4.458 53.9%

7/6/81 Peerless gave a breakdown - Sell S10 following

six major Sells. The KO trade would not have been made

if Peerless was used, too. A new Buy signal on 9/28/91

after a sell-off, then opened the way to buying again.

38 AmerEx 9/30/81 10.311 23.831 131.1%

39 Sears 12/31/81 12.094 27.375 126.4%

40 Sears 3/3/82 14.25 27.844 95.4%

41 Sears 6/30/82 14.531 25.406 74.8%

42 McDonld 9/30/82 8.0 10.172 27.2%

43 Boeing 12/31/82 10.034 15.958 59.0%

44 PhilMo 3/31/83 7.85 10.078 28.4%

45 WestHo 6/30/83 12.469 15.0 20.3%

46 WestHo 9/30/83 11.594 17.188 48.3%

47 WestHo 12/30/83 13.688 18.813 37.4%

48 Sears 3/30/84 25.406 29.25 15.1%

49 Sears 6/29/84 23.625 37.125 57.1%

50 Disney 9/29/84 3.68 13.688 272.0%

51 Disney 12/31/84 3.742 9.875 163.9%

52 Boeing 3/29/85 18.513 22.718 22.7%

53 Disney 6/28/85 5.867 15.594 165.8%

54 Disney 9/30/85 5.242 18.063 244.6%

55 Woolwort 12/31/85 15.00 24,625 64.2%

56 Woolwort 3/31/86 19. 17.25 -9.2% 29.0%

57 JPMorgan 6/30/86 43.938 33.25 -24.3% 11.0%

58 JPMorgan 9/30/86 40.563 38.875 -4.2% 20.2%

59 Exxon 12/30/86 35.063 44.755 27.6% 41.9%

60 Exxon 3/31/87 42.875 44. 2.6% 16.0%

61 Disney 6/30/87 18.063 19.625 8.7% 8.2%

62 Caterplr 9/30/87 73.5 58. -21.1% 0.5%

On 10/1/1987, Peerless have a fourth major sell. See below.

The new buys after a steep decline, cause us to resume buying

at the end of each quarter.

63 Caterplr 12/30/87 62. 61. -1.6%

64 UnTech 3/31/88 39.0 54.25 39.1%

65 UnTech 6/30/88 38.5 57.25 48.7%

66 CocaCo 9/30/88 10.938 22.188 102.9%

67 CocaCo 12/30/88 11.156 19.75 77.0%

68 CocaCo 3/31/89 12.813 23.25 81.5%

69 Merck 6/30/89 22.289 35.163 57.8%

70 McDonald 9/29/89 29.75 32.875 10.5%

71 Boeing 12/29/89 39.579 50.75 28.2%

72 Alcoa 3/30/90 64.75 64.375 -0.6%

73 Alcoa 6/29/90 63.75 70.5 10.6%

74 Alcoa 9/28/90 62.625 75.875 21.2%

75 Merck 12/31/90 29.955 44.5 48.6%

Consider buying the top AI/200 stock in the industry

represented by the top Tahiti stock.AMGEN more than tripled

by the ned of 1991.

9.25 12/31/1991

AMGN

76 Merck 3/28/91 35.163 43.375 23.4%

77 Merck 6/28/91 38.704 35.375 -8.6%

78 Goodyr 9/30/91 21.938 42.5 93.7%

79 Merck 12/31/91 55.494 30.75 -44.6%

80 MMM 6/30/92 48.5 49.5 2.1%

81 UnionCa 9/30/92 13.125 26.5 101.9%

82 UnionCa 12/31/92 16.625 34.0 104.5%

83 UnionCa 3/31/93 18. 29.375 63.2%

84 UnionCa 6/30/93 19.25 30.625 59.1%

85 UnionCa 9/30/93 19.375 33.5 72.9%

86 UnionCa 12/31/93 22.375 39.75 77.7%

87 UnionCa 3/31/94 22.5 37.5 66.7%

88 Texaco 6/30/94 60.375 85.75 42.0%

89 ProctG 9/30/94 29.813 45.313 52.0%

90 ProctG 12/30/94 31. 48.75 57.3%

91 MMM 3/31/95 58.125 83.0 42.8%

92 MMM 6/30/95 57.375 84.625 47.5%

93 UnTech 9/30/95 88.375 166. 87.8%

94 Exxon 12/30/95 40.25 64.063 59.2%

95 Sears 3/30/96 48.75 45.25 -7.2%

96 MMM 6/28/96 69.0 91.0 31.9% (tied)

JPMorgan 6/28/96 84.625 134.313 58.7% (tied)

97 IP 9/30/96 42.5 43.0 1.2%

98 MMM 12/31/96 83.0 73.688 -11.2%

99 IP 3/31/97 39.0 46.625 15.1%

100 IP 6/30/97 48.563 44.813 -7.7%

101 T 9/30/97 30,72 58.00 88.8%

102 JPMorgan 12/31/97 112.875 114.25 1.2%

103 T 3/11/98 43.833 48.93 +11.6%

104 EK 6/30/98 73.063 64.56 -11.6%

105 WMT 9/30/98 27.313 69.31 +153.8%

106 WMT 12/31/98 40.719 69.31 +70.2%

107 WMT 3/31/99 46.094 69.31 +50.4%

108 WMT 6/30/99 48.25 69.31 +43.6%

On 12/27/1999 a fourth major Sell signal appeared.

The NYSE downtrendline showed how bearish the market

was then. Most stocks were already in an unannounced

bear market. Time to sell all Tahiti stocks and

go to sidelines, except for trading.

76 Merck 3/28/91 35.163 43.375 23.4%

77 Merck 6/28/91 38.704 35.375 -8.6%

78 Goodyr 9/30/91 21.938 42.5 93.7%

79 Merck 12/31/91 55.494 30.75 -44.6%

80 MMM 6/30/92 48.5 49.5 2.1%

81 UnionCa 9/30/92 13.125 26.5 101.9%

82 UnionCa 12/31/92 16.625 34.0 104.5%

83 UnionCa 3/31/93 18. 29.375 63.2%

84 UnionCa 6/30/93 19.25 30.625 59.1%

85 UnionCa 9/30/93 19.375 33.5 72.9%

86 UnionCa 12/31/93 22.375 39.75 77.7%

87 UnionCa 3/31/94 22.5 37.5 66.7%

88 Texaco 6/30/94 60.375 85.75 42.0%

89 ProctG 9/30/94 29.813 45.313 52.0%

90 ProctG 12/30/94 31. 48.75 57.3%

91 MMM 3/31/95 58.125 83.0 42.8%

92 MMM 6/30/95 57.375 84.625 47.5%

93 UnTech 9/30/95 88.375 166. 87.8%

94 Exxon 12/30/95 40.25 64.063 59.2%

95 Sears 3/30/96 48.75 45.25 -7.2%

96 MMM 6/28/96 69.0 91.0 31.9% (tied)

JPMorgan 6/28/96 84.625 134.313 58.7% (tied)

97 IP 9/30/96 42.5 43.0 1.2%

98 MMM 12/31/96 83.0 73.688 -11.2%

99 IP 3/31/97 39.0 46.625 15.1%

100 IP 6/30/97 48.563 44.813 -7.7%

101 T 9/30/97 30,72 58.00 88.8%

102 JPMorgan 12/31/97 112.875 114.25 1.2%

103 T 3/11/98 43.833 48.93 +11.6%

104 EK 6/30/98 73.063 64.56 -11.6%

105 WMT 9/30/98 27.313 69.31 +153.8%

106 WMT 12/31/98 40.719 69.31 +70.2%

107 WMT 3/31/99 46.094 69.31 +50.4%

108 WMT 6/30/99 48.25 69.31 +43.6%

On 12/27/1999 a fourth major Sell signal appeared.

The NYSE downtrendline showed how bearish the market

was then. Most stocks were already in an unannounced

bear market. Time to sell all Tahiti stocks and

go to sidelines, except for trading.

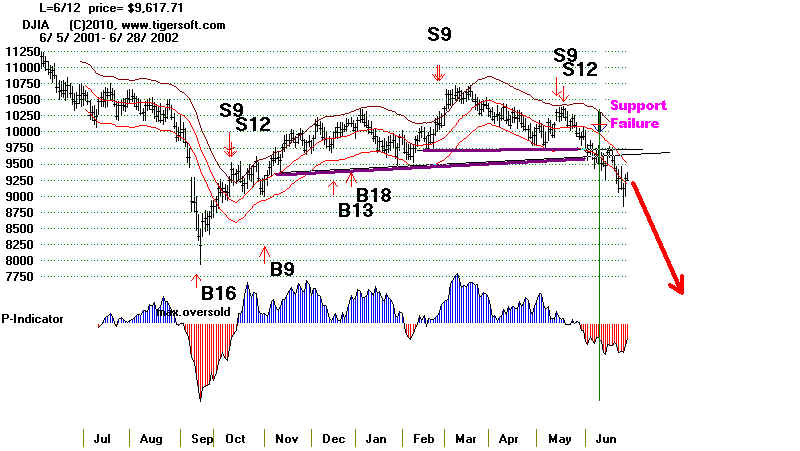

Peerless Major Buy Signal in September 2001 after extreme

sell-off starts Tahiti's Buying again. But on 6/21/2002,

the DJI broke ket support folwing several separate major

Sells.This was the point to sell out Tahiti posiitons.

The chart is shown further below.

108 AA 9/30/01 31.01 39.68

109 JNJ 12/31/01 59.1 55.71 -5.9%

3/28/02 ...No stocks qualify

110 KO 6/28/02 56.0 53.01 -5.3%

After next leg down, New Peerless major Buy B9 on

7/24/2003 should get Tiger users to start buying again.

111 9/31/02 ...No stocks qualify

112 12/31/02 ...No stocks qualify

113 PG 3/31/03 44.53 55.08 +23.7%

114 PG 6/30/03 44.59 53.0 +18.9%

115 CAT 9/30/03 34.42 47.66 +38.5%

116 BA 12/31/03 42.14 67.95 +61.2%

Peerless Major Buy Signal in September 2001 after extreme

sell-off starts Tahiti's Buying again. But on 6/21/2002,

the DJI broke ket support folwing several separate major

Sells.This was the point to sell out Tahiti posiitons.

The chart is shown further below.

108 AA 9/30/01 31.01 39.68

109 JNJ 12/31/01 59.1 55.71 -5.9%

3/28/02 ...No stocks qualify

110 KO 6/28/02 56.0 53.01 -5.3%

After next leg down, New Peerless major Buy B9 on

7/24/2003 should get Tiger users to start buying again.

111 9/31/02 ...No stocks qualify

112 12/31/02 ...No stocks qualify

113 PG 3/31/03 44.53 55.08 +23.7%

114 PG 6/30/03 44.59 53.0 +18.9%

115 CAT 9/30/03 34.42 47.66 +38.5%

116 BA 12/31/03 42.14 67.95 +61.2%

117 KO 3/31/04 50.30 40.31 -19.9%

118 KO 6/30/04 50.48 41.87 -17.1%

119 GE 9/30/04 33.50 32.96 -1.6%

120 GE 12/31/04 36.50 35.30 -3.3%

121 XOM 3/31/05 59.60 76.63 +28.6%

122 HPQ 6/30/05 23.31 40.00 +71.6%

123 HPQ 9/30/05 29.20 44.62 +52.8% (pre-split)

124 HPQ 12/30/05 28.63 49.79 +73.9%

125 HPQ 3/31/06 32.90 50.48 +53.4%

51.84 (4th major Sell - 12/7/2007)

126 HPQ 6/30/06 31.68 45.66 +44.1%

51.84 (4th major Sell - 12/7/2007)

127 PG 9/30/06 61.93

74.12 (4th major Sell - 12/7/2007)

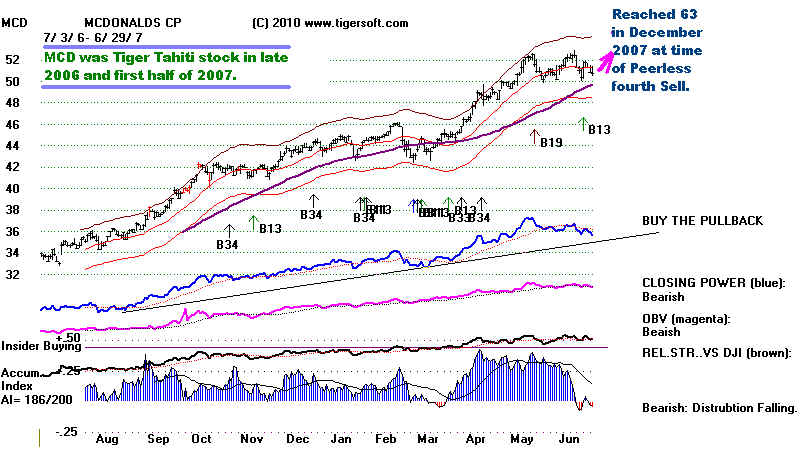

128 MCD 12/31/06 44.33

60.16 (4th major Sell - 12/7/2007)

129 MCD 3/31/07 45.05

60.16 (4th major Sell - 12/7/2007)

130 MCD 6/30/07 50.76

60.16 (4th major Sell - 12/7/2007)

131 XOM 9/28/07 92.56 at July peak.

91.50 (4th major Sell - 12/7/2007)

(XOM 12/31/07 93.69

Multiple Peerless Sells and support failure. Wait a quarter.)

132 XOM 3/31/08 84.58

(CVX 6/30/08 99.13

Multiple Peerless Sells and support failure. Wait a quarter.)

(XOM 9/30/08 84.58

Multiple Peerless Sells, support failure DJI down a quarter.

Wait until 65-dma turns up.)

(XOM 12/31/08 79.83

Multiple Peerless Sells, support failure DJI down a quarter.

Wait until 65-dma turns up.)

(IBM 3/31/09 96.89

AI/200 was only 110. This is too low to qualify.)

On 5/9/09 the 65-day ma turned up. Our TigerSoft

Hotline became quite bullish. Resume buying the

highest AI/200 stock in the DJI or, better yet,

since HPQ was a technology stock, buy the highest

AI/200 stock in the NASDAQ-100 or SP-500 which was

also a technology stock. After a severe sell-off,

with the 65-day ma rising again, we can relax

our AI/200 rules requiring at least an AI/200

score of 130..

133 HPQ 6/30/09 36.68 AI/200=128

also high AI/200 in technology were:

CTXS 32.26 - AI/200=153

AAPL 12.83 - AI/200=179 (computers, like HPQ)

134 HPQ 9/30/08 47.21 AI/200=167

also high AI/200 in technology were:

CTXS AI/200=175 39.23

DELL AI/200=166 15.26

AAPL AI/200=150 185.35

117 KO 3/31/04 50.30 40.31 -19.9%

118 KO 6/30/04 50.48 41.87 -17.1%

119 GE 9/30/04 33.50 32.96 -1.6%

120 GE 12/31/04 36.50 35.30 -3.3%

121 XOM 3/31/05 59.60 76.63 +28.6%

122 HPQ 6/30/05 23.31 40.00 +71.6%

123 HPQ 9/30/05 29.20 44.62 +52.8% (pre-split)

124 HPQ 12/30/05 28.63 49.79 +73.9%

125 HPQ 3/31/06 32.90 50.48 +53.4%

51.84 (4th major Sell - 12/7/2007)

126 HPQ 6/30/06 31.68 45.66 +44.1%

51.84 (4th major Sell - 12/7/2007)

127 PG 9/30/06 61.93

74.12 (4th major Sell - 12/7/2007)

128 MCD 12/31/06 44.33

60.16 (4th major Sell - 12/7/2007)

129 MCD 3/31/07 45.05

60.16 (4th major Sell - 12/7/2007)

130 MCD 6/30/07 50.76

60.16 (4th major Sell - 12/7/2007)

131 XOM 9/28/07 92.56 at July peak.

91.50 (4th major Sell - 12/7/2007)

(XOM 12/31/07 93.69

Multiple Peerless Sells and support failure. Wait a quarter.)

132 XOM 3/31/08 84.58

(CVX 6/30/08 99.13

Multiple Peerless Sells and support failure. Wait a quarter.)

(XOM 9/30/08 84.58

Multiple Peerless Sells, support failure DJI down a quarter.

Wait until 65-dma turns up.)

(XOM 12/31/08 79.83

Multiple Peerless Sells, support failure DJI down a quarter.

Wait until 65-dma turns up.)

(IBM 3/31/09 96.89

AI/200 was only 110. This is too low to qualify.)

On 5/9/09 the 65-day ma turned up. Our TigerSoft

Hotline became quite bullish. Resume buying the

highest AI/200 stock in the DJI or, better yet,

since HPQ was a technology stock, buy the highest

AI/200 stock in the NASDAQ-100 or SP-500 which was

also a technology stock. After a severe sell-off,

with the 65-day ma rising again, we can relax

our AI/200 rules requiring at least an AI/200

score of 130..

133 HPQ 6/30/09 36.68 AI/200=128

also high AI/200 in technology were:

CTXS 32.26 - AI/200=153

AAPL 12.83 - AI/200=179 (computers, like HPQ)

134 HPQ 9/30/08 47.21 AI/200=167

also high AI/200 in technology were:

CTXS AI/200=175 39.23

DELL AI/200=166 15.26

AAPL AI/200=150 185.35

134 HPQ AI/200=184 12/31/09 51.51

CTXS AI/200=182 41.61

AAPL AI/200=147 210.73

135 HPQ AI/200=177 3/31/10 53.15

CTXS AI/200=179 47.47

AAPL AI/200=129 235.00

134 HPQ AI/200=184 12/31/09 51.51

CTXS AI/200=182 41.61

AAPL AI/200=147 210.73

135 HPQ AI/200=177 3/31/10 53.15

CTXS AI/200=179 47.47

AAPL AI/200=129 235.00

TAHITI with Peerless Rules:

1) SELL Tiger's Tahiti System's Stocks after Four Peerless Major Sells.

2) A Breaking of Key Support Shows A Bear Market Has Started.

3) Do Not Use Tiger's Tahiti System after a 40% DJIA Decline in 10 Months

Back-testing shows that four major Sell in 8 months should be treated as an automatic Sell.

Three major Peerless Sell signals and a support failure are also an automatic Sell.

The pattern of multiple Peerless Sell signals and a support failure is deadly for the stock

market. There are few exceptions to this rule since 1928. 1977 is the single big exception.

After the support failure, wait for a Peerless major Buy and then Buy at the end of the next

quarter. If the DJI is down more than 40% from it's high, become even more cautious.

Wait for the 65-day ma to turn up and then buy again at the end of the quarter..

Below are all the cases since 1966 of multiple Peerless Sells and A Support Failure.:

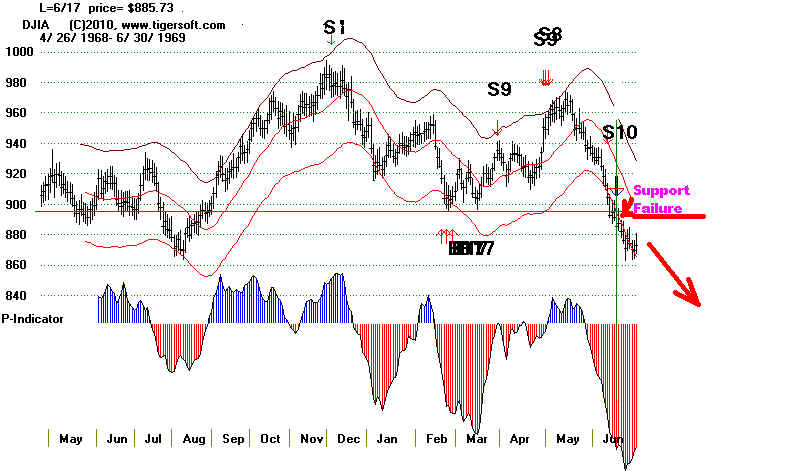

Three Major Sells and Support Failure in June 1969

Earlier Major Sells in Previous 6 months Major Support Failure Subsequent Decline Reached

-------------------------------------------- ----------------------- ------------------------------

S1 (12/1/68), S9 (3/28/68), S9 (4/30/69) 6/17/69 - 886 5/26/70 - 631

S8 (5/2/69), S19 (6/11/69)

-----------------------------------------------------------------------------------------------------------

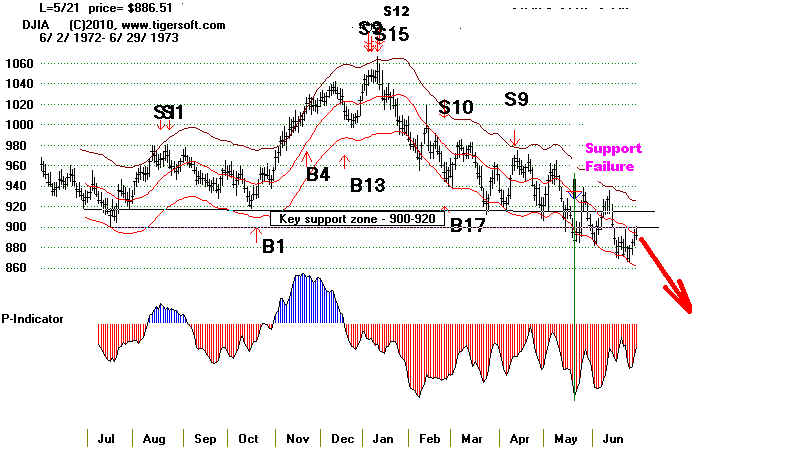

Fourth Major Sell in January

1973

Key Support Failure in May 1973

Subsequent Low - 12/6/75 - 577.60

S9 (4/12/72), S12 (5/22/72), S9 (5/24/72)

S9 (5/30/72), S12

(8/3/72), S9 (8/4/72)

S9 (8/10/72). S1

(8/24/72), S15 (1/5/73)

S9 (1/8/73), S12

(1/12/73). S9(4/11/73)

----------------------------------------------------------------------------------------------------------

Fourth Major Sell in January 1981

Key Support Failure in August 1981 at

900

DJI subsequently fell to776.90 on 8/12/82

S2

(8/7/80), S1 (8/14/80), S9 (11/14/80)

S9 (11/19/80),

S12 (1/2/81), S9 (1/7/81)

S12 (4/1/81), S15

(4/24/81), S10 (7/6/81)

----------------------------------------------------------------------------------------------------------

Fourth Major Sell in October 1987

Not shown below: 4/6/87 - la/ma=1.039 (high) P= -2

IP21=.187 - Dimminished

Sell S9

S12 (5/6/87), S12 (6/8/87), S9 (6/9/87), 10/14/87 - 2413

12/4/87 - 1766.74

S9 (10/1/87), S12 (10/2/87).

S10(10/16/87)

-----------------------------------------------------------------------------------------------------------

Fourth Major Sell in May 2002

Key Support Failure in June

2002 - 6/12/02 - 9618

Subsequent DJI Bottom -10/9/02 - 7728.27

S9 (12/28/99), S15(1/7/00), S4 (1/11/00),

S1 (4/6/00), S12 (7/17/00),

S12 (12/8/00),

S8 (12/28/00), S12 (4/10/01),

S9 (4/11/01)

S9 (4/16/01), S4 (5/17/01),

S12 (10/10/01)

S12 (10/11/01), 2/26/02 (S9),

S12 (5/14/02),

S9 (5/17/02)

--------------------------------------------------------------------------------------------------------

Fourth Major Sell in December

2007

Key Support Failure in January

2008 - 1/5/08 - 12501

Subsequent DJI Bottom -3/9/09 - 6547.05

In October 2009, the DJI fell more than 40% from

its high.

In these curcumstances, it is best to wait for the 65-day ma to turn up

and then buy at the end of the next quarter or when the 65-day ma

turns up.

S9 (7/17/07), S9 (7/23/07),

S4(10/5/07),

S12 ( 12/6/07), S9 (12/7/07)

DJI and Peerless Signals: 2007-2008

DJI and Peerless Signals:

2008-2009