USE TIGERSOFT

TO LOOK BENEATH A STOCK's SURFACE

or

PUT YOUR INVESTMENT CAPITAL at BIG RISK.

2/24/2011 (C) 2010 William Schmidt, Ph.D. www.tigersoft.com

WALL STREET PROFESSIONAL USUALLY KNOW FIRST!

WATCH

THEM WITH TIGERSOFT CHARTS'

"PROFESSONALS' CLOSING POWER"

It's just not a good idea to buy a stock solely or simply because it

has rising earnings.

Earnings are often manipulated and anticipated by insiders who are

privy to more information

than the investing public. Earnings are also subject to trend

changes for a lot of reasons that

insiders know long before the public. Companies just don't like

to talk about coming bad news.

But that doesn't stop a company's insiders and the Wall Street

Professionals that follow a

stock closely from selling their shares to the unsuspecting Public when

it is to their advantage.

This happens over and over. Reading our website will give you a

better sense of how

often and what you can do about it.

Take the

case of gold miner Newmont Mining (NEM). Since September 2010, Gold

has risen from 124 to 137, about 10%. If you had correctly

guessed Gold would rise, it

might have seemed a good idea to buy the world's second biggest

producer of gold, NEM.

After all, you might say, surely the rising prices of Gold will

outpace any production costs'

increase and the stock will surely rise. WRONG. NEM

fell from 65 to 55, a 15% loss.

HOW TIGERSOFT CAN HELP YOU:

HOW TIGERSOFT CAN HELP YOU:

3 POINTERS

Looking beneath

the surace, as only TigerSoft can do, would have helped an investor greatly.

We teach the lessons of more than 30 years' professional software

development in the stock

market and puting on education seminars for regular stock

investors:

1) Know that false price

breakouts are DANGEROUS like NEM made

when it rose

only briefly above 63 to a new all-time high and then fell back.

.

Read ... Tiger Blog - FALSE

BREAKOUTS: How to Recognize Them and Profit

and

Spot A False Breakout

before It Fails

2) MOST IMPPORTANT - Always watch our invention, the trend of the blue

Tiger Professional Closing Power. CP broke its uptrend about the same time that NEM made

a false breakout. This shows that Professionals had changed their mind about the stock.

Our website here and our software have made this invention into a

key tenet in what we

teach, See the Blog we wrote about this Closing Power trend-break and the new appearance

of Insider

Selliing in the stock back at this

time. .

See October 11, 2010 What Happens When

Gold Mining Stocks Get out of Step with Gold Prices.

3) Tiger's own Accumulaion Index showed red distribution, rather than the blue TigerSoft

Accumulation that normally preceeds a bullish advance.

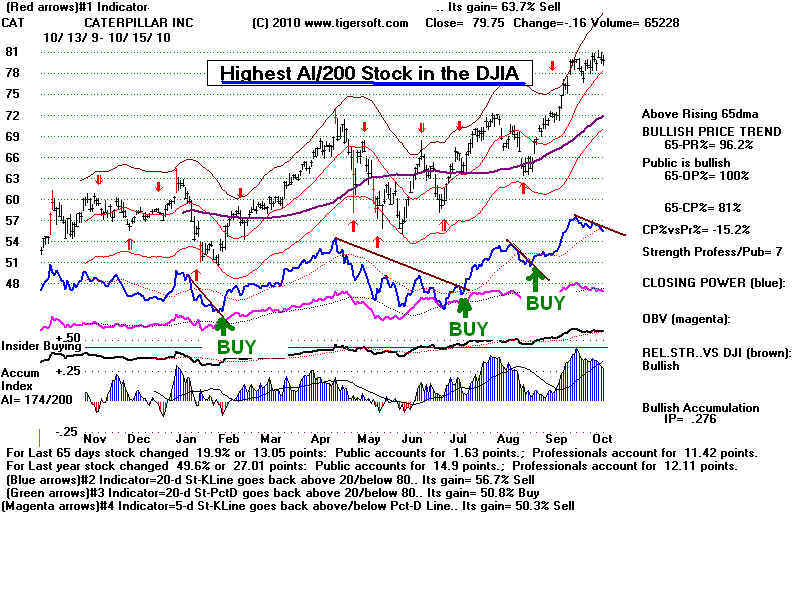

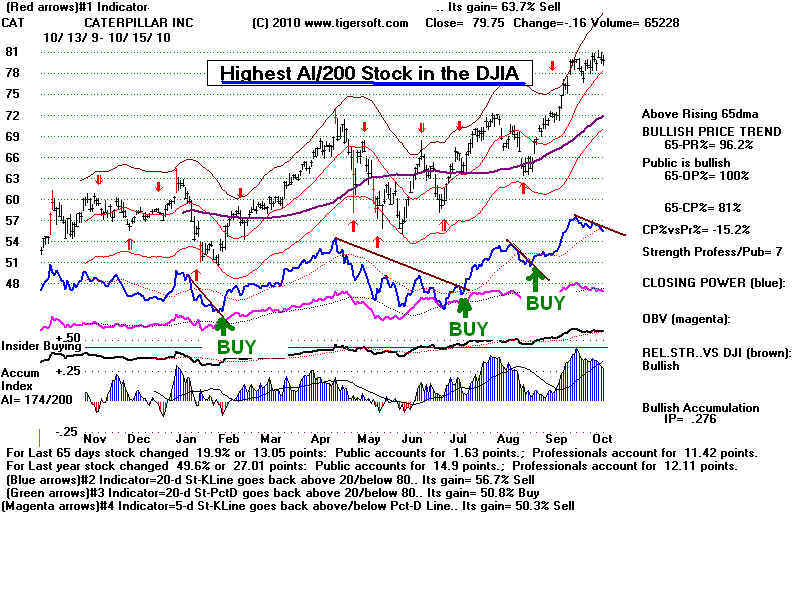

4) Buy the highest

Tiger Power-Ranked Stocks.

Many other stocks showed much more bullish Insider Buying and Net

Professional Buying

at this time.

For example, CAT (Caterpillar) rose more than 25% to its high 3 months

later. See

its recommendation here on 10/15/2010.

Or CMG (Chiptole Mexican Grill,) which we

re-recommended here on 10/15/2010

when it was $182. it hit $260 a week ago. We first

recommended it below $50 at the end of 2008.

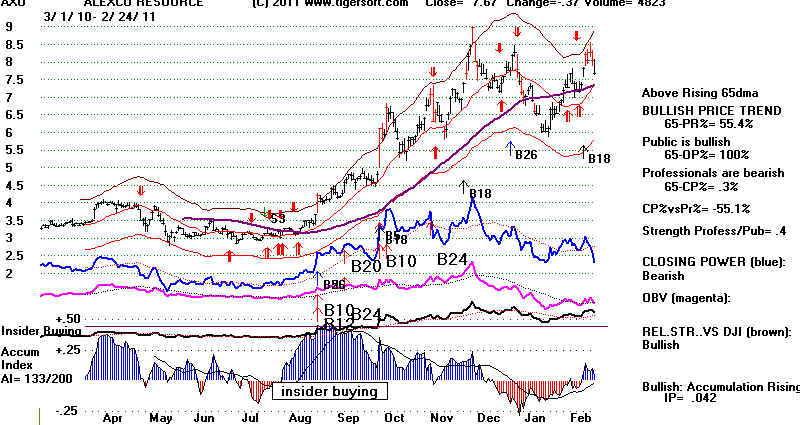

What Gold Stock Should I Buy?

See

October 11, 2010

Tiger's

Measurement of tnsider Buying Distinguishes The Best and Worst Gold Stocks in Advance.

October 6, 2009 GOLD's

Breakout Past 1000/ounce into All-Time High Territory Invites Comparisons with 1970s.

There were also lots of Gold and Silver stocks that looked better than NEM

back in October 2010.

See if you can spot the insider buying and rising Professional Closing

Power in the stocks

below. The conclusion is pretty clear. It was not a good stock

to buy just any

well-know Gold Stock just because Gold prices have been rising and

probably wopuld

continue to rise.... TigerSoft teaches to look beneath the surface of the

stock's trading and see

what insiders and Wall Street professionals are doing. Always

note when there is a

change in the Professional Closing Power trend from up to down.

It means Professionals

have become net sellers.

WHY DID NEM FALL SO HARD TODAY?

We can only guess the real reasons. Production costs at NEM are rising

steeply,

on a perentage basis,

probably faster than the price of gold. In

all of 2010, it cost NEM $260 to

produce

an

ounce of gold that they marketed for $1150/ounce. In

the last quarter of 2011, it

cost

more than $500 which they sold for $1366/ounce. In addition, they warned that their

Batu

Hijau Indonesian mine would bring them less revenue, due to the Indonesian

government's decision to

penalize them for past pattern of massive pollution.

See 2/14/2008 Tiger Blog

Newmont's Gold

Mining Brings Protests All over the World:

Widespread

Environmental Degradation and Health Hazards:

...Indonesia

will terminate NEM's copper mine.

HOW TIGERSOFT CAN HELP YOU:

HOW TIGERSOFT CAN HELP YOU: