Daily Blog

-Tiger Software

SILVER STOCKS:

A NEW RUN IS STARTING

Anyone Remember 1980 when

Silver hit $50/ounce.

SSRI IS OUR #1 BUY IN GROUP.

(Follow Up)

November 6, 2007

=======================================

William Schmidt,

- Tiger Software's Creator

(C) 2007 William Schmidt, Ph. D. - All Rights Reserved.

No reproductions of this blog or quoting from it

without explicit written consent by its author is

permitted.

Send any comments or questions

to william_schmidt@hotmail.com

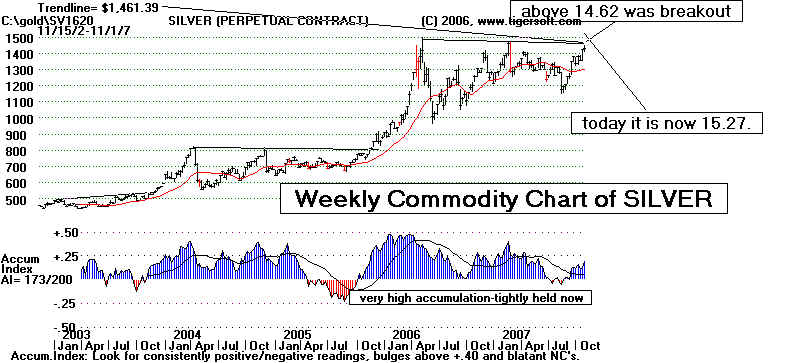

Important price breakout advances are now taking place in Silver and

the silver stock, SSRI. These were expected. What most do not appreciate is that only a

few price new highs qualify as "Tiger Breakouts". But these did. You can see the conditions we use to

qualify such breakouts in my book "Explosive Super Stocks". 175 pages. $75.00 A taste of it, with

many of the key conditions mmentioned, is seen at http://www.tigersoft.com/--3--/index.html .

See also http://tigersoft.com/Tiger-Blogs/10-28-2007/index.html

Qualified breakout buying is a trading technique designed to use trading capital

most efficiently. Most of the time, stocks are going sidewise, rather than decisively rising.

Tiger breakouts are designed to get you into the stocks that are moving. In the weekly chart

of SLV below you can see that 100% of all the gains in SLV (Silver as a Commodity) came in the

three months following the price breakout.

The Tiger Breakout approach is also designed to get you into the stocks that are strongest,

at any one time. Many of these rise very quickly. Some rise hundreds of percent in a year. But

vigilance is needed to use this approach, when breakouts fail, the stocks have to be sold at a small loss.

This assures you that you are in the very strongest stocks and that a decline in the market as a whole

does not hurt your investment capital. When the stock or commodity behaves expected, our studies

show we should just let it advance, "let it run". As long as it makes new highs and not minor new lows,

your profits will grow. Eventually, it will top out and decline. Our Explosive Super Stocks book

shows you how to recognize the top in the stock and not overstay your welcome in it. Many people

use certain moving averages in this case. We discuss this. But we look also at the internal strength

readings for the stock. Almost always there are tell tale signs that the stock is peaking and about

to decline.

I suspect that the breakout in Silver will mean at least a 33% gain in three months. A move

to 20 is technically the least that is expected because of the 5 point height of the preceding price

pattern that is being broken above.