TigerSoft News Service 5/5/2010 www.tigersoft.com

Why is the market falling?

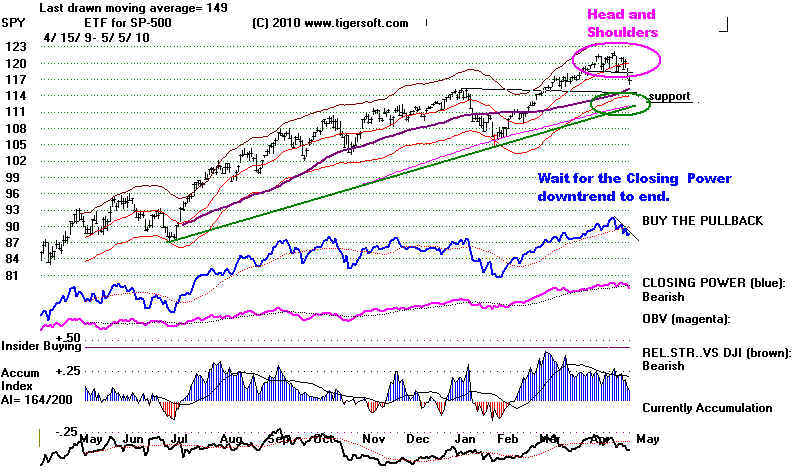

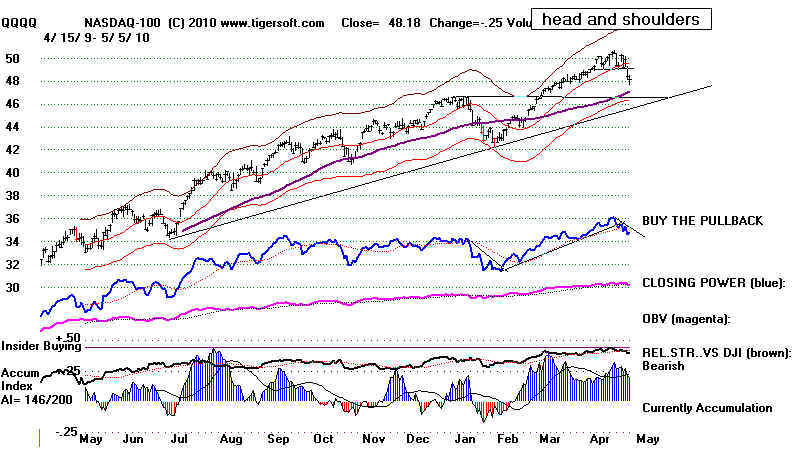

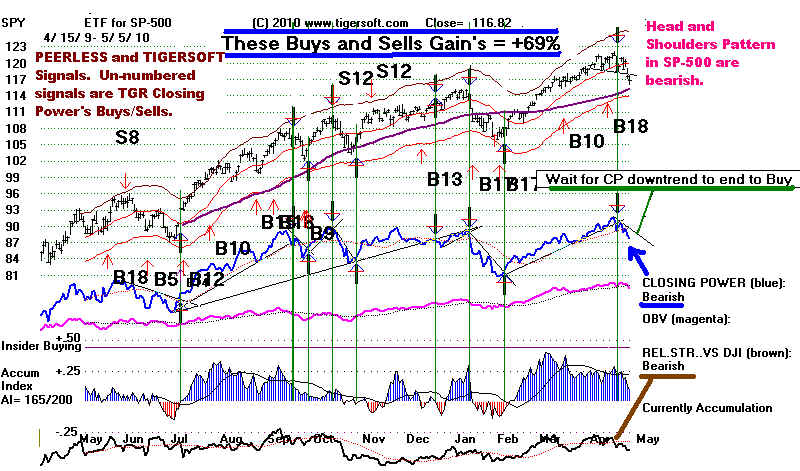

Chartists point to the bearish looking head and shoulders pattern in the DJIA, NASDAQ,

SPY and QQQQ. Research we have done shows these patterns are reliably bearish.

The patterns are widely known. So, there is a self-fulfilling aspect to them.

SPY Head and Shoulders Patterns: 1983-2010: These Are Reliably Self-Fulfilling

and Also Authentically Bearish Patterns.

Peerless Stock Market Timing: 1915-2010 $395

Real-Time Track Record since Start of Peerless in 1981

Environmentalists will point to the Gulf Coast Calamity. The unexpected Gulf catastrophe

may just keeping getting worse. Centering hopes on doming an erupting volcano of oil one

mile down seems a very long shot!

TigerSoft has a more sinister explanation.

May 5, 2010 Has The Fed Secretly Funded A Financial War on The EURO without

Obama's

Knowledge? The US

Constitution declares that only Congress can declare war for the US.

Presidents have long ago usurped

this power. Now the Fed may be, too. Since the Fed wants

to keep its activities secret, we

may not know the truth for a long, long time. The Fed has

far to much power to be allowed to

act secretly.

Bankers including Goldman Sachs are now making the Greek and

Spanish Budget Crises

much worse. The situations

there are spiraling downward. Bankers and Hedge funds have

made the situation much more

dangerous: first, by urging the creation of the Euro,

which replaced the Greek Drachma or

Spanish Paseta and, two, by using by Credit Default

Swaps to bet on collapse,

thereby creating much more fear, panic and unemployment in Greece

and Spain.

Bankers can now not only deny credit, now

they can now drive an economy into the dirt

by buying unregulated credit

default swaps, not for purposes of insurance, but to do harm

and speculate on disaster. Their

unregulated quest for profits exaggerates the market's moves

both ways. We have seen that

they can create a wildly speculative bubble. Now we

are seeing that they can make war

on a whole country.

The

Dollar's strength this year is not accidental. I argue below it is happening because

the Fed has given massive amounts

of money to a consortium of the biggest banks, especially

Goldman Sachs, who are now raiding

Greek Government bonds using unregulated

Credit Default swaps. They are part

of a larger consortium that includes George Soros

and other hedge funds, who believe

that they are attacking the weakest link in the EURO.

The Dollar is rising steeply now

against all the world's floating currencies.

This helps imports, but hurts

American exports. Big US banks and the Fed love a

strong dollar. The banks want

the US to be the unchallenged center of world finance

and the Fed wants the financing of

the trillion dollar deficits to run more smoothly.

There remains a fear that the bear raid on Greece

will go too far. Or that Europe

may reciprocate. In these

cases, a world financial panic may follow. Goldman, Soros

and the other hedge funds and

zombie banks may go too far on the downside, just as

when they create a bubble and

prices go too far on the upside. Another fear, we hope

paranoid, is that this consortium

will become a Frankenstein-like monster that the Fed

cannot control and it will turn on

California, Georgia or Massachusetts bonds and then

US Treasury bonds.

Of course, one hopes to be wrong in

laying scenarios like this out. The best way to

ensure that credit default swaps

are not misused by monopoly-banks turned into

dangerously out-of-control, mammoth

bear-raiding hedge funds, would be for Congress

to ban CDS altogether, or at least,

to make buying credit default swaps legal only if one

is already long the bond and if all

CDS trades reported and traded openly. Anything

short of this will be proof that

these scenarios are all too real. Allowing downside speculation

on entire countries or US

governmental entities is insanely dangerous. Why is no one

talking openly about this in the US

media? Apparently, no

one wants to be the first to stick up and

be hammered. The story of the

formation of the gang that want to break Greece has been

been reported in the Wall Street

Journal. It is the FED's connection with this that has been

missing in the American press.

See also the

Tiger Blog www.tigersoftware.com/TigerBlogs/April-28-2010/index.html

Is The US FED Funding

An

Undeclared Financial War on The Euro?

by William Schmidt, Ph.D.

(C) 2010 www.tigersoft.com

May 5, 2010

We know Goldman

Sachs has nearly unlimited borrowing rights at the US Federal Reserve Discount

window even though it is not a bank. It

can put up all the unworthy, worthless home mortgage collateral

it wants and get billions and billions in loans

from the Fed at an interest rate of nearly 0 interest. All this

the Fed does even though the Goldman is not a

commercial bank.

In the past I have suggested two reasons for

the Fed's generosity towards Goldman Sachs:

1) Goldman is the most "connected"

bank on Wall Street. Its people work everywhere in the US

government. Goldman was by far the

single biggest contributor to Obama. Goldman helps sell

US Treasuries and can help rig that

market.

2) Goldman's famed computerized trading program

has also been indispensable to the Fed and the

Obama Administration this past year to

keep the stock market rally alive, even after the market started to

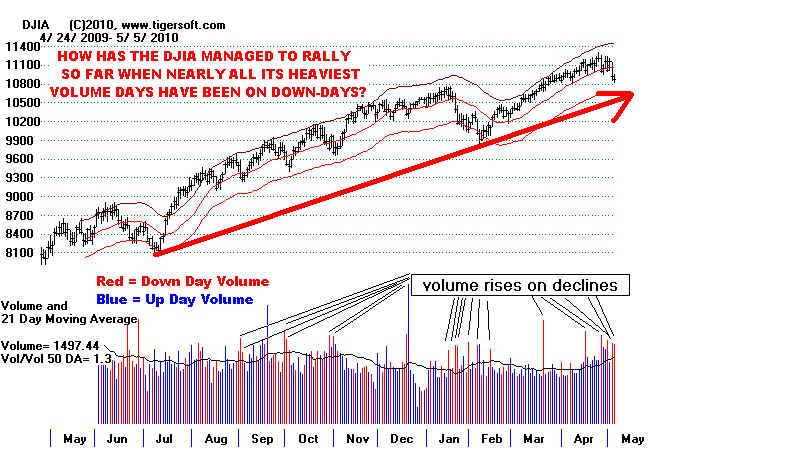

look a little ragged, as seen when the heaviest

volume days were nearly all down-days. The heavy-volume

RED down days this year (see below) have far

outnumbered the few high volume BLUE up-day days.

The proof of how important Goldman's

computerized trading has been commented on by earlier Tiger"

blogs. Embarrassed by this, the NYSE

stopped publishing the data proving this last July. At the time

Goldman's trading for its own account

constituted more than half of all NYSE and NASDAQ trades.

More than half!

Now Goldman's powers to boost US markets

may be wearing thin for a while. As a result, it is looking for a

new target for its trading.capital.

The thesis of this Blog is that instead of profitably manipulating and

exaggerating the US stock market bubble,

it has shifted to bear raid tactics and is working on

destroying a whole country, Greece in

consort with a collection of huge hedge funds and zombie banks.

In this we see again that Goldman is

totally amoral. It is without conscience. But it knows its limits.

I believe it has been already ordered by

the FED and the Obama Administration, not to sell short US securities.

That order against bear raiding does not

apply to European countries!

Goldman's Attack on Greece Is An Attack on the EURO

There is mounting evidence that the FED has a new reason to give billions to Goldman at

nearly

zero interest rates and with

only toxic debts put up by Goldman as collateral. Goldman plays a key role in

their scheme to boost the

Dollar by weakening the EURO, the.Dollar's competitor. Strengthening

the Dollar may not help

American exports much, but it will help the financing of the trillions of dollars of US

Debt.

The FED seems to have given a

green light to an ambitious George Soros backed plan to attack the EURO

at its weakest, most

vulnerable spot, Greece. The plan initially centers around buying Greek bond credit

default swaps. This is

a speculative bear raid. The credit default swaps are NOT being bought as insurance

by Greek bond holders. They

are being bought in large numbers to drive down Greek credit ratings,

make it harder and harder,

more and more expensive for the Greek government to borrow the money

it needs to operate. If

this organized bankers'/hedge fund bear raid against Greece is successful,

it will be used on other

European countries, as needed.

The remarkable thing is that

the Fed is funding the plan through Goldman and the other zombie banks.

Now we see why the Fed does

not want these banks to loosen their credit to home owners and

small businesses. It

wants them to fight an undeclared war against the Euro. The US media totally ignores

this. I doubt if Obama

even knows of this undeclared war!

The US Dollar's Strength Started This

Year

as The EURO began to decline in earnest.

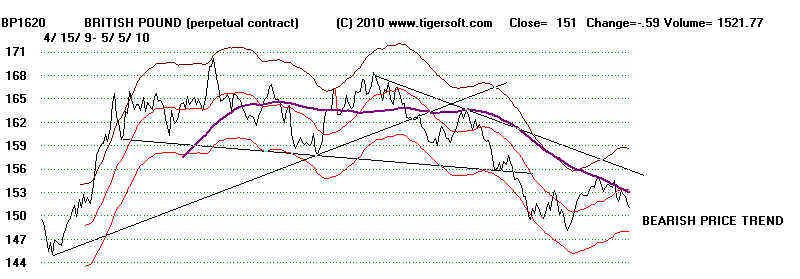

British Pound

Swiss Franc

GOLD IS ONE WAY OUT FOR INVESTORS

The Bankers Hatch Their Plan.

( Source: http://www.alipac.us/ftopict-190201.html

http://www.rense.com/general90/euro.htm )

Here is the entirety of a provocative study posted by an anonymous British journalist..

"It has been evident for some time that the ongoing speculative

attack on Greece,

along with such other countries

as Spain, Ireland, Portugal, and Italy, was not primarily a reflection of their economic

fundamentals, nor yet a

spontaneous movement of "the market," but rather an orchestrated action of

economic warfare. The dollar had

been relentlessly falling through the late summer and autumn of 2009. It obviously

occurred to various Anglo-American

financiers that a diversionary attack on the euro, starting with some of the weaker

Mediterranean or Southern

European economies, would be an ideal means of relieving pressure on the battered US

greenback. Since these

"degenerate elites are incapable of directly solving the problem of the dollar

through increased production, full

employment, and economic recovery, one of the few alternatives remaining to them is to

create a situation in

which the euro is collapsing faster, leaving the dollar as the beneficiary of some

residual flight to quality or safe

haven reflex.

This is what emerged during the first week of December with a

speculative assault or bear raid against

Greek and Spanish government bonds as well as the euro itself, accompanied by a scurrilous

press campaign

targeting the "PIIGS," an acronym for the countries just named, coming from

inside the bowels of Goldman

Sachs.

I have discussed this phenomenon several times over the last two to three weeks on my

radio program on GCN.

Now comes

concrete proof of this conspiracy in t the form of a Feb. 8 "idea

dinner," held at the

Manhattan townhouse of Monness, Crespi, Hardt & Co, a

boutique investment bank. Among those present

were:

SAC Capital Advisors,

David Einhorn of Greenlight Capital (a veteran of the fatal assault on Lehman Brothers in the

late summer of 2008),

Donald Morgan of Brigade Capital, and,

most tellingly, Soros Fund Management.

The consensus that emerged that night over the filet mignon was

that Greek government bonds were the weak flank

of the euro, and that once a Greek debt crisis had been detonated, all outcomes would be

bad for the euro.

The assembled predators agreed that Greece was the first

domino in Europe. Donald Morgan was adamant that the

Greek contagion could soon infect all sovereign debt in the world, including national,

state, municipal and all other forms

of government debt. This would mean California, the UK, and the US itself, among many

others. The details of this

at dinner were revealed in the headline story of the Wall Street Journal on Friday,

February 26, 2010. (See

article at

http://online.wsj.com/article/SB40001424052748703795004575087741848074392.html

Nor was this the only cabal in town intent on attacking the

euro through the week Greek flank. The article cited

suggests that GlobeOp Financial

Services and Paulson

& Co. are also piling on. The zombie banks were

|also heavily engaged. The article reported that Goldman

Sachs, Bank of America-Merrill Lynch, and

Barclays Bank of London

were also assisting speculators in placing highly leveraged bearish bets against the euro.

Note that these zombie banks are alive today because of US taxpayer money, in Barclay's

case through AIG.

It amounted to a deliberate attempt to create a large-scale world monetary crisis which

would certainly bring |

with it the dreaded second wave of the current world economic depression. The creation of

monetary chaos

in Europe through the convulsive destruction of the euro under speculative attack would

cripple commodity

production in western Europe, severely undermining one of the dwindling areas of the world

economy which

are still functioning. The genocidal implications for humanity ought to be obvious, but

the assembled hedge fund

hyenas were not concerned with these consequences.

George Soros has been

telling every media outlet that will listen that the euro is doomed to fall apart and

break up

over the short run. Soros even has a

theory to deploy as part of his speculative attack. Soros argues that the

fatal flaw or original Sin of the euro is that it was based on a common central bank among

the participating

countries, but lacked a common treasury and tax policy. This means that a country like Greece can no longer

defend itself from a speculative attack on its bonds by the simple expedient of currency

devaluation, since

there is no more drachma, and the euro is controlled from Frankfurt, not Athens.

British spokesmen are quick

to point out that, even though the financial situation of London is far worse than that of

Athens, the British government

is already devaluing the pound through a downward dirty float.

Given Soros's infamous track record,

he must be taken seriously. In 1992, Soros became world famous

through his attack on the European Rate Mechanism, which he executed by a highly leveraged

speculative assault

on the British pound, at the time one of the weaker members of the ERM. Soros' speculative

attack led to a pound

devaluation and the ragged breakup of the ERM, and netted Soros £1 billion in profits. It

was as if Soros had

personally stolen a £20 note from every man, woman, and child in Britain. The speculative

gains were no doubt

gratifying, but the overriding political purpose of the assault was to sabotage that phase

of European monetary policy.

The London Economist has gone out of its way to mock Spanish Prime Minister Zapatero's

remark that Spain

was under international speculative attack. Press organs of the city of London and Wall

Street have ridiculed the Greeks

as a nation of paranoid conspiracy theorists. And yet, the revelations made so far are

strong circumstantial

evidence of pre-concert, as Lincoln would say. Even the US Department of Justice has been

forced to send letters

to the participants in the infamous "idea dinner," warning them not to destroy

any of their records and thus putting them

on notice that they are under investigation. While we should not have any illusions about

the prosecutorial zeal of

Attorney General Eric Holder, who once represented the international financial bandit Marc

Rich, this is at least a

beginning. Spanish and Italian judges are noted for their independence, and one of or more

them may wish to

examine the activities of Soros, Goldman Sachs, and their

hedge fund allies.

Greece does not need an

austerity program, as the Greek labor movement has eloquently argued in the course

of their successful and admirable general strike last week. Greece does not need a

bailout from Germany, the

sinister International Monetary Fund, or from anyone else. Least of all does Greece need to accept the

advice of

Austrian school or Chicago schools charlatans who recommend the catharsis of a

deflationary crash that would destroy

an entire generation through unemployment, poverty, and despair. Greece needs to defend

itself with a 1% Tobin

tax on all derivatives and other financial transactions. Greece should take the

lead in outlawing credit default swaps,

which amount to issuing insurance without meeting the capital requirements of being an

insurance company. Greece

needs to enforce EU and national antitrust laws. If Soros and his gang succeed in breaking

up the euro, Greece

should make the best of it by immediately imposing heavy-duty exchange controls and

capital controls to

protect the new drachma, on the model of Malaysia a dozen years ago. Greece should shut down

domestic

zombie banks and seize its central bank and use it to issue 0% credit for industrial and

agricultural hard commodity

production. If the Greeks made plain what they intend to do if they are forced to fall

back on the drachma, the

financiers who fear such an example would have another reason to relent.

Another obvious expedient is that of a bear squeeze or short squeeze. Soros, Goldman Sachs, and their

gang of

hedge fund allies have now used derivatives to establish short positions against Greek bonds and

the euro, betting

that these latter will go down. Political pressure is now being brought to bear on the

European Central Bank and the

Greek central bank to undertake an unannounced large-scale purchase of Greek bonds and

euros in the forward market,

causing the Wall Street predators to lose their bets, thus punishing them severely with

extravagant losses. This is

normal central bank practice, and it will be astounding if the Greeks do not execute such

a maneuver very soon.

The world now faces a stark choice between two alternatives, with Wall Street forcing the

issue. The first is that

the zombie banks and hedge funds, having been saved and bailed out by national states and

their taxpayers, will repay

the favor by driving the national states and all forms of state, provincial, and local

government into bankruptcy. This

will be synonymous with the destruction of modern civilization itself. The second and

preferred alternative is that the

national states summon the political will to use the inherent powers of government to

place the zombie banks, hedge

funds, and related purveyors of derivatives into bankruptcy receivership and shut them

down once and for all, relying

in the future on nationalized central banks for the provision of credit. The second

alternative would allow the

preservation of modern civilization as we have known it. But in the meantime, the

derivatives-based speculative attack

on the southern flank of the euro has accelerated the arrival of the second wave of

depression, which now appears

likely to strike the world before the end of 2010.

http://www.alipac.us/ftopict-190201.html

By Sean O'Grady

Thursday, 4 March 2010

Fears of a hedge fund "conspiracy" to destroy the euro gathered pace yesterday

when the American authorities

ordered some funds not to destroy records of their trading in the single currency. The

move comes after the

US Federal Reserve promised to probe claims that the use of credit derivatives by Goldman

Sachs had, ironically,

helped Greece enter the eurozone a decade ago. Although the latest Greek austerity plan

helped to calm markets

and nudged the euro higher against the dollar, traders warned that the euro's traumas were

far from over. Indeed,

it seems that the EU and the hedge funds are about to intensify their economic warfare,

with the opening of a new

front in America.

The US Department of Justice has asked a number of the hedge funds whose executives

attended a dinner hosted

by New York-based research and brokerage firm Monness, Crespi, Hardt & Co on 8

February, to preserve

their trading histories. According to an agenda obtained by Bloomberg, those present

discussed a number of "themes",

including the chances of the euro falling against the dollar. Aaron Cowen, an executive at

SAC Capital Advisors, David

Einhorn, head of Greenlight Capital, and Don Morgan, who runs Brigade Capital Management

LLC went to the dinner,

as did a representative from Soros Fund Management.

The presence of a Soros employee has set alarm bells ringing, as George Soros' formidable

reputation as an

investor – as well as a maker and breaker of currencies – goes before him. So

far-reaching is his influence that

any hint from him of negative sentiment towards an asset or currency can turn into a self-

fulfilling prophecy.

While the meeting may have been no more than an exchange of ideas, with no commitments on

any side,

the presence of so many powerful American financial interests in one room discussing the

euro will no doubt fuel

the conspiracy theories currently swirling around the foreign exchange markets and in

political circles.

The Greek prime minister, George Papandreou, has condemned speculators with "ulterior

motives" for making

his country's difficulties worse and destabilising the euro. If the dinner meeting in New

York was part of a

concerted effort to move markets it might well break US anti-trust laws. Conversely, other

hedge funds have

said they have avoided euro denominated sovereign debt for fear of regulatory retaliation.

The forces are massing. The value of the "bets" made by hedge funds and others

against the European currency

has reached more than $12bn – almost double the amount of a few weeks ago, suggesting

that the pressure will

persist. The number of credit default swap (CDS) contracts made to the same effect has

also soared.

Many CDSs – in effect a means of insuring against the risk of default – have

been taken out by those with no

ownership of the underlying asset, such as Greek government bonds, in so called

"naked" CDS trading. Very

low interest rates provided by central banks have also made such bold currency plays more

viable, as they reduce

the cost of funding or "covering" them.

For the moment though, the euro seems set to survive its Greek calamity. A swingeing

programme of VAT rises

and public sector wage cuts were widely rumoured to be the price Greece will have to pay

for the long-mooted

EU bailout of around €25bn. It should also clear the way for a successful €5bn

bond issue at the end of the week.

As was widely anticipated, Athens yesterday announced a further €4.8bn in fiscal

consolidation, about 2 per cent

of GDP, in the third package in three months. There will be a rise in VAT, further tax

hikes on fuel, alcohol and

tobacco, and more reductions in the public-sector wage bill.

This is in line with the demands European finance ministers have been making on their

Greek counterpart.

Yesterday's plan also had a positive effect on the cost of insuring Greek government debt,

which fell back again.

However, a further €20bn will need to be raised by Greece over April and May, and

more explicit assurances

that the other eurozone states will stand by Greece financially may be needed.

The anticipation of a deal between Athens, Brussels and the two nations liable for much of

the bill – France and

Germany – was also heightened by the announcement that Mr Papandreou will meet

Chancellor Merkel this

Friday before seeing President Sarkozy on Sunday. By the time Mr Papandreou faces all his

fellow EU leaders

in Brussels on 16 March he should be able to demonstrate concrete progress towards his

stated ambition of getting

Greece's near 13 per cent of GDP budget deficit down to 9 per cent next year and back

below the Lisbon Treaty

limit of 3 per cent by 2012.

However, mutual suspicion and name-calling between the hedge funds and regulators on both

sides of the Atlantic

still threatens to escalate into something more serious.

The EU's new Internal Market Commissioner, Michel Barnier, said this week that he would

investigate short sales

of the euro and the abuse of the credit default swaps market. He is currently supervising

the Commission's latest

directive to regulate the hedge fund industry, the alternative investment fund managers

(AIFM) directive.

This measure has the potential to kill the EU hedge fund business, which is 80 per cent

concentrated in London.

Clauses in the draft AIFM directive that require regulatory equivalence in territories

where hedge funds usually

domicile their money, such as the Cayman Islands or Jersey, would effectively end many

hedge funds' life in the

EU. And it is a substantial business. European hedge funds, predominantly in the UK, grew

by 9.1 per cent in

the second half of last year to reach $382bn, according to Hedge Fund Intelligence, part

of a global wave of

almost $2trillion, more than enough to move certain assets or currencies, especially if

leveraged with cheap

central bank money.

Lord Turner, the chairman of the Financial Services Authority said on Tuesday he backed an

investigation into

short speculative positions. He said: "It may be that even if you banned it, it

wouldn't make a big difference,

but there are questions as to whether you should be allowed to take out an insurance

contract where you don't

have an insurable interest."

The French Finance Minister, Christine Lagarde, has said she wants the EU to take a united

approach against

"speculators" betting on CDSs, and the German Finance Ministry has also called

for review of "over-the-counter"

products such as CDSs, which are not traded on any central exchange and, arguably, lack

transparency.

Such sabre rattling is yielding results. Some hedge funds, including Brevan Howard and

Moore Capital, have

avoided euro-denominated sovereign debt because of the threat of a "regulatory

squeeze", though they may

continue to take a position against the euro itself.

Brevan Howard, Europe's largest hedge fund, with $27bn of assets under management, has

said the short

trade in eurozone government bonds was "extended, crowded, fully pricing the

fundamentals", and indeed

the CDS spreads for Greek paper have been narrowing markedly in recent weeks. The firm

added that the

hedge funds were facing the same sort of pressure over short-selling activity that they

did at the peak of the

crisis on 2008, when they were banned temporarily in some places from going short on bank

shares,

something that had little long-term effect on the fate of the banks.

In the war between the hedgies and the authorities, many observers believe that Spain,

rather than Greece,

will prove the decisive battle ground. As Spain's economy is so much larger than that of

Greece, a bailout

would be far more difficult to fund even for the zones largest economy Germany, where

political resistance

to further rescues may be insurmountable.

In the long term, the resolution of this struggle may be political rather than economic.

Mr Papandreou has

suggested speculation against individual nations would be rendered impossible if sovereign

debt was issued

by a European Treasury on behalf of all states, just as the US Treasury does. President

Sarkozy has also

spoken enthusiastically and often about the need for "European economic

governance".

But a pooling of budget and Treasury functions across the zone would remove the last

defences of German

fiscal prudence: the others have gone. The Maastricht criteria, transferred to the Lisbon

Treaty, limited budget

deficits, national debt levels and outlawed cross-border bailouts; All have been, or may

shortly be, swept away

by the financial storm. The hedge funds are, in part, betting that the German government,

or its people, will prefer

to preserve their treasured economic security rather than the cherished political project

of European unity.

As so often during momentous episodes in European history, it all depends on Berlin.

George Soros: The man that governments fear

The involvement of George Soros in the euro crisis has revived uncomfortable memories of

the success –

and profits – he enjoyed by betting against the pound during the ERM crisis of 1992.

"The man who broke

the Bank of England", he was soon dubbed, and he reputedly made $1bn from his

activities then; the concern

is that he will now break the euro. The influence of the Hungarian-American currency

speculator, stock investor

and philanthropist is such that he attracts many followers, and his bets can thus become

self-fulfilling through

"momentum trading". Even if he does not actually destroy the eurozone, he will

leave it badly mauled.

The auguries are not good. At the Davos World Economic Forum in January, Mr Soros declared

that he

thought the euro "may not survive". And if there is one theme in his long career

it is that he enjoys making

one way bets on economic inevitabilities; often the certainty that a fundamentally weak

currency will have

to leave a fixed exchange rate system (as with the pound in 1992). By the spring of 1992,

it was becoming

clear that Britain was a part of the European Exchange Rate Mechanism at the wrong rate.

It was overvalued

compared to the German currency, and we were increasingly uncompetitive. The only way it

could be sustained

was for British interest rates to be kept far too high for UK domestic conditions (though

that did hammer inflation

out of the system). The pain the ERM was causing, unnecessarily, to the British economy,

was becoming unbearable.

Soros spotted his chance.

In retrospect, he followed what was an obvious strategy. In this case, he borrowed around

£6bn and

converted it to German marks at the fixed rate, shorting his sterling position. It was

almost a one way bet.

If sterling collapsed he would hit the jackpot. He hit the jackpot. A £350m side bet on

equities rising after the

devaluation was a bonus.

The Tory government led by John Major was humiliated for its economic incompetence, and

was left out of

contention for two decades. The political advisor to the then chancellor, Norman Lamont,

was a certain

David Cameron. One can guess the lessons he learned from the experience.

Almost 80 now, Mr Soros has been a pantomime villain ever since, but he perhaps did the UK

a favour.

"Black Wednesday", 16 September 1992, heralded a savage depreciation of sterling

followed by a long period

of sustained low inflation and export-led growth. The Greeks could do a lot worse.

http://www.independent.co.uk/news/business/analysis-and-features/fear-and-loathing-as-the-hedge-funds-take-on-the-euro-1915776.html

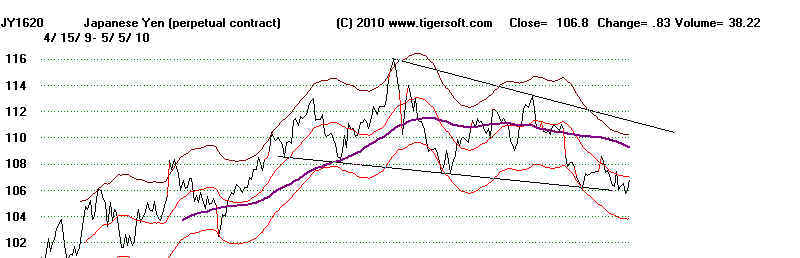

A break in its down-trend will be a Buy after a test of support.