|

Daily Blog - Tiger Software Send any comments or questions |

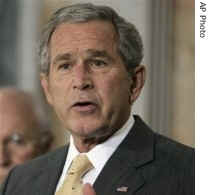

Bush Says Investors Should Not Worry Bush Says Investors Should Not Worry  "WASHINGTON, Aug. 8 — President Bush, seeking to reassure Americans about the economy and combat Democratic criticism of his policies, said on Wednesday that recent financial market turbulence was not a cause for worry but a natural adjustment from the improvident lending of recent years. (I say, "Phooey! Trust You Once, Shame on You... Trust You Anymore, Shame on Me". Your Iraq war will cost 1 trillion dollars and more when all the bills come in. That is the primary reason the US credit is over-extended! ) “I believe that markets ultimately look at the fundamentals of any economy,” Mr. Bush said. “And the fundamentals of our economy are strong. Inflation is down. Real wages are increasing. The job market is a strong job market. People are working. Small businesses are flourishing.”  Does The Market Now Decline When Bush Speaks? It did this in 2002. My sense is his appearance now is damaging to the stock market. His approval ratings are now just too low to give him much credibility. His appearance now reminds investors of negatives. If the market were rallying, he would just be ignored. His calls for tougher penalties for Wall Street criminals on 7/9/2007 has also had a negative effect. The 2001-2002 decline owed much to Insider Trading allegations and convictions. Here is a serious discussion of this phenomenon. http://dir.salon.com/story/politics/col/spinsanity/2002/07/27/markets/index.html http://www.spinsanity.org/post.html?2002_07_21_archive.html ================================================================================== Quote from By Lawrence Kudlow July 20, 2007 It has been widely reported that President Bush simply refuses to turn against the surge in Iraq, or even compromise on it.... I have long believed that stock markets are the best barometer of the health, wealth and security of a nation. Quote from VP Dick Cheney about what the US will do after the invasion of Iraq "Well, I don't know, we haven't thought much about that." Fortune Magazine Quote from Senate Majority Leader Harry Reid (D-Nev.). "It is laughable that a man who has turned record surpluses into record deficits would lecture anyone about proper investments for our nation." =================================================================== Recall what Conservatives Said in 2002. Bush Foreign Policy and the Failing Stock Market by Jon Basil Utley (Source: http://antiwar.com/utley/?articleid=1632 )

|

|

. . .

|