1.

Major Peerless Sell Signals

Peerless is a software program I wrote back

in 1981. I used to travel

around the

Southwest with an Apple

II-plus, putting on seminars in brokers' office and selling

a book and software for $250.

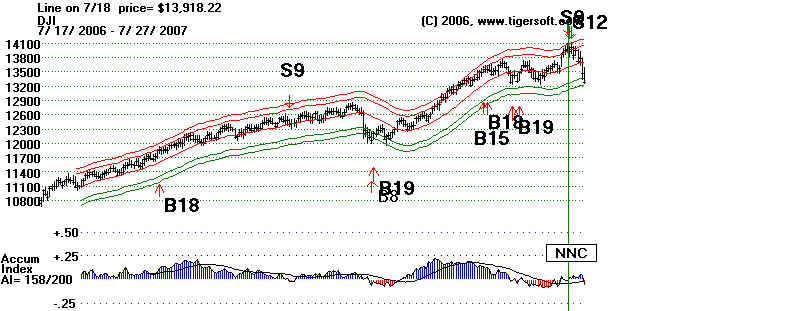

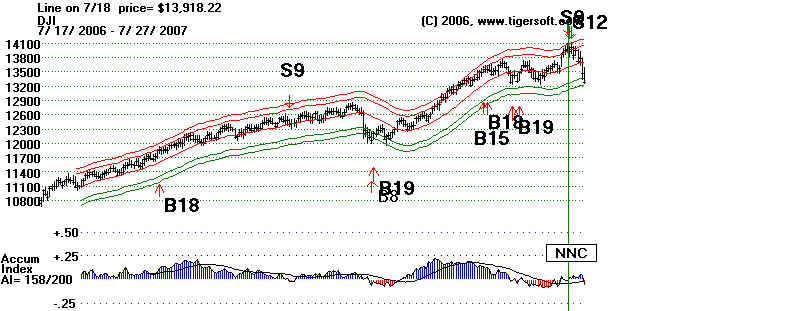

Twenty six years later, the very same major signals

that I had discovered then

still work. On July 17th this year, just eight trading days

ago, Peerless gave an

automatic major Sell "S9" and Sell "S12". Compare the

recent major Sell signals

with what occurred in January 1973. Exactly the same

algorithms called the top in

January 1973, not long before oil prices shot through

the roof because of the oil embargo, a year before Nixon

was impeached and a year

before Congress refused to

keep funding the US war in Viet Nam, and 18 months

the DJI fell from its high of

1050 to 580, a decline of more than 40%. There are some

technical defferences, but

the similarities are clear-cut and the historical parallels

eye-opening.

This is our "bread and

butter", so I can't tell you what it is based on, until you buy

our program, but compare the

top in January 1973, shown first, with the apparent

top eight trading days ago,

shown second. Buy our software and we'll show you

how to call these tops better

than you ever imagined possible.

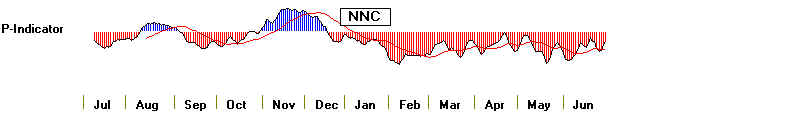

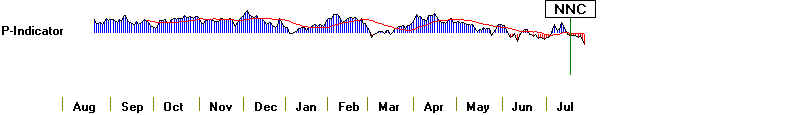

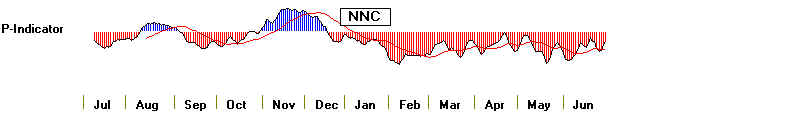

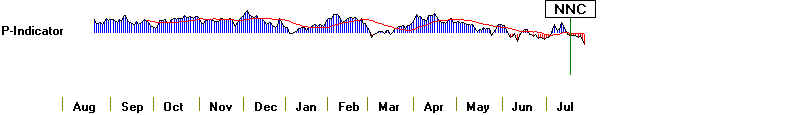

January 1973 Top

|

July 2007 Top?

|

What Should You Do When You Get A Major Sell?

The first thing to do is to use the Peerless Help Routine and see how accurate

and powerful the particular

signal is. Doing this, we see that there have been 194 days

when an "S9" signal

occurred beteeen 1965 and 2007. The average DJI drop at the time of

the next major Peerless Buy

is 5.3%. That might not seem like a lot, but it is impressive

when you realize these are

Sell signals and the DJI rose from 800 to 13200 in this period.

71.8% of the them brought

declines at the time of the next major Peerless Buy signal.

There was a simultaneous

"S12" major Sell at the 14000 top recently. Looking up the

S12's track record, we see

there have been 58 of them up to mid 2006. These averaged

a drop of 6.1% at the time of

the next major Peerless Buy. 79.7% of them were profitable.

You could also study these

results and see how "S9" and "S12" signals do in Julys and we

can also take the first

occurrence if there is a cluster of days with "S9" signals. When we do

that

we see only 2 earlier July

cases where there was a simultaneous "S9" and S12" as we just saw.

In both cases, these S9-S12

Sell signals took place as the DJI made a new all-time high

and fell 15%

S12

7/16/1970 - This was at the end of the 1969-1970 bear

market. It does not really

match

the current situation, where we have had an on-going bull market. The

DJI

fell in this case 1.9%, at which time Peerless gave a major Buy.

S12

7/17/1978 - The DJI disregarded this Sell signal and

rose 5.7% before Peerless

gave

a reversing Buy Signalfell in this case 1.9%, at which time Peerless gave a major Buy.

S9

7/12/1982 - This was at the end of the 1981-1982 bear market. So it does

not really apply. The DJI fell 5% from 825 to 780, But on 8/17/2007 Peerless

gave a major Buy and the 1982-1983 bull market started.

S9/S12 7/13/1990 - This was at

an all-time high. There also was a "Sell S12" here.

The DJI fell immediately and sharply, reaching a mini-bear market bottom in

October with a major Peerless Buy signal. At that point

the DJI had falled

15.6%. This was at the time Iraq invaded Kuwait.

.

S9/S12 7/8/1998 - This was at

an all-time high. There also was a "Sell S12" here.

The DJI fell immediately and sharply, reaching a mini-bear market bottom in

October with a major Peerless Buy signal. The DJI had

by thrn falled 15.2%.

S12

7/6/2006 - This signal was over-ridden by a previous

NASDAQ buy that is so

powerful

that it cancels Peerless Sells for 3 months. The DJI in this case did

fall

to the lower band. This signal also occurred on a rebound after a sell-off,

and

so does not really apply.

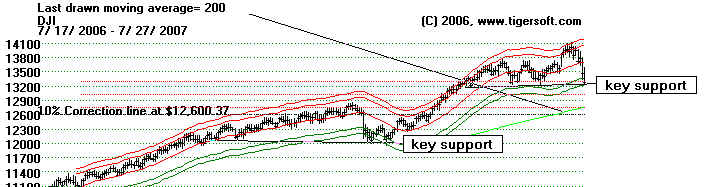

What does it take to

reverse a Peerless Major Sell. If the DJI bounced off

the support at 13200

tomorrow, will it be a good place to buy?

Our

studies show that the lower band is reached about 80% of the time after

either an S9 or S12.

When they both occur simultaneously, the DJI has always reached

the lower

band. But the odds heavily favor a break-down.

So

will there be a significant bounce from the lower band? Usually that is

where professional buyers do

come in. But how tightly will they hold if prices

start to weaken again.

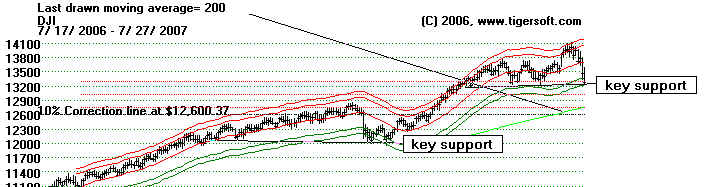

The key question the markets will face next week is

whether the well-tested

support seen at 13,200 on the DJI will hold. You might

want to compare the support

at 13,200 with the support that held in March at

12,000. We pay

attention to key moving averages. A 200-day moving average

is shown in the chart below.

We monitor percentage retracements, too. A 10%

correction would bring the

DJI back to 12,600. That level is important because it

also coincides with the

200-day moving average.

Until

Peerless gives a major Buy signal, we have to advise great caution. Traders

can watch the market

intra-day and play a support level like we see at 13,200. But investors

should wait for Peerless to

give a Buy signal.

Our nightly Hotline - $298/year - discusses these

and many other nuances,

such as foreign markets, the

way the US markets behave in the second half of years

that end in "7",

what is portended by the history of combined "S9+S12" signals

at all-time highs portend and what

to watch for from Crude Oil, foreign currencies

and metals, as well as US housing,

REIT, real estate and bank stocks.

2. Using

ETFs To Short The Market

You

don't have to go short the market to make money ina declining market. And

you can use the vehicles decribed

below to hedge and protect profitable long positions

you wish to hold, perhaps for tax

reasons. Four of the newer ProShares ETFs allow

investors

to get short exposure to a stock

index without having to set up margin accounts or

worry about margin calls:

Some of these vehicles are:

Short

QQQ ProShares (PSQ)

Ultra-Short QQQ (QID)

Short S&P500 ProShares (SH)

Ultra-Short S&P500 (SDS)

Short Dow30 ProShares (DOG )

Ultra-Short Dow (DXD)

DXD,

DIA, SDS, SPY, QID, QQQQ 1-yr chart:

(Source:

http://etf.seekingalpha.com/article/39285

)

---------------------------------------------------------------------------------------------------------------------------

Watch

those Interest Rate Charts:

-----------------------------------------------------------------------------------------------------------------------

3.

Will Foreign Markets Escape The Down-Draft of the Peerless S9/S12?

They

did not after the May 5th, 2006 S9.

England's FTSE crashed 550 points, or 9

percent:

Japan's

Nikkei, down 1,900 points, or 10.8 percent:

Emerging

markets experienced the most dramatic slide.

India's Sensex Index, suffered a crash, dropping 2,500 points, or 20

percent after

the

Peerless S9 of May 5, 2006..

Brazil's Bovespa, down 6,000 points, or 14 percent:

The Korean Seoul Composite, fell 140 points, or 9.5 percent:

The Hong Kong Hang Seng Index, down 1,550 points, or 8.9

percent:

Singapore's

Straits Times Index, down 250 points, or 9.4 percent:

Taiwan's Weighted Index, fell 700 points, or 9.3 percent:

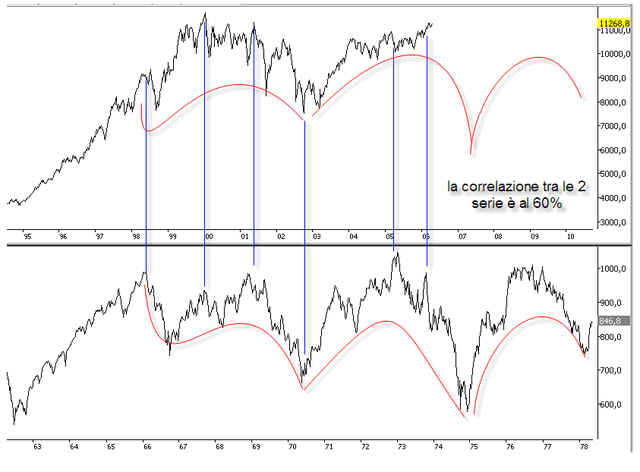

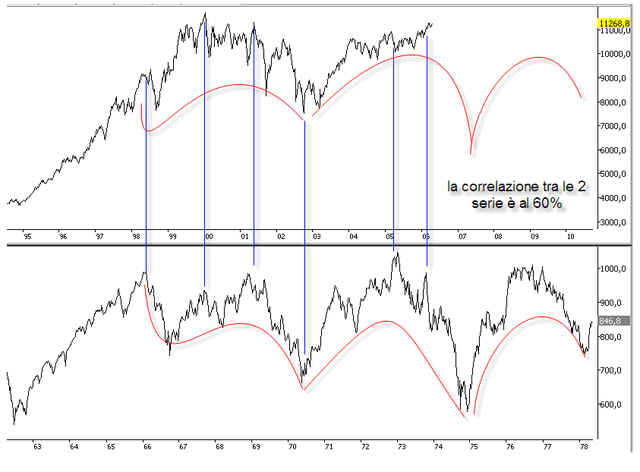

4. An Eerie Paralel:

Something

to think about.

Barry

Ritholz, of The Big Picture Blog, created a post comparing the

present with 1973-74 cycle,

using

a chart to show that today's Dow is following the 1970's Dow's pattern with an eerie

correlation.

If

the comparison holds true, 2007 is similar to 1973, a year that marked the start of an

18-23 month

bear

market that finally ended with a 40 percent loss. Here is his chart:

.

|