The Terrible Happens.

Should

You Panic with Your Investments?

Five

Case Studies: 1915, 1941, 1957, 1963 and 2001

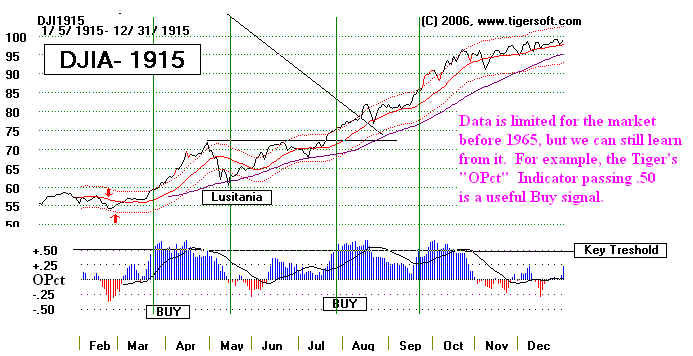

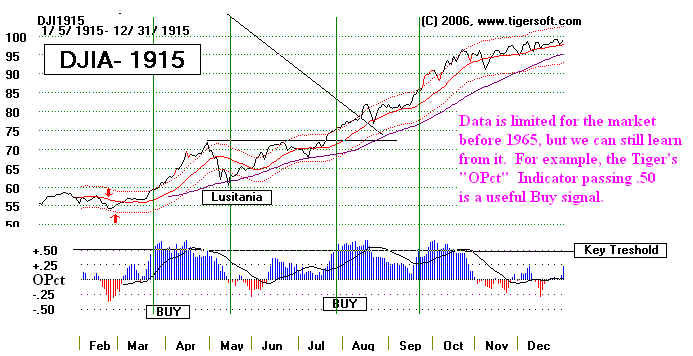

1915 - Sinking of

Lusitania.

http://home.pacbell.net/steamer/lusita.htm

(Editor's

note: This would seem to make as good a movie as the sinking of the Titanic.

But like Steinbeck's best

novel, "In Dubious Battle", Hollywood does not want to touch the

issues raised here.)

Say, for example, you are an

investor back in 1915. The US has stayed neutral

in the European War,

but then the passenger liner Lusitania is sunk by a German

submarine with the loss

of more than 1100 people, including 112 Americans. Surely,

this means the US will

be thrown into the bloody war. Should you sell all your stocks.

Here

is the Tiger chart of the year 1915. Technical analysis usually wins out over

heeding "raw

emotions". That was as true in 1915 as it is today. The DJI held at its

long-term moving

averages and rallied with very positive readings from Tiger's volume

tools.

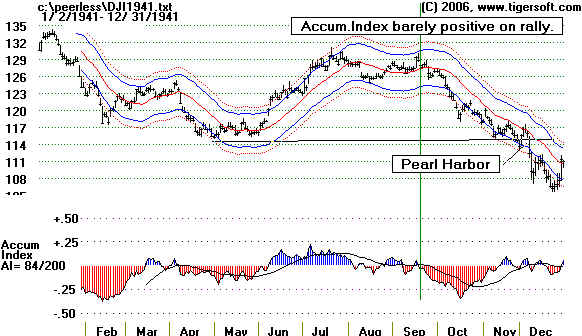

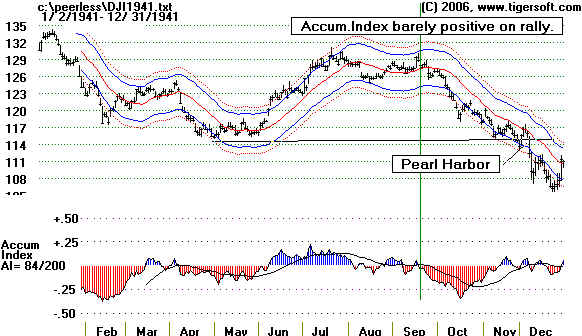

Japanese Attack on Pearl Harbor - December 7, 1941

(See

http://www.american.edu/TED/ice/japan-oil.htm)

The DJI and the

US stock market was already in a decline after mid-1941. In July 1941

the US had imposed an oil embagro on Japan.

Those who followed international developments

knew that the US would not be able to escape

World War II for very much longer. Japan's

imperial ambitions depended upon oil. (The same

is still true. For the US to be the pre-eminent

power in the world, it needs more and more oil.

Hence, Bush's war on Iraq.)

Tiger

"Accumulation Index weakened in September 2001, so that its readings were barely

positive as the DJI came close to tagging the

upper band zone we use. The breaking below

the 125 lows of August were confirmed by

Tiger's volume indicators making corresponding new

lows.

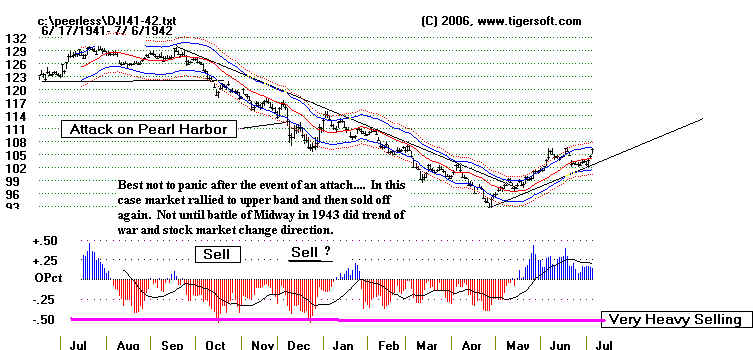

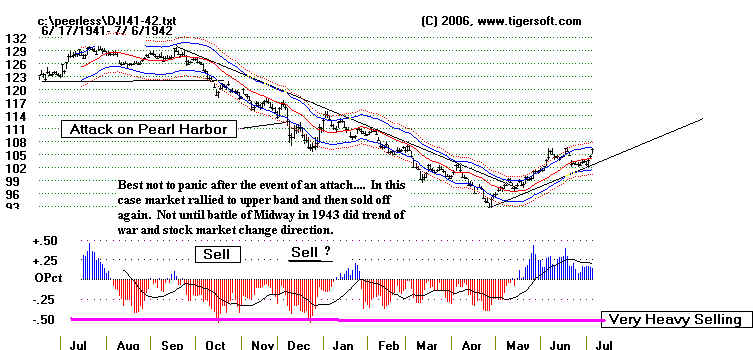

Not

until the Battle of Midway in May 1943 Did The Market Turn Upwards.

The

DJI's downtrend-line here was very well-tested. That made its upside violation

very

significant technically. Note how the Accumulation Index turned positive.

The

tide of war had turned, and with it the US stock market.

1957

- 'Sputnik" Bear Market

Peerless

sytem easily called the top in October 1957, just before the DJIA

fell 20%. "Someone

always knows." Use Peerless and buy when others are panicking.

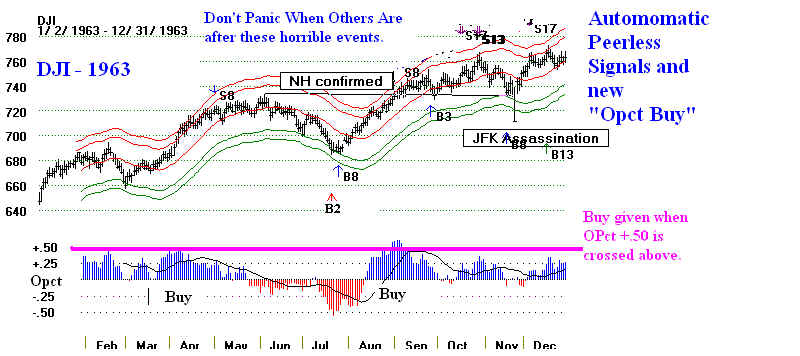

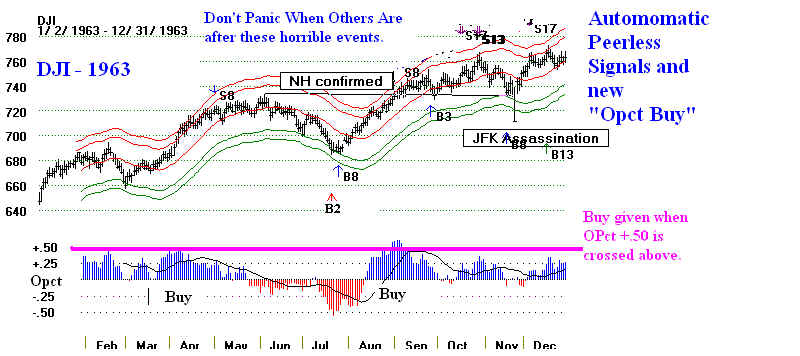

1963

- JFK Assassination

Would you have panicked

when President Kennedy was assassinated? Not a good idea.

The next day the market was up strongly. Of course, much of

American business was holtile

to Kennedy. Still, at first it seemed Oswald was a CIA

assassin.

9-11-2001 Attack

The

market was closed for more than a week after the attack of early 9/11/2001.

The attack took place before

the market had opened. It had closed at 9605.51 the day

before the attack. 10

days later, on 9/17, it opened down about 600 points and then fell

another 1000 more beofre

reversing intra-day on 9/21. Our Peerless chart gave a major

Buy on this day. The

DJI was as oversold as it has been at the bottom of the October 1987

Crash. The Peerless major Buy

B16 on 9/21/01 reversed the major Sell from the beginning

of the year.

|

| Dow Jones Performance After Major U.S. National Security Events |

| Event |

Date |

% Change for Daya |

6-Months Later |

1-Year Later |

| aIf the event occurred after the U.S. market closed or on a

non-trading day, the % change for day reflects the next trading day's activity. |

| SOURCE: Dow Jones web page. |

| Terrorist Attack |

09/11/01 |

-7.12% |

10.47% |

-10.66% |

| Oklahoma Bombing |

04/19/95 |

0.68% |

14.92% |

32.46% |

| WTC Bombing |

02/26/93 |

0.17% |

8.41% |

14.07% |

| Operation Desert Storm |

01/16/91 |

4.57% |

18.73% |

30.14% |

| Panama & Noriega |

12/15/89 |

-1.53% |

7.17% |

-5.32% |

| Reagan Shot |

03/30/81 |

-0.26% |

-14.56% |

-17.12% |

| Vietnam Conflict |

02/26/65 |

-0.41% |

-0.81% |

5.48% |

| Kennedy Assassination |

11/22/63 |

-2.89% |

12.04% |

21.58% |

| Sputnik Launched |

10/04/57 |

-2.01% |

-4.59% |

15.60% |

| Korean War |

06/25/50 |

-4.65% |

2.36% |

9.34% |

| Pearl Harbor |

12/07/41 |

-3.50% |

-9.48% |

-1.37% |

| Lusitania Sinks |

05/07/15 |

-4.54% |

36.01% |

| Dow Jones Performance After Major U.S. National Security Events |

| Event |

Date |

% Change for Daya |

6-Months Later |

1-Year Later |

| aIf the event occurred after the U.S. market closed or on a

non-trading day, the % change for day reflects the next trading day's activity. |

| SOURCE: Dow Jones web page. |

|

There's more coming in my book on the stock market since 1915 using the

perspective of Peerless

Stock Market Timing. Stay tuned.

.

|