PAGE 6

TIGERSOFT www.tigersoft.com

(C) 2012 Wm. Schmidt, Ph.D.(Coumbia University)

===================================================================================

Use TigerSoft to watch what

Market Professionals

and Corporate Insiders are doing.

Use TigerSoft's

AUTOMATIC OPTIMIZED

and TECHNICAL SIGNALS

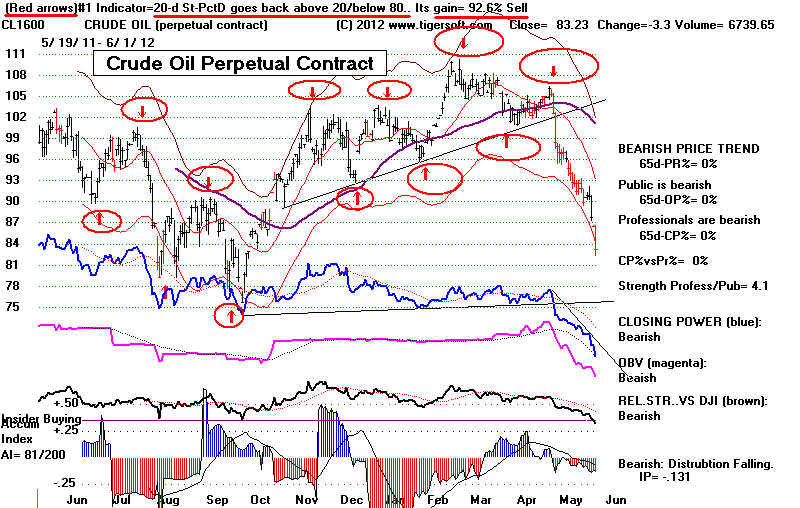

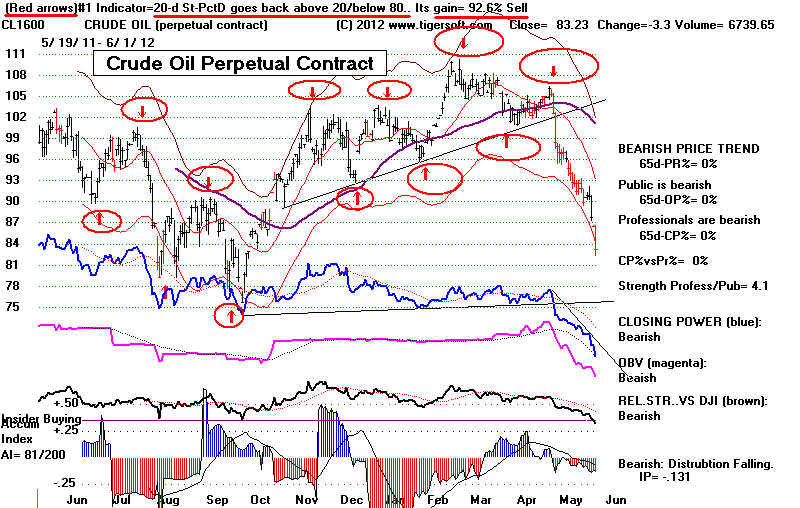

TigerSoft charts all start by showing you the best simple

trading

system

for a stock. The 20-day Stochastic was flawless in 2011-2012

for

the perpetual contract of Crude Oil.

TigerSoft automatically finds the stocks in any

universe of 1000

stocks that can be traded most profitably using simple automatic Buys

and Sells based on the best of 60 different" trading system that the

software instantly tests. Past success does not guarantee future success,

of course. But you can readily learn what systems work best without endless

research and trial and error.

Each chart shows the optimized

trading system's Buys and Sells.

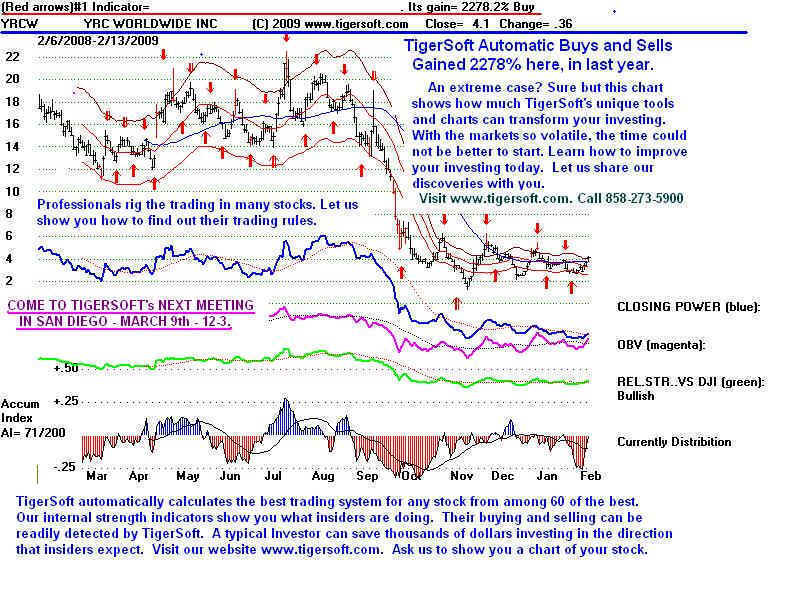

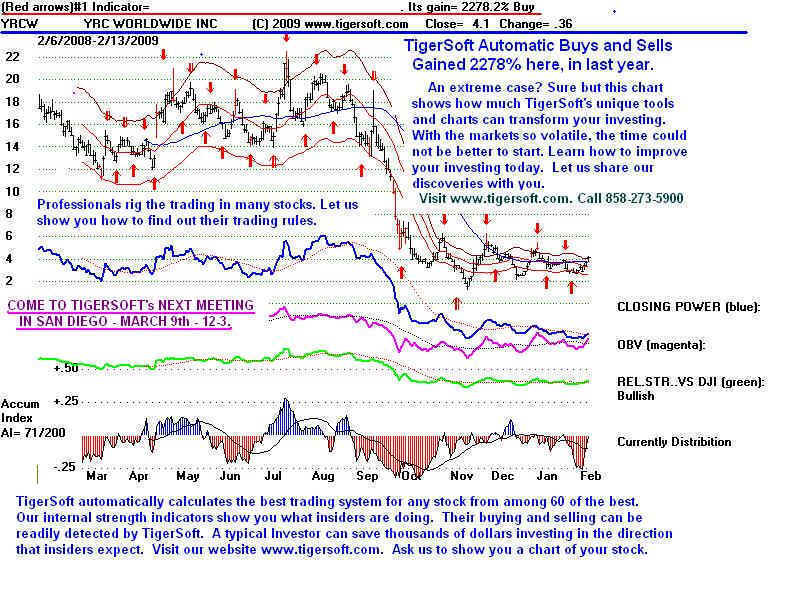

Example - YRCW below - Often simply trading the short term automatic

TigerSoft Buys and Sells is very profitable. But the basis of the best

system's Buys and Sells will vary over time. The virtues of the Tiger program

are:

1) The best system is shown automatically. You do not have

to wonder what it was and attempt to determine it by hours of

trial and error.

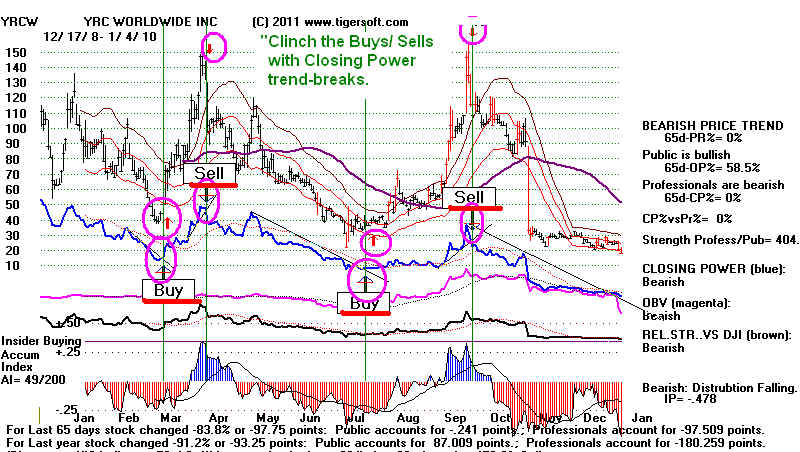

2) Tiger quickly adjusts to the changed circumstances with

new signals if a different system becomes #1. See the second chart below.

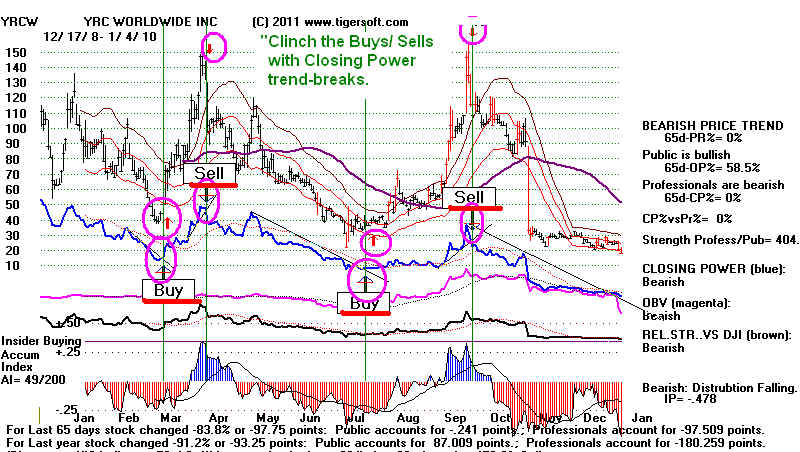

3) You will want to use Tiger's Closing Power to "clinch" the

Buys and Sells. See the 2010 chart of YRCW, the second one below.

You can also put the

Peerless Buys and Sells on it, as well as an array of technically

based signals, as you choose.

The software's trading results assume

$10,000 is originally invested

and new each trade fully utilizes available capital and

costs $20. Users may also see the trade results using the next

day's openings. They get a list of the trading results for

all Buys and Sales, with or without Short Sales. The biggest

paper losses for long and short positions are also provided.

7/21/2010 - Examples of

TigerSoft Trading Signals

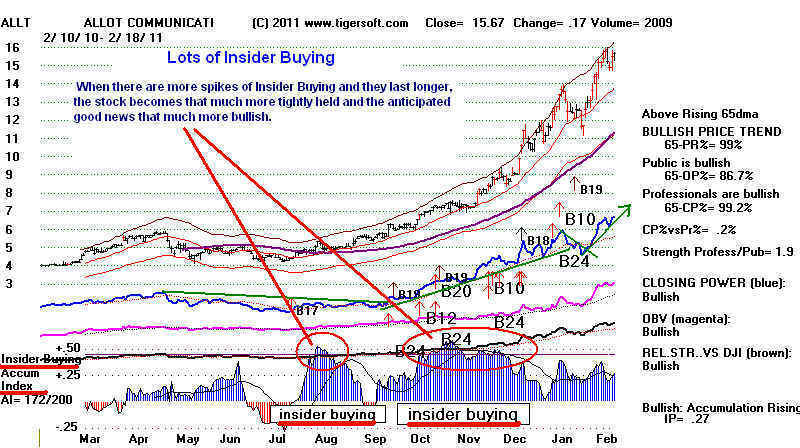

Pick a bullish stock and take

additional positions on each automatic

Buy. Eventually, you will want to take profits when there is finally a Sell.

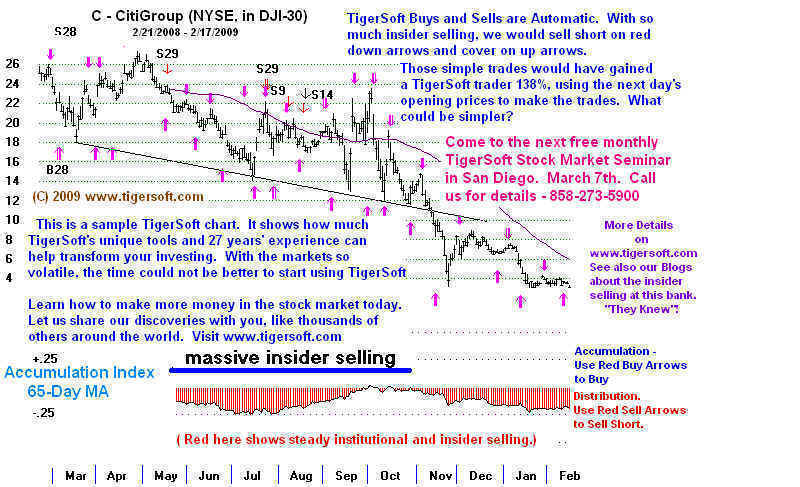

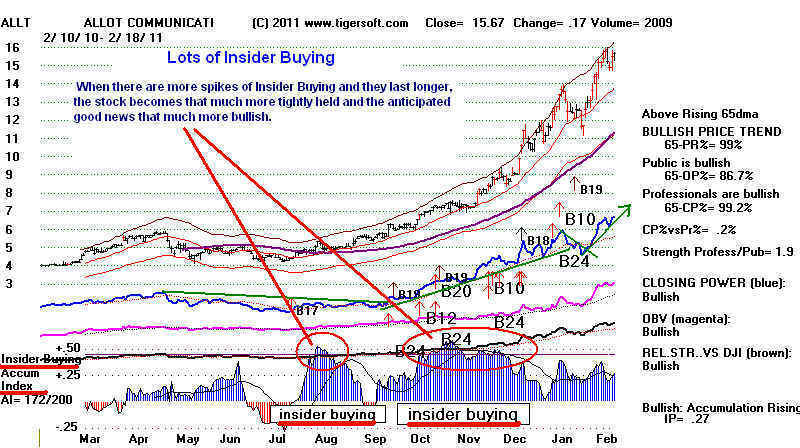

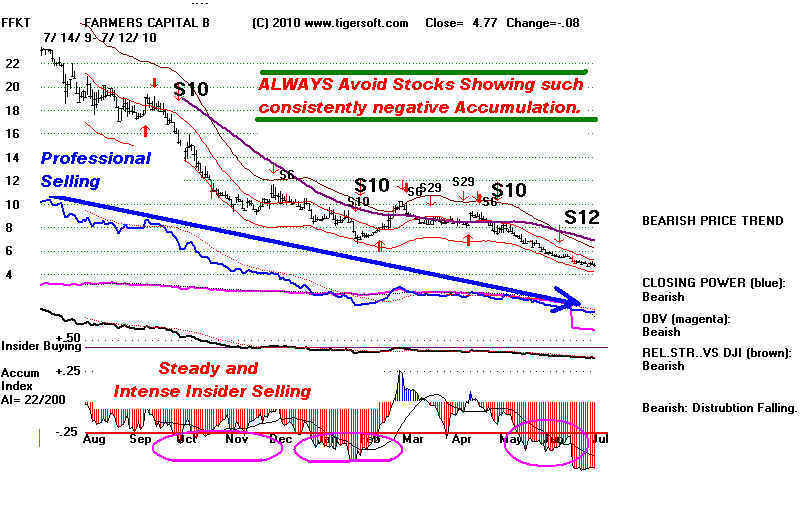

Using TigerSoft properly,

your investments should all show

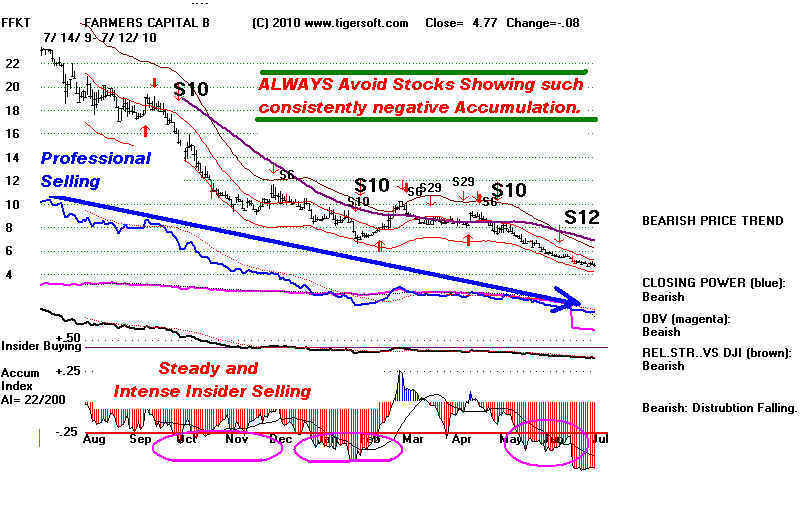

heavy insider and professional buying. They should never like

the stock below. It shows far too much insider selling. The negative, red

Accumulation Index readings should jump out at you. In addition,

you can see that the Blue Closing Power is in a steady steep decline.

Professionals are heavy net sellers. Use the automatic Sells to sell

short such stocks.

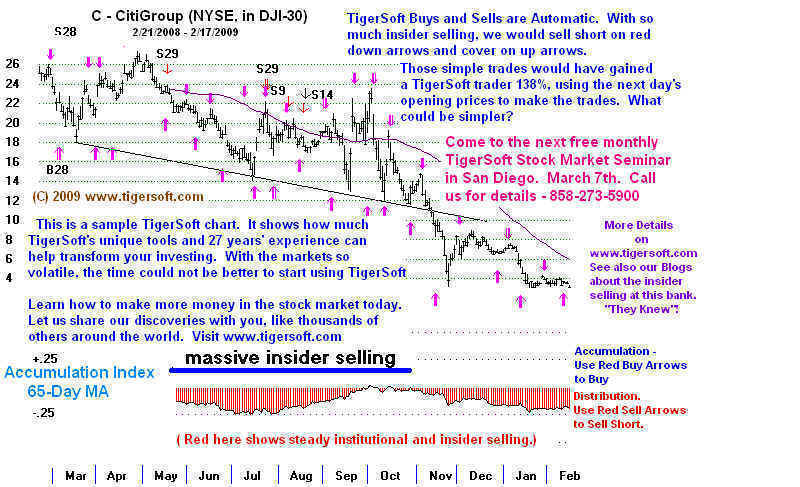

CitiGroup - 54 to 1

in two years. Short such heavy red Distribution stocks

on New Red Optimized Sells.

Cover on red Optimized Buys except where there has been a clear breaking of

support.