TIGERSOFT's Accumulation Index

BUY When Insiders Who Are BUYING (Accumulating)

SELL When Insiders SELLING (Distribution) Your Stock,

Commodity, Metal or Currency.

(c) 2010 www.tigersoft.com

All rights strictly reserved.

TigerSoft

invented the "Accumulation Index" to show what corporate and

Wall Street professionals are doing with particular stocks when they buy or sell it

gradually without immediately affecting price much at all. This gives you plenty

of time to do your own due-dilligence. We take postitions on the automatic

signals TigerSoft then produces.

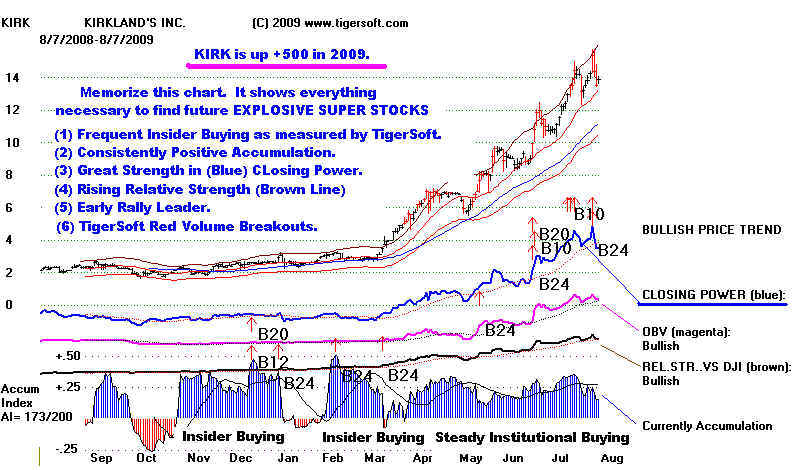

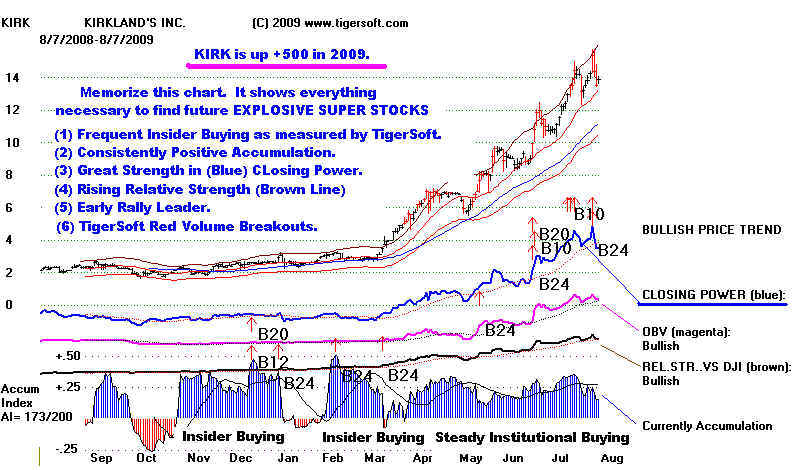

Sometimes insiders are buying into price weakness. KIRK showed such selling

in

late 2007, three months before it shot upwards by 400% in 6 months.

Sometimes insiders are selling into price strength. AAPL showed such selling in

September 1987, right before it crashed 50% in 3 weeks. AAPL has shown the same

pattern at a number of more recent tops. Subscribe to our services and read more.

INSIDER

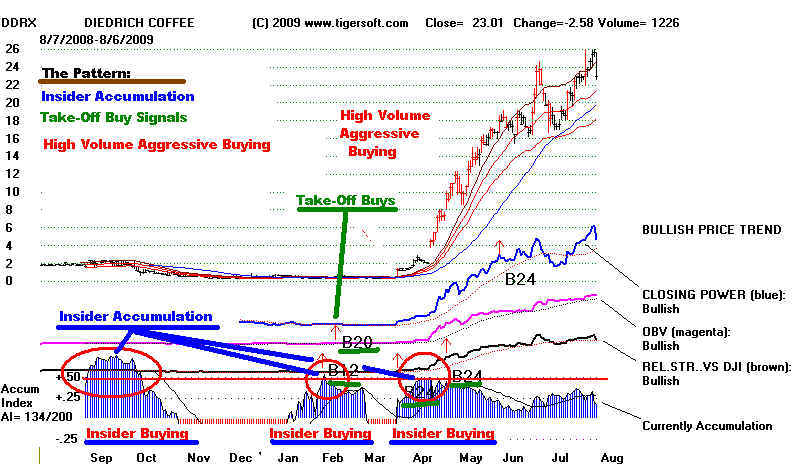

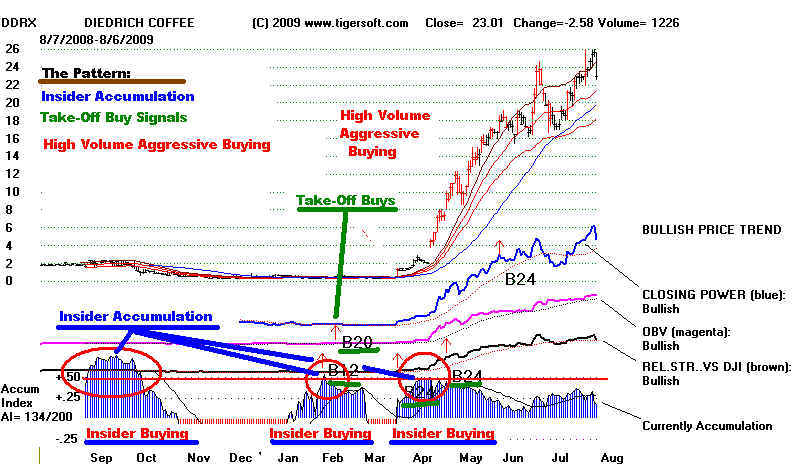

BUYING - HOW TIGERSOFT SPOTS IT

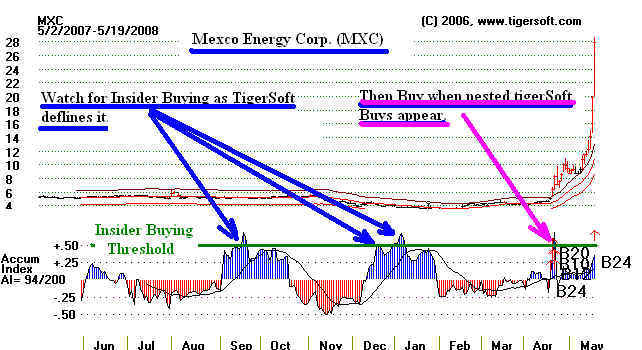

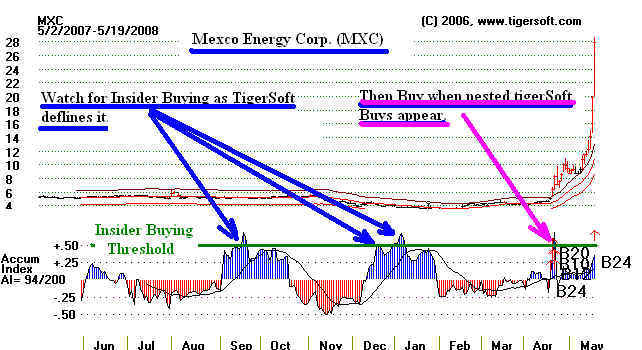

Insider Buying is

commonly shown by bulges of the Accumulation Index that rise

above a

critical level.

Such stocks may not immediately go up. The overall market may weaken

the stock after

their buying. Insiders, themselves, may even do some selling in

such stocks to keep it

from rallying too strongly before they have taken the full-sized

position they want.. Since

they know it will eventually rise very meaningfully, they will try to

take very big positions.

WATCH WHAT

DOCTORS ARE BUYING IN THE CLINICAL TRIALS

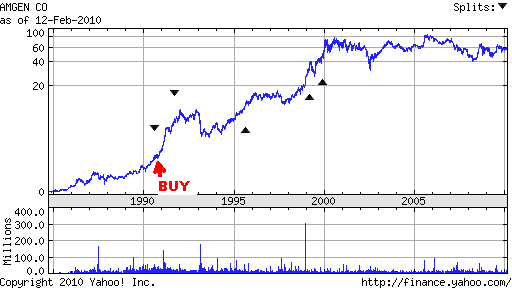

Often this is because earnings are

about to improve dramatically, as when a biotech

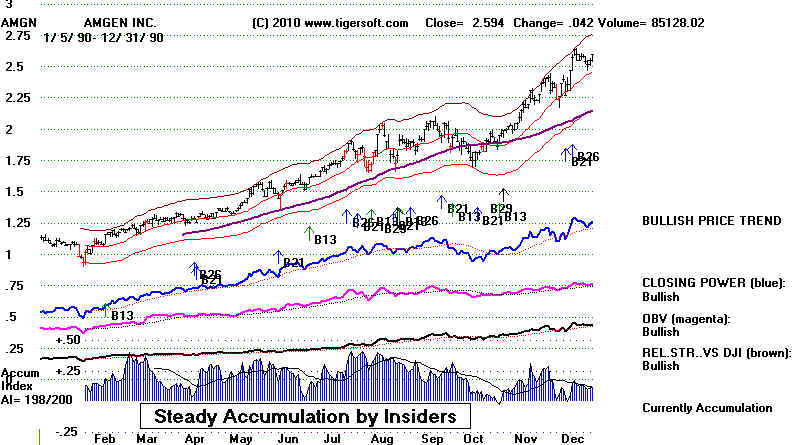

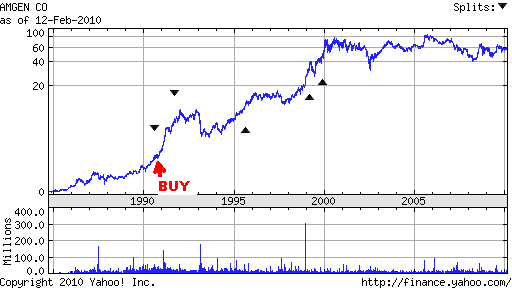

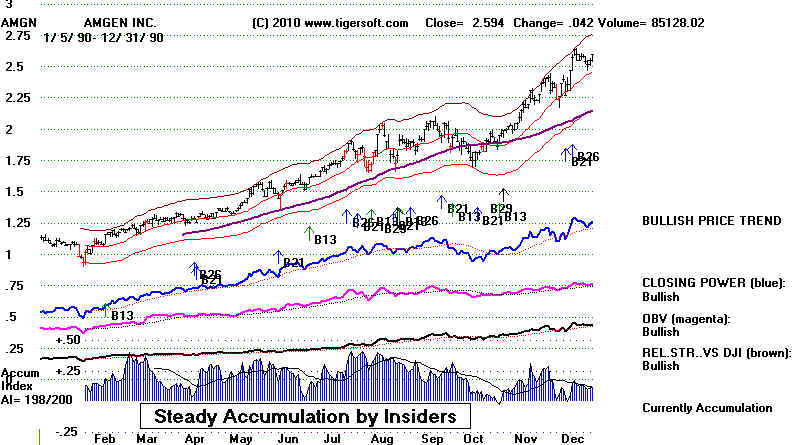

approaches FDA approval for a block buster drug. AMGN in 1990 had two drugs in

very successful clinical trials. We can bet that the doctors who saw the success of

Neupogen and Epogen were buying it hand over first, even as the general market

was weak because of the invasion of Kuwait by Iraq.

See all the high (blue)

Accumulation for a year. This is exceedingly rare.

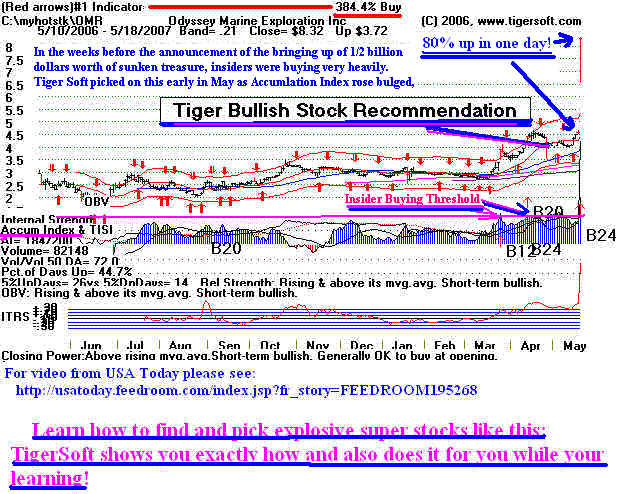

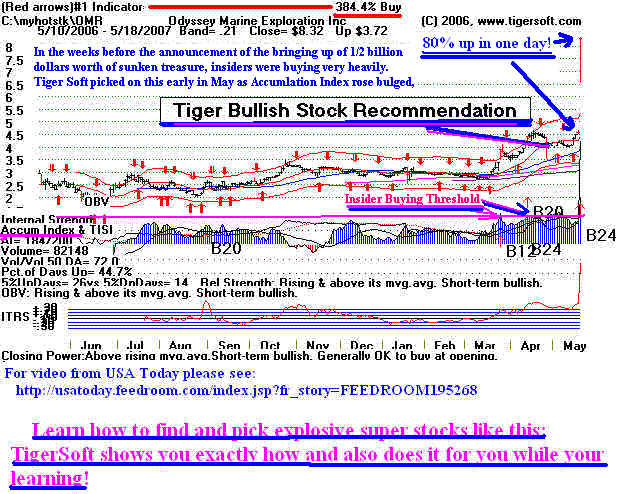

Insider buying we detected in April 2007 in stock of Odyssey

Exploration. It was

occasioned by the chief of exploration for the company buying shares in his own stock

in large amounts. This was spotted by others in the brokerage business who

took

his BUY OMR orders, we can surmise. This insider knew OMR would leap higher

because the public had not yet been told that the company had just found $500 million in

underwater silver and gold coins.

INSIDER BUYING

CAN SOMETIMES

TURN QUICKLY INTO INSIDER SELLING

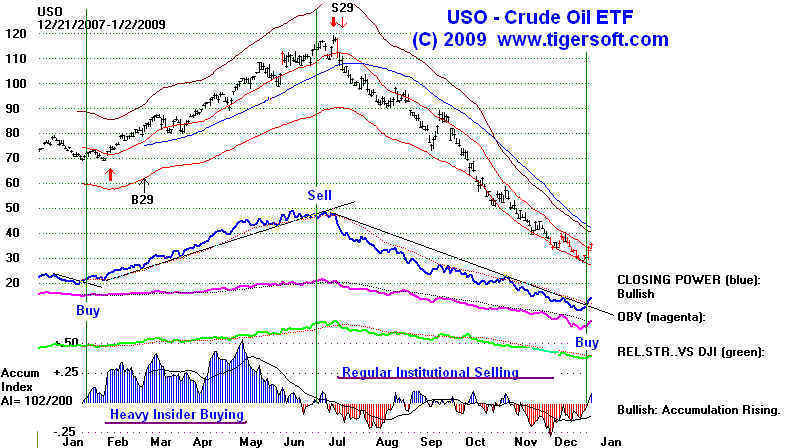

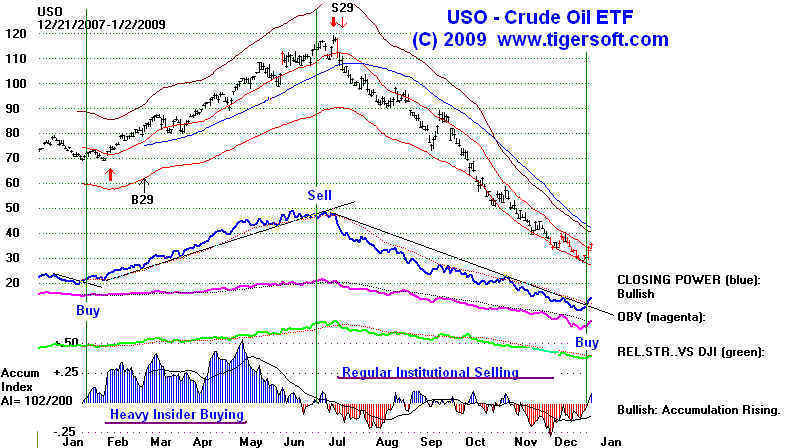

A new technology

can generate insider buying, too. So can rising oil, metal

or commodity prices, but this is a trend that can reverse suddenly.

SINISTER

PRICE MANIPULATION

Such bullish bulges of insider buying can also be the start

of a massive scheme to

manipulate a stock price much higher with false earnings. CGN in 1997 was such a

case.

We recommended it for purchase on 5/1/97 at 6.688. We only saw the insider buying

and knew nothing of the way the stock's rally was being rigged. This was a time

when many tech stocks made big advances. We considered this just another well-

sponsored stock. As it turned out, after the stock reached 17, we discovered the

rally was based entirely on Wall Street fraud and manipulation. Charges of fraud

were

brought against CGN's insiders for falsifying earnings. The stock completely and

rapidly collapsed.

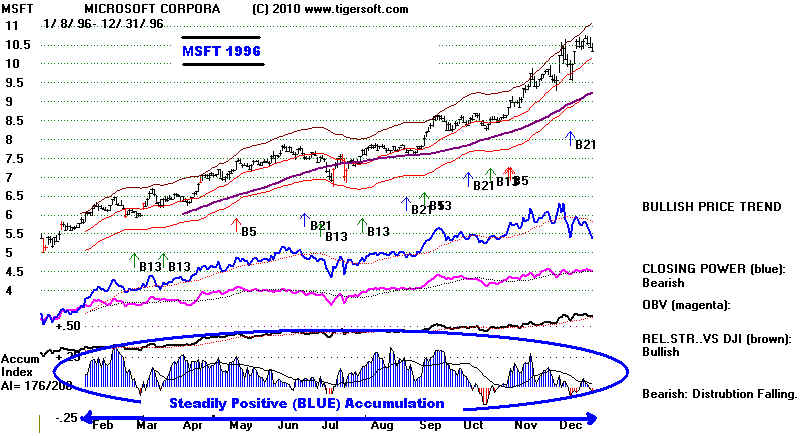

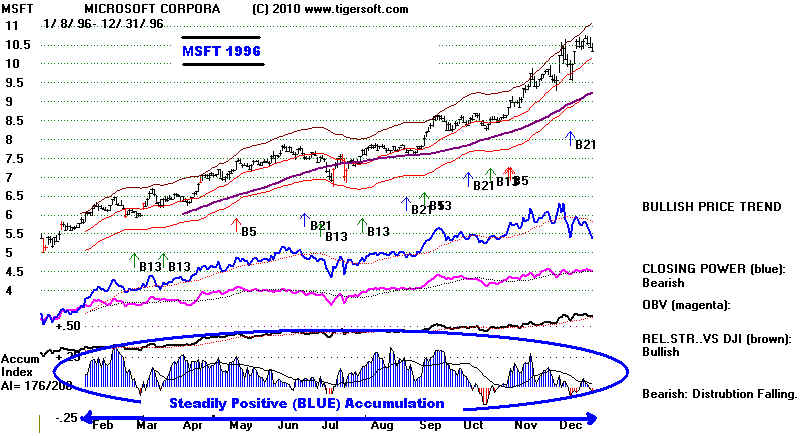

STEADILY

POSITIVE ACCUMULATION - INSTITUTIONAL BUYING

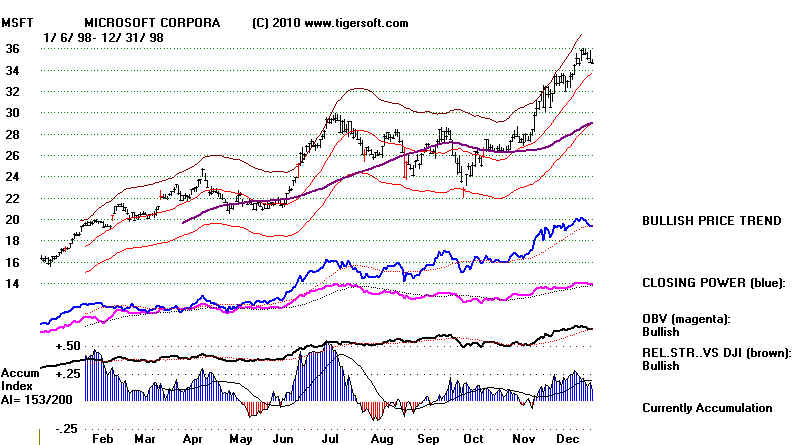

Patient buying on weakness or patient selling on

strength is most common. The insiders

here believe that they have a little time to take or exit large positions. But make

no mistake

about, these insiders believe they know what to expect. At low but steadily

positive levels, the

Accumulation Index represents institutional buying. MSFT showed this pattern from

1996-1998.

MICROSOFT

1996

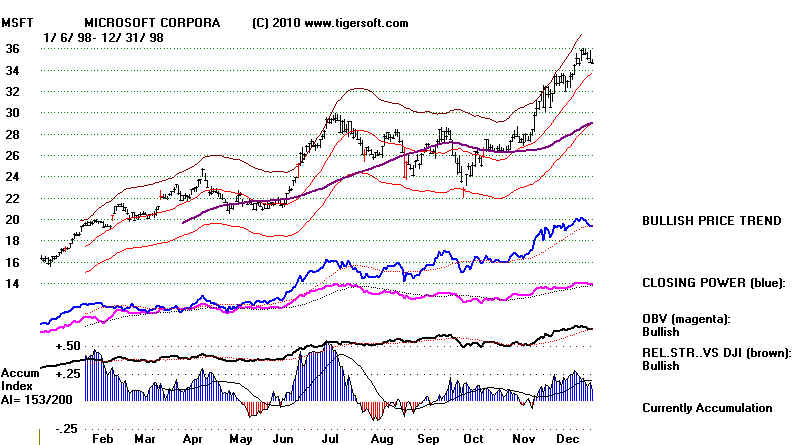

MICROSOFT

1997

MICROSOFT

1998

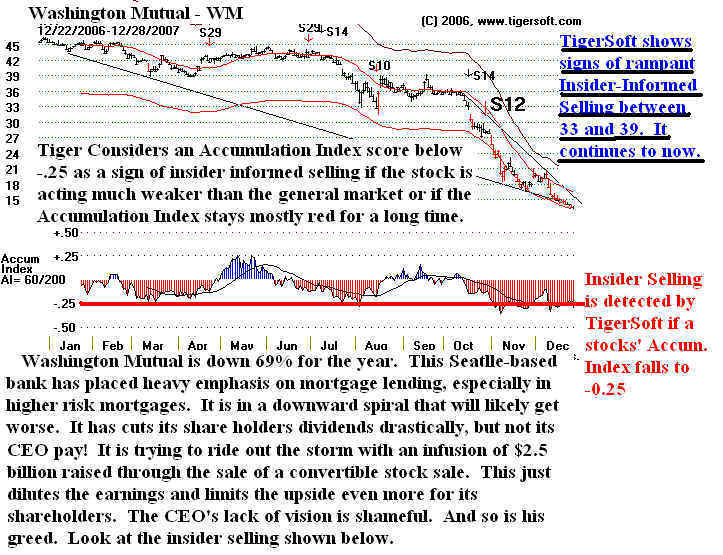

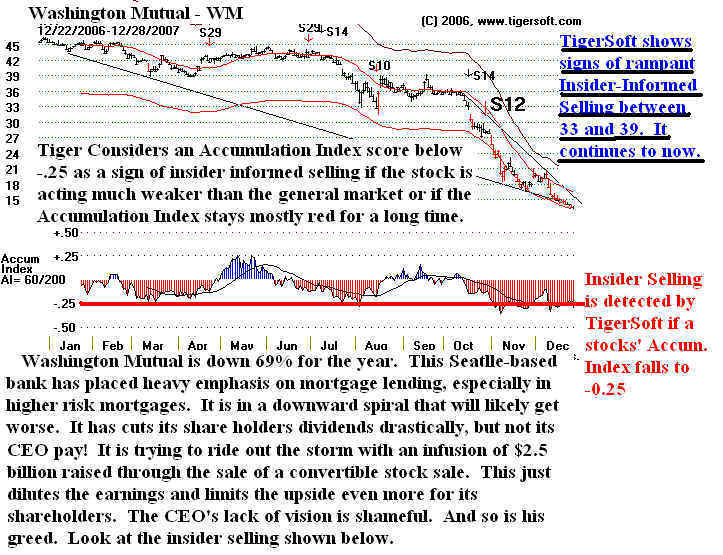

STEADILY

NEGATIVE ACCUMULATION

INSIDER

AND INSTITUTIONAL SELLING

Insider always know when the collapse is coming. They sell

their own shares, long

before they let the public know how bad is the state of the company they have bled

dry.

Two clear cases of this are Washngton Mutual and Citigroup. Our Blog for 12/28/2007

warned WM might easily go bankrupt, based on how extensive the insider selling was.

December

30, 2007 Insider

Selling at Washington Mutual and CitiGroup

Should

Make Shareholders "Mad as Hell".

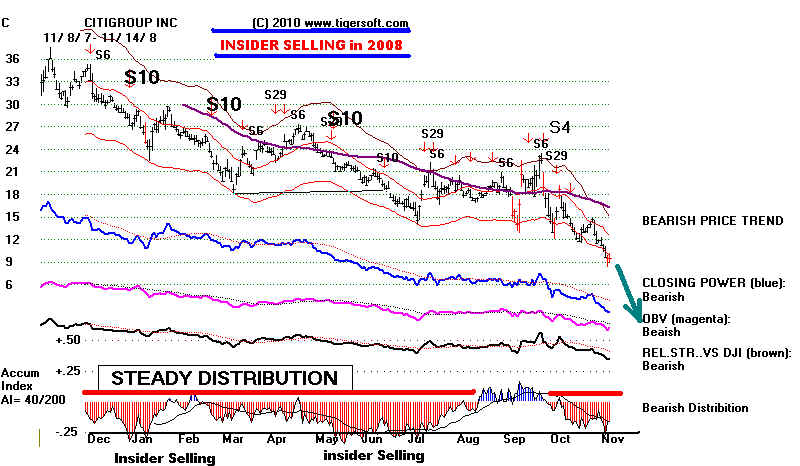

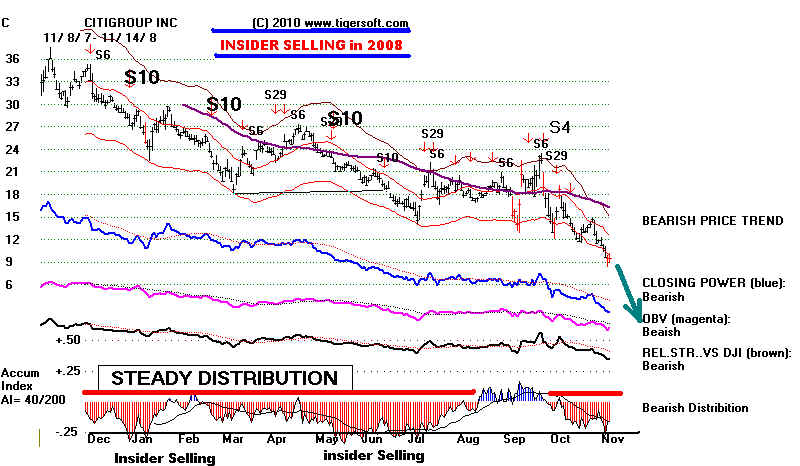

We postulate insider selling occurs when a stock, commodity,

metal or a currency

shows an Accumulation Index (red) reading below -.25 and the stock deteriorates

versus the general market. Nowhere was this more clearly seen than in the

case of

of CitiGroup after Robert Rubin's masive insider selling at the top in 2007 and

then

in 2008.

CitiGroup - 2007's ROBERT RUBIN's INSIDER SELLING and ITS

RIPPLE-EFFECTS

| 22-Jan-08 |

RUBIN ROBERT E

Officer |

9,010 |

Direct |

Disposition (Non Open Market) at $24.20 per share. |

$218,042 |

| 22-Jan-07 |

RUBIN ROBERT E

Officer |

77,500 |

Direct |

Sale at $55.05 - $55.05 per share. |

$4,266,0002

|

| 19-Jun-06 |

RUBIN ROBERT E

Officer |

196,624 |

Direct |

Disposition (Non Open Market) at $48.36 - $48.36 per

share. |

$9,509,0002 |

CitiGroup

- 2008's INSIDER SELLING

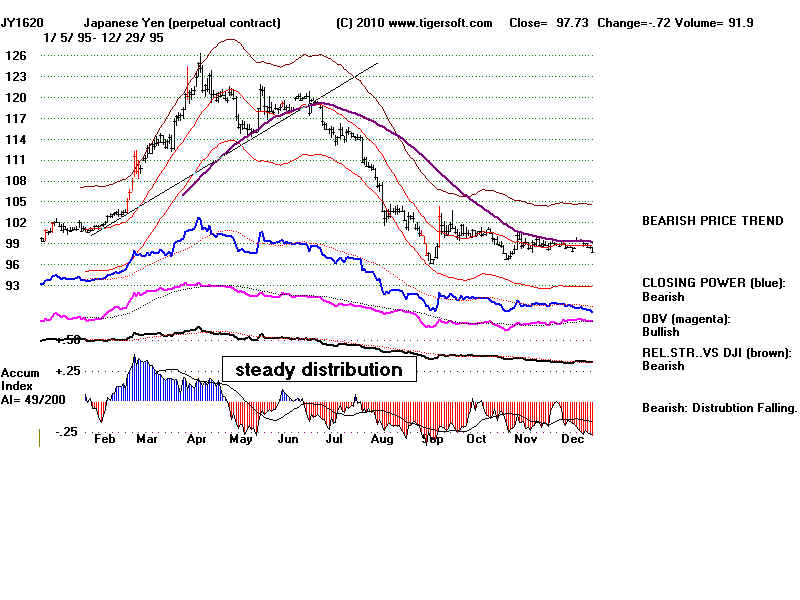

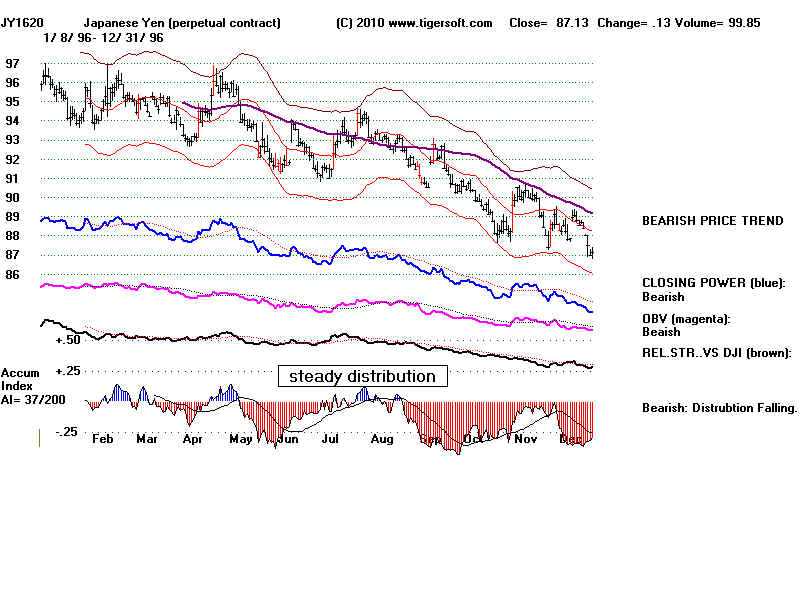

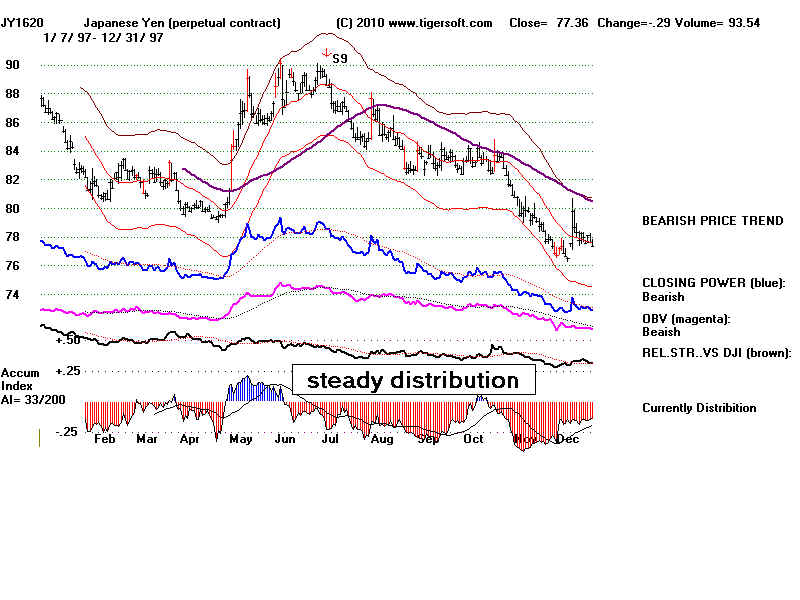

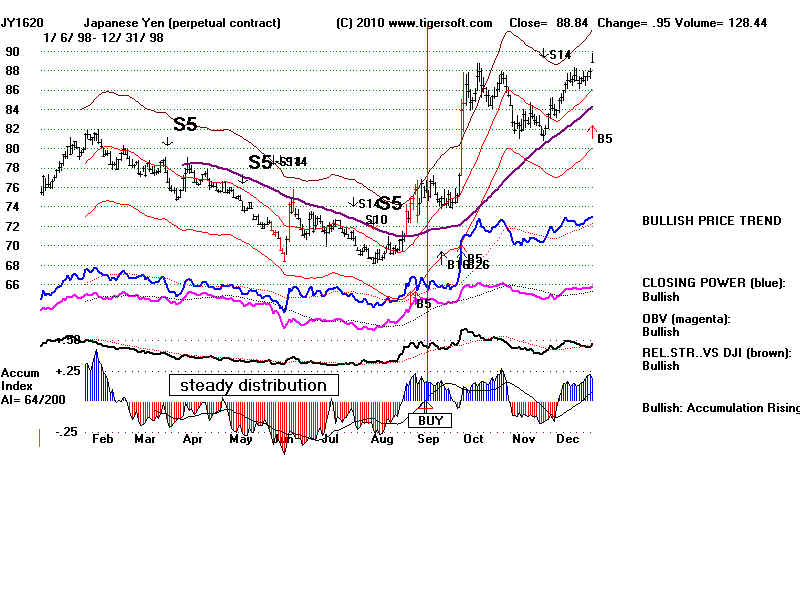

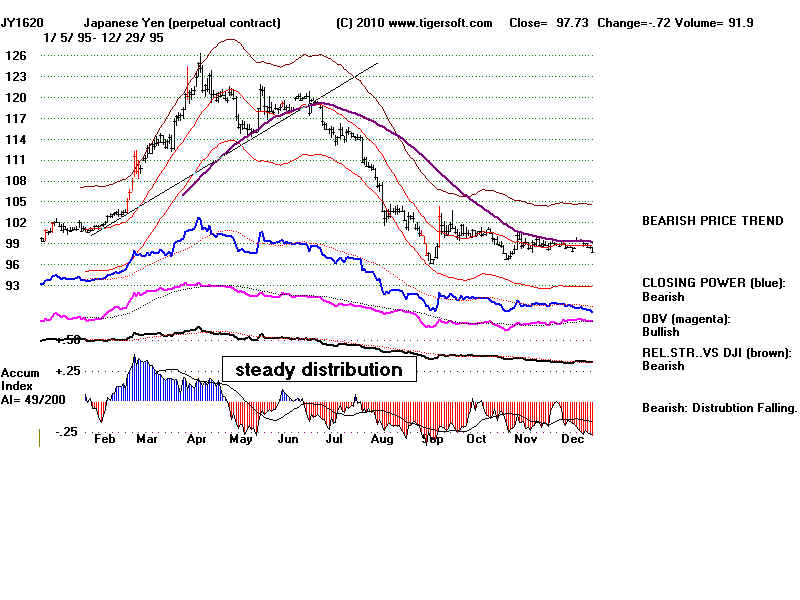

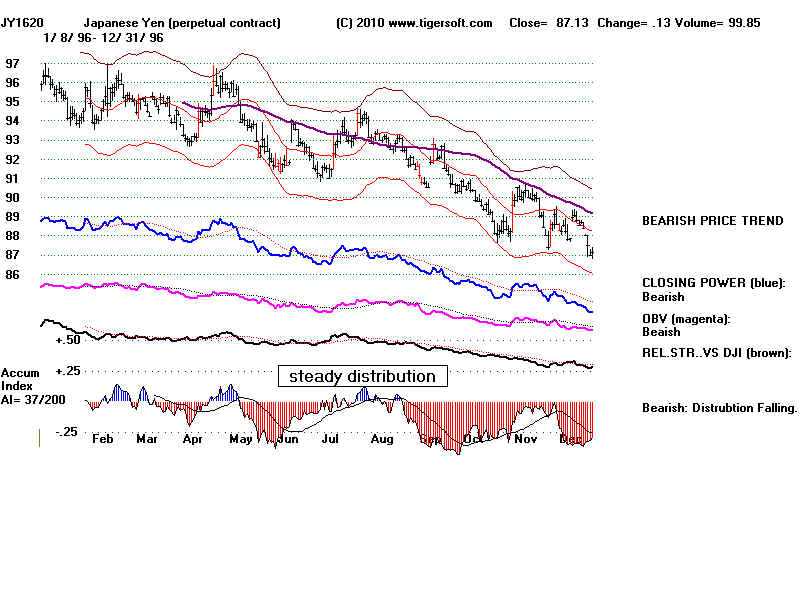

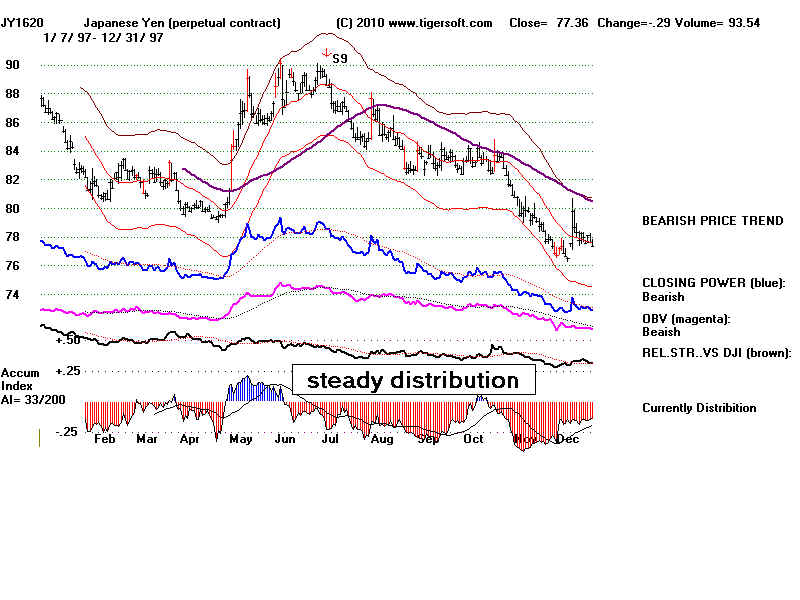

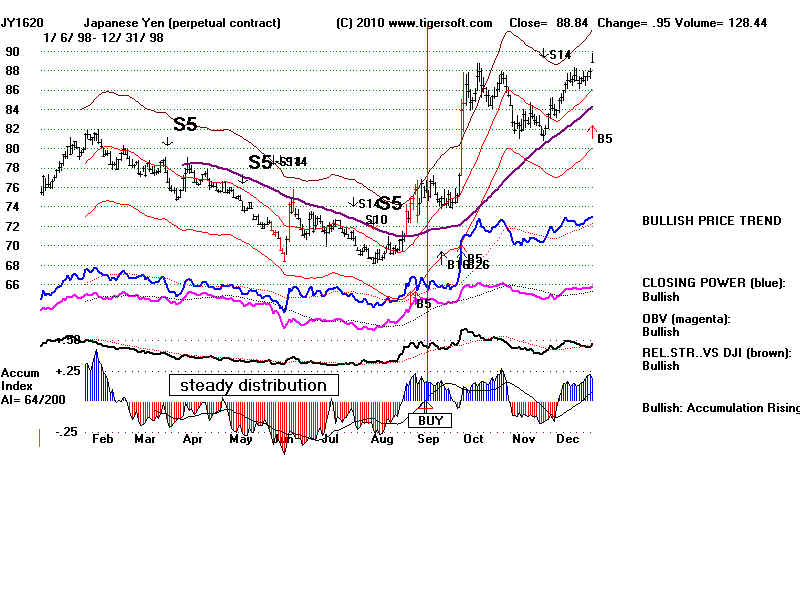

Japanese YEN -

1995-1998

Steady

(RED) Distribution

In this period the Yen fell from 120 to a low of 68.

See below how the negative (red)

Accumulation Index

showed outsiders using TigerSoft's

Accumulation Index

that insiders were steadily selling

throughout this 4 year

period.

|

|

|

|