Buys & Sells for Every Stock,

ETF, Commodity You Graph.

See also TigerSoft's TRADING RANGE BUYS/SELLS

HGSI - TigerSoft Gain = +3026.8%, 2009-2010

Statistics TigerSoft shows for each stock.

27 winning trades, 6 losing trades.

Biggest Gains = +451%, 40%, 31%

Biggest Paper Loss = 14.5%

HGSI between 2009-2010 was a prime example of how TigerSoft can make

you big money. . Using Tiger's red Buys to go long HGSI and its red Sells to

sell and sell it short would have gained a trader more than +3000% in the

last 12 months. Each year there are stocks and ETFs like this. Find them

early on with TigerSoft. Why let the Professionals make all the money?

Review: TigerSoft Internal Strength Indicators:

1) The Blue Closing Power below the price bars measures

net Professional buying or selling. We distinguish it

from Public buying/selling.

2) The Magenta OBV Line crudely measures aggressive and

selling oressure. It is often less sensitive than the indicators

we have created.

3) The Brown Relative Strength Line measures how well the

stock is doing when compared with the general market.

4) The Blue (positive) and Red (negative) Accumulation Index

measures patient buying and selling. At the extremes, it

shows insider buying and insider selling. With it, we

can distinguish patient accumulation from emotionally

driven public buying and selling.

TRADING STOCKS ARE CONTROLLED BY PROS:

TIGERSOFT LETS YOU JOIN THE FUN.

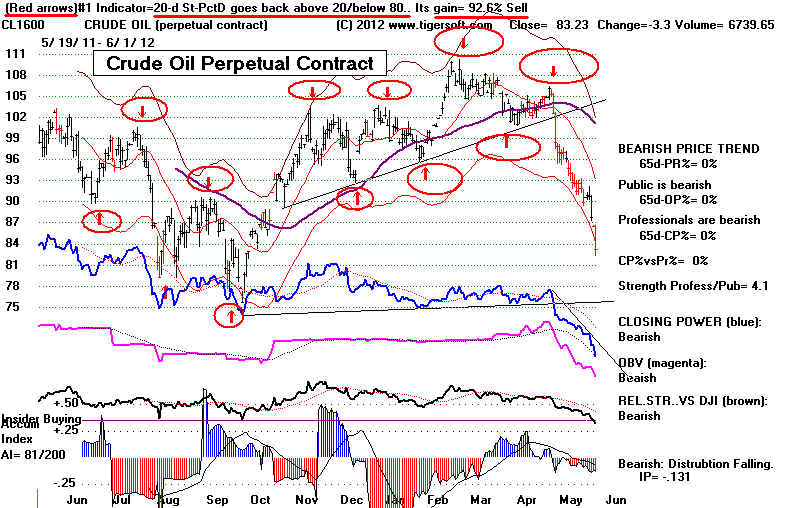

TigerSoft charts all start by showing you

the best simple trading system

for a

stock. The 20-day Stochastic was flawless in 2011-2012 for the

perpetual

contract of Crude Oil. This system's Buys and Sells are in red.

The trading

gain here is shown on the top line. It was 92.6%.

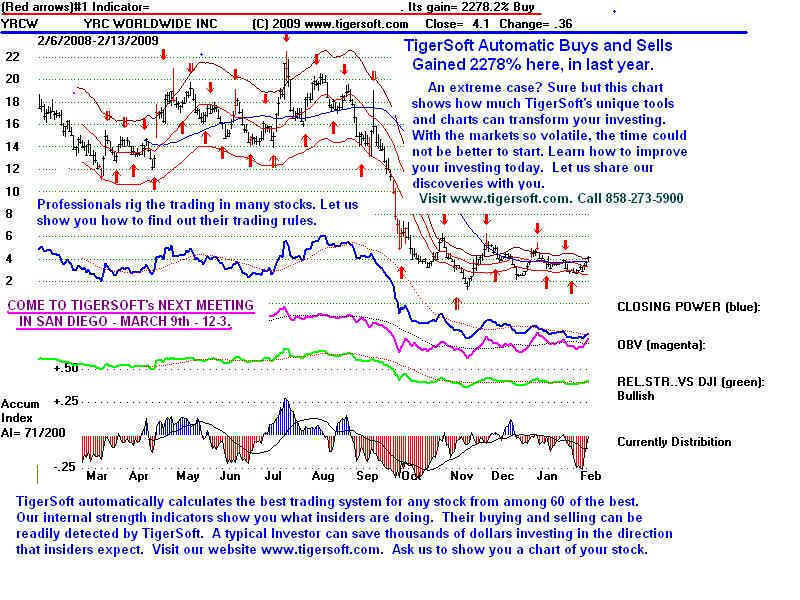

Example - YRCW - Trade short term automatic

TigerSoft Buys and Sells.

YRCW - TigerSoft Gain = +2278.2%

SHORT-TERM TRADING SIGNALS BASED ON

BEST STOCK'S CURRENT BEST TRADING SYSTEM

70% of the time the

market is going sidewise, not significantly up nor down.

Many Professional traders swing in

and out of stocks repeatedly.

For many, the direction of the

general market or a particular stock is not

clearly up or down. After a

big January - June advance, what do you do?

Some go away for long vacations.

But other Professionals switch to

trading and hedging. Summers

more than any other time of the year

are good for short-term trading.

This is an especially good time to use TigerSoft's

automatic Buys and Sells when the

software finds that the best trading system

is a 5-, 14- or 20-day Stochastic.

Of course, we also recommend Peerless

Stoch Market Timing and our Tiger

Internal Strength and Momentum Indicators,

as well.

A particularly effective trading system

can work for more than a year. It does

so because the most heavily capitalized

Professionals are making it work

and because it suits the psychology of

those currenly buying and selling it.

TigerSoft finds such systems as faster

than you can put a chart on your

computer screen. There is no need

for trial and error or optimizations,

slowly worked out, one trial after

another. Our Tiger Power Ranker gives

you a complete list of the most

profitably traded stocks, ETFs and commodities

and what trading system works best with

them.

The gains are often phenomenal.

Trade these stocks especially

using our trading rules, which emphasize:

1) Using stop losses for when a stock starts to change its

trading personality and a paper loss exceeds the earlier

biggest paper loss..

2) When in doubt, require a Closing Power trend-change to

confirm am automatic Buy or Sell.

3) Trade mostly with the prevailing price and CLosing Power

and with the trend as indicated by the current Peerless

signal.

Our

Trading manuals show you everything you need to know

about how to find and trade such stocks,

often better than even those

who own and run the compnay.

Certainly, much better than

even the smartest engineers and sales

people working for the

firm. Instead, your eyes will

be opened. You will see exactly

how market professionals are rigging and

trading these stocks.

The top row of every TigerSoft chart shows you the best system

to use and what its track record

has been for the last year.

Tiger's Power Ranker flags the new

red Buys and Sells. The

results assume $10,000 is invested

initially and all subsequent

red signals result in a Buy or a

Sall with commissions being

$20 pwe Buy or Sell. You can

also see what happens if the

trades are all taken a the next

day, as well as getting a list

of the trades and outcome plus

results showing the biggest

paper losses and the number of winning

and losing trades.

Stock 2009-2010

Long Short

Symbol Trading

Trading (Winning

Trades

Gain

Gain Losing Trades)

---------------------------------------------------------------------------------------------

AIN

+236% +68%

(6 wins 1 loss)

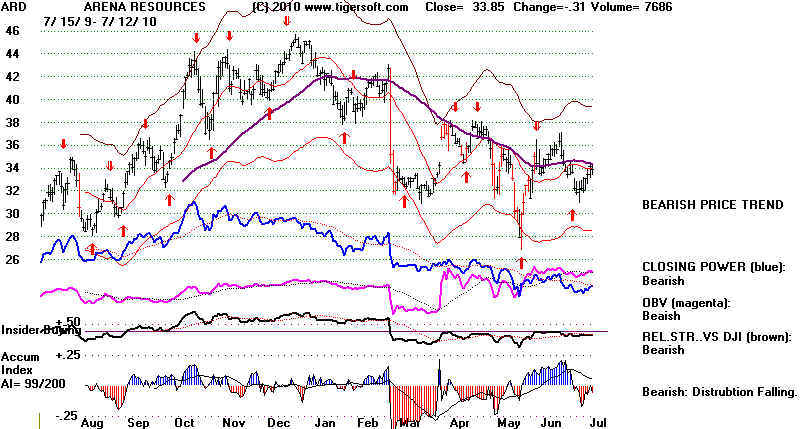

ARD

+335% +129% (10

wins 0 losses)

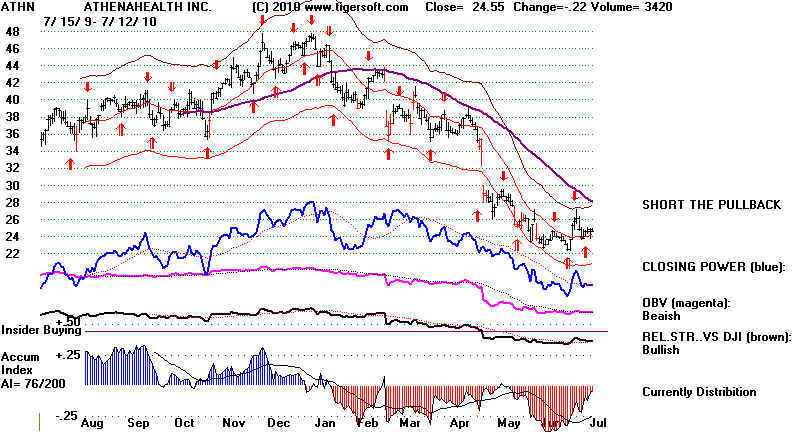

ATHN +253%

+51% (11

wins 3 losses)

ATI

+275% +138% (11 wins 3

losses)

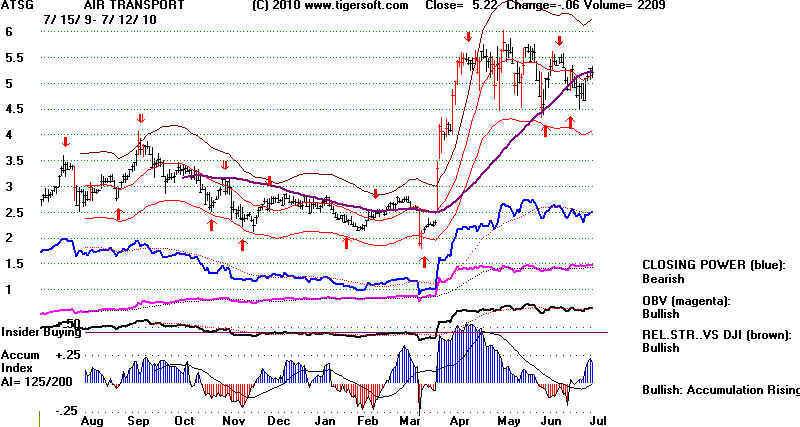

ATSG +995%

+347% (6 wins 1 loss)

BDC

+215% +78% (13

wins 2 losses)

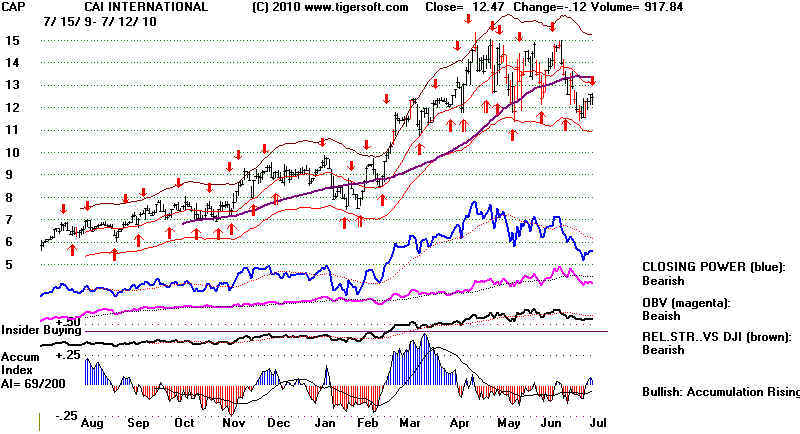

CAP

+257% +130% (15 wins 4

losses)

ESL

+201% +119% (13 wins 2

losses)

GRA

+206% +107% (12 wins 3

losses)

HMIN +226%

+97%

(10 wins 4 losses)

JOYG

+204%

+94%

(13 wins 4 losses).

|

|

|

|

|

|

|

|

|

|

|

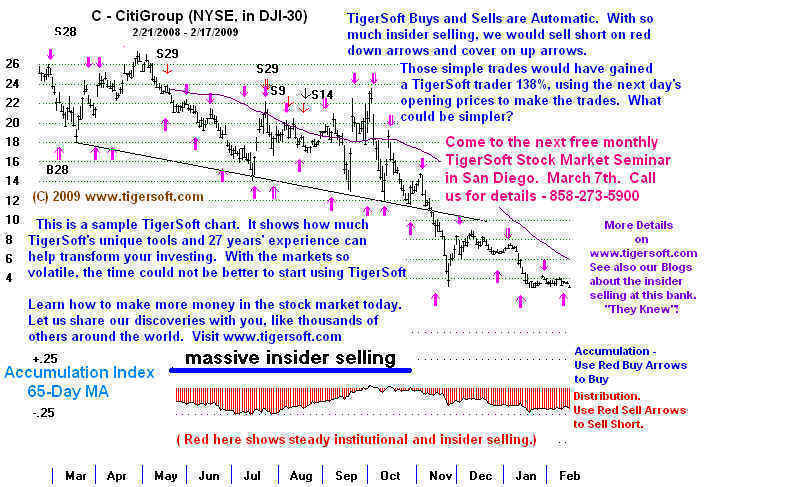

CitiGroup - 54 to 1 in two years.

Short such heavy distribution (Insider Selling) stocks on all New Red Sells

JRCC - another example

Look at how well these automatic Red Signals work with JRCC

Update 2/20/2010 (C) 2010 www.tigersoft.com

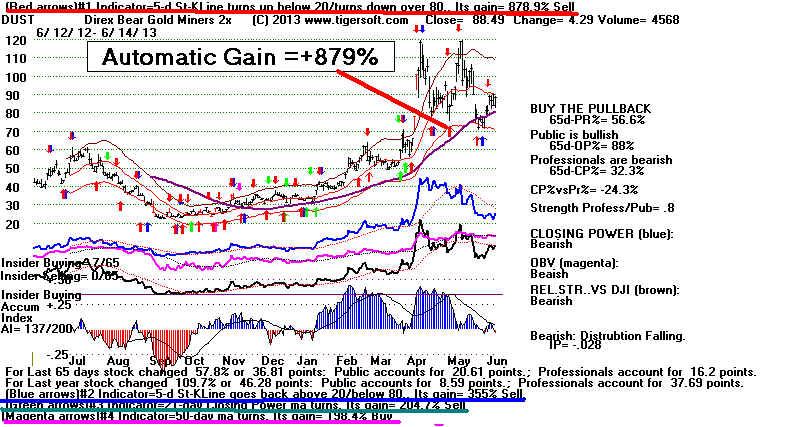

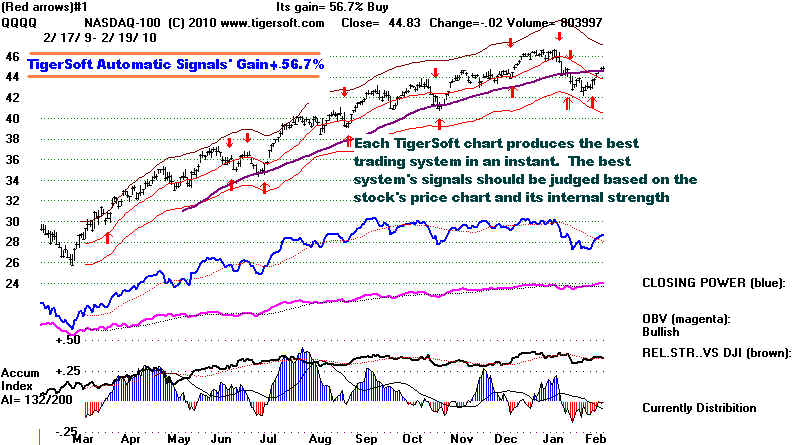

Below are

some recent NASDAQ-100 TIgerSoft charts. They

show the initial screen display for a TigerSOft

chart. The

top line shows the basis for the TigerSoft

automatic Buys and Sells

and the percent gain for the last 11 months

trading these

red Buys and Sells. The basis of the

signal has been whited

out here to protect value of our research.

The

TigerSoft chart shows you in an instant what hours of

trial and error would show about what indicator

works best

with a given stock, at any point in time, based

on the

last year's data. Stocks tend to

have personalities and

attract certain types of traders. These

optimized Buys and

Sells tend to continue to be successful.

And when the stock's

behavior does change, so does the basis for the

red Buys and

Sells. Not shown here, TigerSoft charts

also automatically

show the second, third and fourth best systems,

too.

These

charts show four internal strength indicators

beneath the price chart. A bullish chart

will show rising

indicators and a positive Tiger Accumulation

Index at the

bottom. Automatic readings for each

indicator will say

"bullish." Downtrending

internal strength readings will

give a "bearish" automatic note

beneath the indicator.

We want to confirm a Buy signal with good

internal strength

indicators.

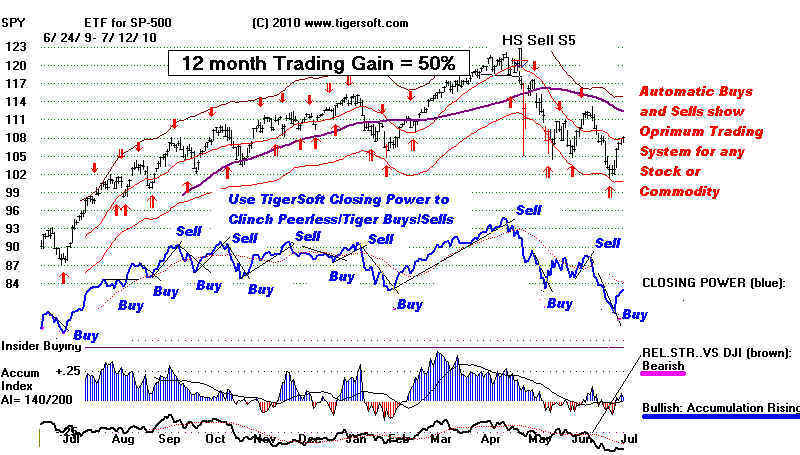

TigerSoft Chart of SPY with Automatic Buys and Sells

Trade Mostly in the Direction of Its Closing Power.

More examples below:

Yahoo - TigerSoft's Automatic Buys and Sells' Gain here = +125.9%

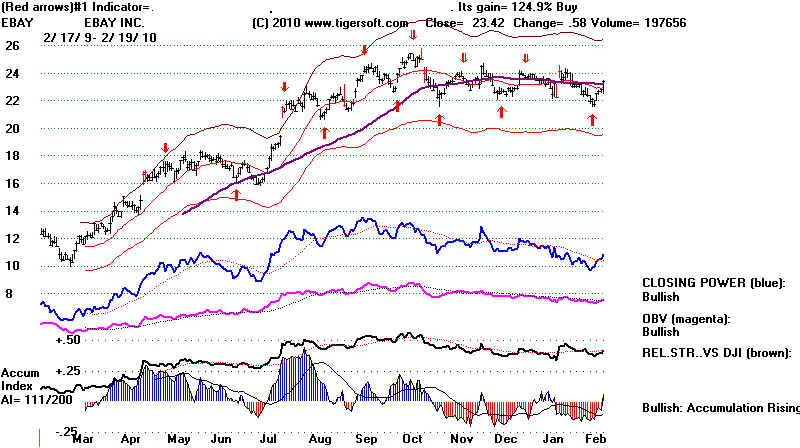

EBAY - TigerSoft's Automatic Buys

and Sells' Gain here = +124.9%

INTC - TigerSoft's Automatic Buys

and Sells' Gain here = +143.3%

SHLD - TigerSoft's Automatic Buys

and Sells' Gain here = +238.7%

JOYG - TigerSoft's Automatic Buys

and Sells' Gain here = +330.7%

Yahoo - TigerSoft's Automatic Buys and Sells' Gain here = 125.9%

EBAY - TigerSoft's Automatic Buys and Sells' Gain here = +124.9%

INTC - TigerSoft's Automatic Buys and Sells' Gain here = +143.3%