Elite Stock Professional Service (ESP)

6/1/2007

(c) 2007 William Schmidt, Ph.D.**

Note that the charts of recommended stocks are at the bottom

of this page.

===========================================================================

Suggestions:

Comments here are meant to suggest the aspects of chart analysis

that may be helpful to you. In a few cases, I may have long or short

positions in some of these stocks. But the positions are small and

I am just as likely to buy these stocks later next week, especially

if they act well.

The market is up too much to buy laggards now. Below are new highs

with an AI/200 over 150 and an IP21>.50

========================================================================================

*BUYS*

AI/200 Symbol Close Change Comments

------ ------- ----- ------ --------

191 CNMD Conmed 31.85 +.54 http://www.conmed.com

CONMED Corporation provides surgical devices and equipment for

minimally invasive procedures and monitoring by orthopedics, general

surgery, gynecology, neurosurgery, and gastroenterology surgeons and

physicians worldwide.

190 DAVE Famous Dave's 21.83 +.51 IP21=.50 http://www.famousdaves.com

Famous Dave?s of America, Inc. engages in the development, ownership,

operation, and franchising of restaurants under the name of Famous Dave's

in the United States.

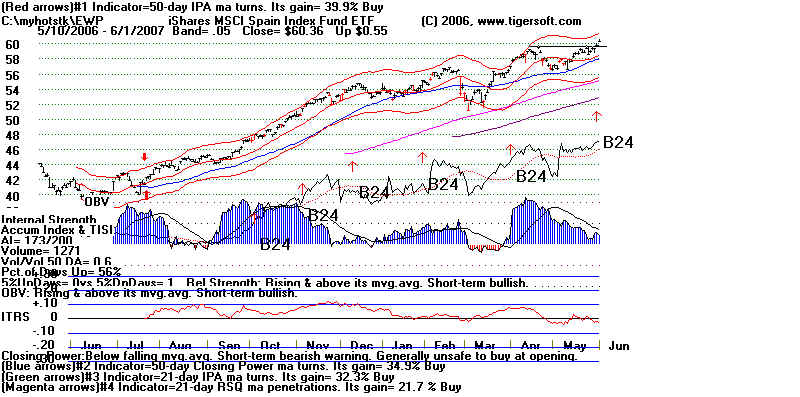

175 EWP IShares Spain 60.36 +.55

171 FAF First American 55.11 +1.56 ITRS<0 Trading move. http://www.firstam.com

The First American Corporation, through its subsidiaries, provides

business information and related products and services in the United

States and internationally.

199 GPX GP STrategies 10.01 +.16 IP21=.40 http://www.gpstrategies.com

GP Strategies Corporation, through its subsidiaries, provides training,

engineering, and consulting services primarily in the United States,

Canada, the United Kingdom, Mexico, Singapore, Malaysia, and India.

Its training services include fundamental analysis of a client's

training needs, curriculum design, instructional material development,

information technology service support, and delivery of training.

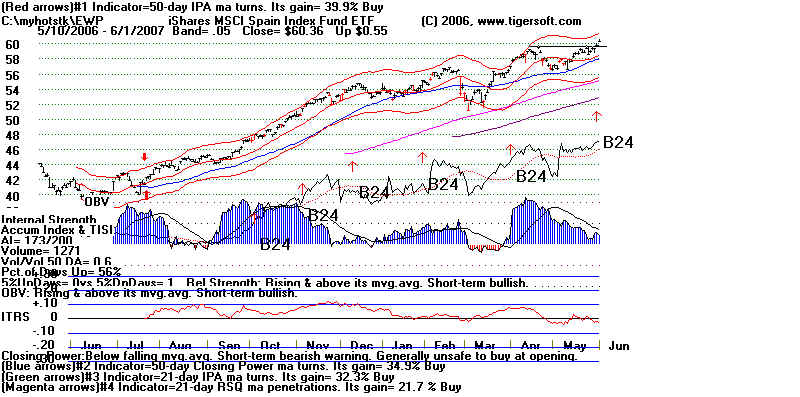

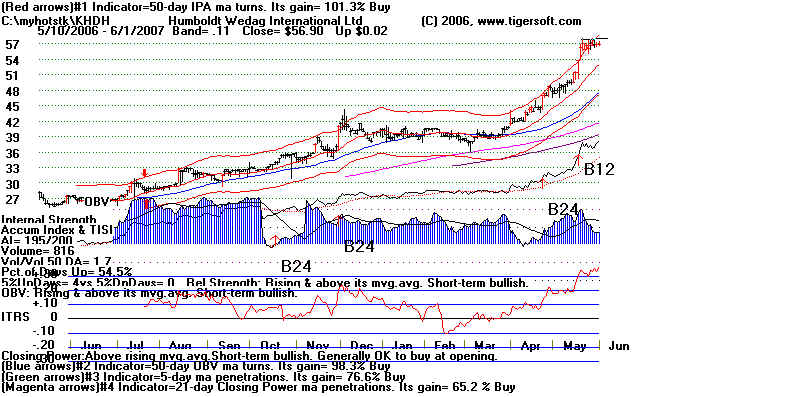

161 KEYN Keynote Systems 16.00 +.21 IP21=.23

Starting another big move.

http://www.keynote.com

Keynote Systems, Inc. provides technology-based services that enable

corporate enterprises to enhance their online business performance and

communications technologies primarily in the United States. It offers

services in three categories: Internet Test and Measurement, Customer

Experience Test and Measurement, and Mobile Test and Measurement.

175 MICC Millicomm Intl Cellular 92.22 +7.14 Nice tradng breakout!

http://www.millicom.com

Millicom International Cellular S.A. and its subsidiaries provide mobile

telecommunication services. It offers prepaid services using mass market

distribution methods; provides local and long distance telephony,

broadband Internet, fixed wireless telephony, and public telephony

services; and operates an international gateway, a high-speed data

business, and a television station.

163 PEGA Pegasystems 10.82 +.07 IP21=.50

http://www.pega.com

Pegasystems, Inc. and its subsidiaries engage in the development,

marketing, licensing, and support of software for managing business

processes. It offers a suite of business process management products

to plan, build, and manage business process management solutions.

also

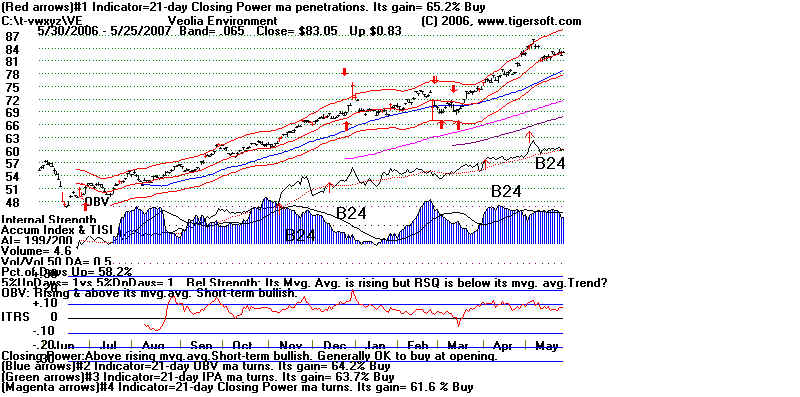

199 VE Veolia 199 83.05 +.83 IP21=.35

http://www.veoliaenvironnement.com

Veolia Environnement SA and its subsidiaries provide environmental

management services for various public authorities, industrial,

commercial, and individual customers worldwide.

Buy on breakout over 58:

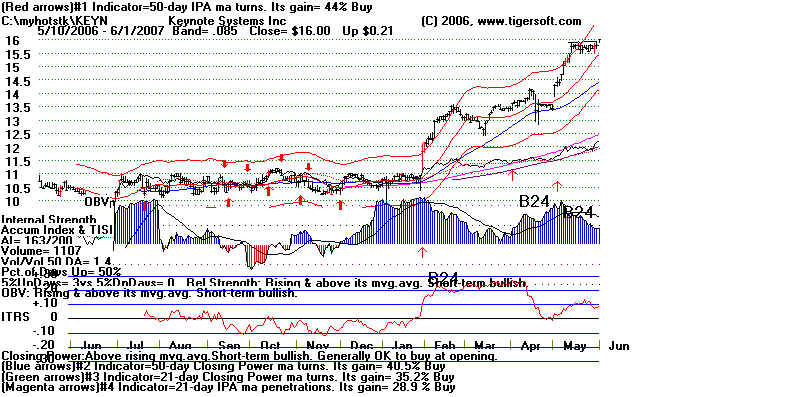

KHDH Humboldt Wedag Intern. 56.90 +.02 http://www.khdhumboldt.com

KHD Humboldt Wedag International, Ltd. operates as an industrial plant

engineering and equipment supply company. The company provides

proprietary technologies, equipment, and engineering/design services

for cement, and coal and mineral processing industries.......................................................................................

......................................................................................

=======================================================================

*SHORT SALES:*

AI/200 Symbol Close Comments

------ ------ ----- -----------------------------------------------------

None

________________________________________________________________________________________

*** Abbreviations:***

price versus 50 day ma

AR = Above rising 50-dma (Bullish)

ATH = All-time high

BF = Below Falling 50-dma (Bearish)

Current IP21 vs (TISI) 21-day ma of IP21

A = above

U = Under (Bearish)

SS = Sell Short

BO = Breakout

NC = OBV non-confirmation.

IP21=current Accum Index.

TISI = 21-day ma of IP21.

..........................................

================================================================================================

================================================================================================

Highest AI/200 Stocks: AI/200>190, Above Rising 50-day ma, over $10

These are stocks that institutions are buying heavily for 1-3 year gains.

They should find plenty of support at key moving averages.

AI/200

----------------------------------------------------------------------------------------

200 ALD 32 +.3 26-33 yearly range ...Back above all ma..On Sell

200 AXA 43.99 +.30 Pull back after recent bulge of Accumulation.

AXA ADRs. AR

200 APRO 22.15 AR thin IP21=.50 23 is recent high. Lagging OBV

200 ADF 8.11 -.01 Slow moving.

***200 CRH 50.94 +1.53 Friday prices broke above two tops at 50. Thin

OBV is angling up. High IP21=.25

Very strong. ITRS=.12. (Buy)

200 CTQ 15.47 +.09 Calamos Strategic Total Return IP21=40 15.8-12 mo high

200 DT 19.29 +.75 NH bu OBV NC. IP21=.22

200 FCM 18.66 -.12 AR 19-12 mo high...

OBV was making NHs IP21=.40 Very slow moving.

200 GMA 23.61-.12 very slow moving... Below 200-day ma Good OBV and IP21=.25 ITRS=-.10

200 HEW 30.37 +.35 1 31=12 mo high...Flat.. IP21=.12 ITRS<0. (Buy)

... Hewitt Accociates

***200 NWK Network Equipment 11.1=12 mo high. OBV at NH. IP21=.30 (Buy)

200 SCI 14=12 mo high. IP21=.05 ...STeady uptrend.

200 SVLF 5.1 =12 mo high. IP21=.25 ITRS<0.

200 TI 29.10 +.10 Below all key ma.. ITRS>0... IP21=.25..Telecom Italia

***200 USA 9.05 AR Red Buy...OBV confirming IP21=.50 (Buy)

Liberty All Star Eq. Fund.Augmented B24...but slow moving.

***200 VWO 86.42 +1.67 confirmed NH this week. IP21=.30 (Buy)

.... Vanguard Emerging Markets.. Steady advance.

'---------------------------------------------------------------------------------

199 AEG 20.46 +.42 AR 15.5-22 yearly range.

head and shoulders pattern.

199 APAGF 91.75 +.5 BF - Thin... On Red Buy.

Apco-Argentina Year-long breakout confirmed by OBV and very high IP21.

198 AHO 12.54 +.04 At rising 50-dma. IP21=.25. Earlier bulge of Accum

...positioned for a Buy.

***198 AMAC 7.99 0.17 Recent breakout after B24 Bulge at 7.

... American Medical Alert. (Buy)

| 199 BTN Thin AR 6.5=12 mo high. IP21=.30.. Strong OBV

199 CET 20.71 +.05 NH not confirmed by OBV.. IP21=.20

199 EWN 30.52 -.09 Recent IP21 bulge>.50 now IP21=0

... Netherland ETF 31.2 =12 mo high.

199 IDC 29.09 +.06 AR At rising 21-day ma. IP21=.15 Strong uptrend.

199 GIL 35.34 +.39 OBV NC... IP21=.05 Gildan Activewear

30.5=12 mo high. ... Interactive Data Corp.

199 ILF 217.22 +6.67 Powerful Uptrend... IP21=.20 OBV confirming.

... IShares SO-Latin America

199 IX 136.17 +.43 On Buy...... Trading Range 130-140

Orix Corp. OBV at NH Tokyo, Japan http://www.orix.co.jp

199 SNPS 27.76 +.74 At falling 50-dma. ITRS<0 OBV is lagging.

***199 VE - Veolia 74.63 +.69 Strong OBV.. IP21=35.

Very high readings from IP21 regularly. (Buy)

'----------------------------------------------------------------------------------------

198 CW 45.98 +.91 Challenging high at 46.25. IP21=.25

Curtiss Wright ...Steady uptrend.

***198 GPX 10.82 +.16 IP21=.35...Challenging 12 mo high at 10.7 (Buy)

NH OBV confirming GP Strategies

http://www.gpstrategies.com

GP Strategies Corporation, through its subsidiaries, provides

training, engineering, and consulting services. (Buy)

198 DUC 11-12 yearly trading range. Weak OBV

198 ELOY 25.67 +.34 New Red Buy... OBV has strengthened... IP21=.25

3 months ago IP21 surged above .60 on new high.

Augmented B24 was on 1/12/07 = 21.91

***198 HEIA 35.39 -.20 NH confirmed... IP21=.32... ITRS=-.08

... Heico Corp. Breakout was at 34. (Buy)

198 ILF 205.54 +5.09 NH OBV NC Latin America 40-Index Fund.

IP21=.12 OBV confirmed last high.

***198 OME 8.68 -.08 OBV confirming NH by wide margin. IP21=.25 (Buy)

... Omega Protein (Buy)

198 TL Telecom Italia ARDs... 33=12 mo high. upport at 27.5

'--------------------------------------------------------------------------------------

197 BORL 5.99 +.03 6.17 - 12 mo high. OBV at high. IP21=.30 Bullish

197 CIA 7.90 +.15 Citizens IP21=.40 OBV strong. (Buy)

... 8.2=12 month...Thin ... Steady uptrend.

... Note tell-tale bulge in July... Thin

197 SYK 67.14 -.17 AR 69.5 =12 mo high. OBV is lagging.ITRS<0 Stryker

***197 VE 83.05 +.03 IP21=.40 ...at rising 21-dma (Buy)

197 EWL 27.27 +.11 OBV NC ...Weakening OBV. Switzerland index fund.

197 QADI 8.29 Nelow all moving averages. ITRS=-.15 IP21=.25

'---------------------------------------------------------------------------

196 FCEA 69.35 -.75 4 IP21<0... Was Strong OBV

... AR... 72 =12 mo high. .. Forest City

196 MSA 43.41 +.41 AR... 44.1 = recent high OBV NC IP21=.25

196 EFD 34.09 +.28... NH confirmed...IP21=.40 ... Short-term Sell

... Efunds Corp ... Breakout was at 29.

196 CCBL 14.75 +.11 15 is 12 month high OBV is at NH. IP21=.20

C-Cor Inc.

196 CEVA 7.43 8.25-12 mo high, OBV is lagging.

196 MATW 44.60 -.39 NH not confirmed by OBV IP21=.35

... Matthews International

196 WVCM 32.02 -.14 Up from 16 in January...IP21=.20 OBV confirming

***196 XLV 6.77 +.04 IP21=.20 Strong OBV confirming NH.

SPDRs Heal;th Sector (BUY)

'--------------------------------------------------------------------------------------

195 CHU 14.02 +.14 16=12 mo high. IP21<0 OBV is lagging.

... China Unicom ADRs

Buy ***195 KHDH 56.98 +.98 NH confirmed ...IP21>.25

Steady uptrend (Buy)

OBV is strong ..Thin .. Closing Power is in uptrend.

Strong Closing Power. Normally a bullish sign.

195 IT 27.56 IP21=.30 28.12=12 mo high...Gartner

***195 KHDH 56.90 +.02 Powerful. Breakout would occur at 38.1

Traders shoud buy on stop of 38.1

195 IWM 84.77 +.57 OBV confirmed NH... IP21=.10 Russel 2000

195 SZE 56.97 +.41 IP21=.05 Note B24 and IP21 surge in April.

195 NBG 11.77 -.27 AR Earlier B24 OBV is lagging Natl Bank of Greece.

Near recent high. IP21=.25 12=12 mo high.

195 LXU 19.35 -.39 Steady uptrend. Last high at 21 confirmed.

IP21=.25...On Red Sell... Lsb Laboratories.

195 MGEE 34.23 +.31 MGE Energy Below rising 200-day ma 37=12 mo high.

195 SFL Possible head and shoulders top developing.

Ship Finance Ltd.

195 TG 25=12 mo high.. IP21=.01 ITRS<0

'---------------------------------------------------------------------------------------

194 IPR 91.15 +1.20 IP21<0 Hesitation. Interna Power

194 KYO 98.7- -.25 IP21=.12 100 is a barrier. Kyocera ITRS<0

194 SZE 56.82 -.73 59=12 mo high. IP21=.12 ITRS<0

'---------------------------------------------------------------------------------------

194 CYE 8.54 +.01 IP21=.50 Slow moving. BlackCorp

193 ACAS 48.42 -.01 American Capital ... 58 was last January high.

Double top? On Sell.. V ...ITRS< 0

193 ATAX 10.45 +.06 10.6=12 mo high. OBV at NH. IP21=.25

193 FMS 49.20 +.11 OBV NC Weak OBV, BR ..Fresenius Medical I21=.35

193 IJR 73.20 +.37 NH IP21=.20 OBV lagging.. On Red Sell.

IShares Small Cap

193 MAT 28.35 +.34 30-12 mo high. IP21<0

193 TY 26.57 +.13 IP21=.20 OBV confirming NH Tri-Continental

193 VGR 19.75 +.46 ... 20=12 mo high. OBV is lagging...Vector Group

'----------------------------------------------------------------------------------

192 CEVA 7.43 Thin Ceva Inc. Weak OBV IP21=.40

JQC 192 13.92 +.06 Nuveen Income Fund Slow!

192 MAG 5.24 +.26 6=12 mo high. OBV trailing downward. AR IP21=.15

192 MW 53.00 -.34 Men's Wearhouse OBV NC of NH

192 NTN 1.13

192 SNCI Sonic Innovations 10.3=12 mo high. IP21=.15 Strong OBV

192 SNAK 2.99 AR

'--------------------------------------------------------------------------------

***191 ABB 21.74 +.29 NH OBV confirming. IP21=.25 (Buy)

B24 - 10/27/06 = 15.01

191 CAFE 2.19 +.01 IP21=.40 OBV confirming uptrend. (Buy)

191 CLDA 22.30 +.10 IP21>0. AR Clinical Data

191 CNMD 31.85 +.54 NH is confirmed by OBV.. IP21=.20

... Conmed ... Stong uptrend

191 DMC 13.06 +.92 13.5=12 mo high IP21=.30

191 EWD 36.87 +.26 IP21<0 Sweden ETF IP21<0 OBV is weakening. Red Sell.

191 JHT 19.45 +.11 18.5 is previous high. Slow moving.ITRS<0

191 LZ 66.93 +1.21 Breakout was at 55 in APril. OBV confirming NH

IP21.27. Strong but extended. Lubrizoil

***191 MCD 50.95 +.40 At rising 21-day ma IP21=.35 (Buy)

191 VPL Very weak OBV. IP21=.25

191 ZILG 5.85 -.15 IP21=.35

'---------------------------------------------------------------------------------------

***190 DAVE 21.83 +.51 Strong uptrend. NH confirmed. IP21=.50 (Buy)

.... Famous Dave's of America

190 NFI 5.75 -.10 Micro Financial up from 4.

----------------------------------------------------------------------------------------

*CONFIMED NEW HIGHS*

OBV should confirm NH

IP21 should be >.25 ... Better is IP21>.50 and under <.80.

AI/200 should be above 138 ... Better is AI/200 >150.

Red high volume & gaps confirm the breakout.

Stocks should probably be over $10 unless you watch them closely.

ITRS>-.04 and under .80

Notes: Many times a flat topped breakout that is exactly defined and well-tested

brings a quick move of 15%. Of the conditions above, the least important is

probably the AI/200 value being above 140. ITRS should be above -.04.

Look at CHDX. This shows the importance of an earlier IP21 bulge above .50

or even .60 if the OBV confirms. Piggy-back pattern are just above the

flat topped pattern mean much higher prices. See also CUBA, IGLD, RYAAY for same reason.

OBV confirming unless stated.

AI/200 Close IP21>.25 unless stated

====== ======

ABB ABB Ltd 191 21.74 +.27

ACN Accenture 165 41.26 +.32

AIRM Air Methods 167 37.07 +1.75

AOLX Applx 178 15.88 +.33 IP21=.20

***BGC General Cable 179 71.02 +2.07 IP21=.35

BOBE Bobe Evans 151 39.59 +/89 Breakout Thursday. ITRS<0

BSQR bSuare 153 6.09 +.32

BTM Brasil Telecom 150 21.99 +.78

***CNMD Conmed 191 31.85 +.54 (Buy)

COLM ColumbiaSportwear 165 70.38 +.65

CP Canadian Pacific 176 73.38 +1.91 Breakout was at 58 in March.

***CRH CRH Plc 200 50.94 +1.53 IP21=.20 (Buy)

CRNT Ceragon 177 9.76 +.21 IP21=.20 Breakpout=6.5

CYCL Centennial Comm 181 10.22 +.03

***DAVE Famous Dave's 190 21.83 +.51 IP21=.50 (Buy)

DNB Dun & Broadstreet's 181 100.80 +.75 IP21=.35

DSG Wilshore Small Caps 178 105.69 +.86 --- too thin!

DT Deutsche Tele 200 19.29 +.75 OBV is lagging

EFA IShares MSCI EAFE 165 81.56 +.53 IP21=.20

EVN Eaton Vance 171 44.24 +.35 Breakout at 39. Over-extended

***EWP IShares Spain 175 60.36 +.55 (BUY)

***FAF First American 171 55.11 +1.56 ITRS<0 Trading move.

GAP Great Atlantic Tea 158 34.70 +.19

GIB CGI 175 10.89 +.08 IP21=.20

***GPX GP STrategies 199 10.01 +.16 IP21=.40 (Buy)

GT Goodyear 184 36.13 +.66 IP21=.25

GTI Graftech 157 15.08 +.40 Breakout was at 10.Running.

HMN Horace Mann Educators 156 22.55 +.27

IART Integra 165 51.40 +.08

IJH IShares SP-400 172 91.88 +.55 IP21=.20 - thin

***KEYN Keynote Systems 161 16.00 +.21 IP21=.23

Starting another big move.(Buy)

LBY Libbey 161 23.15 +.73 extended

LFG Landamerica Fin 151 103.22 +10.53 Big jump on Friday.

LZ Lubrizoil 191 66.93 +1.21 IP21=.25

***MICC Millicomm Intl Cellular 175 92.22 +7.14 Nice tradng breakout! (Buy)

NAFC Nash-finch 161 47.69 +.64 Over-extended.

NFS Mationwide Fin. 177 61.00 +.08 OBV NC

ONVL Onvia 182 8.40 +.05 IP21=.50

***PEGA Pegasystems 153 10.82 +.07 IP21=.50 (Buy)

RCCC Rural Cellular 164 33.40 +.45 Running

RDK Ruddick 179 31.97 +.68 OBV NC

STE Steris Corp 161 30.28 +.21

TAC Transalta 154 26.79 +.33 IP21=.45 .. thin

_______________________________________________________________________________________

*BUY B12s *- IP21>.45 and ITRS>.30 and AI/200>100 and NH

BULLISH B12'S Many times a B12 will retreat back to its rising 50-day

ma and then take off. Consider the case of STV in June. On the other hand,

if a B12 occurs on a line formation breakout, do not look for a pullback for a while.

See this in USLM in February. The best B12s occur with the stock making a new high.

Previous week's B12 should be bought on pullbacks to rising mas and at point

of breakout. IP21 should be greater than 147 in this environment. Buy B12 AI/200 must equal at least 120. NH must be occurring

Study cases of KHDH, OMR and RIV:

B12 recently AI/200

============ =======

AWX 90

EPEN 171 13.72 +.12

PLPC 109 53.17 +2.45

***RIVV 159 36.52 +.64 IP21=.50 (Buy)|

SNT Senesco 115 1.51 +.31

WRP Wellsford 144 11.02 +.02 IP21=.50

______________________________________________________________________________________

_______________________________________________________________________________________

BEARISH Stocks Many times beaten down stocks get a boost when

tax-loss selling lifts at end of year. So, be careful here.

Look at AMD, ANPI and ANPL. One of best places to short a weak stock is after it

drops back below 50-day ma and its IP21 drops below its TISI (the

21-day ma of its IP21. IP21 = the current value of the Accum Index.

ITRS should be below -.10. Best to watch ITRS, too. Short sales should

normally be in ITRS downtrends.

New Lows (NL) and "Bearish" and Top Patterns and violations of key MAs

IP21 should be below TISI (falling IP21) or below -.25

Watch ITRS. ITRS downtrend is very useful. OBV need not confirm a new low.

In a strong market, it is often best to simply use a Buy Stop above|

21-day ma.

New Lows over $5.00

AI/200 Comments

------ --------

FBMI Firstbank 101 18.90 -.06

NBN Northeast 71 17.30 -.10

UIL UIL Holdings 102 32.58 -.22

------------------ end of report -------------------------------------------

|