currency has either sold-off so much or risen so much that, at least, some kind of

reversal "should" "normally" be expected soon. This begs many questions.

For example, how much of a reversal is one looking for? Mostly TigerSoft

traders are looking for moves longer than a few days. Two-weeks to 6-months

is good goal for traders looking at end-of-day data. So, while we view

end-of-day hourly charts, we are mostly interested in what daily charts

can offer.

Prices may look "oversold" on an hourly chart but still be near the top on a weekly

chart. The hourly "oversold" condition will help the trader only if the uptrend

in the longer-term chart continues. One should therefore be cognizant of the

status of a stock on the basis of the longer term chart, 5 year weekly or longer,

as well as the Tiger Daily chart that goes back a year. If you are a very short-term

trader, having intra-day charts will be helpful, but it is not essential and can

sometimes be mislading.

On the basis of what indicators is "Over-Bought" and "Over-Sold" defined?

1) The bottom of Price Trading Ranges show an "over-sold" condition. The

top of the trading range shows the "over-bought" condition. EBAY shows

an unusually well-tested set of parallel support and resistance lines. Most

trading ranges so not have so many swings in them without a breakout or

breakdown.

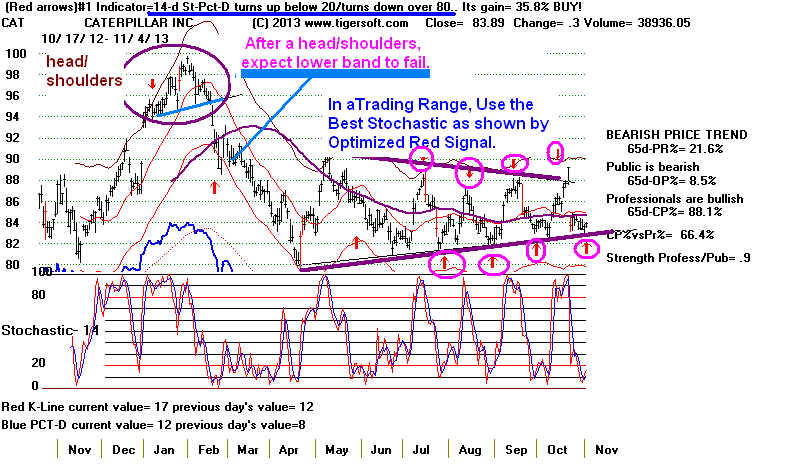

2) Tiger's Price upper and lower price bands on a daily chart are important. But

we know we must also be aware of the internal strength of a stock when the bands

are reached. We should also realize that flat-topped trading range breakouts

will often send a stock up past the simple tagging of the upper band, just as a

breakdown below well-tested support will often cause prices to drop below

the lower band. Head/shoulders patterns like a trading range breakdown

usually bring too much weakness to use the lower bands, Stochastics, CCI

or the RSI to identify a reliable over-sold condition. See chart of CAT below.

3) Stochastic' Oscillators help. They tell us how far up from the bottom to the top a stock

in within its, say, 5-day range, or its 20-day range, or its 65-day range. A stock

might be expected to have more reversal potential when it is below the 20%-level

in all three time periods, but this is not necessarily so. A trader may prefer a

short-term 5-day over-sold condition when the stock's momentum is still strong.

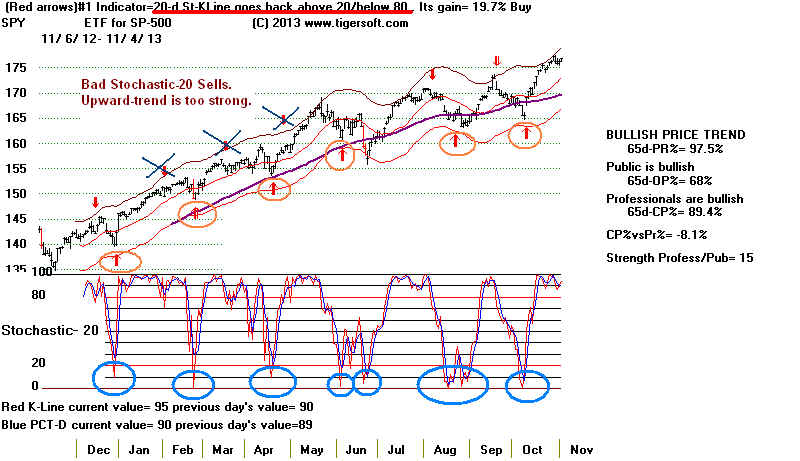

In the chart below, the 20-day Stochastic Buy signals work nicely, while

three of the 20-day Stochastic Sell signals are premature. This shows that

momentum can trump what are normally "overbought" Stochastic readings.

See at the bottom of the screen the Stochastic oscillators. The second blue

one is a 3-day smoothed "slow" Pct-D Stochastic. Falling below 20 and then

rising above 20 gives the Buy signals.

Stochastic overbought and oversold Buys and Sells work best

as a team together when prices are locked in a trading range.

Tiger's automatic signals will tell you what length stochastic to use.

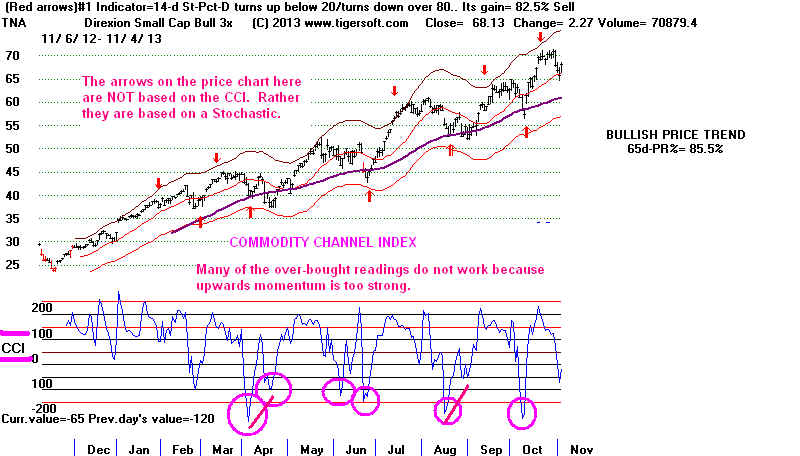

4) The CCI Oscilator helps Index Option traders a lot. They are especially

interested in intermediate-term moves when the CCI (Commodity Channel Index)

registers oversold and the trend is up, especially as defined by Peerless.

When the Tiger Automatic Signals also contribute a reinforcing Buy, it's

clear the uptrend has re-started. If you trade index options, don't wait

for a clinching signal. Buy on weakness when the option premiums

are lowest.

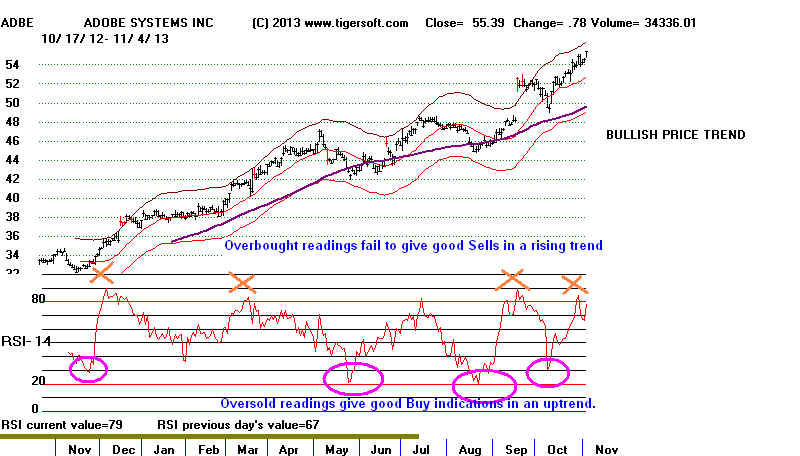

5) RSI (not to be confused with TigerSoft's Relative Strength tools)

also shows over-bought conditions. They work in a way that is similar

to the CCI. There is lot of writing about the RSI on the internet. Buy

the RSI dips below 30 in an uptrend. Do not use the RSI moves over

70 or even 80 to Sell. See ADBE below. The opposite is true for the

stocks in a downtrend. Use the RSI moves above 70 to sell, but do

not use the moves below 30 to buy.

Uptrending Stock. Use RSI Over-Sold Readings to Buy

.:

Down-trending Stock. Use RSI Over-Bought Readings to Sell Short