TIGERSOFT and the Commodity Channel Index (CCI) Indicator

(c) 2013 www.tigersoft.com All rights strictly reserve

--------------------------------------------------------

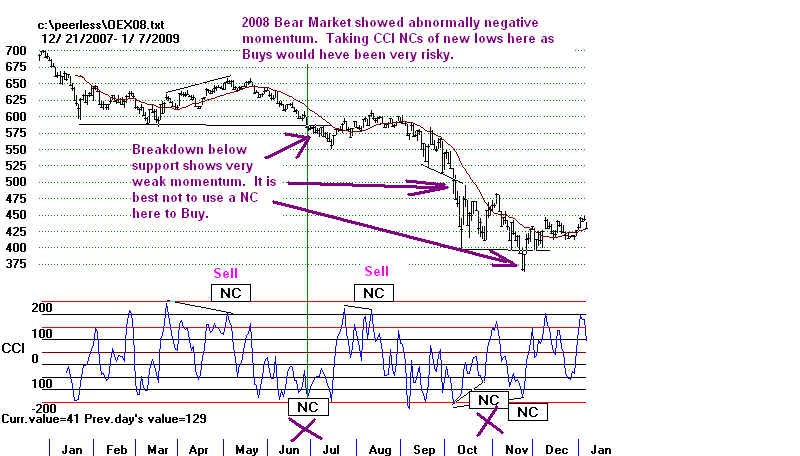

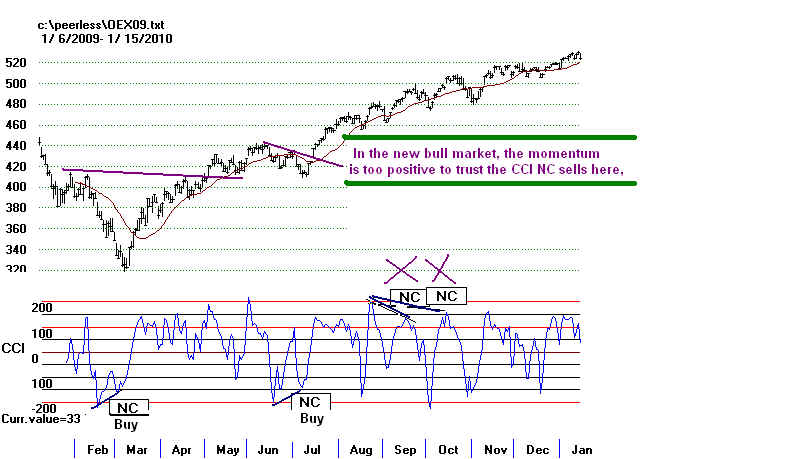

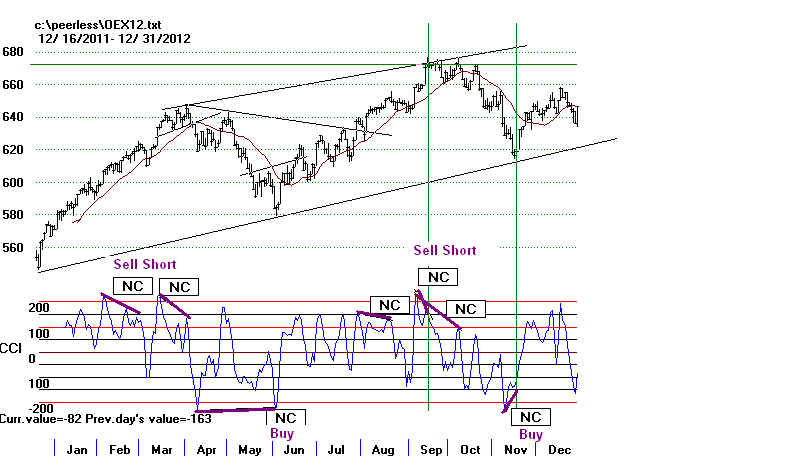

The CCI was created by Donald Lambert.in 1976. Its formula is

shown and explained elsewhere on the internet. Its primary use

is to show extreme overbought and oversold conditons. As with the

Stochastic and RSI Indicators, it is not advisable to use the CCI

when momentum is extremely strong, as in bear market of 2008 or

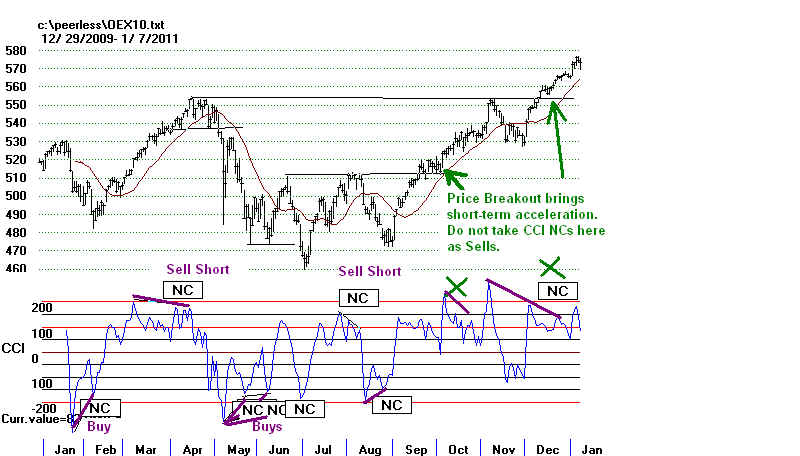

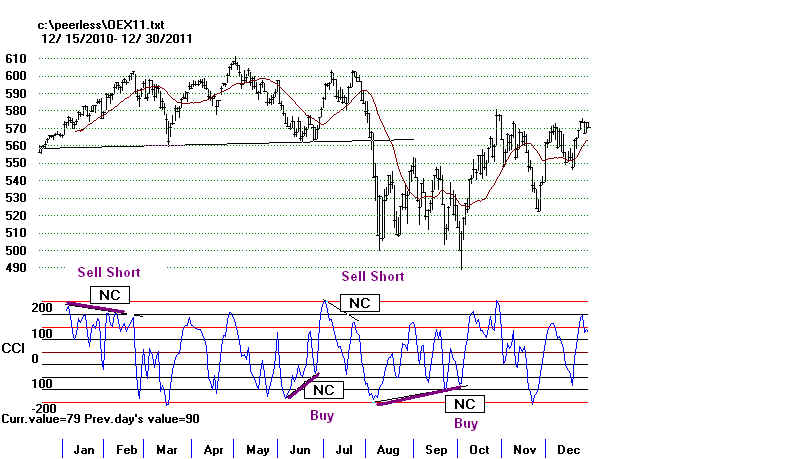

the new bull market of 2009. In more normal markets, we can trade profitably

CCI NCs after the CCI first registers oversold by falling below -175

or overbought readings above +175. This is especially true of Index options

on the OEX and SP-500. In the examples below, you can see that

readings of the CCI above +200 and below -200 often work, but I

think you will find that subsequent CCI NCs work better.

I wrote a short study on this subject for the period 1980-2006. It is

available for $38.50 from TigerSoft. Below you can see how this strategy has worked

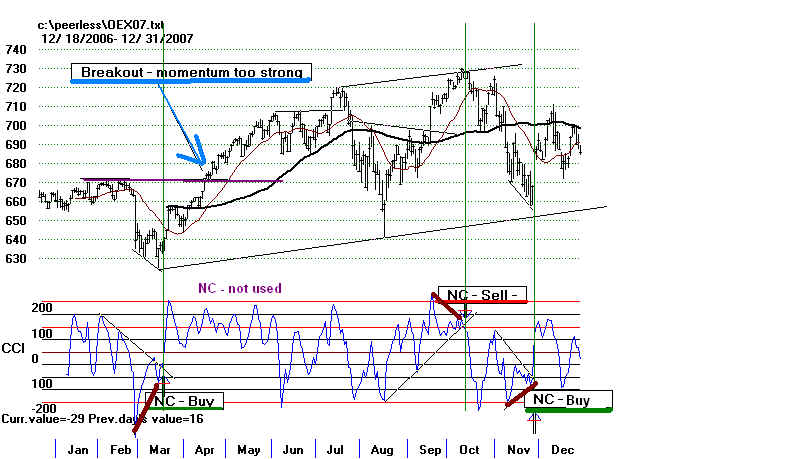

in the years since 2006.with the OEX, the SP-100. I do not show here how

the Peerless signals should be factored in. Suffice it to say, price breakouts and

breakdowns often suggest the momentum is too strong to take the

CCI NCs of new highs or lows as Buys or Sells, respectively.

2007 OEX and CCI NC Trades

.

.