(c) 2013 www.tigersoft.com All rights strictly reserve

TIGERSOFT's PRICE BANDS

(c) 2013 www.tigersoft.com All rights

strictly reserve

TigerSoft invented fixed percentage interval Price

Bands around a Moving Average

back in 1981.

Now they are used widely by many chartists and technicians.

Our bands

originally were fixed percentage intervals above and below the

21-day ma. Since then we have found it useful to put

bands above 7-hour,

35-hours, 65-day

and 52 week moving averages. Here we focus on the

bands above and

below the 21-day ma which are used in our daily charts.

The bands

represent typical over-bought and over-sold conditions. Reversals

usually take

place at the bands, but not always. We pay close attention

when the bands do

not bring reversals. Just as Sherlock Homes heeded

the dog that did

not bark, we are alerted by bands that do not bring reversals..

Band

Breakouts/Breakdowns

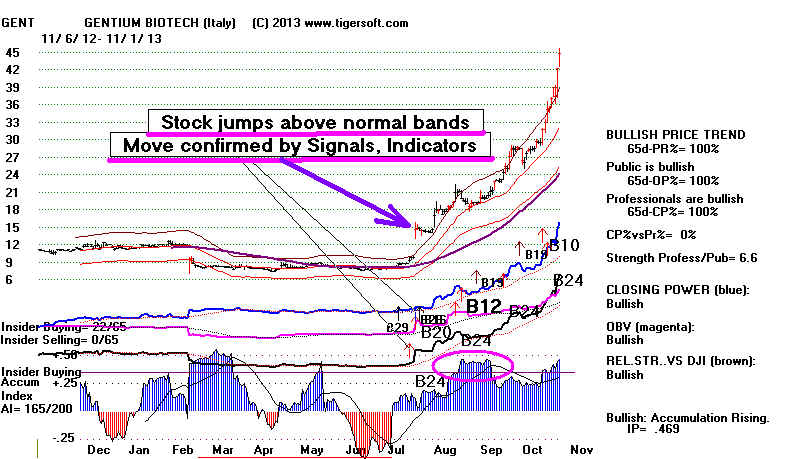

When prices

move past the bands, the stock is either accelerating up or

accelerating

down. Usually this is a break-away move if there are major Buys

(B10, B12, B20 or

B24) and the TigerSoft Accumulation and TigerSoft Closing

Power are

confirms the moves.

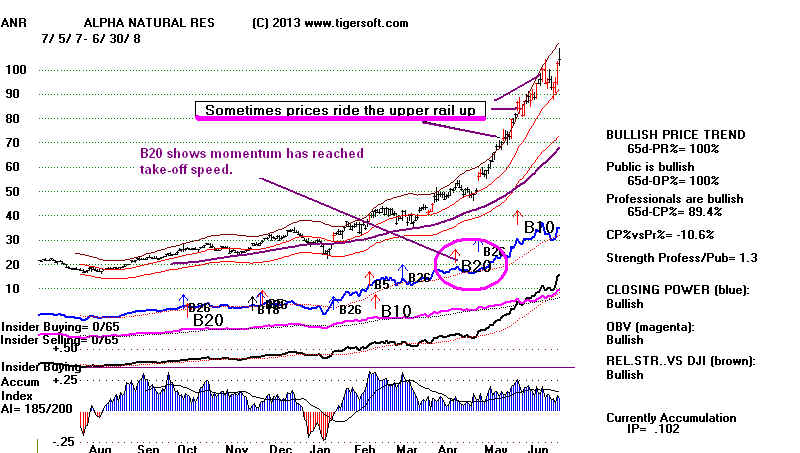

Prices

Ride The Outer Rail: Powerful Momentum Up

Often you

will see prices ride the outer band up. Internals are usually very

good.

You will also see Tiger/Peerless buys at this time if prices are apt to

continue to

advance. With stocks we would look for B12 and B20 signals,

particularly..

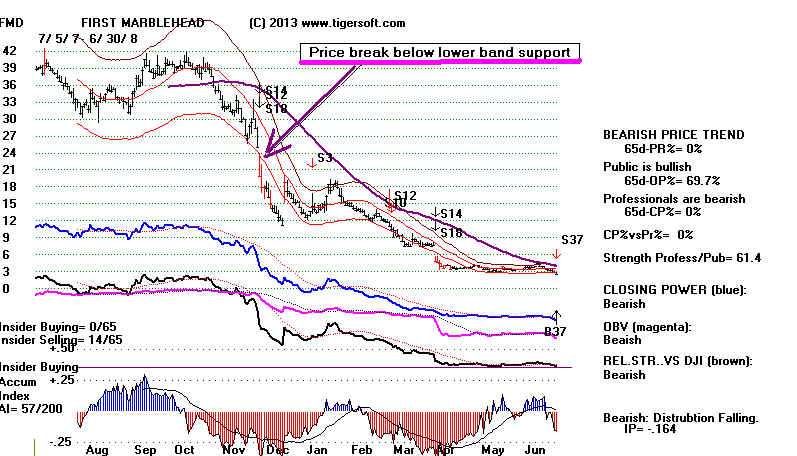

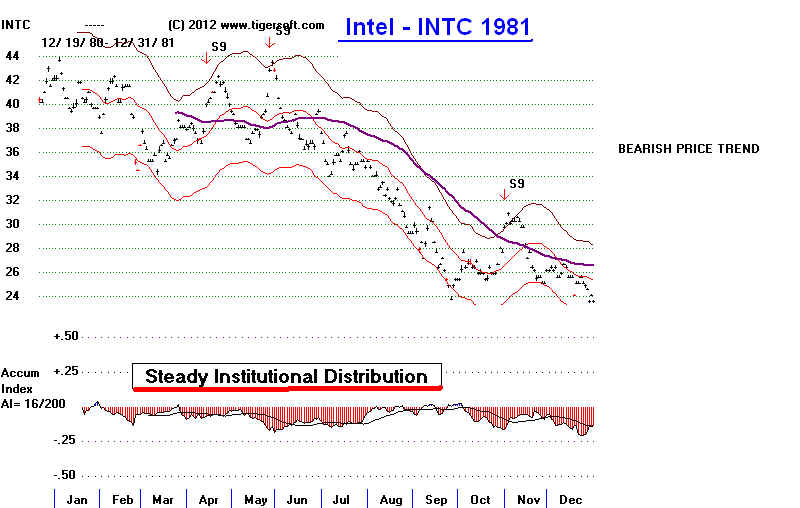

Prices

Ride The Outer Rail: Powerful Momentum Down

Most of the Tiger

and Peerless signals are derived from where the index, stock

or commodity is

in relation to the price bands and how strong (Blue Accumulation

and Insider

Buying) or weak (Red Distribution or Insider Selling) the stock is.

The internal

strength indicators are the bottom of the Tigersoft or Peerless chart

are constantly

measured up against the stock's price action and the ratio of

the stock's

closing price and its 21-day ma. Thus, we simultaneously employ both

momentum and

divergence analysis in generating automatic signals.

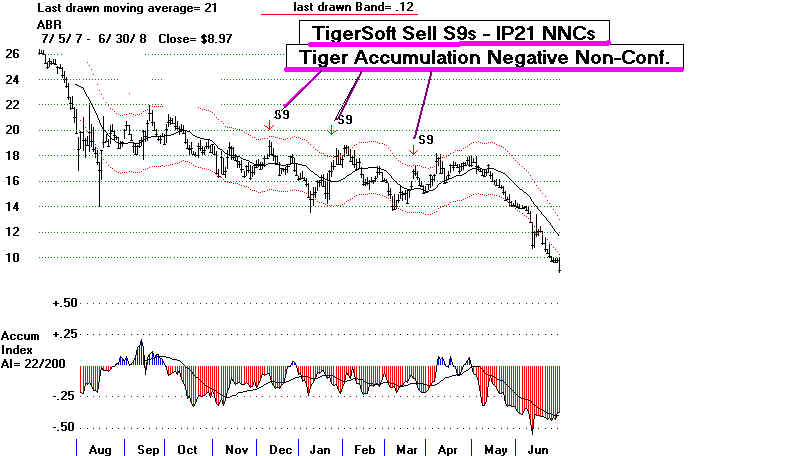

TigerSoft

Sell S9s Show Stock IP21 NNCs.

See more examples

at http://tigersoft.com/--1--/52109index.html

HOW

THE BANDS ARE SET

In 1981, the

DJI's upper and lower bands were set at 4% and then 3 1/2%.

You can see how

well the bands showed the path of the DJI back in 1981.

Only in August

did the DJI go beyond the boundaries of the lower band.

The bands, in

effect, captured and bracketted about 93%-95% of the trading.

This is the basis

of the current optimization of bands, done with

PEERCOMM + Tiger

Stocks + Optimize Bands and Drop Earlier Data.

At the time, on an Apple II+, we

considered 8% band the right width for

most DJI-30 stocks. A typical NASDAQ stock was about twice as

volatile. So we assigned 5% band to most NASDAQ stocks.

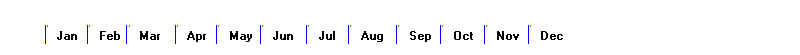

This worked fairly well in 1981 for most stocks. See AA and AMAT below.

.

.

![]()

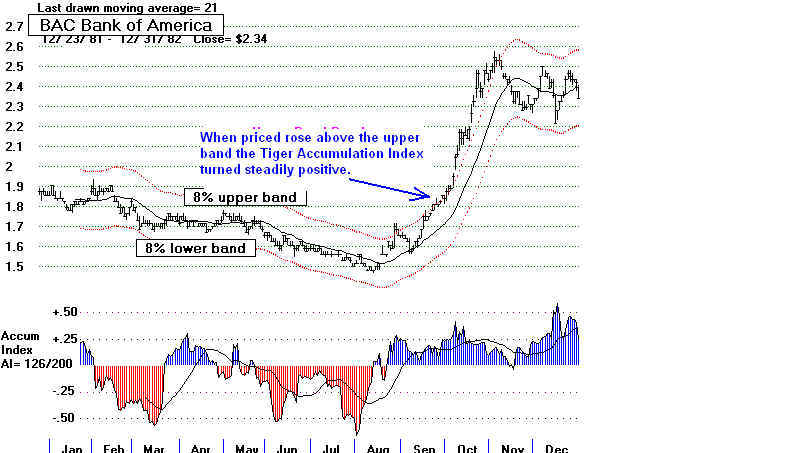

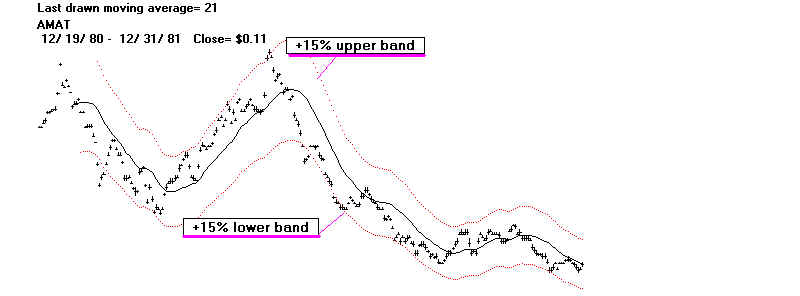

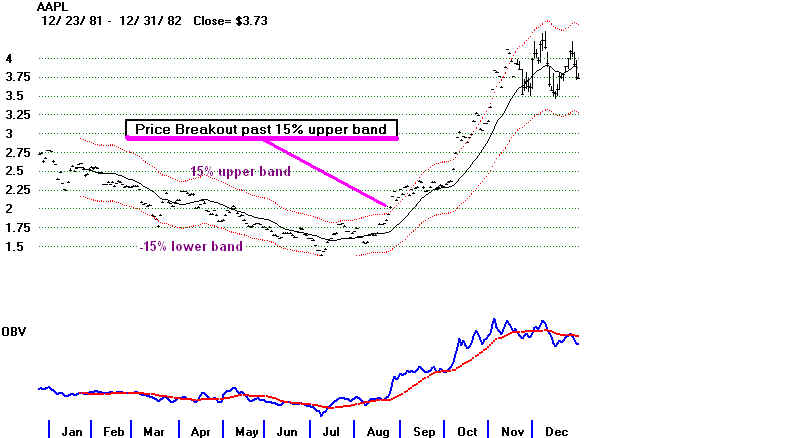

Then, in August 1982, prices moved way past the normal upper bands.

The subsequent bull market showed the importance of such breakouts.

It was also clear that high volume on the breakouts was important.

In AAPL's case the OBV (On-Balance-Volume Line) made a new high

in mid August, long before prices did. Volume led prices. In BAC's

case, the Tiger Accumulation Index (which we invented in 1981, too)

switched from negative to steadily positive for a BAC. Big institutions

were again buying the stock.

The greater memory of the IBM PC and then

Windows in the 1990s

allowed us to provide

ways for the users to redraw -optimize bands.

The best fitting lower

band did not have to be the same width as the best

fitting upper band.

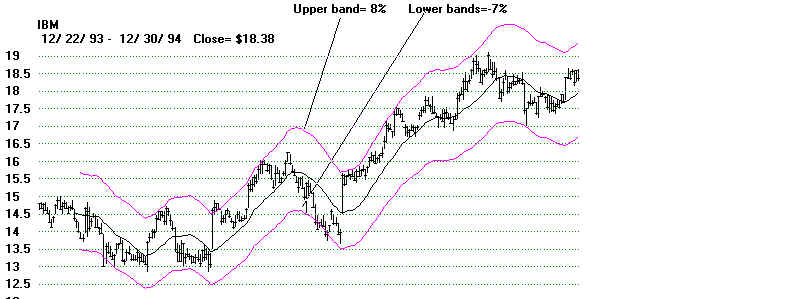

Below is the optimized band chart for IBM for 1994.

In the table below, see

how the Optimized bands around the 21-day ma

have changed from year

to year.

> The upper bands have ranged from +2.7% (1991) to +18% (2002).

> The upper band does widen in a bull market but it has tended to rise

even more in a bear

market.

> The lower bands have ranged from +2.4% (1985) to +18,5% (1987).

> When the lower band % is low, it shows a bull market environment.

> When the lower band is high, a bear market is signified.

> When the upper band's % is much greater than the lower band's,

it is a sign of a new bull market (1982 -1984, 1991, 1995 and 2009.

IBM PRICE BANDS AROUND 21-DMA

==============================

Upper Lower

Band Band

------------------

1980 +7.5%

-8.0% (mini-bear market)

1981 +5.0%

-5.5%

1982 +9.5%

-5.5% (start of bull market)

1983 +7.0%

-4.5% (bull market)

1984 +6.0%

-4.8%

1985 +4.1%

-2.4% (bull market)

1986 +8.5%

-5.5% (bull market)

1987 +5.5%

-18.5% (bear market)

1988 +5.5%

-4.2%

1989 +4.3%

-3.5%

1990 +4.3%

-7.5% (bear market)

1991 +7.0%

-3.8% (start of bull market)

1992 +2.7%

-3.2%

1993 +2.8%

-2.3%

1994 +3.0%

-3.6%

1995 +4.0%

-2.0%

1996 +4.0%

-3.8%

1997 +6.0%

-6.0%

1998 +10.5% -8.5%

(mini-bear market)

1999 +14.5% -13.0% (bear

market coming)

2000 +10.5% -13.0% (bear

market)

2001 +15.5% -12.0% (bear

market)

2002 +18.0% -14.0% (bear

market)

2003 +6.0%

-6.0%

2004 +5.5%

-4.6%

2005 +7.0%

-6.5%

2006 +6.0%

-3.7%

2007 +6.0%

-7.5% (start of bear market)

2008 +6.5%

-17.0% (bear market)

2009 +9.0%

-6.0% (start of bull market)

2010 +4.5%

-4.8%

2011 +6.5%

-7.0%

2012 +4.3%

-5.5%

2012-2013 +4.6% -6.0%

====================================================================================