Tiger

Investment Software

PO Box 9491

San Diego, CA 92169

(858)--273-5900

william_schmidt@hotmail.com

INSIDERS ALWAYS KNOW.

Simple Rules to Make You Money!

---> Print These Out..Memorize Them <---.,

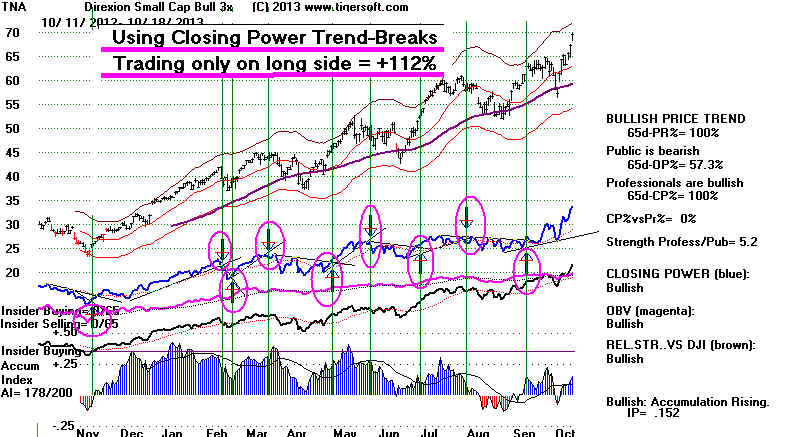

1) If you're somewhat new to

technical analysis,

I suggest working with one the very actively traded major market ETFs. We favor are DIA,

SPY, QQQ, IWM, TNA

and also FAS. If you're buying, decide which is strongest. Buy that one for as

long as Peerless is on a buy and the Closing Power is rising. This is simple and

reliably profitable. See TNA

below using Peerless signals first and then

Closing Power trend-changes to make the trades.

2) Watch the direction of the Blue

Closing Power

to see what professional money managers think of stock, ETFs, Commodities, Metals and

Currencies.

Tests of support are buying opportunities

when the Closing Power hooks up.

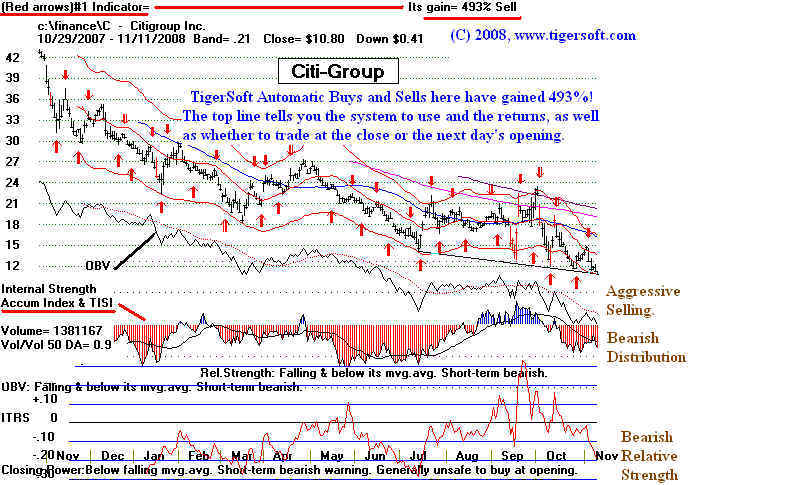

The opposite provided excellent shorting

opportunities when heavy RED distribution is present.

3) Watch the Accumulation Index (IP21) to see if Insiders are actively Trading the Stock. If

IP21 is above .38 they are probably Buying provided relative strength is strong, But

if IP21 is below -.25 and relative strength is weak, they are probably Selling.

4) Trade the confirmed trend of the 65-dma with TigerSoft Buys/Sells. Confirmed means that

the Closing Power,

Accumulation Index, OBV and Relative Strength are

stated to be "Bullish" when stock is above its 65-dma,

and vice verse.

5.) Buy B10s, B12s, B20s and B24s after a Bulge of

The Accumulation Index are Times To Buy

if Stock Is Not Too Far from its Base. This means

buy on the first and second Buys, but be careful after that.

6. Use Peerless and get the Nightly Hotline. History teaches.

We are doomed if we do not learn its lessons.

Multiple Peerless Sells and a major DJI Support Failure

Usually Launches a Bear Market.

6. Watch the trend of the NYSE A/D Line and A/D Line of the group of stocks you are

trading.

7. Understand how Support and Resistance work.

8.) Watch for Red High Volume Confirmations of Breakouts and Breakdowns. But note

that Red High Volume at Upper and Lower Band May Be "Churning" and Lead to a

Reversal.