RAMPANT INSIDER SELLING - MORE EXAMPLES:

George Bush, Jr and Harken Energy - HKN - 1990

Novastar Financial - NFI - 2007

Quebecor - IQW - 2007

Discovery Laboratories - 2006

Newmont Mining - NEM - 2006

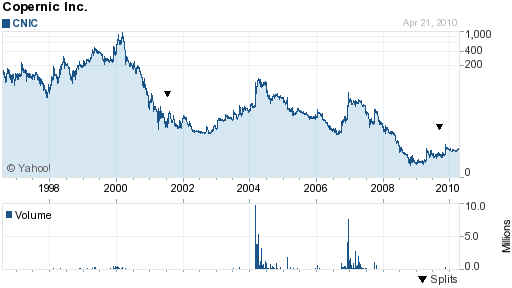

Copernic - MAMA - 2004

Here are a few more of the most heinous examples of insider selling right before the bad news

comes out. Such cases seldom make the news or are prosecuted. Perhaps, that's because

insider trading charges would snow-ball into an avalanche, if laws against it were ever

enforced and the white collar perpetrators prosecuted. Only glaring and egregious cases

are ever prosecuted.

You might think that the SEC polices cases where there is such rampant insider selling prior to

the news. Not so! If you are a shareholder of a stock like this, your best bets are on contacting

a lawyer who files class action lawsuits on behalf of aggrieved shareholders and buy our software.

SEC filings for corporate insiders' selling are incomplete.

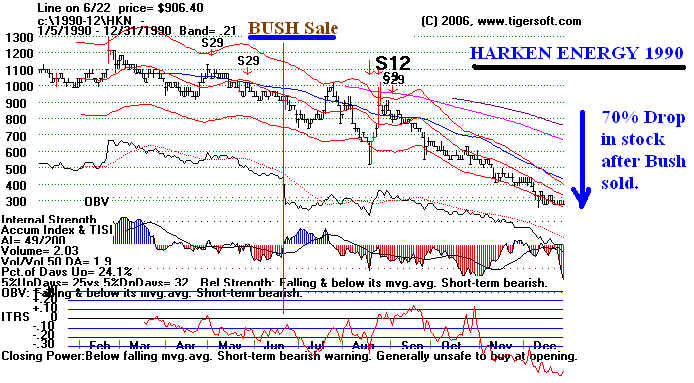

George Bush, Jr and Harken Energy - HKN - 1990-

The SEC does not enforce the insider trading laws except in a minor fraction of the cases

where it occurs. They are window-dressing to make investors feel there is a level playing field.

See the egregious case of insider trading involving George Bush Jr. and Harken Energy. On June 22,

1990 Bush sold 212,140 shares of Harken Energy. He was on its Board of Directors. Two months

later Harken announced losses of $56 million and financing problems. By the end of the year,

Harken had lost 70% of its value. Bush did not inform the SEC of his sale, as the law requires,

by the tenth day of the month following the transaction. He filed the report in March the next year.

Asked why when the issue came up, at first, he said that the SEC lost the filing. Later he blamed it on

Harken lawyers. The SEC investigated the matter. It determined he has NOT engaged in insider

trading and that the late filing was no problem. Why? The chairman at the time was Richard Breeden,

a good friend of the Bush family who had been nominated to the SEC by George H. W. Bush and had

been a lawyer in James Baker's firm, Baker Botts. The SEC's general counsel at the time was

James Doty, who would represent George W. Bush 9 months afterwhen he sought to buy into the

Texas Rangers (although Doty excused himself from the investigation). Bush's own lawyer was

Robert Jordan, who had been "partners with both Doty and Breeden at Baker Botts and who later

became George W. Bush's ambassador to Saudi Arabia." (See full report at bottom of this page.)

We use "insider trading: to mean "insider informed trading", the type of extensive buying or selling

which is so prescient that the buyer or seller clearly must have had access to information from the

company which was not available to the general public. We define it technically in our book on short

selling. For purposes here consider insider selling to be detected when the stock's Accumulation

Index drops below -.25 and its ITRS (relative strength) is negative. Usually the blue 50-day mvg.avg.

is falling. This means the stock is being sold by insiders while the rest of the market rallies and

this stock is lagging. There are numerous examples on our website. They will "jump out" at you

with a little study. And our automatic major Buys and Sells will make them very apparent when

you look at a chart. With the Tiger Power-Ranker you can quickly scan a large number of stocks

for those showing the most Accumulation or Distribution.

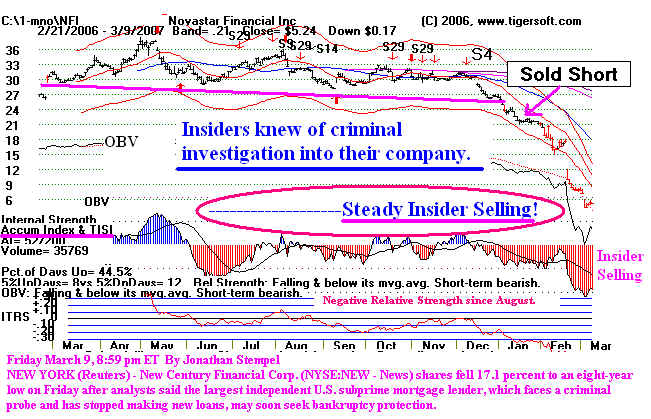

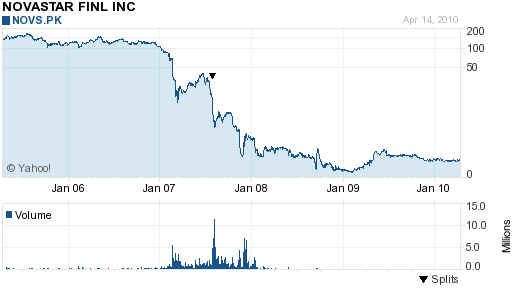

Novastar Financial - NFI - 2006-2007

The 2006-2007 chart of Novastar Financial (NVI) is a classic example of insider selling.

NovaStar Financial, Inc., together with its subsidiaries, operates as a residential mortgage

appraisal management company. The company offers appraisal services to lenders and

borrowers. It also holds certain nonconforming residential mortgage securities.

TYPICAL PROFILE OF RAMPANT INSIDER SELLING BEFORE THE DECLINE

QUEBECOR WORLD INC NYSE:IQW - 2007

11/18/2007

We want to show you how much TigerSoft's Accumulation Index can save you

in the coming bear market. Here is the TigerSoft chart QUEBECOR

WORLD INC (NYSE:IQW)

Above $9 it showed massive Insider Selling that was to extreme detriment of other

shareholders.

Some smart lawyer is going to get TigerSoft, find these stocks and build a

class action law suit

based on insider selling like that which is shown in this case. In April 2010, with the general

market up more than 50% from the bottom, IQW sells for 3 cents a share on the

Toronto

Stock Exchange.

Nearly all its news back in August and September was completely misleading.

Its' a fair guess that they wanted to distract from what was really happening.

Aug 2, 2007 - Quebecor World Wins 27 2007 Gold Ink Awards

Aug 3, 2007 - Quebecor World (USA) Inc. Offers to Purchase up to 50.1%

of Outstanding Private Notes of Quebecor World Capital Corporation and Launches

Consent Solicitation

September 13, 2007 - Quebecor World Combines French and Belgium Operations

to Create Greater Customer Value

September 28, 2007 - Quebecor World Announces it has Agreed to New Terms

in its Bank Credit Facility and is Proceeding With the Redemption of All of Its 8.42%,

8.52%, 8.54% and 8.69% Senior Notes

September 28, 2007 -Quebecor World Gets $750M Credit Line

October 15, 2007 - Quebecor World Announces Percentage for Fixed Dividend Rate

on Series 3 Preferred Shares Effective as of December 1, 2007

--------------------------------------------------------------------------------------------------------------------------------------------

--------------------------------------------------------------------------------------------------------------------------------------------

DSCO - 2005-2006

From $7-$8 in 2006 to 50 cents in 2010

--------------------------------------------------------------------------------------------------------------------

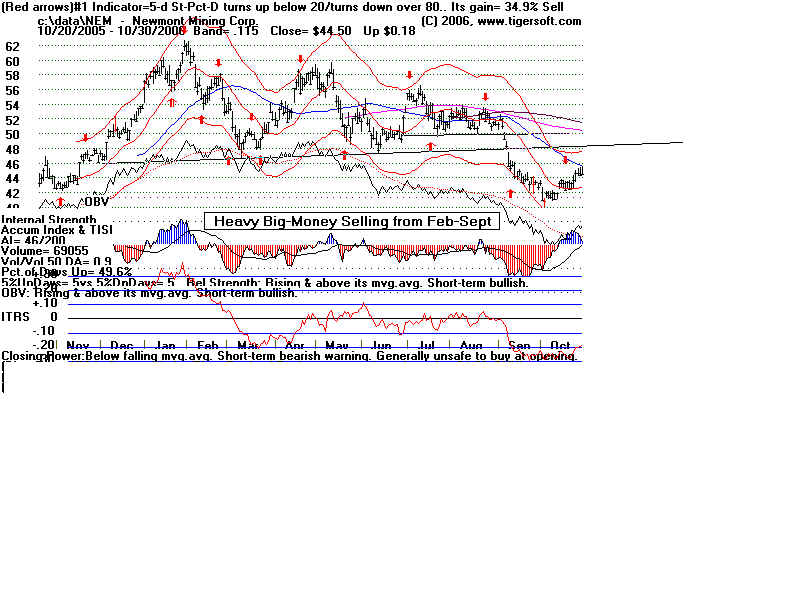

Newmont Mining - NEM - 2006

Look at how gold stock Newmont Looked Before Its Recent Decline from 50 to 40.

Note the heavy Red Distribution (Insider and Big-Money Selling) while the stock was going

sidewise between 48 and 58. Also see how the OBV Line - representing aggressive selling -

was making new 12 month lows with the stock still over 48.

What precipitated the decline was the accouchement made late in the decline by

NEM that it's earnings' outlook would be much duller than expected for the next two years.

Reuters: October 2, 2006

headline: Uzbek court declares Newmont gold venture bankrupt

" Newmont, the world's second-largest gold miner, has run into difficulties in the former

Soviet republic at a time of worsening diplomatic relations prompted by U.S. condemnation

of a government crackdown on a rebellion in Andizhan a year ago....In July, Uzbek authorities

seized gold and some of the assets belonging to Zarafshan-Newmont, the other 50 percent

of which is owned by the government of Uzbekistan, and launched two tax claims for

payments it said were due between 2002 and 2005....Denver-based Newmont has called

the tax claims an attempt by the Uzbek government to expropriate its share of the company.

The company has said the joint venture met its tax obligations...CEO Wayne Murdy said

last week the company would write off its operations in Uzbekistan, where the joint venture

ran for more than a decade. "We are finished there. When I left Uzbekistan in June, I took

the last two expatriates with me," Murdy told Reuters in an interview last week....

Newmont's 50 percent share of gold sold by the Uzbek joint venture last year was 122,700

ounces. ($73 million) ...The company expects equity gold sales between 5.6 million and

5.8 million iunces worldwide in 2006, dropping to between 5.2 million and 5.6 million ounces

next year before recovering in 2008 and 2009 when projects in the United States, Ghana and

Australia reach full production."

This bearish news was known to the company and insiders in June. It was not released

until October. The stock fell to a low of 39 from the 52-54 level, where the insider selling

had started. There it bottomed out soon after the news was finally released. Traders correctly

assumed that the decline had already factored in the Uzbekistan nationalization.

--------------------------------------------------------------------------------------------------------------------

==================================================================================

LINKS ON INSIDER SELLING USING TIGER SOFT

Previous articles on the subject of INSIDER SELLING.

June 24, 2007 See the Tiger Accumulation chart of 1929.

The 1929 Crash: Could

It Happen Again? Yes- Absolutely.

July 9, 2007 Stock "s9"

Signals: Tips for Stock Traders

August 2, 2007 A Look at Biggest Losers since major

Peerless Sell S9/S12 on 7/17/2007

August 3, 2007 Widespread Insider Selling

before The Bad News Comes out.

August 7, 2007 How To Pick The Best Short

Sales

August 13, 2007 Killer Short Sale

Techniques

September 17, 2007 Insider Selling and Data

Falsification at ImClone in 2001

September 17, 2007 Lots of Stocks Look Like

Good Short Sales

November 15, 2007 How To Spot and Easily

Survive Dangerous False Breakouts.

In addition, look at my website http://www.tigersoftware.com/

It is dedicated to this topic.

-----------------------------------------------------------------------------------------------------------------------

George

W. Bush 's

Insider Trading in

1990 with Harken Energy

From Wikipedia, the free encyclopedia

http://en.wikipedia.org/wiki/George_W._Bush_insider_trading_allegations

Allegations of insider trading have been made against George W. Bush, later elected President of the United States, for his 1990 sale of stock in Harken Energy Corporation, of which he was a director. The sale raised the issue of whether it constituted illegal insider trading.

In House of Bush, House of Saud, Craig Unger asserts that at the time of Bush's sale, Harken Energy "was expected to run out of money in just three days" (p. 123). In a last-ditch attempt to save the company, Harken was advised by the endowment fund of Harvard University to spin-off two of its lower-performing divisions–"According to a Harken memo, if the plan did not go through, the company had 'no other source of immediate financing.'" Bush had already taken out a $500,000 loan and sought Harken's general counsel for advice. The reply was explicit: "The act of trading, particularly if close in time to the receipt of the inside information, is strong evidence that the insider's investment decision was based on the inside information... the insider should be advised not to sell." This memo was turned over by Bush's attorney the day after the U.S. Securities and Exchange Commission (SEC) ruled that it would not charge Bush with insider trading. Bush's motivation for selling was his desire to pay down the debt incurred funding the purchase of his interest in the baseball team.

On June 22, Bush sold his 236,140 shares of stock anyway for a net profit of $848,560. The very next quarter, Harken announced losses of $56 million, which continued to the end of the year when the stock "plummeted from $4 to $1.25."

The subsequent SEC investigation ended in 1992 with a memo stating "it appears

that Bush did not engage in illegal insider trading," [1]but noted that the memo "must in no way be construed as indicating

that the party has been exonerated or that no action may ultimately result" [2]. Critics have contended that the SEC's makeup may have influenced the

conclusions of the investigation, although no evidence of impropriety has been found. The

chairman at the time was Richard Breeden, a good friend of the Bush family who had been

nominated to the SEC by George H. W. Bush and had been a lawyer in James Baker's

firm, Baker Botts.

The SEC's general counsel at the time was James Doty, who

would represent George W. Bush 9 months afterwhen he sought to buy into the Texas Rangers

(although Doty recused himself from the investigation). Bush's own lawyer was Robert

Jordan, who had been "partners with both Doty and Breeden at Baker Botts and who

later became George W. Bush's ambassador to Saudi Arabia."

References

- ^ Kelly Wallace (July 3, 2002). White House defends Bush handling of stock sale. CNN.

- ^ Anthony York (July 12, 2002). Memos: Bush knew of Harken's problems. Salon.

- ^ Robert Bryce. Governor Deadbeat. The Auston Chronicle.

Edit] See also

|