TigerSoft News Service 4/8/2010 www.tigersoft.com

TigerSoft News Service 4/8/2010 www.tigersoft.com

WHEN TO SELL A STOCK USING TIGERSOFT

Can You Reallty Afford Not To Use TigerSoft/Peerless?

2009 and 2010 have seen more stocks quadruple, quintuple, even rise 10 fold,

than any year I can remember, and by a wide margin. This has provided a wonderful

opportunity to make some huge gains. But, not all stocks rose in this bullish

environment. A rising tide does NOT lift all boats, or all boats equally. The rising market

tide has actually sunk some of the leakiest boats, those with big holes of heavy insider selling,

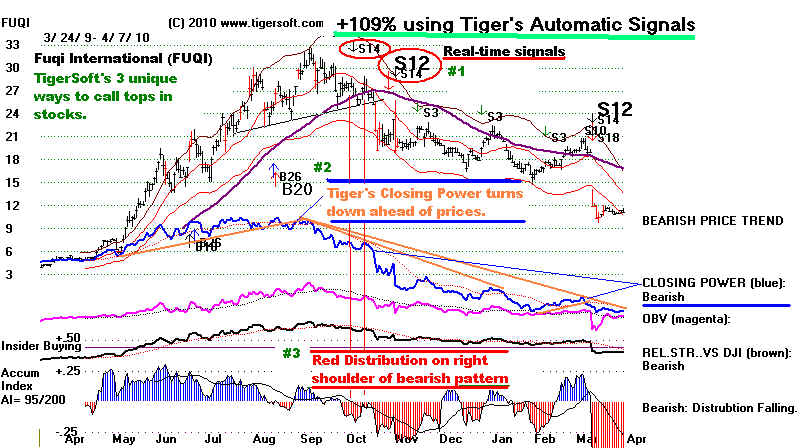

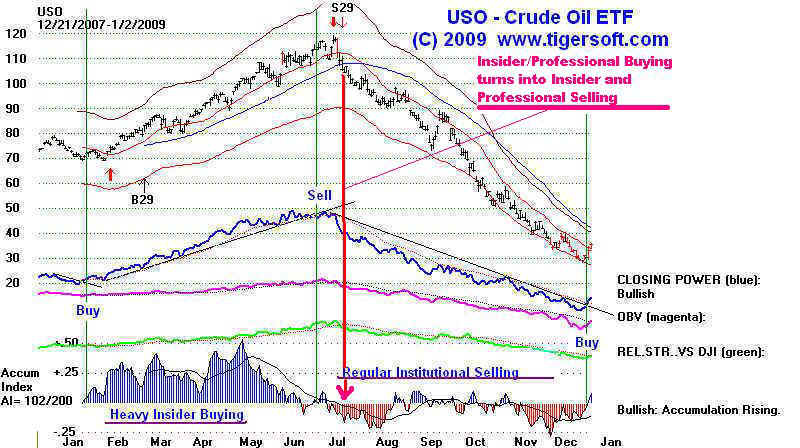

that previously were resting on the bottom! You can see on this page how Tiger users

would have known to avoid or sell the worst performing stocks of 2009-2010. We use

1) Automatic TigerSoft Sells,

2) broken price uptrends, support and key moving averages,

3) heavy down-day volume,

4) weakening Relative Strength,

5) red Distribution from Tiger's Accumulation Index and

6) a decliing TigerSoft Professional Buying/Selling Indicator (Tiger's Closing Power).

It is always hard psychologically to sell a stock you thought would be a winner.

But we do it easily. TigerSoft's tools have been tested and fine-tuned over 29 years.

That gives us confidence. And, most importantly, we know how well Tiger's system

is for finding truly explosive super stocks. So, if one stock turns weak and shows

heavy insider and professional selling, we can readily find a much better stock with

Tiger's Power Ranker.

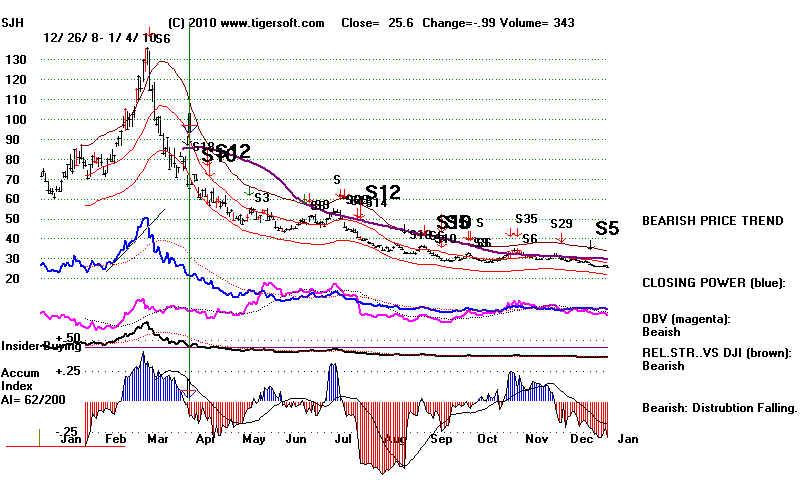

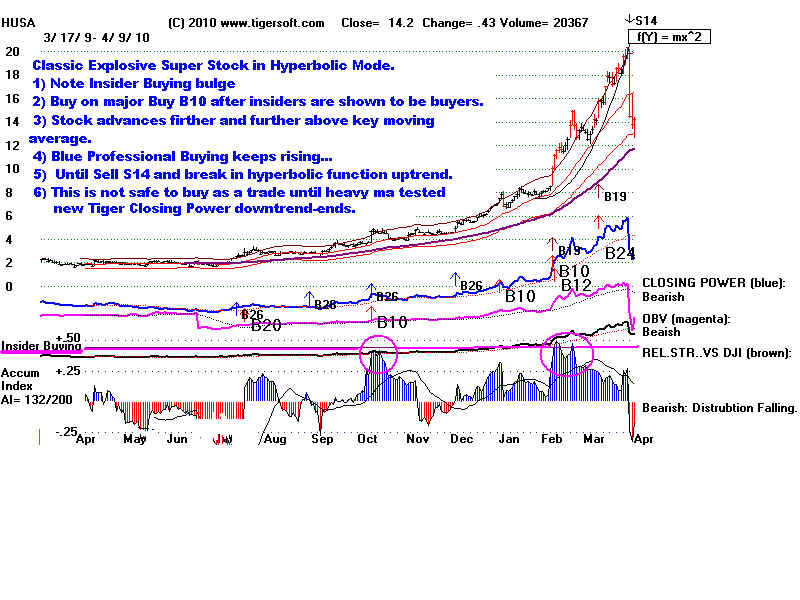

Stocks seldom keep rallying past a a triple or a quadruple without

a correction. Those that do not "correct" themselves with an intervening

decline become much more vulnerable to a larger decline when it does come.

Such a stock has attracted lots of momentum players. Once the stock

turns, they exit quickly. Such a stock is also made more vulnerable if the

vertical advance has forced all the shorts out, who might otherwise be expected

to cushion a decline.

Thus it behooves us now, with so many stocks having gone "hyperbolic in the

2009-2010 bukk market. to study how these stocks will eventually breakdown.

TigerSoft recognizes the vulnerability of such stocks by:

1) The TigerSoft Automatic Sells

2) Turning Down by Tiger Closing (Professional Buying) Power

3) Turning Negative by Tiger Accumulation Index

by William Schmidt, Ph.D. (Columbia University)

Author of TigerSoft and Peerless www.tigersoft.com

Make Money. Use TigerSoft To Track Key Insider Buying and Selling in All Your Stocks

www.tigersoft.com PO Box 9491 - San Diego, CA 92169 - 858-273-5900 - william_schmidt @hotmail.com

--------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

TigerSoft Blog

WHEN TO SELL A STOCK USING TIGERSOFT

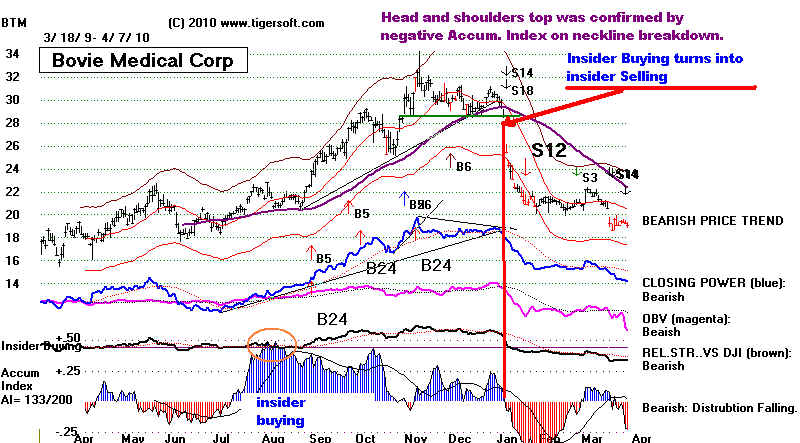

Even in a bull market, some stocks go down or top out ahead of the

market top, which we would expect Peerless to tell us is occurring.

Here are some examples of stocks that gave plenty of warnings.

TigerSoft usually produces automatic Sell signals in plenty of time to get out

before there is a significant decline. TigerSoft's inventions, the Accumulation

Index (invented in 1981) and Closing Power are vital, if you want to escape

unscathed from a stock that has a bad turn downwards, in a bull market or

otherwise. The Accumulation Index will turn negative, often showing how

utterly a new high is or as the stock breaks key support, a long uptrend-line

of an important loner term moving average. Tiger's Closing Power shows

what Professionals are doing in the stock as opposed to the broader public

as is shown by TigerSoft Opening Power. Much more often than not, when

the Closing Power turns down, even if the Public is still buying on balance,

the stock will keep falling. At some point the Public may turn bearish, too.

That brings either a much steeper decline or a climactic bottom.

Note how consistenly these three unique TigerSoft tols help an investor

avoid a serious decline.

1) Automatic Sells - Each number is explained in HELP section.

2) TigerSoft's Closing Power turns down.

3) TigerSoft's Accumulation Index turned from positive (blue) to negative (red).

See also: Phases of A Typical Speculative Stock.

Attractive Short Sales

Flag Insider Selling with TIgerSoft