3/10/2010

www.tigersoft.com

3/10/2010

www.tigersoft.com around the World to Maximize Stock Profits and Avoid Devastating Declines.

|

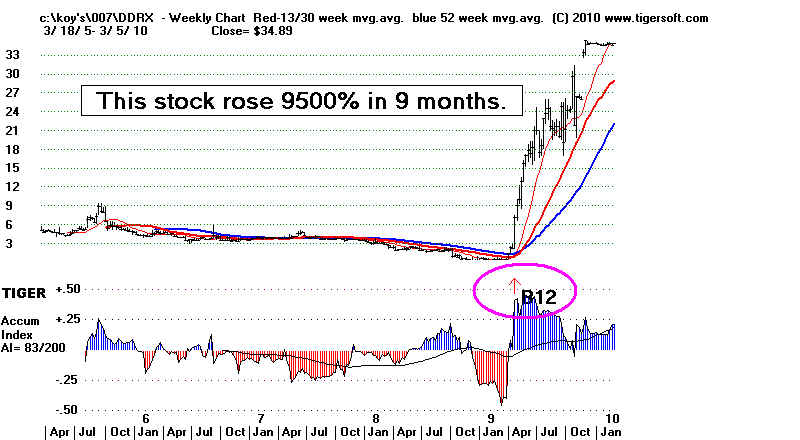

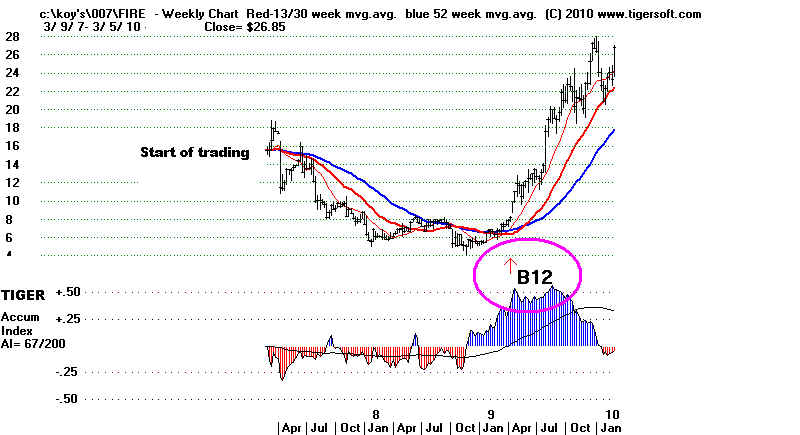

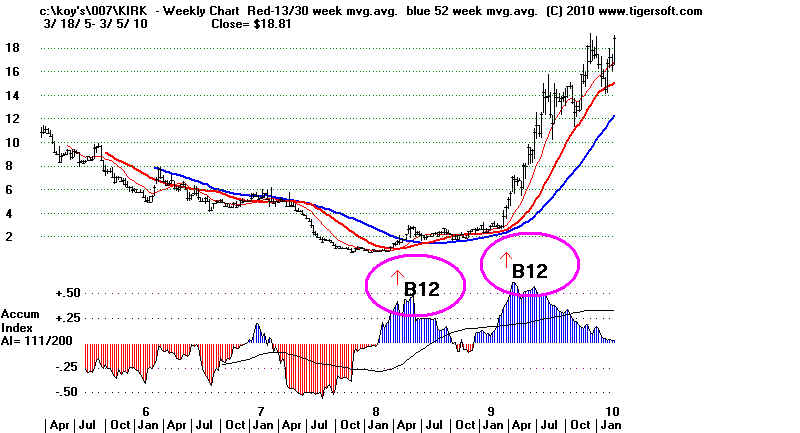

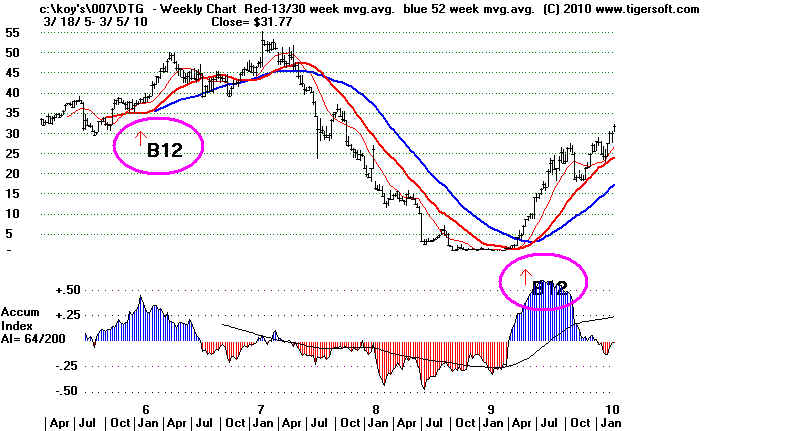

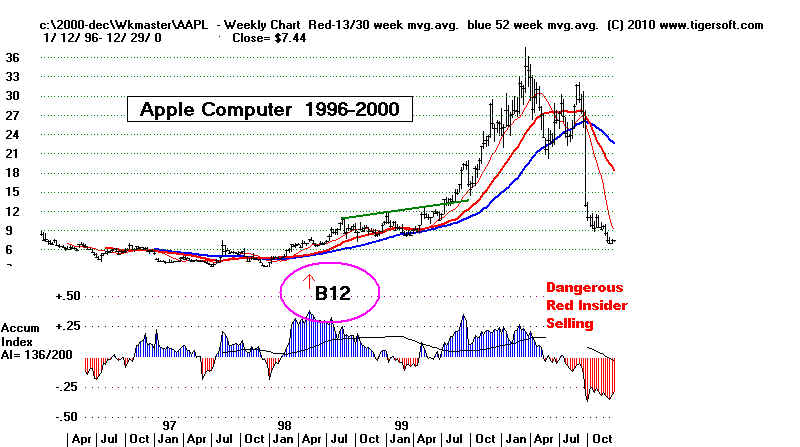

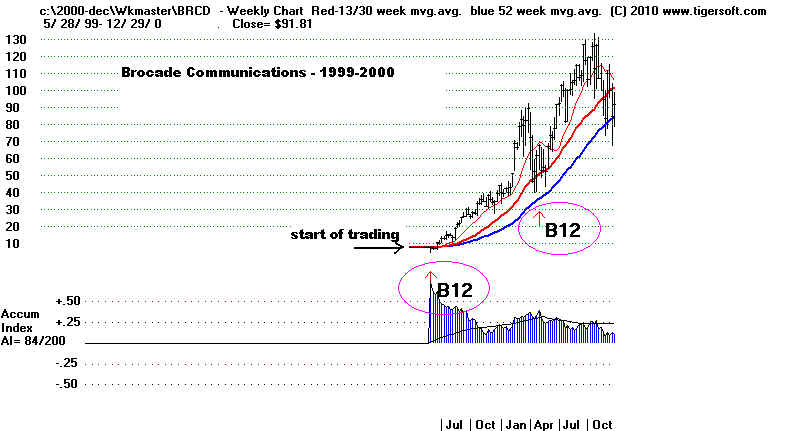

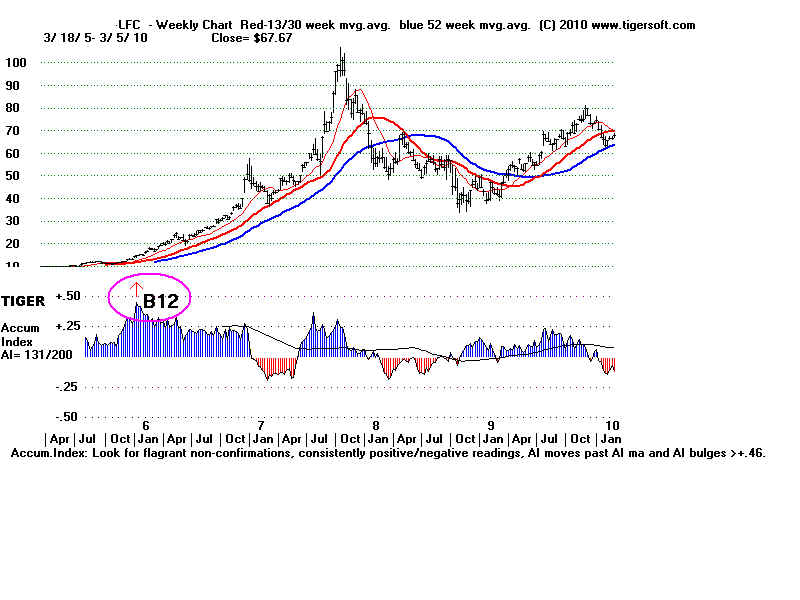

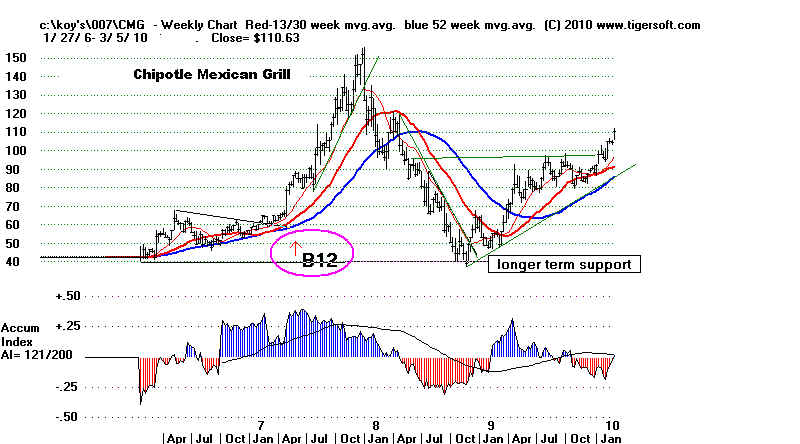

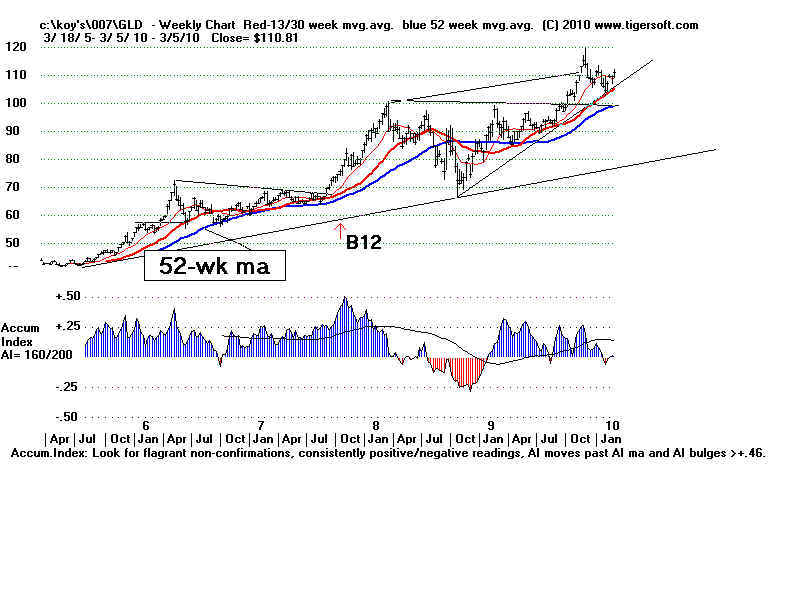

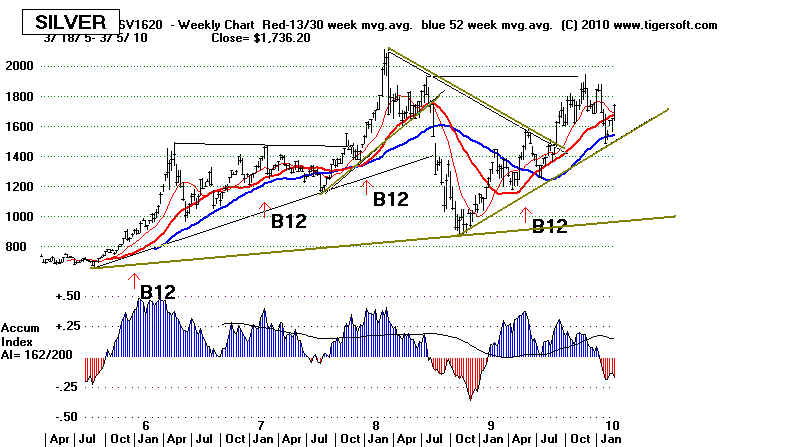

Introducing the: Automatic, Reliable, Very Profitable Tiger Weekly Buy B12s by William Schmidt, Ph.D. - Creator of TigerSoft and Peerless Stock Market Timing --------------------- Speculative Stocks ---------------------- Four 2009 examples should convince you we have somethng special here. And this is only a small part of all that TigerSoft and Peerless offer. It should demonstrate the value of our highly original research, work and indicators. Many of the gains here are staggering! 1. DDRX - Diedrich Coffee - 2 to 34!  FIRE - Sourcefire - 7 to 28  KIRK - Kirkland's - 4 to 18  DTG - Dollar General - 6 to 33  --------------------- Speculative Stocks ---------------------- Earlier era B12s also worked their magic. Here are a few some examples. 1999-2000    2006  2007  Tiger Weekly Buy B12s: High Caps, Growth Stocks, Foreign Stocks, ETFS, Commodities and Currencies  We emphasize always watching for signs of We emphasize always watching for signs of insider buying and selling. Insiders always know first. This study shows another way to watch for Insider buying using weekly charts. This approach permits longer term holding. And it works well with optionable high capitalization SP-500 and NASDAQ-100 stocks, too. This is particularly of interest because most of these stocks have much higher liquidity and also, up to a point, are safer. |

BACKGROUND

Here

are rules for profiting from TigerSOft weekly charts. Rules for this are being

offered

as working hypotheses. They have grown from many years' experience.

They do not always work, of course,

but used consistently over some time, they

should help enormously.

See also www.tigersoftware.com/TigerBlogs/March-6-2010/index.html

In particular, we want to start screening for weekly Buy B12s. You will want to

use our weekly data and a new

flagging flagging program that can dervive these

signals from daily data for all

stocks, every Friday evening.

Very reliably profitable are weekly Buy B12.

These Buy B12 weekly signals occur

automatically with the latest software when

the Accumulation Index past a key

threshold. The signals work exceptionally well

and most reliably (>90%) when

they occur with the stock still in or close to its base,

not too far above its 52-week ma

and with the stock not up more than 40% in the last

10 weeks.

My study

of just the NASDAQ-100 and SP-500 stocks' 5-year weekly charts show that

90% of these bring high gains

using the rules discussed.

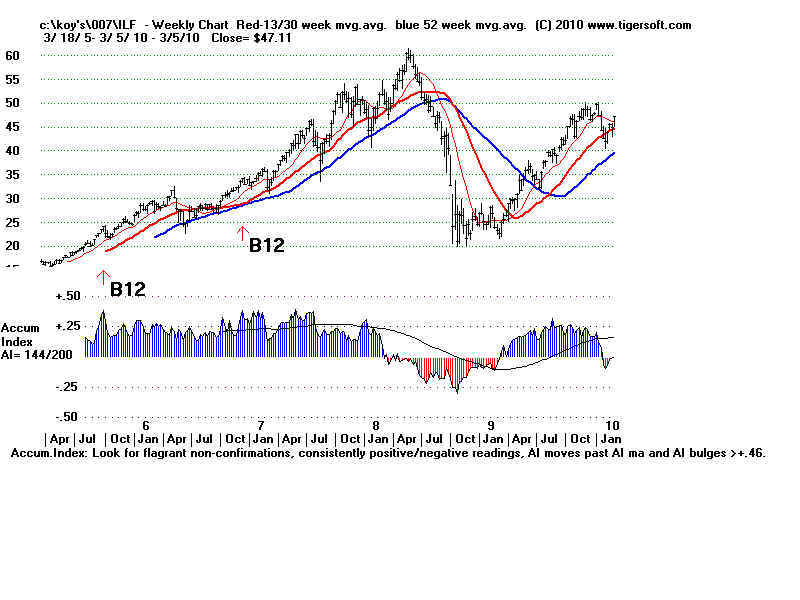

See the examples of ILF, GLD, RIMM below Note

that the first is in a base. The second one

occurs with prices much more

extended. We have rules that prevent us from chasing

these signals too far.

I strongly suggest

studying some of the more successful Weekly Tiger B12s.

----------------------------

Country ETFs -----------------------------------

ILF - IShares S&P Latin

America 40 Index

---------------------------- SILVER ETF-----------------------------------

------------- RIMM - Research in Motion - 38 to 140 --------------

=========================================================================================

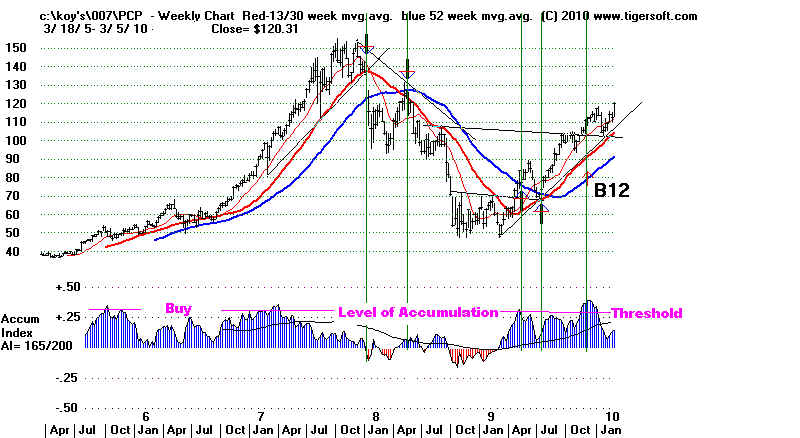

PCP is one of the more recent Buy B12. Its chart shows the

value of the moving averages we show. We also see that levels of

Accumulation above a critical level can sustain very big advances

even without a Buy B12.

But why settle for second best when we can screen all stocks

for Buy B12s. 90% of these bring high gains using the rules discussed.