8/29/2007 -

Staffing Companies' Stocks As

Predictors of The US

Stock Market

When companies slow down or stop hiring, it shows that they are not confident of

of the business outlook. Historically, many of the staffing companies top out months

or even a year ahead of a big general market turn down.

A new 12-month price low by our Tiger Staffing Stocks' Index would certainly suggest

an important top has been already reached this year. Until then, there is a chance

for a recovery later this Autumn. A general market decline in about a year to

a year

and

half might then be predicted, based on the pattern of many of these

stocks to top

out

ahead of the general market. And, in fact, a new Administration is

often greeted

with

a bear market. Interestngly, most of these staffing stocks do not bottom out before

the

market begins a new bull market. Turns upward in new hiring must depend upon

the

confidence a stock advance usually brings and reflects.

-------Tiger's Index of 19 staffing companies is shown

in year's chart below. -------

The index has fallen to a point just above its 12 month lows. That must be

considered

important technical support. A decline below that would mean the current decline is

most likely not an intermediate-term correction, but a bear market. The Peerless

major

Buys and Sells work well with this index. The optimized Red signals should be

watched.

It is still on a Sell.

Tiger Users Can Trade Some of These Very

Nicely!

Most Are

Over-Looked by Professional Traders.

Most of these stocks do not offer enough volatility to make them particularly attractive

speculations on growth. But their moves up do coincide with Peerless buys. So

they might

be used as a proxy for buying an intsrument to participate in a bull market.

Brokerage

stocks, however, probably serve that purpose and their down-turns better coincide with

Peerless major Sells.

I would suggest that professinal traders look at these stocks. They are mostly

over-looked. But can be very prifitably traded using Tiger's automatics Buys and

Sells.

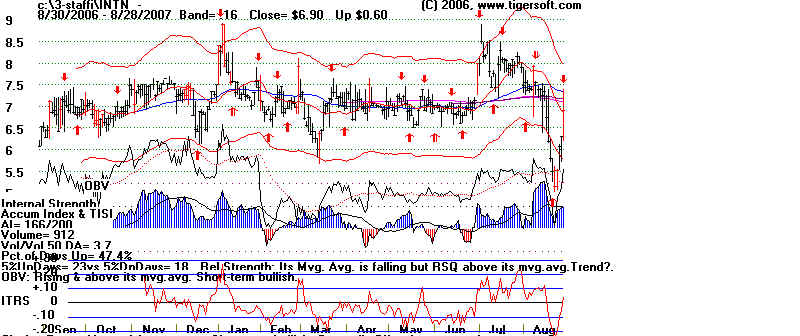

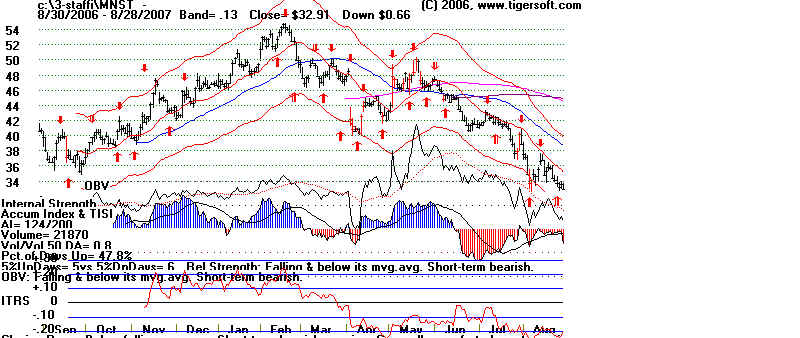

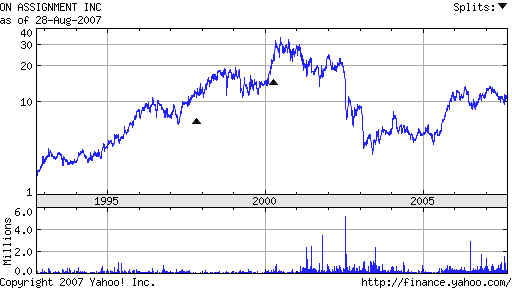

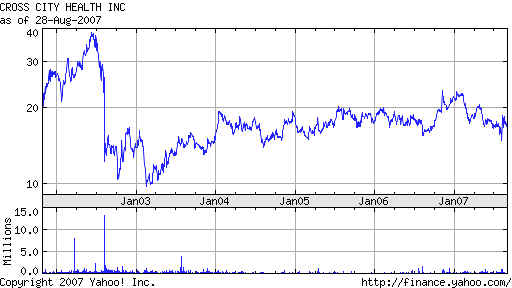

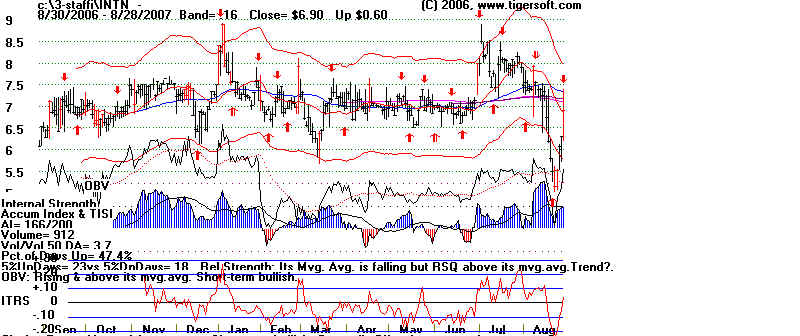

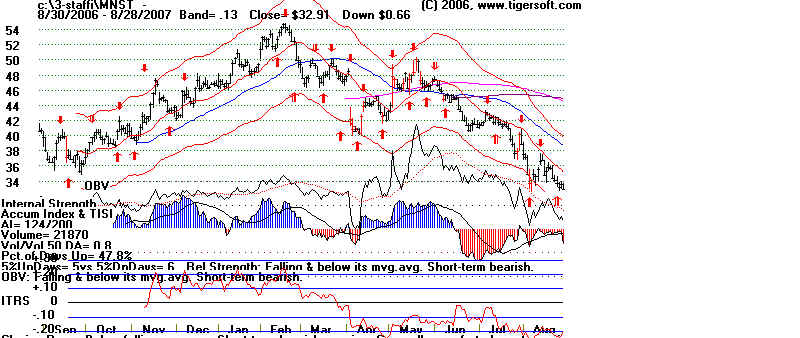

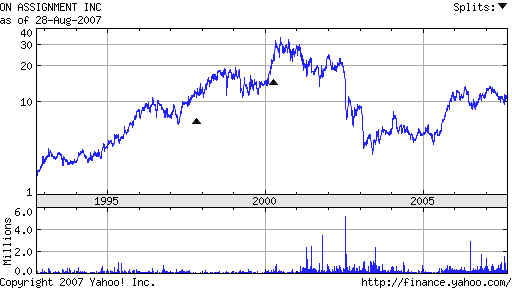

The best for this purpose are INTN, ASGN, CCRN and MNST. A trader using Tiger's best

trading system would have gained a whopping 283.2% on INTN, 130.6% on ASGN,

120.5% on JOBS, 99.3% on KNXA and 59.5% on MNST.

INTN shows lots of Accumulation. And Tiger's best system is extremely profitable with it.

130.6% on ASGN

MNST

-------------------------------------------------------------------------------------------------------------------------------------------------

Here are the stocks included in the Tiger

Index of Staffing Companies.

AHS American Hospital Supply - temporary healthcare

staffing

AHS bottomed with the US stock market

in March 2003. But it has peaked out

ahead of US stock market, which advanced until July

18th, 2007.

ASGN On Assignment Inc. - staffing in

laboratory/scientific, healthcare, and

medical financial and health information

ASGN peaked in 2000 at the same time the SP-500 did.

It bottomed at the same

time the market did in 2003. Its recovery was muted

compared to overall market

subsequently.

CITP - Comsys IT Partners, Inc. - information

technology (IT) staffing

CITP has topped out already, in April 2007.

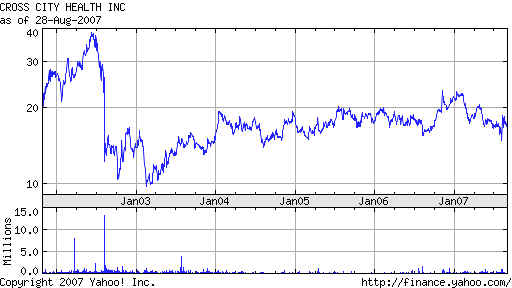

CCRN Cross Country Healthcare Inc - healthcare

staffing

CCRN also turned tup witht he general market in

March 2003. Its recovery was

not nearly as robust as the general market.

And it has apparently topped out early

in 2007 ahead of the DJI and SP-500 by 7

months.

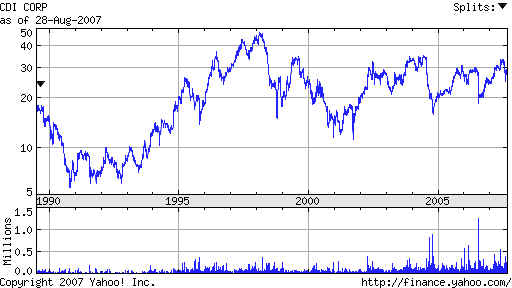

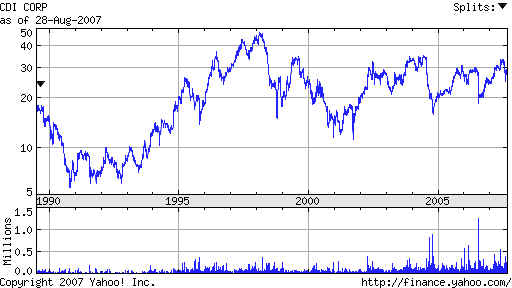

CDI - Engineering and

information technology outsourcing and professional staffing

CDI peaked in 1998, two years ahead of general

market. It bottomed in late 2001,

18 months before the stock market generally. It

has failed to make new highs with

the overall market. But it also has not started

a serious decline yet.

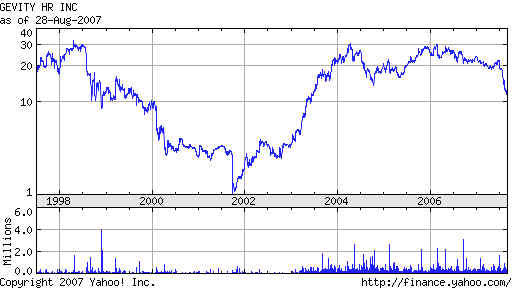

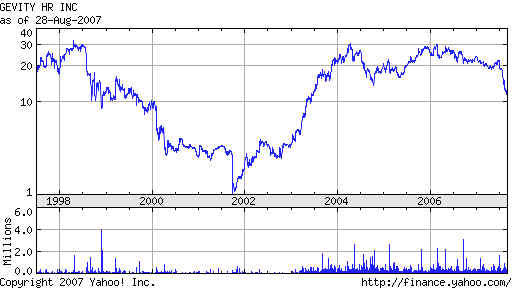

GVHR Gevity HR Inc - human

resource (HR) management solutions to small and

mid-sized businesses. The company offers payroll

administration services, such as

administrative processing, W-2 preparation and

delivery, tax processing and payment,

paid time off processing, health and welfare plan

processing, time and attendance service,

and payroll and HR-related reports services

GVHR peaked in 1998, two years ahead of US

stock market. It bottomed in

October 2001, 18 months ahead of general

market. It peaked in ealy 2006, about

18 months ahead of the general stock market..

HHGP Hudson Highland Group Inc

- Accounting and finance, legal, and IT staffing.

HHGP peaked two months ahead of US this

year. Note its big swing up.

HSII Heidrick & Struggles

International Inc - Executive search and leadership

consulting services

HSII peaked with the US markets in 2000.

It bottomed with the overall market

in the first quarter of 2003. It is still

in an uptrend. But it has not made new all-time

highs as has the DJI and SP-500.

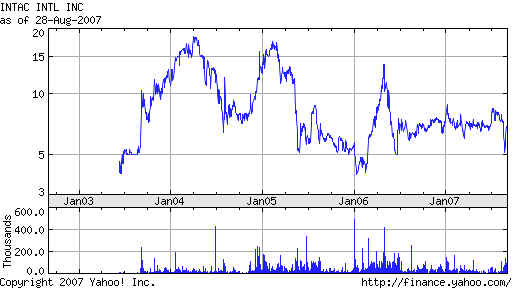

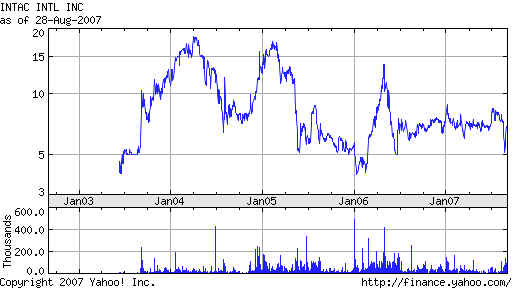

INTN Intac

International Inc.(Hong Kong) - Educational and career development services

primarily in China

INTN is lagging the rest of the stock market by

a wide margin.

JOB General Employment -

technology, engineering, and accounting professionals.

JOB peaked in late 1997 more than two years

ahead of overall market. It bottomed

with the market early in 2003 with the world

markets. Its weak recovery ended

early in 2007, 7 months ahead of the recent

peak.

JOBS 51job Inc.

Recently peaked 2 months ahead of

US markets.

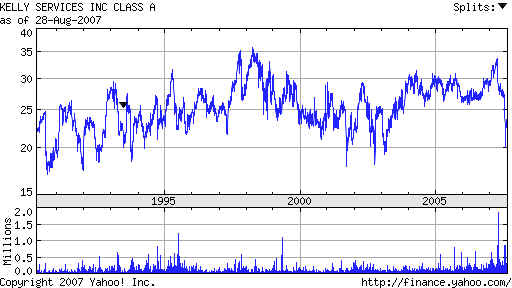

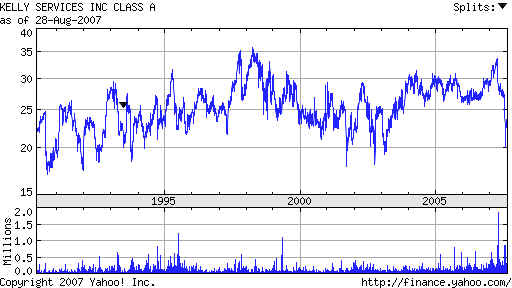

KELYA Kelley Services

- word processing and data entry, and as administrative support staff;

staff for contact centers,

technical support hotlines, and telemarketing units; substitute teachers;

support staff for seminars,

sales, and trade shows; technicians to the technology, aerospace,

and pharmaceutical industries; and

maintenance workers, material handlers, and assemblers.

KELYA peaked in 1998, 2 years

ahead of general market. It bottomed with the

overall market early in 2003.

Its recent peak coincided closely with the market's.

It seems more intereste din

bouncing back and forth as a trading vehicle for professionals

than in making a sustained trend..

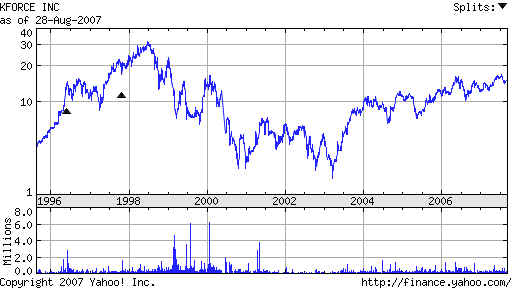

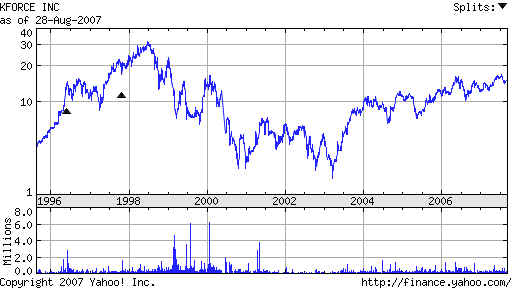

KFRC

Kforce Inc. - Technology; Finance and Accounting; Health and Life Sciences; and

Government Staffing

JFRC peaked in mid 1998, two years

ahead of general market. It bottomed at the

same time in early 2003. It

is still in an uptrend, though it has not made new highs.

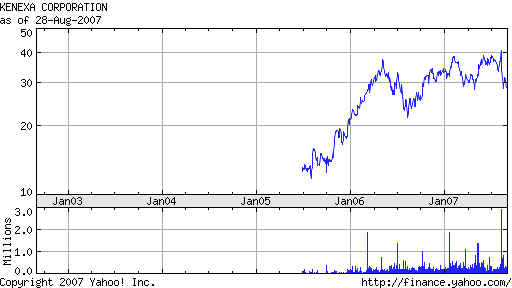

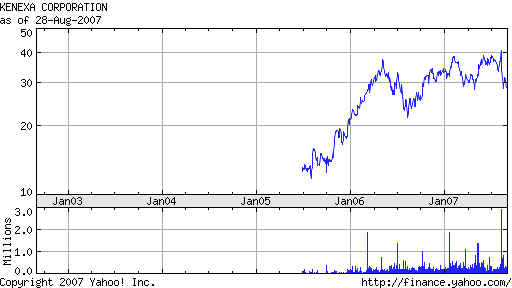

KNXA

applicant tracking system, which automates and streamlines the recruiting process;

and testing and

assessment solutions,

KNXA seems to have peaked with the

general market in July 2007.

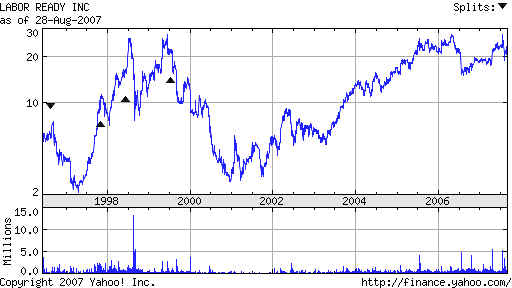

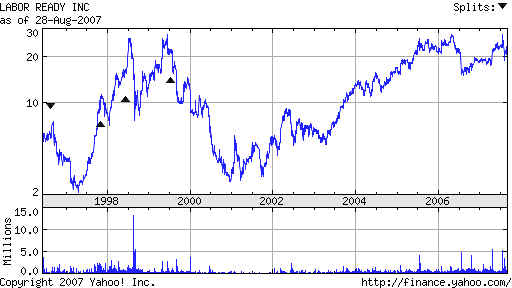

LRW Labor

Ready Inc. Manual labor

LRW peaked in mid 1999

nearly a year ahead of general market. It bottomed in late 2001,

15 months before the

market as a whole did. It is not clear if it has peaked again this

year, but it does

show a double top, as it did in 1998-1999.

MAN Manpower Inc. - general employment services.

This peaked in mid 1997

more than 2 years ahead of the general market but did

not sell off in thr

2001-2003 bear market. It is now in a strong uptrend, though

it did pek recently

with the general market.

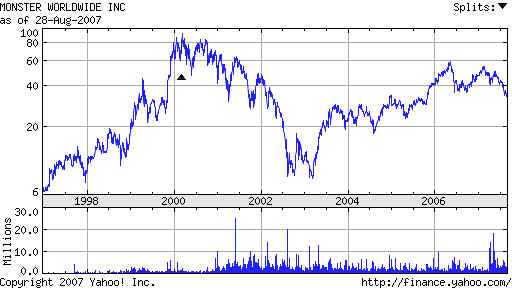

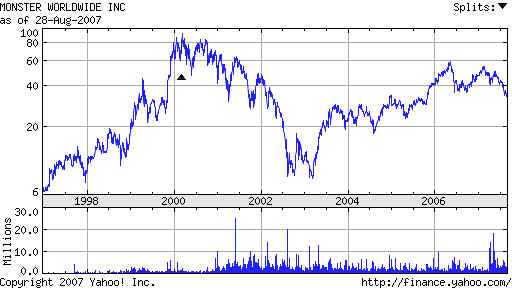

MNST

Monster Worldwide Inc - Online employment services.

MNST peaked in

2000 and bottomed in early 2003 with the general market. Its

mid 2006 peak was

a year ahead of the general market.

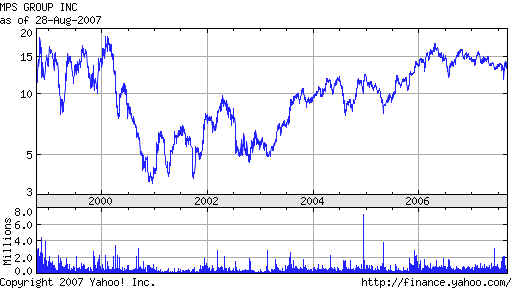

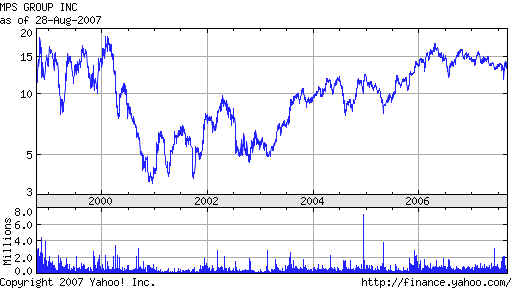

MPS MPS

Group Inc.- staffing and recruiting services in the disciplines of accounting,

finance, law,

engineering, and healthcare sectors

MPS peaked a month

before the SP-500 did in 2000. It bottomed 3 months before

the general market did

finally in early 2003. It seems to have reached a peak a year

ahead of the general

market.

MRN Medical

Staffing Network Holdings Inc.

MRN is lagging.

.

|